West Red Lake Gold Mines Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK): Significant Property Position, Totaling 3,100 Hectares in the Red Lake Gold District, Interview with John Kontak, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/1/2020

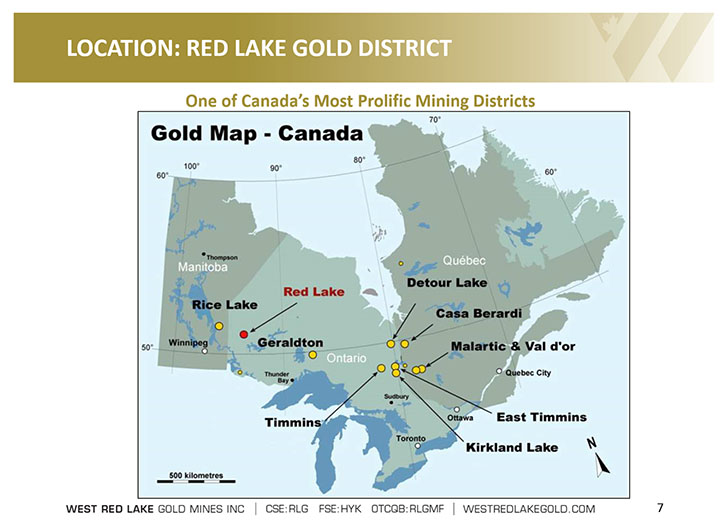

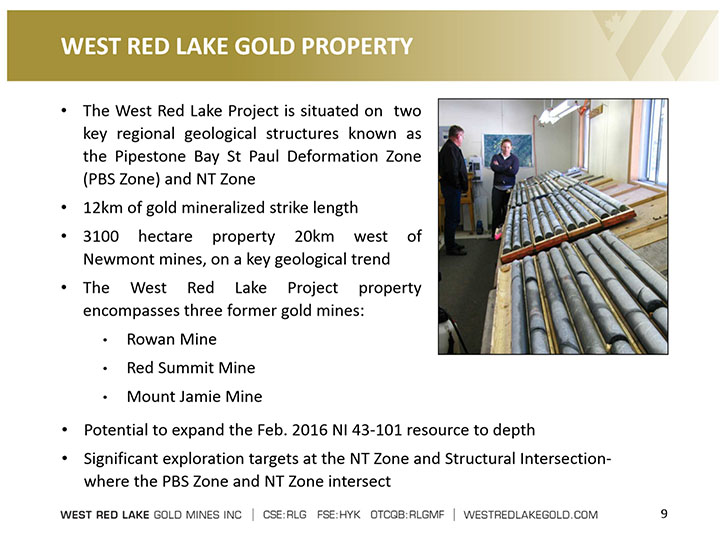

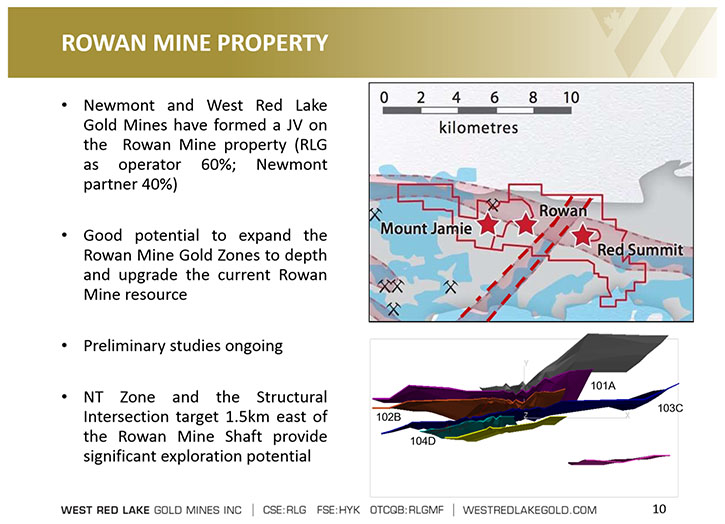

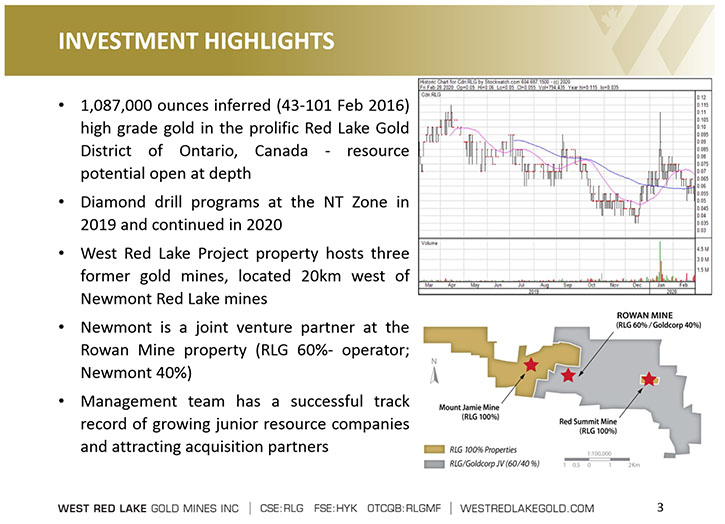

West Red Lake Gold Mines Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK) has assembled a significant property position, totaling 3,100 hectares in the Red Lake Gold District, which is host to some of the richest gold deposits in the world and has produced 30 million ounces of gold from high grade zones. There are three former gold mines on the property: the Mount Jamie Mine and Red Summit Mine properties are 100% owned by the Company and the Rowan Mine property is held in a 60%-owned joint venture with Newmont Corp. During PDAC 2020, we learned from John Kontak, President of West Red Lake Gold Mines, that Evolution Mining will be acquiring the Newmont part of the Rowan Mine property, while West Red Lake Gold remains the operator. The January drilling program showed gold near surface. Near-term plans include follow-up drilling and exploring a new deposit at the NT zone, along with the Rowan Deposit.

West Red Lake Gold Mines

John Kontak: Evolution Mining is formally preparing to acquire the founding assets of Goldcorp; the Red Lake Mine, the Campbell Mine, and the Cochenour Mine, which became Newmont's assets when Newmont took over Goldcorp, so now they will become the assets of Evolution Mining. We had a good lunch with Evolution Mining at PDAC.

Now that the PDAC is over, we're going to get busy on the property and continue to explore our assets. I spoke at the PDAC lunch, Al, on Tuesday. The Federal Reserve had reduced the federal funds rate by 50 basis points in the morning. And then another 100 basis points to leave the federal funds rate at zero. By the US government's own numbers, the US is at negative real interest rates. I have a chart that goes back to the 1970's. Nothing correlates so well with a positive gold sentiment, than negative real interest rates in the United States. It's almost a perfect negative correlation. As real interest rates go negative in the United States, the price of gold in US dollars turns up. We're getting about $10 an ounce in the ground, in our market cap, based on our Rowan resource, our inferred resource of 7.57 grams per ton, 1.1 million ounces, all within 500 meters of surface. These assets get revalued by Capital Markets in a positive gold environment. Historically speaking, assets like ours, in a well-developed gold district, with the workforce, roads, the hydro and the mills with capacity to produce the gold bars, assets like that got $100 or more in a strong market. So these assets get revalued by a magnitude, if not more.

What we're doing with Tom Meredith as Executive Chairman and Ken Guy as Exploration Manager, and myself, is what we've done in the past. Our two prior assets were in Timmins and those assets are now held by McEwen Mining and Osisko Mining, transactions valued as much as a couple 100 million dollars. With the same management team, we want to develop these assets so they're valuable to the Canadian Mining community and people like McEwen Mining and Osisko Mining. There're other quality players out there, as you know Al, Kirkland Lake, Alamos, and Evolution Mining, our joint venture partner, produces about 750,000 ounces a year in Australia and is now taking an interest in the Red Lake gold district. There're other players there, you know them, Pure Gold, Premier Gold, Great Bear Resources, Rubicon, all developing their properties.

Pure Gold’s Madsen Mine may be in production later this year. People are investing 100's of millions of dollars. $500 million in the case of Evolution Mining. Pure Gold is bringing the Madsen Mine into production and we want to do our part and develop the property. So our focus has been the historic Rowan Mine deposit. We have good potential to expand to depth below the resource at Rowan. We drilled a hole approximately 500m below the existing 43-101 inferred resource and encountered the same geology with gold present.

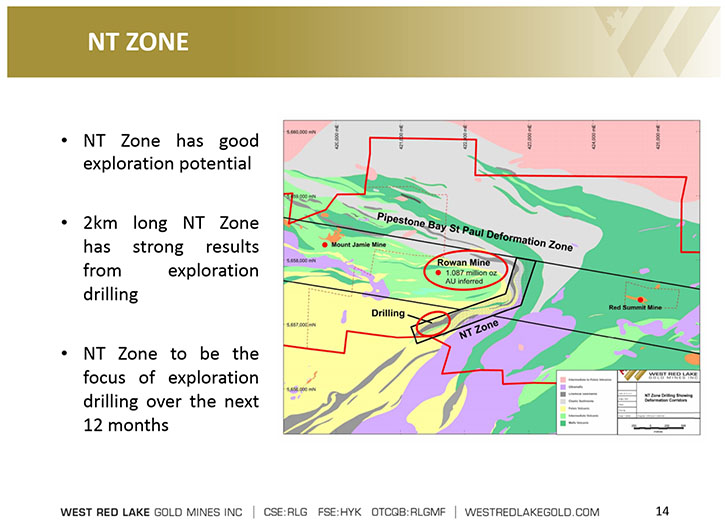

Recently we've been busy exploring at the NT zone with good success. Also there are three former mines on our property, the Mount Jamie Mine and the Red Summit Mine that we own 100% and the Rowan Mine, a joint venture with Newmont. All three of the historic mines are on the Pipestone Bay St Paul Deformation zone. The main East West trending structure that goes about 20 kilometers to the East to the large complex of the Red Lake Mine, the Campbell Mine, the Cochenour Mine. But there's a second gold bearing structure that comes on our property from the Southwest and that's the NT zone, where our last two drill programs have been.

We put 20 holes there with two drill programs, the second drill program results were news released in January 15th of this year. We had 12 grams over 13 meters, within 100 meters of surface. So the shallow holes have all shown gold. The intercepts in the widths certainly make us want to go right back in there. That's what we'll be doing in 2020 drilling and exploring the NT zone so that we would have a second deposit on our property. That we will be exploring, along with the Rowan Deposit, upgrading and increasing as we go to depth, a new deposit. With the NT zone we will have two deposits on our property. Then the NT zone crosses on to our property from the south boundary and continues about two kilometers North East trending, following that trend of the strike length of the NT zone as we drill this year to the North east.

Then it intersects the Pipestone Bay St Paul Defamation Zone. So there's a structural intersecting of two gold bearing structures on our property. Red Lake of course is famous for the structural intersections of gold bearing structures, that's complicated drilling because the geological force crumbles and fractures the rocks. With some exploration luck, I'm not sure luck is the right word, but it's difficult drilling, that's where we could add a blue sky portion to the story; where we can find a significant deposit at the structural intersection of the gold bearing structures. But, in time, we will put some holes in that structural intersection, we'll look for a large deposit.

In the meantime, we're going to explore a second deposit at the NT zone. So the shareholders have the opportunity to benefit from both the Rowan and ZT zone deposits. Then the blue sky portion as we try to find a significant deposit at the structural intersection. Following the PDAC, the mining sector in general feels like it's going into a positive environment. The battery metals of course, lithium, copper, palladium, those people were all positive and raising money, and busy on their properties, and those in the precious metal sector like ourselves.

We're positive and certainly the players in Red Lake, Ontario are positive. We think that Gold is a currency. I'm told the 10 year T-bill pays less than 1%. So historically when one is looking at the federal funds rate, they have negative real interest rates in the United States, which already exists in the Eurozone and Japan and most of the global economy. That typically sets up for a positive Gold environment and we want to take advantage of it for our shareholders. Just as Tom Meredith, our Executive Chairman and Ken Guy, running the exploration programs and the geological team, and myself as President, we want to take advantage of the positive Gold environment for our shareholders, just as we've done in the past.

Dr. Allen Alper: Well it sounds like an exciting year for West Red Lake Gold Mines. Sounds like this will be a really great year and it looks like the timing is great in the industry. Things are starting to turn around and picking up. Gold prices have firmed up and now the juniors will follow.

John Kontak: That of course is how it happens, when the big miners, Agnico Eagle, Barrick, and other companies have a very high-level of production, when they start to hit 52 week highs, as they've been doing. It really started last summer, when the price of gold moved from 1350 to 1515 in US dollar terms, when the Federal Reserve ultimately lowered the federal funds rate by 75 basis points in 2019. They reduced the federal funds rate as much in the first quarter of 2020 as they did all year in 2019. That is the type of economics, that historically speaking, has had a positive Gold Market.

We had a good conference here in Toronto. People were positive. Talked to a lot of shareholders. They're looking forward to a good year. A lot of bankers looking to do deals and the industry is doing deals, which is always a good sign. When people like Evolution Mining are investing something in the order of $500 million to acquire a gold producing complex in Red Lake Ontario, that's the type of activity by big players that in time, and it may not be a lot of time, bodes well for the junior exploration and development companies like ourselves.

Dr. Allen Alper: That sounds great. Sounds like 2020 will be an excellent year for yourself and others.

John Kontak: It's getting warmer in Toronto Al. We're going to be very busy on the property in the remaining months of 2020. We look forward to a good year and to have it continue into 2021. It'd be very good to have a period of time, and these things do happen in our very cyclical industry, where we have a good period of time, 24, 30, 36, months. That's why when that happens, companies like ours, are able to raise more money at higher prices and develop the assets quicker. As it continues there'll be time to do a transaction with the Canadian gold producers as we have done in the past and all our shareholders get upgraded to more senior paper in a very liquid stock. In the meantime, we'll look forward to delivering some shareholder value in our own stock over the course of 2020 and after that.

Dr. Allen Alper: That sounds excellent. That's a great opportunity for your shareholders and your stakeholders. Could you tell our readers/investors about your share and capital structure?

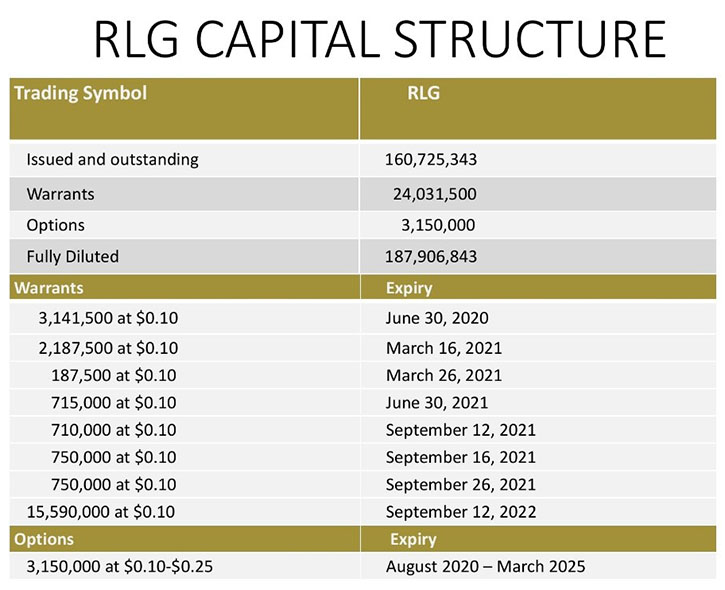

John Kontak: Yes, we have about 161 million outstanding having just completed a $842,000 financing that we news released on March 17. We raised money to drill. 187,906,843 totally diluted. The management has about 8% of the company. We also have a major institutional shareholder. Tom and I do not have options. We buy shares. So we're fully aligned with the shareholders. We have some other significant shareholders, who have a history with the company and are senior executives in the Canadian Mining Community. We can be in touch with almost half the stock with just talking to six or seven people. We trade in Toronto and New York on the OTCQB and in Frankfurt and we have investor relation activities, in all of those places, to support investors.

So we have a well distributed shareholder base of people, who understand the sector and will let us get the job done over the next couple of years. Even at these prices, we always keep working to advance the project and we look forward to a period where capital moves into the gold sector. The last time that money moved into the gold sector was 2016. Our stock went to less than five cents at the beginning of the year to 35 cents stock during the course of 2016. Then because of the Federal Reserve, it was tough in 2017 and 2018, but it started to come back in 2019 and we think 2020 as well.

Dr. Allen Alper: All that sounds excellent. It seems like timing was great and you have a great property. It's always good to see that management has skin in the game and strong, loyal supporters. Excellent!

John Kontak: Yes, we talk to people in Europe, the European shareholder base is positive. We had a very good webinar based out of New York recently and it was well attended. A lot of good feedback and of course we're always busy promoting all these things in Canada. We just attended the conference here, talked to a lot of people in Vancouver, and Calgary, and Montreal. That gives you a very good feel about what your shareholders are saying, and what they're saying is that they're looking forward to 2020.

Dr. Allen Alper: That's excellent. John, could you summarize the primary reasons our readers/investors should consider investing in West Red Lake Gold Mines Inc?

John Kontak: Number one is always the Management Team. When I hear about a company for the first time and I go to the website, the first thing I look at is who's running the show. With Tom Meredith, myself, and Ken Guy, this would be the third Ontario gold exploration and development company that we monetized. We want to do what we've done before however every cycle is different. We've seen a number of these cycles over the decades and we're focused on what we know best, which is gold exploration and development in Ontario. That's what I first look at. The other thing is a well-developed mining jurisdiction, like Red Lake, Ontario, so we have, when one looks at the economics, a relatively low capex to bring a mine into production in Red Lake, Ontario.

One can look at the Pure Gold feasibility studies, etc., because it's the road, the hydro, the workforce, etc. Pure Gold has their own a mill. For us, our economics would probably be a toll milling operation because there're mills with capacity in Red Lake, Ontario, including Evolution Mining, which will be operating two mills. We have an experienced management team, well-developed mining jurisdiction, and a high-grade inferred resource at 7.57 grams per ton. So it's a high grade, close to surface deposit, in a well-developed mining jurisdiction, being developed by an experienced management team. Then the other thing of course is capital flows into the sector. For the macro economic reasons I spoke of earlier, including central bank policy that looks historically like the type of macro environment that's led to a positive sentiment for gold. Should that continue through 2020 and beyond, we intend to take advantage of that for our shareholders just as we have in the past.

Dr. Allen Alper: Oh, that sounds excellent. That sounds like it's an excellent opportunity for your shareholders and also for stakeholders. That really sounds great. Anything else you'd like to add John?

John Kontak: Just to thank you for interviewing West Red Lake Gold Mines for Metals News, Al.

Dr. Allen Alper: I enjoyed talking with you, John. I know our readers/investors are going to enjoy reading about what you’re doing. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.westredlakegold.com/

John Kontak, President

Phone: 416-203-9181

Email: jkontak@rlgold.ca

|

|