GT Gold Corp. (TSX-V: GTT): Exploring for Precious and Base Metals in Canada's Golden Triangle, Backed by Newmont Goldcorp and Ross Beatty, Sucessful Team, Interview with Paul Harbidge, President & CEO. PDAC Booth 2323

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/27/2019

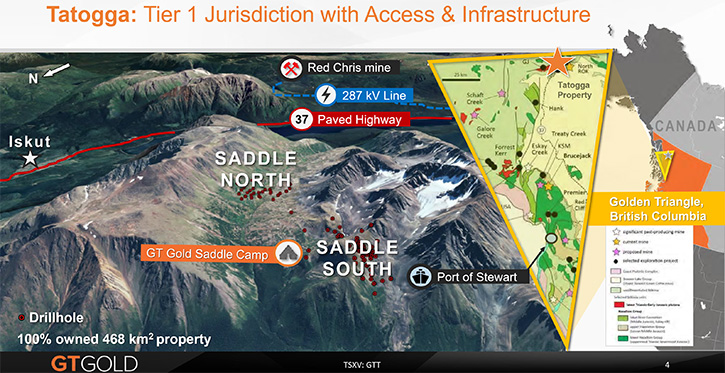

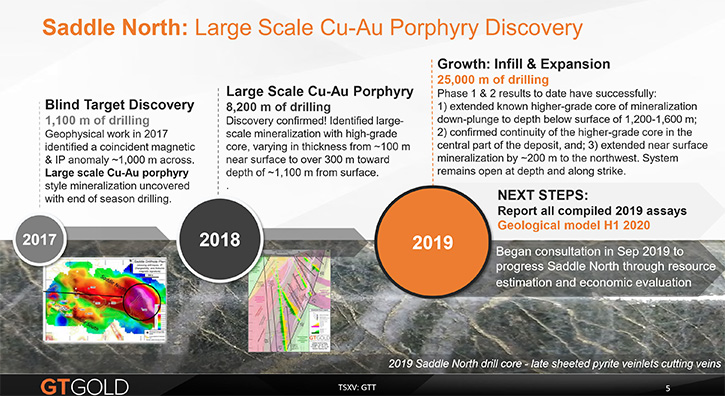

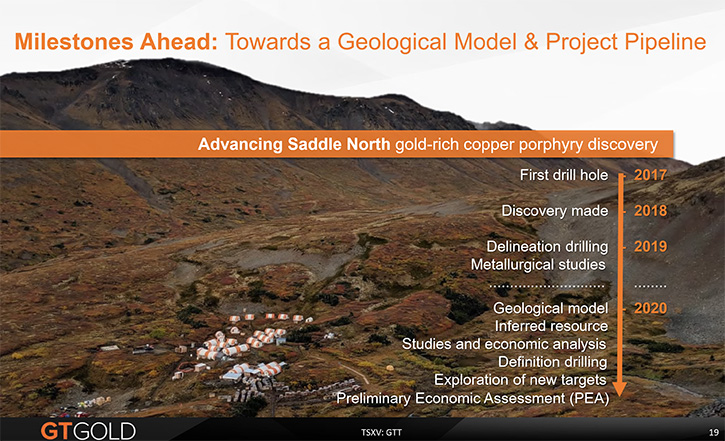

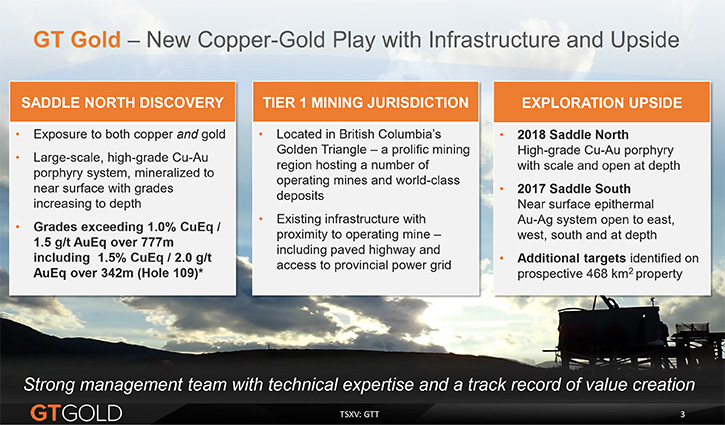

GT Gold Corp. (TSX-V: GTT), https://www.gtgoldcorp.ca/ is focused on exploring for base and precious metals in Canada's Golden Triangle. The Company’s flagship asset is the wholly-owned, 46,827 hectare, Tatogga property, located near Iskut, BC, upon which it achieved two significant discoveries in 2017 and 2018, at its Saddle prospect: a near surface bulk-tonnage and potential deep high-grade, underground-style, epithermal gold-silver vein system, at Saddle South and, close by at Saddle North, a large-scale, richly mineralized porphyry gold-copper-silver intrusion. We learned from Paul Harbidge, President, CEO and Director of GT Gold, that their discoveries are brand new greenfield exploration discoveries, near the road and a hydro power line, with the cheapest electricity in Canada. Near-term plans include building geological model in Q1 of 2020 that will form the foundation for an initial NI 43101 compliant resource estimate in Q2 2020, and that will lead onto a PEA by approximately Q4 in 2020.

GT Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Harbidge, President, CEO and Director of GT Gold. Paul, could you give our readers/investors an overview of your Company and also what differentiates it from others?

Paul Harbidge: Sure. GT Gold is an exploration company. We are Canadian based. We have a project in Northern BC, called the Tatogga Project. We're a Company that's only three years old and in that three years we've made two significant discoveries.

The first one being a precious metal-rich vein system. Three kilometers to the east of that, we have discovered a gold-rich copper porphyry that has multi-million-ounce gold and multi-billion pounds of copper potential. That’s not only located in the safe jurisdiction of British Columbia, Canada, but it is also close to excellent infrastructure.

We are 10 kilometers from the main paved North/South Highway 37 and we are also close to the hydro power line, which generates the cheapest business power in Canada, about 4 cents a kilowatt.

Paul Harbidge: These are brand new greenfield exploration discoveries. They're not old projects that have been sitting on the shelf for decades and are being re-looked at because of increasing metal prices. These are brand new greenfield exploration discoveries. I would say that's one of the key features that differentiate us from our competitors. We've done the prospecting phase and we've made these discoveries and, as you're aware, when you look around the world, there's such a lack of new good quality exploration discoveries.

Dr. Allen Alper: Oh, that sounds great. It's great to be right at the forefront of extremely large discoveries and in an excellent area.

Paul Harbidge: I’m also extremely proud of our Management and Field Teams as well as a very supportive Board.

Dr. Allen Alper: Oh Yes. You have an exceptional Management Team. You have a fantastic background; I would like you to tell our readers/investors about that.

Paul Harbidge: I'm a geologist by education and an explorer by work experience. Prior to GT Gold I was the Global Head of Exploration for Goldcorp for three years. Prior to that I was the Head of Exploration for Randgold Resources, where I led the Team through a lot of the big discoveries in Africa. I was part of the executive team that created exceptional value in the gold industry. When I joined we were a dollar and when I left we were $120 and a $10 billion Company, which was achieved by making our own discoveries, that is where real value is created.

I left Goldcorp following the acquisition with Newmont. After Newmont had made an investment in GT Gold, Newmont called me up and said that GT Gold was looking for a new CEO. Newmont thought that I would be a good candidate to be able to take the Company forward. But I said I wanted to do my own due diligence. I wanted to go and look at the project, look at the drill core and the data. With a background of making big discoveries, I very quickly saw that this already had the ingredients to be a really significant discovery and mineralized system and I had no hesitation in joining.

More recently we brought Shawn Campbell on as the CFO. He had spent a long time working at Goldcorp in various roles, both on a financial side as well his work in capital market and investor relations. We have Michael Skead as the Project Development Manager. He's made a number of discoveries in his career and has also taken projects from exploration through to production.

We have Charlie Greig, who is a VP of Exploration and the person who made the initial discoveries on the project.

This is another differentiation A management team that comes from a senior company background and we understand what it takes to be able to deliver large scale projects.

Dr. Allen Alper: Oh that's excellent. That's a very, very impressive team, with outstanding track records.

Could you tell our readers/investors about the Golden Triangle and why it's such a great place to be working?

Paul Harbidge: The Golden Triangle has had more than 150 mines in operation, since the first prospectors arrived in the 1800's. It has great mineral wealth and a number of actively producing mines. Some of the biggest mines that have been developed in recent years are in the Golden Triangle there. Most notably the Red Chris Mine, which is 15 kilometers away from where we are, which attracted Newcrest from Australia to the region when they purchased 70% from Imperial Metals.

We also have New Afton, another large porphyry deposit that came into production in the last few years by New Gold. We have the Brucejack mine of Pretium, a large underground vein system. And a number of other big projects in the works for development, including Galore Creek and KSM, with a lot of activity. I think the other thing that's really encouraging as well as obviously good infrastructure, politically stable jurisdiction, particularly when you compare, what's happening in other parts of the world. Whether it's South America, and there's a President leaving Bolivia, the protests in Ecuador and Chile, problems in Peru, the changing government and financial crisis in Argentina. Then again, BC really stands out. And it's also been encouraging that the BC government has a $20 million budget and is on a worldwide tour promoting British Columbia as a jurisdiction for exploration and mining. And that it's very much open for business and investment. Not only that, but the First Nations Leadership has also been going with the government and both have been singing from the same hymnal sheet, about how open for business the Province is. And so again, that's very encouraging.

Dr. Allen Alper: Oh that sounds excellent. Could you tell our readers/investors some of your prime focus and goals for 2020?

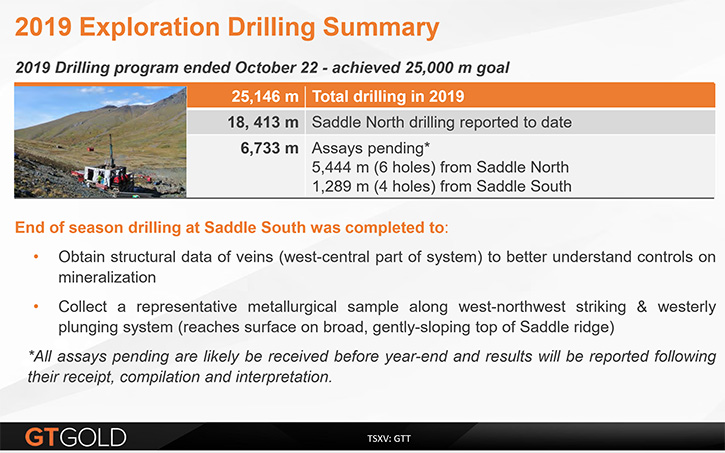

Paul Harbidge: Yeah, certainly. With two discoveries to our name at the moment we have a dual strategy. The first strategy is the project development primarily focused on the gold-rich copper porphyry of Saddle North. We have the remaining results approximately 6,700 meters of drilling from the 2019 campaign, which are due in the next few weeks. And we'll be looking to release those results either prior to the holiday season or early new year.

And then into 2020 we'll have preliminary metallurgy from the project. Then it's about building the geological model, which is the fundamental building block to any resource business. And I think we tend to see a lot of people not paying so much attention to that geological model and it's more of a mineral model. But for me it's non-negotiable; a proper geological model includes lithology, structure, alteration, mineralization, hardness and density; all of those different layers. To form that geological model, which we aim to complete by the end of quarter one. That will form the foundation for an initial resource estimate and that will be an NI 43-101 compliant resource in quarter two. And that will lead onto a PEA by approximately quarter four in 2020.

And then the second part of the strategy is the exploration and that's about going out and finding additional deposits. And we believe that we're in a very prospective part of British Columbia. I think from the results that we're receiving as well as the nearby Red Chris mine that this is starting to develop into a major new porphyry district in this part of the world.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure and your equity?

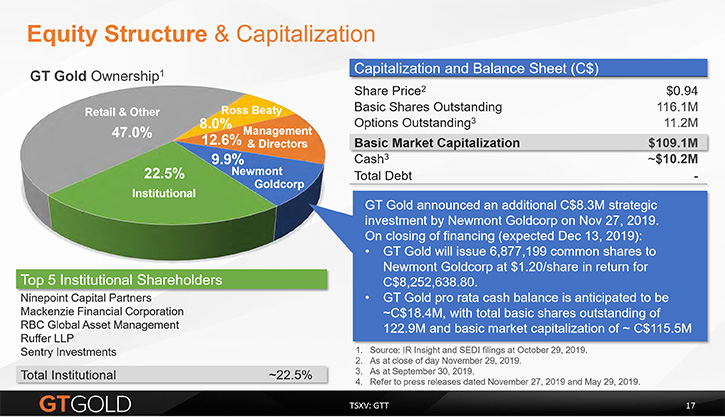

Paul Harbidge: We put a release out yesterday that stated that we have a key strategic investor in Newmont Goldcorp. That initial investment, 9.9% was made in May of this year. And that was Newmont’s first investment into a junior post the Goldcorp transaction. That raised us $17.6 million of flow through capital.

As of last week, we closed a further financing with Newmont where they increased their stake to 14.9 and that was at a 30% premium to the market price on the day of announcement. And over the course of about a month, that was a 50% premium on the price. For us it was a further stamp of approval that a major company like Newmont Goldcorp was prepared to increase the stake at a significant premium, when we see a lot of financing at the current time generally being done at a discount to market price.

We have Newmont Goldcorp as a key strategic investor at 14.9%. We have Management and Directors, with an ownership of around about 12%. We have Ross Beatty, a well-known personality in the mining industry in Vancouver, with about eight 8%. We have a large institutional shareholding spread through Canada, the U S and Europe. We have just over 120 million shares outstanding, a market capitalization of $120 million.

I think a key point to make here, Al, is that with that investment from Newmont. As a company, we've only raised $38 million in our history. We have a market cap of $120 million. That should reassure investors that we're very prudent with our expenditure. We have a good investment return for our shareholders. Having only spent $20 million, made two discoveries and still have $18 million in the bank.

Dr. Allen Alper: That's excellent. That's very impressive, the team you have and the investors you have. That shows that Newmont Goldcorp has great confidence in the team and the project and must think it has great potential.

Paul Harbidge: It's been a struggle in the junior market over the last little while. The focus for the market is very short term. And it's been about restructuring of balance sheets, paying down debt and free cashflow. And now that a lot of that work has been done. Now we've seen a rash of M&A activity over the last couple of weeks with companies buying, producing assets. The reality is, if you look at a lot of the big companies, whether it's Newmont, Rio or BHP, they have no pipeline of projects. There's a real lack of good quality, new exploration discoveries.

I think that's where we stand out. We have these greenfield discoveries, which we believe to be high quality. With Newmont coming in, I think it attests to that. And I think you're going to start to see market sentiment change, going into next year. As some of these single assets are acquired, the focus is going to be on the next generation of potential projects for building. To me it was very encouraging to see Barrick sell a project in Senegal to Teranga, which is at feasibility level and it's only around 3 million ounces of reserves for over $400 million.

Dr. Allen Alper: Well that shows there's great potential. Could you tell our readers/investors the primary reasons they should consider investing in GT Gold?

Paul Harbidge: We have a lot of catalysts coming up, we have some good research out there now. Paradigm initiated on us this week. We have Michael Gray from Agentis. Everyone's highlighting that we are undervalued for the potential size of the deposit that we have. With the news flow, we feel there's a good runway for share growth in the short term. As a junior company, we're mindful that this is a project for a big company and we're not kidding ourselves that this is something that we're going to develop. The key for us right now is to create the value and look to sell this to a big company to develop it.

As well as being able to deliver an initial resource next year. We also have significant exploration upside. We have targets around our known porphyry, but also, we have a target called Quash Pass to the southwest of our main area. Where we have a 7-kilometer soil anomaly, anomalous in gold, copper, silver. We also have a coincident geophysical anomaly, it has structural framework, which fits in with the regional picture on how these deposits are hosted.

We're seeing alteration, good rock chips and it's not seen any drill holes. So that's going to be one of our primary focuses for 2020 as well. We have a large resource coming, significant exploration upside and the fact that it's in British Columbia to me are all good catalysts for share price growth and why people should be investing in GT Gold.

Dr. Allen Alper: That sounds like outstanding reasons to consider investing in GT Gold. Paul, is there anything else you'd like to add?

Paul Harbidge: I think the other thing to mention is First Nations. We have one band that we work with, the Tahltan. They're a key stakeholder along with our shareholders, our staff and government. We have a very good working relationship with them. The natural resources are very much ingrained in their society. They have also been traveling the world promoting BC as a jurisdiction. They're very supportive of projects. Some of the biggest projects have been permitted in BC over the last few years. So very much part of our business going forward.

Dr. Allen Alper: Well that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.gtgoldcorp.ca/

GT Gold Corp.

Paul Harbidge

President and Chief Executive Officer

Tel: (647) 256-6752

Charles J. Greig, P.Geo

Vice President, Exploration

Tel: (250) 492-2331

Email: info@gtgoldcorp.ca

|

|