Blue Star Gold Corp. (TSX-V: BAU; Frankfurt: 5WP): Exploring High-Grade Gold Projects in Northern territory of Nunavut, Canada; Interview with Stephen Wilkinson, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/7/2020

We learned from Stephen Wilkinson, President and CEO of Blue Star Gold Corp. (TSX-V: BAU; Frankfurt: 5WP), that they are focused exclusively in the Western half of the Northern territory of Nunavut, in Canada, with projects situated inside the Arctic Circle on the Inuit-owned lands. Blue Star owns the highly prospective, 8,015 ha, Hood River gold property that has a number of bonanza-grade gold occurrences, grading hundreds of grams per ton. In addition, according the its latest news release, the Company has recently exercised its option and has acquired the high-grade, development-stage Ulu Gold Project that hosts high-grade resources of over 830,000 estimated gold ounces, of which 605,000 oz are in measured and indicated category, with excellent potential for resource growth. We learned from Mr. Wilkinson, Blue Star will undertake the site cleanup at Ulu project, as they promised to the Kitikmeot Inuit Association, to turn it into usable soil again. Other plans for 2020, at Ulu project, include adding resources through drilling and surface sampling.

Ulu Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Stephen Wilkinson, who's President & CEO of Blue Star Gold. Steve, could you give our readers/investors an overview of Blue Star Gold.

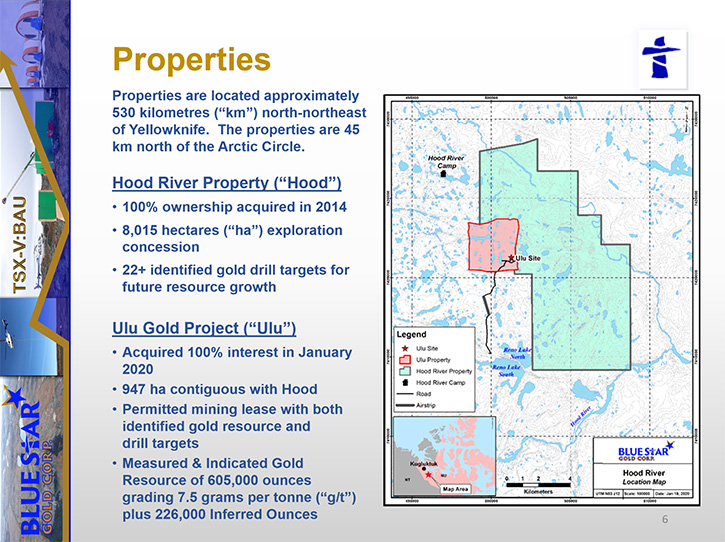

Stephen Wilkinson: Certainly, Al, it'd be my pleasure. Blue Star is a Company that's focused exclusively in the Western half of the Northern territory of Nunavut in Canada. Our projects are situated approximately 45 kilometers, or about 27 miles north of the Arctic Circle and about a hundred kilometers south of the Arctic Ocean, south of the future Grays Bay deep water port.

To give you a little bit of a background. Our name, Blue Star, comes from the Intuit for the North Star. If you look at the Nunavut flag, you'll see that there's an Inukshuk statue that's typical of the North, pointing to a blue star in the upper right corner of the flag, and that's their blue star. So we thought that that was a very appropriate name for a company focused on that part of Canada.

Dr. Allen Alper: That sounds great.

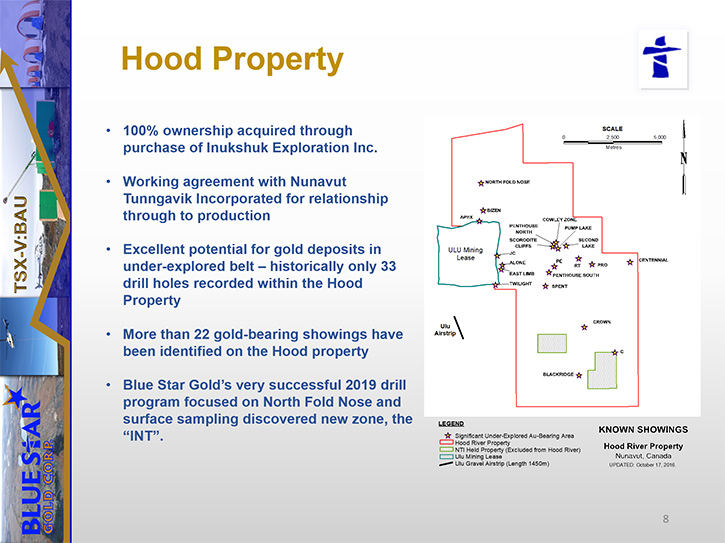

Stephen Wilkinson: Our properties are essentially clustered into a single group of about 9,000 hectares, covering a portion of the Inuit-owned lands. Within those concessions we have the Hood River property, which is 8,000 hectares. The Hood is the largest portion of our land position, all of which is an exploration property. It's had very limited drilling on it, but it's been looked at and had the tires kicked by the likes of BHP and a number of smaller diamond explorers. But it really hasn't been looked at closely for its gold potential.

An old classmate of mine, Bruce Gold, acquired the concessions about six years ago and introduced me to them. The two of us then proceeded to find a home in the company that is now Blue Star. What attracted me to the Hood River concessions was the fact that there was a number of what looks like strata-bound, structurally controlled Bonanza-grade gold occurrences. One that I particularly like, on the Hood River, is known as the Penthouse, the Penthouse North and South.

These occurrences are grab and channel sampled and are grading literally hundreds of grams per ton, with really no drilling been completed on them to define any of the potential resource. However, there was one area of the Hood River concessions, in the Northwest corner, where there was drilling by BHP and they encountered a couple of very interesting zones grading in the order of seven to nine grams over three to five meters. That really caught my attention as having good potential.

Not long after acquiring the Hood River concession, in 2014, in January 2015, we optioned the adjoining Ulu mining lease. Ulu was a discovery made by BHP in 1988. It was drilled and had started having resources defined and some underground development put in place, and ultimately the project was sold to the old Echo Bay Mines. Echo Bay had the Lupin mine, about 120 kilometers to the South, and we're looking for an additional feed for that operation.

At the time Echo Bay picked up the property, the ultimate development in the property was by Decline. That went a total length of about 1.7 kilometers, (about 5,600 feet) and down to a depth of about 155 meters below surface. The zone they were drifting on was called the Flood Zone. It was interpreted to be a series of veins, within a body of volcanic rocks, a very good grade. The longstanding resource on that was about 400,000 ounces at 11 grams.

I thought that, coupled with the great exploration potential in the Hood, it would make a great acquisition. We closed on the Ulu, in terms of the real estate portion of it, last fall, and completed the acquisition a few weeks ago in January, 2020. Blue Star now owns the mining lease outright, the capital equipment on site, the water permit, the land access permit, airstrip, and a lot of capital equipment. We also have deposited with the Federal government and Nunavut regulators a total of $2.4 million into our remediation security accounts.

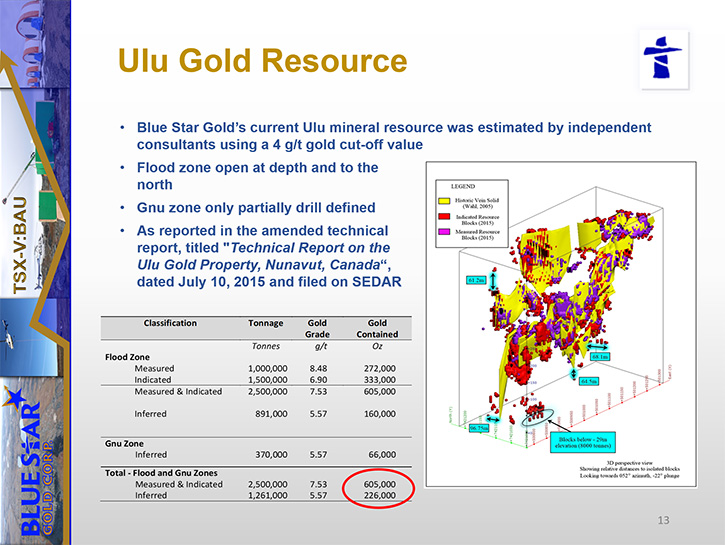

Previously, we had this property under option with Mandalay Resources and we did some work on it. We've completed preliminary metallurgical studies. We've done a reassessment of all of the surface drilling, looking and prioritizing the surface occurrences that are at the Ulu. We found that the historical resource of 400,000 ounces, 11 grams, was in gross error. In fact, as we did our work on the project, we found that their previous modeling had omitted 40% of the drill intersections on the deposit and 60% of the assays of the drill intersections of the gold mineralization, which if they had been included in the original resource, would have doubled the number of ounces that are in resource.

Stephen Wilkinson: We ended up expanding the gold resources from 400,000 ounces to 830,000 ounces in a global resource of measured, indicated, and inferred. Two thirds of that resource are measured and indicated, the grade is about eight grams per ton. By creating this new interpretation of the Flood Zone, we identified some significant blank areas within the resources, which we can drill.

We also were looking at the fact that the resource really only goes down about 450 meters below surface. The deepest intersection of mineable width is 14.9 g/t Au over 7.7 m in BHP’s drill hole, 90VD-75, at 610 m below surface and was drilled below resource blocks. So we're pretty confident that we can greatly expand our current 830,000 ounces. We hope to be able to get at that starting in June of this year.

So there's the history and the background and the resources, Al.

Dr. Allen Alper: Oh, that sounds excellent. A high-grade, a very large resource and a lot of potential for growth. Sounds very good! Could you tell our readers/investors your key goals for 2020?

Stephen Wilkinson: Absolutely! We're planning on a three prong approach for our properties. Firstly, we're going to undertake to clean up the Ulu site from the last 20 or 30 years of past work to solidify our relationship with the people of the North.

Certainly the sensitivities of the people in the North have to be recognized. If you want to have a good working relationship, you have to show that you're a good economic and environmental partner. There are a number of areas where there have been spills of hydrocarbons, diesel fuels and oils and so forth. We've promised the Kitikmeot Inuit Association that we will land farm that material. This means that we'll go in, scrape up the contaminated material, lay it out in a controlled manner, feed it with water and bacteria, turn it over a few times and let Mother Nature clean the soils down to a usable soil again.

The other thing that's troubling to all of us, is that much of the capital equipment that was brought in in the 1990s has just been left to rot. So we're going to clean that material up and put what we can, safely, into a landfill. However, we can use some of that capital equipment that's there. There's a working D8 Caterpillar bulldozer, there's an excavator, a couple of road graders, there's what I call a heavy roller. And that equipment is great for maintaining our 1.2 kilometer long airstrip and the roads that were in and around the camp.

There are rock haulage trucks that are available to us. I think there're three of them that are in good working order. So there's quite a fleet of equipment that we're inheriting here and by giving it a good servicing, we know that we will be able to get quite a long life out of it, and this is attractive to our friends in the North because they see that as some of the capital equipment we can use for the eventual construction of the Grays Bay road, which is the proposed all weather road from the Grays Bay port on the Arctic Ocean ultimately down to Yellowknife. Of course the Ulu property lies strategically right along that route.

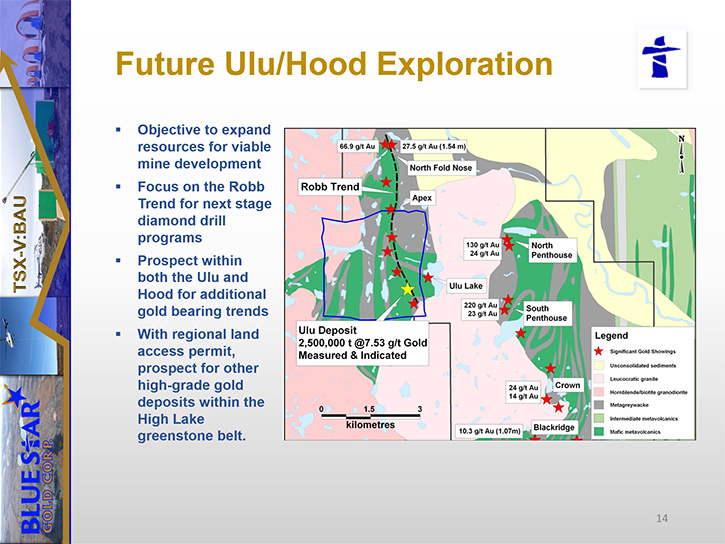

The second part that we want to be doing here is adding resources through drilling and detailed surface sampling. Our main zone has some fairly significant holes in the mineralized area. For example, the gold zones were not well drilled close to surface because it was assumed the crown pillar would not be mined. Of course, not too far down plunge, on the zone at about 400 meters down, there is a lot of room for infill drilling. So our objective there will be to try and bring that initial resource up another couple of hundred thousand ounces so we can hit that magical million ounce zone. And then of course we have the other 40 odd gold occurrences that we need to prioritize for future drilling.

This last year for instance, we did 11 drill holes, approximately five kilometers North of the main Ulu mineralization and established, through surface sampling and mapping that we have a five kilometer long trend, along which there're several occurrences of gold mineralization. The Northern most one was the one we drilled. Together with the other gold zones, the mineralization is just like a string of pearls over this structural control belt. We call this gold trend, the Robb trend, after the geologist, who defined it in 2019. We are ready to do about seven or eight high-priority drilling targets on the Robb Trend gold zones, and we have more than 30 that still have to be mapped out, sampled, and prioritized. We have a lot of work to do.

Dr. Allen Alper: Sounds great! Sounds like you have this great opportunity to increase your resource. Excellent! It sounds like you have some nice high-grade gold there.

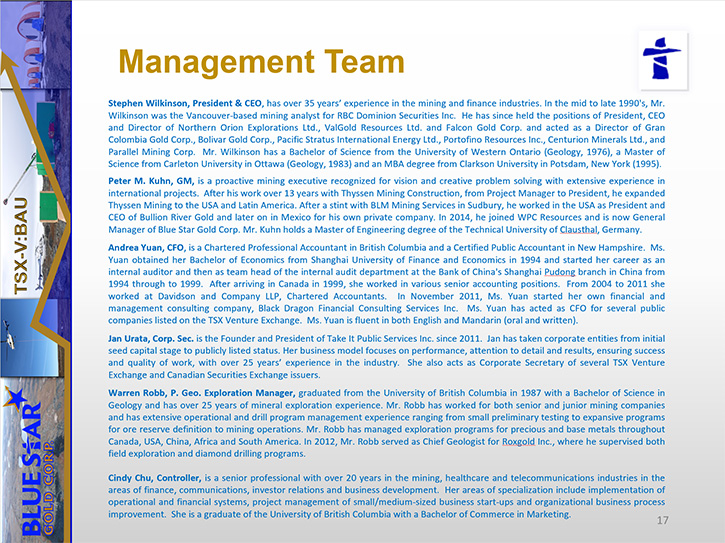

Stephen Wilkinson: Right! Also, one of the greatest assets we have is the team that's come together for Blue Star over the last five years. We have some very dedicated people, a very professional staff and a very well-qualified Board of Directors, which is actually an interesting story.

Our largest shareholder and Director, Dr. Georg Pollert is a German national. Dr. Pollert is an entrepreneurial engineer, who helped design and build a new biofuel plant in Germany and that's where he gained his initial wealth. He's expanded recently into Canada and of course he has a very keen interest in gold deposits and is working with us in that regard. We have a German banker, Klaus Schmid, a retired President of one of the large regional banks in Germany.

Klaus is quite familiar with the mining industry. He was involved through the early days of helping to finance at Osisko Mining and now of course he's focusing on us. He's a great person to liaison with investors in Germany. Here in Canada our Chairman, Robert Metcalfe, is a quite a well-known individual in the mining industries. He and I have worked together on a number of different Boards. We met on the Board of Bolivar Gold Corp., a company that started out with a resource of about almost 800,000 ounces in Venezuela. We built it up to a multimillion ounce resource, started to build a plant on it and it was taken out for I believe about $450 million by Goldfields in February 2006. Later on, Mr. Metcalfe and I were Founding Directors of Grand Columbia Gold Mines in Colombia, also worked together on the Pacific Rubiales Energy. Now of course Bob is working with me as our Chairman on this Board.

We have also as a director a retired CA-CPA, Ken Yurichuk. Kenny and I've worked together on projects, wow, since about 1985. He's a man, who knows his taxation, knows junior mining. And I believe he was an instructor with four CA's in Canada on tax treatment.

We have former analyst and mining executive, Judy Baker on our Board, also. I have known Judy since I was an analyst with Dominion Securities in the 1990’s. We actually competed against one another in those early days. But we've managed to stay good business associates and I was very happy when she came on board for us. So those are the five Directors we have. Nobody on Management is on the Board of Directors, so our Board of Directors is entirely independent of Management. That way we can get proper direction and guidance from the Directors as well as oversight as we move forward. I think it's a good corporate governance move, too.

Dr. Allen Alper: Sounds like a very strong Board of Directors.

Stephen Wilkinson: It's actually exciting. I've never had a better group to work with, Al, and the Management team, the same thing. We have several people on board here. Our General Manager is a former President of the mining contractor Thyssen Mining in Canada. We have Warren Robb, a geologist with many decades of experience as our Exploration Manager. He's actually the longest standing employee of the Company. He's worked with the predecessor companies over the years also. Now he's stayed on with us and we get the benefit of his experience.

We have Dr. Daniel Rubiolo. Daniel and I met in Argentina. He's a Canadian citizen from Argentina originally. He's a very, very excellent geo-scientist and has a strong appreciation of structural geology, with regard to gold deposits. He's brought a lot to the table. And we're also recently acquired an international geologist, a younger fellow, Nezih Dumral. Nezih is from Turkey but has resettled in Canada and brings a high-level of digital modeling knowledge to the exploration team.

We have our new CFO, Andrea Juan, a lady that came to us from Shanghai originally. She's a certified professional accountant in the States and now a CPA in Canada. She has been working for a number of junior mining companies as a CFO, and now she's working with us. Our controller, Cindy Chu, has worked with me for nearly 15 years on various roles. It's interesting these long standing relationships you have when you want to build a good team. I think everybody here is properly empowered to do their job and move it ahead.

Dr. Allen Alper: Well, it sounds like you have excellent team. That's great. Could you tell our readers/investors a little bit about your share and capital structure?

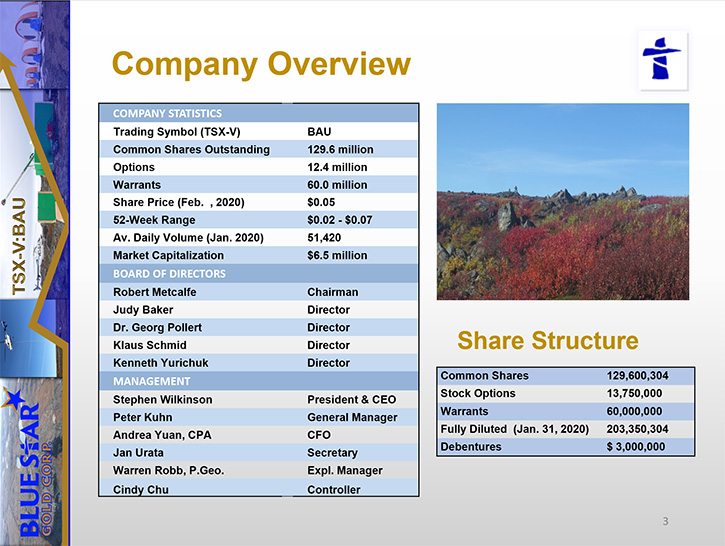

Stephen Wilkinson: Absolutely. Absolutely. As we stand today, our capital structure is in three general parts. We have the common shares of about 129 million outstanding right now. We have about 14 million stock options outstanding, and we have a $3 million debenture with warrants attached for 60 million shares. So all in all we have, on a fully diluted basis, about 280 million shares outstanding.

The cash that would come in with that, on a fully diluted basis, would be an additional $6 million. So I'd say we've more than doubled our current market cap. But, considering how our current markets have been going in Canada, it's not that unusual. Considering the distribution of our shareholding on a fully diluted basis, it's interesting because more than half of the Company, almost 52%, is held by board and management.

A further 27% is held by high-net-worth investors in Canada and overseas and a modest shareholding by institutions of about 2%, which leaves only the actual float of the Company, the retail investors at about 19% of the shares. About 55 million shares, out of the 280 million, would be in the retail and trading hands outside the Company.

Dr. Allen Alper: Well, it's good to see that Management has skin in the game and believes in the project. That's great!

Stephen Wilkinson: Exactly! Our largest shareholder, Dr. Pollard, has been instrumental in supporting the Company through this market malaise, between buying shares, taking placements, advancing his funds to keep the door open and including the deals. He will have invested in total about $6 to $7 million and that's pretty fantastic, when you think of how tough things have been for junior mining in the last little while. We haven't been able to provide him with a lot of news because most of what we've been doing is concluding the acquisitions and thank goodness he has been patient through that.

Dr. Allen Alper: Sounds like this will be an important year for you. You have very strong goals and long-term investors to support your effort. And it sounds like things are going to be turning around for the junior mining group.

Stephen Wilkinson: I think you're very right there. We're seeing a lot of news interest in the juniors that have survived these several years of difficult markets because the small to microcaps that are still doing well have been building their asset base and making the assets more valuable, and they're not getting credit for it in the market.

Blue Star is an excellent case in that regard. Now that we can actually claim ownership to a very strong resource, we're probably trading at a valuation about 20% of our peer’s. So we think we have a lot of work to do to let the market know how undervalued we are, not just because management says so.

We actually can compare ourselves to others and also add to that value through the course of this year. We have done preliminary metallurgical studies on our material. We'll continue doing metallurgical studies and hopefully very soon be able to give a scoping study level report, so that we can define target levels for resource ounces that we should be aiming for, in order to make a viable deposit.

In terms of grade and tenures, right now Blue Star looks very attractive. We do need to get some confirmation and I think that that'll leapfrog us up the ladder of valuation again. Certainly it's going to be part of Management's objectives to make sure that the market is aware of what we're doing. So I'll be wearing out my shoes and my suitcases trying to give people an indication of what this Company's worth.

Dr. Allen Alper: Oh, that's great. Sounds like that'll be an opportunity to get your story out to investors. Could you summarize the highlights of why our readers/investors should consider investing in Blue Star Gold?

Stephen Wilkinson: Certainly, I think we have here a strong value base, where after years of building it, we can launch on it. That base is comprised of A) gold resources and the expandability of those gold zones is something that most mining juniors can only wish for. The second thing we have here is a dedicated Board and Management that's been putting its own dollars to work here and will continue to.

We have the expertise and the database, courtesy of years of previous work in much earlier markets, which is also catapulting us up the valuation ladder, as we go out in the field. We look at everything from established resources through to blue sky, green fields types of occurrences, so that we can be supplying news about the economic value of the deposit, news about growth of resources, and news about discovery. Between all of those and our capable people here to follow up on each of those, I think that we can deliver a great deal for our shareholders and anybody who's interested in becoming a shareholder.

Thank you for interviewing me and Blue Star Gold Corp. for Metals News.

Dr. Allen Alper: You are very welcome. Sounds like it might be an excellent opportunity for our readers/investors. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.bluestargold.ca/

Stephen Wilkinson, President and CEO

Telephone: +1 778-379-1433

Email: info@bluestargold.ca

|

|