GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF): Africa’s Emerging Uranium Producer, Backed by Very Strong Strategic Shareholders; Interview with Daniel Major, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/10/2020

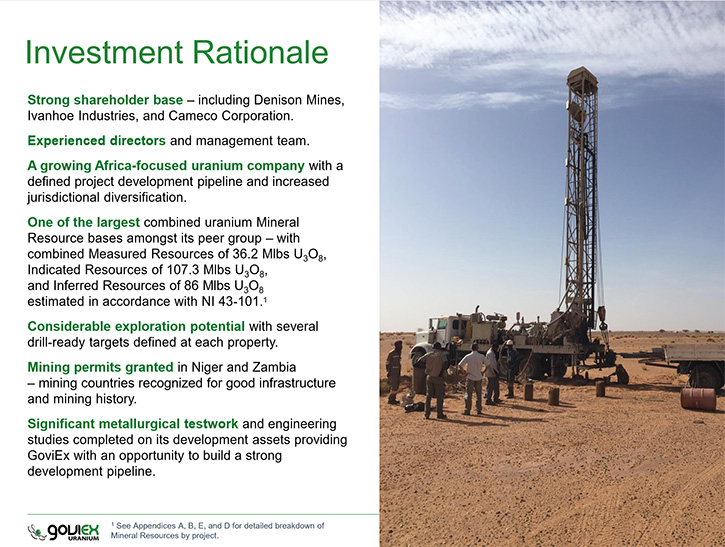

GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF) https://www.goviex.com/ is a mineral resource company, focused on the exploration and development of uranium properties in Africa. GoviEx’s principal objective is to become a significant uranium producer, through the continued exploration and development of its flagship mine-permitted Madaouela Project in Niger, its mine-permitted Mutanga Project in Zambia, and its other uranium properties in Africa. We learned from Daniel Major, CEO of GoviEx Uranium that, with the uranium market improving, they believe they can bring their Madaouela project, currently at the stage of bankable feasibility study, to production. Mr. Major foresees rising uranium prices as the result of the imminent uranium supply deficit.

GoviEx Uranium Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Chief Executive Officer, Daniel Major, who is CEO of GoviEx Uranium. Could you give our readers/investors an overview and also tell them what differentiates GoviEx Uranium from others?

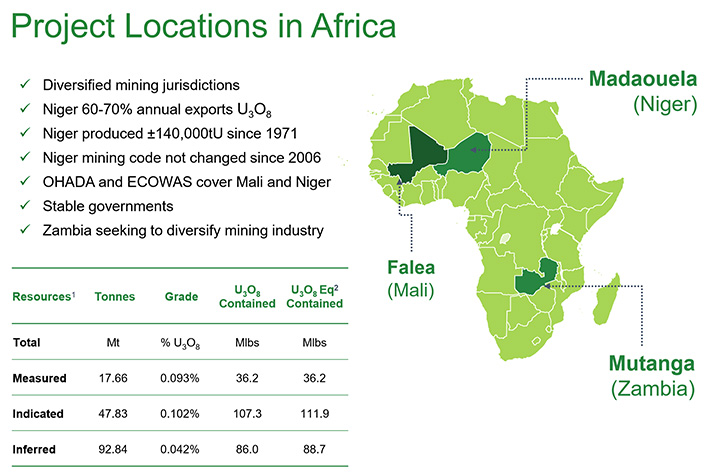

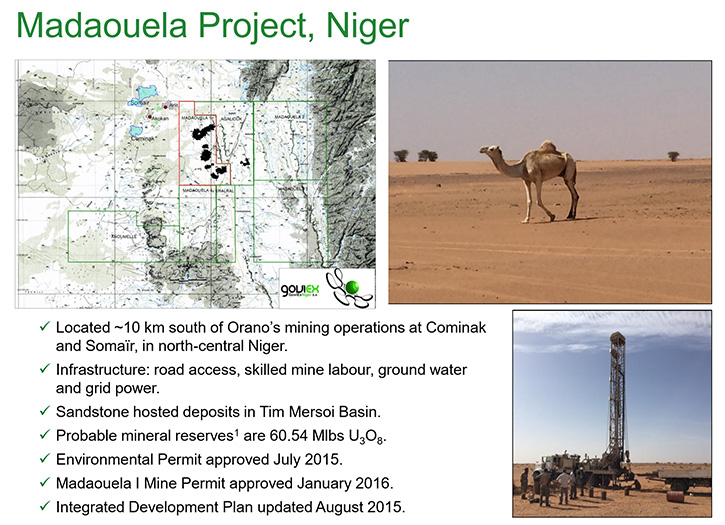

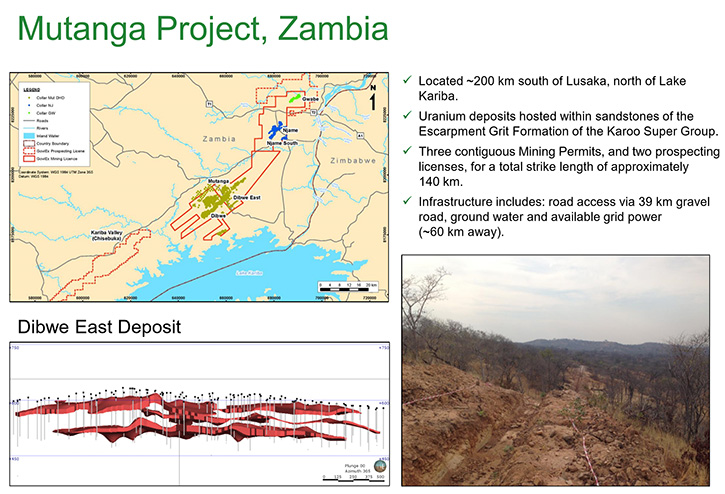

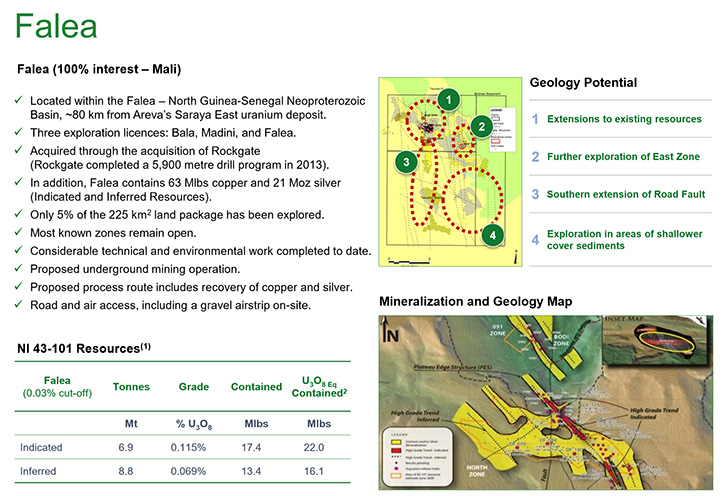

Daniel Major: Certainly, Allen, GoviEx is a uranium development focused company, with a focus on Africa. We have three uranium projects in Africa, two of which are fully mine permitted. Those being our project in Niger, Madaouela and our project Mutanga in Zambia. We also have an advanced exploration project in Mali called Falea. The key focus of the Company is the Madaouela project. We're working on getting that one ready for completion of its bankable feasibility study and financing, because we believe the fundamentals of the uranium market are improving. One of the things that stands out for us is our ability, with a fully permitted project, to go into construction and production, with the uranium market improving. There are a lot of other uranium projects out there, but that certainly gives us a first-mover advantage.

Dr. Allen Alper: That's an excellent position to be in. Could you tell our readers/investors a little bit about the supply and demand, and forecast what's happening with uranium?

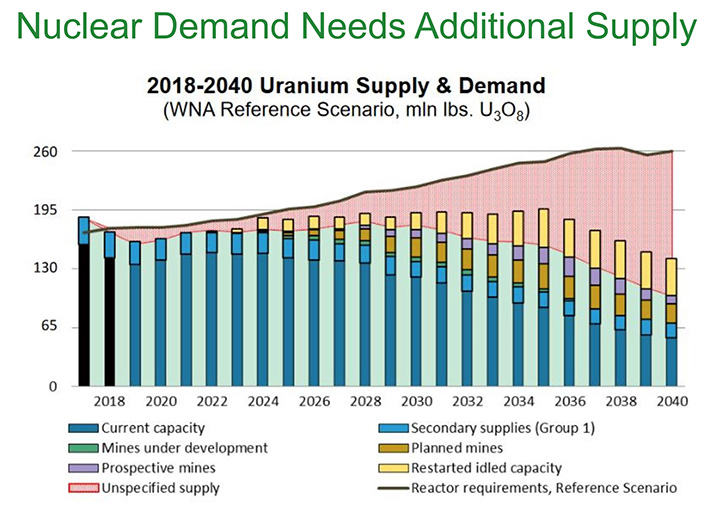

Daniel Major: Absolutely. I think the biggest change we have seen was the World Nuclear Association's fuel report in September. That was a very in depth analysis. They show that we're looking at about a 2% per annum growth in demand. But the recent changes in the last few years, with supply constraint, particularly from Cameco and Kazatomprom, have resulted in the market now being in a supply deficit. And in the foreseeable future that supply deficit will be maintained. In order to fill that gap, we have to have some major restarts coming back. The companies that have put those supply constraints through have historically indicated they need long-term uranium pricing well over $40 to $50 in order to justify those restarts.

So we are in a state of supply deficit, until such time as we see much higher prices that justify new projects to come through. That's in the short term. As you move forward a few years, you then have a number of major mines scheduled to close anyway. They run out of resources and then the gap widens even further and you definitely need a lot of new projects to come through. The support is there for the higher price going forward.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit about the different project locations that you have in Africa, and about operating in those countries?

Daniel Major: Absolutely. So the primary project is Niger, right in the middle of the Sahara desert. It's a country that has produced about 140,000 tons of uranium, since the early 1970s, predominantly from two mines owned by Orano, which used to be Areva. It's a country where uranium accounts for 60% to 70% of its exports every year. So it is very much associated with the uranium industry. All the infrastructure's there, roads, power, water. One of the country’s major mines is due to close in March of 2021. Therefore there is a fairly large labor force there, fully trained, looking for work. So we have a fully trained labor force potential to move on to our project.

The next one is Mutanga, in the southern part of Zambia. Again, all the infrastructure's there. You have a government, in the case of the Zambian government, that's looking for diversification from its historical position as a major copper producer, looking for other minerals. Uranium is very much on the top of that pile. The Zambian government is also looking at the future, looking at nuclear energy as a potential generation source within country. So very interesting, all the infrastructure's there and people trained in mining are already there.

The last project on the Guinea border is in Mali, right over on the west hand side of Mali. It's an advanced project that needs infrastructure development, but it's surrounded by gold mines, all pricing and exploration. So it's in a mining region. We tend to feel very comfortable in the regions, in which we're operating.

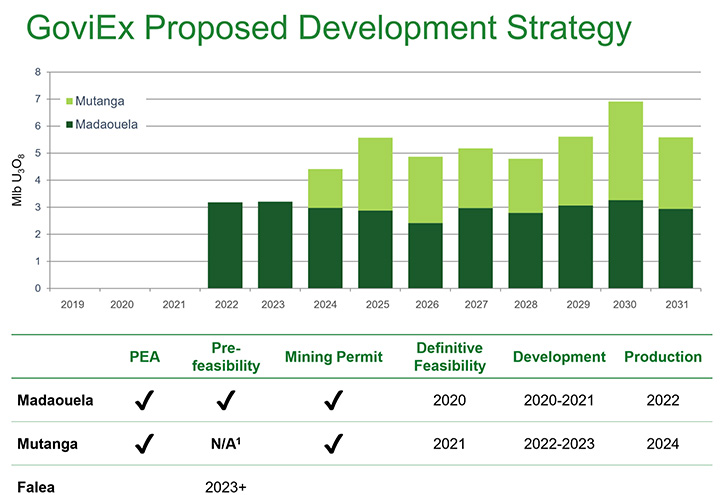

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your proposed development strategy?

Daniel Major: The development strategy has been all about getting the final feasibility study completed, working on the debt to go with that, and the off-take structure. At the moment, our preoccupation is that final feasibility study. We already have the permit, so that's out of the way. But it's getting our costs down, so we really looked at our projects, particularly on our technical side, to see what we can do to reduce operating and capital costs. But at the same time, to reduce operating risks. So where we have looked at some innovative ideas, technology-wise, we're revisiting those and saying, "Can we reduce the technical risk associated with that to make these projects simpler?"

So that's very much the focus at the moment. While we wait for the uranium price to recover, what we're trying to reduce our operating and capital costs, so that we don't need to wait for very high uranium price to start up. We're looking for something more along the lines of the price that the tier one producers, Kazatomprom and Cameco, are looking for. Which, is somewhere around the $50 mark, where we think we would like to be able to finance this project.

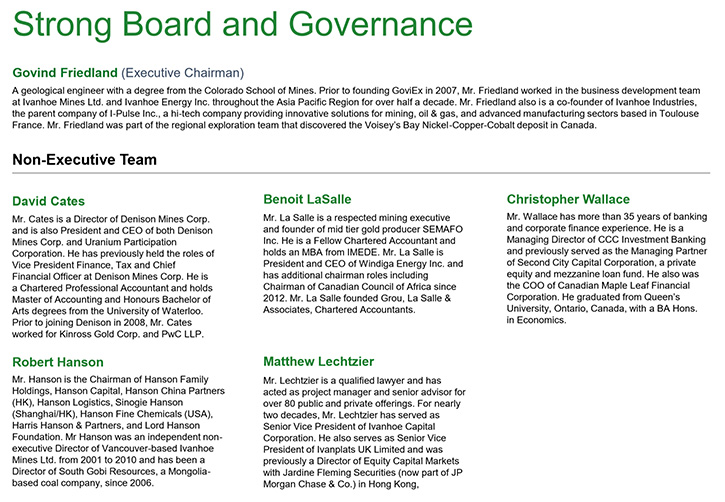

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors your background and your team’s background?

Daniel Major: We all have long histories in mining. We have a relatively small team, but most of us had time in the uranium industry. My background has also included platinum, manganese, gold, molybdenum, pulp and paper. I've been an investment banker. I've worked in Africa, North America, and Russia as well. We all have broad experience across many jurisdictions. The technical guys as well, both on the geological and the process side, very similar backgrounds, and similarly the Board. We have a Board, who brings together skill-sets that cover everything from legal, to debt disclosure, from the point of view of West Africa. So we do bring together a lot of skill-sets, within the group, that blend well together.

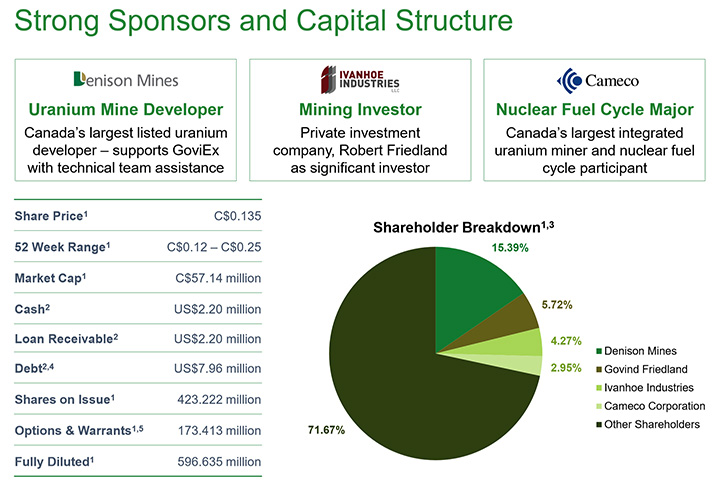

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a little bit about your strong sponsors and capital structure?

Daniel Major: Over time we've acquired some very interesting strategic companies from the industry, including Denison Mines, Cameco, and Ivanhoe. We have a fairly liquid share structure. We trade very well on the TSX V and on the OTC QB. About half of it is held by funds and half of it by retail. So we're in a very comfortable position from a Company point of view. And we're really looking forward to the rise in the uranium price.

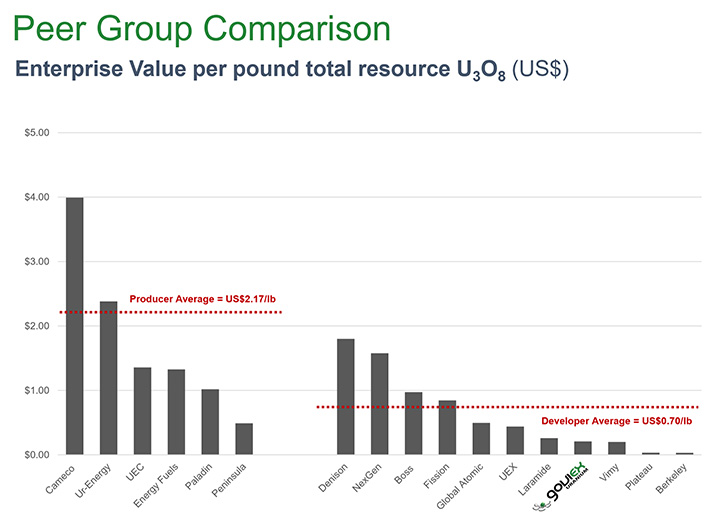

Dr. Allen Alper: That sounds excellent. How do you compare to your peer group?

Daniel Major: If you look at us from the value of pounds in the ground, we're undervalued compared to our peer group. And I think that is undeserved. We certainly have a fully permitted project. Yes we are in Africa, and people perceive a risk there. But we are already permitted. So while other projects in less risky jurisdictions may look more interesting, they still have their environmental permitting to go through. In North America particularly, that is a major technical risk to go through. So part of our value argument to investors is very much the fact that with an improved uranium market and financing we have the ability to go into development and production without the long-lead permitting requirements that others must navigate. In the last cycle, the best performing shares were those companies, whether in Africa or North America, that were able to go from being developer companies to being producers.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors why they should consider investing in GoviEx Uranium?

Daniel Major: Well, firstly the uranium market. Obviously we believe with the supply deficit out there, strong growth in demand, the fact that to fill the gap you need a much higher price. We're going to see a rising uranium market. All uranium companies will go up with a rising uranium price. But again, as we are already permitted, we have the ability to advance into development and production, and that comes with a natural re-rate. Because we have our mining permit already for that project, and a very supportive Nigerian government, we believe we have that potential to get that first mover advantage and become a producer in the next cycle.

Dr. Allen Alper: Wow! That sounds excellent. Sounds like very strong reasons to consider investing in GoviEx Uranium. Daniel, is there anything else you'd like to add?

Daniel Major: No, Allen, I think we managed to get all the pieces in there. You give me nice questions so I can fit all of the bits in I need. Thank you for interviewing GoviEx Uranium Inc. for Metals News.

Dr. Allen Alper: That's great. I enjoyed talking with you again. I think you have great properties, great jurisdictions, great support, and a great Management and Board and Technical Team. I think your Company will do very well.

https://www.goviex.com/

Govind Friedland, Executive Chairman

Daniel Major, Chief Executive Officer

+1 604-681-5529

info@goviex.com

|

|