Foran Mining Corporation (TSX.V: FOM): Copper-Zinc Exploration and Development Company in the World Class Flin Flon Greenstone Belt, Manitoba and Saskatchewan, and the Largest Undeveloped VMS Deposit in the Region; Interview with Patrick Soares, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/24/2019

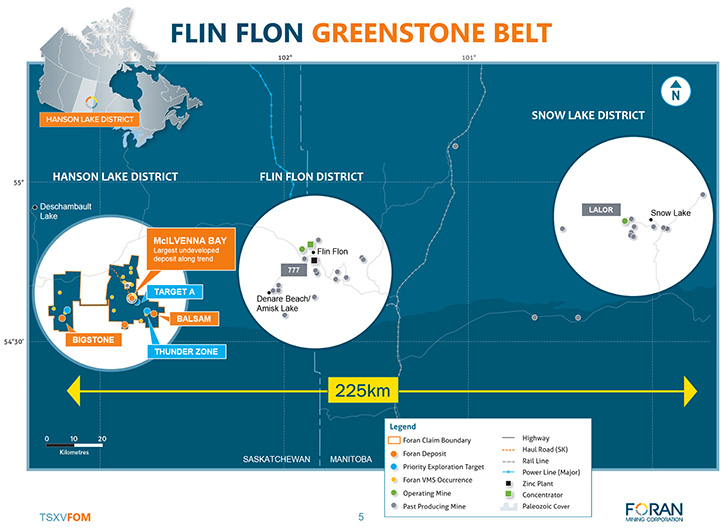

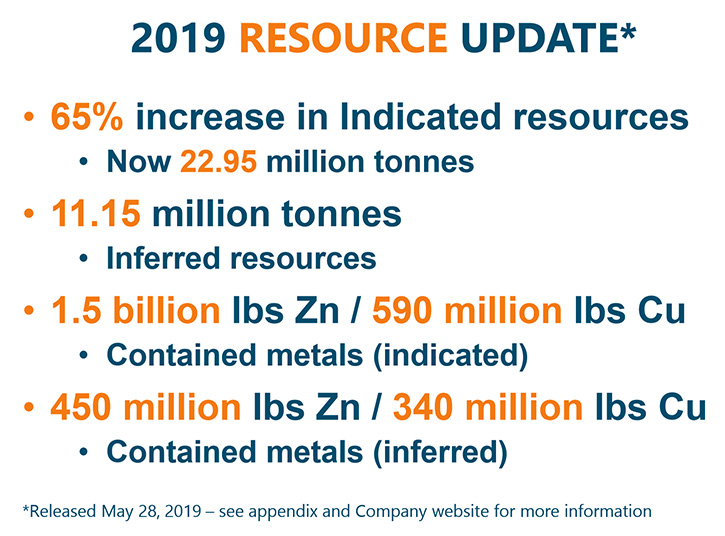

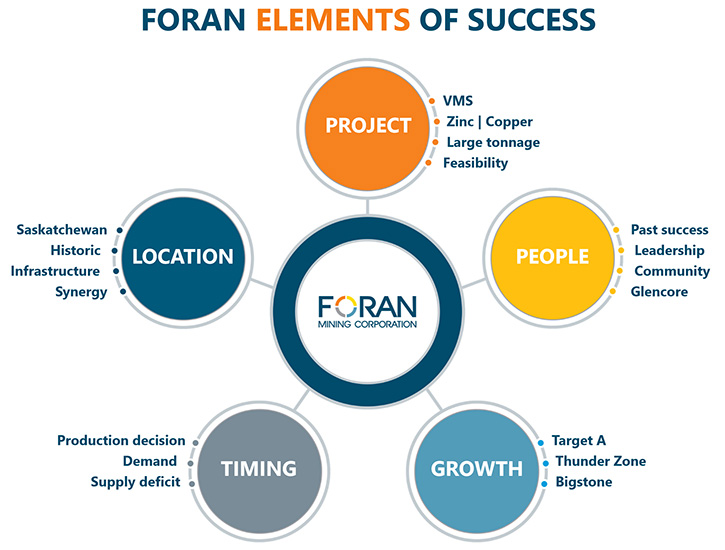

Foran Mining Corporation (TSX.V: FOM) is a copper-zinc exploration and development company with flagship McIlvenna Bay project, located within the Hanson Lake District, 65 kilometres from Flin Flon, Manitoba. It is part of the world class Flin Flon Greenstone belt and the largest undeveloped VMS deposit in the region. We learned from Patrick Soares, President and CEO of Foran Mining, that they have outlined a large mineral deposit, with 23 million tons of indicated resources and an additional 11 million tons of inferred resources. The Company's Management owns about 17% of the stock, and friends and colleagues own another 15%, and have participated in all the financings along the way and have stood beside shareholders, with the ultimate goal of becoming a producer.

Foran Mining Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Patrick Soares, President and CEO of Foran Mining Corporation. I wonder if you could give our readers/investors an overview of Foran and also what differentiates Foran Mining Corporation from others.

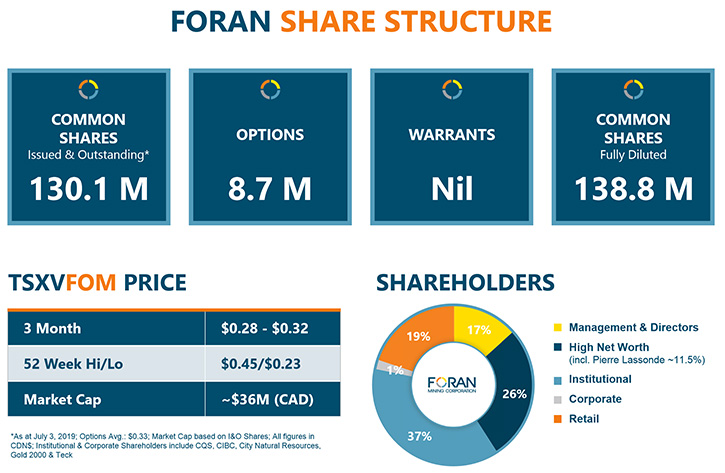

Patrick Soares:Foran is a group of entrepreneurial, mining professionals, who have teamed up with a group of investors, who are either involved in mining, or know it well. Our executive chairman, Darren Morcombe, who found the original shell, Foran, is the single largest management shareholder. He was joined by Pierre Lassonde, the mining legend, who is Chairman of Franco Nevada. They're the two largest shareholders of our Company. Combined they control about 24 to 25% in stock. Other Management and Directors own an additional 6 or 7% of the stock.

Friends and other colleagues who trust our skill set and trust our judgement, own another 15% of the stock. All our actions are carefully thought out not just as management, but as shareholders. We are all big believers in our Project. When we have financed the Company over the years, management has stood beside shareholders and participated in the financings. Our actions make it clear that our objective is not just to promote this project, but to get it to a completion stage where it becomes Canada’s next copper zinc producer.

You may ask why we feel so strongly about this Company and Project? The McIlvenna Bay deposit in Saskatchewan is a rare deposit to find. This large deposit is nestled near the mining town of Flin Flon which over its 100 year history has mined more than 16 similar deposits. What we recognized is that McIlvenna Bay lies on an underexplored property and could be the jewel in a crown within other multiple similar deposits just as what happened in Flin Flon. This was an opportunity waiting for a mining team to bring to fruition.

McIlvenna Bay, is a large copper-zinc VMS deposit which was recently upgraded to just shy of 23 million tons of indicated resources, and an additional 11 million tons of inferred resources has been defined. This is like having 1.5 billion pounds of zinc and 590 million pounds of copper in the indicated categories as well as additional inferred resources of 450 million pounds of zinc and 340 million pounds of copper. But McIlvenna Bay is not the only deposit on our properties. There are the Bigstone and Balsam Deposits too. These are thought to be smaller in size and the flagship McIlvenna Bay project, but more exploration is needed to understand them better. When we first looked at McIlvenna Bay in 2010, we couldn’t believe our luck. How could a deposit of this size near infrastructure and a mining town still be unmined? We set a goal for ourselves to upgrade the Deposit and unlock its value. We wanted to build Saskatchewan’s first base metals mine in years.

Dr. Allen Alper: That's the objective.

Patrick Soares: I think that in itself differentiates us from a lot of other peer groups. We are motivated to get this Deposit to production.

Dr. Allen Alper: Well that's great. It's good to see that Management and the Directors have so much skin in the game and are aligned with other investors for the success of the project. So, that sounds great. Could you tell our readers/investors a little bit more about your background and the team?

Patrick Soares: Sure. I'm a geologist that has worked mainly in the mining space. I started off by working in gold mines in Yellowknife in the Northwest Territories, and Lupin in Nunavut. I've also worked, for a short time, at the Pine Point base metal mine that's now closed. I left active mining in 1996 to start working with junior companies such as Sutton Resources that was taken over by Barrick Gold in 1999, and after that with EuroZinc Mining that was taken over by Lundin Mining after I left. I worked with Aurizon Mines, which was a company that re-opened the Casa Berardi gold mine in Quebec and was eventually taken over by Hecla.

Then I became CEO of a company called Brett Resources in 2007, where we were developed a gold deposit in Ontario called Hammond Reef. We were taken over by Osisko Mining in 2010. So I have always been involved either with mining or trying to develop mines. In some cases, we made it to the end point where we did get them into production. For instance, Sutton's original gold mine in Tanzania, Bulyanhulu, is now owned by Acacia. It was funded by Barrick and spun out of Barrick into what became African Barrick and is now Acacia Mining. EuroZinc actually purchased the Neves-Corvo VMS deposit in Portugal, so that's a current mine in the Lundin group of companies. Then, Aurizon, of course, took Casa Berardi to production. We didn't manage to get Hammond Reef into production, but at the right gold price, it too will be a producer. Our objective here is to get McIlvenna Bay to the production stage and push it all the way through because that's where real value is created, once you're in production, once cash flow is started.

Dr. Allen Alper: Excellent. Could you mention a little bit about the other members of the team?

Patrick Soares: We're a pretty lean team. It's myself as CEO. We have a terrific CFO, Tim Thiessen. He's been involved with junior projects, including operating projects. He worked with some of Frank Giustra’s companies prior to joining us. We have a VP of Exploration, Roger March, who has worked with the Cumberland Resources that developed the Meadowbank gold project in Nunavut. Cumberland was taken over by Agnico Eagle and has also worked on a VMS deposit that is in BC. We have a group of seasoned people that understand both operations and cash flow. Our Executive Chairman, Darren Morcombe is Australian. He worked originally with Normandy Mining in Australia.

Normandy merged with Franco-Nevada and Newmont in 2002 and then Darren got a chance to work with the Franco team, deploying Newmont capital at the time. They purchased a refinery in Switzerland, near Lugano, where Darren currently lives. With a lot of hard work and entrepreneurial spirit they managed to turn a the refinery into an amazing cash flowing operation that was processing about 25% of the world's gold at one point. It turned out to be a huge success. Darren is very accomplished at finding undervalued assets, turning them around and creating wealth. That's why he works so well with guys like Pierre Lassonde, because that's exactly what Pierre does.

Our team is a combination of entrepreneurs, and mining professionals that know how to create wealth. We understand that hard work, creativity and imagination will take you to places beyond those, who saw the task as being too tough. Like all mining teams, we run into problems, but we were imaginative and creative enough that we seem to come up with solutions to our problems. It is a rare team that does that.

Dr. Allen Alper: Yeah. It sounds like you have a very strong, experienced, knowledgeable diverse group. So that sounds great. Could you say a few words about zinc and copper demands?

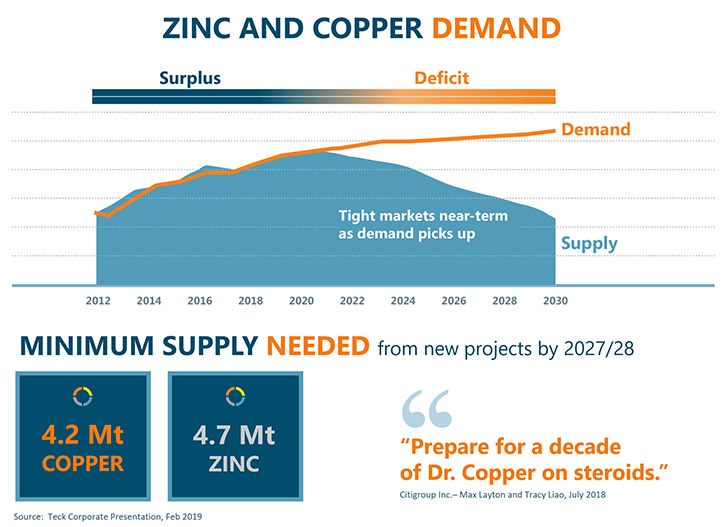

Patrick Soares: The projections right now are that zinc will be at shortage for the next few years because a number of the mines are shutting down and the Chinese have shut down smelters in China, due to pollution problems. So the actual zinc supply is tight right now. China is in a bit of a downturn currently and so the current demand for zinc isn't very high. But we think that that will turn around. We think that copper itself turned around, because there is no doubt that there is a huge movement afoot right now concerned with climate change and the push to electric vehicles is enormous. We believe that the demand for metals such as copper and zinc and cobalt is going to go through the roof. For instance, if Britain meets its objective to go completely electric vehicles by 2025 at its current rate, with about 66 million people, it would need to consume 85% of the world's currently produced copper.

It would need twice the cobalt that's currently produced and the rare earths will be off the scale. So we believe, moving to electric, reducing pollution and trying to get the earth to be less polluted, there's going to be an enormous demand for zinc and copper for a long time. Much more than we can produce at the current prices. So that's going to force prices up, if governments are serious, if there really is pressure to take it to the next level. If one country of 60 million people demands that much in resources, you can imagine what China and India and even North America will need in resources, especially copper, zinc and then the cobalt and some of the other groups such as lithium, etc. to meet their objectives. That can't happen over a short time frame.

Dr. Allen Alper: Well that sounds like an excellent opportunity for copper and zinc and the other critical minerals and metals. Could you tell us more about Foran's share structure?

Patrick Soares: Currently we have approximately, 130 million shares outstanding. Management and Directors own about 17% of that. Pierre Lassonde owns about 11 1/2 %, approximately 26%, including peers, held by high-net-worth individuals, so friends of ours. The institutional ownership is about 37% and then retail is about 19% so we don't do a lot of trading. We have been trying to focus on getting more people investing from other jurisdictions and more retail, but at the current time, our focus has been to get our project through to production. Currently we're conducting a feasibility study. We have an agreement with Glencore Canada, that they have agreed to manage their feasibility work for McIlvenna Bay in return for off-take from McIlvenna Bay.

We felt that was an offer that was too good to turn down, so we have moved forward with that. We have done about 27,000 meters of additional drilling on the property since 2018 and 2019 infill drilling on the project and that's how we brought in this new resource that I mentioned earlier. We grew it. Currently we are trying to complete the feasibility work. We told the markets that by year end we will have a feasibility study and we are working very hard to do exactly that and get the study out in the next little while.

Dr. Allen Alper: Excellent. Could you tell our readers/investors the primary reasons they should consider investing in Foran?

Patrick Soares: We are a group that is vested in our project. We have a lot of our own net-worth in this Company. We are an experienced and diverse group of professionals, who use our imagination to take it to the next step where, thanks to Pierre, we're also connected to a wide array of other mining companies, and investment people to whom he can introduce us. Pierre is like having the best investment banker you could ever have working with you and the project itself. If you're a mining town, people in the area support mining.

They live off mining. Flin Flon itself has the 777 mine that only has a couple of years of life left. We provide a potential solution if we get a positive feasibility study out that allows the people of Flin Flon to work at another mine once the 777 shuts down. We have the opportunities of zinc and copper working in our favor. All the central bankers from the developed countries have recently told their nations that our governments have to start spending fiscally. If infrastructure projects become a primary focus, the demand for all these metals is going to rise and also the prices and give us a reason to get McIlvenna Bay into production.

We're trying to catch that production before these metals prices rise because we want to actually get the cashflow into the Company as metals prices are rising. Not chasing it like explorers often do. They chase the metals prices and they manage to get to production just as metals prices are rolling over and then it's too late. That's why we're working so hard to get it to production or make a production decision anyway before metals prices start to rise.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Patrick?

Patrick Soares: We have been fairly quiet over the last year while we've been doing this feasibility study. That's hurt the share price a little bit. We're hoping in the next little while to get more news out there and to get on the road more and tell the world about our Company.

Dr. Allen Alper: Sounds excellent. Sounds like you are working very hard. You have great people. You are in a very mining friendly area, with a great resource. Your success will benefit the people in the area very much as the existing mine runs out. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.foranmining.com/

Patrick Soares

President & CEO

409 Granville Street, Suite 904

Vancouver, BC, Canada, V6C 1T2

ir@foranmining.com

|

|