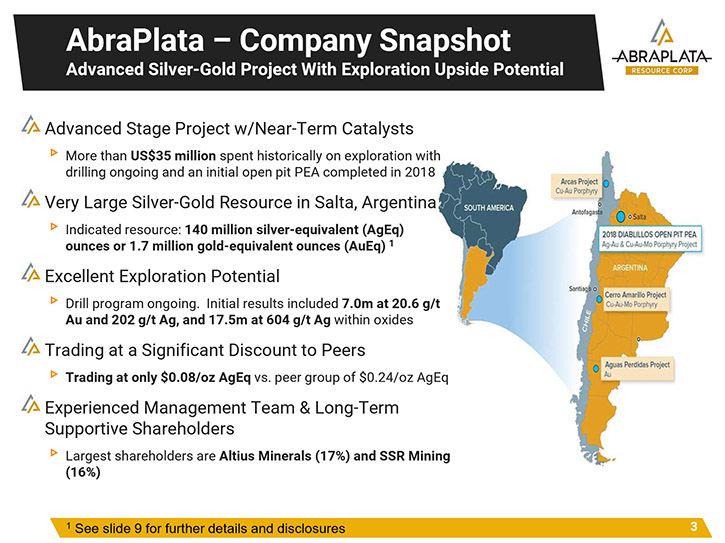

AbraPlata (TSX-V: ABRA): Advanced Huge Silver-Gold Project with Upside Potential; Interview with John Miniotis, President and CEO; PDAC Booth 2215B

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/28/2020

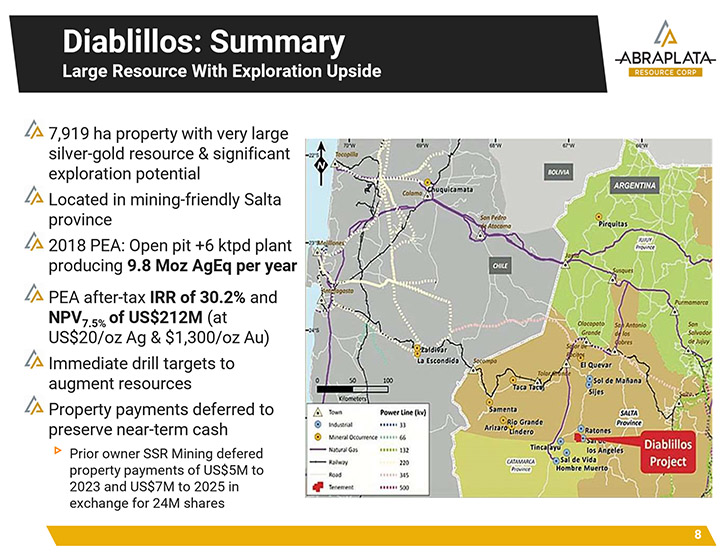

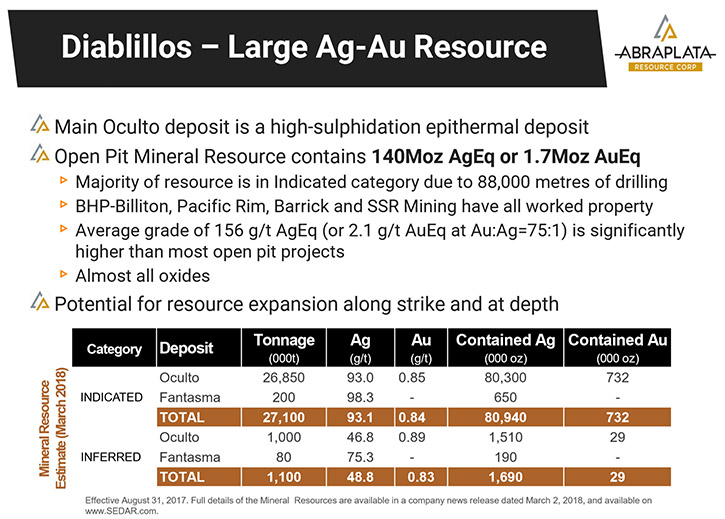

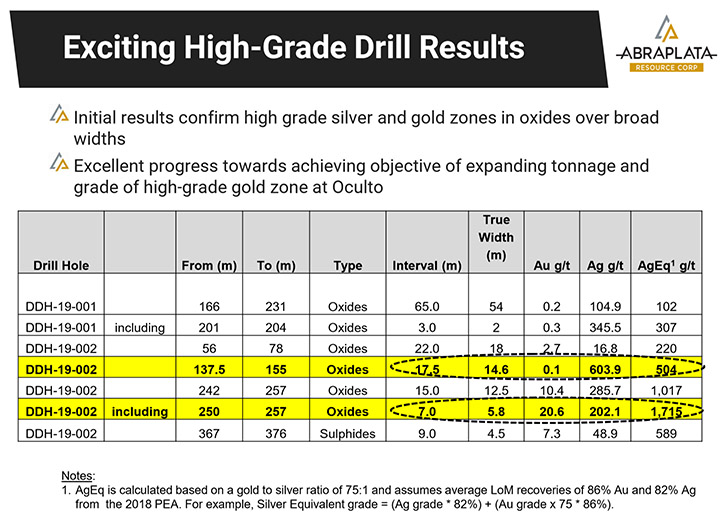

AbraPlata (TSX-V: ABRA) is focused on the Diablillos silver-gold property, located in the mining friendly province of Salta, Argentina, that holds 140 million silver-equivalent ounces or 1.7 million gold-equivalent ounces in indicated resource, with significant expansion potential. This is a very large advanced-stage project, with a robust initial open pit PEA, completed in 2018, and an ongoing drilling program that shows initial results of 7.0m at 20.6 g/t Au and 202 g/t Ag, and 17.5m at 604 g/t Ag within oxides. We learned from John Miniotis, President and CEO of AbraPlata, that 2020 plans include a 3,000-meter drilling program that will result in an updated resource and an optimized PEA. According to Mr. Miniotis, AbraPlata has a very low valuation relative to its peer group, while at the same time holding very good exploration upside potential, as witnessed by their recent drill results. In addition, AbraPlata owns the Arcas project in Chile, where Rio Tinto has an option to earn up to a 75% interest, by funding up to US$25 million in exploration. The Company also owns the highly prospective Cerro Amarillo property, with its cluster of five mineralized Cu-(Mo-Au) porphyry intrusions, and the Aguas Perdidas, Patagonia-style epithermal Au-Ag property.

Aerial view of the Diablillos Camp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Miniotis, President and CEO of AbraPlata Resource Corp.

Could you give our readers/investors an overview of your Company?

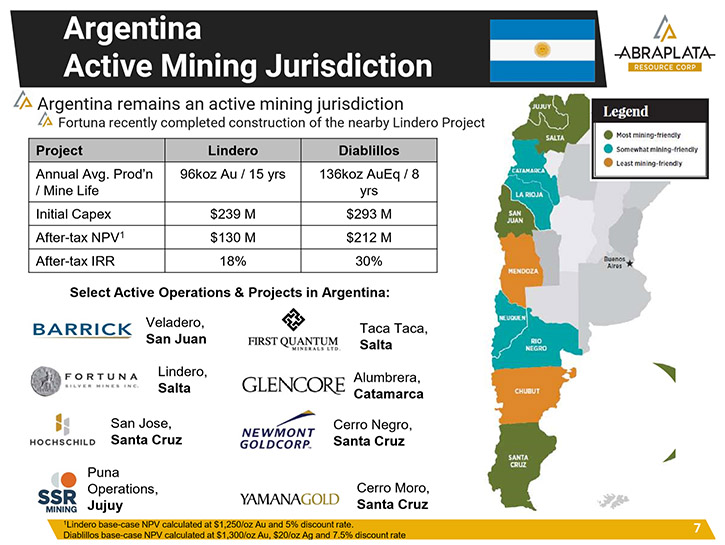

John Miniotis:AbraPlata is a silver and gold focused exploration company. We have our assets located in Argentina and Chile. Our flagship project, in the Salta Province in Argentina, is called Diablillos. It's quite a large, advanced-stage, silver gold project, where we currently have an indicated resource base of about 80 million ounces of silver and over 730 thousand ounces of gold. An approximate breakdown of the revenues there, will be about 60% silver, 40% gold. In 2018 we put out a PEA on the project that showed a NPV of over US$200 million, with an after tax IRR of 30%, based on US$20/oz silver and $1,300/oz gold. The study was based on a large, open pit scenario and we feel there remains excellent upside potential to unlock value further from the project.

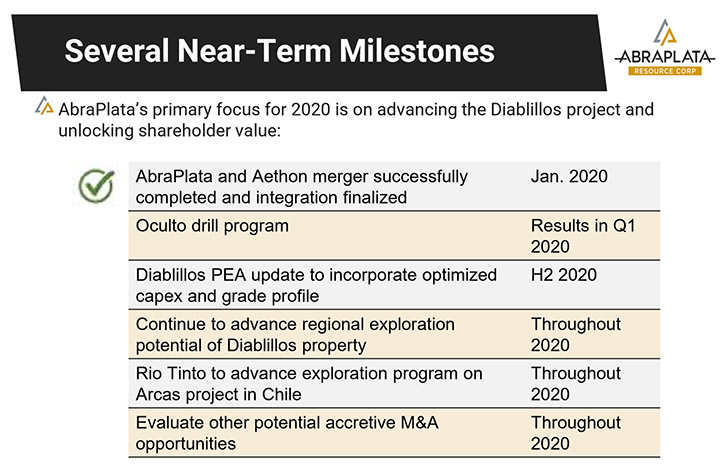

Dr. Allen Alper: That sounds excellent. Could you give our readers/investors the highlights of your plans for 2020?

John Miniotis: We started our initial drill program in late 2019. We’ve now announced results from the first three holes in the program, which have included some very high grade intercepts. In our third hole, targeting the vertical continuation of hydrothermal breccias into the basement, underneath the current silver-gold resource, we also hit a high-grade copper intersect in sulphides. The intercept of that hole included 15 metres of 5.1% copper, 2.35 g/t gold and 658 g/t silver, so quite a remarkable start to our drill campaign.

We're very excited to continue following-up on the drilling. We have a plan for a 3,000 meter drill program this year, which would be about seven or eight holes in total. The main objective of the current drill program is to expand the deeper gold resource and then complete additional work, which would enable us to release a new optimized PEA.

Dr. Allen Alper: Well that's great! That would be excellent. Could you tell our readers/investors a bit more about the projects?

John Miniotis: Diablillos is in the mining-friendly Province of Salta in Argentina. AbraPlata acquired the project back in late 2016, from SSR, which was formerly Silver Standard. There's been over $35 million spent on the property historically, so it’s quite an advanced stage asset. We feel the project is significantly undervalued by the market, and so our focus remains continuing to advance the project and unlocking value for all stakeholders.

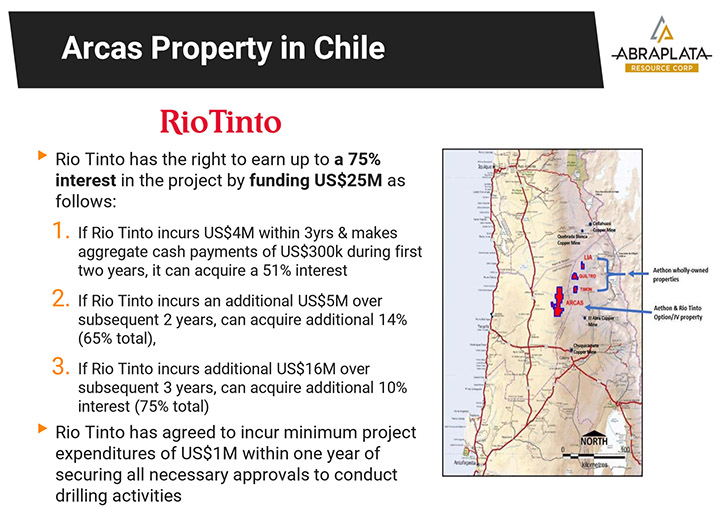

In addition, we should also highlight that we have a project in Chile, called the Arcas Property. It's an earlier stage project, located in Northern Chile, where we have Rio Tinto as a partner. Rio Tinto is currently advancing that project and they have the option to acquire a 75% stake in that property, by spending $25 million US over the next eight years.

Rio Tinto is an absolutely ideal partner and we're very happy to have them advance Arcas, while we focus our efforts at Diablillos.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors a bit about your background, your Team, and your Board?

John Miniotis: Yes, I have a finance background and have been focused in the mining sector for about 15 years now, in various corporate development and M&A focused roles. Some of the companies I've worked for, on the corporate side, include Barrick Gold, Lundin Mining, and AuRico Metals. I then became Interim CEO at Aethon Minerals, which merged with AbraPlata in December 2019. In addition to myself, our Chief Geologist is David O'Connor. He is based down in Argentina and has over 40 years of experience. Dave has made a number of discoveries all across South America. So we're very happy to have Dave lead our technical team.

On the technical side, we also have full access to the resources of our largest shareholder, which is Altius Minerals. As many of your subscribers may know, Altius has a very impressive track-record and is backed by an exceptionally strong technical team, so having them provide us with their technical expertise is a tremendous advantage for a company of our size.

In terms of our Board, we also have a very experienced Board with extensive technical skills, corporate development and M&A, as well as legal skills. We have members from both Altius and SSR on our Board, representing our two largest shareholders. Overall I believe we have a team with a very good track record.

Dr. Allen Alper: Well it sounds like you have a great team, great experience, and knowledgeable and excellent backing. So that's really wonderful!

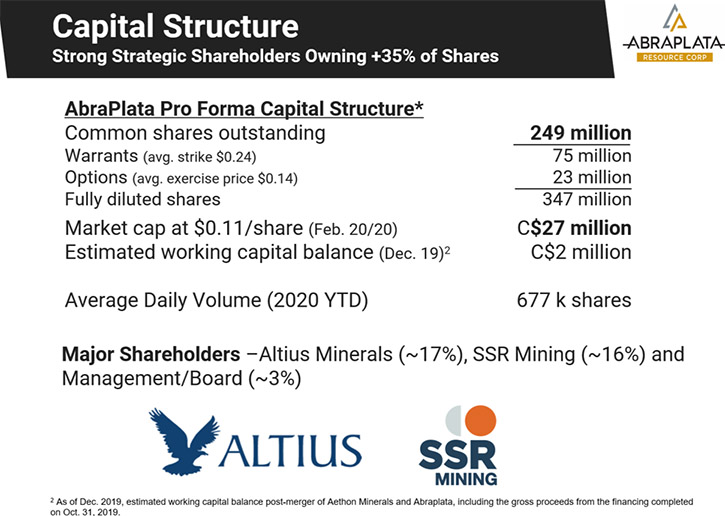

Could you tell our readers/investors about your share and capital structure?

John Miniotis: Yes. We have approximately 250 million shares outstanding. The shares are quite tightly held, with insiders, including Altius and SSR, owning about 36%. The Company also has a very clean balance sheet, with no debt.

Dr. Allen Alper: Well it's great to have that kind of backing from Altius and SSR Mining. That gives you both financial support and also technical support. That's really great!

Could you tell our readers/investors, the primary reasons they should consider investing in AbraPlata?

John Miniotis: Yes, firstly we have a large indicated silver gold resource at our key project, so we provide excellent leverage to both silver and gold prices.

We have a robust PEA that’s already been completed on the project, showing a good after-tax IRR of 30%, and yet we also see excellent potential to further optimize and improve the economics of the project as the year progresses.

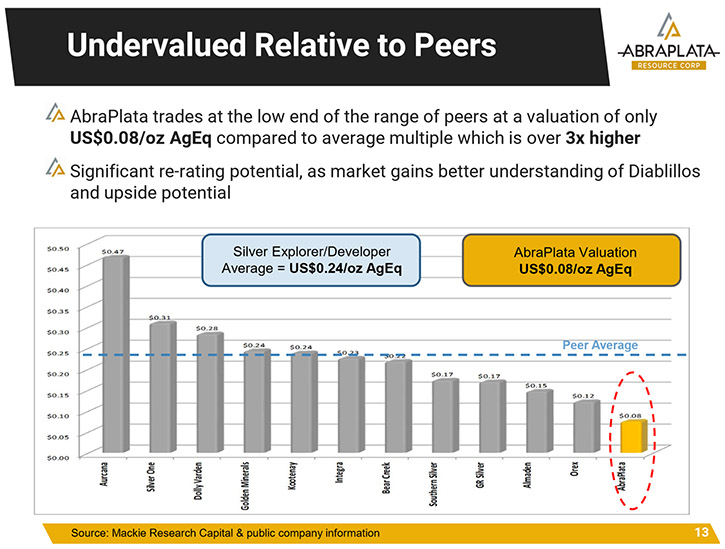

At the moment, we’re trading at a very low valuation, relative to our peer group. We are currently trading at a deep discount to our peers, when valued on either a P/NAV basis or an on-situ $/oz resource basis. Based on some of the recent drilling success we’ve had, our share price has started to gain some momentum here, and we feel we are likely in the first inning of what could be a substantial re-rate in our share price.

Finally, I'd say we expect to have several catalysts in the near future, as we look forward to completing our drill program and announcing the remaining results over the next few months.

Dr. Allen Alper: Oh, that's great! Sounds like 2020 will be a very excellent and exciting year for our readers/investors and of course AbraPlata. So that sounds great!

John Miniotis: Thank you. Certainly, we are very, very excited!

Dr. Allen Alper: That's excellent! Could you tell our readers/investors how it is operating in Argentina?

John Miniotis: Argentina, varies greatly, depending on which province you're in. The provinces are quite highly autonomous. For the most part, they have their own set of regulations that impact mining activities. We're in the Salta Province, which is a mining-friendly province, and we've had no issues there whatsoever. In fact, this project's been around since the ‘90s, with a long track record of exploration and throughout that time there have never been any political issues impacting the project. So frankly, we see Salta as being quite a favourable jurisdiction.

I'd say another vote of confidence for the province is that Fortuna Silver has just recently completed construction of the Lindero Project, which is located about 100km or so to the west of us. I believe a strong vote of confidence is that many corporates are looking to invest and ultimately construct and operate projects in Argentina’s mining-friendly provinces. We remain excited to be working in Argentina at this time, and believe there’s an opportunity to find other undervalued opportunities in the Country.

Dr. Allen Alper: Oh, that sounds excellent! That sounds like the Company's positioned very well, and working in a very mining friendly area that will give you great support. So that's terrific!

Is there anything else you'd like to add, John?

John Miniotis: No, I think that's it. Thank you very much. I appreciate the opportunity to give Metals News readers/investors an update and look forward to providing further updates as they become available.

Dr. Allen Alper: Thank you. That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.abraplata.com/

John Miniotis, President & CEO

Tel: +1 416-306-8334

|

|