Adriatic Metals PLC (ASX: ADT, LSE: ADT1): Developing the World Class High Grade Polymetallic Vareš Project in Bosnia & Herzegovina; Interview with Paul Cronin, Managing Director and CEO. PDAC Booth 2738

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/19/2020

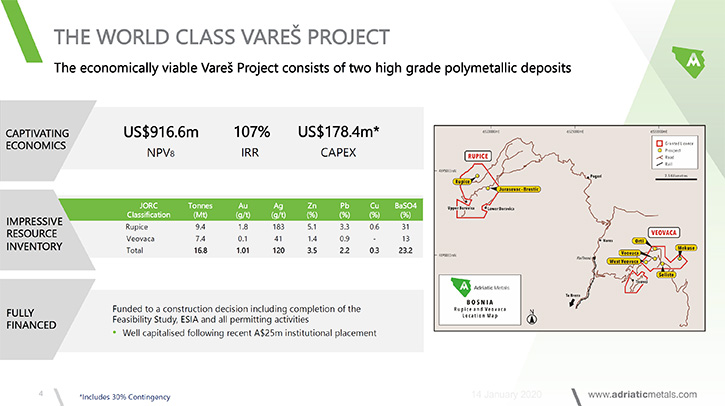

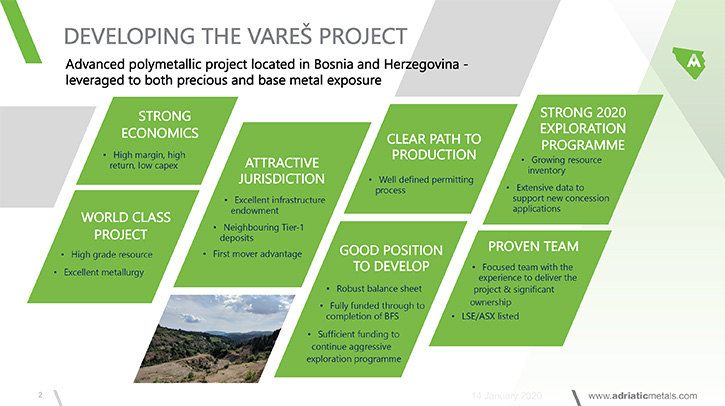

Adriatic Metals PLC (ASX: ADT, LSE: ADT1) is a precious and base metals explorer and developer, with the first mover advantage, via its 100% interest in the polymetallic Vareš Project in Bosnia & exploration deposit at Rupice. Adriatic’s short-term aim is to expand the current JORC resource at Rupice, as well as conduct exploration on a number of other prospects within the property. We learned from Paul Cronin, Managing Director and CEO of Adriatic Metals, that this is a very strong economic project, low capital cost, high value, and quick payback in eight months. Adriatic has been very successful in terms of its share price and market capitalization, as well as in raising the capital needed to expedite its exploration efforts and to advance the project rapidly into the development phase.

Adriatic Metals PLC

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Cronin, who is Managing Director and CEO of Adriatic Metals.

Paul, could you give our readers/investors an overview of your Company and also what differentiates Adriatic Metals from others?

Paul Cronin: We're a base and precious metals mine developer in Bosnia and Herzegovina. I think what probably differentiates us from our peers is; one, our polymetallic nature. We're not exposed to either base or precious metals. We have inbedded hedging in our exposure to both.

Two is the fact that we're in Bosnia and Herzegovina, so we have a first-mover advantage. Bosnia has a unique exploration application system, which requires companies to pay €500,000 per square kilometer for a concession there. Because we own so much data in that region, we've been able to take small concessions and advance those, without having to outlay significant amounts of capital upfront.

Three, I think, is that we have a very, very strong economic project, low capital, high valuation, and quick payback in eight months. I think that is why our project has gone from strength to strength in terms of its share price and market capitalization, but also why we've been so successful in raising the capital that we need to take the project forward, on a very rapid development timeline.

Dr. Allen Alper: Very well thought out! Could you tell our readers/investors the highlights of your exploration and work during 2019 and some of your plans for 2020?

Paul Cronin: Certainly, we've only been around since 2017. But, in 2017, when we first started our Company, we went into one of the old administration buildings, on some freehold land we own in Bosnia. It was terribly rundown. On the floor, and in some cupboards there, we found hundreds of typed reports, which detailed the exploration history in that region of Bosnia, and that's been incredibly helpful to us in being able to shape our exploration program.

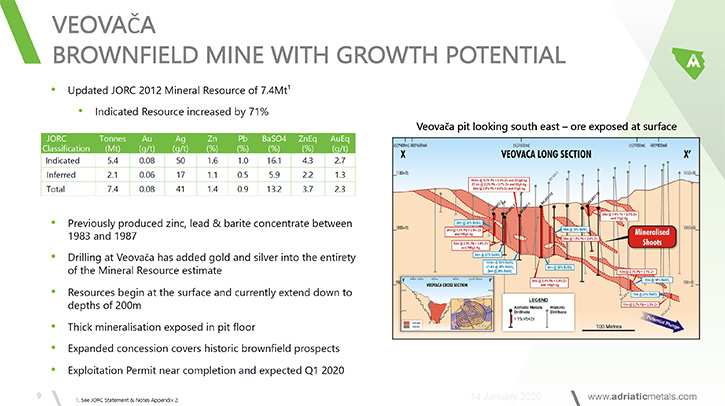

The other major milestone of 2017 is when we went up to Rupice. We cleared tracks up there, surveyed, found the old drill collars and whatnot, and re-geo-referenced everything. We put in our first hole and it was an absolute cracker barn stormer. We hit 64 meters at 34% zinc equivalent. From then on it's really been about exploration, until this year we put out our first metallurgical results, which were very positive and well received by the market. Last week was a scoping study, which I think has really hammered home what the value of this project is, given its grade, its mine-ability and its infrastructure advantages, being effectively a brownfield project on a formerly producing site.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background and your team?

Paul Cronin: Sure. I was a commodity trader, and an investment banker in the resources sector for a number of years. I left the bank in 2013, went to run a small junior uranium company, took that to a tenfold increase in valuation over a two-year period and I sold it in 2015. Since then I've been involved in Adriatic Metals. I'm the biggest shareholder of Adriatic Metals. I've been involved in it from its founding right through to today.

My team, more importantly, has been handpicked. When we decided to take the Company public in 2018, I handpicked a Board I thought would be able to steer the Company forward. I wanted to have a diversified Board in terms of the skillsets, and also a board that had a strong track record of delivery in their field of expertise.

So the first person we brought in was Peter Bilbe. Peter is the Chairman of Independence Group in Australia, which is a multi-billion dollar mining company. I then brought in Julian Barnes. Julian is one of the more famous geologists in the Balkans, having been the head of exploration for Dundee Precious Metals for a long period of time. We also have Miloš Bosnjakovic, who was the vendor of the project, but has stayed on and helps us out with government and community relations in country. He's been instrumental in the success of the Company today. Then we've added Michael Rawlinson. Michael was the head of metals and mining for Barclays Bank in London. More recently we've added Sandra Bates, who's an experienced mining lawyer and a partner at Fladgate legal firm in London. So we have a real mixture of skills and diversity.

We also have another Director, John Richards. John is a Board nominee by one of our largest shareholders, Sandfire Resources in Australia. He has a strong corporate finance background, a little similar to Mark Rawlinson's, but obviously brings a whole different set of experiences and skills to that boardroom.

Dr. Allen Alper: Well that's a very impressive Board, with diverse backgrounds in mining, finance and legal. I'm very impressed with the team you put together, Paul, and also your strong background. Could you give our readers/investors some information on your share and capital structure?

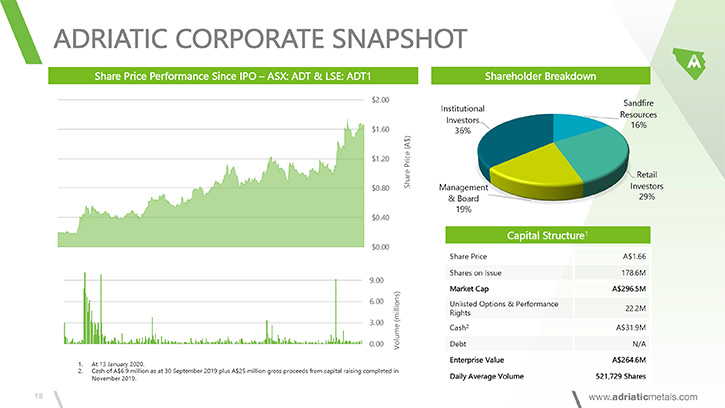

Paul Cronin: We listed on the ASX in May 2018. We had a pre-money valuation, of $16 million Australian. We raised our first money on the IPO at 20 cents per share. Since then we've raised another $35 million, 10 million in November 2018, and then more recently we raised another $25 million just a few weeks ago. We have 178 million shares outstanding. Our share price is currently about $1.68 per share, so all of our shareholders have enjoyed very generous returns to date. We don't have any warrants outstanding. We have a small number of options and performance rights to Management and Directors.

Dr. Allen Alper: Well done! You and your team have done very well. Could you tell our readers/investors a little bit about your shareholder breakdown?

Paul Cronin: Management and Board own about 20% of the Company, with myself and Miloš being the lion's share of that. The institutional investors make up about 35% of our register. Sandfire Resources are about 16% and the rest is primarily retail.

Dr. Allen Alper: Sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Adriatic Metals?

Paul Cronin: I think we're moving up the development curve and we're hitting those revaluation milestones very quickly. Our share price is up 100% since we issued the scoping study, we're moving quickly into a pre-feasibility in Q2 next year and we'll be into our bankable feasibility study at the end of next year.

But the fundamental reason that we'll see share price grow over the next 12 months is our exploration program. We have a good size solid resource and it's very high grade. But at the moment we still have five rigs turning, and those five rigs are continuing to extend that deposit to the north, south and to the east. So we'll put out an updated resource in early Q2 next year, but at this stage we see that resource growing.

We also have a valuable database of exploration data on other projects nearby, some of them on our concessions and some of them are not. And they're not under concessions held by anybody else. So we'll be doing a lot more exploration drilling over the next few months. We expect that will lead to a significant increase in tons that we can feed into our central plant.

Dr. Allen Alper: Sounds excellent! Is there anything else you'd like to add, Paul?

Paul Cronin: You can't really overvalue that first-mover advantage in a place like Bosnia. Because of the structure of their exploration laws has meant that there aren't a lot of juniors operating there. But when you have the position we have, which is that strong first-mover advantage and are able to work with government to secure new concessions and work through the permitting of a project very quickly, then you're in a tremendous position to realize a lot of value.

I also want to thank you for interviewing us for an article in Metals News.

Dr. Allen Alper: I’ve enjoyed talking with you about what you have created. You have done an amazing job. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.adriaticmetals.com/

Paul Cronin

Managing Director & CEO

info@adriaticmetals.com

|

|