Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF): Colombia’s Largest Underground Gold and Silver Producer, Highly Profitable with Significant Expansion Opportunity; Interview with Mike Davies, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/26/2020

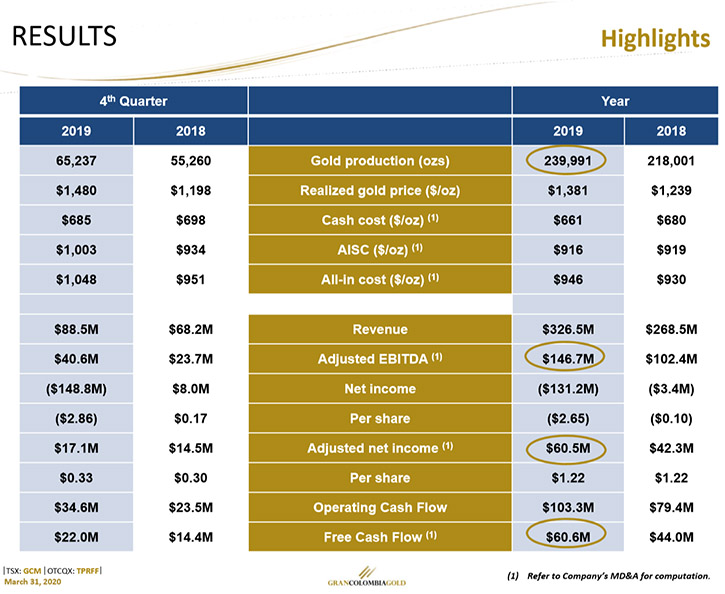

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) is a Canadian-based mid-tier gold producer, with its primary focus in Colombia, where it is currently the largest underground gold and silver producer, with several mines in operation at its high-grade Segovia Operations. Gran Colombia owns approximately 74% of Caldas Gold Corp., a Canadian mining company, currently advancing a prefeasibility study for a major expansion and modernization of its underground mining operations at its Marmato Project in Colombia. We learned from Mike Davies, CFO of Gran Colombia Gold, that in 2019 they produced close to 240,000 ounces of gold at as low as $916 all in sustaining costs an ounce, generating US $326.5 million in revenue and came a long way in terms of strengthening the balance sheet. We learned from Mr. Davies that Gran Colombia Gold has spun out their Marmato operation into a new company called Caldas Gold Corp. (TSX-V: CGC). According to Mr. Davies, the Marmato asset has a significant expansion opportunity as outlined in the 2019 PEA.

Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, who's CFO of Gran Colombia Gold. Mike, could you give our readers/investors an overview of what differentiates Gran Colombia Gold from others?

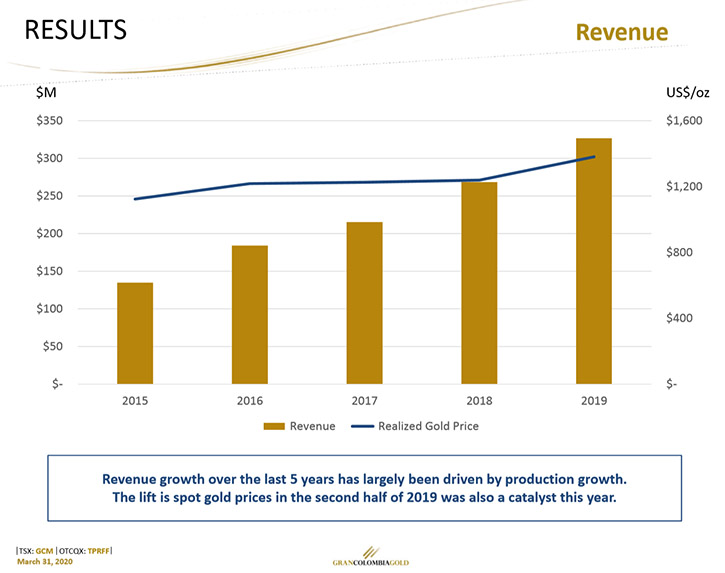

Mike Davies: Yeah, thanks. I think the key things, Gran Colombia is a high-grade gold producer. Our primary project is our Segovia Operations in Colombia, which represents about 90% of our production. We are a free cash-flow yielding company. We have a high free cash-flow yield. We've continued to take steps over the last couple of years to improve our liquidity, the strength of our balance sheet, and we've had a pretty solid growth profile aided by not only some pretty strong grades in the operations, but growth in production and more recently the additional benefit that the increasing gold price environment is having on our revenues and EBITDA.

Dr. Allen Alper: That sounds great. Could you give us the highlights of the results of last year, 2019?

Mike Davies: 2019, for us, was another record year on a number of fronts. We produced close to 240,000 ounces of gold, which was up from 218,000 the year before. We continued to manage our costs well. Our cash costs came in below guidance at $661 an ounce. Our all in sustaining cost was $916 an ounce, so it was a couple dollars better than the year before. Our all in cost, which included non-sustaining capital and exploration expenditures came in at $946 an ounce, below our guidance of 950 for the year. Cost metrics were all pretty solid. Revenue hit a new high, both with the increase in production and the higher gold prices.

We had $326.5 million in revenue last year, in US dollars. Our adjusted EBITDA grew to $146.7 million last year. Our adjusted net income was also up to $60.5 million and our free cash flow hit a new high of $60.6 million last year, which was pretty strong performance for us compared to the $44 million the year before. We finished the year with about $84 million of cash and our debt position was also at $84 million, so we came a long way in terms of strengthening the balance sheet.

Dr. Allen Alper: That's excellent! Outstanding performance! That's really great to share, improving like you have and improving your balance sheet. That's really something to be very proud of! Could you tell our readers/investors a little bit about your portfolio?

Mike Davies: Yeah, it's a portfolio that's been getting more exciting as time goes by. Our core asset, as I've mentioned, is our high-grade Segovia Operations. One of the top five underground gold mines, by grade, globally. Produced 214,000 ounces last year. Recently, we've had another milestone corporate event. We've spun off the Marmato mining asset that we have in Colombia. It has a producing mine that did just under 26,000 ounces last year, but more importantly it has a really significant expansion opportunity that we outlined in a PEA last fall that we're now pursuing.

The new company that we've started is called Caldas Gold Corp. Our project sits in the department of Caldas in Colombia. Caldas Gold is listed on the TSXV and Gran Colombia owns 74% of that Company. We also have a roughly 20% interest in Gold X Mining, which has the Toroparu project in Guyana and about 20% interest in Western Atlas, which has an exciting exploration project up in Nunavut, next door to Agnico Eagle’s Meadowbrook Project, and they're about to start drilling. And, we have the Zancudo Project in Colombia that is currently under option and being drilled by IAMGOLD.

Dr. Allen Alper: That's excellent! A very nice portfolio! Great potential for growth! Could you tell us a little bit about your exploration potential?

Mike Davies: Yes, exploration at Segovia continues to be a primary initiative. The reason for the spin out is that we really want to focus our internally generated cash flow on our tremendous exploration opportunity that we see at Segovia. We have a 3000 hectare piece of private property in Colombia, very unique type of title. There are 27 known veins of mineralization in the title from more than 150 years of past mining in the title. We're currently only mining on three of those veins, where our three mines are located and where most of our exploration activity has taken place historically.

We're now in a position, and we've started a little bit towards the end of last year, to step out in a regional exploration program, where we expect to do more than 10,000 meters of drilling this year to look at the other 24 veins, which we're not currently mining, for new mining fronts for us in the future. In addition, we have some pretty exciting extension and deep drilling going on at our Providencia and El Silencio Mines, which have been the source of our high-grade production over the last few years. A lot of exciting exploration potential!

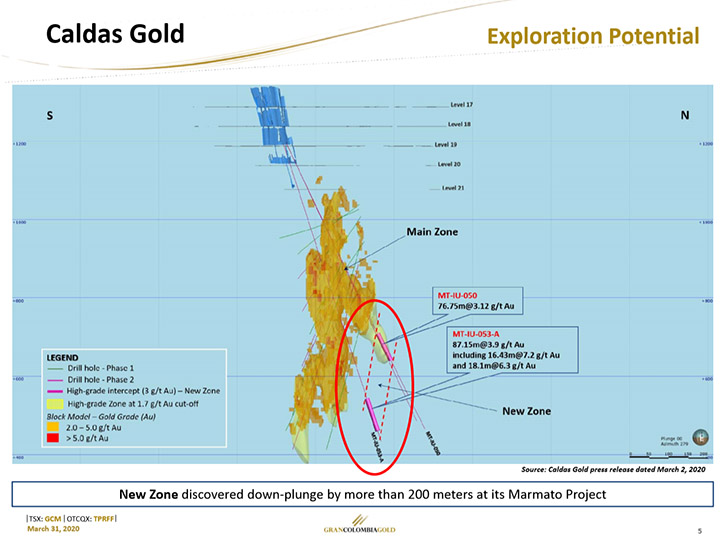

And, in Caldas Gold, we've continued to drill the deep mineralization that we discovered a few years ago and which is the basis for the expansion of the project. We continue to find some very broad widths, with high grades, grades that are higher than what is in the current resource from last summer, which is the backbone to the PEA. We're pretty excited about the option to see a larger resource at the Marmato Expansion Project as it moves forward.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your total cash cost per ounce?

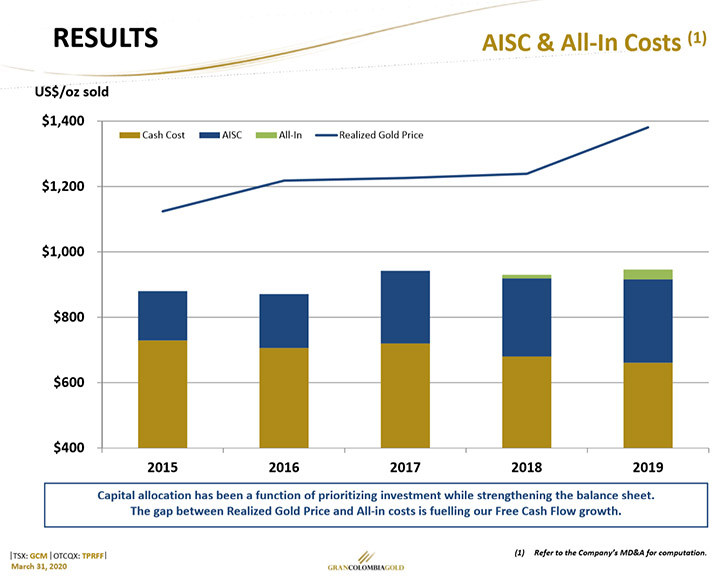

Mike Davies: Our total all in cash cost per ounce, as it's defined by the World Council, was $946 last year. That included the $30, or so, non-sustaining capital expenditures, primarily related to the exploration work and preliminary economic assessment work that we were doing at Marmato.

Our all in sustaining cost was $916 that included about $250 of CAPEX and G&A, most of it CAPEX. The CAPEX largely focused on our Segovia Project. We continue to drill the project, develop new fronts, which have been the source of our production growth in the last couple of years, and continue the modernization and mechanization of the project, including, last year, a tailings storage facility that's using dry stack technology and a filter press to basically be the backbone of our milling operations for the foreseeable future.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a little bit about your capital structure?

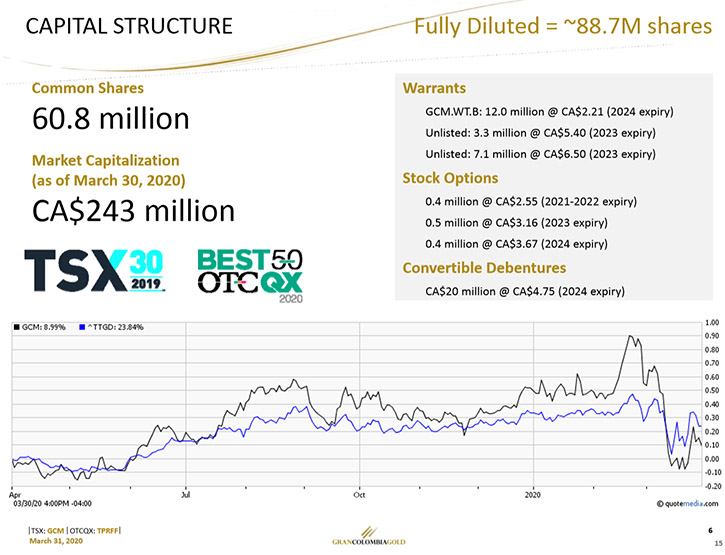

Mike Davies: We currently have 60 million shares outstanding. We did a private placement back in February. Eric Sprott completed his second milestone investment in Gran Colombia, bringing himself up to about 11% of the Company. A couple of other institutional equity funds participated in that equity offering. On a fully diluted basis, we're at about 88 million shares, including warrants, options and some convertible debentures.

We've continued to see our share price rise quite well, over the last three years. Last year, it continued to perform well. Recently, in March, with the COVID-19 situation, our stock fell like everybody else’s, but it has started to show some nice recovery in recent days, continuing on the strength of gold, it has been in and around the C$6 level. It's had a good rebound, but I think it continues to be below the analysts’ targets for our stock, so I think there's some valuation upside to be had, as these markets turn themselves around.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors what Gran Colombia Gold is doing during the COVID-19?

Mike Davies: I think it's something that we're proud of in the sense that we are doing what mining companies with resources should do in these days. We're taking care of our local communities. If you follow us on Twitter and LinkedIn, you'll see a number of messages we put out about the support that we've been providing in both the communities of Segovia-Remedios that are attached to our Segovia operations and Marmato, Supia and Riosucio that support our Caldas Operations at Marmato.

We've been providing food, meal kits, largely proteins that they can't get locally, to the communities, which are being distributed by the local municipalities to families in need, during the isolation and quarantine that's going on in Colombia at the moment. We've also been donating funds to the local hospitals in those communities for some critical care units and other medical supplies that are required to look after the communities. We've also been providing sanitation and other supplies to the local military and the police.

At the same time, we've also put in all the procedures at our mine sites, so that we're able to continue to operate through the COVID-19 situation. We a little lower on personnel during the first couple of weeks of April and as our recent guidance on April's production indicated we're running at lower rates in the first couple of weeks than we will be in the second half of April. We've seen our compliment of employees improve and we're expecting to have a month, in both companies, between 60 and 75% of a typical gold production. I think it's a testament to all of the staff in our operations and every single function, to work together to figure out how to have people working safely, during this time, in the mines, and at the same time fulfill our most important needs for production and processing, as well as maintenance and security at the sites.

We've continued to operate and continue to be responsible to the communities. Our Toronto office has been closed since early March and people have been working remotely. We've had all the travel bans and everything else implemented. I think we are in good shape as a company, and I think everybody's performed well in terms of implementing what needed to be done to respond to this crisis.

Dr. Allen Alper: Well, that's excellent. That's really something to be proud of, how you're responding in this time of global crisis. Mike, could you refresh the memories of our readers/investors and also new readers/investors on your background and your team?

Mike Davies: Our Founder and Executive Chairman is Serafino Iacono, our CEO Lombardo Paredes, who's based in Medellin and as I've always said, deserves the credit for the operational turnaround that's taken place in Gran Colombia in recent years. Our Head of Exploration, Alessandro Cecchi, and his team continue to get great exploration results at both Segovia and Marmato. I've worked in public companies and with this group now for the last 13 years and with Gran Colombia for the 10 years since it started. I have a CPA in Canada. I think we have a well-rounded team and we have lots of great people running our various functional departments in Colombia.

Dr. Allen Alper: Oh, that's great! Your Company has shown excellent performance and you've improved your production and lowered your cost. You're doing very well and that's really something to be proud of. Could you, Mike, tell our readers/investors, what are the primary reasons they should consider investing in Gran Colombia Gold?

Mike Davies: Well, I always first start with the first proposition. Investors are in this to make money. Our stock has performed well and is still below analysts’ targets. It's a Company that's poised to continue to improve. We have a good free cash flow yield. Our production has been pretty solid. As the gold price has been rising, so too have our revenues and our free cash flow. I think we have very good exploration potential in our projects and some really high-caliber projects. Segovia has definitely been a crown jewel and Marmato, I think, is going to turn out to be a great asset for us, as it's proceeding forward, a good quality package of assets. I think you've mentioned the management team has done a great job the last few years; controlling costs, implementing the strategy to expand and modernize the Segovia Operations, which has been the backbone of our production growth and ultimately now, the gold price increase has become another catalyst to the free cash flow yield that we're generating.

I think all the way around, we are in a solid position. We turned in another good first quarter of performance. We produced 56,000 ounces in total in Q1 and in April, unlike many companies, we've been able to keep the wheels turning and keep the production going. We're not going to come out of this struggling, trying to get ourselves back into full operation. Our balance sheet has continued to be strong. We reported at the end of March that our Gran Colombia cash position stands at $81 million, Caldas Gold has another $14 million cash and Gran Colombia's debt related to its Gold Notes, now that we've completed a special redemption at the end of March, was down to just under $45 million or about half of where it was a couple of years ago. The balance sheet is even stronger now than it was. Weathering through the storms of things like COVID-19 we're much better equipped to handle them financially.

Dr. Allen Alper: That's outstanding performance! Is there anything else you'd like to add, Mike?

Mike Davies: I think we've covered a lot of the main points today. We're very pleased with how this has moved forward. We're very happy that we've been able to perform through this COVID-19 situation the way we have. I think the way our people have risen to looking after themselves and the communities locally has been fabulous. They all deserve credit for doing what they've been doing. And, we look forward to getting back to normal when the time comes and continuing the journey with this Company.

Dr. Allen Alper: That's really great. I‘ve enjoyed talking with you again. I'm very impressed.

Mike Davies: Yes, thanks.

Dr. Allen Alper: What your company's doing is great. It’s a great company!

Mike Davies: Thank you for interviewing Gran Colombia Gold for Metals News.

Dr. Allen Alper: Thank you. It has been very interesting hearing about all the great things you are doing.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|