First Cobalt (TSX.V: FCC, OTCQX: FTSSF): First Cobalt Has the Only Permitted Cobalt Refinery, in North America, Capable of Producing Battery Materials. Interview with Trent Mell, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/9/2020

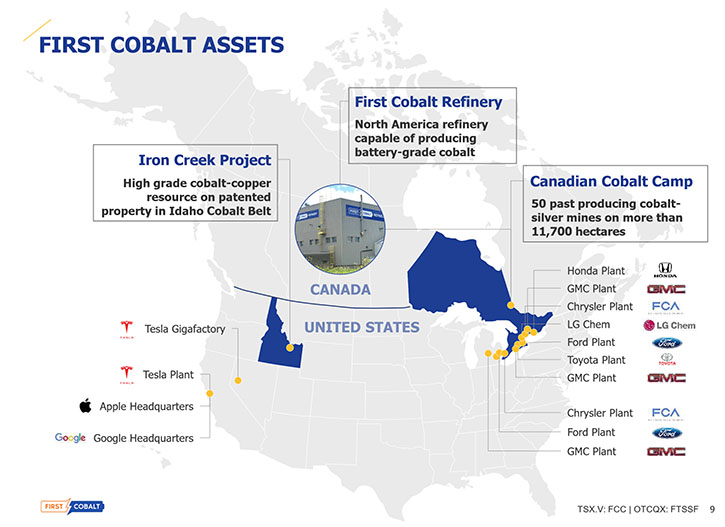

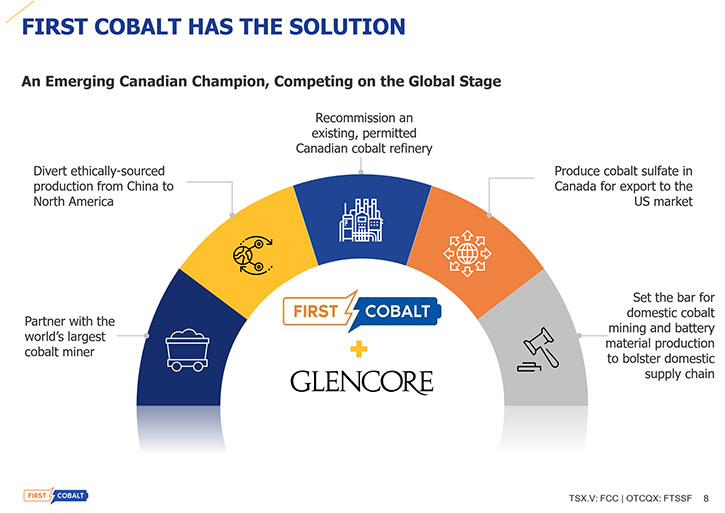

We recently talked with Trent Mell, President and CEO of First Cobalt (TSX.V: FCC, OTCQX: FTSSF). First Cobalt is positioned to have its Refinery producing Cobalt as early as Q4 2020. First Cobalt has partnered with Glencore and they have been working on a feasibility study that will be released in a few weeks. The Company has the only permitted cobalt refinery in North America capable of producing battery materials. Look for the feasibility study results; First Cobalt should be revalued when they go into production.

Their main exploration project is the Iron Creek Cobalt Project in Idaho, USA, a primary cobalt deposit that currently contains an Indicated Resource of 2.2 million tonnes at 0.32% cobalt equivalent (0.26% cobalt and 0.61% copper) for 12.3 million pounds of contained cobalt and 29 million pounds of contained copper as well as an Inferred Resource of 2.7 million tonnes at 0.28% cobalt equivalent (0.22% cobalt and 0.68% copper) for an additional 12.7 million pounds of contained cobalt and 40 million pounds of contained copper.

First Cobalt Refinery

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Trent Mell, who is President and CEO of First Cobalt. Trent, could you give our readers/investors an overview of the important happenings in the cobalt market, and then go on to give us an overview of First Cobalt, and what differentiates First Cobalt from others.

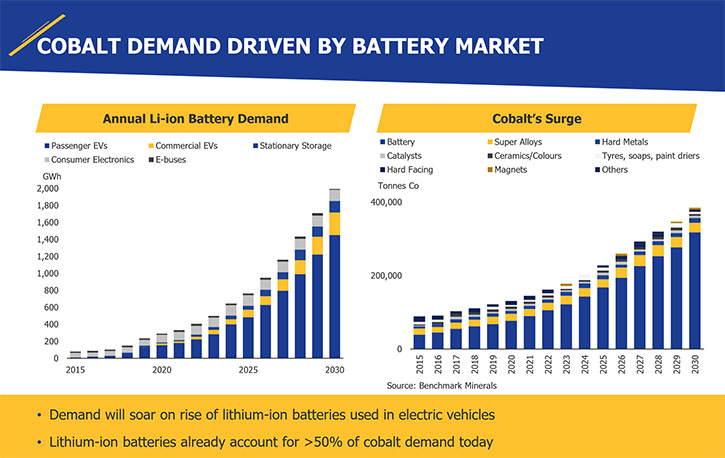

Trent Mell: From the cobalt market perspective, we finished 2019 with a global electric vehicle penetration rate of about 2.8%. Forecasts for this year were 4.3%, though this will certainly be impacted by pandemic-induced slowdown. However, the point remains that we are still in the early days of adoption, looking at a significant increase in penetration in years ahead. The long-term trajectory is pretty clear.

In 2020, the outlook for cobalt is much more constructive than it was in 2019 and in the latter half of 2018. We have seen a quiet and steady rebound in the cobalt price, which hit a low of $12 a pound in August of 2019, and then increased to $18.00 per pound until the pandemic hit.

That is healthy price appreciation, which took root as the high level of artisanal production we saw in 2017 and 2018 has been gradually absorbed into the market. The backdrop for the future is very strong, even if we face short term headwinds. Volkswagen is coming out with their ID.3 electric vehicle in Europe in the spring, the Ford Mustang is coming later this year and we are going to start to see other European and American auto companies start to release their EV lineup. These are exciting times for car enthusiasts and environmentalists alike.

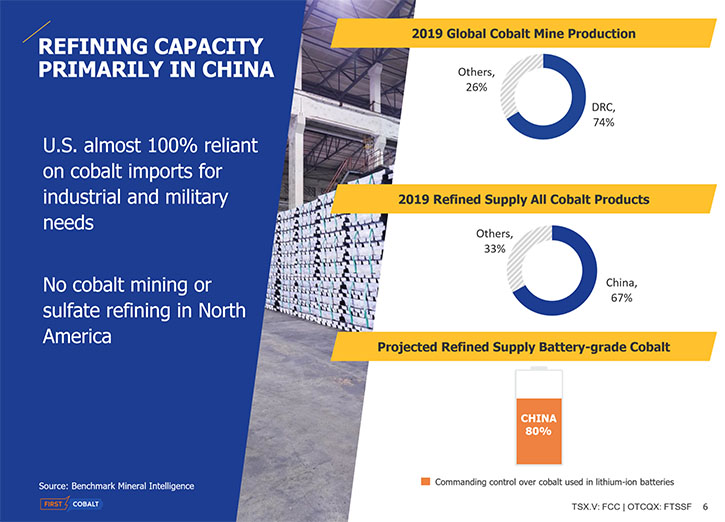

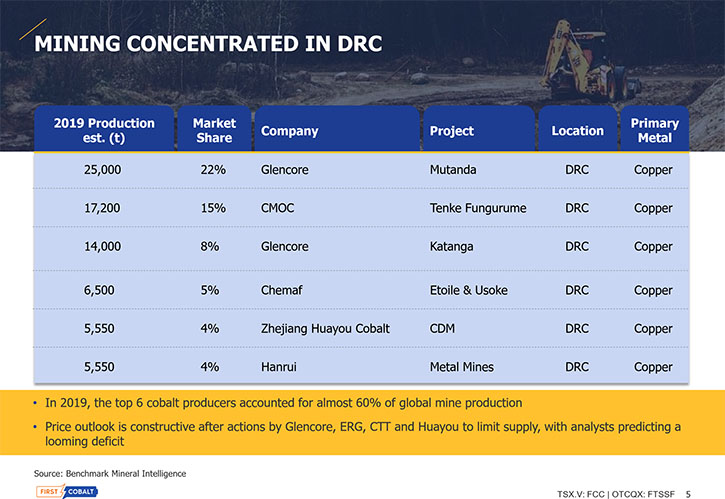

The macro side is very healthy. And yet we still face this issue of a concentration of supply chain, around the DRC and China. There is a real opportunity for a company like First Cobalt to come in and make its mark.

As an ancillary point, I would also highlight Tesla‘s advances in China. They had a great ramp up in production in China and sales have been very strong.

Recently, we saw headlines about a cobalt-free battery in China and that has naturally generated a lot of questions for me. Are we going to a cobalt-free future in batteries? The short answer to that is a resounding ‘No’. The battery that was being referred to in the financial press is an LFP cathode, or a lithium-iron-phosphate battery, which is a known technology at the entry level of the battery market. It has a low energy density which means it is a lower range battery specifically intended to compete at the entry level in China. I have it on very good authority that this is not something we should expect to see in Europe or North America. Given its short range, nobody would want it. It represents an opportunity for Tesla to compete at a lower price point in the Chinese market, while their standard extended range vehicles, on the contrary, actually contain a little more cobalt than the ones we see here in the U.S. given the battery maker they have partnered with in China.

With that important Tesla-China market update out of the way, I am happy to turn the focus back to First Cobalt and where we are in the market.

Dr. Allen Alper: Yes. Give us an overview, and what differentiates your Company from others.

Trent Mell: For the past seven months, we have been working on a feasibility study to restart our refinery. When we created this Company, we started with the mineral assets. We created a massive asset base comprised of Canadian and U.S. exploration properties. We have done a fair bit of work on these properties and are very encouraged with what we see. Particularly with our asset in Idaho, where we have a new resource update and the deposit keeps growing with almost every drill hole.

Having said that, we have a really unique opportunity here with a permitted cobalt refinery in Canada, in Northern Ontario. It is the only one on the continent that could produce a cobalt material quickly, for the electric vehicle market.

We partnered with Glencore late last year. They have funded us US$5 million to complete a feasibility study, to do more detailed engineering and metallurgical work on the proposed restart and expansion. Now we are in the final phases. We have about four weeks to go and then we expect to release the study, which will give a higher level of detail and confidence to the estimated capex and opex and timeline to produce what we hope would be up to 5% of global refined cobalt.

It's been a busy period for us, a lot of inward focused work, a lot of engineering, a lot of consultants doing their work on environmental and so forth.

What is unique is that we have a building that is built and permitted, and we are finding ourselves, at this point in time, being more of a chemical company than a mining company. We are putting ourselves at the very front end of the automotive supply chain.

If all goes well, we could see ourselves with a modest first cashflow this year from the pilot plant scenario, and then following through with a big expansion next year, to a throughput rate of 55 tonnes a day, which could generate about a 5% market share or 5,000 tonnes of cobalt per year. And there is nobody else in our space that can do what we plan to do.

It is a relatively modest capex because we are working with an existing refining complex. We also have a partnership with Glencore, and we believe we can make it happen in fairly short order. Our competition for that end of the market, the refining side, basically is a large refinery in Finland and then China. So, we find ourselves with an opportunity to do something really special here on this continent and support the growth of the North American electric vehicle supply chain.

Dr. Allen Alper: Well, that sounds excellent. That's a great position to be in, and a unique position. It would give the western world independence from China, and also the Congo.

Trent Mell: Yes, it is a unique story from the critical minerals perspective. We know that the U.S. current administration is keen to see America reduce reliance on China for critical minerals. Frankly, it is no different up here in Canada and our business plan plays right into that. It is a quick, easy delivery.

The feed material would still come from the DRC, via Glencore, and that is because we do not yet have cobalt mines here in North America. They are coming. But in the meantime, instead of diverting all that material from Africa to China, we can bring African feed directly to North America and create our own supply chain, while we develop our domestic mineral assets.

There is an important strategic component to what we are doing. First Cobalt plays handily into some of the policy objectives of the current administration.

Dr. Allen Alper: That seems great. I would guess Glencore takes steps to make sure that the cobalt is from legitimate sources.

Trent Mell: Yes and that is very important. Good question, thank you. The strategy that we are working towards would represent a closed supply chain. By that I mean that mine material arriving at the refinery would come from one of two big Glencore commercial operations. At our end we would only be taking material from that Glencore operation. This eliminates the opportunity for artisanal feedstock or for traders to sell us alternative sources of feed for our refinery. From an end buyer's perspective, whether it be an automotive company or a battery company, there is no risk of ever being embarrassed by material of an unknown provenance finding its way into their vehicles.

And that is obviously extremely important to them. And it is important to us. Working with Glencore, we will have the appropriate certifications and traceability protocols in place. But given that you are starting with Glencore and not an intermediate or small-scale producer, there is already a great measure of comfort that you can get that our certification process will hold up to scrutiny.

Dr. Allen Alper: Sounds great. Could you say just a couple words on Glencore's position in the cobalt market?

Trent Mell: The advantage of having Glencore as a partner is, they are the world's largest miner of cobalt, with over 30% of mined cobalt supply every year. They are also the largest trader of cobalt in the world, to my knowledge. So, our partner can provide us the feed and they can ensure that the refined product is placed in the North American supply chain.

We benefit on both ends. They also have the technical expertise and their center of operations in Canada is only two hours away from our refinery.

In summary, there are a lot of benefits for us, as a pre-cash flow startup company, to have a company of Glencore’s size, with their technical expertise and balance sheet. It is hard to imagine a better partner. Now it is up to us to make sure that we execute on our end of the relationship.

Dr. Allen Alper: That sounds excellent. Could you tell, our readers/investors, a bit about your background, your Team and your Board?

Trent Mell: Sure. I started my mining career with Barrick Gold, the world’s largest gold miner. I have worked in the nickel industry with Sheritt International. I have also worked in palladium and a couple of other gold plays. It is only over the past 6-7 years that I have dabbled in junior mining. First Cobalt is the second company that I have run. I also spent a couple of years raising capital for junior miners and Canadian mining companies – some $250 million or so.

But my passion is building projects and building teams. When I put this company together, three years ago now, I was very deliberate in ensuring that all of us had an operating background. When you look at the pedigrees of the senior leadership team, companies like Inmet Mining Corporation, Falconbridge Limited, First Quantum Minerals Limited and Barrick Gold are going to show up on their bios. That is important for our success because these are people, who have worked around the world, building, exploring, operating mines and in some cases, even reclaiming them after their useful life.

That has really helped. When I turn to the Board level, we have a mix of skills. We have project development, mining, smelting and refining experience, but we also have good business acumen from outside the resource sector. We have a former Governor of Idaho. We also have the country’s President for Snyder Electric. It really is a nice balance of skills.

We also have Henrik Fisker, automotive entrepreneur, as a Special Advisor to the Company. In addition, there are a number of partnerships and third parties that we rely on. We may be a small company but, importantly, we know how to partner with big partners, such as engineering firm Ausenco, to ensure that we stay on the right track.

Dr. Allen Alper: It sounds like you have a great background, and your whole group has an outstanding background, as well as excellent track records. So that's great. Could you tell our readers/investors a little bit about your share and capital structure?

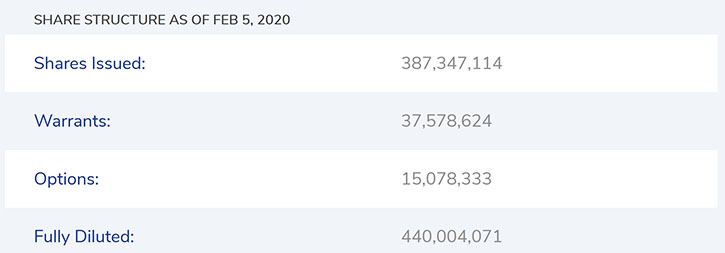

Trent Mell: We have a pretty hefty share structure, with over 380 million shares outstanding. That is a function of a merger with an Australian company some time ago. Be that as it may, we have good liquidity, often trading about a million shares a day on the Toronto Venture Exchange, the OTC QX and alternate exchanges.

We had, as of last quarter, a cash balance of about US $5 million and a debt facility with Glencore that has a three-year term. That debt is part and parcel of the refinery project and will eventually be rolled up into a larger debt financing package to get that off the ground.

Our treasury is in good shape for the next 12 months, so we have no intention to raise equity capital for some time. And certainly, there is no intention to incur any significant dilution to get the refinery going. Given that we are going to be selling our off-take on a prepayment basis, it makes sense to take on a debt-like structure to get this off the ground.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in First Cobalt, Trent?

Trent Mell: Cobalt has been coming off its lows. Equities have been a little slower to respond. In fact, if you look at First Cobalt and the small handful of cobalt peers that are out there, the equities have not really responded to the cobalt price rally. That will change.

As I alluded to earlier, we have a whole bunch of electric vehicle models that are going to start to hit the market in 2020. This EV revolution that started with China, and of course included Tesla, in the rest of the world, is starting to gain traction in Europe. I expect to see some significant gains in the European market in 2020, potentially with world-leading penetration rates. The slowdown induced by the COVID-19 pandemic will have a transient impact but we will get through that. Once we do, the march towards electrification will continue. There is no doubt about it.

We are experiencing a once-in-a-lifetime transformational event that will forever change the way we get around. How do you get exposure to that? Sure, you can buy Tesla $500/share. At the other end of the spectrum, you have startup companies that have not yet participated in an EV rally. I strongly believe the value proposition of First Cobalt remains quite compelling. On the heels of some of the big milestones that are coming up for us, as we progress our way through 2020, I expect to start seeing an appreciation of our share price.

Dr. Allen Alper: Sounds like excellent reasons for our readers/investors to consider investing in First Cobalt. Trent, is there anything else you'd like to add?

Trent Mell: To anybody out there who is considering investing, or who is already invested, we welcome all inbound calls and emails. We are happy to connect with investors who have questions. I think our year ahead is really compelling. We hope to hit first cash flow in a matter of months and that is a really big moment for a startup.

I am really, really excited with what lies ahead. I hope people will follow our progress.

Dr. Allen Alper: That's great. 2020 will be an excellent, important year for First Cobalt and will be great for your shareholders and stakeholders, so that's excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Trent Mell: Thank you, Al, for interviewing First Cobalt for Metals News.

Dr. Allen Alper: I’ve enjoyed talking with you. Very exciting stuff!

https://www.firstcobalt.com/

Twitter @FirstCobalt, twitter.com/FirstCobalt

Facebook facebook.com/firstcobalt/

LinkedIn linkedin.com/company/first-cobalt-corp./

|

|