Timberline Resources Corporation (OTCQB: TLR; TSX-V: TBR): Advancing District-Scale Gold Exploration and Development Projects in Nevada; Interview with Dr. Steven Osterberg, President and CEO; PDAC Booth 2848

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/13/2020

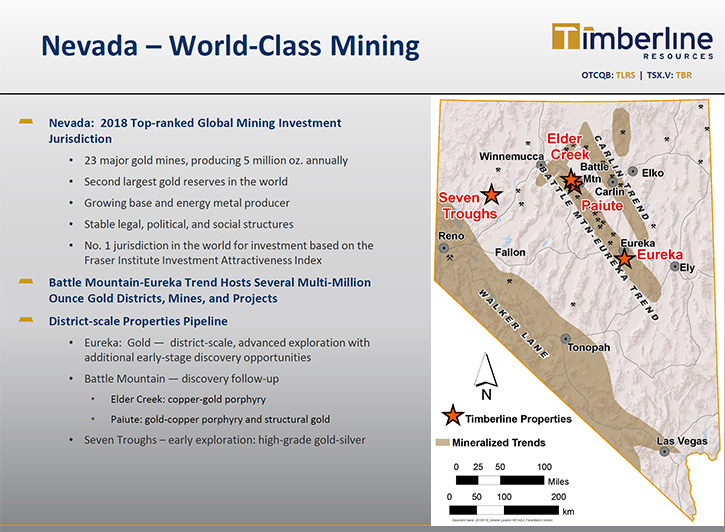

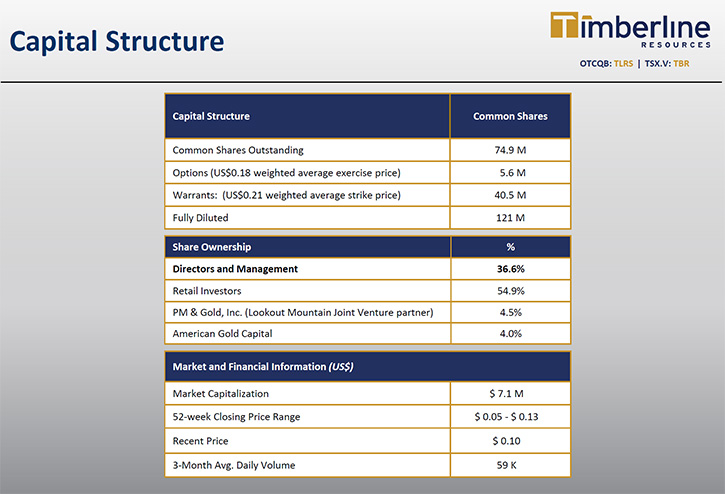

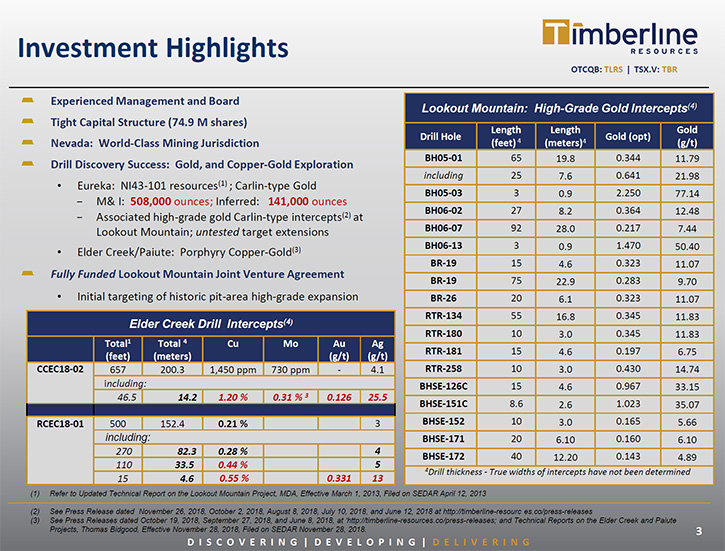

Timberline Resources Corporation (OTCQB: TLR; TSX-V: TBR) is advancing district-scale gold exploration and development projects in Nevada, where the Company controls mineral rights on over 43 square miles. We learned from Dr. Steven Osterberg, President and CEO of Timberline Resources, that they chose to focus on Nevada because it is a world-class mining and mining investment jurisdiction, with well-established districts. Timberline's projects are located on the prolific Battle Mountain-Eureka gold trend. The Company has drill discoveries in three projects, including a high grade multi-gram discovery on Eureka Project that holds over 500,000 ounces of qualified resources and is open for expansion. We learned from Dr. Osterberg, that Timberline has a very tight share structure, very high insider ownership, with Directors and Management holding about 37% of the Company, and a very diverse Board, with both technical and capital markets experience.

The Eureka Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Steven Osterberg, who is President and CEO of Timberline Resources. Could you give our readers/investors an overview of Timberline Resources, Steven?

Steven Osterberg: Yes. Thank you, Allen. I appreciate the opportunity to discuss the Company with you. Timberline is principally a gold focused explorer. All of our projects are in Nevada. That's a strategic decision of the Company. Two of our projects have a copper component as well as gold. Why Nevada? Many companies are here because it's a world-class mining and mining investment jurisdiction, with well-established districts. Our projects are on the Battle Mountain-Eureka trend. We have drill discoveries in three projects right now, including a high-grade, multi-gram component on part of our Eureka Project area that has over 500,000 ounces in qualified resource right now open for expansion.

We have a tight share structure, about 75 million shares outstanding, very high insider ownership, about 37% by Directors and Management, and a diverse Board, with both technical and capital markets experience.

Our Board Members and Management have been involved in everything from private companies and juniors, up through majors, and they have extensive experience in Nevada.

Dr. Allen Alper: Well, that sounds excellent! Could you tell our readers/investors a little bit more about your projects?

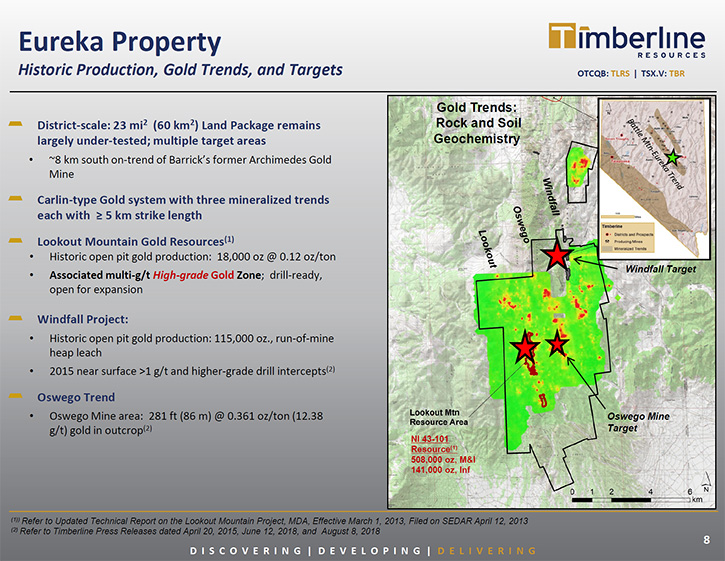

Steven Osterberg: Yes, happy to. Our flagship for many years has been the Eureka Project. It's a very large property block, about 23 square miles. It sits immediately south of the town of Eureka, in what is a long running historic mining district. Most recently of significance, Barrick operated their Archimedes mine there, which produced better than a couple of million ounces, and there's still some in resource there and likely for the future.

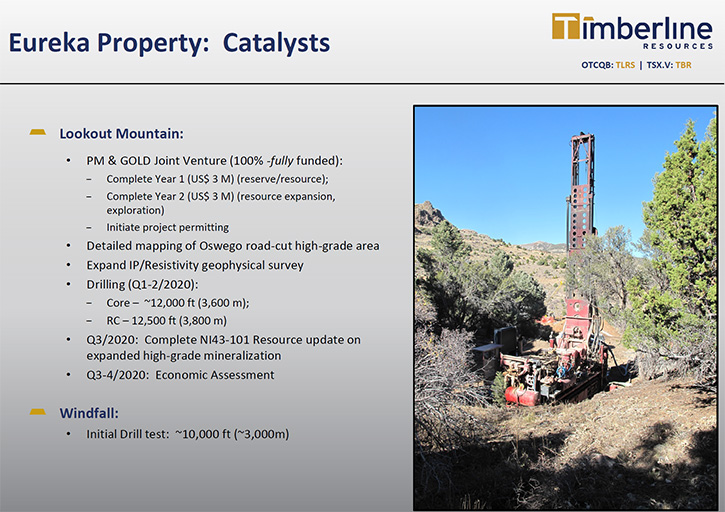

Our property then sits just south of that and has a couple of project areas within it. Most significantly is the Lookout Mountain Project, and then secondly, the Windfall Project area. As a side note on Windfall, this was arguably the very first stand-alone, open-pit, cyanide heap leach operation in Nevada, if not the world, operating first in the mid-1970s. We own that in its entirety and we'll be doing some further work on that in the future, but our main focus has been on the Lookout Mountain Project.

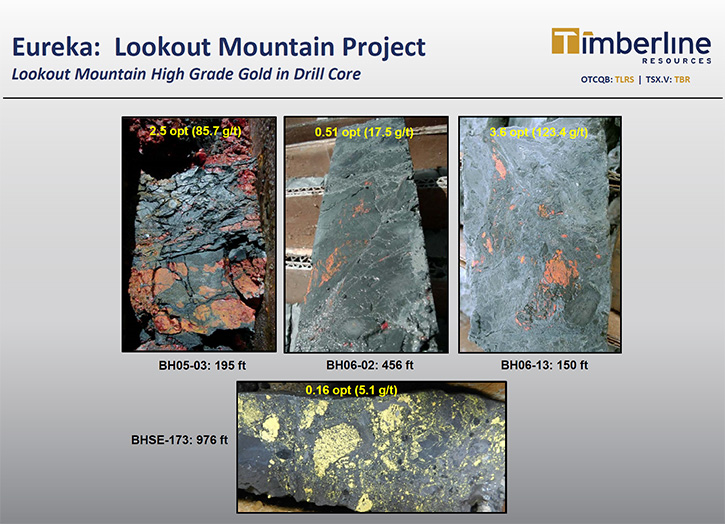

The Company acquired this back in 2010 and spent considerable effort bringing this classic Carlin-type gold deposit up through a defined NI43-101 resource of 508,000 ounces in measured indicated and 141,000 in inferred. The deposit occurs along a north-south trend of approximately four to five kilometers. It's open in both directions, north and south as well as down dip. In addition to that, we also recognize, within that resource area, better than 20 drill cores, which have drilled through a zone, with multiple multi-meter intersections of greater than 10 grams per ton. So it's a very high- grade zone. Some of this high-grade mineralization is exposed in the bottom of a very small historic open pit that operated in the mid-1980s, where it produced about 18,000 ounces.

So we have a high-grade zone, within this long system of lower grade mineralization and we are very much focused on that high-grade zone right now. Over the past several months, we've been re-evaluating it and re-logging drill core, and doing some remapping to better understand the controls on the distribution of and the signatures of that high grade mineralization. And we're now poised to begin a significant drilling program of around 25,000 feet over the next several months, to upgrade and expand it. That project work is being fully funded through a joint venture that we entered into with a private party back in mid-year 2019. Initially our partner will fund $6 million over two years to earn a 51% interest in the project. We're very excited about the work on Lookout Mountain.

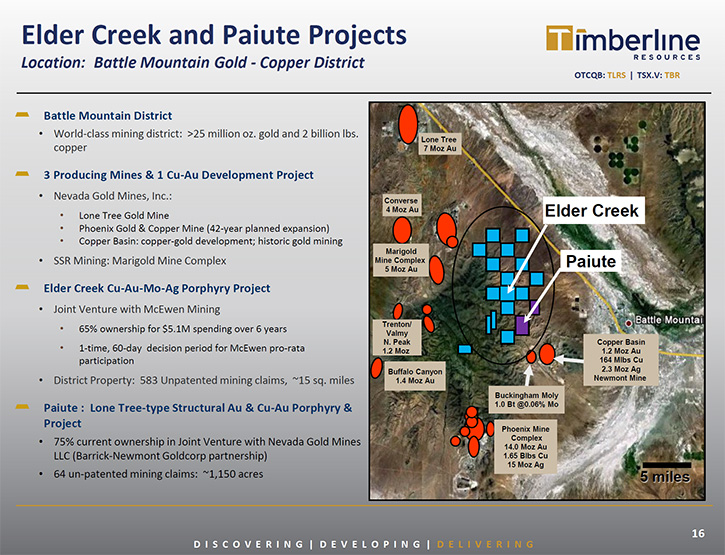

We also have work going up in the Battle Mountain District, farther north on the Battle Mountain-Eureka trend. Battle Mountain, of course, is a very prolific historic gold district. It has produced well over 25 million ounces. There are several multi-million ounce deposits and there has been significant copper production as well. Currently there is gold and copper production by several companies. Gold and copper by Nevada Gold Mines, and gold produced elsewhere by SSR, for example, so a very well-endowed district.

We have two project areas there. The first is a partnership with Nevada Gold Mines, wherein we currently have earned approximately 75% and increasing ownership interest. Our focus here is on gold in a corridor of faults, along which gold has been introduced. Also, we have a new gold discovery from late 2019 that's associated with an intrusion. We see similarities in these occurrences to the other operating mines in the district, for example, Nevada Gold Mine’s Lone Tree, as well as Phoenix projects.

Highlights from that recent drilling include a 216 meter deep drill hole, with gold mineralization pretty much from the surface to the final depth, and also intense silica alteration in the rocks. The mineralization is focused in about six different multiple meter thick intervals, each carrying typically from around a half gram to a gram per ton gold. That's very much in line with the grades in the existing mines and operations in the district. So with near surface and these thick sections of mineralization and great infrastructure in this property area, Paiute has become a really attractive exploration opportunity that we will be advancing with further drilling.

Our second project up there is Elder Creek. This is also a large intrusion-related project. It is a polymetallic, porphyry copper system, with copper, gold, silver as well as some molybdenum. There's some separate gold mineralization in the system as well. On this property, we are earning ownership into the project from McEwen Mining, who is the underlying owner. We've now drilled in three areas that we have targeted to date and we've intersected mineralization in each of these initial tests, completed from mid-2018 through 2019. With the size of this project, we are considering engaging a strategic partner to support us with further advance of the project.

So that's a pretty good snapshot of our projects.

Dr. Allen Alper: Well, they sound like excellent projects in a great area, with great potential. Sounds excellent!

Steven Osterberg: Yes, absolutely.

Dr. Allen Alper: Could you tell our readers/investors a little bit more about your background, your experience, Management Team and Board?

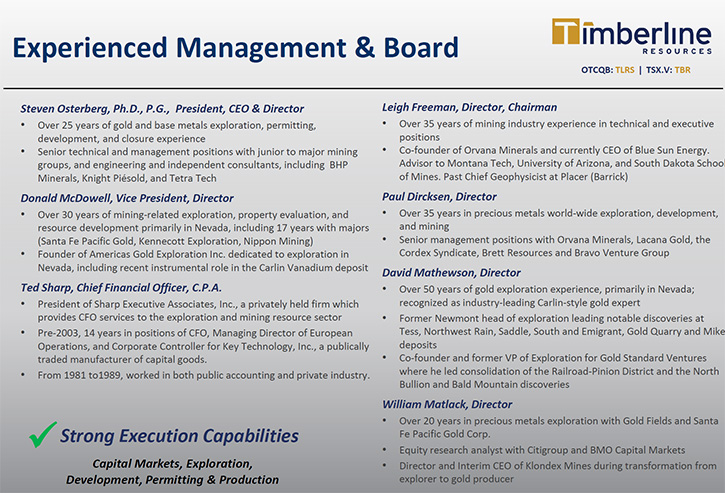

Steven Osterberg: I joined Timberline back in early 2012, a position leading the technical work for the Company. I spent a lot of time in my early years with the Company overseeing advancement of an asset we had at that time, up through EIS and approval by state and federal agencies, and then shifted towards focusing in Nevada, back in around 2014 and '15. In early 2016, I was asked to take my current position as President and CEO, and have been leading the Company since.

I'm a geologist by background, with a PhD. I have worked both independently and for a number of companies including juniors like Timberline. I spent some time with Noranda, Minnova, and other mid-tiers and then several years as a senior geologist with BHP Minerals. Then I moved on to a couple of different mining-related consulting groups. In the course of that experience, with these consulting groups, I've touched on everything from permitting through working side by side with engineers to see how these projects are built and how they're advanced, and even how they're closed, and then also working in a capacity doing business development work.

Great experience for myself, and so I manage Timberline with that background. I am actually the only full-time employee. That's strategic, to keep our costs and our overheads down. I do have one of my Directors, who is also Vice-President, Don McDowell. He works on a part-time basis as needed for us. We do everything else on a consulting or contract basis, as needed.

Don is an interesting individual by background. He is very much Nevada focused. He has worked independently, for many years prior to which he worked for majors, for example, Santa Fe Pacific, Nippon Mining, and Kennecott.

Our Chairman is Leigh Freeman. He was very much involved in the early years and a co-founder of Orvana Minerals. Paul Dircksen worked at Orvana as well, and for many, years as a geologist with the Cordex Group. He is involved in a number of discoveries for that rather famous group founded by John Livermore and very important in the history of exploration for Carlin-type deposits.

David Mathewson joined our Board in 2018. Dave is well known in Nevada exploration circles, one of the very highest level Carlin-type gold deposit experts in the industry. He worked for Newmont for a number of years as their Nevada Head of Exploration, was very much involved in a number of their very important discoveries. Dave's connection with Timberline comes through his interest in the Eureka Project and some independent consulting work he had done prior to Timberline's ownership, and his recognition of the potential of this very large Carlin-style system, and particularly focused on the high-grade mineralization that we're now looking at.

Recently, we've added another Director to our Board, William Matlack. Bill comes from a diverse background. In his early years, he was a geologist for Gold Fields, as well as Santa Fe Pacific. Later he spent many years doing capital markets and analyst work for BMO as well Citigroup. Most recently he was a Director and Interim CEO for Klondex Mines. He is, in fact, our very largest shareholder of the Company.

So that's the team.

Dr. Allen Alper: Well you and your Board have great backgrounds, particularly in the area where you're working, so that really sounds very, very good. It seems like you're very well positioned. It's nice to hear that there's a lot of skin in the game by the Management Team and Board, so that's great.

Steven Osterberg: Yeah.

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Timberline Resources?

Steven Osterberg: Yes, I'll be happy to. First of all, it is about gold! We're finally in an overall sustained increased price environment. Only time will tell, but there is growing enthusiasm out there for the potential of precious metals, in particular, gold. Nevada is such a great place to be. We're working in the gold sector and as a junior, discoveries that are made here can, in fact, be permitted and ultimately developed. It is a world class jurisdiction in that regard.

The assets we have are outstanding. We have great drill results to build upon and a tight share structure, with strong, strong insider commitment, and a great team as well. Timberline is an investment opportunity for a multiple, given our current valuation. We anticipate seeing our market price increase as we advance these projects, with the gold market poised to improve further.

Dr. Allen Alper: That sounds like an excellent opportunity.

Steven Osterberg: Thank you.

Dr. Allen Alper: Is there anything else you'd like to add, Steven?

Steven Osterberg: Yes, this year we are planning to focus, over the next several months, on our Lookout Mountain Project, which is fully funded by our joint venture partner. We are very close to being ready to begin that drilling effort and we should have excellent news flow coming out of that.

We also anticipate advancing Paiute. That'll be our second priority. We've already begun to acquire some additional geophysical data that will be very important to help us identify and target the next round of drilling and follow-up on the discoveries that we've just recently made.

So I think it's going to be a very exciting next six months. We look forward to advancing this work. Thank you very much for interviewing Timberline Resources for Metals News.

Dr. Allen Alper: You are very welcome. It has been great talking with you and learning about all your exciting plans. It sounds like it will be an exciting year for Timberline. You'll be reporting results, as the year goes on, that I think will be very rewarding for your team and your investors. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Steven Osterberg: Thank you.

http://timberlineresources.co/

Steven A. Osterberg

President and CEO

Tel: 208-664-4859

E-mail: info@timberline-resources.com

|

|