First Cobalt Corp. (TSX-V: FCC; OTCQX: FTSSF): Working with Glencore on Domestic Cobalt from the only Permitted Primary Cobalt Refinery in North America; Interview with Trent Mell, President, CEO & Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/27/2019

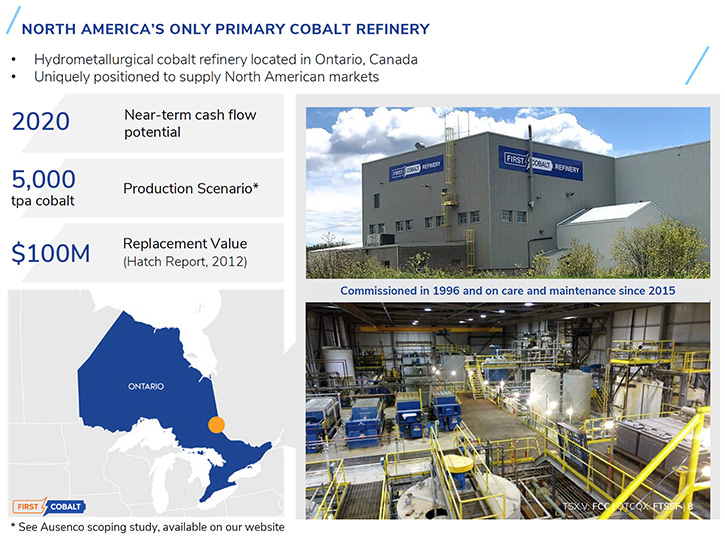

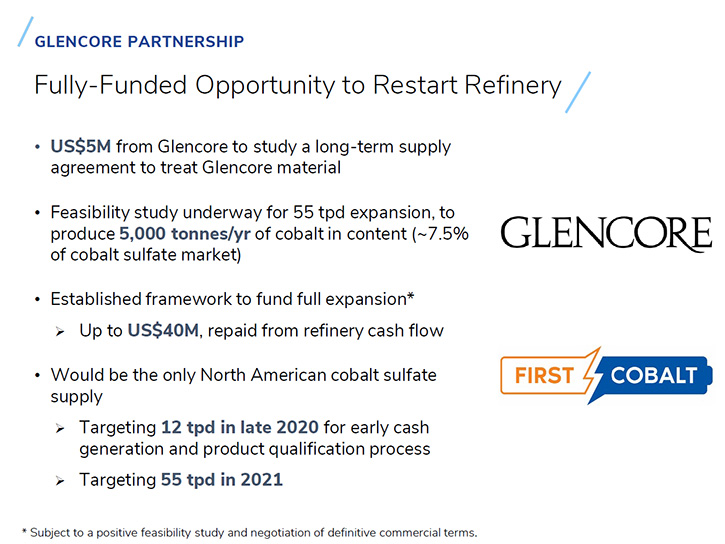

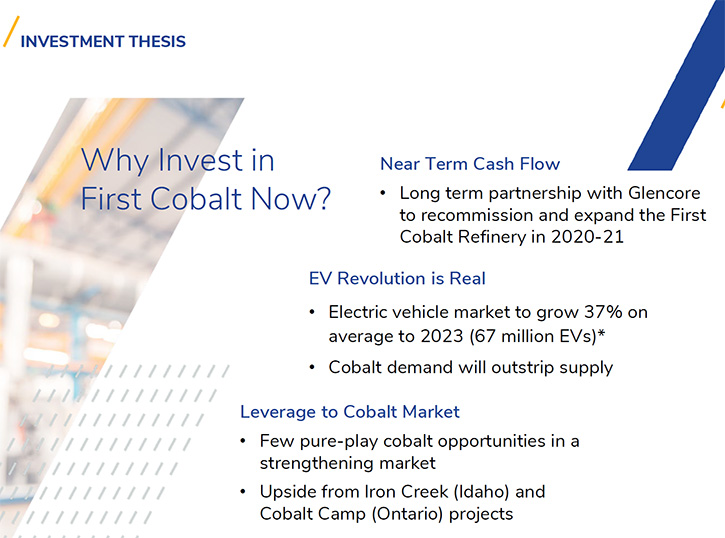

Near-term North American cobalt refiner, First Cobalt Corp. (TSX-V: FCC; OTCQX: FTSSF) is the owner of the only permitted primary cobalt refinery in North America: the First Cobalt Refinery in Ontario, Canada, could produce more than 5,000 tonnes of cobalt sulfate per year for the battery market. We learned from Trent Mell, President, CEO & Director of First Cobalt Corp., that they have recently announced a long-term partnership with Glencore that, based on the results of a feasibility study, will help fast-track the reactivation of the First Cobalt Refinery. Glencore provided $5 million to complete a feasibility study and is prepared to supply feedstock from their operations, provide the CapEx to finance the recommissioning, and place the offtake with an automotive partner. This partnership will allow First Cobalt Corp. to become a producer and achieve first cash flow, without diluting its shareholders.

First Cobalt Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Trent Mell, who is President, CEO & Director of First Cobalt. Trent, could you give our readers/investors an overview of First Cobalt and tell them what differentiates First Cobalt from others?

Trent Mell: Certainly. Thanks for interviewing me at First Cobalt again, Allen. Our Company's been around for about two and a half years now. We were formed, much like many other cobalt players, when the commodity started to take off as a result of concerns for the supply, as electric vehicle penetration increased. We went through a period of high prices and depressed prices, and the market is now starting to normalize. Over the challenging period we are coming out of, most of our peers have disappeared. We have had the good fortune to consolidate some really attractive North American assets and to have acquired the only permitted cobalt refinery on the continent, located in the Cobalt Camp.

We have an advanced project in Idaho, which has a growing resource in the Idaho Cobalt Belt and one that we are really keen to keep pursuing. We also consolidated half of the Canadian Cobalt Camp, leaving us with 50 historic high grade silver and cobalt mines. In the current environment, however, the sole focus of our time and dollars is to recommission our cobalt refinery in Ontario. Our key differentiator is that we have a refinery that's largely built, it's permitted and it can be reactivated in short order. We recently announced a partnership with Glencore, a long-term partnership to make that happen.

Dr. Allen Alper: Could you tell our readers/investors a bit more about your partnership with Glencore?

Trent Mell: When you look at the cobalt supply chain, the vast majority of cobalt is being mined in the Congo. The vast majority of that will find its way into a Chinese refinery or Chinese controlled refinery. We are all too aware of the geopolitical back drop that exists today. We have concerns over Chinese dominance in certain critical minerals. Rare earths and cobalt are right at the top of the list because of their importance for national defense and our economy. Cobalt is essential for jet engines, gas turbines, military applications, and it's of course important for the EV (electric vehicle) revolution that we are seeing unfold before our eyes.

We have the only downstream facility, the only refinery on the continent that is permitted to produce cobalt sulfate for the battery market. The arrangement we have with Glencore right now, who has already provided $5 million for us to complete a feasibility study, further validates previous work we have done. Assuming we achieve the expected outcome on that study, Glencore would like to enter into a long-term supply agreement. They would: (1) provide us with feedstock from their mining operations, (2) advance money to fund the CapEx to finance the recommissioning and an expansion, and (3) they would place the offtake with an automotive partner. As you can see, we have a really great opportunity to work with Glencore, to achieve cash flow, without diluting our shareholders. This capital advance would be repaid with future production.

Dr. Allen Alper: Well that sounds excellent. Could you tell our readers/investors a bit more about your plans going forward and getting into production and what that would look like, the effect on your status?

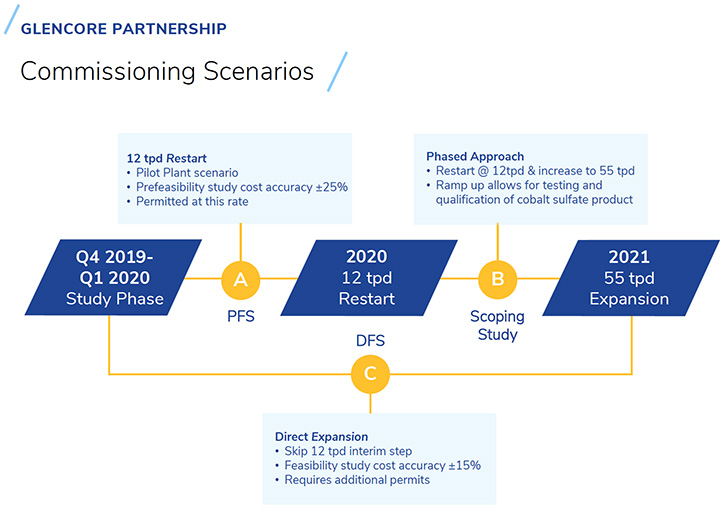

Trent Mell: To give you a sense of where we've been. Over the past year, we've completed metallurgical testing to confirm that the abundant supply of cobalt hydroxide in the DRC would be suitable for processing. In fact, it is a very high grade and is very easy for us to treat. We have also completed a scoping study that gave us the comfort to undertake a global marketing effort to identify a suitable strategic partner. Now that we have settled on Glencore as a partner, we are focused on three important catalysts. The first one is to complete the feasibility study, which will be done in Q1 2020, less than 5 months from now. The second catalyst will be the agreement between us and Glencore on a quick restart of the refinery. By that I mean recommissioning the existing refinery, producing about 1,000 tons per annum of cobalt.

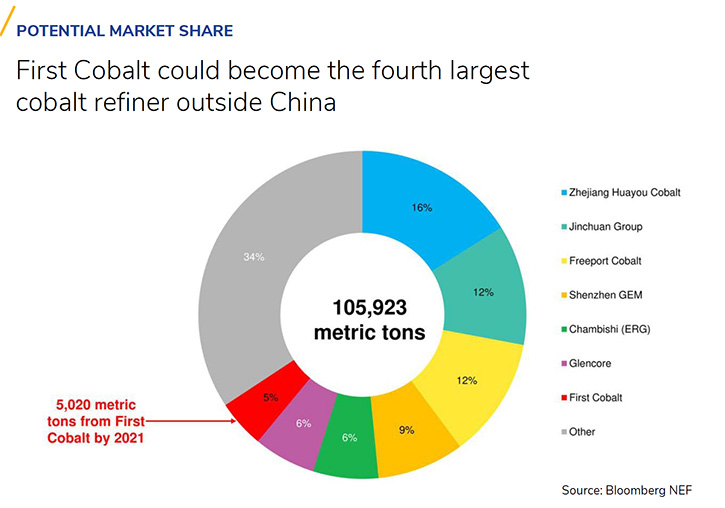

The quick restart will provide proof of concept and allow us to produce a battery grade cobalt sulfate we could certify, with one of the auto companies. The third catalyst, a year thereafter, is a significant expansion, to 55 tonnes per day, which would allow us to produce over 5,000 tonnes of cobalt per annum, or about 25,000 tonnes of cobalt sulfate. This represents about 5% of the global market. So, in very short order we can find ourselves with cashflow, roughly a year from now, with more significant cashflow a year thereafter, then very quickly becoming a rather important player in the cobalt market. This cash flow would reduce or eliminate our dependence on the capital markets for our future activities, including exploration activities and ultimately mine development activities in Idaho.

Dr. Allen Alper: Well that sounds excellent. That's a great position to be in, to have all those cobalt properties and to have Glencore, with experience in processing and marketing cobalt. So that's excellent.

Trent Mell: Yes, Glencore is the largest cobalt miner in the world, with approximately 30% of the world's mine supply coming from their operations. And these are large commercial operations, so you don’t have the concern about child labour or conflict minerals. They are also the biggest trader of cobalt worldwide. So, you are right, we have landed on an excellent partnership.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your background and your Team?

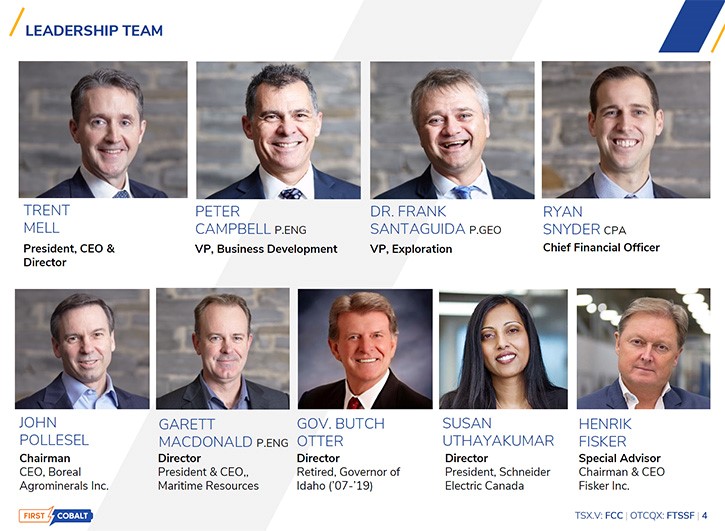

Trent Mell: Sure. All of us come from larger mining companies with global operations. I have 20 or so years of mining experience in operations and mine development. I have a commercial background and I cut my teeth at Barrick Gold. I have also worked at Sherritt International; I have worked at North American Palladium. I have worked in various commodities. This is my second time running a junior mining company. My first was at Falco Resources. When I built the team at First Cobalt, I deliberately sought out a leadership team that, like me, had experience with the global miners. People that understood how to permit, how to build, how to operate, and could see beyond the exploration phase to what we are ultimately targeting. We have been on every continent, with collectively over a hundred years of operating experience. It has benefited shareholders by bringing to the fore, people, who have a good network and a good breadth of experience.

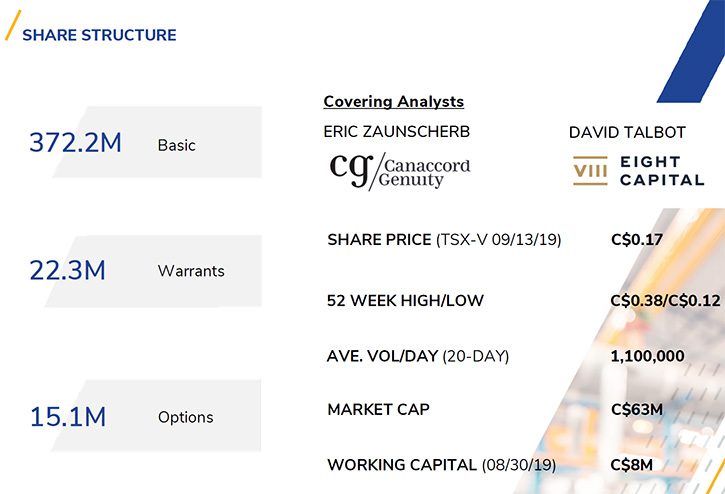

Dr. Allen Alper: That sounds great! Could you tell our readers/investors a bit about your share structure and capital structure?

Trent Mell: We have $5 million of debt with Glencore, which is funding the feasibility study, currently underway on a major refinery expansion. We have about $7-8 million of working capital today. Our needs are quite modest because our sole focus today is the refinery. The capital cost of the recommissioning and future expansion would be financed by a Glencore advance, which would be repaid by future production. So, we are in decent shape on the treasury side, although we are always careful with capital allocation. We have about 370 million shares outstanding. We have good investors out of Australia and Switzerland, and we are developing a growing following in the U.S. because our Canadian refinery and our U.S. and Canadian properties play well with the agenda in Washington D.C. to decrease reliance on foreign supply of minerals. I have had the opportunity to spend some time in D.C., spend time in the White House, talking about our plans and how they could help enhance the U.S. National Security interests.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in First Cobalt Corp.?

Trent Mell: There are three main reasons to look at First Cobalt. One is the risk profile of our Company, the second is the EV revolution and the third is the commodity. Starting with the commodity, cobalt went through a sort of boom period in 2017 and early 2018, but it moved too far too fast and it yielded an adverse response. We are working our way through this now and we have seen a price response. Cobalt hit a low of about $12.80 this summer and has come back to about $18. It certainly feels like the worst is behind us and most analysts agree. The smart money is looking at the sector again and the big banks have started to publish more bullish outlooks on cobalt. Citibank, Macquarie and others are now calling for cobalt to be one of the top performing metals. There is an opportunity to get in before the equities start to reflect that change in sentiment because we haven't seen the sentiment shift yet in the cobalt equities.

The second reason is the EV movement. Only 2% of global EV sales today are electric and we are already seeing a strain on the supply chain, with billions of dollars being invested in electrification worldwide. Porsche and Ford recently introduced flagship EV models to great fanfare and the pace of product launches will increase over the next 12 months. You can’t make EVs without cobalt, lithium and copper.

Third, if you're a commodity investor, you understand that there is a lot of risk in a mine development story. It starts with making sure that the geology is right and you don't fully know that until you start mining a deposit. You also have to ensure all the permits are in place. Then, there is the execution risk on the capital estimates, which are usually in the hundreds of millions. First Cobalt’s Refinery doesn’t face those risks. We have a known feedstock that will be coming to our, with known grades and characteristics, so we don't have to worry about the geology. The permits are already in place, though we will have to amend them for a planned expansion. Lastly, the CapEx that we are looking at is currently estimated at US$37.5 million. That is a very modest amount in this industry and given that the infrastructure and building are already in place, there is not a lot of room, once we complete our feasibility study, for the CapEx to come back and bite us. Relative to a new mine development, execution risk for us is very modest.

Dr. Allen Alper: In the transition, is there anything else you'd like to add Trent?

Trent Mell: We are entering a new age of battery metals, and they will drive the economy to a greener future. Looking at your investment vehicle, you can try to pick a winner in say Tesla, Volkswagen or Ford or you can invest in the commodity and diversify your exposure across all of the brands. In that regard, I think cobalt is a good way to go. It is an essential ingredient and that is not going to change anytime soon. Cobalt is also highly levered to the EV market with more than half of global production today going towards lithium-ion batteries. First Cobalt is one of the very, very few pure play cobalt companies that could give investors that kind of exposure.

Dr. Allen Alper: It seems like you have a great company, a great opportunity, big properties and the value of your refinery is actually greater than your market cap at the moment.

Trent Mell: That is right. I hope we can close the gap on that before too long. Q1 2020 is when our feasibility study will be completed so investors should have a keen eye out for that. At that point, Glencore and First Cobalt can make a final determination on how to proceed and it looks like we could be operational, within six months of a restart decision. Thus, the refinery could be operating at 12 tonnes per day by Q4 2020 and the expanded flowsheet of 55 tonnes per day could be commissioned around Q4 2021. In other words, all of this can happen pretty quickly.

Dr. Allen Alper: I enjoyed talking with you Trent. Have a great day. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Trent Mell: Thanks a lot for that, Allen. Always a pleasure to speak with you.

https://www.firstcobalt.com/

Trent Mell

President, Chief Executive Officer & Director

info@firstcobalt.com

+1.416.900.3891

|

|