Perseus Mining Limited (ASX/TSX: PRU): Becoming a 500,000-Ounce-Per-Year Gold Producer, with Three Operating Mines in West Africa; Interview with Jeff Quartermaine, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/26/2019

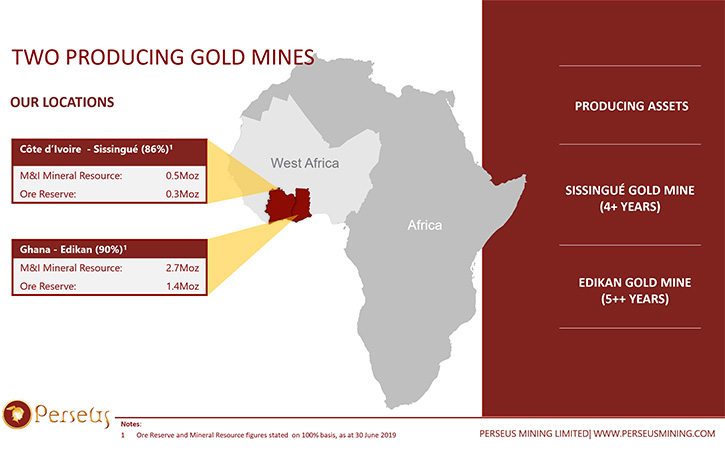

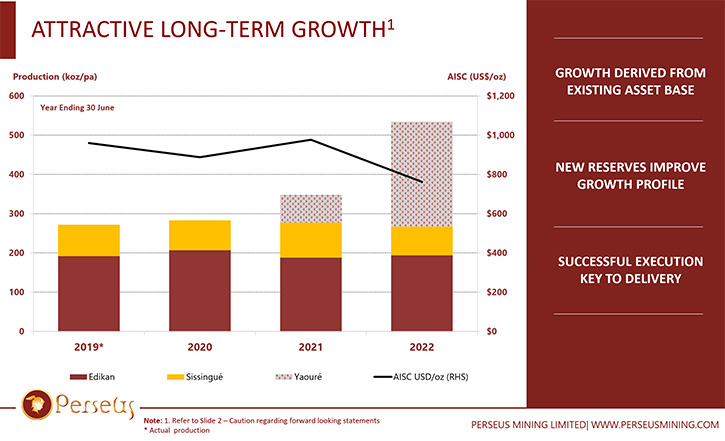

Perseus Mining Limited (ASX/TSX: PRU) aims to become a 500,000-ounce-per-year gold producer, with three operating mines in West Africa. The Company has developed and brought to production two gold mines; the Edikan Gold Mine in Ghana, which has produced about 200,000 ounces of gold per year since 2012, and the Sissingué Gold Mine in Côte d’Ivoire, that commences production in January 2018. Perseus is currently building its third gold mine, the Yaouré Gold Project in Côte d’Ivoire, which is expected to pour first gold in late 2020. We learned from Jeff Quartermaine, Managing Director and CEO of Perseus Mining, that the Company has had 11 strong successive quarters of outstanding operating performance. With the three mines, Perseus will be generating two hundred million dollars a year, which puts the Company in a very strong position to continue to grow the business, using organic growth potential. According to Mr. Quartermaine, Perseus Mining operates in two of the better West African countries, with less of a political risk.

Perseus Mining Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jeff Quartermaine, who is Managing Director and CEO of Perseus Mining Limited. Jeff, I wonder if you could give our readers/investors an overview of your Company. Also tell us what differentiates your Company from others and what you're doing in West Africa.

Jeff Quartermain:Perseus Mining is an Australian and Toronto listed gold company. We are involved in all phases of the gold business, exploration, development of properties and mining and producing gold. While we're domiciled in Australia, the focus of our businesses is in West Africa, where we have two operating mines and a third mine currently in development. We have had a very successful year that just passed and in the next couple of weeks we'll be about to report the results for the September quarter and I expect them to be very strong. In fact, this will be the 11th successive quarter, where we have achieved production and cost, very much in line with market guidance and our internal targets. So operationally the Company is performing exceptionally well.

In the last year or so, we've also made significant steps forward, in terms of the development of our business. We started as a single mine company, with one mine operating in Ghana. January 2, 2018 we poured the first gold from our second mine, which is the Sissingué mine, located in Cote d'Ivoire. That mine development was brought in ahead of schedule and on budget. Since then, I'm very pleased to say that the mine has consistently performed well above expectations, both ours and those of the marketplace.

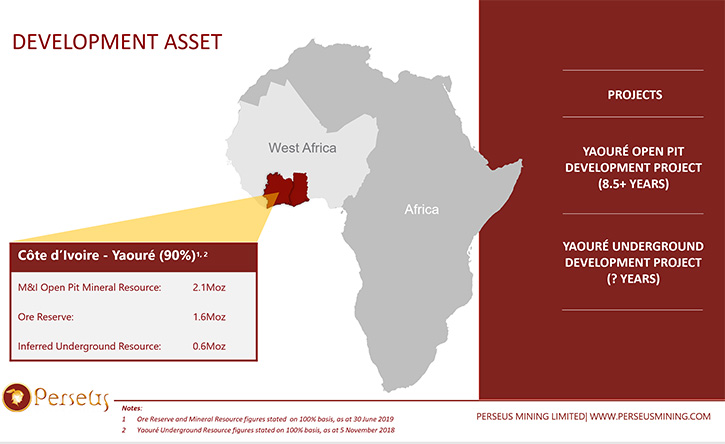

In this most recent year, we have advanced our third project such that in the June quarter we have managed to finalize licensing with the government in Cote d'Ivoire. We've brought in all of the financing that's required and we started development. As we speak today, we are very well advanced on that development project. In fact, I believe the plant site for the processing plant has been handed over to the contractor to start work on foundations and the like.

So that project is well underway and we think we'll be delivering its first gold, around the end of 2020. December, 2020 is the target date for first gold. Now what this means is that when that mine is fully functioning, Perseus will be producing around a half a million ounces of gold a year at a cost of around $800 per ounce, in which case we will have achieved the current objective of the Company, to become a mid-tier gold producer that consistently produces cash flow for our shareholders.

We plan to be producing 500,000 ounces at $800 an ounce, with a margin of 400 US dollars an ounce. Clearly at the current gold prices, that margin is a lot higher, but nevertheless we'll be generating in the order of a couple of hundred million dollars a year. That puts us in a very strong position, in terms of our ability to continue to grow the business, but also to return funds to our shareholders.

Now, what differentiates us from our peer group? We have a very strong growth profile ahead of us, an organic growth profile, a profile that's not dependent on exploration success or acquisitions, but is dependent on us simply performing. It depends on us being able to operate our mines properly and to be able to build. In the past we've demonstrated that we're very capable of doing that.

Also, we're operating in two of the better countries in West Africa. West Africa is regarded by some people as being politically volatile, perhaps more politically volatile than North America or Australia. That's a matter of opinion to be perfectly frank, but nevertheless there is that perception. But by being located in two of the better countries, we've been able to spread the risk and hopefully alleviate volatility in the future.

We see a very strong future for the Company. I think in comparison to our peers, we are relatively underpriced, certainly on all the multiples that you would typically examine. One reason we are underpriced, is probably the result of us having our operations focused in West Africa. Also that our Company had a slow start from being a junior explorer, to a developer, to an operator. It's taken us some time to get our business on a fair footing.

I'm very pleased to say that that has been achieved. The facts support what I'm saying very clearly; 11 strong successive quarters of outstanding operating performance, the construction of a first class mine in Sissingué ahead of schedule and on budget, and the bringing into development of a third mine at Yaouré, as we expected, and to be fully financed, without putting any pressure on our balance sheet.

Dr. Allen Alper: Well, excellent, excellent! Could you tell our readers/investors a bit more about your reserves and your resources?

Jeff Quartermain: Yes. We have quite a reasonable reserve inventory, resource inventory. It's been conservatively calculated at our two producing mines. At one of our mines, the Edikan mine, we have a resource of approximately 2.7 million ounces, a reserve of 1.4 million ounces. At Sissingué, a small mine, the resource is .5 million ounces, reserve about 300,000 ounces, so in total between those two mines we have about 3.2 million ounces in resource, 1.7 million as reserve. At our third mine, which is in development at the present time, we have a further 2.1 million ounces in resource, 1.6 million ounces in reserve. So if we add up the three of those mines, we're talking about a little over 3.3 million ounces in compliant reserves as we speak.

What those resource reserve numbers actually do not include is an underground resource we have identified at our third mine Yaouré. When we did the feasibility study for that project, we looked at an open pit operation and that's what we are developing upon. But having done the feasibility study, our geologists were looking carefully at structures in the area and identified that the main structure that delivers gold to this project continues through the footwall and further down dip from where the pit is located. As it goes through the foot wall, it's about five meters thick and it grades about five to six grams a ton. Our people were curious about this and decided to see if they could estimate a resource that might be able to be mined by underground methods.

So they looked at the drill database, bearing in mind this drill database was acquired to delineate the limits of an open pit operation, not to delineate an underground operation. Nevertheless they took the drill data that was available and were able to estimate a resource of about 600,000 ounces, grading six grams a ton. This is mineralization that extends along strike for about 1.2 kilometers, down dip as far as we've identified, by about 200 meters.

Now the challenge for us is to identify exactly how far this structure goes and whether there are any repetitions of the concentration of gold that we see in the bottom of the pit that we are planning to mine. We will be working very hard to try and understand those structures a lot better and to pinpoint our drilling. I would expect that in time we're going to see a material increase in that resource from successful drilling results.

At the moment we have 3.3 million ounces in reserve. We expect that to grow materially, in coming years, through organic means, through successful drilling adjacent to infrastructure on each of our three properties and on the tenements that we currently hold. In addition to the near mine exploration, we're also looking to the future and considering adding a program of greenfields exploration, where we consolidate an area of ground and look to explore and hopefully identify resources, within a 10 year horizon, that can then be commercialized to keep our business going into the future.

So the reserve resource inventory is reasonably sizeable, but the potential for expansion through the drill bit is very, very exciting. We think it is likely to yield very material gains for our shareholders in years to come.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background and your team?

Jeff Quartermain: I’m a professional engineer and accountant, MBA, et cetera. I guess I've been a manager in the resources industry for much longer than I would care to admit. We have pulled together a very, very high quality team of people. Of all the things we've done over the years, one thing of which I'm especially proud is the team of people we've been able to assemble both in our corporate office and on each of our operations.

We have an outstanding team of professionals, people who are very highly accomplished in their own right, very skillful in their respective areas and most importantly people, who adhere to the culture of our business and are all committed to achieving common goals.

We have an excellent group in Perth. It's a fairly small corporate office, about 25 people that range from the receptionist through to myself. Out on the sites, we have excellent teams as well, largely populated by indigenous members. So if we look at our Ghanaian operation, as a good example, where we employ around 400 people directly, 395 of those people are Ghanaians and only five are expatriates. In Cote d'Ivoire, a smaller operation, but with a similar proportion of expatriates to locals.

We've assembled a team that is populated by high-quality experienced professionals, who are able to mentor local people and bring them through in a way that they operate in a manner that's consistent with our corporate goals. It gives them experience so they can move on in their lives, when the time comes, and be very productive members of the mining profession.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your share and capital structure?

Jeff Quartermain: Our share structure is typical of an Australian company, which is different, in many respects, from North American companies. We have about a billion shares on issue, as a result of having issued shares at a very low price, when the company was quite small. Our market capitalization today is running around, about 850 million Australian dollars I guess, about 550 million US dollars, I think, in market capitalization. Our shares are very widely held in the sense that probably about 41, 42% is held by residents of the United States. About 31, 32% is held by residents of the UK and Europe and 20 odd percent is held by investors from Australia. So it is a truly internationally owned Company.

We are listed in Australia, but I think the ownership speaks for itself. It's diverse, it's mainly institutional. We have a very, very strong following of high quality resource funds, who clearly know what they're looking at and can clearly recognize value when they see it. I have to say that those shareholders have been exceedingly loyal followers of what we've been doing over the last few years. I'm actually on the last day of a road show now, after having met something like 55 funds in the last couple of weeks and probably a dozen or more brokers. The overwhelming view of our shareholder base is they're extremely happy with the way the company's progressing and the way we've been able to turn the business around into a viable, sustainable business that really can hold its place very comfortably in the ranks of the gold producers around the world.

Dr. Allen Alper: Oh, that's very good. You have had outstanding accomplishments in the last couple of years. Could you tell our readers/investors the primary reasons they should consider investing in C?

Jeff Quartermain: I think the reason any investor invests is to make money and Perseus Mining represents an excellent opportunity. We have gold reserves that provide leverage to a higher gold price and I think there's enough evidence in existence to suggest that the gold price is probably not going to fall away anytime in the near future. In fact, if anything, you'd have to think that the risk is on the upside as far as gold price is concerned. Although one has to admit that none of us have any real idea of where the gold price is heading in the future, but certainly the feeling, the sentiment is very, very positive at the moment. I think that bodes well for a gold company as a matter of principle.

Now in terms of Perseus in particular, I think we have been a fairly well kept secret. We had a very poor year in 2016 and I sat down with my colleagues and with some of our investors and I said to them at that stage, "Look, what do we need to do to get out of the penalty box after such a horrible year?" They said to me, "You've got to perform. You've got to produce good quarters, one after the other." I said, "Okay, let's get on and do that." So after a year where we produced all very strong quarters, the share price hadn't appreciated terribly much. I said, "Well look we've done those good quarters, what do we do now?" And they said, "You've got to do some more and furthermore you've got to build the Sissingué project on time and on budget." Well we did that. We did another four strong quarters and we built the mine ahead of schedule and on budget and still the share price was not moving too dramatically.

So we've continued to perform for 11 successive quarters now, and we've also queued up the development of our third project. The overwhelming sentiment from investors to me on this trip was you've been here before. You laid out a plan in the past and you'd done everything you said you were going to do. That is an understanding that I think is starting to filter into the awareness of the market, but it hasn't yet fully been reflected in the share price.

I think as the investment community starts to recognize our name and starts to recognize our accomplishments and starts to compare the value in this Company to the price of our peer group it's going to be a fairly compelling situation to invest in us and to take advantage of the next steps up in the share price that we think will materialize as we continue to deliver results.

Dr. Allen Alper: Well those are all extremely good reasons to consider investing in Perseus. Is there anything you'd like to add Jeff?

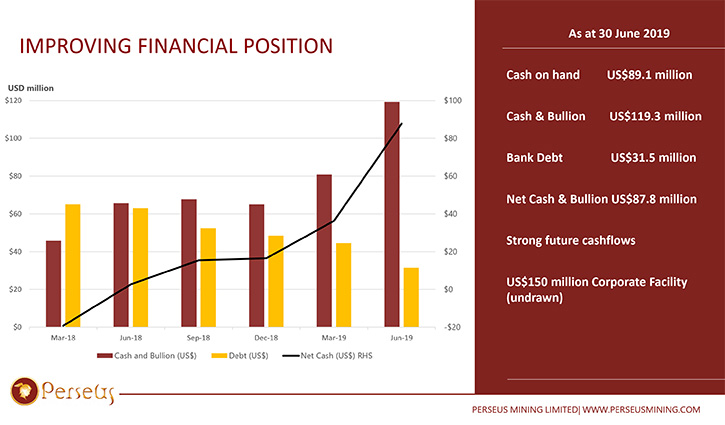

Jeff Quartermain: No, I think that pretty much covers it and reflects the dialogue that we've been having. I guess there is one further thing. One point of difference between ourselves and many of our peers is the strength of our balance sheet. Now I have a saying that the lie detector test that every mining company should take is the growth of cash on the balance sheet.

If you look at Perseus' growth in cash over the last couple of years, it's been very, very clear. We currently have around 120 million US dollars on the balance sheet of gold and bullion and we have 40 million of debt. So we're net cash positive by 80 million US dollars. That's grown from a fairly small figure several years ago. We're generating a little over a hundred million of cash per year at the moment and that'll extend to 200 million when we reach the 500,000 ounce mark. We have a very strong balance sheet. We don't need to go back to the market to raise equity to continue our activities or to bring growth to the business. We just need to keep doing what we're doing. I think we're in a good position. That is something that does set us aside from many of our peers, who have very good ideas, but don't have the financial wherewithal to deliver those outcomes. We do.

I also want to thank you for interviewing Perseus Mining Limited for Metals News.

Dr. Allen Alper: I’m pleased to.

You are in an excellent position, to have cash and have your cash growing. Many, many companies are in debt and are having trouble. Cash is so important in this business, while you're exploring and growing you need funds. It's excellent to be in a position where you can grow your cash.

http://www.perseusmining.com/

Jeff Quartermaine

Managing Director

+61 8 6144 1700

jeff.quartermaine@perseusmining.com

|

|