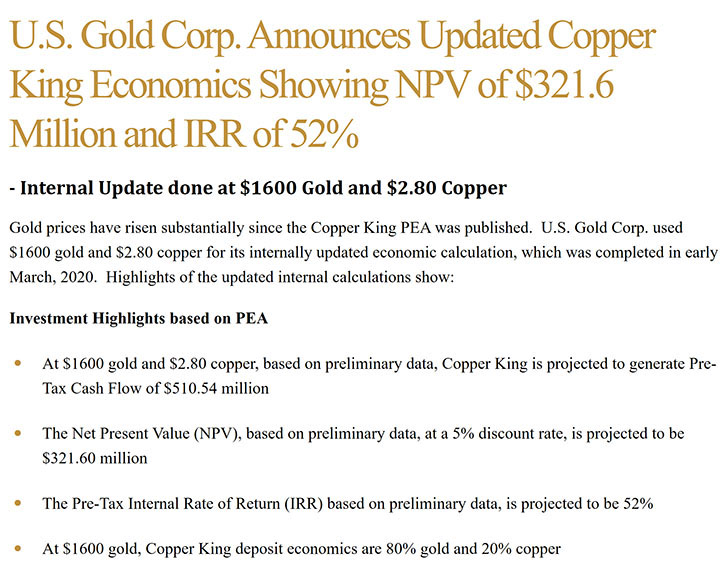

U.S. Gold Corp. (NASDAQ: USAU): Updated Internal Economics of Copper King Project Show NPV of $321.6 Million and IRR of 52% in East Wyoming, and District Scale Exploration Properties on the Cortez and Carlin Trends in Nevada; Ed Karr, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/1/2020

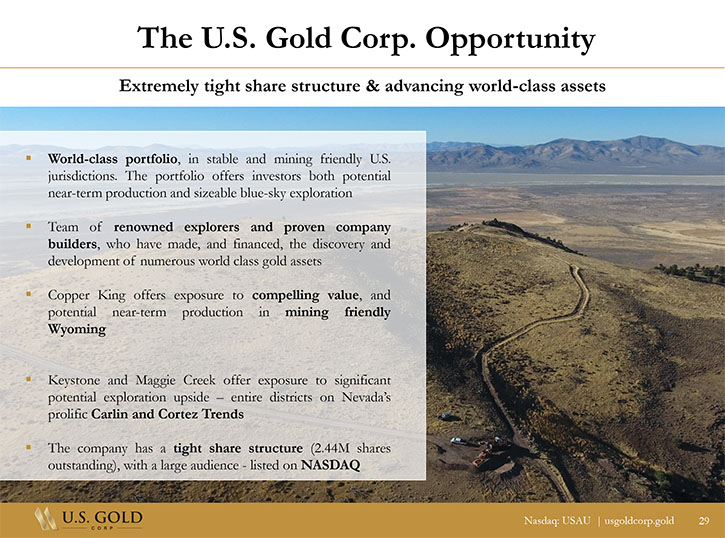

U.S. Gold Corp. (NASDAQ: USAU) has a portfolio of exploration properties in the USA including Copper King, a PEA stage gold/copper property located in Southeast Wyoming, and Keystone and Maggie Creek - district scale exploration properties on the Cortez and Carlin Trends in Nevada. We learned from Ed Karr, who's President and CEO of U.S. Gold Corp., that the Company recently internally updated the PEA sensitivity tables on the Copper King project shows that at $1600 gold and $2.80 copper the project is very robust with NPV of 321.6 million dollars using a 5% discount rate. In Nevada, the more advanced Keystone project has a potential to become a world-class gold system. U.S. Gold Corp. is one of the very few junior exploration companies listed on NASDAQ, has an extremely tight capital structure with only 2.44 million shares 30% of which is owned by management and insiders.

The Copper King Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ed Karr, who's President and CEO of U.S. Gold Corp.

I've seen you announce some fantastic news recently. Maybe you could update our readers/investors about what's happening with Copper King project in Wyoming, and also what's happening in Nevada, with your District Scale Exploration, Keystone and Maggie Creek projects.

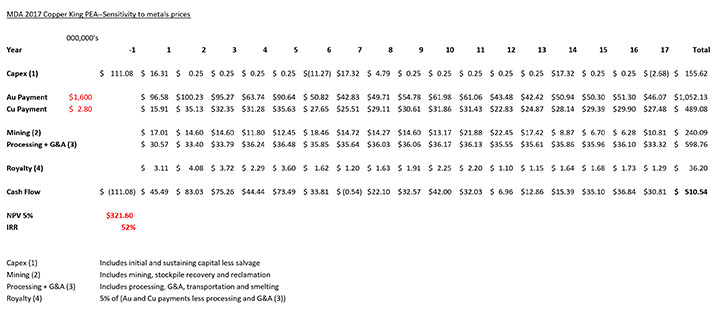

Ed Karr: Be happy to, thanks so much, Al, for having us back. We really appreciate the interest. We put out a press release on the 24th of March, talking about some of the internal updates we did on the economics of Copper King. I'm sure all of your readers/ investors know gold's been on a nice upward trajectory. Gold sold off a little bit in early March as the U.S. dollar strengthened quite dramatically. But now we're well back above 1600 dollars an ounce. I think this morning we're about 1650. We updated the internal economics of our PEA on our Copper King deposit located in Wyoming just outside of Cheyenne. You know, it's a very robust resource. We've always known that. We do have a preliminary economic assessment on the project that was authored by Mine Development and Associates. They did that back in December of 2017. And they used at that time, $1275 gold and $2.80 copper.

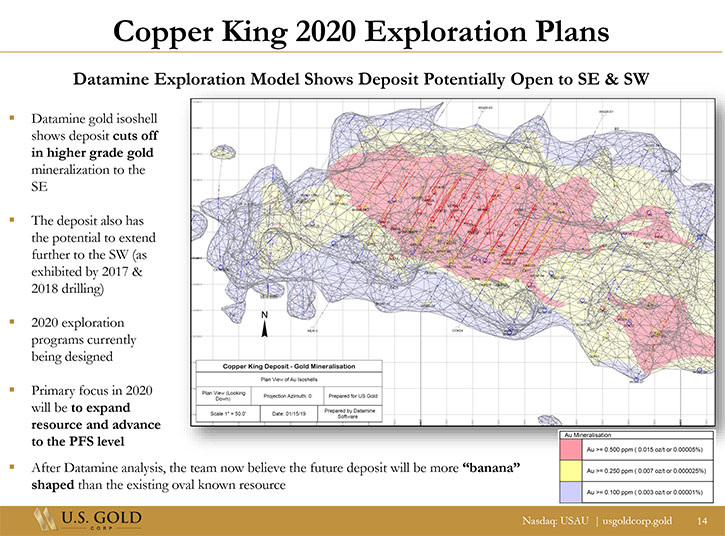

The Copper King project is predominantly gold. At 1600 dollar gold, the economics are about 80% gold and 20% copper. We looked internally at the updated economics at $1600 gold. If your readers/investors are interested, the full PEA for Copper King is on our website. They can go there and look at it. Throughout the document, there are several tables, with these geological reports, that show what the value will be at different commodity input prices. We used 1600 dollar gold for our recent internal update. Tim Janke, a Mine engineer on our Board, updated the sensitivity tables. It was very, very eye-opening and exciting for us, because as our press release stated, at 1600 dollar gold and 2.80 dollar copper, the Copper King project has a net present value with a 5% discount rate of 321.6 million dollars. And the internal rate of return, Al, is 52% per year. So, this is very, very robust.

Dr. Allen Alper: That's fantastic!

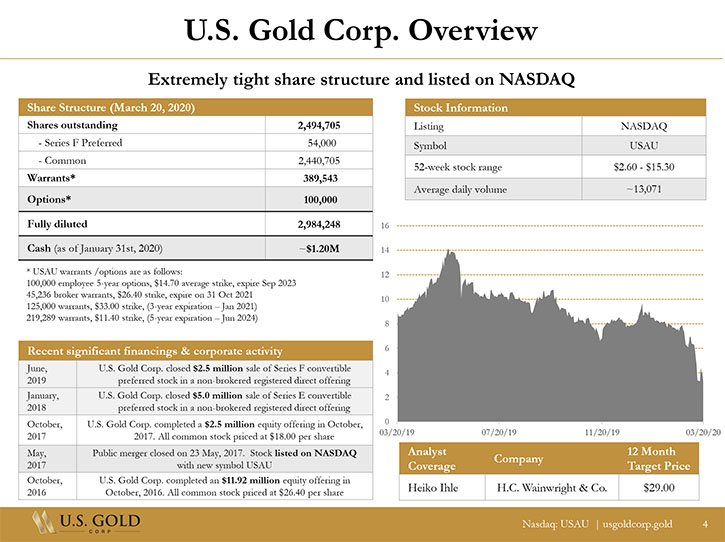

Ed Karr: Yeah, very viable. U.S. Gold Corp, when you look at the market capitalization of the Company today, the last I looked our share price was right around the $9 range. We recently did do a consolidation. As you know, Al, we're traded on the NASDAQ, and one of the ongoing requirements for NASDAQ companies is, you have to stay above a dollar for ongoing listing compliance. Our price had slid below a dollar towards the end of last year, and in March the whole sector was hit very strongly to the downside. So, we made a decision as a Board to do a consolidation to get back in good graces with NASDAQ. And we did a 10-for-one reverse.

Today in the Company, at the time of this interview, we have only 2.44 million shares of common. That's it. There's no debt. Only 2.44 million shares of common. At that $9 stock price, it's been a little volatile since this recent press release. But at $9, we're looking at a Company today with a 20 million dollar market cap.

A lot of these development stage companies that have assets like Copper King, at the PEA level, they trade, even in the sold off market, at approximately 20% of their net present values. Well, that could imply for us a potential 64 million dollar market cap. I mean if that were the case, we'd be looking at a significantly higher share price, because we only have a 20 million dollar market cap today. You know, the share price could basically triple. And we have one analyst that covers us, Heiko Ihle, at H.C. Wainwright. He actually has a $29 price target on us. So that would coincide with about a 20% NPV of Copper King at 1600 dollar gold level. So that's the update on Copper King, Al.

Dr. Allen Alper: That sounds like an excellent opportunity for our readers/investors to consider. Excellent! Could you update our readers/investors on what's happening in Nevada?

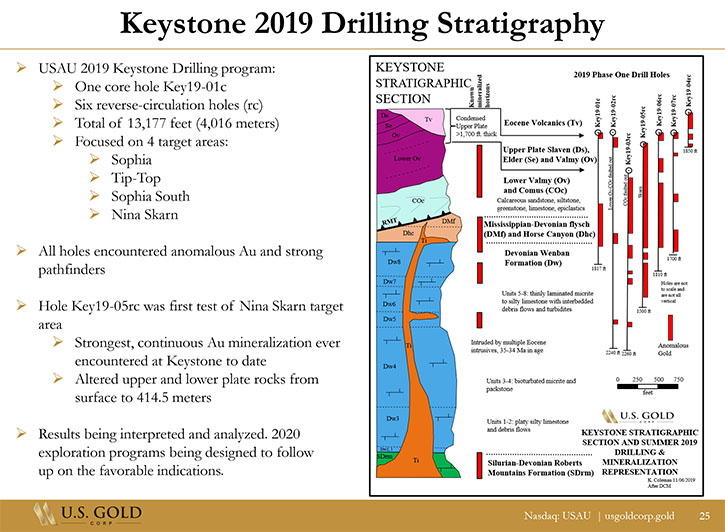

Ed Karr: Yeah. Be happy to. Nevada is the home of our two district scale exploration opportunities. Our more advanced project is Keystone. That is located on the Cortez trend 10 to 15 miles South of Barrick Gold's Cortez Hills complex. We have a big property position there, about 20 square miles, 12,000 acres. It's about six miles long by three and a half miles wide, 650 mining claims. We've been hard at work at Keystone over the last several years.

We were quite excited last year, with our 2019 drilling, because we had a hole that was quite encouraging, Keystone 19-05RC. We drilled that in a target area called Nina Skarn. The hole, although it was not a major discovery, but we believe it showed us that we're on the edge of a potential world-class gold system. These big gold systems and gold deposits can be very compact, formed from tight feeder zones. But, you can have this halo effect from these world-class deposits that might shoot out anything like a kilometer from the actual deposit, itself, in radius.

So, we think this drill hole, KEY19-05RC, which we drilled at Nina Skarn, is definitely in the halo of something significant. And over the winter, now into the spring, our team, led by Project Geologist, Ken Coleman, has been hard at work developing our 2020 Keystone exploration programs. We're putting that together now and looking at it internally. We really hope that we can be out on the project, Al, sometime in summer of 2020 to follow up on this Nina Skarn hole and potentially vector into a world class discovery.

Dr. Allen Alper: That sounds excellent. Could you refresh the memories of our readers/investors on your background and your Team and your Board?

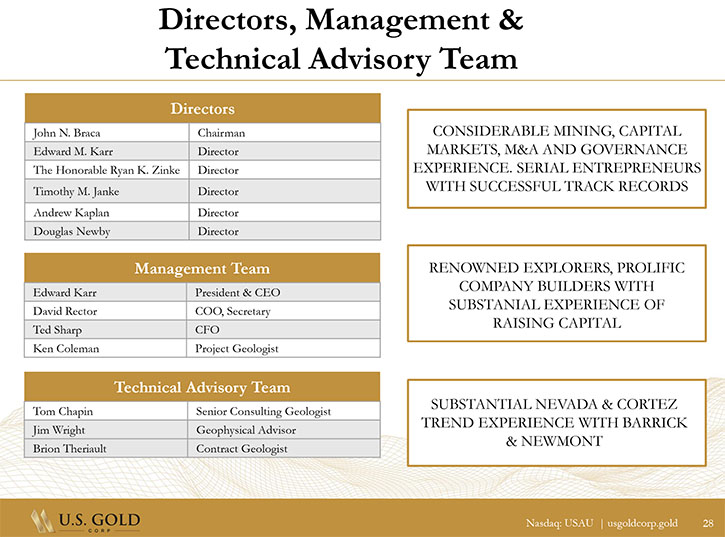

Ed Karr: Be happy to. My background is a capital markets, financial professional. I've been on the Boards of lots of different companies over the course of my career. I had raised a lot of money for the natural resource sector. And I was the founder, now President and CEO of U.S. Gold Corp.

We have a very experienced and distinguished Board. A couple people are noteworthy to point out. We have Secretary Ryan Zinke on our Board. He was the former Secretary of the Interior under the Trump Administration, a Cabinet level Secretary. He's a geologist from Montana. As Secretary of the Interior, he was directly responsible for BLM. He knows the permitting process as well as anyone out there. Secretary Zinke has been extremely helpful with us on our Copper King project in Wyoming, dealing with the state regulators, trying to push that towards a potential production decision.

We added a new Director in September of last year. His name is Douglas Newby. Douglas was the former CFO of PolyMet Mining. He knows permitting and the mining industry extremely well, and he is now the new independent Chair of our Audit Committee.

So, we have a quite experienced Board, lean and mean Management Team. We do rely on a lot of outside contractors, geologists, geophysicists, drillers, et cetera, to push the business forward. We know these difficult times with COVID-19 will ultimately pass. We want our employees and contractors always to be safe. Safety is our foremost consideration. Once this does pass, we'll be back out on our projects drilling and advancing them forward towards discovery success.

Dr. Allen Alper: That sounds excellent. It sounds like you have an extremely strong Board and are very well positioned. Looks like you have great plans for 2020. Could you tell our readers/investors the primary reasons they should consider investing in U.S. Gold Corp?

Ed Karr: We are traded on the NASDAQ and are one of the very few junior exploration companies listed on NASDAQ. We have an extremely tight capital structure, only 2.44 million shares of common. Management and insiders own about 30% of those. We have significant stakes, ourselves, and a lot of our own money invested in this Company.

And I really believe, Al, that this market is setting up for maybe the biggest bull markets of our generation. I think that governments and central banks around the world are going to print a tremendous amount of money. We're going to see massive amounts of fiscal and monetary stimulus to try and combat the economic downturns of the Coronavirus, COVID-19. This is ultimately going to lead, in my opinion, to asset price inflation. It should flow into the market.

And I think that gold is really going to fly the second half of 2020. My own personal opinion is we'll be at a new all-time high before the end of this year. So, timing is excellent. We have great projects. We see real value in U.S. Gold Corp, with our Copper King project, with a potential 321 million dollar NPV at 1600 dollar gold and tremendous leverage to rising gold prices. If the price of gold continues to go up, our shareholders will have more and more value in our Copper King project. And then we have the real blue sky in our Nevada exploration properties. So it's an exciting time for us.

Dr. Allen Alper: Yeah, it looks like 2020 will be a very exciting time for people in gold mining, who have gold properties that are of value. I think what you pointed out about U.S. Gold Corp are very strong reasons for our readers/investors to consider investing in U.S. Gold Corp. Is there anything else you'd like to add, Ed?

Ed Karr: You know, Al, there's lots of information on our website, which is www.usgoldcorp.gold. Investors can go there and sign up for news releases, look at presentations, and really dig deep down into our projects. Our PEA on Copper King is up there, which is a very detailed document. There are lots of other documents and technical reports.

And yes, please watch the Company. Feel free to reach out to Management anytime. I'm very accessible (especially these days!). We are doing lots of webinars now that a lot of people are working from home, just to try and keep our shareholders and investors updated. I would invite all of your readers/investors, Al, to participate in one of our upcoming webinars to get a full update on the Company.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.usgoldcorp.gold/

U.S. Gold Corp. Investor Relations:

+1 800 557 4550

ir@usgoldcorp.gold

|

|