Perseus Mining Limited (ASX/TSX: PRU): Increasing Gold Production in West Africa to Over 500,000 Ozs per Year; Interview with Jeff Quartermaine, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/21/2020

A rapidly growing gold producer Perseus Mining Limited (ASX/TSX: PRU) operates two gold mines in West Africa and is developing its third mine, with the goal to increase gold production to over 500,000 ounces per year in 2021/2022. We learned from Jeff Quartermaine, Managing Director of Perseus Mining, that they are focused in Ghana and Cote d'Ivoire, the two countries that rate very highly in terms of mineral endowment, political stability, and safety and security, and where Perseus has a very strong social license to operate. According to Mr. Quartermaine, the Company's strong cash flow can not only fund future growth of the Company, but has brought closer the decision to fund the future dividend stream for investors. Near term plans include bringing the third asset, the Yaouré Gold Mine, into production by the end of the year.

This interview was done before the onset of COVID -19. Perseus Mining will do a follow up interview with Metals News shortly to bring our readers/investors up to date with the current state of affairs.

Perseus Mining Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jeff Quartermaine, who is Managing Director and CEO of Perseus Mining Limited. Could you give our readers/investors an overview of the Company, and also what differentiates Perseus from others?

Jeff Quartermaine: As a snapshot of the Company, we're an Australian domiciled company, but we're West African focused. So we are a multi-mine gold producer, developer, and explorer. We're active in multiple jurisdictions in West Africa, in particular Ghana and Cote d'Ivoire. Of all the countries, in not only West Africa, but Africa as a whole, I think these two countries rate very highly in terms of relative merits. Particularly as measured by mineral endowment, political stability, and safety and security. All of which are very important, as far as investors are concerned. And these countries stack up very well.

Now, as a company we have been very consistent and reliable in our gold production in the last few years. And our production profile is steadily growing towards 500,000 ounces per year, from our fiscal year 2022 onwards. Over time, through reliable production, we've managed to build a fair level of balance sheet strength in the Company. We have strong cash flow, from which we can not only fund future growth of the Company, but also fund the future dividend stream for our investors. We're giving very serious consideration as to when is the right time to switch that on. When I say the right time, what we need to do in order to initiate the dividends is to have a clear line of sight to steady free cash flow. Because it's our intention, once we get to that position, where we can confidently say X percent of our free cash flow goes to growth, and Y percent goes to shareholders. Having made that decision, we want to make sure that that can be sustained into the future.

There are two keys to our success; one is that apart from having good assets, we have a very strong social license to operate in the countries where we work. That has been established over many years of hard work, on behalf of our team, ensuring that not only do we have a sound philosophical basis for what we do, but also very sound processes and procedures, in dealing with the environment, in dealing with our host communities and governments, and the way we conduct our business. So having done that over time, I think we can reasonably say that we're welcome in the countries where we operate, and that's very important for longevity and stability as far as our operations are concerned.

The second point that is very critical, in terms of being able to run the business, successfully, is the experienced Board and Management Team that we have now. I think one of the more valuable assets that the Company has is its human resources, and the skillset and commitment that's resident in our Management Team. One of the things we've worked very hard doing, in recent times, is ensuring that from top to bottom we have a clear understanding of what the corporate values of this Company are, and that we feed that down through the business. Adherence to those values is an integral part of what we do, day in, day out. As an example, one of our core values is achievement. We do what we say we're going to do, every time. That's something that I know has been picked up by our staff. They live by that and that's one of the reasons why our production has been very much in line with our standard guidance for quite some time.

In fact, we've had 12 successive strong quarters. The way things are going in this quarter, we're almost two thirds of the way through, we should have another reasonable quarter again.

Dr. Allen Alper: Oh that's excellent! It's great to have goals, and accomplish your goals, and to have such great results. That's excellent! Could you tell our readers/investors a bit more about your properties, and also some of your financial performance?

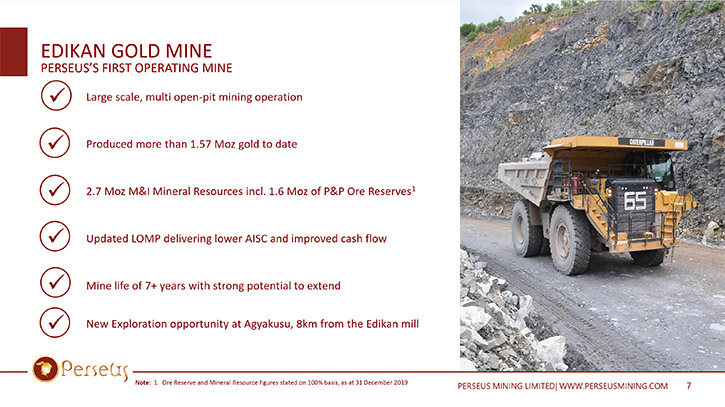

Jeff Quartermaine: Certainly. We have two operating mines at the present time. One is in Ghana, one is in Cote d'ivoire, and we have a third property that is currently in development and will be producing gold later this year, we would expect, given the current progress they've made in that development. I’ll run through each of those individually. Our first mine was the Edikan mine, which is in Ghana. It is a large-ish multi pit operation.

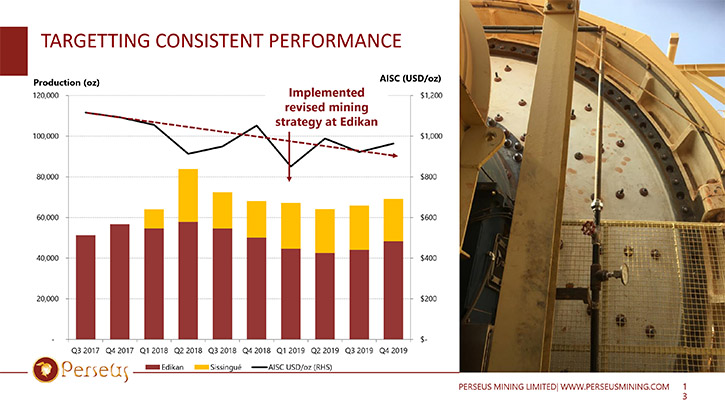

We started it the 1st of January 2012, and we've been running for about eight years, and we have about eight years remaining. We're almost half of the way through the life and the reserve that we have available to us there. Now, the interesting thing about that is that Edikan established a reputation of being a very difficult mine in our first eight year period. This was a fair assessment, but in the last couple of years we've implemented a range of very important initiatives there, where we've turned it from being a difficult mine into one that's now producing consistently month in, month out. So we're producing around 200,000 ounces a year at around US $1,000 per ounce. That is likely to be reduced going forward. Over the next eight years, we expect Edikan to become known as a cash cow for the Company, rather than being known as a difficult mine. It should be a source of quite considerable revenue and cash flow to be able to fund other activities.

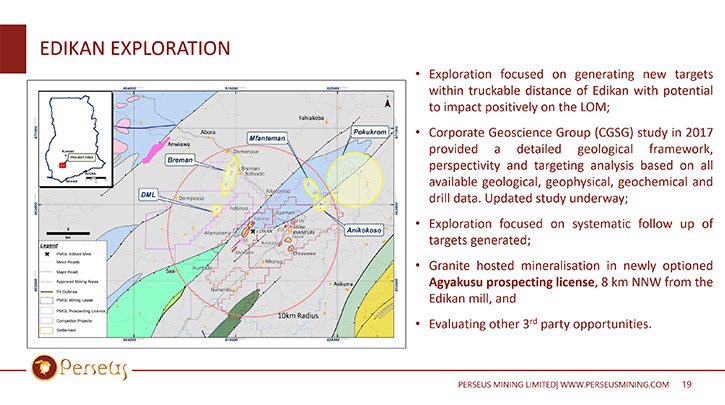

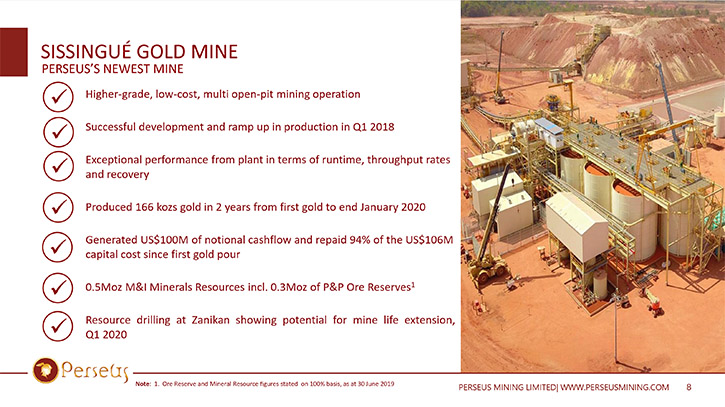

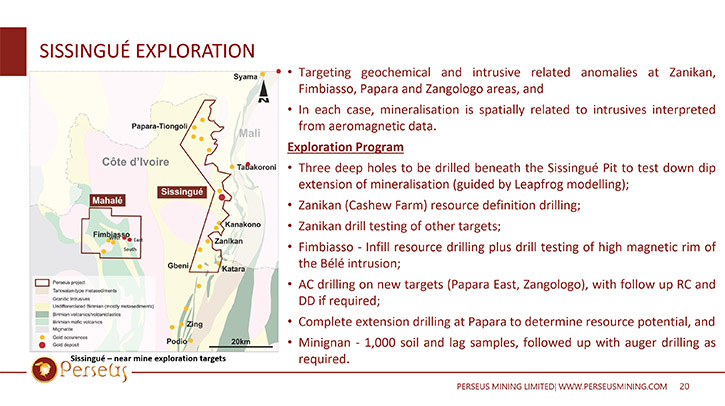

We do have some interesting exploration properties, very adjacent to the mine. We recently set about starting to drill one of these, but this has temporarily been put on hold while we negotiate full access with local farmers. We have very high hopes that that could also lead to a further extension of the mine-life at Edikan. The second of our properties is Sissingué. Now, that's a much smaller operation than Edikan. It has an annualized through-put rate of about 1.8 million tons a year, compared to Edikan's 7 to 8 million tons per year. But Sissingué has a higher grade and lower costs. So whereas Edikan produces around the 200,000 mark, Sissingué produces 80 to 90,000 ounces a year. But it does it at a cost of about $750 an ounce. What that means is that we brought that one into production in January 2018 and by the end of February this year, so 24 months later, we have generated $106 million of national cash flow from the operation, which equated to the initial investment.

So in effect, we had paid back our initial investment in two years. We still have about three plus years based on current reserves to go. And the next three years will also, given the relatively low operating costs, be generating quite a handsome margin and a handsome cash flow for our shareholders. Like Edikan, the exploration potential in the vicinity of Sissingué is very good and we're working quite hard at the present time to bring a number of mineralized deposits into the resource and reserve category. We think that before too much longer, we'll be able to share some positive news with our shareholders on that particular score

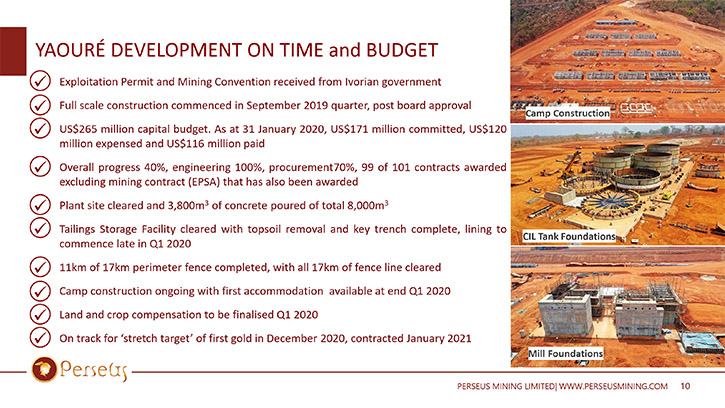

Yaouré, is a development project. We gained our licenses to develop our mining concession last year. Around the middle of the year, we took a decision to move forward with development.

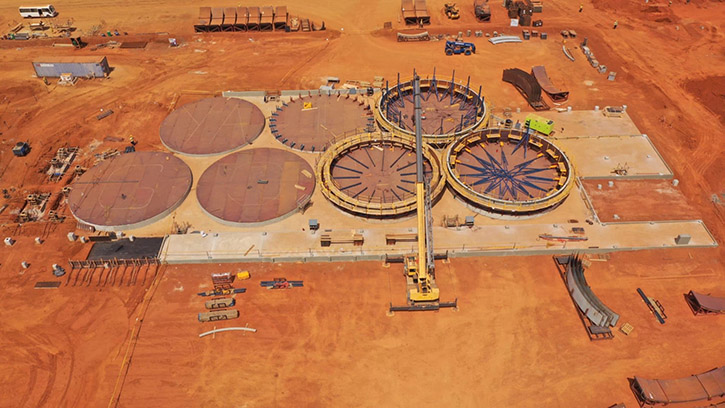

Now the capital budget for that project is $265 million. As of the end of January, we've spent $116 million in cash on that project. We're about 40% to 50% of the way through the build. Our overall progress is actually about 45% at the moment. Everything about that project is running very nicely. You and your readers/investors might enjoy visiting the Perseus Mining website, and looking at our monthly posts of a video of the site, taken by drones. You can track the production progress as it's going. Anyone who takes a look at that video will see that the progress that has been made is extremely good and very much on track, on budget, and on schedule. If anything, it's actually slightly under budget and ahead of schedule, such that we do expect to be producing first gold later this year, which is in line with our strict target for production of gold.

The actual contracted target is January, 2021, but we think at this rate we should be able to be producing by the end of this year. The Yaouré property is a really very exciting situation for us because, as it stands at the moment, it's going to be an open pit mine of about an eight and a half year duration. However, it does appear that we've discovered quite a substantial resource off to the side of the main pit, and we believe that this resource can be mined through underground mining methods. So far we've delineated the resource of about 600,000 ounces of gold, grading five to six grams a ton. But we've recently completed an exploration program, where we have gone down on the main seem, and we have stepped out about a kilometer, drilling diamond holes into it to try and target the structure, and we've hit the structure and we've identified mineralization. So that knowledge is now being used to inform a three dimensional seismic study, over the area, that'll be commencing on the 1st of March.

With the results of that study available to us, we should be able to inform a very targeted drilling program aimed at delineating specific structures that we would seek to be mining from underground. In fact, the potential for that underground operation is very large and we're very excited that that will deliver significant growth for our shareholders in years to come.

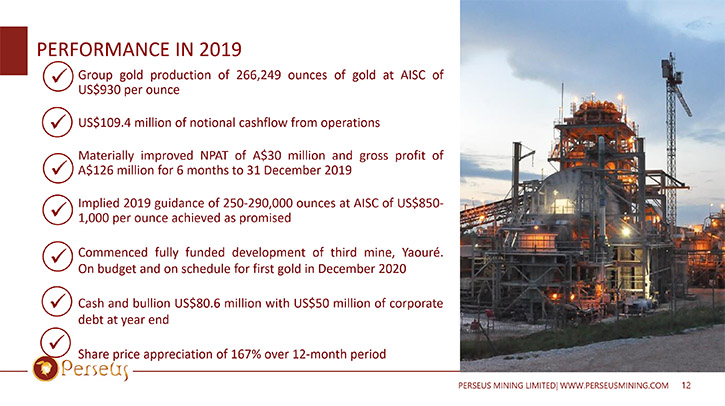

Our general financial performance, over the last 12 months, has been quite strong. In fact, in 2019 we produced around 266,000 ounces of gold at a cost of about $930 an ounce. This generated about $109 million of national cash flow from the operations that converted into reasonable profits. We recently announced our half year results, so a half year profit to the 31st of December. That was Australian dollars, $30.4 million in net profit after tax, which was 193% higher than the six months in the prior year. So we can see that we're certainly moving along strongly in that department. That net profit after tax was based on an EBITDA of about $124 million and you’re generating reasonable profits. On an annualized basis, that converts to about 5.2 cents a share. The operating cash flow of $73 million converts very nicely in terms of cash flow per share. When you start to look at Perseus on a ratio basis, earnings per share, or cash flow per share, cash flow multiples relative to our peer group. Even though we've had very strong share price performance this year, we're still relatively inexpensive compared to some of the peers. We think that the very strong share price performance that we've seen, over the last six months and into this current calendar year, has every potential to continue into the future.

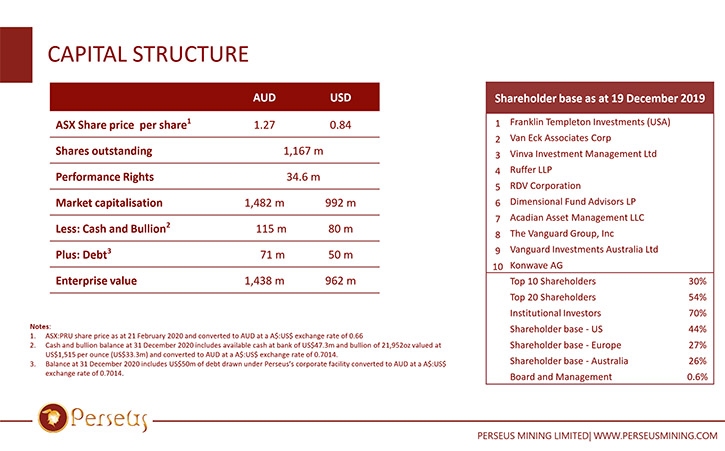

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors more about your capital structure?

Jeff Quartermaine: Yes, certainly. Our balance sheet at the present time is reasonably robust. At the end of the year, we had $81 million of cash and bullion on hand, and at the same time we had $50 million of debt. So we had a net positive cash position of around $30 million. That isn't a huge amount, but it is quite an achievement because during the course of last year, we also spent about a hundred million dollars on the building of all of our projects. So notwithstanding the fact that we're in the midst of a fairly heavy, fairly intensive capital program, our balance sheet is still positive in terms of net cash. We did have a 150 million debt facility available to us. We have up to $100 million of undrawn debt available, should that be needed for either development purposes or otherwise.

We don't anticipate drawing that at all. Given the high levels of cash generation at the present time, courtesy of the high gold price, we won't be drawing terribly much more of that debt at all. It's really going to be a case of managing our leverage position over the next few months. We don't like to overbear our Company, bearing in mind that gold is a cyclical business, but we will draw a little more debt. Mainly we’ll use cash flow from operations to fund, not only our development project, but also the exploration program that we have on hand.

Dr. Allen Alper: That sounds excellent. Could you refresh the memory of our readers/investors and tell new readers about your background, your Team and Board?

Jeff Quartermaine: I've been with Perseus now for almost 10 years. I started here in the role of CFO and then moved into the CEO role a couple of years later. I've had the pleasure of leading this Company through both tough times and more recently through good times. I am proud that in the process of doing that, we've put together an absolutely first-class team of people both in our corporate office and in each of our operating sites. We've been very fortunate to be able to attract and retain people of that caliber. I think, as we go forward, we will be able to offer our employees even better career paths, by having multiple operations, around which people can move and get new and varied experiences.

It is a good team, with a very good mix of skills. There's good gender balance. Women are very well represented in our Management ranks, as are people of all races and colors. We all work very, very well as a group. I think the key to that is that we have, in recent times, truly established our culture and we clearly understand what our true values are. Having done that, we've been able to get all of our people to align themselves with those values and act on them. For me, I think that's one of the more important initiatives we've achieved. It has enabled our people to realize that potential and deliver very good outcomes.

Dr. Allen Alper: That sounds really great! Could you tell our readers/investors a little bit about how it is operating in West Africa?

Jeff Quartermaine: Operating in West Africa is the prime experience for us. We are guests in the countries over there. We're not natives, we're foreigners, but we've always been very well received. Provided we treat people well and with respect, there's no reason why that should not continue in the future. We feel very comfortable operating in both countries. Ghana is a former British colony and Cote d'Ivoire is a former French colony. So both of these places are quite different. They do involve different operating philosophies. We've adjusted to that and we're very comfortable there.

I'm currently at the BMA Global Mining and Metals conference here in Fort Lauderdale. One of the issues that has come up, in discussions with a lot of shareholders, is the issue of security. Because I guess there have been quite a lot of headlines, in recent times, coming from countries such as Burkina Faso and Mali, where there have been violent incidents, involving allegedly radical Islam groups. While those events are true and have occurred, and there does seem to be quite an arm wrestle going on in those countries, between the governments and forces from outside, the same can't be said about the countries in which we operate. Now that's not to say it will never happen, or it can't happen. What I'm saying is that it doesn't occur at the moment.

And one of the reasons why it doesn't occur at the moment is that the governments both in Ghana and Cote d'Ivoire are very vigilant in terms of protecting the national integrity and sovereignty and protecting their borders. So we feel very safe operating where we are now. That's not to say that we don't have security measures in place. We most certainly do, because our people are our most valuable asset and we want to make sure, at all times, they're safe and kept out of harm's way. So we do have security measures in place. We don't talk about them particularly, but our people are very comfortable coming to work every day, and we do everything we can to make sure they're safe.

Dr. Allen Alper: That sounds like you and your team know how to operate and are very well-prepared and experienced in operating in West Africa, and doing very well. Could you tell our readers/investors the primary reasons they should consider investing in Perseus?

Jeff Quartermaine: Well the obvious reason why they should invest in Perseus is because we believe that the best is yet to come. We've seen significant share price appreciation in recent times. We believe that as our Company continues its journey from being a small single mine, single country operation, to a multi mine, multi-jurisdictional business that will be reflected in our share price. I think our Company is very well managed, if I say so myself. We are financially strong. We have a very clear plan and vision as to where we want to go, and for us, it's all about execution. I would say you and your readers/investors should watch our progress. If you want evidence of our ability to deliver on our promises, look no further than the last two to three years and see what we've achieved in that time. You will see we've delivered on every promise that we may have made in the last couple of years, and we expect to continue to do that in the future.

Dr. Allen Alper: That sounds excellent. It's nice to invest in a company that has such great potential and is so well-positioned, well managed, and has such a great track record of doing what they say, and have such growth potential. Is there anything else you'd like to add, Jeff?

Jeff Quartermaine: I do appreciate you giving me the opportunity to profile our company for you and your readers/investors. We are very proud of what we are accomplishing and what we foresee accomplishing in the near future and beyond.

Dr. Allen Alper: Well, it sounds great. You are right to be proud! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://perseusmining.com/

Jeff Quartermaine, Managing Director

+61 8 6144 1700

jeff.quartermaine@perseusmining.com

|

|