Piedmont Lithium Limited (Nasdaq: PLL; ASX: PLL): In the World-Class Carolina, USA Tin-Spodumene Belt, Becoming the World's Lowest Cost Lithium Hydroxide Producer: Interview with Keith Phillips, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/27/2020

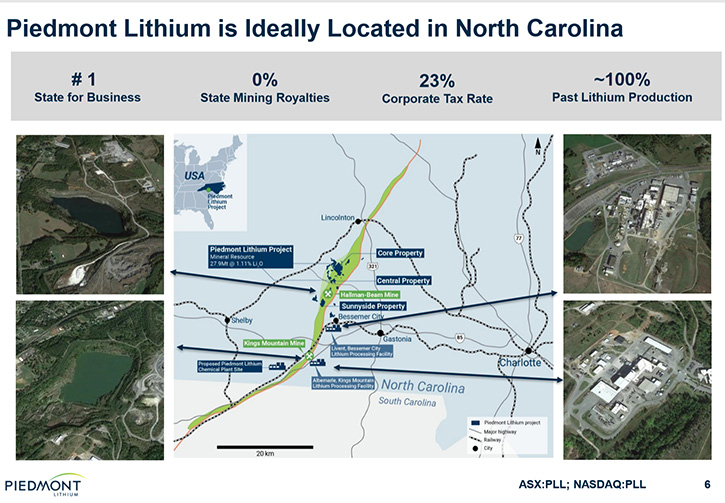

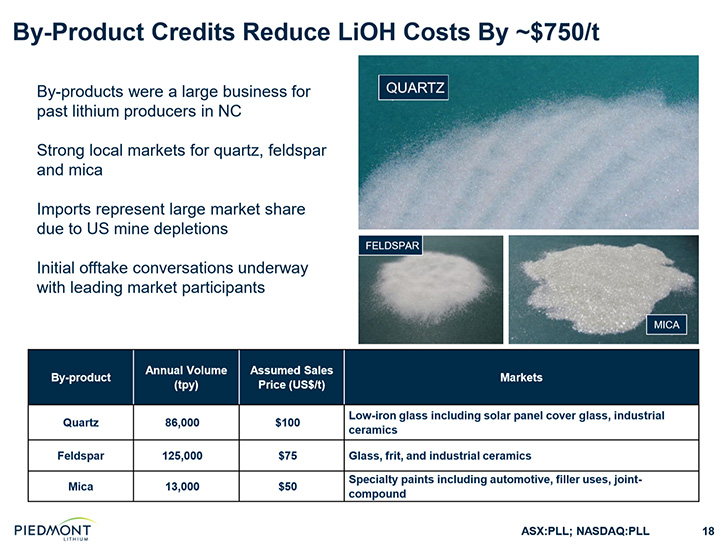

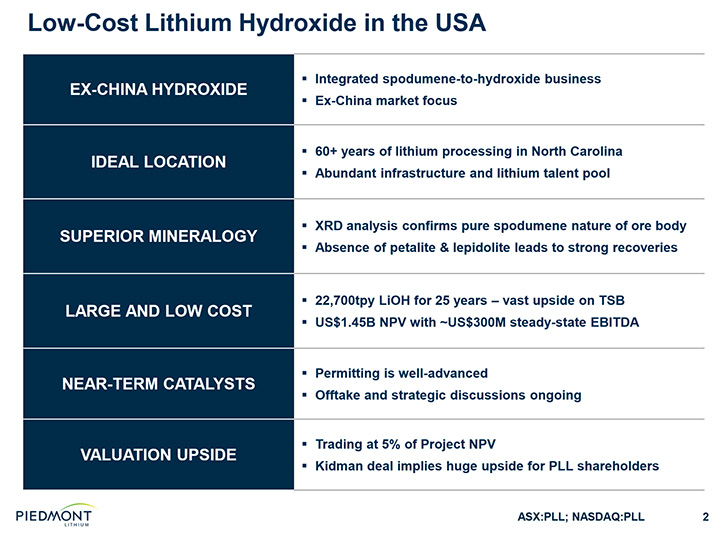

Piedmont Lithium Limited (Nasdaq: PLL; ASX: PLL) holds a 100% interest in the Piedmont Lithium Project, located approximately 30 miles west of Charlotte, North Carolina, within the world-class Carolina Tin-Spodumene Belt and along trend to the Hallman Beam and Kings Mountain mines, historically providing most of the western world’s lithium between the 1950s and the 1980s. We learned from Keith Phillips, Managing Director and CEO of Piedmont Lithium, that this is a very large, high-grade, high-quality lithium belt, with outstanding mineralogy, located in an enviable area from an industrial infrastructure perspective, in close proximity to customers and with a low-cost operation. The region is also known for its large, by-product, industrial minerals like quartz, feldspar and mica. Piedmont Lithium is working on developing a large enough market for these minerals to reduce their already low costs even further and become the world's lowest cost lithium hydroxide producer, for the high-nickel cathode materials industry.

Piedmont Lithium Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Keith Phillips, who is President and CEO of Piedmont Lithium. I wonder if you could give our readers/investors/investors, an overview of your Company and what differentiates Piedmont Lithium from others?

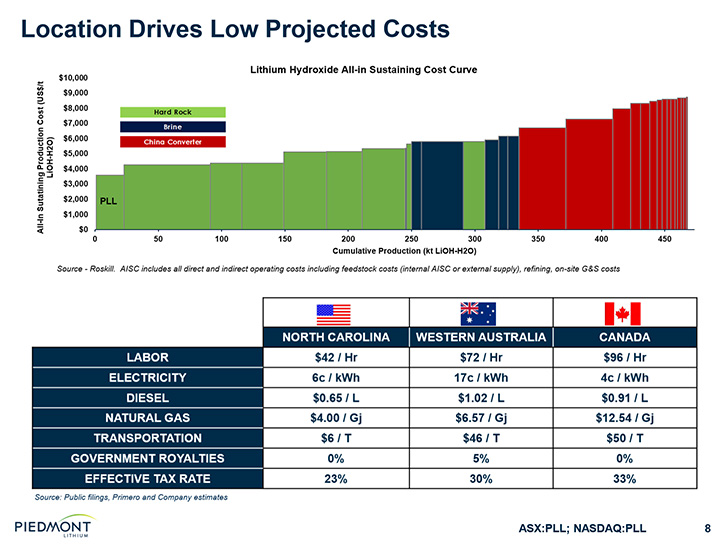

Keith Phillips: Sure. The principal differentiation is our location. We're in North Carolina, 30 miles west of Charlotte on a prolific mineral belt, the Carolina Tin-Spodumene Belt. The TSB is a very large, high-grade lithium belt, with outstanding mineralogy and it's located in an enviable area from an industrial perspective. We have absolute first rate infrastructure, two major railways, interstate highways, a good population base, low cost power, et cetera. So it's unique relative to virtually every other lithium project, which tend to be located in remote regions of the Andes or Western Australia or Northern Canada. And that ultimately drives two big advantages for us.

It drives very low costs because we're just in a low cost environment, and it puts us very close to our customers. Most of the automotive business is growing in the Southeastern US. As those plants turn to electrification, they will increasingly attract battery plants and cathode plants and we'll be a supplier, a local supplier to those plants and differentiated in that respect from virtually everybody else. So that's the principal advantage.

Dr. Allen Alper: Oh, that sounds excellent. Sounds like you're in a great location. I know your quality is quite high, and you benefit from your by-products. Could you tell our readers/investors a little bit about that?

Keith Phillips: Yes. Historically there were two big lithium mines operating in the region for a few decades, from the 1950s into the 1990s. We know that at least one of them had roughly half of their revenue coming from by-product industrial minerals like quartz, feldspar and mica. That's a big opportunity for us. Those are materials that are important in businesses like the glass, ceramics, pigments and building products businesses. They tend to be localized in the Southeastern US because of the abundance of those minerals in that region.

So there are pure play quartz, feldspar and mica mines in North Carolina, for instance. But that's not the case in Northern Canada or Western Australia, where most of the spodumene is. Most of the hard rock lithium mines are there, but without the same population base to justify recovering industrial mineral by-products. So we're working to develop a very large by-product market, which will reduce our already low costs further. I think, without by-products, we'd still be the world's lowest cost producer. But with them, we think it will be by far the world's lowest cost producer.

Dr. Allen Alper: That's excellent. My understanding is your labor costs are less than your competitors.

Keith Phillips: Yeah. Labor costs obviously vary by region, and when we talk about labor, we talk about all-in costs with benefits and with any costs associated with camps. So if you have a mine in Northern Quebec or in Western Australia, you very likely have a camp where your workers are flown in and flown out every couple of weeks. They're housed, they're fed. There are nurses and doctors on call. That adds dramatically to the cost, as you can imagine. We don't have to do that. There are three and a half million people living within a 30 mile drive of our site. So we believe we'll attract a number of people locally who will drive home at night and that'll be better for them and better for us from a cost perspective.

Labor rates in the region are competitive. We spend time with some other big industrial businesses in the Southeast and in the Charlotte vicinity and I wouldn't say the costs are low. They're first-world labor cost, but they're very reasonable and certainly a lot lower than those in more remote areas.

Dr. Allen Alper: That sounds very good, and I understand your energy costs are quite competitive.

Keith Phillips: Yes, they are. For electricity, for instance, there's traditional coal and gas, but there's also nuclear and hydro, and other renewable sources. North Carolina is actually the #2 state in the US for solar, trailing only California. Duke Energy in North Carolina is working hard on that. So electricity costs are pretty low, around 6 cents per kilowatt hour in our region. Quebec has even lower cost, so Quebec has exceptionally low cost at probably 4 cents a kilowatt hour, but in Western Australia, where half of the world's lithium comes from, the electricity costs are more like 18 or 20 cents a kilowatt hour in US dollar terms, triple ours, and you need a lot of electricity.

Electricity is probably 10% of the cost base in our model, for our chemical plant, for instance. And if our costs were three times as high, that would be a burden. But fortunately they're not, so that's a big advantage. And obviously being in the Southeastern US, we have the lowest cost natural gas in the world and that's a huge advantage as well compared to some of the other locations.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit about what products you envision selling and the quality that you feel you'll be getting?

Keith Phillips: Yeah, the by-products aside, the product we will produce, our core product, is called lithium hydroxide. So currently, most of the lithium in the world is produced in either carbonate or hydroxide form. Carbonate is used for a lot of purposes including batteries. The battery for your cell phone or laptop is probably using lithium carbonate. But increasingly, automotive companies want to produce cars with longer range, and to do that you need batteries with higher energy density. Higher energy density batteries require high nickel cathode materials that use more nickel and less cobalt. When you do that, from a chemical perspective, you have to use lithium hydroxide. Lithium carbonate won't work in that environment.

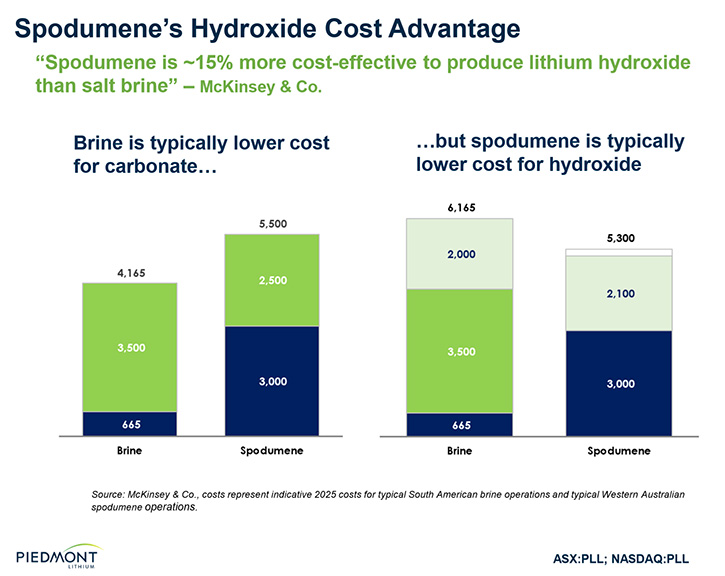

So lithium hydroxide demand is booming. Every car Tesla makes uses batteries with lithium hydroxide. What Ford and VW and others are planning to do will require lithium hydroxide. So hydroxide demand is booming. At the same time, the cost of producing lithium hydroxide has been judged by some to be lower, coming from hard rock spodumene than from brine. The idea that brine is lower cost is a myth. So that's a big thing for us. We'll be a low cost producer of lithium hydroxide from spodumene, which is the favored choice for most customers these days.

Dr. Allen Alper: That sounds excellent. Could you give our readers/investors an overview of the market, the supply and demand and the evolving markets for lithium hydroxide's electrical vehicles, et cetera?

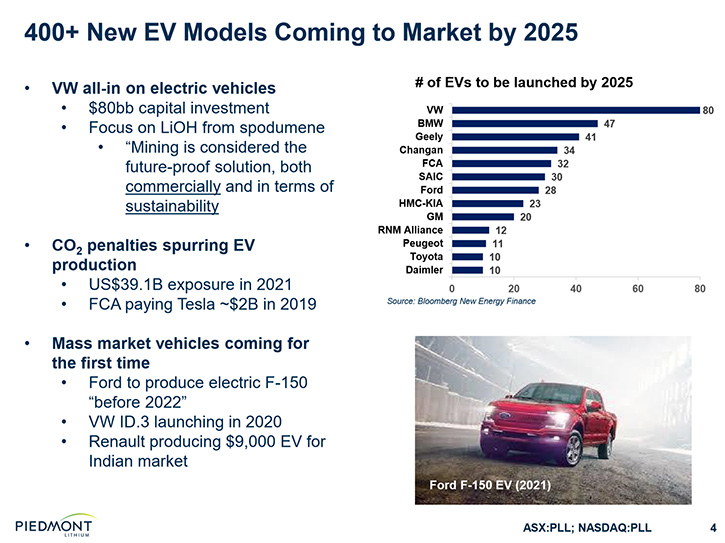

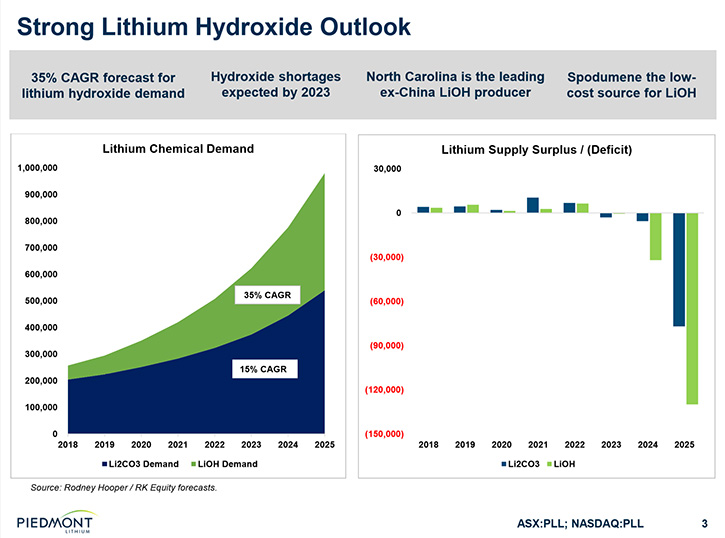

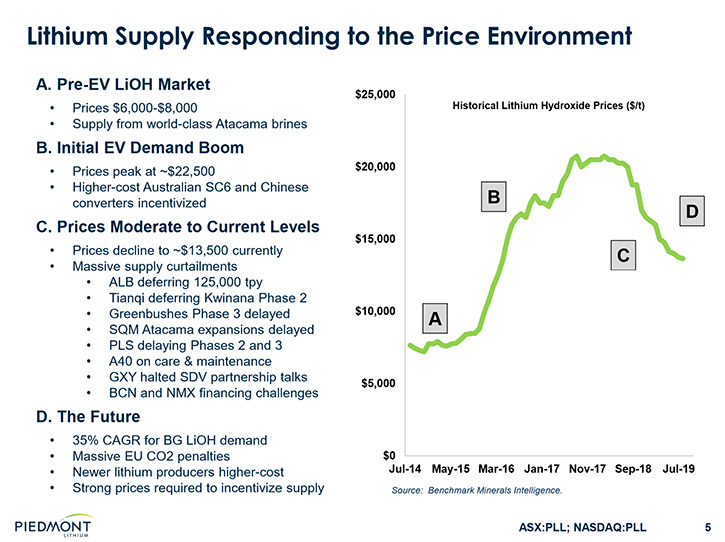

Keith Phillips: Yeah, it's an interesting story. It's a somewhat ironic story, where demand for electric vehicles continues to rise. Demand for lithium continues to rise, but we're starting from a very small base. The market is now quite small. We're probably at a little over 2% electric vehicle, EV, penetration globally. That is expected to grow to 8% or 10% by 2025 and then really skyrocket from there. I'm a Tesla driver. These are faster, smoother, quieter cars. They're less expensive to operate. Over time they'll be far less expensive to own and everyone's going to want one. So the market, the long-term demand structure is outstanding. It's particularly outstanding for hydroxide, because most people want cars with longer range. Those require hydroxide.

In the short term, given how small the market is, we had three big projects come on stream in Australia last year and that was enough to imbalance the market. So we're growing from a small base, but from a production perspective, there were three big new mines that came on. So for the last 18 months or so, prices have been falling. Inventories have been building from these new mines. This is a dislocation that I view as temporary that we'll have to work through in the first part of 2020. I think that will happen. I think the market will then start to rebound. What's really going to drive it is that Ford has introduced their Mustang Mach-E electric vehicle. They're expected to bring a Ford F-150 electric vehicle, expected to announce that formally in 2020. GM has just made a $2.2 billion investment in a battery plant in Ohio with LG. They're going to make electric cars and more electric vehicles, probably trucks and SUVs.

As all these vehicles electrify, demand will continue to grow. Supply is going to really struggle to keep up. And while lithium prices and lithium equities have fallen more, to me it's inevitable that there will be a rebound. The result of that is that many people have slowed down their projects. We have not. Ours is an outstanding low-cost project, so we're accelerating it. But most people are slowing down or deferring their projects indefinitely. So we're going to have major supply shortfalls in the not too distant future, certainly, I think, by 2021 or 2022. That'll work itself into prices in advance of that and our project's going to come on stream at the perfect time. So we're very bullish medium-term.

Dr. Allen Alper: That sounds like an excellent market scenario and excellent that you are moving ahead and getting ready for when the market will expand rapidly. Could you tell our readers/investors about your background and your team?

Keith Phillips: I was an investment banker in New York for 30 years. I spent 20 of those running mining teams at places like Merrill Lynch and J.P. Morgan, and did a lot of work with large-cap companies like Rio Tinto and Valet and Anglo American and Barrick, et cetera, but did a lot of work also with emerging mining and industrial companies like ours, explorations and development businesses going into construction and ultimately production. So I joined the Company two and a half years ago and have been driving the strategy.

Our founders, are a group out of Perth, Australia called Apollo Minerals. The lead guy there is Taso Arima, who is New York-based. He had the vision to put lithium production back into North Carolina, really insightful. He was very early and we were very much a first mover in that area.

And then the other, a couple of the core parts of the team, Patrick Brindle is our Vice President and Project Manager. He's quarterbacking all of the engineering and metallurgy, permitting efforts, et cetera. Lamont Leatherman is Co-Founder and Chief Geologist of the Company and he's the one responsible for the really large, world-class mineral resource, we've identified, that continues to grow. So that's the core team.

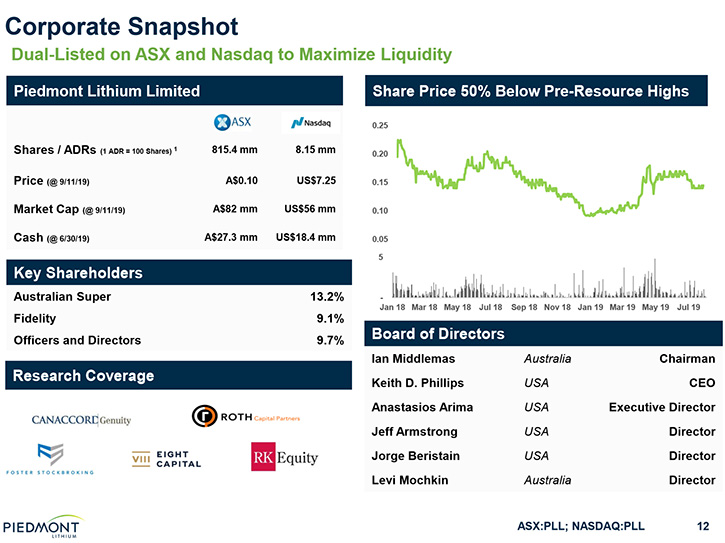

Dr. Allen Alper: That sounds great. Would you tell our readers/investors about your share and capital structure?

Keith Phillips: We're an Australian Company. The Company was founded by an Australian group. We're listed on the Australian stock exchange and also on Nasdaq. In Australia we have a typical Aussie capital structure with a lot of shares outstanding, 824 million shares trading at about 12.5 cents, so a market cap of about 100 million Australian, about 70 million US dollars. On Nasdaq, we've listed ADRs, so we're listed both in Australia and on Nasdaq. We have a full US listing. We're one of five lithium stories listed in the United States, one of two pre-producers. Lithium Americas is the other.

Our shareholder base is global and we have some strong supporters. Most of the stock is in Australia. We do have important shareholders in the US and Canada, Europe and Israel, et cetera. And we have two particularly large institutional shareholders, Australian Superannuation Fund owns 13% of the Company and Fidelity owns 9% of the Company. So from an institutional perspective, we have an unusually strong shareholder base for a company at our stage and we're quite proud of that.

Dr. Allen Alper: That's excellent. It's great to have financial backing and be able to rely on that to grow your Company and position it. So that's excellent.

Keith Phillips: Thank you.

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Piedmont Lithium?

Keith Phillips: Yeah. I think the primary reason to invest in Piedmont Lithium is to get exposure to this mega trend that's underway to electrify the vehicle business globally. I was a skeptic of that trend, before I became involved in this Company. And I've learned that these cars are dramatically less expensive to own. Fueling costs are less than half of what gasoline would typically cost. Maintenance costs are de minimis. As battery costs fall, the purchase prices themselves will be lower than internal combustion cars. So it's really an economic thing. Certainly these cars are cleaner and are environmentally better, but that's overwhelmed in my view by the pure economic advantages of electrification.

So this is a mega-trend that's happening. Whether or not someone owns an electric car, it's happening. Tesla is the fastest growing car company in the world. Everyone is following in their footsteps, in the electrification business, including Ford and GM, and VW, BMW, Mercedes, et cetera. These companies are all in. And I think the best way to play that space is to play the raw material supplying it, i.e., lithium. Every one of those companies will use lithium ion batteries. Lithium is considered the irreplaceable element, in the words of Volkswagen. We have the only American greenfield lithium spodumene to lithium hydroxide project. It's uniquely low cost and strategic, and the stock is, we think, very cheap. And we have just immense leverage to the upside in the electrical vehicle business.

Dr. Allen Alper: Oh, those sound like outstanding reasons to consider investing in Piedmont Lithium, Keith. Is there anything else you'd like to add?

Keith Phillips: I appreciate the opportunity to be interviewed by you for Metals News. Piedmont Lithium is very focused on developing our shareholder base here in North America. We're already well-held in Australia. So I look forward to having people learn more about us.

Dr. Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.piedmontlithium.com

Keith D. Phillips | President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Anastasios (Taso) Arima | Executive Director

T: +1 347 899 1522

E: tarima@piedmontlithium.com

|

|