Ubique Minerals (CSE: UBQ, OTCMKTS: GRNBF: Exploring and Developing High-Grade Zinc Properties in Newfoundland, Canada; Interview with Dr. Gerald Harper, CEO and Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/24/2020

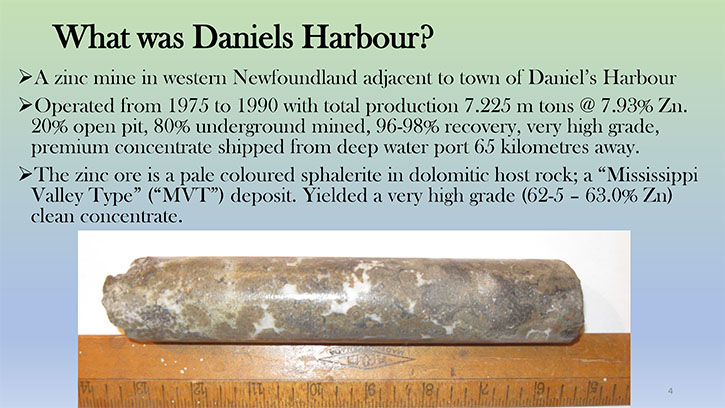

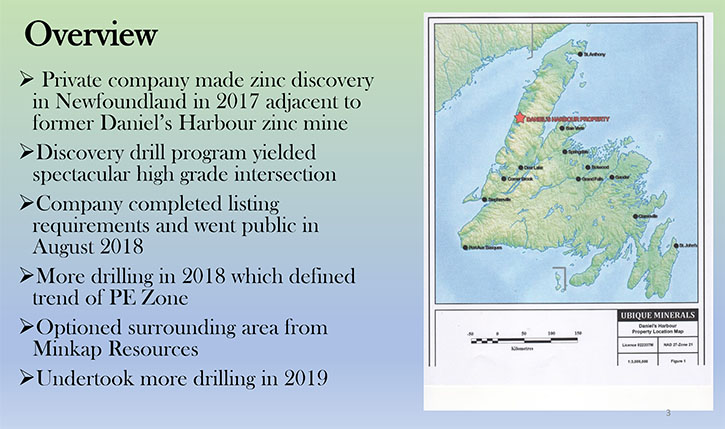

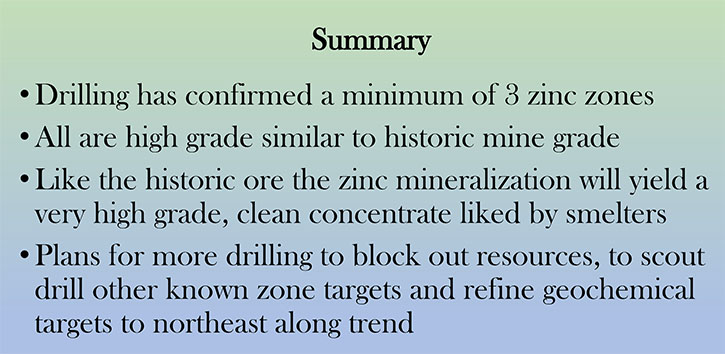

Ubique Minerals (CSE: UBQ, OTCMKTS: GRNBF) is a zinc exploration company, focused on further exploring and developing their Daniel's Harbour zinc properties, strategically situated in Newfoundland, Canada. We learned from Dr. Gerald Harper, Director and CEO of Ubique Minerals, that Daniel's Harbor is a past-producing, very high-grade zinc mine that produced eight million tons of premium zinc concentrate, with no impurities that was bid for by smelters around the world. After acquiring the property, Ubique Minerals conducted three drilling programs in 2017, 2018, and 2019 and all of them have extended the ore zones and have intersected more mineralization. Near-term plans include raising funds to drill several potentially high-tonnage targets to build up the resource and go forward with a pre-feasibility study.

Ubique Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Gerald Harper, who's President, CEO, and Director of Ubique Minerals. Could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

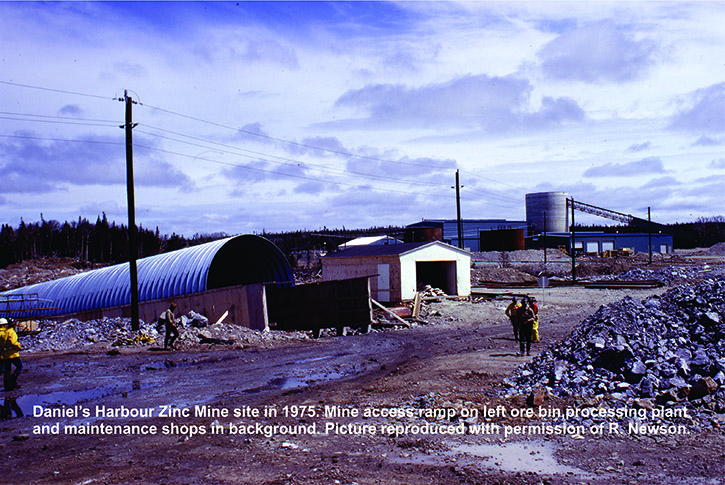

Dr. Gerald Harper: Yes, I'd love to. Ubique Minerals is a relatively new company to the public market. We are a public company. We went public in September 2018, listed on the Canadian Stock Exchange, the CSE under the symbol U-B-Q. We came about because there used to be a zinc mine in the province of Newfoundland, on the West Coast, called Daniel's Harbor. It was a very high-grade mine over its lifetime. It produced eight million tons of 8% zinc with a very high-grade concentrate, no impurities, and a premium concentrate that was desired and bid for by smelters around the world. It shut down for various reasons, mostly not related to the ore body. It closed down in 1991. The staff, who had all been there for many years, mostly retired in the local community. Among those was the Chief Geologist and later Mine Superintendent, who had retained a lot of information about the mine and was a wealth of information.

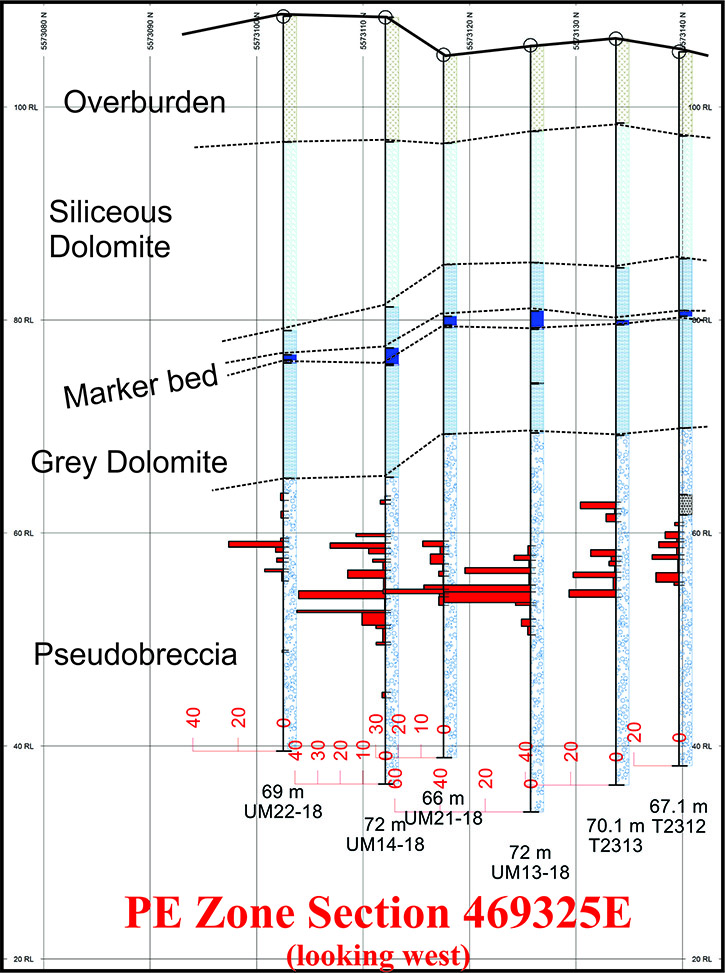

He felt that there was a lot more opportunity there. He got a group of investors and we put together a group in 2017, through a merchant bank called Greenbank Capital and privately funded a drill program and bingo; we pulled in the third hole, the highest grade intersection of zinc, which had ever been hit in the Daniel's Harbor area. That was the start of demonstrating that the ore bodies had not been exhausted. Since then, we have had drill programs in the summer of 2017, 2018, and 2019 and all of them have extended the ore zones and have intersected more mineralization. We now have an indication, we have three zones, which have potential for significant tonnage and our plans, in the next year to year and a half, are to raise enough funds to drill off those zones and one or two other potential zones to build up the sort of tonnage; which would be needed as the threshold to go forward with a pre-feasibility study.

Drilling underway with a maneuverable rig that does minimal damage to the environment

A section through a high grade zone drilled

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background, which is outstanding, and also your Management Team and Board?

Dr. Gerald Harper: I've been trying to retire for quite a number of years now and mining geology has become a hobby for me rather than a career. I just enjoy doing it! So in 2009, I returned from Mongolia, where I'd spent the best part of 10 years overseeing the feasibility study and development of a uranium mine, among other things and had reached a point where I didn't need to work any longer, but was able to take advantage of opportunities as they arose. And several opportunities did arise. I'm a co-discoverer of a platinum palladium deposit, which hopefully will be in production in the next few years. I'm also the discoverer of several platinum nickel-copper deposits in central Canada. Many years ago I worked in Newfoundland as Manager of Exploration and Development for a company which has long ceased to exist and became familiar with the geology of Newfoundland.

Also, I came to like the people of Newfoundland very much indeed. So when I was approached in 2017 about this Daniel's Harbor opportunity, I jumped at it because the thought of being able to go back to Newfoundland, and work with the people there, was a very compelling justification. We’re a very small company and the key person on the team, who works with me, is a former Chief Geologist from the mine; a gentleman called Roland Crossley. He and I get on very well and we enjoy our time out in the bush together, looking for more evidence of future ore bodies. Supporting them is a gentleman called Gaurav Singh, who is our Chief Financial Officer. He is also the Chief Financial Officer of Greenbank Capital, which is the merchant banking group that I talked about before.

That merchant banking group is very important because, between their principal and the bank itself, they have something like 40% of the shares of Ubique. And two or three other investors and I have another significant chunk; to the extent that between us, we have almost 80% of the outstanding shares. We only have 42 and a half million shares outstanding. We're very, very tightly held. The float is minimal, and if there were any significant market interest, it would be very difficult to acquire much in the way of a share position, without having to push the price up significantly.

Dr. Allen Alper: Sounds great! It's nice to see a Company where the Management and Board have skin in the game and believe in the project. It sounds like you're having great fun out in the field and doing discovery. So, that all sounds great!

Dr. Gerald Harper: Yes, it is. Yes!

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Ubique Minerals?

Dr. Gerald Harper: Yes, I would love to. We should be a compelling investment for several reasons. One is that although zinc is somewhat depressed presently, in terms of the metal price, zinc as a commodity is not in oversupply and is unlikely to be in oversupply because there are not any substantial new mines that are on the horizon in terms of deposits; which are remotely likely to be ever put into production, which aren't in the middle of absolutely nowhere, with massive infrastructure costs. We are right on the coast of Newfoundland. We still have a power line into the property. We still have a paved road into the property. We still have gravel road access, from the central mine site, to all of the areas where we're drilling, and the costs of going back into production would be minimal. Shipping concentrate is literally from the coast, within 60 kilometers of the mine site. So all in all a very, very economical property to put into production.

It's also of interest because the average grade of the unpublished, unofficially, estimated resource at this point is approximately 8% give or take the second decimal place. And 8% is exactly the same average grade as all eight million tons, which were mined by the mine in the earlier years, when it was in operation. So we believe that there is nothing that has changed in the geology. We're going to continue to develop reserves at that grade. And when you look at the operating costs of the former mine, their breakeven was about 4% zinc, even at low metal prices. So there's a significant margin with an 8% average grade to make a very attractive operation.

Dr. Allen Alper: Well that sounds excellent. Sounds like a very strong reason for our readers/investors to consider investing in Ubique Minerals. Gerald, is anything else you'd like to add?

Dr. Gerald Harper: Yes, just to give you a little hint of the upside. The deposit is hosted by limestones or dolomites, which are very, very soft rock but very competent. So the geology is a very good environment for mining, but the type of deposit is generally referred to as a Mississippi Valley Type deposit or an M-V-T. And when you look at the other MVTs around the world, which have been mined in places like Missouri and Tennessee and the Northwest Territories of Canada, they have all produced somewhere in the region of 50 to a 100 million tons of ore. Therefore, our former mine, which only produced eight million tons, in theory, left at least 42 million tons, if not 92 million tons still to be found. So I have great optimism that we're going to find a good chunk of that.

Dr. Allen Alper: That sounds excellent. Sounds like it'll be really fun, thrilling; exploring and developing your property. Excellent!

Dr. Gerald Harper: And I might finally retire off to that.

Dr. Allen Alper: Well, it is fun working and it's fun doing things that are enjoyable and getting out in the field. Sounds like you're having fun and making money.

Dr. Gerald Harper: Yes.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.ubiqueminerals.com/

Gerald Harper, CEO

Phone: (416) 232 – 9114

Email:gharper@ubiquezinc.com

|

|