BlackEarth Minerals (ASX: BEM): Fast Tracking the High-Grade Near-Surface Graphite Project in Madagascar: Interview with Tom Revy, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/17/2020

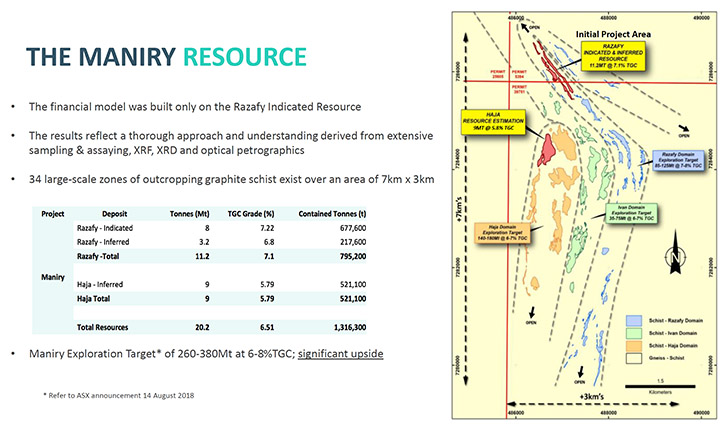

We learned from Tom Revy, Managing Director of BlackEarth Minerals (ASX: BEM), that they are focused on fast tracking the high-grade, near-surface Maniry Graphite Project, located in the southern region of Madagascar. We learned from Mr. Revy that their current resource is about 20 million tons of material, grading from 6% to 7% total graphitic carbon (TGC). The property remains open to further discovery, with the current project area well positioned to pursue its exploration target of between 260-380 million tonnes of graphite at 6-8% TGC. With the ultimate strategy of getting to cashflow as quickly and responsibly as possible, BlackEarth will continue to maintain its current momentum, in order to take advantage of the predicted natural graphite shortage forecasted until 2023/24.

BlackEarth Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Tom Revy, who is Managing Director of BlackEarth Minerals. Tom, could you give our readers/investors an overview of your Company?

Tom Revy: The Company was listed in early 2018 with the focus on developing the Maniry Graphite Project in Madagascar. The project is located in the far South of Madagascar, not far from Rio Tinto's QMM Mineral Sands Operation. BlackEarth is ASX listed and over the last two years we've accomplished quite a lot of tasks in terms of heading towards our ultimate strategy, which is getting to cashflow as quickly and as responsibility as possible.

Dr. Allen Alper: Great. Could you tell us a little bit more about your projects?

Tom Revy: The Maniry Project is located in the South of Madagascar. The project area itself covers about seven kilometers by three and a half kilometers. Geologically, it sits immediately adjacent to a large labradorite intrusion, with subsequent secondary granite intrusions. The project area appears to have gone through a secondary metamorphosis, which has resulted in higher grades and in particular larger flakes being established.

The graphitic material all occurs at surface. It outcrops in about 35 different areas, over that project area, covering areas as much as 600 meters by 350 meters. All the exploration has been done, using diamond drilling which assists in the QA/QC management of the project. We have gone to great expense to understand what's in the ground. Not only have we assayed the normal total carbon, total graphitic carbon and sulfur, we’ve undertaken full XRF across all samples, to understand the chemical or elemental variability, throughout the resource, along strike and down-dip. We've also done extensive XRD and optical pictographics, to understand the mineralogical variation that exists along strike and down-dip as well, ultimately to generate a detailed geo-metallurgical model, from which we should produce a product, which is consistent for end users; whether it's tomorrow, next week, next year or in five years’ time.

So, we've gone about things a bit different from your standard mining project. I think, from a graphite mine point of view, we have ensured that we understand what is below the ground – in detail. We then spoke to off-takers to understand the specifications they require. From there we've basically reverse-engineered all of that into a process flowsheet to ensure that we have a consistent product over and over again. It is a bit different from a normal mineral processing project, but very much targeted towards the end user.

Dr. Allen Alper: That's very good. Could you tell our readers/investors the markets you plan to go after, and the products?

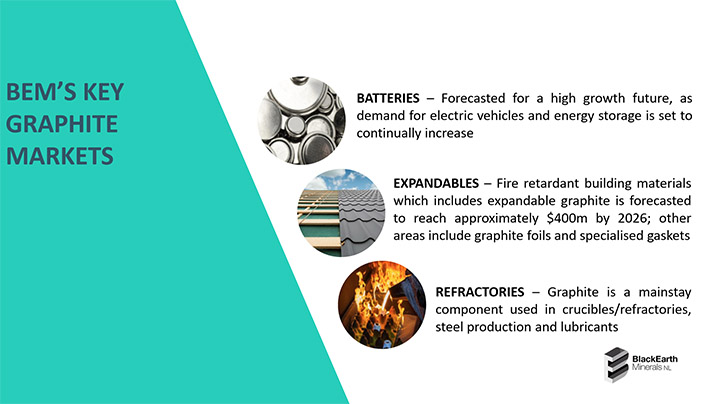

You are right saying products. A lot of people view graphite developers simply as producers of one generic product - graphite. In our particular case, we are looking to produce primarily coarse material. A percentage of about 25% to 30% is suitable for the battery market. Recently we announced that our material has been tested by a German independent laboratory and by a number of end users and we've been given a thumbs up, in terms of its suitability for the battery anode market. Even more importantly, the bulk of our material fits into the high-quality refractory market as well as the expandable markets.

The refractories market is largely linked to global economic growth because of its use in steel production around the world and in particular China. The outlook for that is probably flat to, 2% to 3% growth per annum. The expandable market which takes the product, sometimes as low as 150 micron, but generally above 180 micron; that's the material that really can generate a lot of revenue for the Company and we're focused on that. A good 50% to 60% of our material falls into the coarse category and the prices are potentially US $1,200 $1,600, $1,800 plus depending ultimately on the physical and chemical characteristics of that material and end-user acceptance / demand.

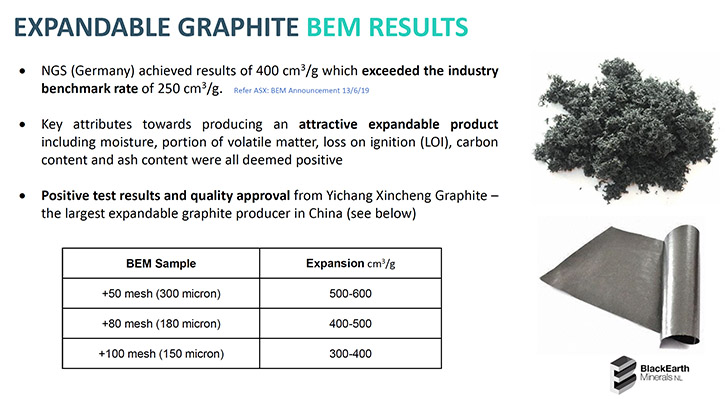

Our focus, from an offtake point of view, is definitely on the expandable side. To that end, we have engaged with a number of “expandable groups” and have had material tested independently, with results from 400 to 700 cubic centimeters per gram, which is significantly above the industry average of about 250 cubic centimeters.

Dr. Allen Alper: Could you tell our readers/investors a bit more about what's happening in the graphite market and what the projections are?

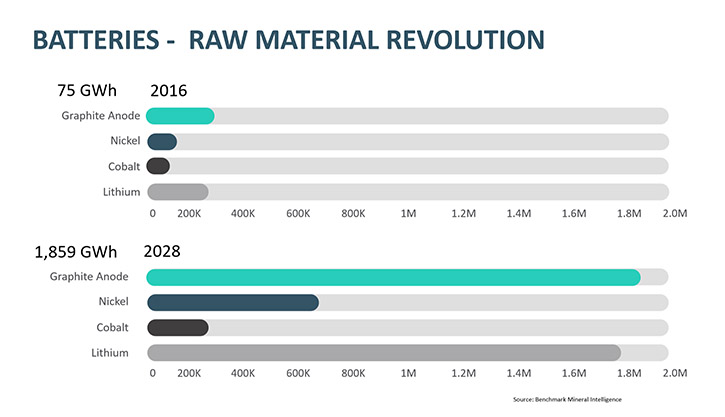

Tom Revy: There are a number of potential developers and new producers, who are likely to be predominantly fine to small graphitic flake producers. That means they are in direct competition with the Chinese, who produce the majority of the world's finer material, primarily for the battery market. Going head to head with the Chinese means that they are ultimately likely to be price takers. The Chinese generally have three types of pricing; the price for which they buy the fine material from overseas, the price for which they buy the fine materials from other Chinese producers and then the price, for that very same product, that they sell to overseas producers, which is the highest price.

The price depends on which side of the fence you're on. The prices can vary, just on that fine material, by around 50%. So, I believe the outlook for the battery anode materials, certainly on the short term, will be flat. By about 2023, 2024, I believe we should start to see improvement in that area. As the demand for lithium-ion batteries increases, we should see the price move positively, and of course that ultimately depends on market acceptance of electric vehicles. Refractory materials are likely linked to global growth and steel demand and the expandables is where we're most excited because we see that there is a significant opportunity in the market there and right now that material is likely to be in high demand. There's a limited supply of this material now, but we believe there’s significant growth potential in the future, particularly in the fire retardant area, where we saw in recent times, some devastating fires in London, the UAE, US and China, where apartments went up in flames fairly readily because of flammable cladding being applied to high rise apartment buildings.

That's now being changed. We're seeing changes in laws and regulations being implemented all around the world, including here in Australia, to new building standards. That means the addition of what could be best described as a fibrous expanded carbon, introduced in quantities of about 2% to 3% to cladding to minimize the threat of flames going up the outside of buildings. So that's a big market. It's only about 60,000 tons a year globally at the moment, but we believe the reason for that is the shortfall in supply. China is gradually decreasing its production of that material (due to a shortage of available and suitable resources) and so we think overall global demand for that particular area is going to grow very, very strongly.

This all takes into account the industry as it is today. What the effects of Covid-19 will have on any of these 3 key product lines for us, on the medium to long term however, is still an unknown.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your resources, what you found, and the extent of it?

Tom Revy: Our resources can be mined all basically from surface, so there's no pre-strip required. We commenced drilling in 2018. Initially we identified a resource of about 11 million tons, most of that was in the indicated category. We continued to drill in the area and found a further 10 million tons, immediately to the South on one of the larger outcropping areas. Our current resource is in the vicinity of about 20 million tons of material, grading from 6% to 7% total graphitic carbon. That sits within a very, very large Exploration Target. That Exploration Target sits within a seven by three kilometers area containing some 260 to 380 million tons, somewhere between 6% and 8% total graphitic carbon. It’s a large graphite district.

The project itself, not only has a robust and sizeable Resource, it also has significant upside, in terms of its ability to be expanded, with the potential to have a very long mine life. There are 34+ large scale zones of outcropping graphitic schist and the area remains open in terms of adding to that Exploration Target and ultimately Resource. After we defined the Resource, we did some further exploration to the Northwest of the project area and we came across an area there, which is returning very, very high-grade graphitic material in the order of 15% to 20% and as much as 40% total graphitic carbon. So, we will be looking at that during the course of this year to enhance the financial attractiveness of the Maniry Graphite Project.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit about the quality of your products?

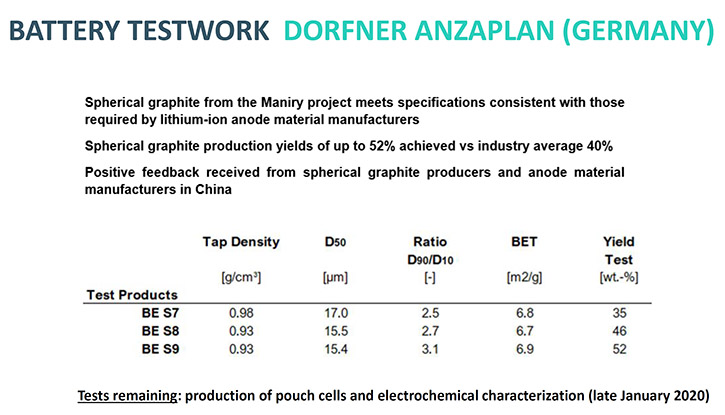

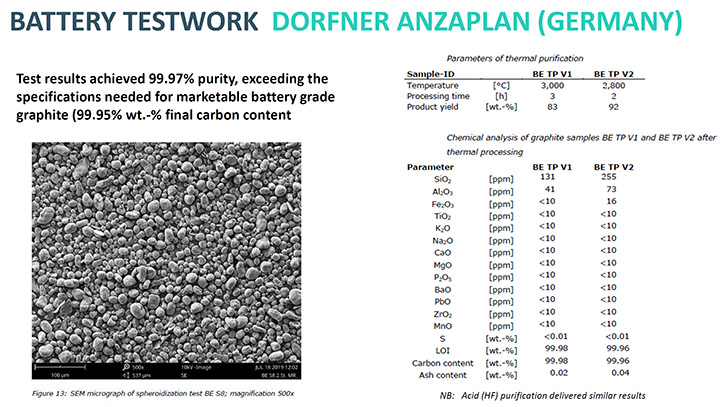

Tom Revy: We're targeting primarily three areas. The battery anode area, the refractories industry and the expandables market. In all cases, we've gone to independent laboratories and end-users and given them a significant sample to be able to test and verify the quality of the material. When we're talking about the battery material, we're typically talking less than 150 micron or finer or minus 100-mesh. That material went through a German laboratory, Dorfner Anzaplan. They undertook initially spheronization test work, purification test work and ultimately produced full cells, using our material, which was tested over a period of time for charging and discharging. The conclusion was, and we've made this announcement recently, that the Maniry material falls in line with some of the highest reference material Dorfner Anzaplan uses, demonstrating its suitability for the anode market.

Along the way, test work returned excellent yield results. We achieved yields up to 52% on our material, where the industry average is about 35% to 40% in terms of spherical graphite production yields. As part of the purification test work, the material achieved results of around 99.97 which is above the minimum requirement of 99.95 and the impurities themselves are not detrimental, in any way, for anode production. That purification was done both chemically and thermally and produced great results in both cases.

In terms of refractory, we had our material tested and ultimately approved by a company called RHI, which is one of the world's largest refractory producers. They have factories located in Europe, in Brazil and also in China and they approved our material for high quality refractories. A test laboratory in Germany, called NGS, indicated that the absence or very low content of calcium carbonate was a good indicator that the product we plan to produce is suitable for not only the refractory industry, but many other applications.

Finally, on the expandable side, NGS also tested our material and they returned a figure of 400 cubic centimeters per gram, which is above the industry benchmark rate of about 250. We then went to a company called Yichang Xincheng Graphite, located in Yichang, China. They tested our material, with positive quality results. Even on our finest material, BlackEarth material achieved results of 300 to 400 but as other materials, course materials returned expansion rates of four to 600.

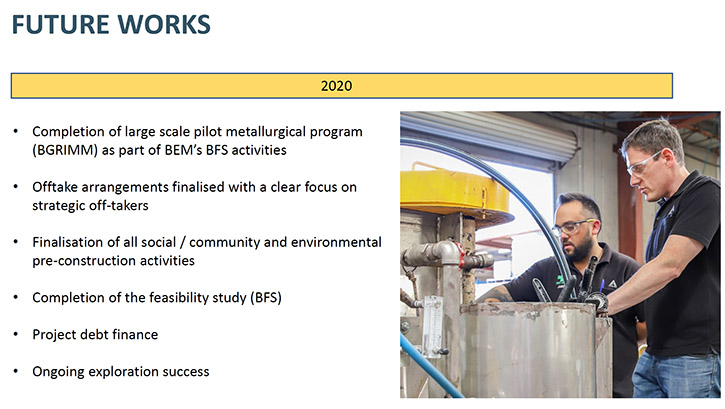

Dr. Allen Alper: Oh, that sounds excellent. Could you tell readers/investors what your primary goals are for 2020?

Tom Revy: It's a pivotal year for BlackEarth in 2020. One of the key initial targets will be to complete our pilot test work. We're undertaking large scale pilot test work based on a 60 ton sample that was mined in Madagascar late last year. That's expected to commence within the next four weeks and should be completed by the late second quarter. The importance of that test work covers a number of areas. First of all, it provides us with full process design criteria from which the engineers can work. It provides us with equipment sizing for the engineers, it provides us with power demands, again, useful for the feasibility study and it also should result in the production of about five to six tons of graphite concentrate, which we'll use to finalize legally binding offtake arrangements prior to startup.

So, it's a very important task that we're undertaking at the moment. It should be completed by the end of second quarter. In the next probably four to six weeks, we should commence drilling on site, that drilling will focus on two main themes. One will be the infill drilling to bring our resource up to a measured category and ultimately that'll be converted to a reserve during the course of the feasibility, once the recovery and cost figures are applied. It will also be to identify the potential of the North-West to significantly increase high-grade material during those first two to five critical years of production. So, we'll be focusing on that, and that will be undertaken and those results will be coming out continuously over a period of about two to three months.

By our third quarter, we believe we'll have legally binding off-takers arrangements in place. In fourth quarter, this calendar year, we should complete the full feasibility tests and hopefully secure the debt funding, so that 2020 should see the end of a lot of the technical work and administrative and approval work, so that we can go ahead and commence the engineering procurement and construction stage in 2021.

All this, of course is dependent on any potentially drawn out, negative effects that may occur as a direct result of Covid-19

Dr. Allen Alper: Well it looks like 2020 will be an exciting time for BlackEarth Minerals.

Tom Revy: Absolutely!

Dr. Allen Alper: That's excellent! Could you tell our readers/investors a little bit about your background, your team and the Board?

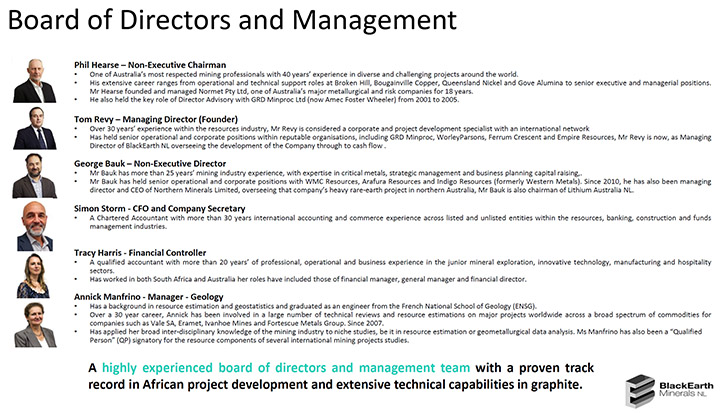

Tom Revy: I’m a metallurgist by background and have been involved in the resource industry for over 35 years. I have been involved in the design, construction and operations of a number of plants around the world. For approximately 10 years, I was involved with two global engineering procurement and construction management companies, one being Minproc, the other one being Worley Parsons and so my focus is project development and implementing projects and development plans for quite some years. That's fundamentally the strength that I bring the Company. I've also been involved in African projects since about 2001, so I feel fairly comfortable operating in that part of the world.

One of the other Board Members, our Chairman, is Phil Hearse. Phil is also a metallurgist, infinitely well qualified in the graphite space, having worked for about eight years or so on a number of projects in the graphite space, again predominantly in Africa. He and I have known each other for probably the last 30 years. George Bauk is a non-executive Director, with significant African experience and project development experience. He has an accounting, commercial corporate background. He's been involved in a number of companies and has good networks in the off-take area, et cetera.

We have collectively a lot of experience in Africa, a lot of experience specifically in Madagascar, graphite, project development and corporate commercial experience. The team is small, I'm the only full time employee in Australia. Everybody else is on contract and used if and when required to minimize expenditure and ensure that funds are predominantly focused on developing the Maniry Graphite Project.

Dr. Allen Alper: Well, it sounds like you have very experienced, knowledgeable people. That sounds great. Could you tell our readers/investors a bit about your share and capital structure?

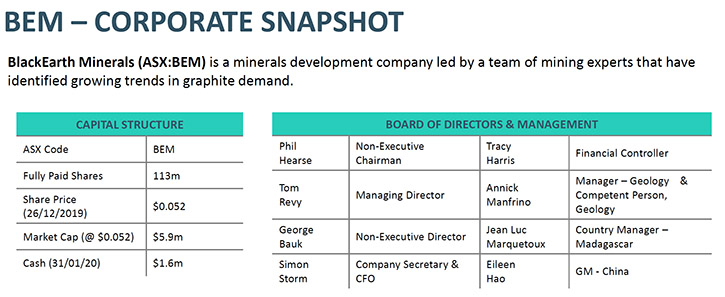

Tom Revy: We currently have 113 million shares on issue and we're currently trading around 3.5 cents. Our March 2020 quarterly was released in late April. We stated in that report that our cash balance was around AUD$1.5 million Dollars. So, that's basically the structure.

Dr. Allen Alper: Sounds great! Could you tell our readers/investors how it is operating in Madagascar?

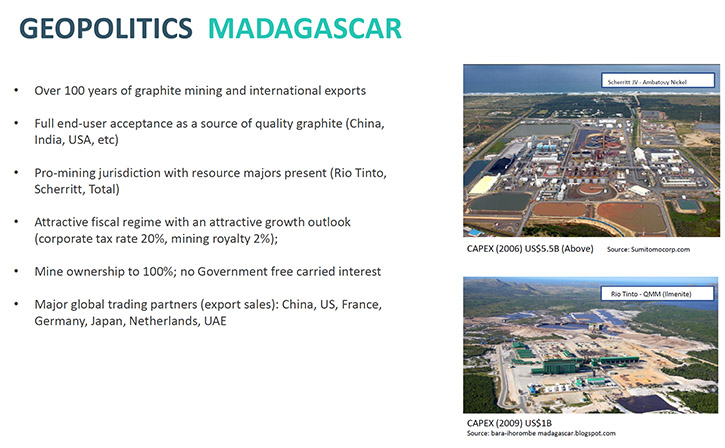

Tom Revy: Madagascar is one of those countries, in which we've been fortunate to be involved. As the Founder of the Company, I specifically went to Madagascar to find graphite assets. Madagascar has been a producer, on a continuous basis exporting graphite concentrate for over a hundred years. It's actually deemed to have some of the best graphite in the world. Back in the twenties, there was a standard called the Madagascan graphite standard, against which the rest of the world measured their own graphite.

There are a number of large resource companies, oil and gas, and mining that operate in the Country. Rio Tinto is in Madagascar. They have $1 billion mineral sands project, some 150 kilometers or so from our project area and they constructed a purpose-built port, which we plan on using. It's open to the public, it's only 45% utilized, so that's certainly an advantage for us.

The Ambatovy nickel, cobalt operation is located near the central East coast of the Country. There are a series of other companies, some ASX and Canadian-listed and London-listed that are operating and planning on building projects in Madagascar on base metals, mineral sands, graphite et cetera. So, we've taken a lot of positive “vibe” from that mining history as well as the presence of other mining operators.

The government is a democratically elected government. The last election was held just over 18 months ago. It was free of any issues. The President was elected for a five-year term. The Mine's Minister knows our project well and we interact with him on a regular basis. The local community is very, very much on our side and understands the value that we potentially bring, in terms of work and other opportunities for them in the near future and for a long period of time. So, we've experienced nothing but cooperation in Madagascar since we've been there, over the last three to four years.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors why they should consider investing in BlackEarth Minerals?

Tom Revy: Part of my history is undertaking due diligence across a variety of projects. I think when it comes to reviewing any projects, across any sort of commodity, it's really important to look at some fundamentals, which differentiate one opportunity from another. The first one in no particular order would be land tenure. The majority of our project sits on a current 40 year granted mining lease, and we have an option to extend that twice for a further 20+ years. So, the only thing we require now is the final environmental approval, which is part of the feasibility process that we're going through. So, that's a differentiator for us. In terms of infrastructure, I mentioned the port earlier, it's open to the public, it's a first world port, 15 meter draft, capable of bringing in any ship and operational probably 99.9% of the year.

There's water, readily available underground. The power will be diesel generated, but it's only a small project we're talking about, so four megawatts installed, two and a half megawatts, drawn at any point in time, so it's not a huge burden to import diesel. The infrastructure is pretty well in place. There's a road already between port and the site.

Resource mining and process - our resource is well defined. The geology is well understood and the expansion potential, given the exploration target, is enormous. The mining is simple. This is a straight open pit scenario. The first three years of mine life at this stage is around the point three to one strip ratio and life of the mine is point nine to one. So less than one to one. The processing is very conventional, it's 100 year old technology. You simply crush it, grind it, float it, dry it, screen it and bag it and get it out of the country. We could then sell it according to the product specification.

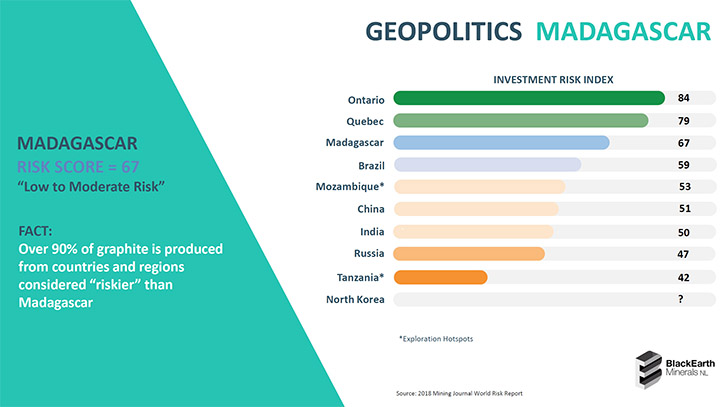

We are targeting high-value products for the expanded market. Having a course product certainly differentiates us from many of the others, who are fine material producers, so potentially going head to head with the Chinese. Geopolitically again, Madagascar is a place, with a long history in graphite. It's very positive towards the mining sector and organizations such as the World Bank and the IFC are supportive of anything that's done in one of the poorest countries in the world, so everybody, including all stakeholders, is very positive.

And finally, the financial return and technical robustness of the project itself, which we released on the 30th of January in 2019, shows internal rate of return of about 42% and NPV of about 100 million US. Startup capital is 41 million US, including owner's cost. So, it's a low CapEx start for a company of our size. It's financeable. The returns are attractive and there is upside in terms of grade, which is significantly leveraging, in terms of reducing the CapEx and potentially OpEx. We will review these leveraging areas as part of the feasibility study that we're undertaking currently and should finish by the end of the year.

Dr. Allen Alper: Sounds like excellent reasons for investors to consider investing in BlackEarth Minerals. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.blackearthminerals.com.au/

Tom Revy

Managing Director

BlackEarth Minerals NL

tom.revy@blackearthminerals.com.au

+ 61 (0) 411 475 376

|

|