Gold X Mining Corp. (TSX-V: GLDX, OTCQX: SSPXF): Developing One of the Largest Gold Deposits in the Americas; Interview with Richard Munson, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/9/2020

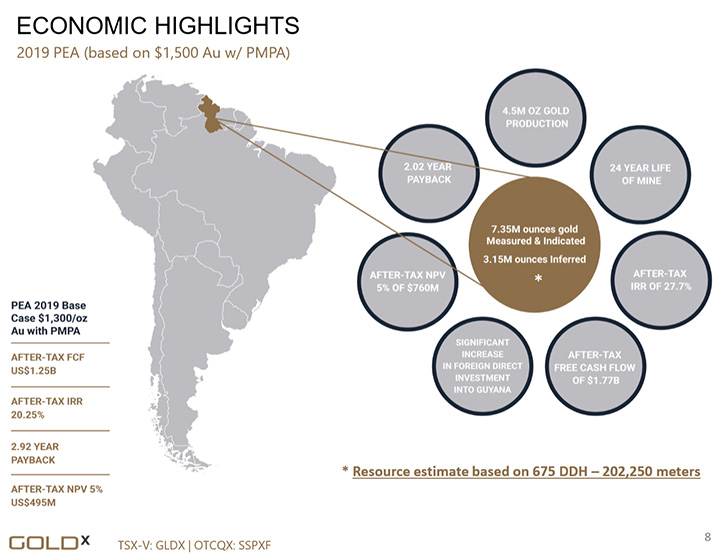

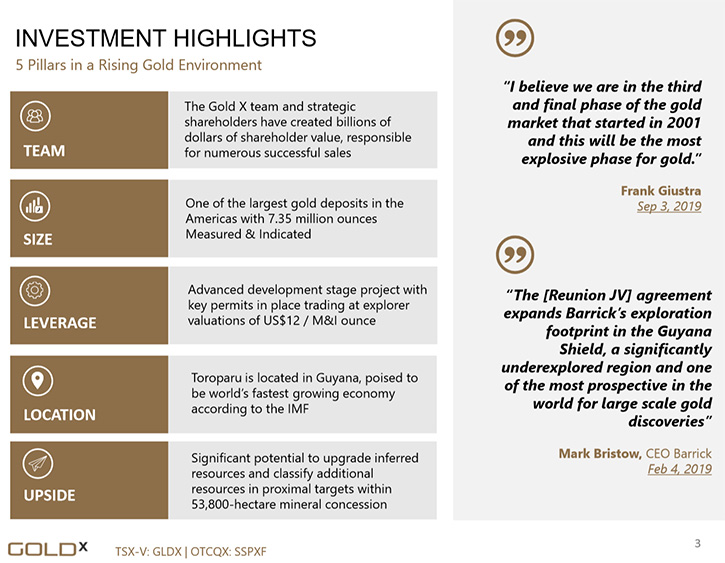

Gold X Mining Corp. (TSX-V: GLDX, OTCQX: SSPXF) is developing the Toroparu Gold Project in Guyana, South America. Gold X has spent more than US$150 million on the Project to date to both classify 7.35 million ounces of measured and indicated and 3.15 M-oz of inferred gold resources, develop engineering studies for use in a feasibility study, and define a number of exploration targets around Toroparu on its 53,844 hectare (538 km2) 100% owned Upper Puruni Concession. We learned from Richard Munson, who is President of Gold X Mining, that Toroparu is one of the largest gold deposits in the Americas, with tremendous potential and optionality, as we enter the next phase of this long term bull gold market.

Gold X Mining

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rich Munson, who is President of Gold X Mining. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

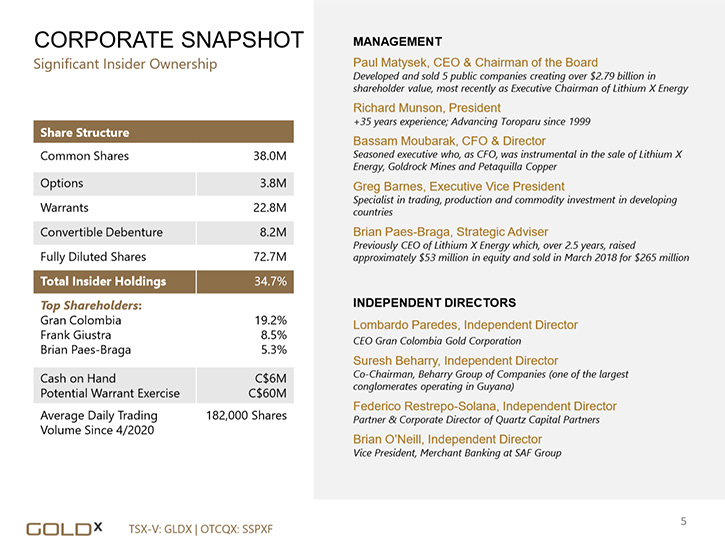

Richard Munson: Happy to, Dr. Alper, and appreciate the opportunity to talk to you and all the folks that read MetalsNews. In terms of what distinguishes Gold X and Toroparu, we must start with the team. The Management Team has just been refurbished, with the addition of Paul Matysek as Chairman of the Board and CEO. Paul has an outstanding track record of success, having sold the past 5 resource companies he has been either Chairman or CEO of, creating approximately $2.8 billion of shareholder value in the process.

I've been with the project a long time, and it was clear to me, as well as to the major shareholders, that given the extensive work that we have done on this project and all of the money that's been invested (US$150 million to date), it was time to bring in a new set of eyes, a new set of energy, et cetera, which we have successfully done, as of April 1st of this year. I am very excited with the level of expertise and energy that Paul has brought to the table, as well as Bassam Moubarak as CFO, Brian Paes-Braga as a strategic advisory and Lucas Cahill as investor relations. It's great for me personally, and it is a tremendous opportunity for the shareholders of Gold X.

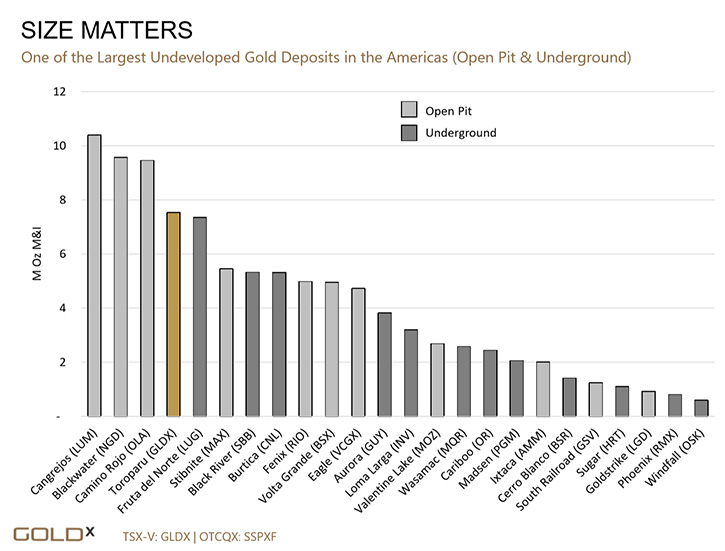

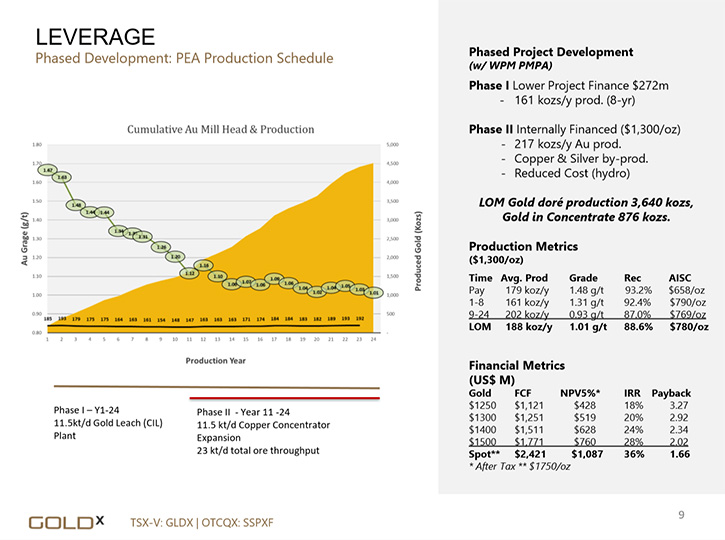

Next, the asset. Toroparu is one of the largest gold deposits in the Americas. It sits currently at 7.35 million ounces, M&I and we have a great opportunity to convert some of the inferred ounces (we currently have 3.15 million ounces inferred) into M&I. With this size of a gold resource, it creates a tremendous amount of optionality. We can start with a smaller phased project with lower capex, which for a junior company should be a requirement and is a very favorable factor that we have at Toroparu. Or if you believe that we are truly in a long term bull gold market, you can build a very large project and produce somewhere in the range of 250,000 to 300,000 ounces of gold a year for 15 to 18 years of mine life.

So that optionality, that size and management team, as well as being in a stable English-speaking, British common law jurisdiction in South America, gives us a great opportunity. And from a value perspective, if you look at the valuations that are being applied to Gold X at the moment, we are valued much more as an exploration company than as a development company. And a popular metric that's used quite often to compare companies is the value that's ascribed to M&I ounces on an enterprise value. And we sit at almost the bottom of the level in terms of our peer companies. I think that really sets the stage for why folks should take a deeper look at Toroparu.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors your primary goals for 2020 and going into 2021?

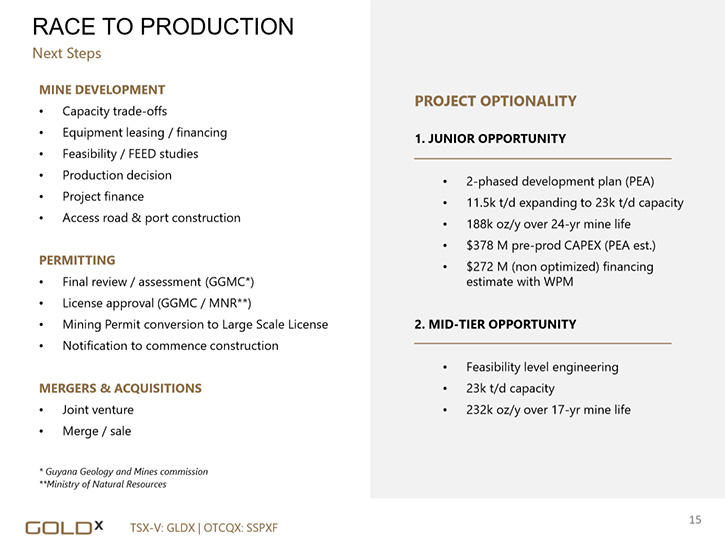

Richard Munson: We're focused right now on, as Paul Matysek says quite often, right-sizing the project. What is the best way for this junior company, with this tremendous potential, to go forward with Toroparu? We have a lot of options we can explore. We will be looking at re-evaluating some of the construction costs, the potential financing of upfront capital. And also we're looking deeply at our resource model once again, to see if there is potential to add lower cost ounces to the resource base, which would allow us to get into production quicker at a lower capex.

In addition to that, we will be working with government to finalize all the permitting steps. We are very far along the permitting timeline, and that's because of all the work we've done over the years. We also are quite far along on technical analysis. As you may know, Dr. Alper, we did a transaction with Wheaton Precious Metals back in 2013. They funded final feasibility work in 2014. So we've taken the project to feasibility-level status on a whole variety of the technical factors that would go into producing the final feasibility.

We've had two recent press releases. One highlighted all the technical work that's been done. The second one highlighted all the permitting work that's been done. And so it shows the investing public, as well as the project finance folks, that this is truly a well-advanced project that is ready to seize the opportunity to make a production decision. The fact that we also have, as our largest shareholder, Gran Colombia Gold and their technical team, which has been quite generous in offering their assistance, we've had lots of opportunities for a give-and-take on these optimization aspects that we've been talking about. So as we go through 2020, 2021, you'll see further advancement on the permitting side and further advancement on the technical side.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors more about your capital and share structure?

Richard Munson: Yes. We have a tight capital structure. One of the things that Paul and company proposed and implemented was an 8 for 1 share rollback. We sit today with about 38 million shares issued and outstanding and about $6 million of cash on hand.

With Paul, Bassam, and Brian's assistance, we were able to do a convertible debenture financing back in 2019. Wheaton Precious took 50%. Gran Columbia took 25%. Frank, Brian and group took 25%. With the proceeds of that convertible debenture, we were able to acquire the interest in the project that has been held by our local partner. So as we came into this year, 2020, Gold X now owns 100% of this project, which has always been an expected outcome, but it is a big step for us to actually pull the trigger on that and become the clear 100% owner of the project.

Dr. Allen Alper: That sounds great. You have a fantastic Team, a fantastic Board and fantastic backers! Could you say a little bit more about their backgrounds for our readers?

Richard Munson: Certainly.

Dr. Allen Alper: They've been extremely successful.

Richard Munson: Oh yes, all have been. You start with Frank Giustra, who came into the Company back in 2015. And I think everyone, certainly on the Canadian side of the investment community, knows that Frank goes clear back to Goldcorp and several other very successful mineral and other ventures. Frank's been a very successful investor-value builder, and he's been of tremendous assistance to us. He truly rescued what was then Sandspring Resources, because as you know, 2014, 2015 were pretty ugly years for junior developers. So we were very fortunate to attract Frank's interest.

Then we also have, Wheaton Precious Metals, a long-time supporter. Gran Colombia Gold is our largest shareholder. Paul Matysek, who has had tremendous success in the mining business, going back to Uranium One, Potash One. Recently with Brian and Bassam Moubarak, they were successful in selling Lithium X. So yes, they've had a tremendous run in terms of building shareholder value.

I've been with the project for many years, and I am fortunate to have been joined in my efforts over the years by Greg Barnes, who is our Executive Vice President. Greg has led all the technical work on the project over the last many years and continues to be dedicated to helping Paul and Brian get this project into production.

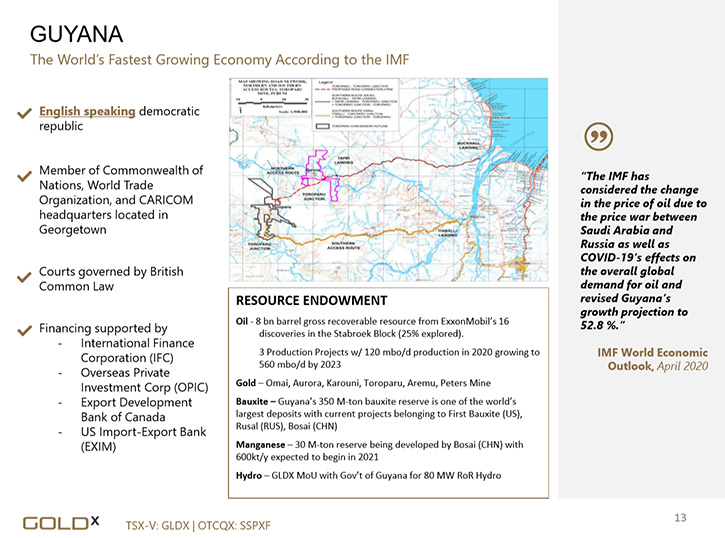

Dr. Allen Alper: Well, that sounds fantastic. A great team, a great resource and location, excellent backing and investors, and that really, sounds great. Could you tell our readers/investors a little more about operating in Guyana?

Richard Munson: I would be delighted to. I went to Guyana, for the first time in 1999, to help a partner of ours do due diligence on a project there. I come from the uranium sector background here in the US. John Adams was my partner at that point in time. John and I were the original Energy Fuels, here in the US. We were looking for an opportunity outside of the uranium sector and Guyana seemed to fit the bill, especially in the early 2000s. The only thing going on was that the Omai Mine was operating there. That was Cambior, and Cambior was very open, very helpful to us. They took us to the site many times at Omai, showed us what they were doing, went through all the efforts they had made to work with the union groups in Guyana.

Then based on that, we ran a small mining operation at Toroparu from 2004 to 2006. We weren't tremendously successful financially, but we did raise enough money to conduct an exploration campaign. We also learned firsthand how to work with government, how to work with the labor force and the ins and outs of getting material in and out of a small country in South America. So that experience has given us a strong background to be able to move Toroparu to a production decision.

I have found Guyana an easy place to be. I've worked in many other places in the world. The common English language, of course, is a great advantage for North Americans. The British common law is a good place to be. Guyana has been recognized as a place you can be involved in providing project finance. I think it was very notable that the IFC led project finance for Guyana Goldfields. So all the Canadian major banks were also participants in the Guyana Goldfields project finance. All in all, a good place to be.

The transformative event that's happened in Guyana at the moment is the discovery of offshore oil. Exxon has 8 billion barrels under their control at the moment, and they have thousands of acres yet to explore. So it is going to be very interesting to see what happens in Guyana. It's a population of about 800,000 people. They have gone from, I think, the second poorest country per capita in the world to about the second richest country per capita in the world. So we're very hopeful that the signs we see that government is setting up a resource trust fund based on Norway's experience, is a great thing for the country and for the people of the country. So we look forward to being able to participate, with other American and other foreign countries in a thoughtful and disciplined development of the natural resources, owned by the country of Guyana.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your support and your arrangement with Wheaton Precious Metals?

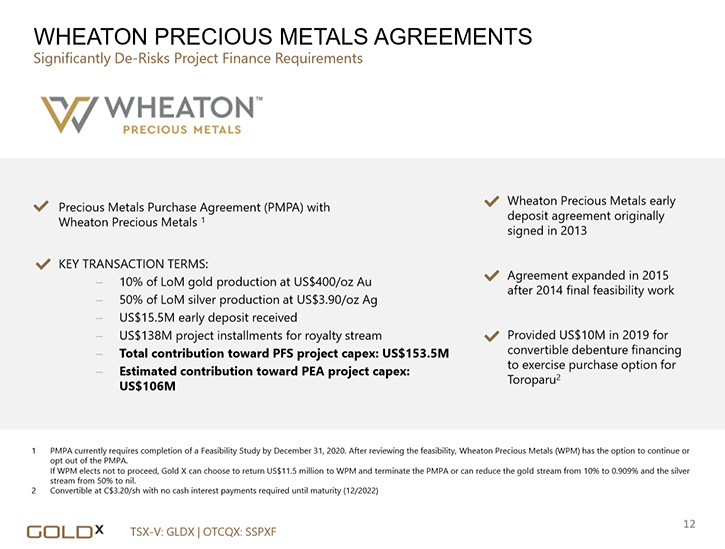

Richard Munson: Certainly. We were able to conclude a transaction with Wheaton back in 2013, and that was based upon a pre-feasibility study, we had published earlier in the year. For me and for my team, it was a very notable transaction, in that we were the first junior developer that Wheaton had done a streaming deal with. And we saw that as validation, not only of the project, but also of the work we had done on the project. So we also structured it in such a way that we got an advance payment that allowed us to do final feasibility work. We went through all the final feasibility in 2014.

We concluded at the end of the year, in consultation with Wheaton, of course, that there really wasn't any reason to write a final feasibility report that would cost several hundred thousand dollars to complete, because as you know, Doctor, there was no gold market home at the end of 2014. And all we would have confirmed to the market is that yes, it's a large gold project. And yes, the grade has stayed about the same as the PFS.

So we decided to put a ribbon around all the data and we had a press release in early May that identified all of that data, all of the studies that we've done, et cetera. Wheaton has been a very supportive partner. I see them as a partner, not as an off-taker or anything else. They have been very supportive, been very helpful to the team and me, and I think that was highlighted by their participation in December, in this convertible debt financing, in which they advanced another $10 million. So I think they're committed to be a long term partner.

And of course, it's a great opportunity for them. They have an option on many million ounces of gold and got in at the ground floor. But a good thing for us going forward, obviously that takes our financing requirements down by roughly a third of what the upfront capital will be of whatever project is ultimately constructed at Toroparu. So for a junior developer, having that kind of capital commitment is very significant.

Dr. Allen Alper: That's great. It's great to have a great project, a great resource, a great partner, and also a great team. So you have a lot going for you, for the Company. That's excellent. Could you highlight the primary reasons our readers/investors should consider investing in Gold X Mining?

Richard Munson: Well, some people say, "Bet on the jockey." Other people say, "Bet on the horse." I think Gold X brings a great jockey, in terms of the team and a tremendous horse, in terms of the resource positivity at Toroparu. We are very far advanced in permitting and in technical work. People sometimes use the term shovel-ready. I think we're close to that status. As I said before, I'll use Paul's term again, right-sizing the project is the key at the moment, and we have a very talented technical team. Gran Colombia is there and we rely on their technical expertise as well, from time to time. And again, another set of eyes is always valuable.

And for an investor, someone looking to get into the gold equity sector, I think if you look at us in comparison to other junior development companies with large projects, you'll find that we are a very attractive value at the moment, with a lot of room for re-rating, as we go through final feasibility, project finance production decision, and final government approval, when we have the project finance and everything put in place. So the path is fairly straightforward, I think more than fairly straightforward, very, very straightforward. And once we are back in business as a world and as a sector in terms of dealing with the current pandemic, I think our pace to production is largely going to be driven by our own efforts, which is a great position to be in.

Dr. Allen Alper: Well, that's excellent. Is there anything else you'd like to add, Rich?

Richard Munson: No I think we have covered the story thoroughly and again thank you for your interest and support.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://goldxmining.com/

Telephone: +1 (604) 609-6132

Email: investors@goldxmining.com

|

|