GMV Minerals Inc. (TSX-V: GMV): Developing the Mexican Hat Gold Project, in Arizona, USA, with Near Term Gold Production Plans; Interview with Ian Klassen, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/22/2020

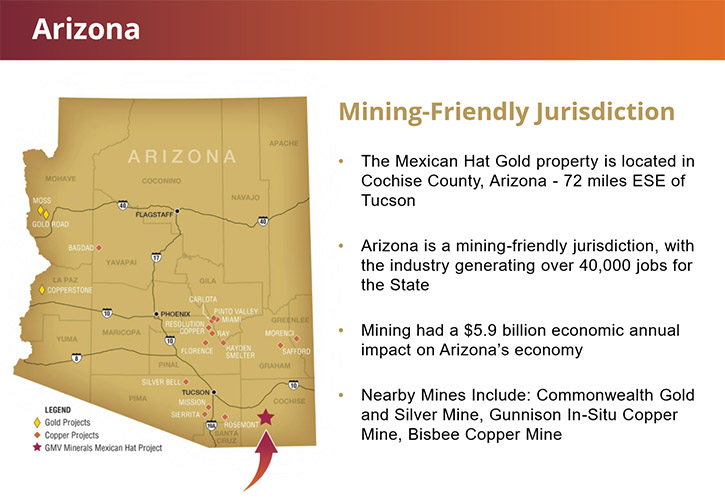

GMV Minerals Inc. (TSX-V: GMV) is focused on developing the Mexican Hat Gold project, located in Cochise County, Arizona, USA, with near term gold production plans. The project contains an inferred mineral resource of 32,876,000 tonnes, grading 0.616 g/t gold at a 0.2 g/t cut-off, containing 651,000 ounces of gold. The NI 43-101 Technical Report, Preliminary Economic Assessment was released in December 2018. We learned from Ian Klassen, President and CEO of GMV Minerals, that they are in the process of updating the PEA, with lower cap-ex and longer mine life. Mr. Klassen believes in a stronger gold market going forward.

The Mexican Hat Gold project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ian Klassen, who is President and CEO of GMV Minerals Incorporated. Could you give our readers/investors an overview of your Company?

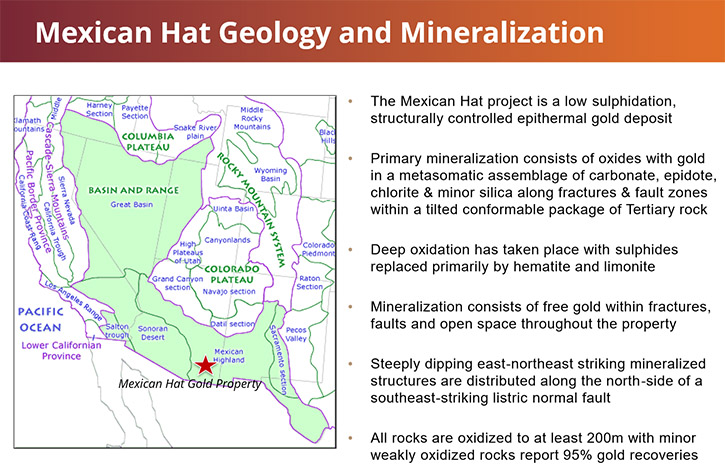

Ian Klassen: Hi Allen! Absolutely. Nice to be with you today. GMV Minerals is a Company that trades on the TSX Venture Exchange. We have approximately 54 million shares issued. We have several hundred shareholders, of whom seven are very large and own between three and five million shares of the Company. We have our entire focus on the Mexican Hat gold deposit, in Southeast Arizona. The Mexican Hat is a low-sulfidation, structurally controlled, epithermal gold deposit, which we've worked on over the last number of years. I look forward to answering any specific questions you might have.

Dr. Allen Alper: Great. Could you give us a little more information on the Mexican Hat project, the size of the resource and your plans for 2020?

Ian Klassen: Absolutely. The Mexican Hat was discovered by a prospector named Manny Hernandez, who unfortunately left us in 2019 before this could be developed into an operating mine. The property itself was previously held and worked on by Placer Dome, a big company in the early nineties. Placer's field staff recommended that the project continue, but head office acted in a different manner, which they're apt to do. Over the years, the project had been held by a number of companies that had fractional ownership, but only under GMV, were we able to assemble the property that is now the Mexican Hat, in which we have a 100% interest. To date there have been 203 holes drilled on the property. We currently have a resource that is open in three directions and we have completed a preliminary economic assessment on the property.

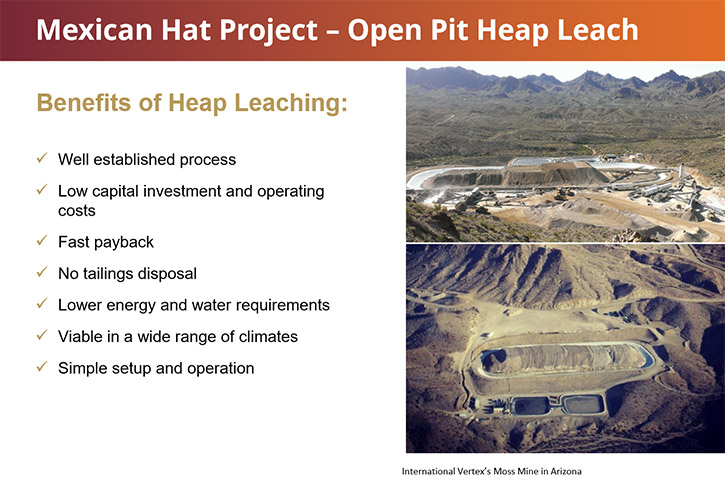

We have a NI 43-101 resource calculation that was done by Tetra Tech and DRW Geological Consultants, which confirmed 651,000 ounces in the inferred category, which graded 0.616 grams of gold per ton. It's not a high-grade deposit, but that's okay as this lends itself very well to an open-pit heap leach style extraction. Importantly, we have terrific metallurgical results, having done a number of bottle roll tests, but also two large column tests that yielded enviably high recoveries in the mid-nineties.

Dr. Allen Alper: My understanding is you might use heap leach technology for mining this project.

Ian Klassen: That's exactly right. We've been really lucky to have direction, from a metallurgical standpoint, from John Fox, who might be well-known to some of your audience. John is a highly respected professional engineer, who is an expert in metallurgy. So, we have every reason to believe that we'll be using conventional, well-proven, leach & carbon absorption technologies. No need to agglomerate and a pretty standard circuit, with two stages of crushing.

We're in the midst, right now, of taking receipt of a new resource calculation on the property, being co-authored by Tetra Tech and DRW Geological Consultants. The reason we did it is because we will be doing a new preliminary economic assessment. In order to do so, because we did drill some of the gaps in our modeled pit at the Mexican Hat, we have to describe those and how they altered the model before we can get going on the PEA itself.

Dr. Allen Alper: So now what are your plans to have the PEA established?

Ian Klassen: Once we update the resource, we will move ahead with the revised PEA. There was nothing particularly overly wrong with the PEA we received in early 2019. The report concluded a two stage open circuit crush. They had us pegged at 15,000 tons a day of throughput, using a conventional heap leach pad. They identified that we had a five year mine life that was open to expansion. We had a low strip ratio for the life of mine of 2.8 years and an internal payback of two years and the internal rate of return of better than 33%. That was all being done on $1,300 gold that had us at about 94,000 ounces a year of production. Overall, not a bad place for us to be. The folks that did our report are very sound and are well recognized for what they do. But we felt that the capex was too high and that the mine life itself being five years, wouldn't lend itself to a conventional financing method.

So we've retained Denver based Samuel Engineering to be our project lead. They have many decades of experience with this type of resource. They're partnering with Golder & Associates, RESPEC and Tierra Group International. And in about four months from now, they'll deliver a PEA to us. As you know, I'm somewhat limited in how I can discuss the economics of the project, until we have a report in hand, but we have every reason to believe it again will be a two-stage crushing with no agglomeration, except this time we'll have an eight year mine life, with a throughput that's geared more to about 60,000 ounces a year of production.

We have a viable project, with a rising gold market located in a safe jurisdiction. I think lots of folks should be watching us.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell readers/investors a bit about what is happening in Arizona as far as mining is concerned?

Ian Klassen: As you know, Arizona is a very mining rich jurisdiction, well known to some very large companies operating in copper, gold, silver and other commodities. The former Commonwealth Gold and Silver Mine is just about four kilometers up the road from us. There's lots of activity, searching for big, large, copper porphyry's, within the state. Arizona Metals is active there as well as a host of others. We look forward to having this project move itself into a development phase, with future drilling that will take our resource from an inferred to a measured and indicated category. It's an excellent jurisdiction in which to work.

Dr. Allen Alper: Oh that sounds great. Could you tell our readers/investors a little bit about your background and your Team?

Ian Klassen: Sure, by all means. I've been a resident of Canada my entire life. In the late eighties and early nineties, I had a real bug for politics and so ended up working in our Nation’s Capital, Ottawa, as the Chief of Staff for the Speaker of The House of Commons. Once I had had my fill of national politics, I moved into corporate communications and finance. It was a natural move from that into working for a few select companies, where we have added value.

We have a management group that really gels and is focused on these projects. As you know, it's been a difficult business, over a number of years. I think we have been really lucky to find an absolutely first rate team on the geological, engineering and administration side.

Dr. Allen Alper: It sounds like you have a very strong background. Could you tell us a bit more about some of the members of your Team?

Ian Klassen: Yeah, by all means.

Let’s start with Alistair MacLennan. He is a well-known Vancouver-based businessmen, involved in a number of different sectors from aviation to oil & gas. He's a very large shareholder, owning over five million shares. He has been a huge supporter of the Company, playing a key role in its development.

Michele Pillon is our Chief Financial Officer. Michele has been working with junior mining companies for over 25 years. Importantly, we also have Dr. David Webb, our acting Project Manager. He has been absolutely instrumental in developing all aspects of the Mexican Hat resource. He is a first rate mining engineer and geologist. On the Board, we have Robert Coltura, Douglas Perkins and Carl Hale. All of whom continue to play key roles in finance and geology.

Dr. Allen Alper: It sounds like you have a very strong team. Could you tell our readers/investors the primary reasons our readers/investors should consider investing in GMV Minerals?

Ian Klassen: I think it comes down to a value proposition. We're in a rising gold market, I think the overall trend of gold is to continue to go up. We haven't seen that in any sort of consistent manner for many years. I think that with the global situation, with COVID and all the macroeconomic issues in front of us, it just speaks to a stronger gold market going forward.

In our particular situation, we have a market capitalization somewhere around C$7.5 million, which is pretty low considering we have a project that's been through a PEA stage and is only going to get stronger. We are focused, have a new approach, with different economics and different components being assembled.

Our project has superb metallurgy, lends itself very well to an open-pit, heap- leach style system and we're on the verge of a new resource calculation and a new PEA that we feel is going to put a brand new face on the Company going forward. We're going to dedicate the time and the effort to knock on a lot of doors and make sure people know about us.

Dr. Allen Alper: Well that sound excellent. Sounds like very strong reasons for our readers/investors to consider investing in GMV Minerals. Is there anything else you'd like to add, Ian?

Ian Klassen: We do have a couple of other strong drill target areas, within our property. We are open at depths, we're open to the Southeast and we're open to the West. Directly south of the Mexican Hat proper, we have what's called the Little Hat, which is a highly prospective target on which we've done a lot of pre-drilling work. I wouldn't be surprised to see us with a drill program on the Little Hat, as well as another target, which is about 500 meters to the East of the Mexican Hat, we call it the Hernandez Hill. We've done lots of soil geochemistry and mapping and an IP survey, on which we're just awaiting the results to help us identify any interesting anomalies.

This area is very interesting to us. It has all the anomalous pathfinders at surface. There's lots of outcropping silicified rock, with opaline quartz. It has all the right mixture for what you'd want to see. So while we have the Mexican Hat and maturing it, we also have these other speculative targets that we feel really good about and are spending a lot of good time and effort trying to analyze. So beyond that, stay tuned to more of our reporting and I think you'll see the value being built in the Company.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.gmvminerals.com/

GMV Minerals Inc.

Ian Klassen

Tel: (604) 899-0106

Email: info@gmvminerals.com

|

|