Amarillo Gold Corp. (TSXV: AGC, OTCQB: AGCBF): Developing Two Gold Properties in Mining-Friendly Brazil; Interview with Mike Mutchler, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/16/2020

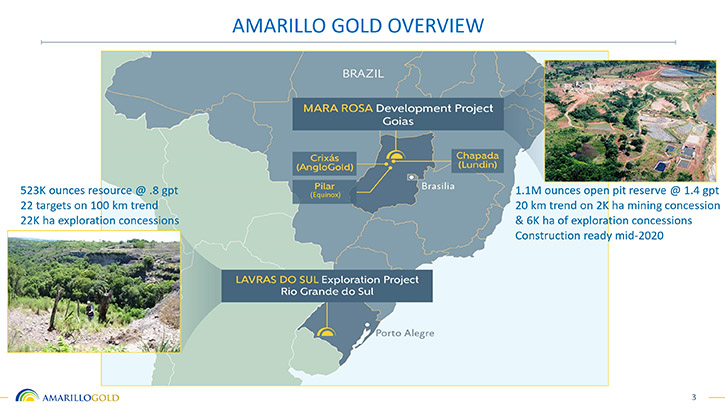

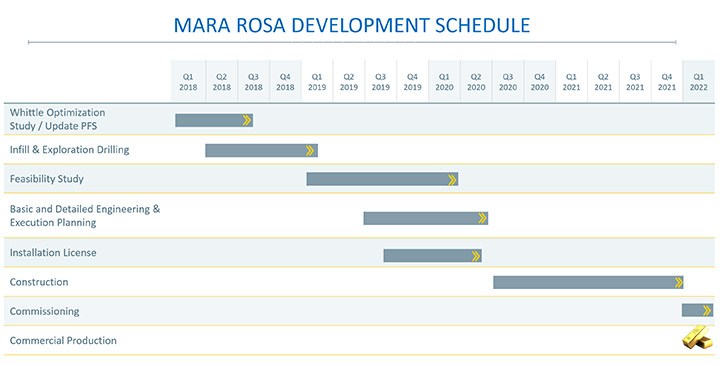

We learned from Mike Mutchler, President and CEO of Amarillo Gold Corp. (TSXV: AGC, OTCQB: AGCBF), that they are developing two gold properties in mining-friendly Brazil. The open pit Mara Rosa Project, in the Goias State, has a NI 43-101 compliant resource of 1.1 million ounces of open-pit reserve at 1.4 grams per ton, and is open along a 20 kilometer trend. The Lavras do Sul Project, in the state of Rio Grande do Sul, in the South of Brazil, is an advanced exploration stage property, comprising more than 22 targets, centered on historic gold workings. Amarillo is currently drilling both properties, with the results expected shortly. Plans for 2020 include; receiving the installation license at Mara Rosa by mid-year, locking in the final construction financing, and commencing construction of the mine. According to Mr. Mutchler, the 7,000 ton per day processing plant will be commissioned in late 2021, with first gold pouring late 2021 and full commercial production in early 2022. Mr. Mutchler believes that right now is a very good time to build a gold mine in Brazil.

Amarillo Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Mutchler, who is President and CEO of Amarillo Gold Corp. Mike, could you give our readers/investors an overview of your company and what differentiates your company from others?

Mike Mutchler: Sure, Allen, and thanks for having me today. We at Amarillo Gold have two gold properties in Brazil. We have our main Mara Rosa development property. There we have 1.1 million ounces of open-pit reserve at 1.4 grams per ton. We're open along a 20 kilometer trend. We have 2,000 hectares of mining concessions from a historical mining operation and another 6,000 hectares of exploration concessions, so we're very excited. We're drilling on the northern part of that trend now, looking for what we think will be satellite ore bodies that will extend the reserve and the mine life. Mara Rosa is located in the mining-friendly state of Goias. We're about a four hour drive from the federal capital of Brasilia. We're about 30 kilometers away from the Lundin Chapada mine, about 60 kilometers away from the AngloGold Crixas mine and also 60 kilometers from the Leagold Pilar mine.

Our second property in the South of Brazil, our Lavras do Sul in Rio Grande do Sul state, a big exploration property, a 100-kilometer trend around a large granite intrusion. We have 22 targets on 22,000 hectares of exploration concessions there. We have a little over half a million ounces of resource on one of those targets and we're drilling now, for the first time in nearly eight years. So we'll be putting out drilling results on both Lavras do Sul and Mara Rosa very shortly.

Dr. Allen Alper: That sounds excellent.

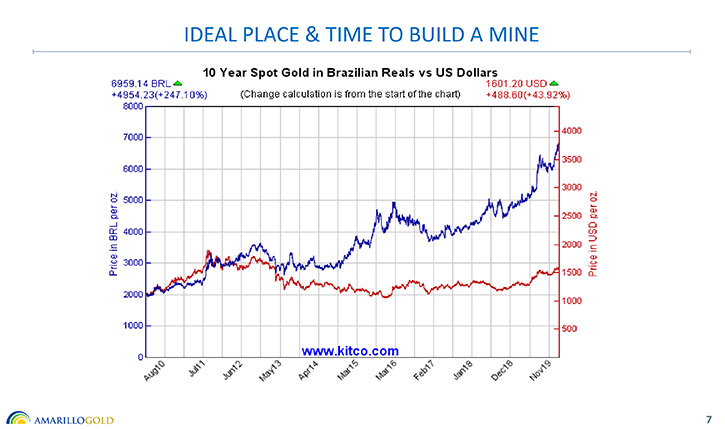

Mike Mutchler: We think it's a very good time to build a gold mine in Brazil. We're seeing, of course, good high gold prices across the world, but we're seeing record gold prices in Brazilian reais. Currently the price of gold is just over 6,500 reais. We've been seeing record gold prices in Brazilian reais for several years, since early in 2013, but that margin continues to grow and it's a very good time to have your products sold in US dollars and your costing in Brazilian reais.

Dr. Allen Alper: That's excellent! Could you tell me more about your projects and also what your pre-feasibility study showed?

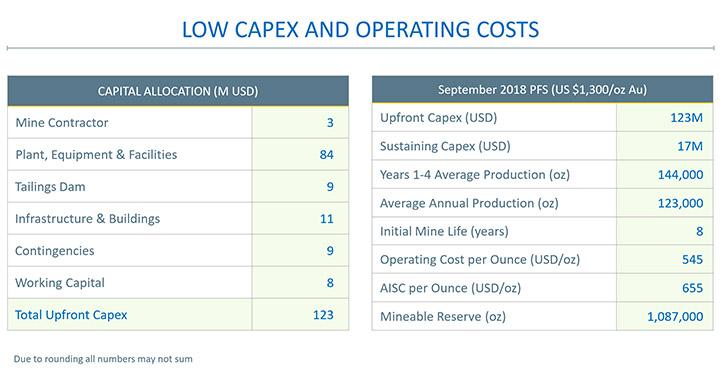

Mike Mutchler: As I say, Mara Rosa is an open-pit deposit. We have 31 million tons at 1.3 gram per ton, one and a quarter million ounces of measured and indicated in the pre-feasibility study. We put that into an open-pit mine plan. We have 24 million tons at 1.42 grams per ton, just under 1.1 million ounces in the reserve. We're completing our feasibility study now. We're going through the final costing on it. We expect to complete our feasibility study in April and we'll have that published towards the end of April.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors what your plans are for 2020? And also, what are your plans going forward to build a production facility?

Mike Mutchler: Late in 2019 we submitted our application for the license to install for Mara Rosa, so that's our construction license. We expect to receive that roughly mid-year. It's about a six month process to receive that. We’ll be wrapping up our feasibility study in April. We've hired Auramet to do our construction debt advising and they're currently talking to construction lenders. We anticipate finishing our feasibility study in April, and getting preliminary term sheets on debt very shortly thereafter. Once we receive the LI mid-year, we'll be fully construction ready and ready to start as soon as we lock in the final construction financing. So that's Mara Rosa. That'll take 18 months to build a 7,000 ton-per-day CIL plant. We'll be commissioning the plant late '21, pouring our first gold late '21, with full commercial production in early '22.

At the same time, we're completing a 5,000 meter drilling program on Mara Rosa this year, again, looking to the North along that 20 kilometer trend, looking for satellite ore bodies that could potentially extend the mine life. Current mine life is estimated at between eight and 10 years, but we believe there're satellite resources there that could extend that mine life.

Again at the same time, we're drilling a 5,000 meter program in Lavras do Sul in the South, first drilling since 2011. The last drilling we did at Lavras do Sul was very exciting, our Butia property. We have a half million ounces of resource there, but the last holes that were drilled we had 120 meters at 3.2 grams per ton, 232 meters at 1.95 grams per ton. So they show good vertical continuity of the target there. We'll be drilling north on that target along what we call Caneleira to the north of Butia later this year.

Right now we're drilling on a property, to the south along the side of the southern rim of the intrusion property, we call Matilde, and we should see results from that drilling coming out over the next couple of months. Our corporate summary is to build Mara Rosa, with minimal dilution for our shareholders. Our long term goal would be to use the cash flow from Mara Rosa to grow the Company, grow the resources both at Mara Rosa and at Lavras do Sul in the South. We think that both the Mara Rosa trend and the Lavras do Sul district have the potential to be multimillion ounce deposits.

Dr. Allen Alper: Well, that sounds excellent! Sounds like 2020 will be a very exciting time for Amarillo Gold.

Mike Mutchler: Yeah, one of the slides in our presentation shows a typical junior gold miner life-cycle, where you do an exploration, you hit a discovery and your equity value goes up. Then when you get into the somewhat boring engineering phases, construction financing, and ultimately construction, you're in that trough where there's not a lot of exciting news coming out. As you start construction and eventually go into production, you see your values go up. But we have two kicks at that can, with the two properties that we have.

We have Lavras do Sul, which is still in that very early exploration, discovery phase. We are very excited by the prospects of a multimillion ounce district there in Lavras do Sul. And then we have Mara Rosa, which we're moving through that boring engineering phase, but we have some good exploration upside there to grow the resource. As we move into construction and ultimately production, we'll see our share price come up from both of those projects.

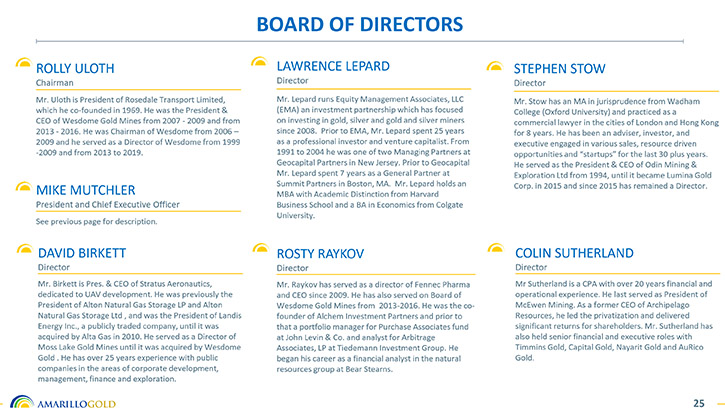

Dr. Allen Alper: Oh, that sounds excellent! Could you tell our readers/investors a bit about your background, your Team and your Board?

Mike Mutchler: Yeah. I'm a 40 year mining guy. I grew up in the States near the Homestake Mine in South Dakota, went to school at South Dakota School of Mines. I spent 20 years initially with both Homestake and then Asarco in the US, working primarily underground, then later switching to open-pit. I left Asarco and went to work for Kinross, initially in Nevada, as Operations Manager of Round Mountain and then into the project development group down in Chile, as Mine Manager for the Cerro Casale study, and then over into Brazil to do a mill expansion on Paracatu. I left Kinross and went to Rainy River Resources. I was the Chief Operating Officer there with Ray Threlkeld. We sold that to New Gold in 2013 and I went back to Brazil as Chief Operating Officer for Largo Resources to finish off the construction on the Maracas vanadium mine.

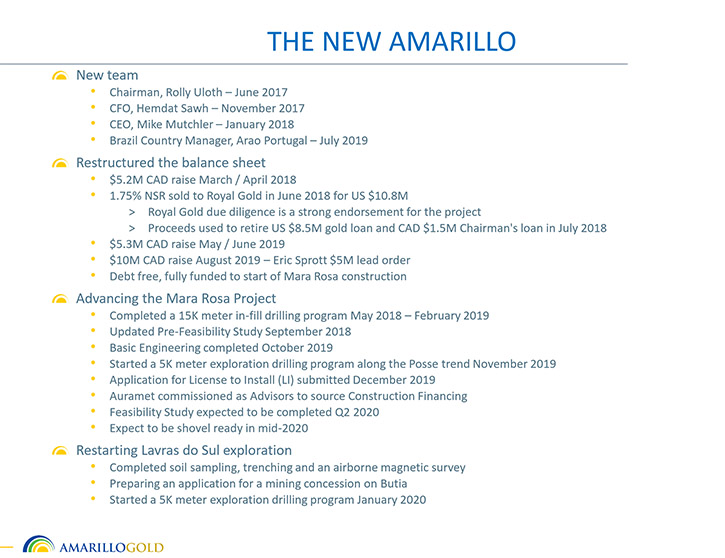

After Maracas was up and running, I did some consulting work with Whittle Consulting and I ran into Amarillo in late 2017, initially as a potential client for Whittle. Then as I learned more about the Company and realized they needed a CEO, I threw my name in the hat and I joined Amarillo in early 2018.

Our CFO, Hemdat Sawh, joined just before I did. We have a whole new Management Group, which started in mid-2017, but Hemdat joined in late 2017. Our Chairman, Rowley Uloth, joined in mid-2017. Rowley is a very successful businessman. He owns the third largest independent trucking company in Canada. He became involved in mining years ago as part of his investment portfolio. He was CEO of Wesdome twice, from '07 to '09, retired and then in 2013 Wesdome was struggling a bit and asked him to come back a second time. So he went back from 2013 to 2016. He restarted the exploration programs there and really set the table for the banquet Wesdome is enjoying today.

Other folks, we have, our most important person is Arao Portugal. He's our Country Manager. Arao is a 40 year mining guy in Brazil. He was former Country Manager with Yamana, during their formative years. He was involved in building eight of the Yamana operations in South America, so very well-experienced, very well known in the Brazilian mining industry and really a big part of our success. He helped the Company receive the initial preliminary license, that's the first permit, in 2016. He led the effort to submit the license for the installation late last year. Now he's working on receiving that license to install and getting ready for construction.

Dr. Allen Alper: Oh, you have a very experienced team and a team with a very strong track record. That sounds excellent!

Mike Mutchler: Thank you.

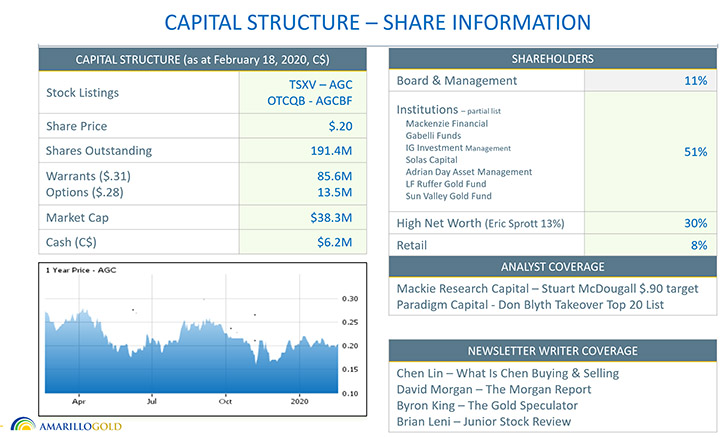

Dr. Allen Alper: Could you tell our readers/investors a little bit about your capital structure?

Mike Mutchler: We're sitting today, with about 191 million shares outstanding, trading today at 22, 23 cents, Canadian per share, so we have a market cap of roughly $40 million or so. We have a little over $6 million cash in the bank. We did a $5 million raise last May and then a month later got a call that Eric Sprott wanted to come in at the same terms. So we opened a second raise, and between Eric and followers of Eric and others who became interested in the story, we did another $10 million raise in August of last year. So that gives us everything we need to get through to start of construction. The next equity, that we anticipate taking, will be part of the construction financing, whatever piece of equity is required for the construction financing.

Our Board and Management own about 11% of the Company. We've put a little over $3 million of our own money in, in the last couple of years and we continue to do so. Several large institutions own about 51%, and high-net-worth individuals, primarily Eric Sprott, at 13%, and a couple of other individuals for a total of 30%. Only about 8% is with retail. We would like to see our retail component grow, to get more retail interests and more trading volume.

Dr. Allen Alper: Well, that sounds excellent. That's great to have such strong support and also to see that management has skin in the game, which shows Management has confidence in the Company. So that's excellent! Mike, could you tell us the primary reasons our readers/investors should consider investing in Amarillo Gold?

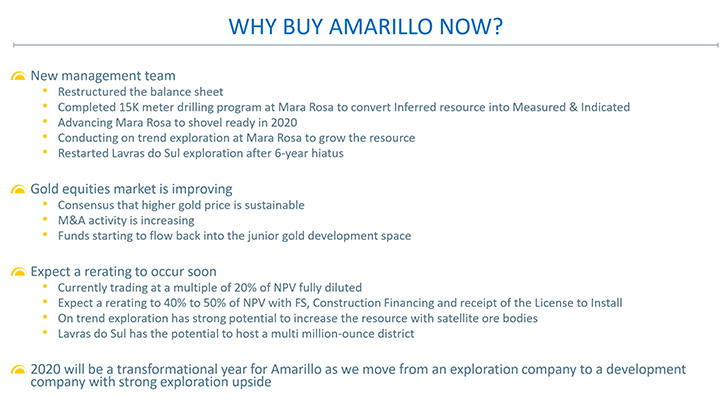

Mike Mutchler: Well, we think it's a very good time to get involved with Amarillo. We're trading at a very low multiple to our NPV of the Mara Rosa project. We essentially don't get any real credit, in our share price, for our Lavras do Sul project and we think we'll change that, with our upcoming drilling programs. We have a new Management team. We've completely restructured the balance sheet. We're debt free. We're fully funded through to start of construction, so we're in very good financial shape. We're advancing Mara Rosa to shovel-ready mid-year this year and we have restarted exploration at Lavras do Sul for the first time since 2011.

We think the gold market has certainly turned. We're seeing good gold prices. Consensus seems to be that those prices are sustainable. M&A activity is starting to increase. It started with the seniors and now you're seeing a little more activity, with the mid tiers and starting to see some junior movement. So we think the M&A side of the gold equity market is certainly turning and we expect a re-rating to occur soon. As we move through de-risking, over the next few months, with the feasibility study coming out in April, construction financing lined up somewhere mid-year, LI received mid-year, we'll be completely de-risked at that point and ready to start construction.

At the time of this interview, we traded at a multiple of perhaps 15 to 20% of the NPV of Mara Rosa, fully diluted. Typical projects, as you're construction ready, can trade in the 0.4 to 0.5 range of your NPV, so we think this will be a transformational year for Amarillo. We're going to move away from being just an exploration company to a development company, but we'll continue to have that very strong exploration upside.

Dr. Allen Alper: Well, sounds like excellent reasons for our readers/investors to invest in Amarillo Gold! Could you tell our readers/investors how it is operating in Brazil?

Mike Mutchler: Yeah. I've worked in Brazil twice before. I think overall the mining environment in Brazil is very positive. The government of Brazil certainly recognizes they need mining. They need the foreign investment in mining to help develop their infrastructure. I was comfortable in Brazil, even prior to the new president. The new president has made it even a little easier for foreign companies to invest in Brazil and he's certainly promoting mining in Brazil. So I think overall the regulatory environment, the political environment is quite good for mining.

Our main development property, in Mara Rosa, is a brownfield site. Western Mining mined on a property there in the early '90s. The community is very supportive of the mine re-opening. They've had those mining jobs there in the past. They know the mining jobs are better paying jobs. They want to see the mine re-open. Mara Rosa is a town of about 10,000 people. It's an agricultural community, no major industry there. Folks in Mara Rosa drive 30 kilometers to work at the Lundin Chapada mine, or 60 kilometers to work at the Leagold Pilar mine, or the AngloGold Crixas mine. So a lot of experienced folks, who would come to work for us, would avoid that longer commute. Mara Rosa is a nice community, so it will be very attractive for new people moving in from outside. We think the environment is very good in Brazil, a mining-friendly country, trying to promote mining.

Dr. Allen Alper: Sounds excellent! Is there anything else you'd like to add, Mike?

Mike Mutchler: I want to thank you for interviewing Amarillo Gold Corp. for Metals News. I feel we have two very positive stories, Mara Rosa moving into construction, with a very short timeline into production, and Lavras do Sul with early, but exciting exploration, from our last program, getting going again now. So I think we have two exciting stories for Amarillo shareholders and I think we have a bright future.

Dr. Allen Alper: Well, that sounds great. It sounds like very strong reasons for our readers/investors to consider investing in Amarillo Gold. You have a great project, a great team and great supporters, and you're in a great country. Sounds like you have everything going for you, Mike! We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

Mike Mutchler: Thanks, Allen.

https://www.amarillogold.com/

Mike Mutchler

President & CEO

416-294-0736

mike.mutchler@amarillogold.com

|

|