Ascot Resources Ltd. (TSX: AOT, OTCQX: AOTVF) Focused on Re-Starting the Past Producing, Premier Gold Mine, located in Northwestern British Columbia in the highly prospective area known as the Golden Triangle. Interview with Derek White, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/13/2019

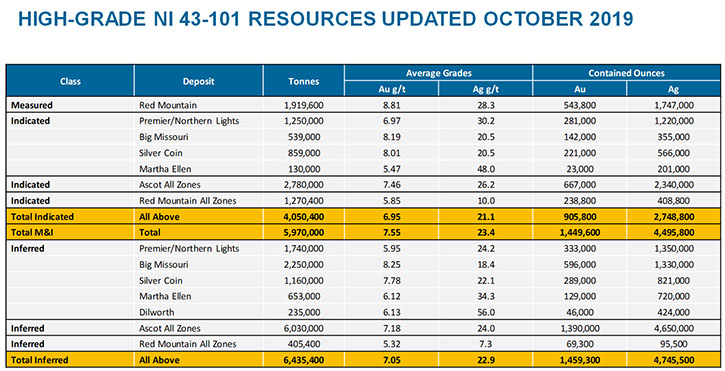

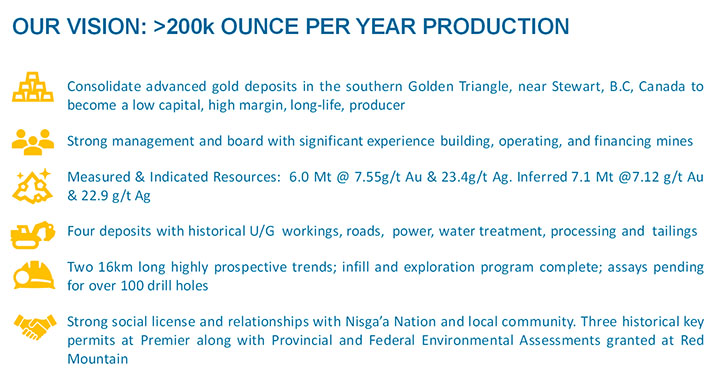

Ascot Resources Ltd. (TSX: AOT, OTCQX:AOTVF), a Vancouver based, junior exploration company, is focused on re-starting the past-producing, historic, Premier gold mine, once North America’s largest gold mine, located in British Columbia’s Golden Triangle. We learned from Derek White, President and CEO of Ascot, that after the acquisition of the Red Mountain and the Silver Coin projects, the Company has about 12 million tons of 50% measured and indicated and 50% inferred high-grade gold resource, around 7.7 to 7.8 grams of gold per ton and about 21 to 22 grams of silver per ton. Near term, Ascot is actively working on upgrading the resources and then converting into either proven or probable reserves. According to Mr. White, what differentiates Ascot is its ability to restart mining, at a very low capital cost, because of the low volume and high-grade nature of the resource and the infrastructure that is already in place. Plans for 2020 include completing feasibility study and permitting, and then financing to restart the mine.

Ascot Resources Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Derek White, who is President and CEO of Ascot Resources. Derek, could you give our readers/investors a short overview of what differentiates Ascot Resources from others?

Derek White: Sure. The strategy for Ascot has been to utilize an existing infrastructure, which was built by Boliden Westmin in the 1990s, to mine for satellite deposits to feed an existing 2500 ton a day mill. Just over two years ago, a new management team came in with a focus of building high-grade resources and re-engineering the refurbishment of the mill and the existing infrastructure. The Company started with no high-grade resources and was able to develop two high-grade resources on its own property. They then acquired two other nearby properties, one called Silver Coin from a group called Jayden Resources. The other one was Red Mountain from a company called IDM Mining.

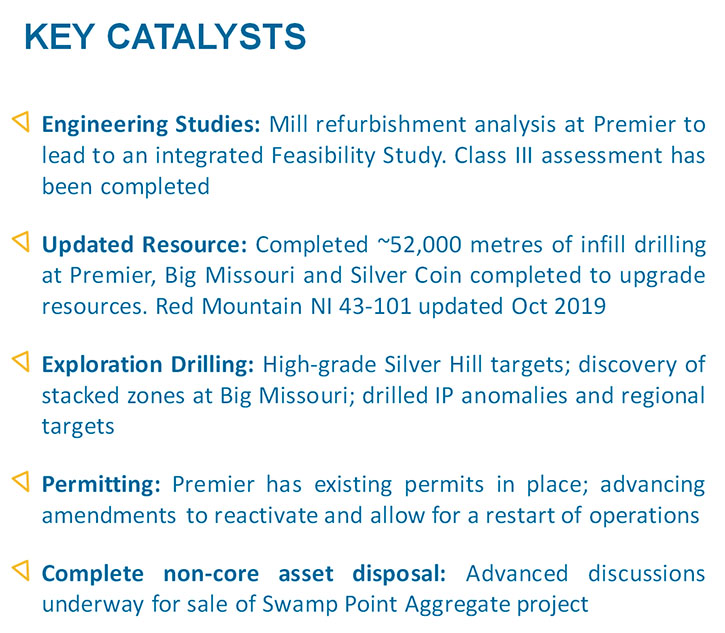

Today the Company has, roughly, 12 million tons of 50% measured and indicated and 50% inferred high-grade gold, around 7.7 to 7.8 grams per ton gold and about 21 to 22 grams per ton silver. In 2019, the acquisition of IDM happened at the end of March. In 2019, the Company completed just over 50,000 meters of drilling. In that program, it would infill drill the three deposits that are close to the mill and upgrade the feasibility level resources that existed at IDM, to work towards a new feasibility study that shows these four deposits feeding this mill. The infill drilling was to convert the resources to a measured and indicated level and then over to either proven or probable reserves.

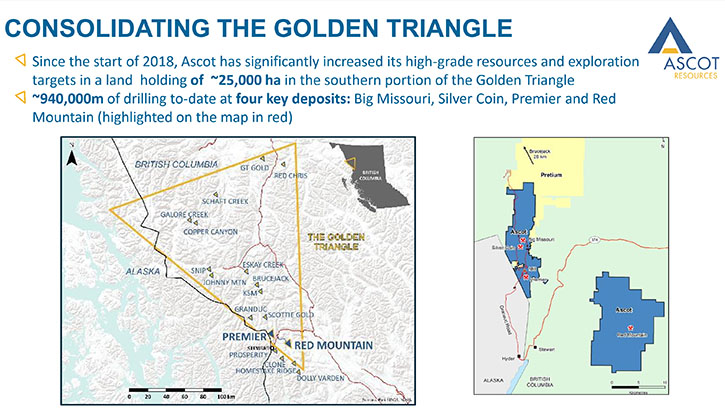

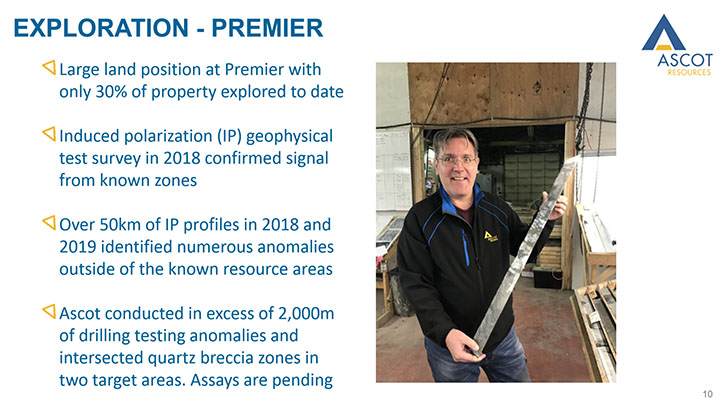

The Company did about five to 10,000 meters of exploration drilling on new deposits that exist outside of the resources area. There're about 15 different targets that they'd been working on the 25,000 hectares of land that they control in the southern part of the Golden Triangle. The Company's been hitting some exciting results earlier stage in the resources we have, and they need to be followed up. But it does indicate there's an opportunity to grow.

So in a nutshell, for a lot of investors, what differentiates Ascot is its ability to restart mining at a very low capital cost because a lot of the infrastructure is already built. The high-grade nature of the deposits and the timeframe in which the Company can go from nothing to production and still have a fair bit of exploration upside. So for exploration guys, there's a lot of upside on the exploration side, and for people that are wanting development that's moving to production, because a lot of this is low capital production in a short timeframe.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about the highlights of 2019 and maybe some of your plans for 2020?

Derek White: Sure. I think the highlights for 2019 were, number one, completing the acquisition of Red Mountain. That happened at the end of March, early April. And then incorporating that into the Company’s plans and working towards the engineering studies that support the restart of the mine. On top of that, one of the zones that the Company found during its exploration activities in 2019 was an area called Silver Hill. The grab samples there were 10,000 grams a ton silver, so extremely high-grade silver, and between 10 and 20 grams gold on a boundary, which is a little bit different from the rest of the property, which were between the same stratigraphy in which Eskay Creek was found. So that was a new target that was unexpected. Our neighbors, Pretium Resources, have also been drilling these kinds of targets on their property, which sits to the east of us.

The other big thing was making a lot of progress on opening up the underground areas, determining where the resources continue to have continuity and higher-grade reserves, and making sure that the infrastructure plans, in terms of restarting the plant and doing things, were falling in line with our expectations. Now, 2019 isn't quite over yet, so we still have a little more work to do, but the Company made tremendous progress on infill drilling, identifying new exploration targets, and advancing the engineering studies towards the ultimate feasibility study for restarting the operation.

In terms of 2020, where does the Company go from here? In the first quarter of 2020, the Company is planning to complete its feasibility work then seek the different financing or capital sources that we will require to restart the mine for low capital cost. And then order the significant components that we need to refurbish the mill and work towards restarting of the mine, depending on the timing of the Mines Act Amendment and the timing of raising that capital. At the same time, continuing to explore the numerous targets that we have to expand the resources and convert more resources into reserves going forward.

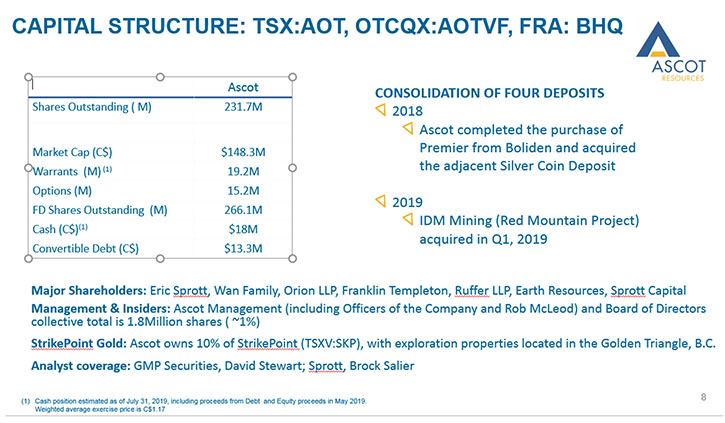

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a bit about your capital and share structure?

Derek White: Sure. When management started in about the fall of 2017 or early 2018, the Company had about 160 million shares fully diluted outstanding. Through the two acquisitions of IDM and the acquisition of Silver Coin, plus raising this capital for the drilling, the Company increased that to about 232 million shares outstanding. The Company, right now, has about $15 million in its bank account, which it's spending towards some of the exploration and engineering studies that are being undertaken.

The next financing for the Company is a combination of project financing, potential royalties, and some equity. The Company believes that by doing that, they can reduce the amount of dilution and allow the increased value to go back to their shareholders.

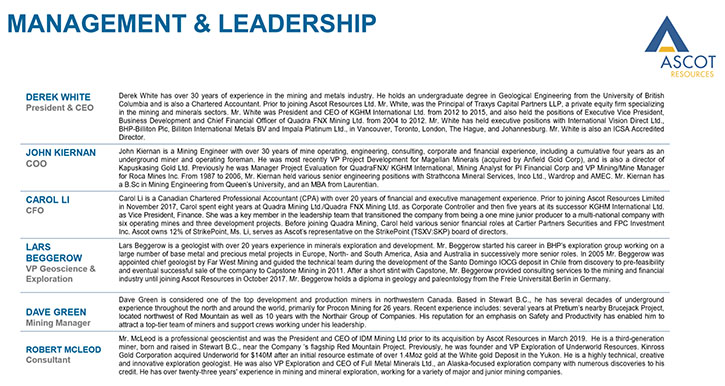

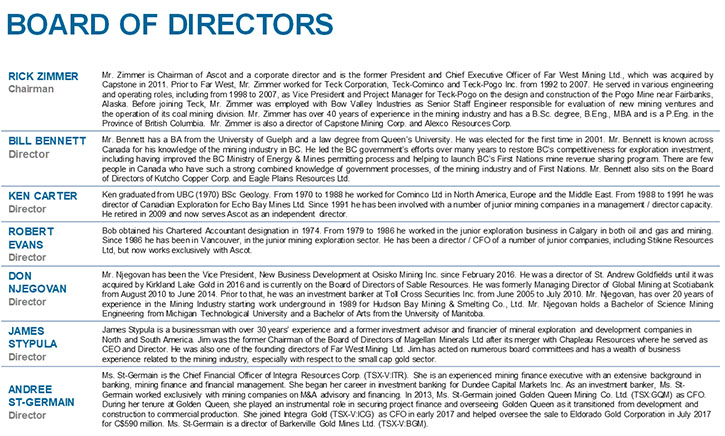

Dr. Allen Alper: That sounds excellent. Could you give our readers/investors your background and your Team and your Board?

Derek White: Starting with myself, I'm an engineer, a geological engineer. I graduated from UBC about 40 years ago, and I've had about 30 to 35 years of experience in the mining industry. Prior to this, I've worked for BHP-Billiton, Rio Algom, Quadra Mining, and most recently Ascot.

A lot of the team that's here came from the Quadra mining days. Quadra was another company that restarted a copper gold mine in Nevada and grew from $100 million to a $3 billion market cap, when they sold the Company to the Polish miner, KGHM. So there are a lot of people here with operating, building, financing skills, and geological skills that either came from BHP-Billiton or from Rio Algom/Quadra FNX. So the team's been together for quite a period of time. There are some other people that have joined us, and so we feel pretty good about it.

On the Board side of it, when the Company hired the new Management Team, we changed the Board around. The Chairman is Rick Zimmer, who's a mining engineer that has spent a lot of his career working for Teck Resources. We have Don Njegovan, who's also a mining engineer, who's the COO of Osisko Mining. We have the former Minister of Mines, the Honorable Bill Bennett, who comes from a legal background. We have a retired geologist named Ken Carter, who comes from Cominco before it was Teck Cominco, and has been involved with both operations and explorations. We have the former CFO, a CA named Bob Evans. When we acquired IDM, Andree St Germain, a CFA and CA, came from the Integra organization and is a recent addition to the Board.

Dr. Allen Alper: Well, you and your Board and Team have great backgrounds, so that's excellent.

Derek White: Yes, Dr. Alper, one of the things we're trying to balance is the upside for explorationists and people that would like to see us increase the resources and those that would like to see us develop the mine and put it back into production to get cashflow. The team is trying to do both of those things at the same time, and is very capable of doing that. That's one of the reasons we like Ascot. It gives people, who like the upside, a lot of exploration, upside targets, and a free option on the restart of a low-cost mine. For those people that liked the mining, we have a short time frame to get back to mining production at a high grade and good margins, with the free option of the exploration. So it appeals to both types of shareholders.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors the primary reasons they should consider investing in Ascot Resources?

Derek White: The first reason is, we've seen the gold price do better over the last six months and we think it's poised for potentially a big increase. It takes a long time for development companies to ultimately get into production. It also requires a lot of capital. Although Ascot's been around for a long time, at least in the last year, the Company has identified the resources and has been putting in the engineering work, this year, to make a restart happen at a low capital cost. Also being exposed to high-grade gold of what I would call significant critical mass level of potential production profile. We have great leverage as the gold price does well. So the timing for us, assuming that the gold price does well for the next few years, couldn't be better. Right now, the stock price has been depressed a little bit waiting for us to finish our feasibility studies, so it's a great time to get in, and there's a lot of leverage at a lower risk.

On the upside, we're in one of the primary areas of the Golden Triangle, closest to the port of Stewart, British Columbia, with a lot of exploration targets. We have over 900,000 meters of drilling here, which is a lot of drilling over a lot of time. So there's a lot of targets to expand in and have additional upside through exploration success. We think if we can expose the shareholders to both of those things, that's something that not that many companies can do.

Dr. Allen Alper: Well, Ascot Resources is definitely an outstanding Company and has great potential. Derek, is there anything else you'd like to add?

Derek White: I want to say to the investors, mining is a long-term game, and I appreciate that we can't do everything immediately. But at these prices, it's really a great opportunity to get in, because as we develop a feasibility study and develop towards production, we expect things to increase in terms of the Company's value. And I would hope that people, if they have any further questions, will contact myself or our investor relations person, Kristina Howe. You can get our contact details at https://www.ascotgold.com/

Dr. Allen Alper: Oh, that's great. Thank you very much, Derek. I enjoyed talking with you and updating our readers/investors. You have a fantastic Company.

Derek White: Well, thank you very much for interviewing us at Ascot Gold for Metals News and I appreciate your comment.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://ascotgold.com/

https://www.vrify.com/explore/companies/ascot-resources-ltd

Ascot Resources Ltd.

Kristina Howe

VP, Investor Relations

Tel: 778-725-1060 ext. 1019

Email: khowe@ascotgold.com

|

|