Galileo Mining (ASX: GAL): A Greenfield Exploration and Prospecting Company, Focusing on Cobalt, Nickel and Gold/Copper in Western Australia; Interview with Brad Underwood, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/3/2020

We talked with Brad Underwood, Managing Director of Galileo Mining (ASX: GAL) about their nickel and cobalt projects in Western Australia. Galileo is focused mostly on greenfield exploration. Brad Underwood describes them as, “an exploration and prospecting company, wrapped into one.” They are experts in target generation and focus on drilling targets to make discoveries. Two projects, both based in Western Australia, have advanced targets for nickel and cobalt. They have a very strong Board with a wide range of expertise and the ability to create value. Galileo Mining is a Company to watch, with upcoming drilling programs to provide a strong news flow in the first half of 2020.

Galileo Mining

Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Brad Underwood, Managing Director of Galileo Mining. Could you give our readers/investors an overview of Galileo Mining and what differentiates Galileo Mining from others?

Brad Underwood: Glad to, Allen. Galileo Mining has been around for a long time. We were founded in 2003 as a private company owned by a mining entrepreneur named Mark Creasy, who is well-known in Western Australia. I worked in a private capacity for Mark from 2010 through to 2018, and I was the general manager of Galileo at that time.

We then listed Galileo in May 2018 and took the Company through onto the ASX. So, we've been an exploration company for a long period of time, and we are continuing to do that as a listed company, this time with additional funds raised through the IPO. I suppose what differentiates us from other companies, is that we are fundamentally focused on exploration and mostly Greenfields exploration. So, we are an exploration and prospecting company wrapped into one.

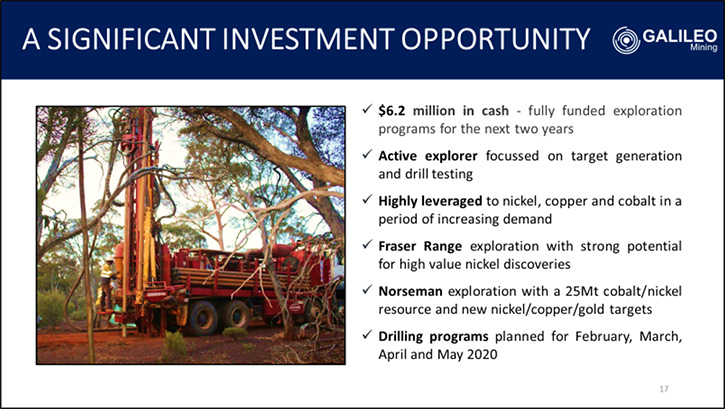

We have a specialty in target generation, and we go out and drill the targets we develop. To give you an idea, over the last 18 months since we listed, we've completed eight drilling programs. We have tested over 20 targets in those eight drilling programs with each round of drilling increasing our understanding of the potential of the ground. So, that is what differentiates us. We are an exploration company focused on drilling targets to make discoveries.

Allen Alper: Could you tell our readers/investors/investors a little bit about the targets you're after and your projects?

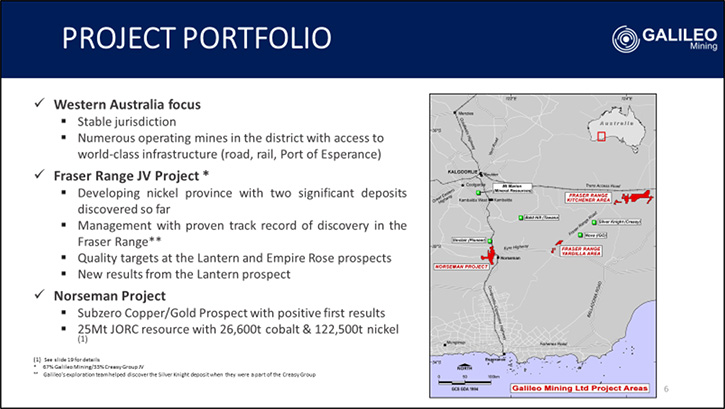

Brad Underwood: Sure. We have two projects, both based in Western Australia. We very much like doing business here. It's a stable jurisdiction and we have a high level of expertise in the state, both in the geology and in the logistics of running exploration programs. One of our two projects is in an area called the Fraser Range, which is a newly discovered nickel belt in Western Australia. Our other project is around the small town of Norseman where we have an existing cobalt resource as well as additional base metal targets.

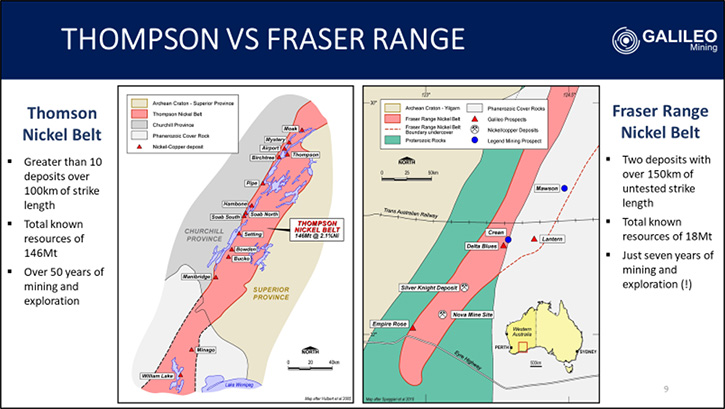

At the Fraser Range we are focused on the search for new nickel sulfide mines. Some of your readers may be aware that the Fraser Range is a developing nickel province that was first proven prospective in 2012 with the discovery of the Nova nickel deposit. Since then there has been a further discovery at the Silver Knight deposit. These are high-value nickel sulfide deposits and we believe the belt is very much underexplored. A good analogy is the Thompson Nickel Belt in Canada which has more than a dozen known deposits spread over 100km of strike. Currently in the Fraser Range we have just two known deposits with a lot of untested targets. The prize is very large and we are out there looking to make discoveries.

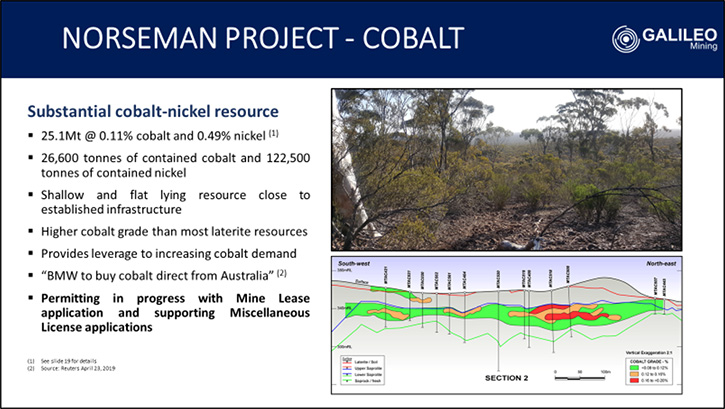

At Norseman, we have a 25 million ton cobalt and nickel laterite resource. Our resource is quite unique in that we have a relatively high grade of cobalt at 0.11%. We are currently working to understand how best to extract the cobalt at a profitable rate without the requirement for capital intensive, high pressure acid leach plants. That's our more advanced project, where we have an established JORC compliant resource. We also have a number of exploration targets at Norseman prospective for nickel, copper and gold.

Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit about your share and capital structure?

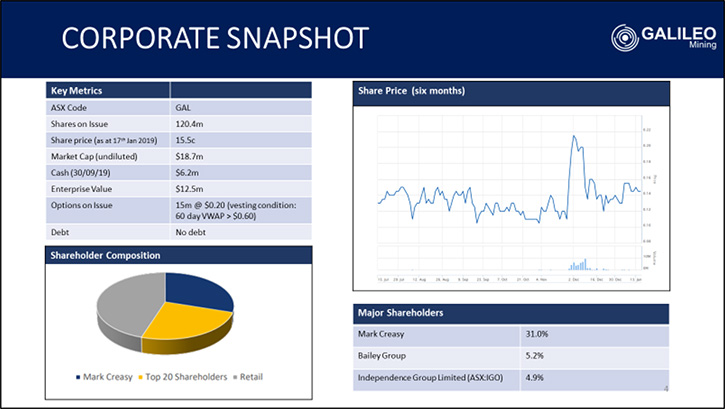

Brad Underwood: Sure. Our share structure is relatively simple. We have 120 million shares on issue and our major shareholder is Mark Creasy. Previously, he owned 100% of the company when it was private. He now owns 31% of the publicly listed company.

We also have Independence Group, a mid-tier mining company who own the Nova nickel mine in the Fraser Range, with 4.9% of the stock. Our top 20 shareholders have around 56% of the Company and there are 15 million options on issue. However, these options have a vesting hurdle of a 60-day share price above 60 cents. The options are designed to incentivize myself and the other directors towards making the company a success, which our shareholders are chasing. So, we're not looking for incremental gains in share price of five or 10%. We’re looking for step change in valuation through discovery.

Allen Alper: It sounds very good. Could you tell our readers/investors your primary goals for 2020?

Brad Underwood: Going into the New Year, we already have developed drill targets from the work we've completed in 2019. So in 2020, we'll again be running exploration programs, particularly at our Fraser Range projects, looking for those magnetic nickel sulfide deposits, which have the potential to be real game changers for the Company.

So over the next six to 12 months, we are really about developing our exploration targets, testing them, and aiming for discoveries to be made from those work programs.

Allen Alper: Well, that sounds very good. Could you tell our readers/investors why nickel and cobalt are so important and the outlook for those metals?

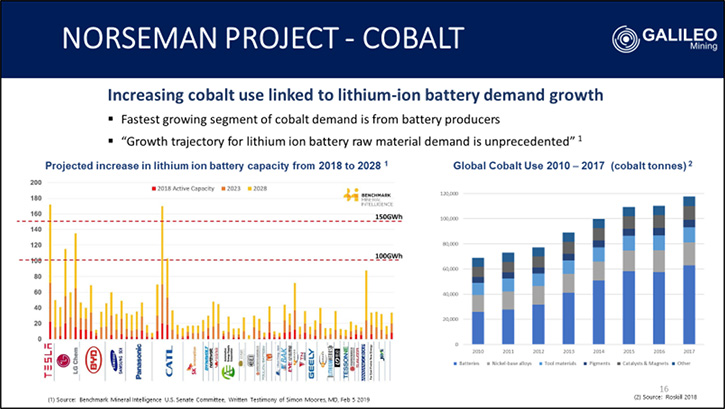

Brad Underwood: We are strong believers in both nickel and cobalt. Nickel, of course, has been around for a long time. It's primarily used in the steel business, but what we are seeing more recently, and certainly within the cobalt market, is the increasing demand related to battery technology. So we expect to see both nickel and cobalt benefit from that increased demand, as new battery technologies are increasingly used around the world.

Nickel has had a period of much reduced prices. But recently we've seen it revert to the long-term average price range, which I believe is around $15,000 U.S. per ton. We are in a highly volatile commodity market. Prices do go up and down. The nickel price has been subdued for so long that we are now seeing it just creep above the long-term average and already people are getting excited about that. But I think we have a lot further to go in terms of the nickel price.

The cobalt price has dropped off over the past year. However, with the projected increase in demand and the risk of the supply, being so concentrated in the DRC, we should see a price recovery in cobalt as well.

Allen Alper: Well, that sounds very good. Could you tell our readers/investors about your background and your Board’s?

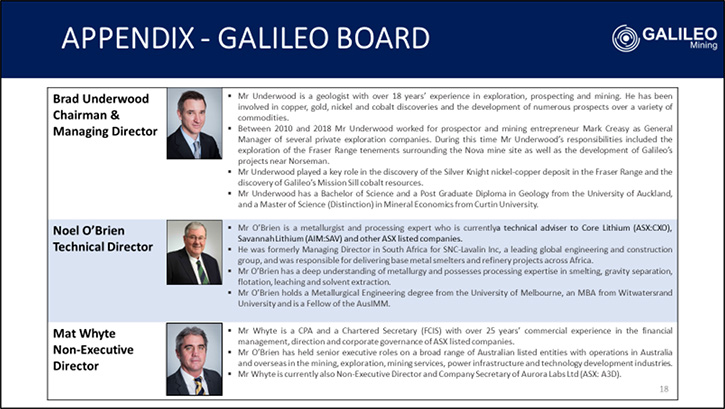

Brad Underwood: I am an exploration geologist. I've also done mining geology and prospecting, but really what drives me most, is trying to make discoveries. I have spent 18 years in the mining industry, around eight of those years was working for Mark Creasy, our major shareholder. I've spent the last two years being the Managing Director of Galileo. My expertise and background is in geology, and specifically, exploration geology.

Our other Board members include Noel O'Brien, who is a metallurgist. He was brought onto the Board to focus on the development of the current resource we have at Norseman, looking at how to efficiently extract the cobalt and nickel. We're progressing those studies now, as well as focusing on the exploration targets, which is my area of responsibility. We also have an independent non-executive director Mat Whyte who has over 25 years’ experience in the financial management of listed companies.

We have a very strong board for a small exploration company with a wide range of expertise and the ability to create value with the team that we have.

Allen Alper: Well, that sounds excellent. Could you tell our readers/investors, the primary reasons they should consider investing in Galileo Mining?

Brad Underwood: I think one of the best ways to understand the value proposition of Galileo is to look at the major shareholders that we have. We have mining entrepreneurs and mid-tier mining companies that hold most of our stock. These are long-term holders who know the business and understand that exploration discoveries take time to make. They are there for the longer term, and they're highly supportive of the Company and what we do.

We know we are in a high-risk business, but we mitigate that risk with the strategies that we have. We also have a high level of cash funding for a junior explorer. At the moment, we have over $5 million in cash, and that will easily last us over the next 18 months, with the expenditure and programs we have planned. We are a very well-funded, very active exploration company, with excellent chances of making a discovery.

Allen Alper: That sounds excellent, Brad. Is there anything else you'd like to add?

Brad Underwood: Thank you for interviewing Galileo Mining for Metals News. It's been a pleasure speaking with you, Al.

Allen Alper: It's been my pleasure. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.galileomining.com.au/

P: +61 8 9463 0063

E: info@galileomining.com.au

|

|