Blackstone Minerals (ASX: BSX): New High-Grade Discovery (King Cobra) at Their Ta Khoa Nickel Project, in Northern Vietnam; Interview with Scott Williamson, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/11/2020

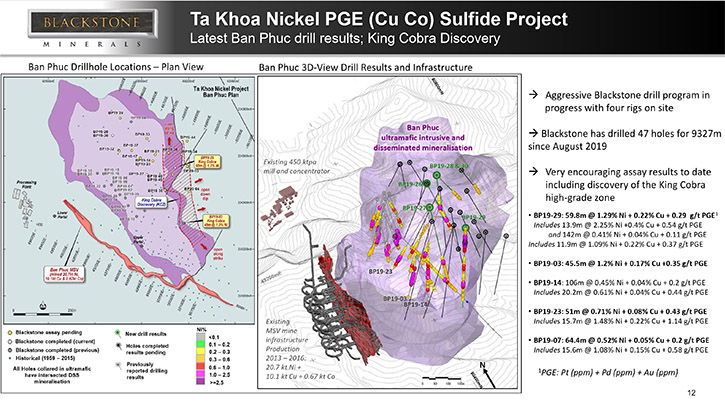

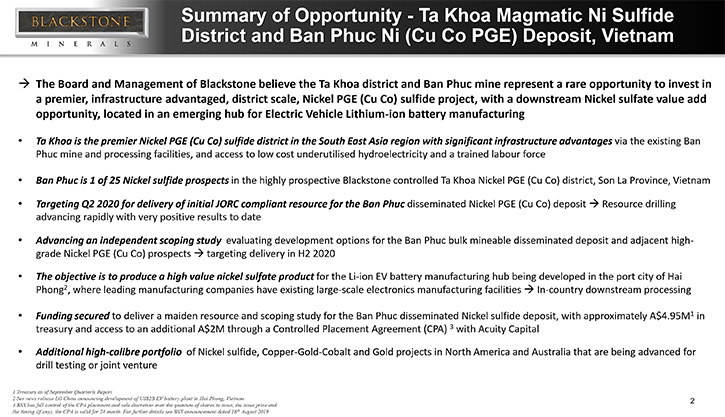

We talked with Scott Williamson, Managing Director of Blackstone Minerals (ASX: BSX), during PDAC 2020. Blackstone just made a new high-grade discovery (King Cobra) at their Ta Khoa Nickel project, in Northern Vietnam. They intersected 60 meters at 1.3% nickel, plus copper, cobalt, platinum, palladium, and gold, four grams per ton on a gold equivalent. King Cobra is a surface deposit, with very high-grade shallow and potentially open-pit ore bodies. Blackstone could be mining this Nickle discovery, within two years. Blackstone has real promise.

Blackstone Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Scott Williamson, who is Managing Director of Blackstone Minerals. Could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

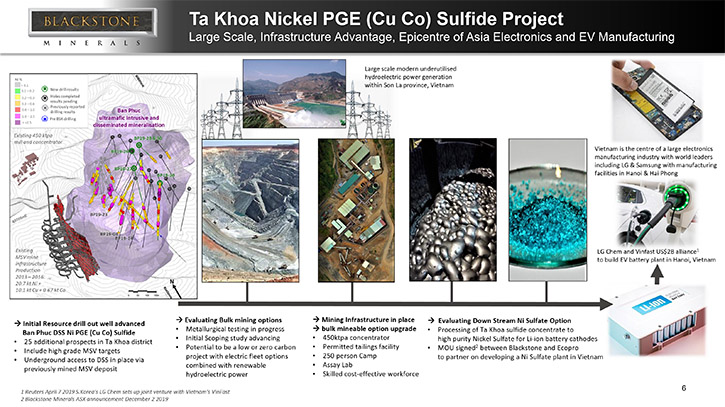

Scott Williamson: Okay, thanks Allen. At Blackstone, our flagship asset is the Ta Khoa Nickel project in Northern Vietnam. It's a nickel-sulfide mine, under care and maintenance. It operated between 2013 and 2016, during some of the most difficult and lowest nickel prices we've seen in the last 10 years. The previous owners didn't do any exploration, outside of that first ore body that they mined. So they drilled and mined a massive sulfide vein. Right next to that massive sulfide vein, is a very large disseminated sulfide ore body, over a kilometer long and 500 meters wide. We're now drilling that ore body. We have four drill rigs. We've just made a new high-grade discovery. We're calling it the King Cobra discovery.

We recently intersected 60 meters at 1.3% nickel, plus copper, cobalt, platinum, palladium, and gold. That's equivalent to about four grams per ton, on a gold equivalent basis. From surface, it’s very high grade, shallow and potentially open pitable ore. What distinguishes us from our peers is that we're looking to build a nickel sulfate plant. There's an existing concentrator, the previous owners sunk $136 million into a concentrator and an underground mine. We're now going to upgrade that concentrator to nickel sulfate and we're using our partnerships, with the Korean battery end users, to joint venture on that downstream processing facility. The catalysts coming up are the maiden resources on that Ban Phuc disseminated ore body, which will lead straight into a scoping study. We're expecting a maiden resource in late Q2 and a scoping study in early Q3.

Dr. Allen Alper: Sounds excellent!

Scott Williamson: We have $2.8 million in the bank that keeps us going for the current drilling campaign. The discovery has actually extended the drill-out phase of that ore body. So we have probably another two months of drilling of this King Cobra discovery, but we're excited because this could lead us down to the source of the mineralization. This very large intrusion might give us an understanding of where the source of all the mineralization is. So we're going to chase that at depth and see what we can discover at depth.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors about your background and your Management Team and Board?

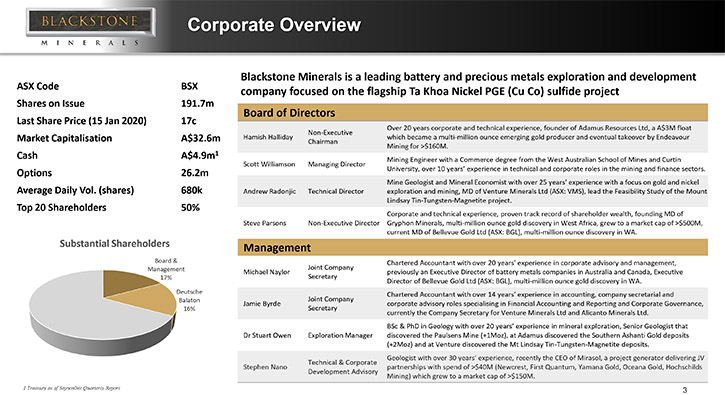

Scott Williamson: I was a mining engineer for the first half of my career. I've worked in mines throughout Australia and Africa. Most of my time was spent in underground mining. I've also done some open pit mining. Then I went into the capital markets as an equities analyst or mining analyst. The second half of my career has been focused on capital markets and investor relations. As far as the rest of the Board, we have a team of geologists that have been working together for 20 years. We have a history of creating shareholder wealth through major discoveries throughout the globe. We've worked in every continent except Antarctica. We have this history of creating shareholder wealth through discoveries. Steve Parsons has recently been very successful, with a company called Bellevue Gold Limited. The ASX code is BGL.

Steve and Hamish have been business partners for 20 years, and have this very strong history of creating very large companies from very small companies. Bellevue is a good example. When Steve started. It was a $5 million market cap. It's now a $350 million company, through discoveries and geological expertise. We believe that Blackstone has a potential to be one of our next success stories, with the ability to create something, with a multiple hundred million dollar market cap.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/ and investors how it is operating in Vietnam?

Scott Williamson: It has an established mining industry. There're over 20 underground mines and over 20 open pit mines. Most of these mines are owned by private Vietnamese or government. That makes for a good operating environment, as we have access to service providers, drilling contractors, all of the usual things that you have in an established mining industry. So, we have very low labor costs and very low power costs. We have a hydropower plant nearby. It's the largest hydropower plant in Southeast Asia, within our province. So we have very low power costs. So far, it's been a very pleasant experience, but we're drilling for $60 US per meter. In Australia or Canada, we'd be looking at many multiples of that. So in Australia it'd be looking at $250 to $300 a meter. In Canada, we were spending $500 a meter drilling in the mountains.

Dr. Allen Alper: That sounds very, very good! Could you tell our readers/and investors a little bit about your capital structure?

Scott Williamson: Yes. We have a tight capital structure. Board and Management have approximately 17%. The Deutsche Balaton fund, from Germany, a very supportive shareholder, owns also around 17%. The top 20 owns 50%. The top 20 is very tightly held by insiders and our closest broker relationships. $2.8 million in the bank at the last quarterly! We’re now trading about a million shares a day. It's good to have liquidity. The market cap has halved since the coronavirus. I think we got up to about 40 million market cap, now we're probably sitting around 20 million.

Dr. Allen Alper: It sounds like there's an opportunity for investors. Could you tell our readers/investors, the primary reasons they should consider investing in Blackstone Minerals?

Scott Williamson: Okay, so we're one of the only nickel explorer developers, with the potential to be mining, within the next two to three years. We'll also have the potential to be producing a premium product, which is nickel sulfate for the lithium ion battery industry. Many of our peers will be producing nickel concentrate and being paid a discount to the nickel price for that concentrate. We believe that we can deliver nickel sulfate, which actually trades at a premium to the nickel metal price. Through our relationships with our battery end users, particularly in Korea, we believe that there'll be minimal dilution to the Blackstone shareholders as we go through this process of studies, building a mine, and restarting it.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add, Scott?

Scott Williamson: We also have a portfolio of other assets. We are particularly focused on the flagship asset, in Vietnam, but we're also looking for joint venture partners on our Canadian asset. That's one of the reasons why we're here at PDAC, to find farm-in partners for our Canadian British Columbia asset.

Dr. Allen Alper: Sounds very good. Could you say a few words about getting the assets?

Scott Williamson: That one is near the Bralorne mine, the most prolific gold mine in British Columbia's history. They mined 4.4 million ounces at 17 grams per ton gold. We have a belt scale opportunity there, we have 48 kilometers of strike potential. We were initially looking for cobalt. We've hit some very high-grade cobalt and gold. We also believe there's a lot of copper in the system. We've done an IP survey. We have a sulfide bearing response in the IP that suggests we have a large sulfide system, 1.7 kilometers long, high chargeability zone, which is ready to drill. There is some very interesting geology. It looks like a very large system that requires a decent balance sheet and a decent focus on that asset. Unfortunately, we can only tackle one big asset at a time. And at the moment we're going to tackle the Vietnam nickel.

Dr. Allen Alper: That sounds very good. Is there anything else you’d like to add?

Scott Williamson: Just to thank you for interviewing Blackstone Minerals for Metals News.

Dr. Allen Alper: I’ve enjoyed talking with you. A very interesting interview! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Telephone: +61 8 9425 5217

Fax: +61 8 6500 9982

admin@blackstoneminerals.com.au

http://www.blackstoneminerals.com.au

LinkedIn blackstone-minerals

Twitter @blackstoneminerals

Facebook @blackstoneminerals

|

|