Peloton Minerals Corporation (CSE: PMC): Exploring for Gold at Three Carlin style Prospects in Nevada and a Project with Two Past Producing Mines in Montana; Interview with Ted Ellwood, President & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/21/2020

We spoke with Ted Ellwood, President, CEO and Director of Peloton Minerals Corporation (CSE: PMC), during PDAC 2020. Peloton is a gold exploration company, scratching the surface of Carlin trend type prospects in Nevada. Peloton has a strong team that is ramping up an aggressive drill program on several projects. Look for lots of great news from Peloton this summer. Peloton also is exploring a project with two past producing mines in Montana.

Peloton Minerals Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ted Ellwood, President, CEO and Director of Peloton Minerals Corporation, here at PDAC, in Toronto. Ted, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

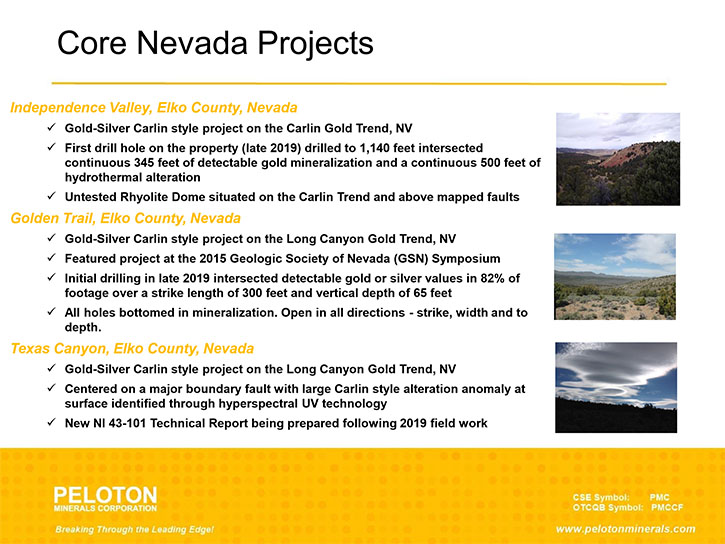

Ted Ellwood: Oh sure, I'd be happy to. Peloton is a junior exploration company that has decided to focus purely on the exploration part of the mine life cycle. We focus on gold in particular and on favorable mining jurisdictions, primarily Nevada and Montana. We have four projects in our portfolio right now. In Montana, we have a project with two past producing mines on it and in Nevada we have three Carlin style gold prospects that are in early stages, but with very strong geology. We expect to be actively drilling on three projects this summer, with a technical report being published on the fourth.

Dr. Allen Alper: Well, that sounds great. Sounds like 2020 will be an exciting year for Peloton.

Ted Ellwood: We hope so. We were successful last year in advancing all four projects, with three drill programs and a field program. All of the projects told us that they warranted further expenditure for exploration, and an expanded drill program on three of them. That's what we are actively putting together right now for 2020. We expect the first drilling to be starting as the summer is upon us.

Dr. Allen Alper: Sounds great! Could you tell our readers/investors what kind of results you've been getting so far?

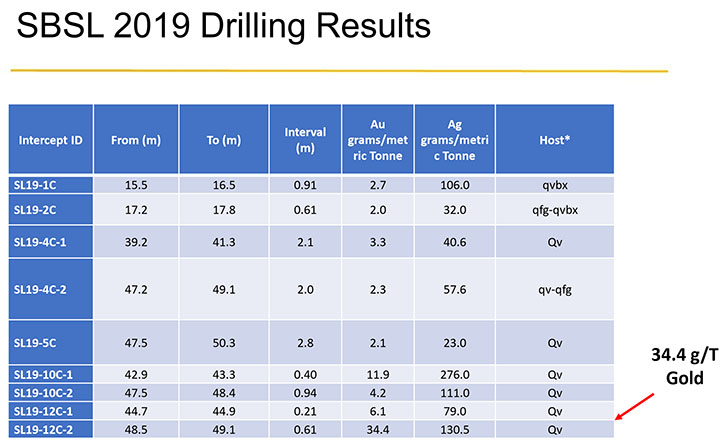

Ted Ellwood: The results so far on the three gold programs we did last year are surprisingly good, considering that was the first drill program on any of the projects. On the Montana project, we got one intersection that graded 34 grams of gold per tonne, which is nothing to sneeze at. That's better than an ounce, and now it needs to be followed up on with further drilling to get a better handle on the extent of that high-grade shoot we’ve discovered.

Then, on the two Nevada projects that we drilled, on one of them we drilled 11 shallow holes and every single hole was mineralized. In fact, 82% of the drill core was mineralized with gold and silver mineralization above detectable levels.

On the other drill project in Nevada, the very first hole that was drilled was a 1,200 foot hole, drilling at an anticline structure. In that hole, 345 feet of continuous mineralization was found, it wasn't ore grade but it was detectable. Anytime that you find a big continuous, mineralized intersection like that in Northern Nevada, that's something to sit up and pay attention to.

So, we're following up on that aggressively. This summer we have identified three or four geophysical targets right in the vicinity of where that hole was drilled and also, 500 feet of hydrothermal alteration was found in that hole. So, that could be the pipe for mineralization. You have geophysical targets within a rhyolite dome structure, which we will test to determine whether gold may have concentrated to form a larger body.

Dr. Allen Alper: That sounds exciting. Could you tell our readers/investors a bit about why those projects are so interesting and why that whole area is of interest, talk a little bit more about the region you are studying.

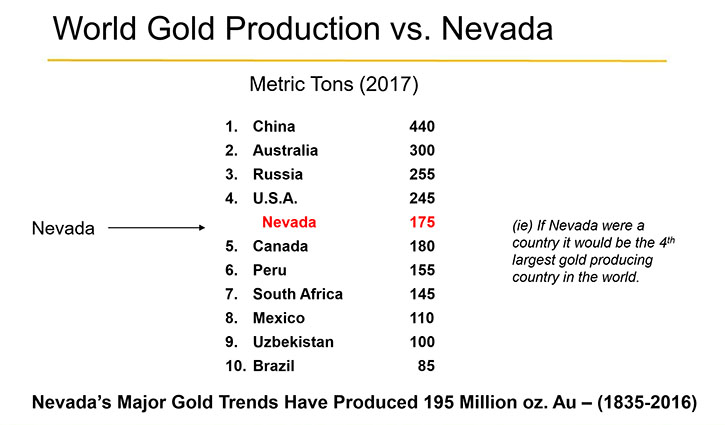

Ted Ellwood: Nevada is interesting from a number of standpoints. First of all, it's very prolific in terms of its gold production and history. If it were a country, Nevada would be the fourth largest gold producing country in the world. Since the 1800’s there have been a number of major gold trends that have been discovered. Every time a new gold trend is found, it's very significant because there's been a series of mines then found all along each of those gold trends. They are quite famous trends, the Cortez Trend, the Battle Mountain trend, the original Carlin Trend. They've all had numerous mine's all the way along them and now there's a new trend that has been discovered, the Long Canyon Trend, and the Geologic Society of Nevada has confirmed that trend. We have two projects along the Long Canyon Trend that we're actively exploring. So, it's a very exciting area to be working in. Personally, I think that the gold that's been discovered in Nevada, near surface, is probably just scratching the surface. Since, those trends have been discovered, there's been over 2 million ounces of gold that's come out of them and I don't think the end is near anytime soon.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit about your background, your Team, and your Board?

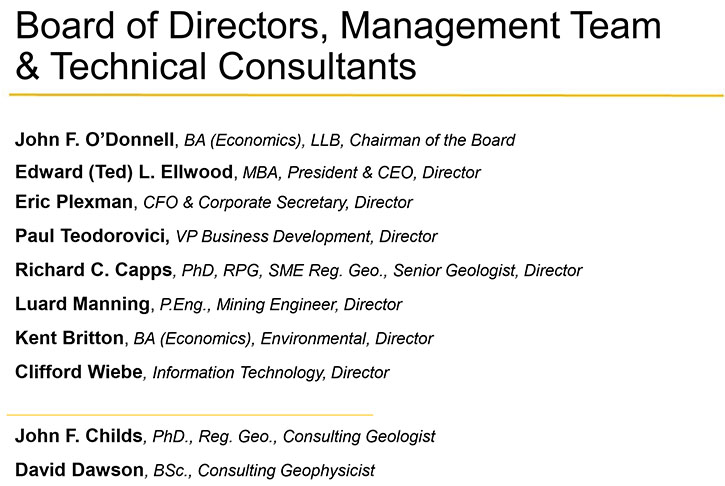

Ted Ellwood: Sure. The Team and the Board have a combined 300 years of experience playing our respective roles in the exploration or mining business. My background, I'm an MBA, so I come from the business side of the industry or the finance side. That having been said, both of my grandparents were gold prospectors in Northern Manitoba, Canada. So, from about the age of five, I was out there banging on rocks trying to find some gold. So, I think that it might come naturally to me. Our Chairman is a mining and securities' lawyer from Toronto, and on the Board we have an engineer, geologist, an environmental person, and finance people. Our senior geologist is considered an expert in the Great Basin area of Nevada, where we're largely focused. We have a former Barrack geologist for Montana and a couple of world-class geophysicists. So, it's a very well rounded team for the exploration business that we are focused on and we're off to a good start, with these four projects. I'm looking forward to getting after them again in 2020.

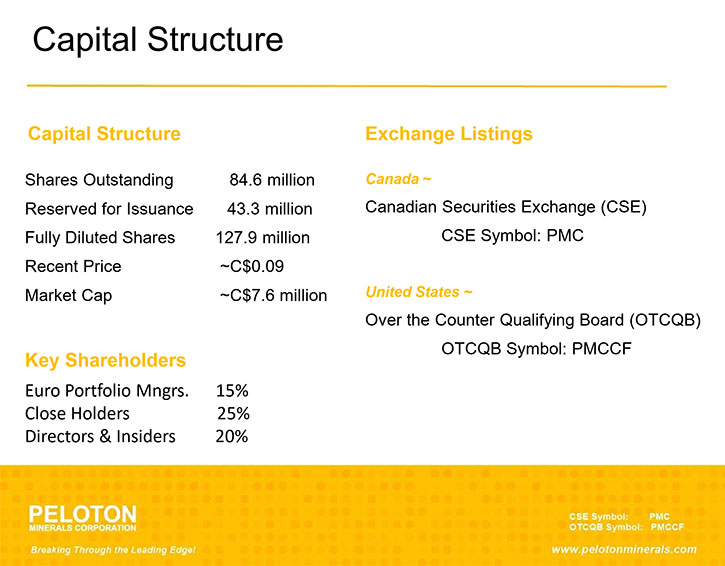

Dr. Allen Alper: Sounds like you have a great background and you have a great team in place, a knowledgeable and well-balanced team, so that sounds fantastic. Could you tell our readers/investors about the Company’s capital structure?

Ted Ellwood: Sure. We're listed on the Canadian securities exchange, trading under the symbol of PMC. We're also trading on the OTC QB market, under the symbol of PMCCF. We have about 80 million common shares issued and we're trading around the eight or nine cent mark. We're not a big company, market cap wise. At the moment we're only about roughly eight million in market capitalization, but then again, that provides plenty of leverage or opportunity as we get chasing after these Carlin style projects. Certainly, our stock price has room to grow or to reflect the value of what those can be. When Frontier Gold found the Long Canyon deposit, where the new Long Canyon Trend is, they started out at 25 cents a share and they were taken over at $14 by Newmont. The total transaction value was $2.3 billion. That gives you an idea of the potential value of those Carlin style deposits that we're exploring for and what they can actually be worth.

Dr. Allen Alper: Well, that sounds excellent. Sounds like you're in the right area, have a great team and a great opportunity. The summer will be fantastic for drilling and learning more about your Company.

Ted Ellwood: Yes, exactly.

Dr. Allen Alper: Could you tell us a little bit about your project in Montana and your partner in that?

Ted Ellwood: Yes. In Montana, we have a private equity firm as a partner that is in the process of going public on the Toronto Venture Exchange. The deal with them is that they're to spend $2 million to earn a 75% interest in the property. They spent about $200,000 or $250,000 late last year on the first drilling program, which was quite successful, with the intersection that had 34 grams of gold per tonne. So, we're looking forward to them funding additional programs this year. They are carrying the funding on that project, so we're happy, as it saves on dilution and moves the project forward.

Dr. Allen Alper: Sounds great! Could you tell our readers/investors the primary reasons they should consider investing in Peloton Minerals?

Ted Ellwood: One of the primary reasons is that if you're looking for exposure to the junior sector, a mine can be worth a lot of money, as illustrated by the long Canyon, which was worth $2.3 billion. We take the portfolio approach to the business, where we add assets to the portfolio on a horizontal basis. Very much the same as you would manage your investment portfolio, where you're adding investments to diversify your risk and at the same time increase your potential exposure for upside. That's exactly what we're offering to investors. It is a valid approach to the exploration business, which is inherently risky. It is a way to manage it, as we are showing.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add Ted?

Ted Ellwood: Just to thank you for interviewing Peloton Minerals Corporation for Metals News.

Dr. Allen Alper: It has been very interesting. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.pelotonminerals.com

Facebook @pelotonminerals

Twitter @pelotonminerals

info@pelotonminerals.com

|

|