Resolution Minerals Ltd (ASX: RML): Exploring the Largely Unexplored 64North Project Surrounding Northern Star’s Pogo Mine in Alaska, with 10 million Ozs; Interview with Duncan Chessell, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/22/2020

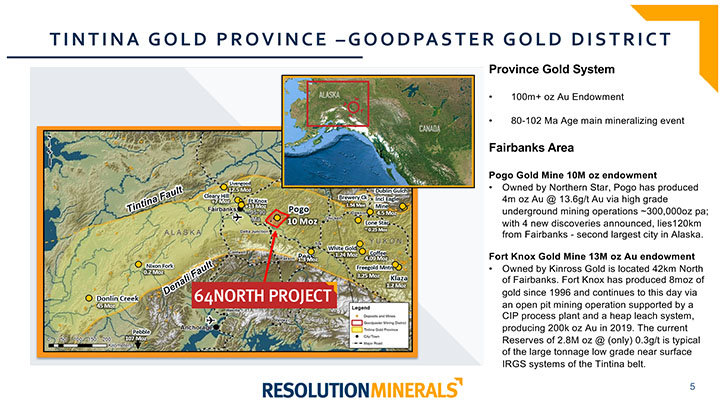

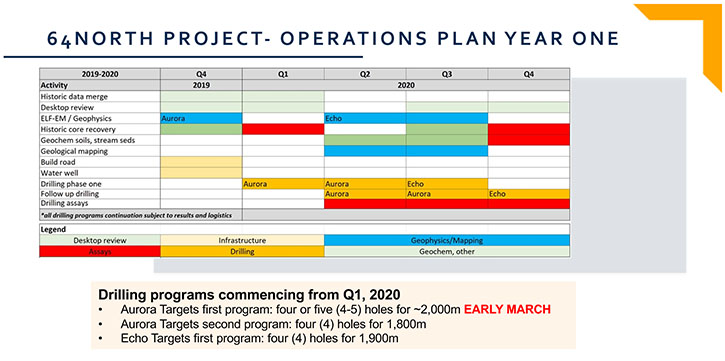

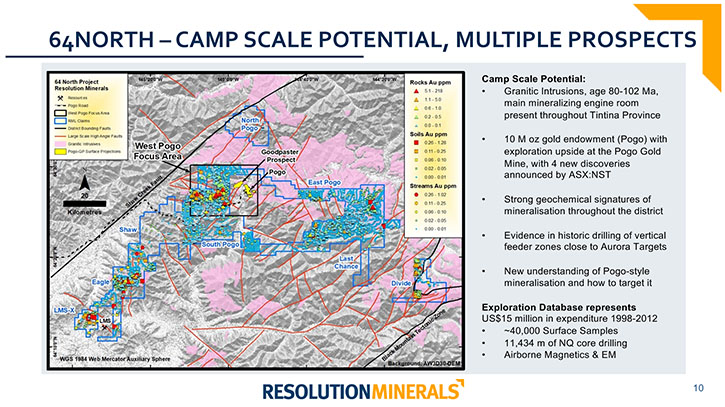

Resolution Minerals Ltd (ASX: RML) (formerly Northern Cobalt) has entered into a binding term sheet, with Millrock Resources Inc., to acquire, via joint venture earn-in, up to 80% of the 64 North Gold Project, located within the Tintina gold province, Alaska, which hosts more than 80Moz in gold, including the massive 45Moz Donlin Creek deposit. Divided into a pipeline of nine prospects, largely unexplored, the 64 North Project surrounds Northern Star’s Pogo Mine, total endowment of 10 million ounces of gold and is currently producing at a rate of 300,000 ounces per annum. We learned from Duncan Chessell, Managing Director of Resolution Minerals that they immediately built a road into the project and were able to commence drilling early this year, with the results coming back right now. Plans for 2020 include a fully funded exploration drilling program at the Aurora and Eco prospects.

RML's Aurora Drill Target with NST's Pogo Gold mine in the background

Dr. Allen Alper: Allen Alper, Editor in Chief of Metals News, talking with Duncan Chessell, who is Managing Director of Resolution Minerals. Could you give our readers/investors an overview of your Company?

Duncan Chessell: Thanks, Allen. Resolution Minerals is an Australian Mineral Exploration Company, listed on the ASX. We have a number of projects around the world, but our flagship project is the 64North Project in Alaska, right alongside the Pogo gold mine, which is a world class, high-grade operating goldmine, owned by Northern Star, which is also an Australian listed company.

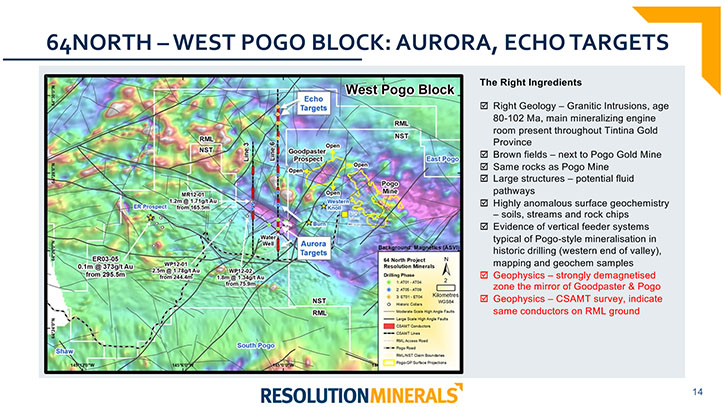

The Pogo gold mine has produced over four million ounces, in its mine life to date, and at a grade of a bit over 13 grams per ton, at a rate of around 300,000 ounces per year, on a historic average. We're sitting right alongside this operating world-class gold mine, with overall a 10 million ounce endowment and we're drilling holes right along the boundary from there in the same rocks, same para-gneiss host rock. We're seeing the same Pogo style IRGS, intrusion-related gold system style of minerals, in the holes that we've drilled to date. And we're about to kick off our next drill program in a few weeks’ time, to vector in, hopefully, on the high-grade gold zones.

We also have a project in Australia, a cobalt resource, the Stanton deposit in Northern territory, up close to the Northern territory Queensland border, the Gulf of Carpentaria. That's a project where we drilled out a new resource in 2017, 18. The price of cobalt came off considerably as that project progressed and unfortunately we were not able to secure funding to take it any further at the time, but we have a view that cobalt will come back. It's also potential for copper. We have some drill-ready copper targets there as well. If we ended up switching back to battery metals, your copper, cobalt focus, then this project is sitting in our back pocket as a great backstop.

We come from a gold exploration and base metals experience set, so we're quite familiar and happy to be playing in the gold space. Love the gold space! We've done a lot of exploration for gold, good place to be right now. And we're very fortunate to have had this opportunity to obtain access to the ground, through a joint venture we're in with Millrock Resources, which is an Alaskan Company, although it is listed on the TSXV. They are based there in Anchorage and Fairbanks.

They are a project generator group, so they don't tend to raise the equity themselves. They tend to come up with the ideas, package the ground, talk to all the local prospectors, pull the whole area together, grab all the historic data and then look for a joint venture partner, such as Resolution Minerals to come in. We're on a sole funding period, for four years, to earn up to a 60% interest initially on projects and through various other conditions, we can go through to an 80% interest in parts of the project, if we wish to. And we're spending through that four year earning period, which is a sole funding period for us, it's 5 million US per annum over the life of that four year earn-in.

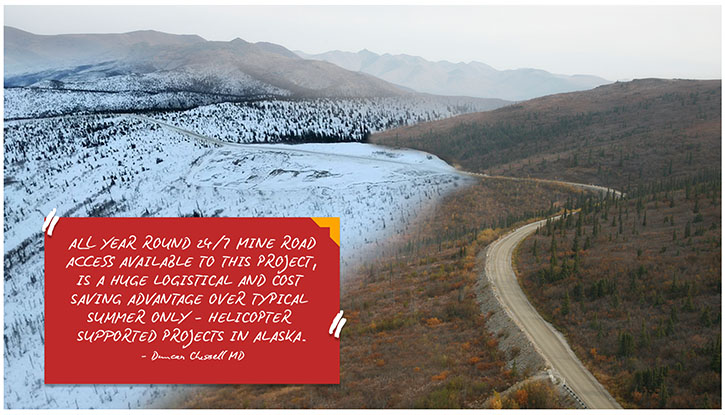

That's it in a nutshell. There are obviously a few nuances to it all, but we only recently acquired the project in late 2019. We not only acquired the project late last year, but we pushed in a road immediately prior to winter setting in, so that we're able to get land-based equipment to site to start drilling. That was pretty key to get land access to this project in Alaska because we're seeing companies go out and spend a lot of money on helicopter accessible projects and the funding requirements on that make it pretty onerous. We want to be able to maximize our “bang for our buck”, as we like to call it in Aussie. To get that value, it was important to get that road in, so we were able to commence drilling in late winter this year.

Unfortunately, that was cut short with COVID related issues, but we feel that we've solved those operational issues now and we're actually looking to send the bulldozer back in to touch up the road, as thaw is happening at the moment and then get the guys back in with the rigs shortly thereafter.

Dr. Allen Alper: That sounds excellent. Sounds like the rest of 2020 will be an exciting time and 2021 will be a great time for Resolution Minerals. That sounds great.

Duncan Chessell: What's your background Allen?

Dr. Allen Alper: I'm an economic geologist.

Duncan Chessell: How long have you had Metals News?

Dr. Allen Alper: I founded it about 20 years ago. I would say about 50% of our articles and interviews are with Canadians and about 35% with Australians. The rest are with the United States and other countries.

Duncan Chessell: Where are you based?

Dr. Allen Alper: I used to be based in the Boston Area, but right now, I'm in Pennsylvania, out in the countryside, where I don't need to worry about COVID-19. We also have an office, an hour away, in Corning, NY and another in Chicago, Illinois.

Duncan Chessell: I spent a little bit of time up at UMass a while ago, it’s a nice part of the world.

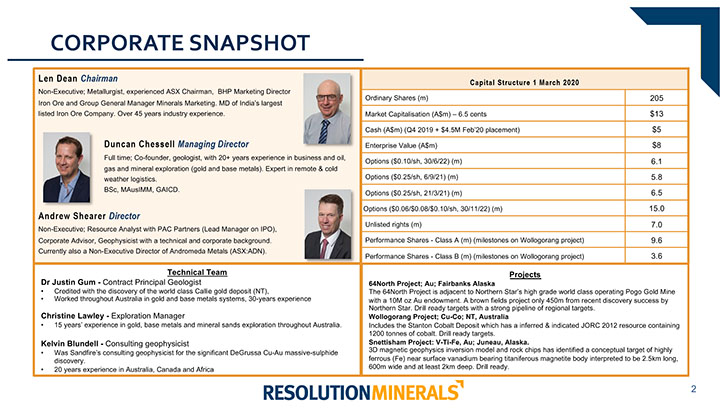

Dr. Allen Alper: Could you tell our readers/investors, a little bit about your background and your team?

Duncan Chessell: I've been involved in various businesses for over 20 years from exploration, geology and mineral stands, a little bit of petroleum work early on, straight out of uni. And then gold base metal exploration, mostly in Australia. A little bit of experience in Papa New Guinea. Not experienced previously in Alaska in exploration, but I also had a background in adventure tourism and ran an adventure tourism business for around about a decade as well. I ended up visiting Alaska a number of times for significant outdoor activity. Used to guide the seven summits, the highest peak on each of the seven continents. Climbed Everest a few times and also Denali and all the highest peaks, on all the other continents. Have an exploration, geology, outdoor background as well. Love the wilderness areas of the world. And certainly, Alaska is a beautiful place to be, with very well endowed mineral systems up there.

I guess that's what really has sparked a renewed interest in going back to Alaska. We have a pretty good geology team as well. A principal geologist, Justin Gum, has been directly credited with the discovery of the world-class Callie gold deposit, in the Northern territory, in the granites and a number of other significant gold deposits in Australia as well. He's worked all over the world, consulting throughout Asia, within other gold projects and base metals and has also been an exploration geologist for about 30 years now.

Also our excellent exploration manager, Christine Lawley, has worked all over Australia, in gold and base metals. And then a great geophysicist as well. We have a pretty good blend of people there, but I guess it's not only that, that we're taking to the team. We've actually joined forces with Millrock Resources. You might've heard of a guy called Phil St George. Have you come across him before?

Dr. Allen Alper: Yes, I did.

Duncan Chessell: Yeah. Phil St George is the principal exploration geologist for Millrock Resources and he's credited with making the discovery of the Pebble deposit in Alaska. That's 50 million ounces of gold. Plus, he added another 12 million ounces of gold on another resource up there as well. He's worked all over the States. We also have, as part of our team, consulting for us, is Gabe Graf, who is the ex Sumitomo exploration's superintendent, who owned the next door Pogo Gold Mine. He stayed on and worked for Northern Star, when Northern Star purchased the mine from Sumitomo in 2018. So he's worked over the fence for our neighbors, which is great to have his experience to draw on. Gabe was also credited with the discovery success of the Goodpaster Prospect, which is right next door to where we're drilling.

Pretty well-rounded team. There're another couple of exploration geologists as well on the team. Greg Beischer, the CEO of Millrock, has been in the minerals game for decades up there with Inco. Then the field exploration geologists, Chris Van Treeck, it goes on, so it's not just Aussies coming in, with no experience of Alaskan geology at all. That's not the case. We have a blended team between the Alaskans and the Aussies. The Aussies have a lot of very strong gold experience over here. And the Alaskans, with a lot of on-ground experience in logistics and also gold systems in there, with Phil St Georgia, having 62 million ounces to his name. He's not a bad guy to have on your side. And then Gabe Graf, having worked all over the Pogo goldmine for Northern Star, is also pretty handy. We have a pretty strong geology team.

Dr. Allen Alper: Well, it sounds like you have a great team there and that's really very, very important and you're in a great location and your team knows how to explore for gold. They also have experience in Alaska too, besides the Australian great experience. It sounds like you have an extremely strong team, Duncan.

Duncan Chessell: Yes, we are fairly pleased with the group and I guess the breadth and depth of experience and expertise in different specializations is pretty good. They're right now in more drill programs, where it's very early stage. We've only had the first assays back from two thirds of the first hole. We're hoping for assays next week for the rest of hole one and hole two. At the moment what we're seeing, is the geochemical sequences, we're seeing gold, bismuth, arsenic and tellurium in close correlation. That tells us that we're in the same system they have at Pogo, same style of mineral system.

The gold grades to date, on the first two thirds of a hole, were not economic numbers, but they certainly tell us that there is gold in the system. We're very close potentially to a larger system. It gives us a lot of encouragement to get out there and drill the rest of these holes. We're fully funded to drill the next program. We are really looking forward to getting out there to see what we have.

Dr. Allen Alper: Well, it sounds like the next few months will be very exciting times for you and your explorers, a lot of fun too.

Duncan Chessell: Absolutely. Everyone's very focused right now on what we're doing on the West Pogo zone. We've broken the project up into nine blocks. One of the blocks, West Pogo, is our main focus for drilling at the moment, at the Aurora prospect. We also have the Echo prospect to the North, which is immediately along strike on the Northwest of the Pogo gold mine itself. That'll be drilled later in the year. The other thing we have, is a number of other prospects on the project area, such as Eagle, Boundary, et cetera, which in many other companies would be their flagship prospect. We're very lucky that we have a huge pipeline of near drill ready, really exciting other prospects.

We're very fixated right now on West Pogo, but we just got on the project. We've only been on the regional work for the last couple of months, desktop review and we're finally formulating our regional exploration plan. We're getting very close to announcing what it is we're planning to do regionally. To me, that is a potential camp scale system, it’s a very prospective project area. There is a lot of gold in the system, all over. It's really exciting. You just don't see this kind of opportunity, as an Australian junior, over here in Aussie. There's just too much competition to get on a project. You would never get this sort of project in Australia these days. It would have been already drilled and tested for decades.

This one's just a bit of an anomaly, in that it's sitting up in Alaska there. You saw the push in the Yukon. You'd probably know it better than I, maybe 10 or 12 years ago. It seemed like people stopped at the Canadian boundary, the border going into Alaska. I don't really know why. Maybe exchange rate or something else. Millrock, wasn't able to attract funding into this project with us, until recently last year. I guess because the Canadian market went to crypto when it went to cannabis stocks. There just wasn't any funding available for this when they picked it up a few years ago, or started to acquire all the ground.

There are a couple of things that have contributed to this being the right time, right place and right commodity, right prospectivity. I feel really lucky that we were able to be there at the right time and right place and see the opportunity and grab it, with both hands, and now we're going to run with it and see what we can achieve.

Dr. Allen Alper: Well, it sounds like an excellent prospect and an excellent opportunity for discovering a huge amount of gold. That really sounds great. Could you tell our readers/investors about your share and capital structure?

Duncan Chessell: There's a bit of a variation in how the share structures often play out with Canadian versus Aussie companies.

At the moment we have 206 million ordinary shares on issue and a series of other options. Some of the Options are listed and some of them unlisted. We publish those on every ASX. It's very clear for all of our investors to see what those are. We have some listed options, 6 million at 10 cents. We have some unlisted options, about 13 million at six and we have another 12 million at 25 cents. Some of those are hanging on from when we IPO'd a couple of years ago, the 12 million at 25 cents options.

We have some unlisted rights. They're performance rights for some of the staff, Board and senior staff, within the Company. There're seven and a half million rights there. Most of those are milestone based. If there are certain ounces to find, then that would trigger some performance rights to various staff members and so on. We do have some performance shares hanging in there as well, from the previous prospect project. The Northern territory project, there're around 12 million of those sitting there. They're timing out in another 18 months. Those performances look like they won't be triggered in time and they'll probably expire.

We have a few Australian institutions in there, in the register and they participated in the last capital raise. We raised four and a half million dollars Australian at 5 cents in February of 2020 via placement. And we had around four or five Aussie specialists coming on that, plus sophisticated investors. The interesting thing with that raise, was we had $12 million bid into the book, within about two hours of going into trading halt. So we closed that raise very quickly. Strong interest and strong support from Australian investors into the gold space at the moment. We don't see that funding is an issue. Now we are focusing on vectoring the high-grade gold zones.

Dr. Allen Alper: That sounds like an excellent approach. Could you tell our readers/investors, the primary reasons they should consider investing in your Company?

Duncan Chessell: I guess if you look at the stage we're at, at the moment, we have some significant indications of incredibly prospective ground. We have drill ready targets and we're commencing drilling soon on those. They have assays still coming in from the last drill program and we're fully funded for the next drill program as well. There's no immediate capital raise coming up and we have drill targets next to a 10 million ounce gold endowment. So, we're in a great neighborhood and we've already hit what we see to be the right rocks.

Dr. Allen Alper: Oh, that sounds excellent. Is there anything else you'd like to add, Duncan?

Duncan Chessell: Thank you for interviewing Resolution Minerals for Metals News. It's exciting times for the Company. News flow over the next few months is going to be very interesting. So watch this space."

Dr. Allen Alper: Sounds excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.resolutionminerals.com/

Duncan Chessell

Managing Director

Resolution Minerals Ltd

+61 414 804 055

duncan@resolutionminerals.com

|

|