Element 25 Ltd (ASX: E25): Australia’s Largest Onshore Manganese Resource, 263 Mt of Manganese, Extremely Low Mining Costs, High Quality: Interview with Justin Brown, Executive Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/10/2019

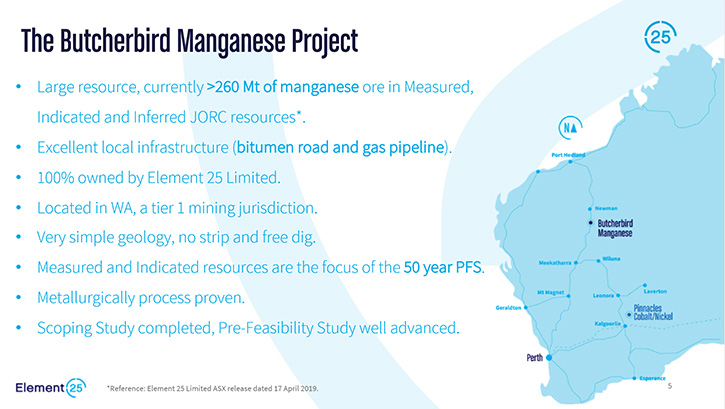

Element 25 Limited (ASX: E25) https://www.element25.com.au/ owns 100% of the Butcherbird Project that hosts Australia’s largest onshore manganese resource. The project is located in a low-risk mining jurisdiction, in Western Australia, near excellent infrastructure. It contains around 263 Mt of manganese ore, with exceedingly simple geology. We learned from Justin Brown, Executive Director of Element 25, that they are finishing the pre-feasibility study at Butcherbird and perfecting a metallurgical flow sheet to make high purity manganese products, including electrolytic manganese metal, and a high purity manganese sulfite for lithium ion battery cathode manufacturers. According to Mr. Brown, their cost per unit of manganese is very low, thanks to extremely low mining costs, very low energy requirement, and use of renewable energy, including up to 50% wind and solar, which will make their high-purity manganese the cleanest, greenest, and possibly lowest cost manganese on the planet.

Element 25 Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Justin Brown, who's Managing Director of Element 25. Could you refresh the memories of our readers/investors and give them an overview of Element 25 and also what differentiates Element 25 from others?

Justin Brown: Absolutely Dr Alper. So we are in the later stages of a pre-feasibility study into the development of our manganese project located in Western Australia. Element 25 has 100% ownership of Australia's largest onshore manganese resource, which currently sits at around 263 million tons in JORC resources. The work that we've been doing over the last couple of years is focused on perfecting a flow sheet to hydro metallurgically extract the manganese from the ore, to make high purity manganese products including electrolytic manganese metal, and a high purity manganese sulfate product for lithium ion battery cathode manufacturers. Key points of difference for the Butcherbird project include the fact that we have extremely low mining costs due to a near zero strip ratio, a free dig situation with all mining above the water table and an ore body that starts at surface.

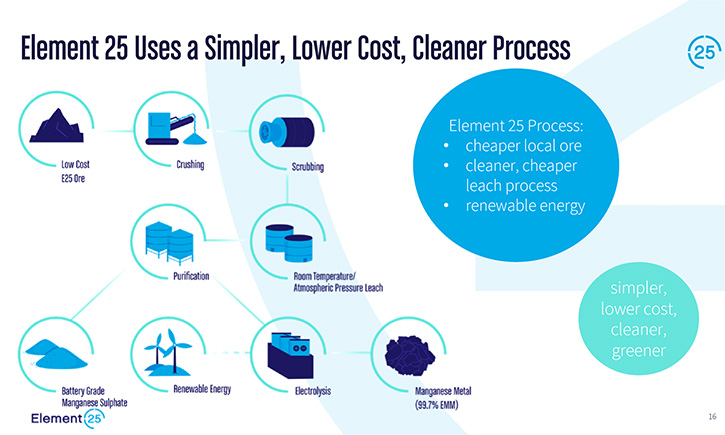

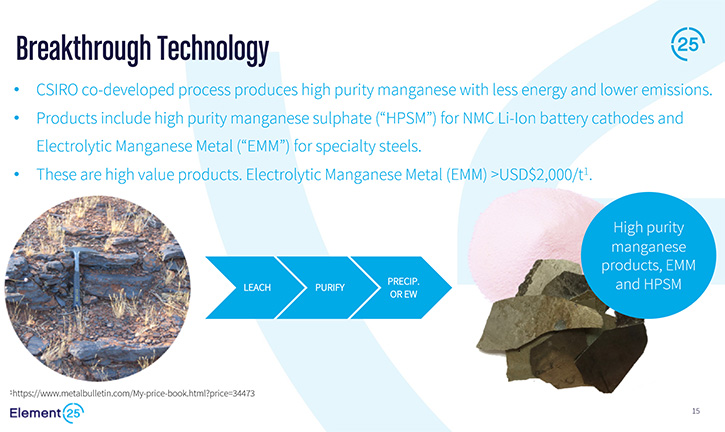

So our cost per unit of manganese is very, very low. And we also have developed a flow sheet in conjunction with the Australian federal government research organization, CSIRO, which has allowed us to leach manganese much more efficiently and quickly than existing producers of these high purity manganese products. And that happens at atmospheric pressures and room temperatures. So there's a very low energy requirement to do the leach. When we make the high purity manganese products, we will use a high penetration of renewable energy and including up to 50% wind and solar, so our high purity manganese will be the cleanest, greenest, and probably lowest cost manganese on the planet.

Dr. Allen Alper: Well that sounds excellent. That's for good. It's great to be in position where you're in a great area and you can make the highest quality. And so that's excellent. Could you tell our readers/investors about your background and the team?

Justin Brown: The team has grown progressively over time. My background is originally as a geologist, I've been working in the exploration and mining industry for just under 30 years, and I've been joined by an experienced mining engineer, who's the study manager. We have a very experienced process engineer, who's helping fine-tune the process flow sheet and plot design. We also an ex BHP-experienced marketing expert, who's engaged with end users in Japan, Korea, North America and Europe, to develop offtake arrangements, which are our key markets. And we also have various supporting staff in the consulting industry, including Lycopodium as the lead engineers. We have some very useful federal government support through Arena and the CRC-P programs who are contributing funding to some of the developmental work that we're doing. So the team is, multi-disciplined, and very experienced and well supported by government and industry.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors more about your projects?

Justin Brown: The focus for us is Butcherbird. We've been divesting non-core projects progressively and generating funds to fund the development of Butcherbird. We also have one project on the books, a nickel-cobalt project, developing in the background, which obviously fits into the strong battery thematic. Nickel and cobalt are both important in battery manufacture, so we see Element 25 straddling the old world and the new. We have the old world steel applications for our products, but also we're very much focused on the new age lithium ion battery revolution that everyone expects to come in the next decade, as electric vehicles take off. Manganese, nickel and cobalt are all strong contenders in that space, and that's where our focus is.

Dr. Allen Alper: That's excellent. Could you give our readers/investors a preview of what's happening in manganese?

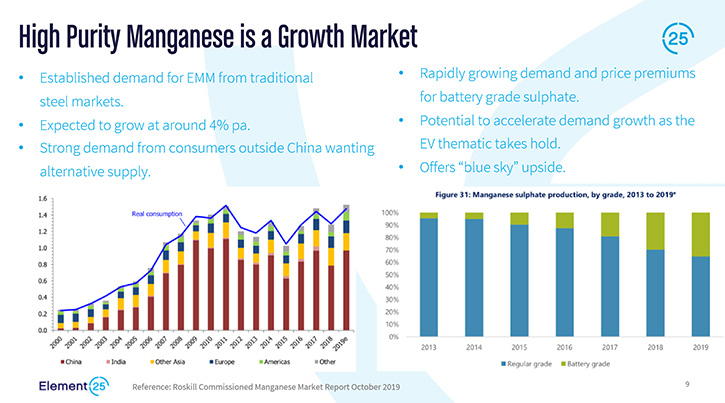

Justin Brown: I think the markets are balanced at the moment. There is the sustained demand from the traditional end-users in the steel industries, and there's a waiting period, while the EV, and the battery industries grow. There're a lot of battery gigafactories under construction, expected to be completed in the next year or two. We expect to see a strong inflection in demand as those factories come into production, which will require additional inputs of manganese along with other battery metals like nickel and cobalt. So we think that strong demand and price appreciation is just around the corner.

Dr. Allen Alper: Oh, very good. Could you tell our readers/investors more about your breakthrough technology?

Justin Brown: Sure. Traditionally when you take oxide manganese ore, and you want to leach it into solution to make these high purity manganese products, you have to do what's called a roast reduction. It's a step where they have to heat the manganese ore up to about a thousand degrees Celsius in order to make it soluble in sulfuric acid. This means that they need to consume sulfuric acid, they need to consume all the energy. They use coal dust as part of the process so they need to consume coal as well. It's quite an energy intensive and polluting process. Our process is quite the opposite. It happens at room temperature. It is very benign. From an energy and from an environmental point of view, it's a much cleaner, more efficient, lower cost process. So it's quite superior to the existing producers. We think that stands us in good stead to be a key player in a decarbonizing world over the next decades.

Dr. Allen Alper: That sounds great. And it sounds like the competitors costs are also rising. Is that correct?

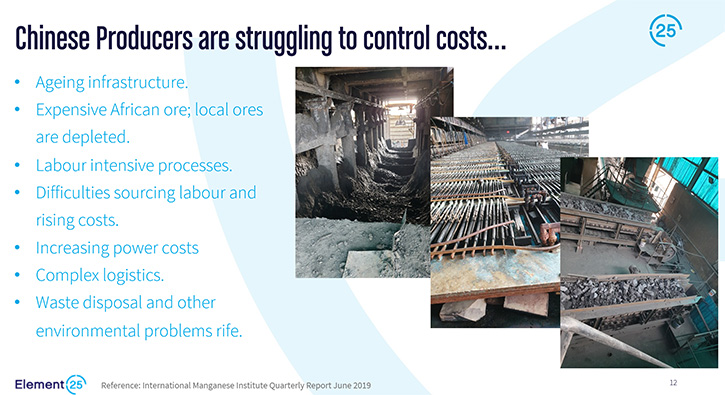

Justin Brown: Yeah, that's correct. So, one of the main competitors is China. China traditionally had a lot of domestic manganese ore. That's depleted now, so they don't have that advantage. They need to get their ores from, typically Africa, at greater cost than what they used to have. Additionally in China, environmental constraints are tightening up, their labor costs are rising, and their power costs are rising. So we're in a really good position to undercut their production cost and be very competitive, lowest quartile, if not lowest cost producer in the marketplace.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

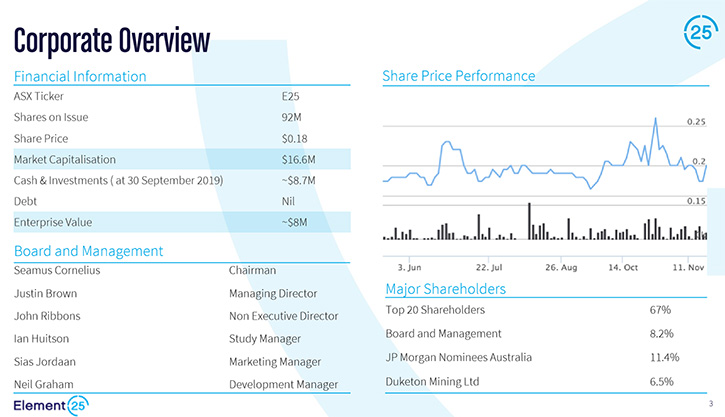

Justin Brown: We've always tried very hard to preserve leverage for our shareholders. So whilst we've been listed since 2006, we still only have just over 90 million shares on issue, which for listed companies is very, very low. We have a modest market capitalization of under $20 million Australian, a balance sheet comprising around about $8 million in cash in net tangible assets, which are funding our current activities. So we're a fairly small cap company, with a tight capital structure, a strong balance sheet, an excellent project, and in our view we present an excellent investment opportunity for those investors looking to get into this market.

Dr. Allen Alper: That sounds great. Is there anything else you'd like to add?

Justin Brown: We expect to land the prefeasibility study as quickly as possible, in which we expect to show a compelling financial case around this project. Also, this is stage one. When we get this project into production, we have a resource base, which will both underpin a multi decade-long production life, but will also allow us to look, aggressively, at expanding. So this is a low cost entry into the high-purity manganese space. But it's also one with excellent growth prospects and unmatched production costs, environmental credentials in a tier one ethical jurisdiction, which I think is going to be important for end users as time goes on.

Dr. Allen Alper: Sounds excellent. Those are compelling reasons for our readers/investors to consider investing in Element 25.

https://www.element25.com.au/

Element 25 Limited

+61 8 6315 1400

admin@e25.com.au

Level 2, 45 Richardson Street,

West Perth, WA, 6005

PO Box 910

West Perth WA 6872

Australia

|

|