Seabridge Gold (TSX: SEA, NYSE: SA): Seabridge’s Exploration Team Has Found More Gold Over the Past 15+ Years than Any Other Company; Interview with Rudi Fronk, Chairman and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/14/2020

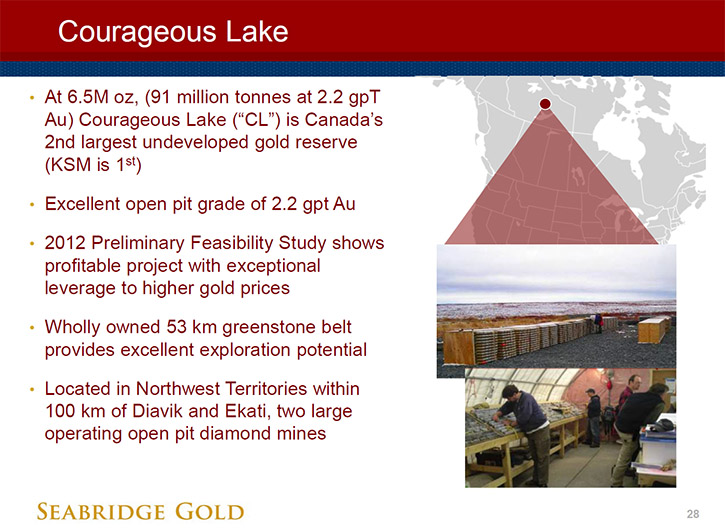

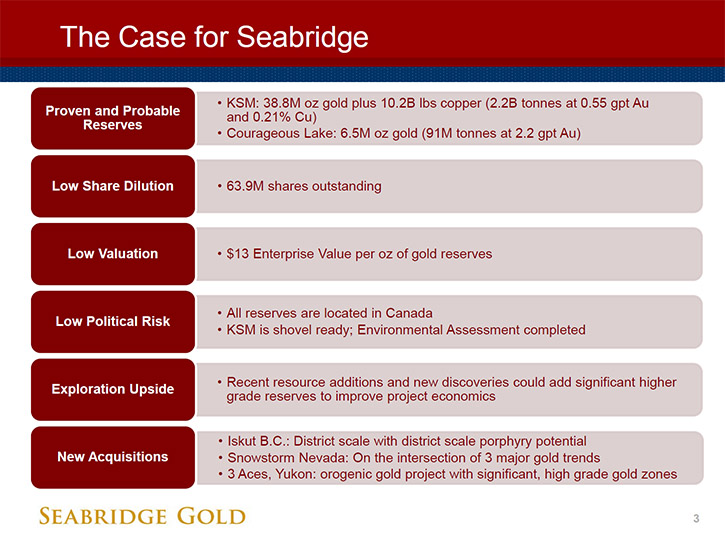

Seabridge Gold (TSX: SEA, NYSE: SA) holds a 100% interest in several vast North American gold resource projects. The Company's principal assets are the KSM and Iskut properties, located near Stewart, British Columbia, Canada and the Courageous Lake gold project, located in Canada's Northwest Territories. Rudi Fronk, Co-founder, Chairman and CEO of Seabridge Gold, believes we are now in a new bull market for gold, and his Company's goal is to continue to provide optionality and leverage to the gold price by increasing gold ownership per common share, as they have successfully done over the past 20 years. According to Mr. Fronk, Seabridge's exploration team has found more gold over the past 15+ years than any other gold company. The Company's current total reserves include 45 million ounces of proven and probable gold reserves, just over 10 billion pounds of copper, and nearly 200 million ounces of silver.

Seabridge Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rudi Fronk, who's Chairman and CEO of Seabridge Gold. Rudi, could you say a few words about what you think of the outlook for the gold market and the prices we're seeing during the coronavirus event, financial difficulties going on and where gold fits into all of this.

Rudi Fronk: Great question, Al. It's one that I am now getting on a regular basis considering what's going on with gold and financial markets. Our thesis really hasn't changed that much as we believe that the price of gold will go substantially higher from current levels due to asset bubbles that have been created mostly from central bank activities.

Our four-fold thesis on why gold will go higher is as follows: First, the world has far too much debt. We had a credit bubble in 2008 and since then global debt is now up another 80% with global debt to GDP at 322% as of Q3 2019. Since then, it has only gone higher.

Second, a recession is now popping the credit bubble. Watch for continuing downgrades and defaults, rising unemployment and huge government deficits due to fiscal stimulus and falling tax revenues. Although COVID-19 will be blamed for the recession, we believe it would have happened eventually anyway as global debts were simply too large in the context of the global economy.

Thirdly, central banks are trying to prevent a collapse by massive monetization of soaring deficits. Finally, as a result of all this, the US dollar and other fiat currencies will fall hard and gold will soar.

Dr. Allen Alper: Well, I appreciate your analysis and information for investors. Could you tell our readers/investors how Seabridge fits into this picture?

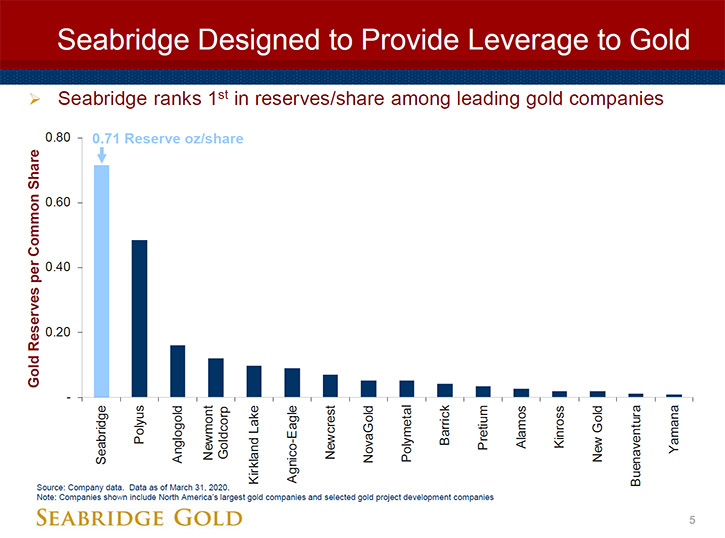

Rudi Fronk: We created Seabridge in 1999, with a contrarian view on gold. At the time, gold was trading at about $260 an ounce and we believed that over time it would go much higher. Our goal was to create what we thought would be the best leveraged play to a rising gold price. To achieve this, we implemented the simple concept of growing ounces in the ground faster than shares outstanding. Our goal is to provide optionality and leverage to the gold price, and with the industry’s leading gold ownership per common share, we have delivered on that.

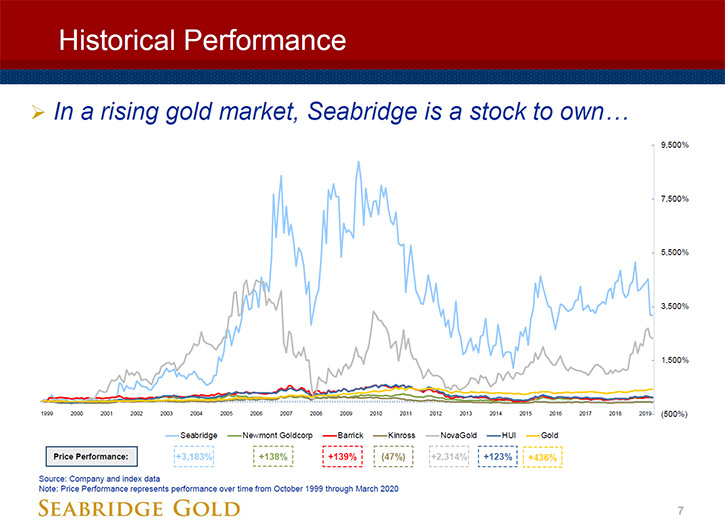

If you look at the past 20 years since we formed Seabridge, our shares on average have outperformed the gold price by over 700%, even with the recent downturn in our share price, due to COVID-19. So, if you're looking for a way to play a higher gold price, we believe that Seabridge common shares continue to provide one of the best opportunities in the market to do so.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors what differentiates Seabridge Gold from other companies?

Rudi Fronk: Well, first and foremost, we don't build or operate mines. Instead, we will take a project through exploration, engineering and permitting, and then either sell the project or joint venture it with an established producer and let our partners build the mine and operate. What our team has done best though, over the past 15+ years, is find gold. Over this time period, our exploration team has found more gold than any other company on the planet, including the major gold companies. Since 2005, our exploration activities have added over 55 million ounces of measured and indicated gold resources plus an additional 50+ million ounces in the inferred category.

Our goal from day one was to build a company that provided more gold ownership per common share than any other company in the industry. We have achieved this. Today, with only about 64 million shares outstanding, each Seabridge common share is backed by almost 2 ounces of gold in the ground. By growing ounces faster than shares outstanding, our shares have outperformed when the gold price is moving higher.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your proven and probable reserves?

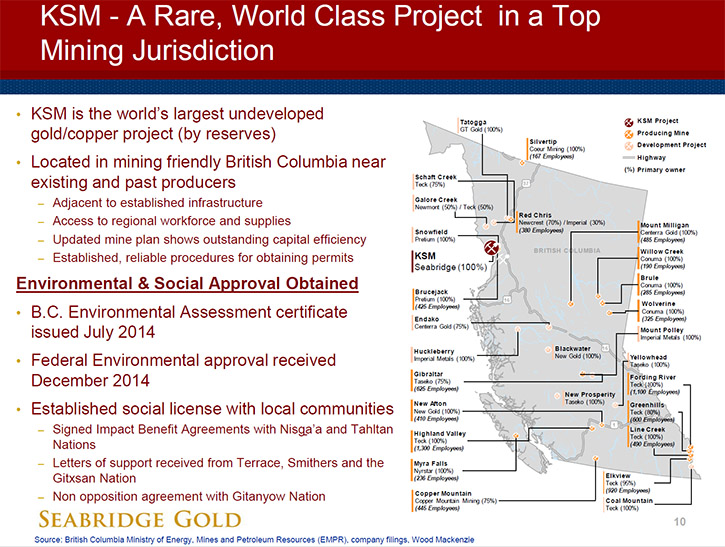

Rudi Fronk: Between KSM and Courageous Lake, we have 45 million ounces of proven and probable gold reserves, just over 10 billion pounds of copper, and nearly 200 million ounces of silver. Most of our proven and probable reserves are contained at our 100% owned KSM project, located in Northern British Columbia. KSM is a large porphyry system with four deposits which collectively have 7.5 Billion tons of total resources containing about 50 million ounces of gold in the measured and indicated categories plus an additional 56 million ounces in the inferred category.

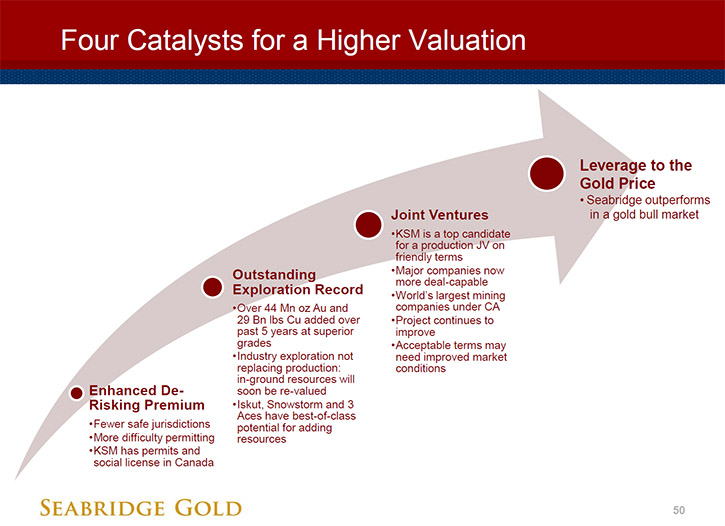

At KSM we have also successfully completed the provincial and federal environmental assessment process. For the past several years we have had on-going discussions, with potential joint venture partners, as we recognize that KSM will require the involvement of a major mining company to build and operate the mine. Although we have had numerous proposals from perspective partners, we have not yet received one we are willing to say yes to. Two years ago, we nearly concluded the deal we want, but the trade wars with China hit the copper price and the deal went on hold. Meanwhile, the looming copper shortage has only increased. More recently, we were advancing discussions on a potential transaction that is now being delayed by uncertainty over COVID-19. So, we wait for better conditions as the gold price rises. We like where we are.

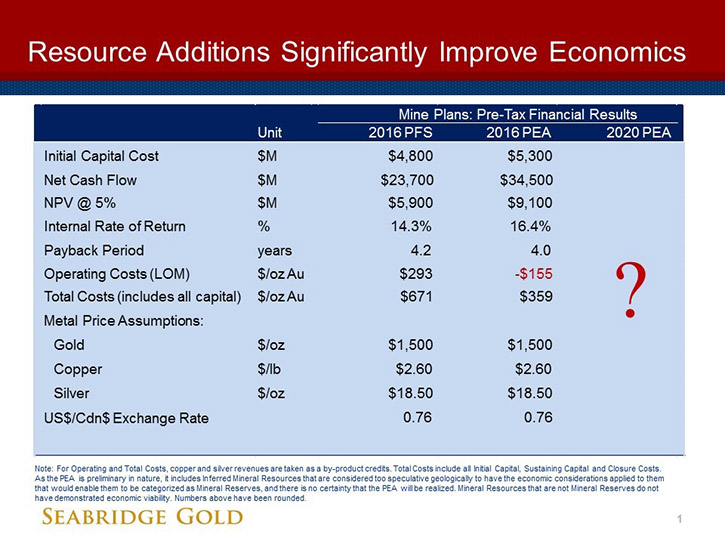

While we wait for a joint venture deal that meets our objectives, we continue to improve the quality of the project by finding better grade material and looking at alternative mine plans that will enhance the project’s economics. In fact, in 2016 we showed an updated mine that captured about 40 million ounces of gold, similar to the 38.8 million ounces we have in reserves, but instead of 10.2 billion pounds of copper in reserves, the alternate mine plan captured 16.7 billion pounds of copper. The end result was that we were able to show better economics on all fronts with significant improvements to net cash flow, net present values and internal rates of returns. Best of all, however, was being able to show a +$300 per ounce drop in the all-in cost of gold production, inclusive of all capital, from $670 per ounce to $360 per ounce.

And we're not yet done improving the project. We are now finalizing a new technical study that will show another alternate mine plan that will incorporate what we have added from exploration since 2016 at the Iron Cap Zone. The updated study should be completed within the next month and our expectation is that it will show further improvements to KSM’s projected economics.

Dr. Allen Alper: That sounds great. Could you talk about the low political risk that Seabridge has?

Rudi Fronk: One of our guiding principles, when we formed Seabridge, was to avoid political risk. In my career, I have been involved with building mines, in third world countries, which were eventually expropriated by governments. Political risk is real and it's not just through outright expropriation. It could also be through creeping taxes, increased royalties or other confiscatory measures. When we formed Seabridge in 1999, we wanted to minimize political risks, so we focus exclusively on North America. Today, if you look at our assets, they're all situated in Canada or the United States, which we believe are two of the best jurisdictions to be in, if you're a mining company.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a little bit about your exploration upside?

Rudi Fronk: We're not a single asset company. We have three other assets in our portfolio, and we just announced the acquisition of a fourth. The most advanced of these other assets is Courageous Lake. An asset in the Northwest Territories that hosts 6.5 million ounces of reserves. Courageous Lake’s reserves sit on only two kilometers of a 53-kilometer-long Greenstone belt.

Not sure who said this, but one of my favorite quotes is “never let a bear market go to waste”. So when the gold market took a major downturn in 2015, we took advantage of the situation and went out and purchased two new projects. In 2016, we bought a company called SnipGold, which gives us a 100% interest in the Iskut property, located in British Columbia, about 30 kilometers from KSM. The work we've done over the past couple of years tells us Iskut could be another KSM. We are hoping to be able to drill a highly prospective gold-copper target later this year.

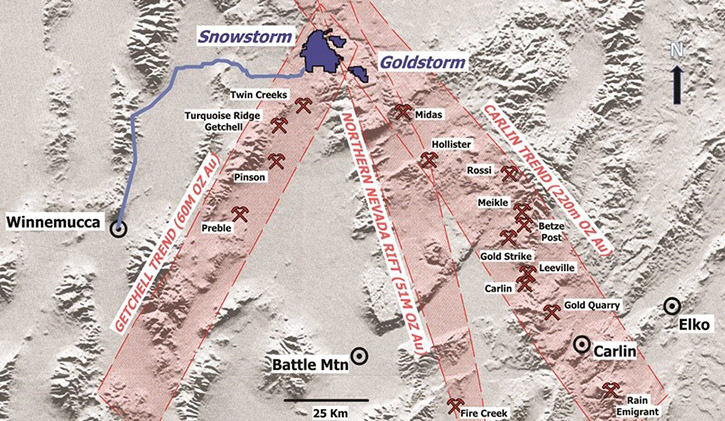

In 2017 we completed the acquisition of a 100% interest in the Snowstorm project, located in northern Nevada. Snowstorm sits on the intersection of three of the most prolific gold belts in Nevada and just north of the Twin Creeks and Turquoise Ridge mines that are now part of the Newmont-Barrick joint venture. We believe that Snowstorm has the potential to host Twin Creeks and Turquoise Ridge style mineralization. This year, we are planning to conduct our second drill program, hoping to vector into high-grade gold.

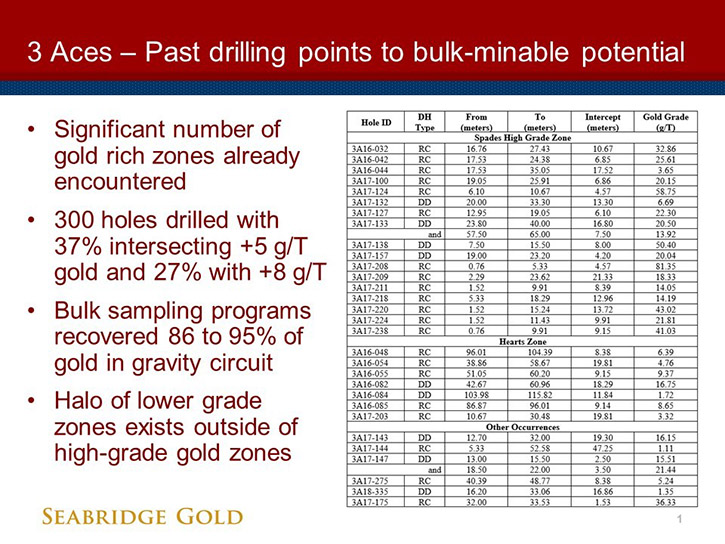

Finally, just a few weeks ago, we announced the acquisition of the 3 Aces project in the Yukon, which consists of more than 350 square kilometers of highly prospective ground. There are gold showings over the entire 35 kilometers of strike length, with numerous near surface, high-grade gold intersections. We expect to close this acquisition later this month.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors your primary goals for 2020 and going into 2021?

Rudi Fronk: In the next several weeks, we are expecting to announce the results of the new Technical Report on KSM that will not only reconfirm the project’s reserves, but also present an alternate mine plan capturing the Iron Cap Zone, which we expect will show a significant improvement in the project's economics.

Additionally, later on this year, we hope to conduct drill programs at both Iskut and Snowstorm. Obviously, our ability to get that done will be based on what happens with COVID-19, in terms of being able to run an exploration camp, with contractors and staff on the ground.

Finally, we are continuing our partnership discussions on KSM. We believe that as the price of gold goes higher, it just strengthens our hand to get the terms we are looking for. And it’s not only the price of gold that should help in negotiations, but also the dwindling reserve base of the industry. There really has not been significant additions to reserves at the major mining companies, while they continue to consume reserves through production. The remaining reserve-life at the major mining companies is the lowest I have seen in my 38 years in the business. As a result, the major gold companies will require new projects to extend their production life. We believe that they will focus on large permitted projects, situated in safe jurisdictions showing good capital efficiency. KSM checks all these boxes.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Seabridge Gold?

Rudi Fronk: First, if we are in the beginning phase of a new bull market in gold, our historic performance shows that in times like these, our share price significantly outperforms gold and other gold equities by a substantial margin. We believe that we're not only going to see new all-time highs in gold later this year, but as a result of the global money printing we are now witnessing, we believe that over time the price of gold can go to multiples of today’s price.

Secondly, would be our ability to add ounces. As I mentioned earlier, our exploration team has found more ounces than any company on the planet over the past 15+ years. We now have four projects other than KSM, which we believe can add ounces, while potentially offsetting any equity dilution required to fund exploration activities.

Last, but not least, at some point we will complete a joint venture on KSM. We believe that we trade at a significant discount to other gold companies because we have been talking about a joint venture for some time, but have not concluded one as yet. We only get to do this once, and for us, the terms of a joint venture are far more important than timing. We continue to dialogue on a regular basis with a number of companies that have the technical, financial and social wherewithal to build and operate a mine like KSM. Although we have turned down multiple proposals over the years, we believe that the market is moving in our favor and as a result of that, we will be able to obtain a joint venture on terms that make sense for our shareholders.

Dr. Allen Alper: Well, that sounds excellent. Is there anything else you'd like to add, Rudi?

Rudi Fronk: We're very excited about where we are right now. It's unfortunate that COVID-19 has been the black swan, leading to the issues now facing the global financial markets. However, we believe that the financial markets were set up for a reset at some point, due to the huge quantities of unproductive debt that has been created since the last financial storm in 2008. Simply put, even without COVID-19 the global GDP was not sufficient to service the level of debt that has been created. We believe that going forward, gold will be a key asset that will protect wealth more effectively than any other asset, and as a result, investors will flock to gold as an alternative to stocks, bonds and cash.

Dr. Allen Alper: That sounds like an excellent opportunity for our readers/investors. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://seabridgegold.net/

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 Fax: (416) 367-2711

Email: info@seabridgegold.net

|

|