Erin Ventures (TSX.V: EV): Advancing and Developing Their 100% Owned Piskanja Boron Project in Serbia; Interview with Tim Daniels, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/5/2020

We learned from Tim Daniels, President and Director of Erin Ventures (TSX.V: EV), that they are a Canadian-based, emerging mineral exploration company, focused on the advancement and development of the 100% owned Piskanja boron project located in Serbia. Piskanja project is a high-grade boron deposit with a NI 43-101 compliant mineral resource of 7.8 million indicated tonnes (30.8% B2O3), in addition to 3.4 million inferred tonnes (28.6% B2O3). According to Mr. Daniels, by the fall of 2022, Erin is expecting to be fully licensed and ready to move forward, with development of the actual mine.

Erin Ventures

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Tim Daniels, who is President and Director of Erin Ventures. Could give our readers/investors, them an overview of your company and what differentiates your company from others.

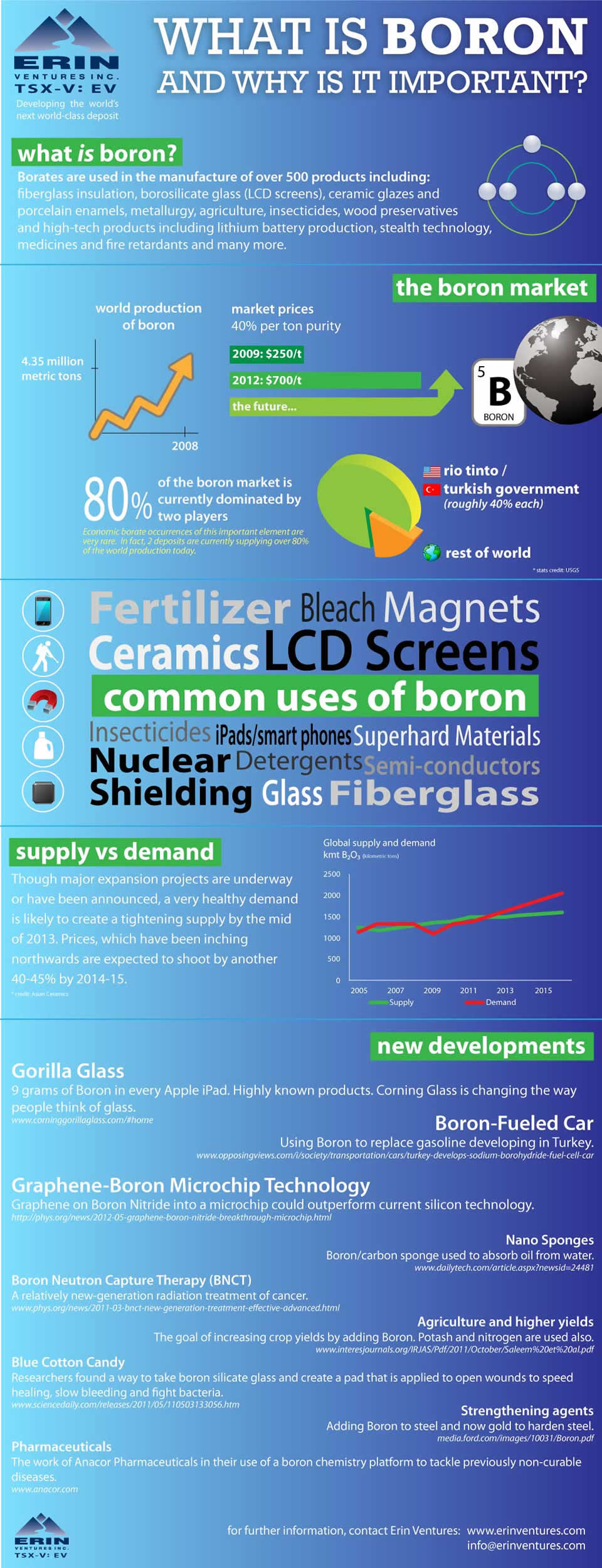

Tim Daniels: Okay. Yeah, I'd be happy to do that, Al. Erin Ventures is a Canadian-based emerging mineral exploration company. For the past several years we've been focused on the advancement and development of a boron project located in Serbia. And I would venture to bet that not many of your followers have had much exposure to the boron market. In that way we are quite different from some of the more vanilla mineral plays that you might have followed in the past.

Dr. Allen Alper: Could you tell our readers/investors why boron is important, a little bit about the market, its uses, its applications and its significance?

Tim Daniels: Yeah, I'd love to do that, Al. Boron is one of these very important industrial minerals that helps shape modern life. Modern life as we know it would be very different without boron and so for that reason, it is an extremely important mineral. It's found in all sorts of products. For example, reach into your pocket and pull out your smartphone. The screen on that smartphone is a Gorilla Glass or the non-commercial name is a borosilicate glass, which has about 10 to 12% boron in the glass. And the boron is very, very important because it gives the glass its shatter resistance and heat resistance. It's also found in computer screens, laptop screens, televisions, the architectural glass that you find on the outside of tall buildings, solar panels and et cetera. So those are the types of borosilicate glass that we see all around us every day.

Besides the glass industry, boron is very important, for example, in the manufacturer of fiberglass insulation and textile fiberglass. Again, it's the boron that gives the glass the ability to extrude and hold its form in the fiberglass, so very important in fiberglass. Ceramic glazes, porcelain enamels and so on also rely heavily on boron. It's the boron content in the ceramic glaze that give the ceramic tiles their strength.

If you're old enough, like I am, to remember Death Valley days with the mule train going across Death Valley, they were pulling borax wagons and borax is one of the common forms of boron, which in those days and to this day is used in detergents, also as a fire retardant. Fertilizers is another big industry. Research is showing that crops around the world are boron-deficient and by adding boron as a micronutrient to the fertilizer, it's making the crops far more productive.

There's many, many uses. It's a very broad and deep market and there're new uses being developed all the time. For example, the hydrogen fuel cell technology that is currently in development relies heavily on boron, nuclear fusion relies heavily on boron, and so on. There're numerous industries that would be very different today if it were not for the boron. So that's on the demand side, it's very broad and deep.

On the supply side, you have the exact opposite situation where there's literally a small handful of companies in a half dozen countries that have economic supplies of boron. In fact, two producers, Rio Tinto with their deposit in California and the Government of Turkey, between the two of them, they produce between about 70 to 80% of the boron each year, depending on which year you're talking about and with the balance of the market being back-filled with a half dozen small producers, mostly out of South America.

You have a true oligopoly situation. And as is always the case with an oligopoly, prices tend to be high and stable, not much fluctuation because the players in the market have a lack of competition and they neatly divide the world amongst themselves and make sure that prices stay strong. A very interesting market in that the supply and demand sides are diametric opposites of each other, where one is very broad and deep and the other is very tiny and well-controlled. So it's an interesting space to be in, to be sure.

Dr. Allen Alper: Could you tell our readers/investors a little bit more about your project?

Drilling in the Jarandol Basin

Tim Daniels: I'd love to. We're located in Southern Serbia and we've been in the exploration stage for the past several years. We've conducted a number of different levels of drill program and exploration program. We have a license on the project. It's a three step process, the first step being the certification of the resource, which involves primarily a resource calculation and an economic evaluation about on the level of a North American PEA. We're in the process of conducting that work now. We expect to have that first step in the mine license process completed by this fall and the two successive steps we expect to happen each one about a year apart. We are expecting by about the fall of 2022 to be fully licensed and ready to move forward with development of the actual mine.

Erin Ventures

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors a little bit about the type of deposit you have?

Tim Daniels: It is an underground deposit. This is a typical evaporate-type deposit for this type of mineral, in that you find the borate zones in beds or lenses. And our beds range in thickness from about a meter and a half for the narrow beds, in one case we're up around 45 meters in the thickest part of the deepest, the thickest bed. And it is a high-grade deposit. Right now we have a mineral resource estimate completed on it and it shows that we have an indicated resource of about 7.8 million tons averaging 31% B2O3, B2O3 is boron oxide, and another 3.4 million tons inferred, averaging about 28.6% B2O3, so certainly a very high-grade deposit. The deposit remains unbounded in two directions and so there remains a good potential to expand our resource size moving forward.

Piskanja Drill Core7

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your background and your Team?

Tim Daniels: My background is financial. I came into the picture many years ago now. I have been President of Erin Ventures for better than 20 years now and prior to that I came from the investment world. I was a stock broker and a regional manager, in charge of our underwriting department. In that capacity I was exposed to and learned a lot about funding resource companies, and I saw what set apart the successful companies from the not so successful companies. And I try to carry that forward into Erin Ventures.

I've surrounded myself with a very strong Management and Board team, all of whom come from very strong mining backgrounds. Two mining engineers, both with their PhDs, one from North America, one from Serbia, both with decades' experience in very large mining operations, but well-rounded. They've also worked with projects at this stage of development, too. They know all aspects of project life cycle, from the exploration through to the development, the operation through to shut-down.

The fourth member of our board of directors is a geologist, also from Serbia. He was the former director of the National Geological Institute and in that capacity had a staff of several hundred geologists under him, and, of course, as a result is intimately familiar with Serbia, geologically speaking, and has been of great help and guidance to us, not only on the ground geologically, but through his contacts and connections both professionally and within the Government of Serbia, so making sure that we're complying at every step with all the rules and regulations. I have a good, strong, well-rounded team that is very experienced with this type of project.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors how it is working in Serbia?

Field Mapping in Jarandol Basin

Tim Daniels: It's been an interesting experience, for sure. One wouldn't recognize Serbia today, versus the Serbia that I first saw when I went there about 20 years ago, looking at various projects because it's come a long, long ways. Serbia is now on a path to membership into the European Union and they've completely revamped all their laws. What's critical for us are the laws that pertain to mining and foreign ownership. It's completely mining-friendly. The laws were completely redrafted in 2016, with great assistance from the foreign mining community, so companies like ours, and Rio Tinto, and Dundee Precious Metals, and Freeport-McMoRan, and several others that are operating in the country collectively, with the government, helped create the new mining laws.

The laws are very friendly towards mining companies. And the government has a strong commitment towards mining and foreign investment. In fact, their stated aim is to see the mining industry contribute 5% to the GDP, up from its current level of 2%. So they're keen to see mining become an ever-growing part of the economy.

Erin Ventures

There is no restriction whatsoever on foreign ownership. Companies can conduct their business in any currency of their choosing. We tend to do most of our business in euros, sometimes in US dollars, sometimes in Canadian dollars as well, but we're not restricted to the local currency at all. There's a 15% corporate tax rate, so certainly one of the lowest corporate tax rates anywhere. And, in fact, there is also, for companies like ours, a 10-year tax holiday available, for which we will qualify based on the size of our project and number of workers that we will be employing.

It is very much a mining-friendly jurisdiction. And one of the things I wanted to mention that attracted me to this project, when I had first seen it, was not only the numbers on the project itself and the fact that it had the ability to be a really robust project, but also the fact that it was located in a historic mining district. We have paved roads right onto the project. We have power lines overhead. We have, within a few kilometers, all the support services that we would need for a mining venture. We have a rail line, literally 200 meters away from our property that gives us rail access to the world markets. Literally all the infrastructure is in place that we need to develop the mine and so every dollar going forward goes into the ground for the mine development. We don't have to spend any money on infrastructure development.

The other thing that's ready and in place is a large, skilled and underutilized, underpaid mining workforce that exists right in our immediate area. It's a tailor-made project to get into production quickly, without having to spend a great deal of time and money developing the support infrastructure that a lot of projects are saddled with.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

Tim Daniels: I can certainly do that. We're traded on the TSX Venture Exchange in Canada and we have just north of 90 million shares outstanding. We're trading in the five to six cent range Canadian. We have a tiny market cap. We're sitting at something less than a $5 million market cap. And it's a tiny, tiny market cap relative to the potential of the project.

Dr. Allen Alper: Well, that sounds like an opportunity for investors.

Tim Daniels: We believe so, yeah.

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Erin Ventures?

Tim Daniels: We have a project that is showing itself to have the potential to be a high revenue, long producing mine. We're into a commodity that has little competition. It's a valuable and scarce mineral, with growing uses and demands. We have a very small current market cap. We have competitive advantages in the marketplace, in that the type of boron that we have in our deposit is really only found in one other deposit and that's the deposit in Turkey. So all the buyers around the world that are looking for this one specific type of borate right now have to rely on one supplier only, which is the Turkish government, and that's never a comfortable position for them to be in. And so when we talk to potential off-takers or strategic partners and ask them if they'd be interested in an alternative supplier, the answer is invariably yes.

Erin Ventures

And so finally, we are the world's only pure boron play, making us a unique investment opportunity. We also believe that the oligopoly that exists in the market, combined with our project's strong fundamentals, at some point will make us an excellent takeover target.

Dr. Allen Alper: Sounds like very good reasons to consider investing in Erin Ventures.

Tim Daniels: We think so.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.erinventures.com/

Erin Ventures Inc. Canada

Blake Fallis, General Manager TSX Venture: EV

Phone: 1-250- 384-1999 or 1-888-289-3746 USA

645 Fort Street, Suite 203

Victoria, BC V8W 1G2

Canada

|

|