Auramex Resource Corp. (TSX.V: AUX): Exploring a Past-Producing High-Grade Gold Mine in the Golden Triangle of BC.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/6/2020

In this interview, Lawrence Roulston, CEO, outlines the compelling evidence for the presence of a large-scale gold deposit underlying the known occurrence.

Auramex Resource Corp. (TSX.V: AUX) is focused on exploring an historic gold mine, in the Golden Triangle, in British Columbia. Years of previous work focused on the area of the old workings. For the first time, Auramex Resource is using a systematic and comprehensive exploration approach that fuses “traditional” and emerging, cutting-edge exploration techniques. We learned from Lawrence Roulston, CEO of Auramex, that last summer they began reviewing the core that was drilled by the previous operators and began looking at it, in the context of modern scientific techniques, to extract valuable information. Plans for 2020 include further reviewing the old core, more surface geological work, as well as geochemical and geophysical programs, all aimed at accurately defining targets for a planned drilling program.

Georgia River project

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Lawrence Roulston, Director, CEO and President of Auramex Resource Corp. I wonder if you could give our readers/investors a vision of Auramex Resource Corp.

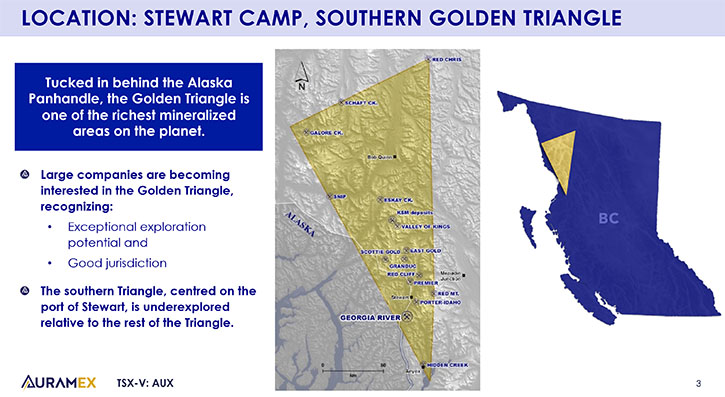

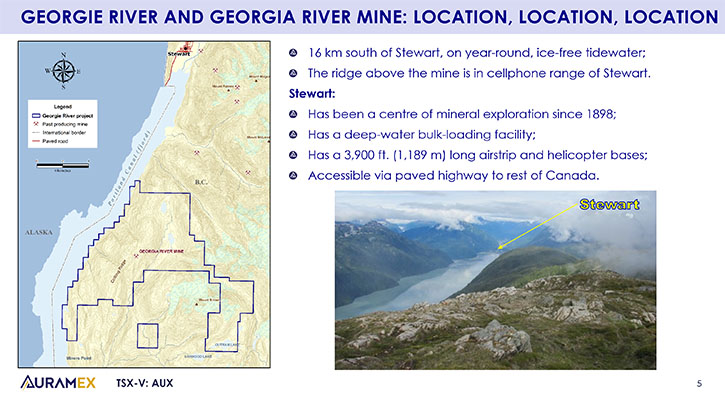

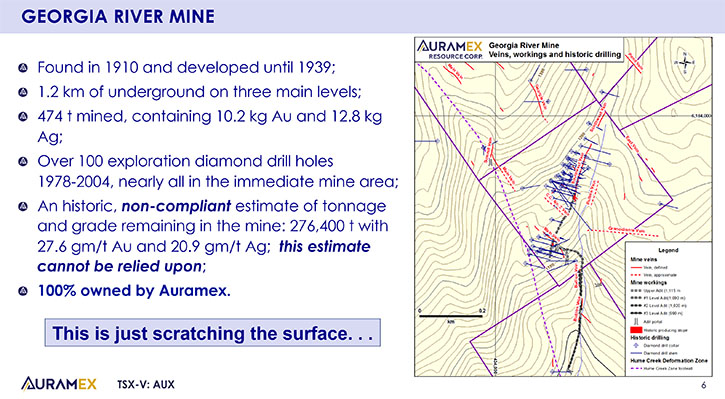

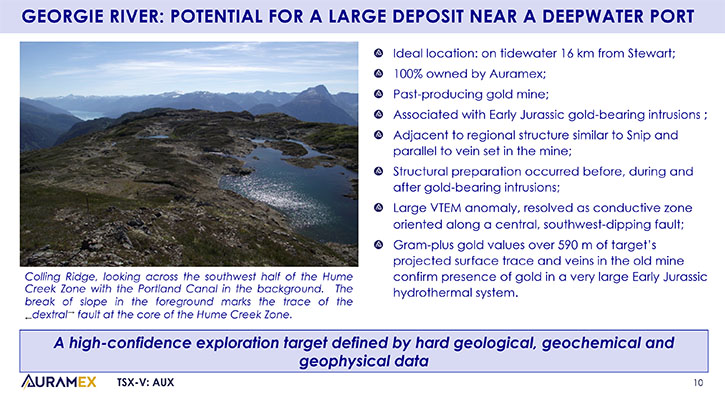

Lawrence Roulston:Auramex is a gold exploration company focused on the Golden Triangle of British Columbia. Our flagship property is the Georgia River Project, located just south of Stewart, along the Portland Canal, a long fjord that goes out to the open Pacific. The project features a high-grade past-producing gold mine. It produced during the 1920s and then up until 1939. During the 1980s and '90s there was some exploration work conducted on the project, mostly focused on reactivating the old gold mine. There wasn't a lot of work done outside of that area until Auramex took control of the project and for the first time started to look at a broader picture of the geology. Nobody previously looked at it this way. We are now seeing the potential for a large-scale gold deposit that underlies the area that was previously mined.

Dr Allen Alper: That sounds very good. Could you tell our readers/investors a little bit more about the project and what your plans are for 2020?

Lawrence Roulston: Yes. Last summer, for the first time, the Auramex geological team began a comprehensive review of the drill core that was drilled by the previous operators. There were more than a hundred drill holes conducted and they were all focused on finding extensions of veins in the area of the old workings. Little or no scientific work was done on that drill core until last summer, when Auramex began reviewing the core in detail. We are presently continuing the evaluation of the historic information. As soon as weather allows, we will be back on the ground, doing further exploration to prepare for drilling.

Dr Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about your background and your team?

Lawrence Roulston: My background in the mining industry goes back 40 years. I started off with a geology degree and then I did the MBA program and worked for several years with one of the major mining companies. I went from there into the management of junior companies in the exploration space. I then spent nearly 15 years writing an investment newsletter that was entirely independent and subscriber-supported. That gave me the opportunity to meet many people in the industry and look at exploration projects in every part of the world. I was then recruited by a big US private equity group. A couple of years ago I got back into managing exploration companies. I made a conscious decision to focus on Auramex because I was very attracted to the geological potential of the Georgia River Project.

Our VP Exploration, Paul Metcalfe is a PhD geologist who has about 30 years' experience working in the Golden Triangle. He's recognized as one of the experts in the geology of this region and has done an outstanding job of advancing the geological understanding of the Georgia River Project, bringing us to the point where we're now looking at the details of a drilling program to test for the larger target potential.

We have a very strong team of professionals who bring a wealth of industry experience.

Dr Allen Alper: Well, you and Paul have excellent backgrounds and that's really fantastic. You're well known in the industry and Paul is also, so that's excellent. Please tell us more about the project and your plans.

Lawrence Roulston: We now recognize that the target is adjacent to and beneath the area that was previously explored. The drilling that was done in the area of the workings provides a lot of very important geological information that is helping us vector toward target zones. During the summer, we examined some of the core in detail on site and we brought some of the core back down. We took a lot of samples from that drill core which we're now looking at, using modern scientific techniques to extract further information. That work is underway at the moment and it will continue until we're able to get back onto the property later in the spring.

The first phase of the planned program this year will be to continue to examine the old core, to do more surface geological work, and to conduct some geochemical and geophysical sampling programs in our target area. All of that work will be aimed at defining, in more detail and more accurately, the drill targets that we want to test with drilling. We're hoping to be able to drill the project later this summer. A permit has been approved, subject to posting a bond. The only thing we're lacking is financing. Our mission right now is to raise awareness for the Company, to put us in a position where we can raise the money and conduct that drill program over the summer.

Historic Core

Dr Allen Alper: Could you tell our readers/investors your thoughts on the mining industry and juniors and what's happening on the market with this COVID-19?

Lawrence Roulston: Well, Al, you and I have both been through a few cycles in the resource industry. At this moment, most investors have run for cover. We all know that these cycles come and go. We have seen fortunes made by the people that take advantage of the down part of a market cycle to load up on shares in resource companies that multiply in value as the market rebounds, as it always does.

Over the past few weeks, the gold price has been volatile. Some people need liquidity. Others recognize the importance of owning a hard asset at a time like this.

Trillions of dollars have been committed to sustain the financial systems around the world. We've seen stimulus packages over the years, but nothing on the scale of what is being put forward right now. The creation of massive amounts of new dollars and yen and pounds and euros will have the same effect that it always does – it will depreciate the value of the currencies. When you measure the dollar against the euro, it is hard to see the moves as everything sinks in tandem. Hard assets, like gold, will maintain their values in real terms. Looking back: following the Global Financial Crisis in 2008, gold declined in dollar terms by about 20%. Over the next couple of years, as the stimulus money was injected into the system, the price of gold more than doubled. There is no reason to think that it will be any different this time around.

Now, jumping over to a high level overview of the gold mining industry: As the gold price increases, the companies that are currently producing are going to see huge increases in cash flow and that is going to be reflected in share prices. The collapse in the oil market provides an enormous benefit for mining. Energy is often the biggest single cost item for a mine. So, rising revenues and falling costs will combine to boost cash flow.

Now, linking all that to the juniors: The gold mining industry produces a hundred million ounces of gold a year. The gold mining industry needs to find a hundred million ounces a year of new resources just to stay level.

Traditionally, the producers have relied on the juniors to make the new discoveries that keep them in business. We are already seeing the producers investing in juniors to gain access to tomorrow’s reserves. With growing cash flow, that trend will accelerate.

I'm very pleased to be part of a Company that is one of the best positioned juniors to make a discovery on a scale that will attract the attention of the larger mining companies and help them replace their depleting reserves. If we find even a fraction of what we believe is there, shareholders of this company will be very well rewarded.

Dr Allen Alper: Well, I think that was an excellent analysis and I appreciate you sharing your thoughts and insights and your knowledge with our readers/investors. You have great knowledge of what's happening from your experience and understanding of the industry. I thank you for that. Could you tell our readers/investors what your share structures is?

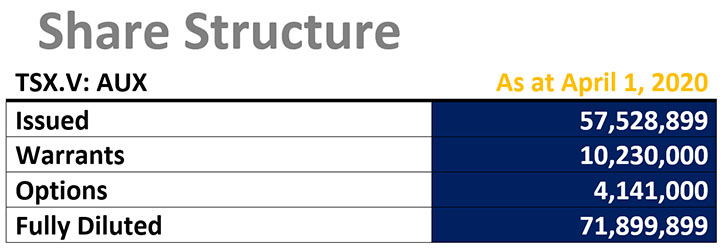

Lawrence Roulston: We have just under 60 million shares outstanding. We have about $40,000 of cash. And we have some debts that were incurred in the course of the last exploration program. The management team, including myself, is the biggest part of that debt as we have not taken anything out of the company for some time. We have a great project, a great story, but we have not done a good job in communicating with investors. We are now, for the first time, beginning to present this really interesting story that we have in terms of exploration potential. Most investors are still nervous about investing in general and juniors in particular. There are a few investors who are wise enough to know that the time to invest is when the market is badly beaten up, as it is now. Our mission now is to find those investors and introduce them to the enormous potential of the gold project that we are moving toward discovery.

Dr Allen Alper: It sounds like excellent potential. In closing, could you highlight and summarize the primary reasons our readers/investors should consider investing in Auramex Resource Corp.?

Lawrence Roulston: Well, in my view, Auramex has one of the top gold exploration projects that I'm aware of anywhere. And I say that after 40 years in the industry, looking at many hundreds of projects. We have multi-million-ounce gold discovery potential. We have an enormous amount of really compelling evidence pointing to a deposit down there. We know that it's a very well mineralized system: We’ve got the past production and the drilling. We are applying, for the first time ever, a comprehensive approach that includes advanced scientific techniques to look beyond the old mine area. Leading edge geological science is preparing us to test the hypothesis that there's a big gold deposit down there. The markets in general, including Auramex, are badly beaten up, presenting an extremely attractive entry point.

Dr Allen Alper: Sounds like excellent reasons for our readers/investors to consider investing in Auramex! Is there anything else you'd like to add, Lawrence?

Lawrence Roulston: Well, Al, I really appreciate you reaching out. It shows a lot of wisdom on your part to recognize that a down period in the markets like this is a great time for investors to be looking for promising companies. As I said earlier, fortunes have been made in the mining industry by those who have the wisdom to buy when the prices are down and not wait until the markets have already recovered. I've been through this a few times now. Fortunes are made by people who come in when markets are down, like now, and load up. By the time the market recovers, the smart money is already well positioned.

Dr Allen Alper: Oh, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.auramex.com/

Lawrence Roulston

President & CEO

info@auramex.com

|

|