Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF): Leading Underground High-Grade Gold Producer in Colombia, Improved Operations, Cash flow, Balance Sheet, Capital Structure; Interview with Mike Davies, CFO. PDAC Booth 2310

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/30/2019

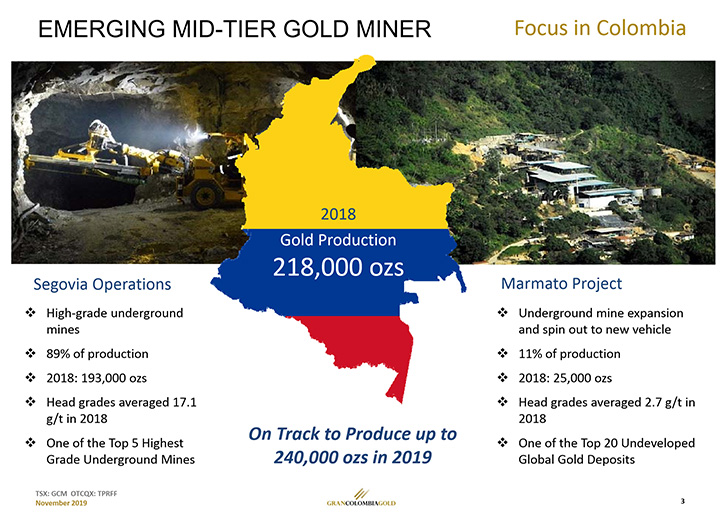

Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF) is an emerging mid-tier gold and silver producer and the leading underground high-grade gold producer in Colombia, with several mines in operation at its Segovia and Marmato Operations. We learned from improving operations, improving cash flow, strengthening our balance sheet and capital structure, Chief Financial Officer of Gran Colombia Gold, that they have been recognized as one of the top 30 companies on the TSX based on their share appreciation over the last three years and included by the TSX in the inaugural TSX30 list of issuers in September of this year. The Company is on track to produce up to 240,000 ounces in 2019, with about 90% of production coming from its high-grade Segovia Operations, where the next 70,000 meter exploration drilling program is about to start. In Marmato, Gran Colombia Gold has completed a PEA in October, giving the Company a path forward to an underground expansion and development of the operations, to take it from its historical 25,000 ounces a year, ultimately to about 160,000 ounces a year by 2024.

Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, who is the CFO of Gran Colombia Gold. Could you refresh the memories of our readers/investors/investors and give them an overview of your Company? Also, what differentiates your Company from others?

Mike Davies: Thanks Allen. Grand Colombia is the largest producer of gold and silver in Colombia. We've been very successful in the last couple of years, turning the Company around, improving operations, improving cash flow, strengthening our balance sheet and capital structure. And so 2019 has been another successful year for the Company on all fronts. I think what differentiates us right now is certainly peer valuation. We're undervalued relative to peers currently at about 60% of analyst target prices for our shares. But that's even after the last three years, where we've been one of the top 30 companies in the TSX according to share appreciation.

Dr. Allen Alper: That's excellent.

Mike Davies: We also are poised for continued appreciation, as gold prices improve from current levels.

Dr. Allen Alper: Well, that's excellent. Could you give our readers/investors a snapshot of your Segovia Operation and your Marmato project?

Mike Davies: Yes, sure.

Dr. Allen Alper: I understand you're on track to produce up to 240,000 ounces in 2019, which is great.

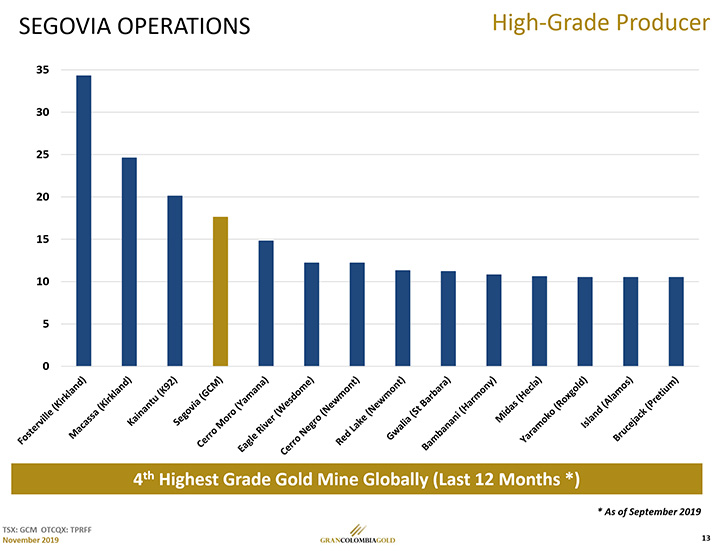

Mike Davies: Yes. Currently we produced 175,000 ounces of gold, during the first nine months of this year, which is up 7%. For the latest 12 months, which ended October, our annual run rate is about 233,000 ounces, so we are tracking towards the upper end of our guidance range for this year. About 90% of our production comes from our high- grades Segovia Operations, which have averaged roughly 16 and a half grams gold per ton this year, putting it in the top five global underground gold mines by grade. So it's an interesting project, but what we find most exciting about it is we still have only scratched the surface in terms of exploration potential. We're currently mining only three of 27 known veins with past production. So we're about ready to kick off about 70,000 meters of drilling, both brownfield and also near the existing mines, to be carried out over the next 18 months.

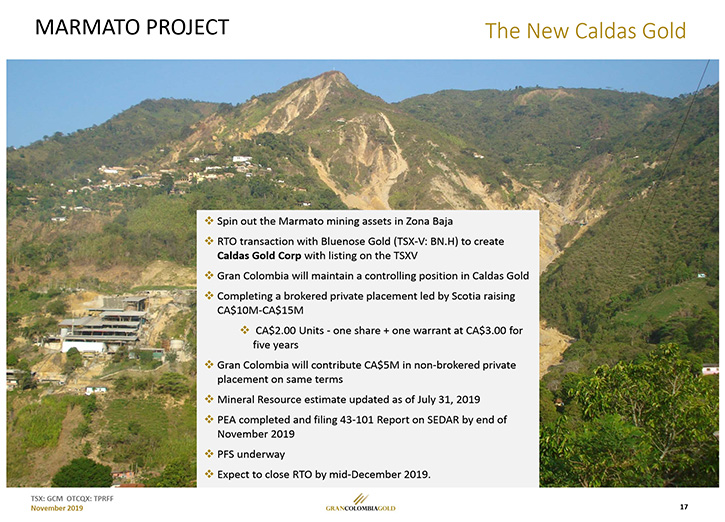

Marmato is an exciting project. It's a mountain of gold located in Colombia. We've consolidated ownership around the mountain years ago, but most recently have come up with a couple of new things with respect to Marmato. First, we completed a PEA on Marmato. In the middle of October we made the announcement and by the end of November, it will be filed, the technical report will be filed on SEDAR, giving us finally a path forward to an underground expansion and development of the operations to take it from its historical 25,000 ounces a year, ultimately to about 160,000 ounces a year by 2024.

We've also announced an updated resource for the project, which is continuing to affirm some higher grade material at depth and it gives us the confidence for the PEA. And probably most significantly, we've announced in October that we are going to spin Marmato out to a separate public company in an RTO transaction, which will continue to have it listed separately on the TSXV.

But we at Gran Colombia will continue to maintain about a 65% ownership in the project, so we can get appreciation for our shareholders through ownership of that stock and continue to direct its development, while keeping it outside the purview of Gran Colombia's balance sheet and cash flows.

Dr. Allen Alper: That sounds excellent. Could you refresh the memories of our readers/investors on your background, your Management Team and Directors?

Mike Davies: Our Company was founded by Serafino Iacono and Miguel de la Campa. Serafino is our Executive Chairman and our CEO is Lombardo Paredes, who has been the one successfully implementing the operational turnaround strategy the last few years. I'm a CPA in Canada with lots of international public company experience and our head of exploration is Alessandro Cecchi, who has been overseeing all the drilling and exploration programs at both Segovia and Marmato, over the last number of years. We have a good team with lots of seasoned experience in Colombia, which sets us apart, I think, from others operating in Colombia, right now.

Dr. Allen Alper: That sounds excellent. It's great to have such an experienced, seasoned team working in Colombia. So that's excellent. Could you tell our readers/investors what's new with Gran Colombia?

Mike Davies: I think probably the two biggest items are the Marmato spin-out. We know that Marmato, from looking at the analysts and everybody else, is not getting any real valuation in today's share price of Gran Colombia. We feel spinning it out will get share price appreciation for us by creating the value of Marmato through the spin-out.

The other thing, we know from our shareholder based feedback is that shareholders in Gran Colombia really like the free cash flow yield that we've got going on. It's in the 30% plus range right now. So they're really pleased with the free cash flow yield of Gran Colombia, which has been driven by the high-grade Segovia Operations. But there were concerns from our shareholders about using that free cash flow to expand Marmato. There were concerns about the potential of significant dilution if we did equity to develop Marmato or similarly a high leverage on our balance sheet again, if we were to go out and borrow project debt to do Marmato.

So for all those reasons we feel that our shareholders can participate in the valuation of the Marmato Operation by maintaining a control position in it. So we'll still have 65% but at the same time, using a separate vehicle allows us to go out and finance Marmato, without an impact in Gran Colombia's balance sheet and capital structure. So the Marmato story, for us, is very exciting because this is a world-class asset and it's about time that we get on with developing it, especially with the current gold market we have, where we can certainly yield benefit from it as we go out and fund it.

The other exciting thing for us is we've had really good exploration success over the last couple of years. We're about ready to launch a very major exploration program in Segovia to add resources, reserves and mine life. We're not just going to be exploring as we have in the past around the three mines were operating, but we will be stepping out into a regional play within our 3000 hectare title and starting to do some drilling on those other 24 veins we're not currently mining.

We're leveraging some new study work being done by GoldSpot Discoveries. It's a junior TSXV listed Company that is using artificial intelligence and machine learning to help us gather data in such a way that we can prioritize our drilling targets and hopefully be more successful in what we do.

Dr. Allen Alper: That sounds excellent. That's really great. It's amazing how much drilling and exploration you're going to be doing and the opportunity to expand your reserve and resources, so that's excellent.

Mike Davies: Well, it's something that's been overdue. We went through several years when gold was much lower, where for survival we had to limit exploration very stringently. So now that we are more successful, with our operating cash flow, and certainly now we know enough about the geology around our three mines, this is the first time in our history we've had the luxury to start looking at drilling outside the mines. And we had our first success as we announced in October with the Chumeca Vein, which runs off from the Sandra K Veins. It's our first of those 24 veins we drilled. We just got a few holes in before we reported, but came back with some really great intercepts and a new understanding that what we thought was a secondary structure turns out to be a main vein. So it's giving us some optimism about what we might find as we go out and explore.

Dr. Allen Alper: That's excellent. That's really great! 2020 is going to be a very, very exciting year for Gran Colombia Gold. Excellent!

Mike Davies: Yes. It's shaping up to be exciting for us moving forward.

Dr. Allen Alper: Oh, that's great. Could you tell our readers/investors about your capital structure?

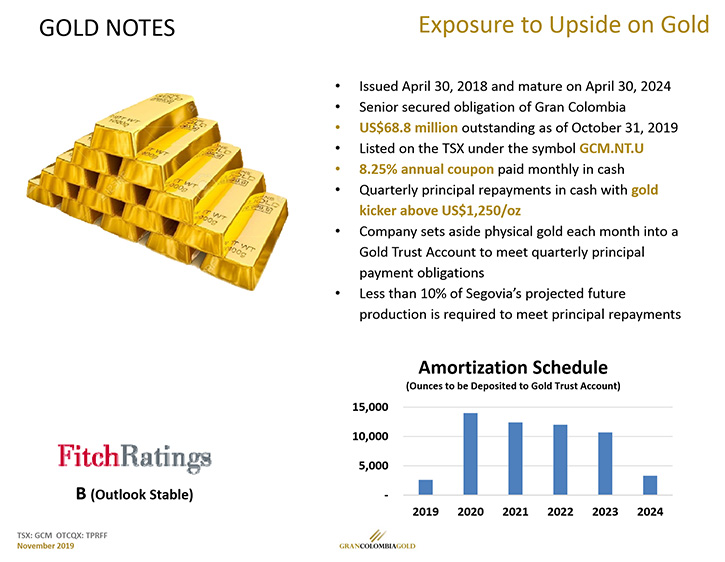

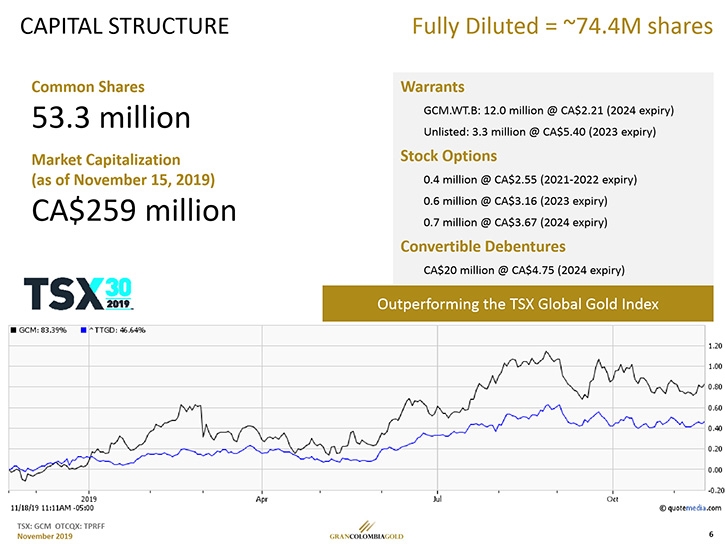

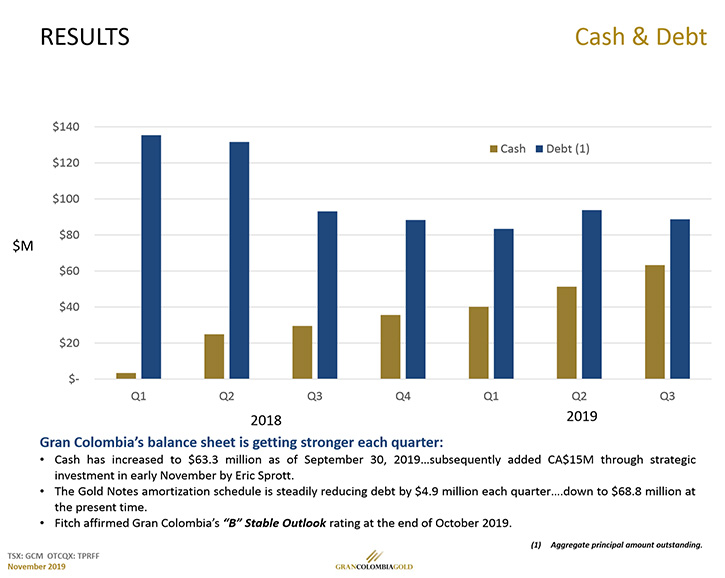

Mike Davies: We did a small private placement with Eric Sprott as a strategic investment in November. As a result of that, we now have 53.3 million common shares outstanding. We trade on both the TSX and the OTCQX. We have about 1.7 million options, 15.3 million warrants, 12 million of which are in the money, 3.3 million of which are at CA$5.40 and then CA$20 million of convertible debentures, which have a conversion price of CA$4.75 per share as well. So all in all, our fully diluted count is about 74.4 million shares. We currently have about US$89 million total debt, including the converts, as well as US$68.8 million of gold notes that are outstanding. And at the end of September we reported a cash balance of US$63 million. So cash has continued to grow through the year as a result of our free cash flow generation.

Dr. Allen Alper: Oh, that's excellent. The Company has really turned around. It's really doing very well and is continuing to do so. Congratulations! Could you give our readers/investors a snapshot of the results?

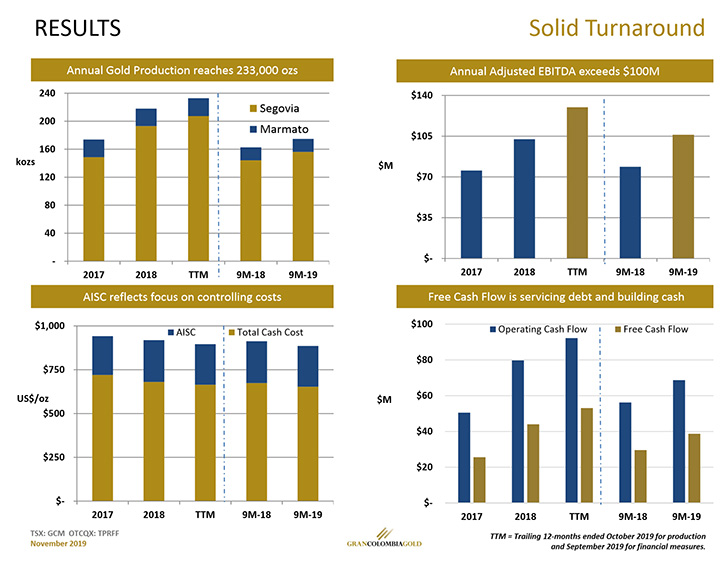

Mike Davies: For the first nine months this year, we reported production of about 175,000 ounces with a realized gold price for the first nine months increasing to US$1,348. Cash cost in that period was US$653. Our all in sustaining was US$886 an ounce and our all in cost, including the non-sustaining exploration, was about US$911. We reported a revenue of US$238 million and if you go on a trailing 12 months and include the fourth quarter of last year, our revenue on an annual basis is over US$300 million now. Our adjusted EBITDA during the nine months was US$106 million and on a trailing 12 months' basis is now up to US$130 million.

We reported adjusted net income during the nine months this year of US$43 million. That's up from US$28 million a year ago. And our free cash flow, which was US$30 million for the first nine months of 2018, came in at US$39 million for the first nine months of 2019. So we saw positive improvement year over year in all of our operating and financial metrics in 2019, in the first nine months and we're on track to meet our guidance for this year.

Dr. Allen Alper: That's excellent. Could you say a few words about improvements to your balance sheet?

Mike Davies: With the changes we made in 2018 to our debt, essentially turning old convertible debt into the new gold notes, our debt basically now just follows a routine quarterly amortization schedule. It's going down about US$5 million every quarter, so by the end of January our gold notes will be down to about US$63.8 million. So that's nice and well controlled. We're using less than 10% of Segovia's production to service the gold notes, so it's not put any kind of strain on our cash flow. The balance sheet, I'd say the most significant improvement we've seen this year is in our cash balance, which has gone from US$36 million at the beginning of the year to US$63 million at the end of September. And then we picked up another CA$15 million in early November with the Sprott private placement. So we should finish the year with an even higher cash balance than at the end of September.

Dr. Allen Alper: That's excellent. Could you highlight the 2019 outlook?

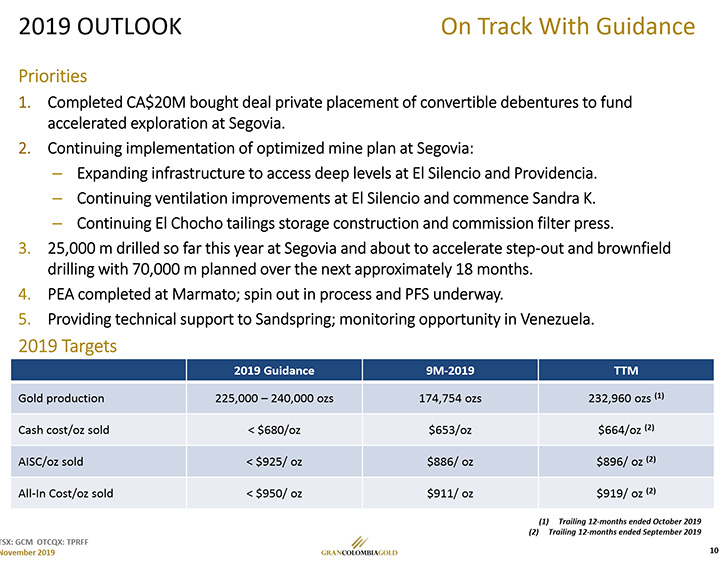

Mike Davies: We've guided this year that we'll produce between 225,000 and 240,000 ounces. Our trailing 12 months at the end of October was 233,000, so we're well poised to meet the upper end of our guidance range for this year. With respect to cash cost, last year's average was US$680. Through the first nine months this year it is averaging US$653 and we expect that for the full year we'll be below last year's level of US$680. On our all in sustaining costs we're at US$886 through the first nine months. Our guidance is that we’ll be below US$925, so I see no issue there. And on the all-in spending cost number, we have US$911 through the first nine months and our expectation was to stay below US$950. So we're better than expected, with respect to the cost guidance. We'll be below our targets for the year. So we're feeling very good and we should end up the year with over US$300 million in revenue and a strong EBITDA number.

Dr. Allen Alper: Oh, that's excellent. Outstanding performance! Could you tell our readers/investors the primary reasons they should consider investing in Gran Colombia Gold?

Mike Davies: I think there're four things we'd probably think. One is certainly valuation. As I mentioned, we're only at about 60% of the value the analyst targets on share price at current levels. So we see a re-rating opportunity, with our share prices as strategy continues to move forward. I think gold price, if gold price continues to move up, that has been a catalyst towards share price appreciation in Gran Colombia. I think the third thing is our track record. Over the last three years we've continued to perform very strong operationally. The high grade Segovia Operations are a tremendous foundation for that performance.

And then the fourth thing I think is that we have an excellent pipeline of projects. We think this new Marmato Company, which we're calling Caldas Gold, in its own right will give us opportunity for valuation growth. But Sandspring resources, of which we own about 21%, is turning a corner toward its feasibility study. And we have some longer term pipeline projects in both Zancudo, and potentially down the road in Venezuela, should there be some regime change there. So we do have an exciting future ahead of us, but I think our near term focus will be on the Segovia exploration and on the Marmato spin-out.

Dr. Allen Alper: Well, that sounds excellent. Those are very, very strong reasons for our readers/investors to consider investing with Gran Colombia Gold. Mike, is there anything else you'd like to add?

Mike Davies: It's always a pleasure and I look forward to continuing to provide updates as we go along. Thank you for interviewing us at Gran Colombia Gold Corp. for Metals News.

Dr. Allen Alper: That's excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|