Wealth Minerals Ltd. (TSXV: WML; OTCQX: WMLLF; SSE: WMLCL; Frankfurt: EJZN): Lithium -Focused, Partnered with Rosatom, Separate Lithium out of Brines, without an Evaporation Process, Interview with Henk van Alphen, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/12/2019

Wealth Minerals Ltd. (TSXV: WML; OTCQX: WMLLF; SSE: WMLCL; Frankfurt: EJZN) is a lithium focused, mineral resource company, with interests in Canada, Mexico, Peru and Chile. We learned from Henk van Alphen, CEO of Wealth Minerals, that they have partnered with Rosatom, a Russian state corporation and the largest nuclear power corporation in the world, with the goal to use its resources and its technology (that can separate lithium out of brines, without an evaporation process). We learned from Mr. van Alphen that, as of recently, Wealth Minerals is expanding into the copper business, with two copper projects in Chile that will be operating as an independent company by the name of Wealth Copper, with a large ownership in Wealth Minerals. According to Mr. van Alphen, they have an opportunity, in the near term, to consolidate the lithium space, with the help of Rosatom.

Wealth Minerals Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Henk van Alphen, CEO of Wealth Minerals Ltd. Henk could you give our readers/investors, an overview of your Company?

Henk van Alphen:Wealth Minerals became involved in the lithium space in Chile in 2016, 2017. 2017 was a fabulous year for lithium. I went to Chile, looked at the lithium space there. Chili is one of the finest places to be when you're in the lithium business. The only problem they had, and to a certain extent still do, is that it's a strategic mineral, and therefore you need to have a partner, or a government corporation partner, in order to be able to either export lithium, or waiting for the regulations to change. They told me three years ago, they were going to change it today. That still hasn't happened. Even though they keep on talking about changing their regulations.

Strategic minerals created the opportunity for a company like Wealth to go in there and grab whatever we could, because there was really no competition. Most other lithium companies are all basically operating in Argentina, in the lithium brine triangle, Bolivia, Argentina, Chile.

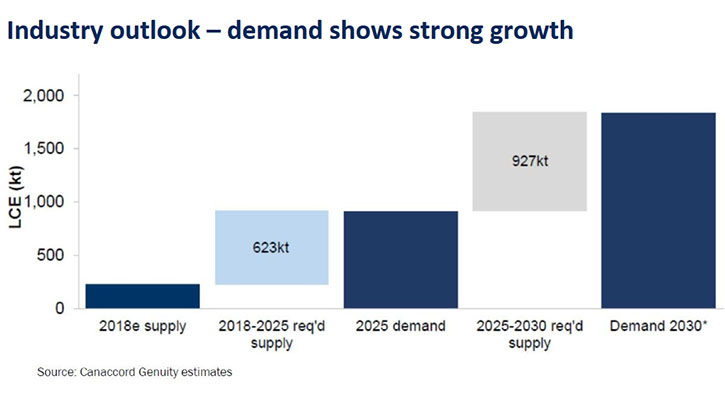

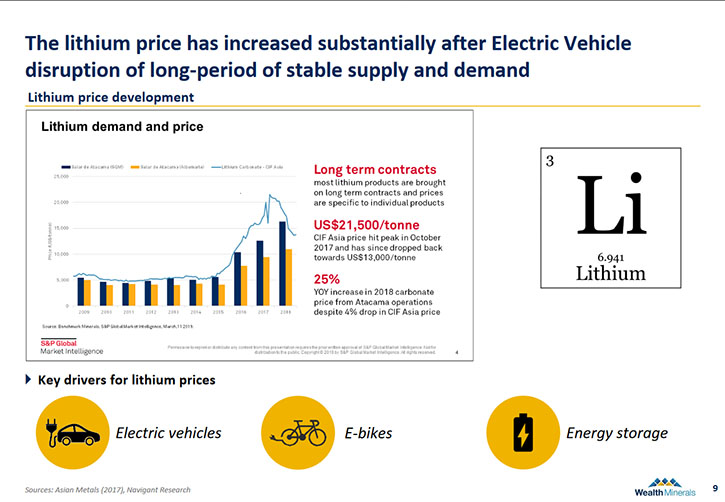

So we are in a sense somewhat unique. I had a friend in Chile, who was the ex-CEO of Antofagasta Minerals. His name is Marcel Awad. I talked to him and I said, "Look, I think there's an opportunity here. We should just grab whatever we can. And then when the regulations change or we make a deal with the government, we'll be the most sought after lithium company." So that actually went very well in 2017 when there were enormous amounts of super exuberance around lithium. It didn't really go that well in 2018 and 2019 as you know. Lithium is not really as popular as it was, even though I think there's going to be quite a shortage of lithium in the very near future, with all these electric cars hitting the market finally. That's probably been delayed a little bit more than anybody anticipated.

So what I've learned over the years, being in the lithium space, certainly in the brine lithium space, is that it's nowhere near as easy to produce as one would think. You have brine. You pump it out of a salar, then you put it into an evaporation pond, it evaporates, and out pops lithium, let's say. That sounds pretty good, but it doesn't really work that well.

There are not too many companies that have moved any projects forward. I think this is also probably one of the reasons why there is going to be a shortage of lithium developing in the near future. In the lithium brine business, I think you need to have a new technology. When you're in the mining industry, new technology is a little bit of a swear word, since it's very difficult to finance.

Most mining companies shy away from it. Last week we announced a deal with a company called Rosatom, which is a very large Russian owned corporation, the largest nuclear power corporation in the world. And they do have a technology that actually works for them in Russia whereby they separate lithium out of brines without an evaporation process. The evaporation process has two negatives. It's very inefficient. It recovers less than 50% of the lithium and it evaporates water in desert environments, which is not popular to do.

So we were very fortunate to sign a deal with Rosatom, whereby they will be our strategic partner moving our lithium projects forward in Chile. That's just happened last week. The thing that I think is very important in this is that they have a technology, and they also have the financial clout to move this forward. So we are blessed with a technology that is actually beyond a bench scale scope. Also, they do have the financial clout to move a project forward, with the new technology. That’s going to be very difficult to do for other technology companies, which are all relying on the money from the companies they deal with. So we're unique in that in the lithium brine area.

The other thing Wealth has done since being in Chile, is we have Marcelo A. Awad as our main person there. Marcelo was the CEO of Antofagasta Minerals, a big local copper producer, trading on the FTSE 100 in London. So I decided we should start a copper company, since we have Marcel, as our main guy there, who was actually a copper man, as opposed to lithium man. We just started putting that together in the last few months. So we have a couple of copper projects in Chile, which will be operating as an independent trading company, with a large, about 40% ownership, to Wealth Minerals. So that's how that all came about.

Dr. Allen Alper: Well that's great! Sounds like you're very well positioned, being in a very rich area for lithium, and in Chile, a great place to be for copper! Could you tell our readers/investors a bit more about your plans for the rest of 2019, going into 2020?

Henk van Alphen: The copper will be spun out into a separate vehicle on the TSX E. It will be called Wealth Copper. Wealth will be an owner of that company in terms of shareholdings, but it will be operating as a separate entity.

Wealth Minerals, since we have done the deal with Rosatom, should start to take advantage of consolidating the lithium space a bit in the lithium triangle, which has a lot of lithium deposits, and a lot of them are just sitting there really not moving forward at all. I think the opportunity to consolidate is there, and somebody should take advantage of it.

And Wealth, with our partner Rosatom and technology, we should at least be one of the companies that try to consolidate that world, as I really believe lithium is going to be a very popular commodity. Today when you buy an electric car, you have the choice of Tesla and a few models. Mainstream car manufacturers have just barely started producing electric models, but that should speed up in the coming years. I don't think there is enough lithium being produced anywhere to satisfy that demand. So lithium should become a very popular commodity again. I think we should try to be at the forefront of that consolidation in the industry.

So that's what I'm trying to do for Wealth Minerals, as well as a couple of other projects. We have a nickel project in British Columbia. I'm just raising some flow through money for that. It's geologically very interesting in the BC government minerals department. They really profiled it quite a bit, in February in Vancouver, as a new exciting discovery that was being made. We own claims in that area, and we're just going to start working there.

Wealth also has had a silver project in Mexico for a long time. I finally made a deal with the people that own the service rights on that project. We're going to be starting to work on the silver project in Mexico as well. So we have the lithium, and those two other projects going at the same time. So that's all the remainder of 2019, and 2020.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your background, your Team, and your Board?

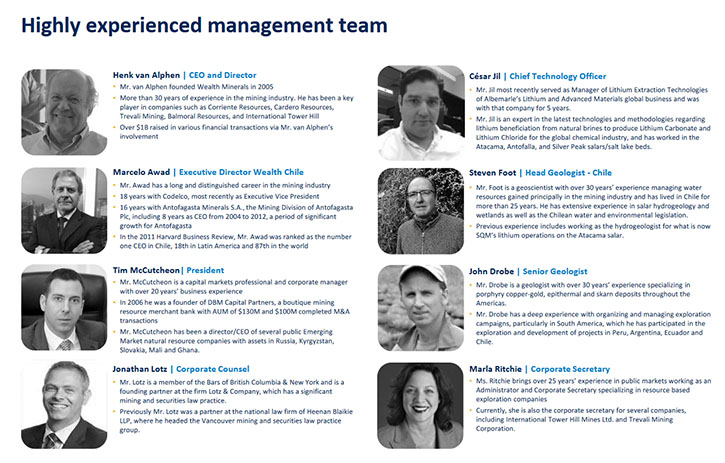

Henk van Alphen: I started my first company in 1990. I went to Argentina with a company, and it became relatively successful. I've started about 12 companies in my career, and all of them have done fairly well in the marketplace, not entirely all with the ending being perfect, but they all have created huge amounts of shareholder value. So I've been doing this for quite a long time.

We have a good team in the office. Geologically and technically, we have highly experienced, extremely knowledgeable geoscientists with specific experience related to what they are doing for us. We have an excellent IR situation. We know how to promote shares.

I've been around, for at least 30 years doing this, and with a reasonable amount of success. I like our geological team and have confidence in them. I think they're much better than most and that's it in the end, finding a good deposit, then being able to move it forward. That’s what it's all about, yeah?

Dr. Allen Alper: Well that's great. That's great to have someone in charge who has a great deal of experience working with companies, and starting them, and moving them along. That's excellent! Could you tell our readers/investors a little bit about your capital structure, your share structure?

Henk van Alphen: It's trading at around 35 cents. There are about 150 million shares outstanding. It's really a retail owned company. We have a very loyal following in terms of shareholders. The top 10 shareholders probably own something like 60% of the shares. So it's fairly well held, long-term shareholders.

Unfortunately, in 2017, Wealth went into the lithium space, when it was a very popular thing to do. We traded at around $2, and now we're trading at 35 cents because lithium fell out of favor. But, it's a commodity that I think is going to be in very short supply. We should see another big boost coming on in the next two, three years. Then obviously the market will come right back to lithium again.

Wealth Copper is a spin out. Wealth will own 25 million shares. The company that is an owner of one of the projects will end up with 25 million shares. Those are restricted for the first three years, can't be sold at all. Then the next two years after that, we can only sell 10% of the volume. So the shares are restricted for five years.

There was a financing done. The total outstanding is about 64 million shares, of which about 50 million are locked up. The next round, once it becomes public, I will be looking to finance, let's say, 10 million shares at 20 cents. So that's the Wealth's Copper spin out.

Dr. Allen Alper: Wow, that sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Wealth Minerals?

Henk van Alphen: For Wealth Minerals in the lithium space, we had a high of $2. We're sitting at 35 cents today, which is probably as low as it's ever been. Things are now turning around. We have a strategic partner, so we can move our projects forward. They will write the checks for moving the projects forward. This is an opportune time to start looking at Wealth, or looking at the lithium space again, because it's not just Wealth that's suffering from low share prices. Every other lithium company has the same problem.

With the new demands coming on in the electric vehicles, I think you'll see a turnaround in the lithium space. On top of that, with Wealth Minerals, we are going to start spending money on our silver project in Mexico, which is really a bulk tonnage, great looking, silver project. Those are hard to come by. We've had it on the books for at least 10 years, and I finally made a deal with the service owner to move this project forward. So that by itself could easily be responsible for doubling the share price of Wealth.

Then we have a nickel project in British Columbia that we're going to start working on. It's a three prong approach now, but overall lithium will be coming back, and it's a good place to start looking again. There was a lot of money made in the early days in the lithium space in 2016, 2017. And then 2018, and 2019, basically killed the whole thing. But it's far from gone. So this is the time you really have to start looking again.

Dr. Allen Alper: Could you tell us a little more about what's happening with electric vehicles and power storage, and what some of the market projections are.

Henk van Alphen: The reason I was convinced to get into the lithium space was, I traveled to China quite a bit. When you go to China, you see the pollution they suffer in the major cities and you know something has to be done. It's not only China, but every major city in the world.

The easiest thing to do is get away from the fossil fuels in cars, and go into electric vehicles. That's just a matter of changing that whole dynamic of gas stations to charging stations. The youth today would be more likely to buy an electric car than to buy one with an internal combustion engine, because it's much better for the environment. Therefore this change is going to take place whether we like it or not. The moving parts in an electric car are nothing compared to those of an internal combustion engine car. So it makes sense for the change to happen.

And once it starts to change, it will go in a big way, because now everybody is worried about the range of an electric car, or charging. Once that suddenly is being dealt with and batteries are becoming more and more efficient and longer range, all those issues will eventually go away. And that may happen sooner than later. All the major companies, like I know Volkswagen is, talking about $80 billion of investments going into electric vehicles. Volvo is going to completely stop making internal combustion engines, starting next year. So the trend is going and will result in millions of tons of lithium being consumed every year. There is no such supply today, nowhere near that much. So there will be a crunch coming, whereby the price is going to come back up again and everybody is going to be running around for the next lithium boom.

Dr. Allen Alper: I think what you're projecting is correct. Most people believe that trend is going towards the electric vehicle, and of course lithium plays a dominant role in that.

Henk van Alphen: Yes, that will have a major effect in the copper space as well because electric vehicles use 10 times as much copper as a normal a car.

Dr. Allen Alper: Is there anything else you'd like to add Henk?

Henk van Alphen: In the Atacama Salar, where we have our big main project, competitors Albemarle and SQM are using an evaporation process. It's one of the driest places in the world. Evaporating water in a very dry environment, is never that popular.

So the change is going to have to happen in the lithium brine business, from an evaporation process to a new technology process. Whoever can do that, is going to be one of the winners. We are very fortunate to have a company like Rosatom as a partner, which has the technology and the financial ability to move it forward.

So I think that will set us apart from most other companies. Plus we operate in Chile, which is one of the most stable jurisdictions in South America.

Dr. Allen Alper: Well that sounds excellent. Could you tell our readers/investors more about the Rosatom process? Or is that confidential?

Henk van Alphen: Those are very confidential technologies in a sense. We are very blessed. We have a person in our organization that was the chief technology officer for Albemarle, the largest producer of lithium in the world. So we have the in-house expertise to understand how the technologies work, how the evaporation process works, but most of the processes are really, quite confidential. But it really is a fancy filtration process that takes the lithium out. It doesn't happen that easily, but that's really basically what it is.

Dr. Allen Alper: Excellent! That sounds very good! Is there anything you would like to add?

Henk van Alphen: Just to thank you for interviewing me at Wealth Minerals Ltd. for Metals News.

Dr. Allen Alper: Thank you for telling us about your exciting plans. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://wealthminerals.com/

Michael Pound, Henk van Alphen or Tim McCutcheon

Phone: 604-331-0096 Ext. 3886 or 604-638-3886

E-mail: info@wealthminerals.com

|

|