INTERVIEW WITH DAMIEN KOERBER - CHIEF OPERATING OFFICER EQUUS MINING (ASX:EQE)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/2/2020

Flagship Project: Cerro Bayo | Country: Chile | Commodity: Gold and Silver

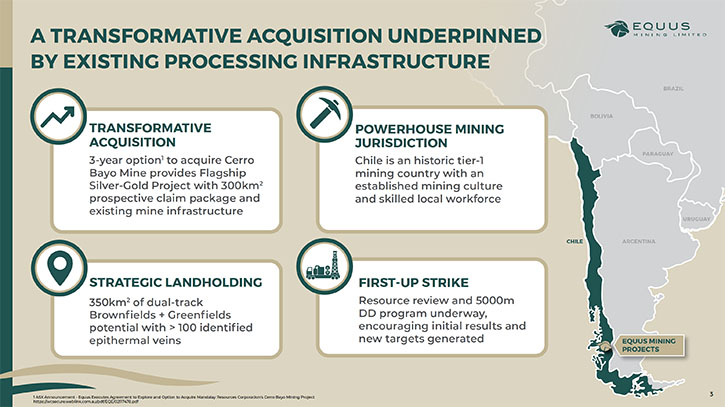

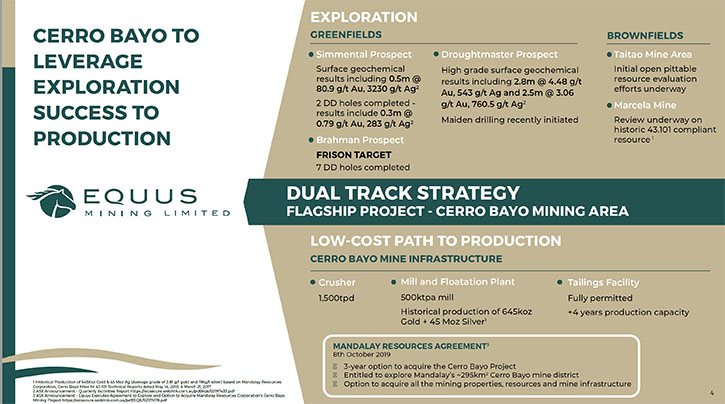

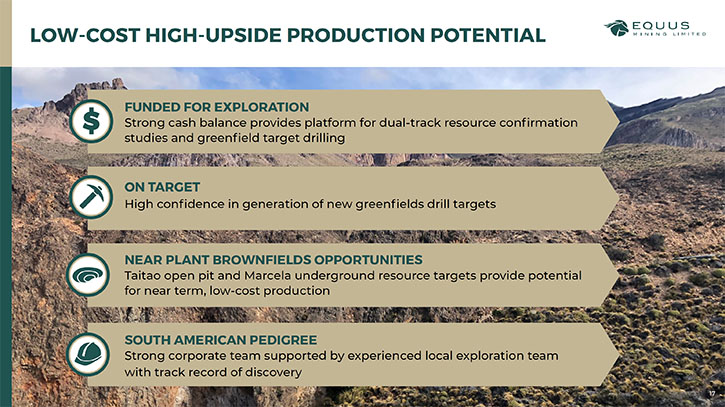

Company Overview:Equus Mining is progressing a dual-track project strategy of becoming a near-term gold-silver producer, targeting a JORC compliant resource at the Taitao Pits by Q3 2020, while simultaneously exploring for greenfields discoveries from targets throughout the Cerro Bayo claim area.

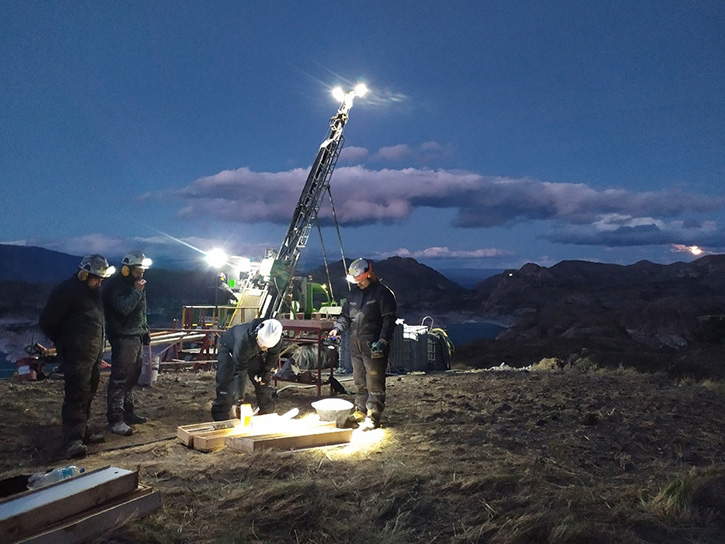

During PDAC 2020, we talked with Damien Koerber, COO of Equus Mining (ASE: EQE). Equus is currently exploring the Cerro Bayo Silver and Gold project, aggressively and intends to establish sufficient resources to put the past-performing mine back into production.

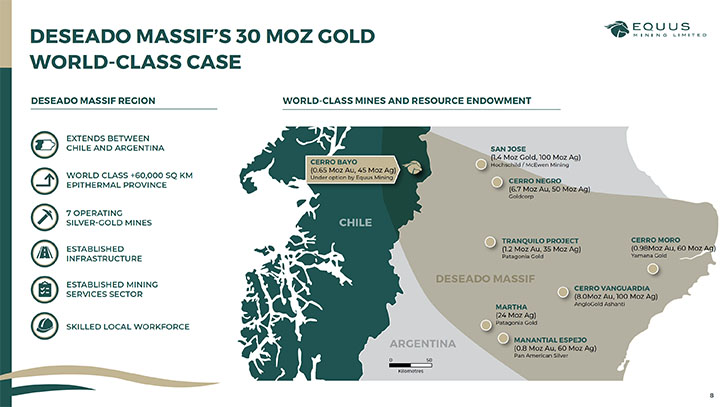

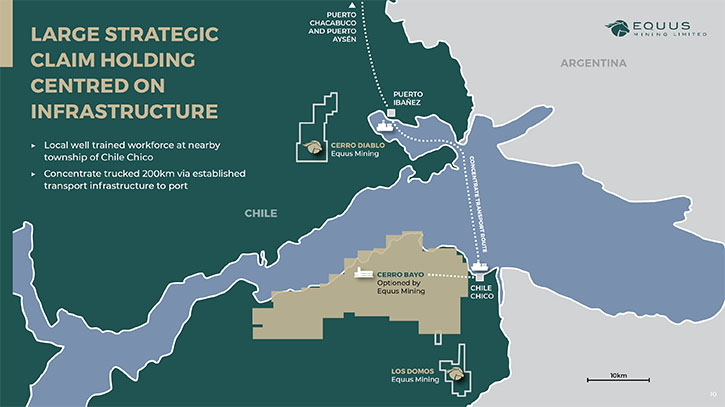

Cerro Bayo is located in the premier epithermal Au-Ag province of the Deseado Massif, which transects Argentine and Chilean Patagonia and which is host to several of the world’s premier gold and silver mines.

The Company is currently undertaking 1,500m of resource definition drilling at the Taitao Pitt, due to be completed shortly, with final results due by the end of June and targeting a JORC compliant resource at Taitao by Q3 2020.

The resource is expected to be supported by high-grade ‘feeder’ ore both from the Marcela Mine (Remaining Measured and Indicated Resources of 21.8Koz gold at 2.53g/t gold and 2.74 Moz silver at 318g/t silver) and additional resources via greenfields discoveries, from targets throughout the Cerro Bayo District, with limited previous exploration. May 27, 2020 press release. “Equus-STANDOUT INTERSECTION BOLSTERS DROUGHTMASTER POTENTIAL 3.8m at 20.4 g/t gold and 55.45 g/t silver”. Indicates opportunities for many of their other greenfields targets.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Damien Koerber, who is the Chief Operating Officer at Equus Mining.

Damien, could you give our readers/investors an overview of your Company?

Damien Koerber: Thanks Allen, glad to be with you. In October 2019, Equus executed an option to acquire the Cerro Bayo Gold Project, which includes approximately 295 square kilometers of mining claims and a 1,500 tpd flotation plant, which is currently under care and maintenance. Collectively, with our two other satellite projects, we control about 350 square kilometers of highly prospective claims, including a mine and a high-value processing plant and most of the equipment required for mine restart.

The mine has been on care and maintenance since mid-2017, after having produced approximately 645K oz Au and 45Moz Ag during a period of 19 years, between 1995 and 2017. The flotation plant, with a 1,500 ton per day capacity, historically generated a very marketable concentrate, with gold and silver recoveries averaging 89% and 92% respectively. As far as existing 43.101 compliant resources, on the Mandalay claim package that we view as being easily exploitable, there exists approximately 50,000 gold equivalent ounces in the Measured and Indicated Resource category.

We also see a huge greenfields opportunity to discover additional resources, which could bolster the case for putting the plant back into production. We have $3 million in the bank and two drilling rigs going at the targets that we've generated since the option agreement was signed.

The Cerro Bayo district is part of the Deseado Massif, a globally significant epithermal province, which extends between Argentina and Chile. Argentina has seven operating mines, throughout the Deseado Massif, several of them very much world-class, including Cerro Negro, Cerro Moro, and San Jose.

Dr. Allen Alper: What are your primary goals for 2020?

Damien Koerber: In 2020, we're applying a dual track strategy of executing both near-plant brownfield and greenfield programs. Our immediate near-plant focus is around the historic Taitao Pit, which was mined between1995 to 2000 to shallow depths of 35-45 meters by Coeur Mining. It was mined when gold and silver prices averaged US$325 and US$5.2 respectively – so at today’s prices we think a good opportunity exists there.

We're very encouraged by the potential underneath and peripheral to the Taitao pit. A pit expansion study was conducted previously, by Coeur Mining, between 2003 and 2005, based on approximately 66,000m of drilling, which we are incorporating into our resource review, which is underway.

We're also going to be reviewing the other existing established resources, including the nearby Marcela underground mine, which is a high grade, vein-style system, with 43.101 compliant remaining resources of approximately 21.8Koz at 2.53g/t gold and 2.74Moz at 318g/t silver. Collectively, those two resources could potentially approach the critical resource mass, to justify a mine restart.

As well as the brownfields focus, the greenfields objective in 2020 is to establish two or three newly generated targets and advance those as individual new targets as high-grade feeder ore for the resource base.

By the end of this year we want to have the resources firmed up at the historic Taitao Pit and the Marcela Mine, while simultaneously advancing greenfields discoveries, spearheaded by advancing our Frison and Droughtmaster Prospects.

Dr. Allen Alper: Well, 2020 is going to be an extremely exciting time for Equus Mining Company Limited. So that's really great.

Damien Koerber: A lot of the exploration throughout this district was done in the 90s/early 2000´s by mining-focused companies, with the last decade being spent primarily on the mines around an area called Laguna Verde. We are applying exploration principles and models throughout the entire district, with a highly experienced and motivated exploration team. Members of this team were involved in other discoveries throughout the Deseado Massif, including Cerro Moro and Manantial Espejo. We feel we're well positioned to be able to both confirm a reasonable existing resource base and also discover new vein systems. On a district scale, throughout Cerro Bayo there are 2-6km‘s between the individual deposits, many of which lie along district scale regional structural trends, which merit a lot more detailed exploration, particularly drilling. Overall, after a relatively short amount of time on the ground at Cerro Bayo, we are very encouraged by the exploration potential of the land package.

Dr. Allen Alper: That sounds exciting, that's great. Could you tell our readers/investors a little bit about your background, your experienced Board and Management Team?

Damien Koerber: Absolutely. I graduated in 1989 with honors from the University of New South Wales, then spent five years with Billiton Gold in Australia and was fortunate enough to be a member of the exploration teams involved in 4 gold discoveries, three in the Northern Territory and one in Western Australia. The latter being the Sunrise Dam Cleo deposit, which is now approaching 12 million ounces gold in past production/reserves.

In 1994 I made my way to South America whereby I was based mainly in Chile, but worked extensively throughout Chile, Argentina, Brazil and Peru, continuously for about 25 years. Most of my experience was focused on epithermal gold, within Patagonian Argentina and Chile. I was part of the discovery team at the Cap Oeste deposit located in the Deseado Massif in Argentina, which attained a 1.2-million-ounce gold equivalent resource and still in production today.

It takes a dedicated unified team to make good discoveries. In Equus we’ve built an experienced team, headed up by our Chief Geologist, Guillermo Chacon who comes with great discovery experience, including the Cerro Moro gold-silver deposit in Argentina.

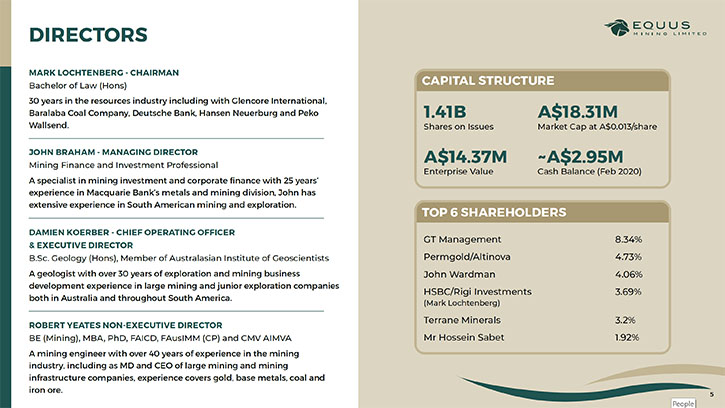

Our Board has some prominent business figures, with Mark Lochtenberg as Non-Executive Chairman and involved in other large ASX-listed companies, such as Nickel Mines. Our Managing Director is John Braham, who brings a distinguished investment and corporate finance career, predominantly with Macquarie bank.

Dr. Allen Alper: Well you have a great background and the Board is extremely strong, so that's truly excellent. Could you tell our readers/investors about your capital structure?

Damien Koerber: We have 1.4 billion shares on issue and a market cap of approximately AUD 18.3M.

At the end of February we had close to AUD$3 million in the bank.

A notable shareholder is Norm Seckold, who was involved in Bolnisi gold, which was sold to Coeur d'Alene back in 2008.

It's fairly tightly held between management and some cornerstone investors that have been with us for quite a while. I have a significant stake also, so plenty of incentive to get discoveries under our belt, the Cerro Bayo mine reactivated and producing gold and silver.

Dr. Allen Alper: Well, it's good to see that the Management and Board have skin in the game and are committed to the Company, believe in the Company and are invested in the Company. Could you tell our readers/investors the primary reasons they should consider investing in your Company?

Damien Koerber: We have, I believe, one of the commanding epithermal district portfolios globally. Highly motivated, and incredibly hardworking, our exploration team is well positioned and capable of making significant discoveries. We're operating in a jurisdiction, which is very receptive to mining with approximately 80% of the local town´s revenue historically derived from mining. So we have very strong support in that town for our activities, and it is a well serviced, nearby base for exploration, which is also credited with a skilled workforce.

I think it's a very compelling story.

Dr. Allen Alper: Yes. I think so too.

Damien Koerber: Cerro Bayo is the core part of Equus´s overall package, and we also hold two other nearby satellite projects. The current focus is clearly Cerro Bayo, but both of these other projects hold fantastic potential and could well provide additional mill feed to the central Cerro Bayo infrastructure in the future.

Dr. Allen Alper: Sounds like excellent reasons for our readers/investors to consider investing in Equus Mining. Damien, is there anything else you'd like to add?

Damien Koerber: We hold a commanding epithermal portfolio, with lots of exploration potential, in a potentially multimillion-ounce district, with established, well maintained mine and processing infrastructure that could permit nearby production.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about Chile? How it is operating in Chile and the Chilean government?

Damien Koerber: I lived in Chile for 25 years and chose that option for a very good reason. Chile is a strongly mining based country that holds and produces approximately 30% of the worlds copper. Chile, in general terms, lacks the highly bureaucratic systems inherent in other South American countries, which commonly experience high inflation and high sovereign risk. Chile possesses a large established network of highly skilled professionals for the mining industry and is logistically very well serviced.

We also enjoy strong support from both the federal and local Chilean government mining bodies and related entities, who view mining as a key industrial activity for the region, within which we operate

Cerro Bayo is located in a region where previously mining was one of the core pillars of the local economy and was one of two mines originally in the district, for which each had been operating for between 20-25 years. Both were shut approximately three years ago, with the other one only recently restarted, but on a very reduced scale.

Dr. Allen Alper: That sounds excellent! I’m very impressed. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Damien Koerber: Thank you, Al

http://www.equusmining.com

Telephone: +61 2 9300 3366

Facsimile: +61 2 9221 6333

Email: info@equusmining.com

|

|