Atico Mining Corporation (TSX.V:ATY, OTC:ATCMF): Focused on Becoming a Mid-Tier, Copper-Gold Producer in Latin America; Interview with Igor Dutina, Corporate Development

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/9/2019

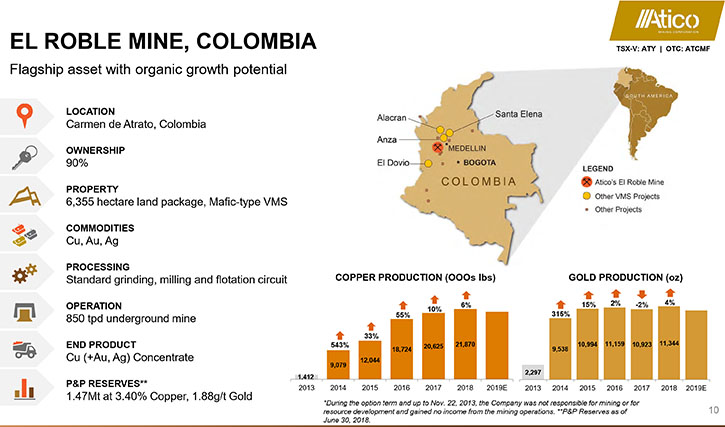

Atico Mining Corporation (TSX.V:ATY, OTC:ATCMF) is focused on developing and operating copper-gold projects in Latin America, with the strategy to build a mid-tier, copper-gold producer, by acquiring advanced-stage projects, with potential for high-margin operations and sustainable organic growth. We learned from Igor Dutina, Corporate Development of Atico Mining, that their plan for the past two year has been is to transform the El Roble Mine to raise operational standards and improve the capacity. Atico managed to grow copper production over 14 times and gold production over five and a half times. Currently Atico is doing regional exploration to improve the resource and organically grow the operation through discovery. We learned from Mr. Dutina that Atico Mining recently acquired Toachi Mining Inc., creating a leading Latin American copper-gold operator, developer and explorer.

El Roble Mine Concentrate thickener

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Igor Dutina, Corporate Development of Atico Mining Corporation.

Igor, I wonder if you could give our readers/investors an overview of your Company and what differentiates Atico from others.

Igor Dutina: Absolutely. Al. Thank you very much for the introduction and for taking an interest in our Company.

Right off the bat, what differentiates Atico is that Atico is a very exciting exploration story, but it's also generating free cashflow. So I think that significantly de-risks and also differentiates us from a lot of the other explorers in the space.

A brief history of Atico- Atico was founded by the same group that founded Fortuna Silver Mines, which is the Ganoza family. This group successfully transformed Fortuna from a 40- or 50-million-market-cap company to an over-a-billion-market-cap Company at its peak. And Fortuna still continues to operate with a high efficiency and strong returns to its shareholders.

The way Atico was formed was with a tremendous review of assets in Latin America by this group. They noticed that there were quite a lot of opportunities in the copper and gold space that didn't necessarily make a lot of sense for Fortuna. The group decided to form a new vehicle, a new company, and that's how Atico came to be.

Atico's flagship asset is the El Roble Mine. El Roble is a mine that's in operation, generating free cash. What's really interesting about El Roble is that it has a very large land package, contiguous of its mining claims and its operating mine.

What really caught the eye of the founding group was that this is a VMS in production, with a large, attractive land package and ample opportunity for discovery.

At that time the plan was to transform the El Roble Mine to raise operational standards and improve and take the operation to the best capacity to be had with the current resources.

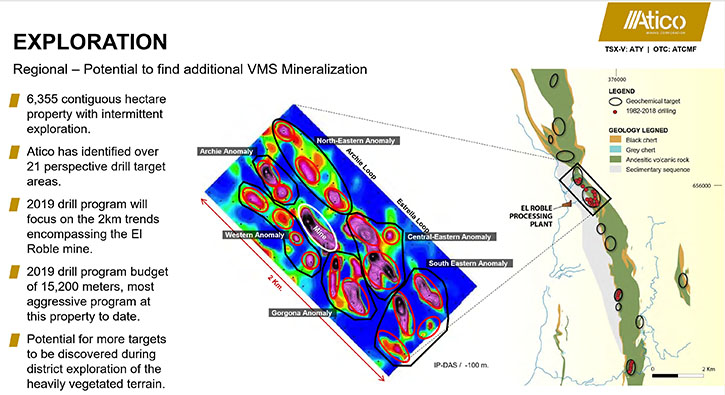

And that's exactly what we've been up to for the last couple of years. The team has significantly been improving operations while, while paying off its debt and preparing for the regional exploration program. In the last 18 to 24 months, we started drilling the regional targets on the larger land package, which is where we think we can add the most value to our current and prospective shareholders.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors a bit more about your plans for the remainder of the year and going into 2020?

Igor Dutina: Absolutely. Thank you, thank you for asking. It's a great question.

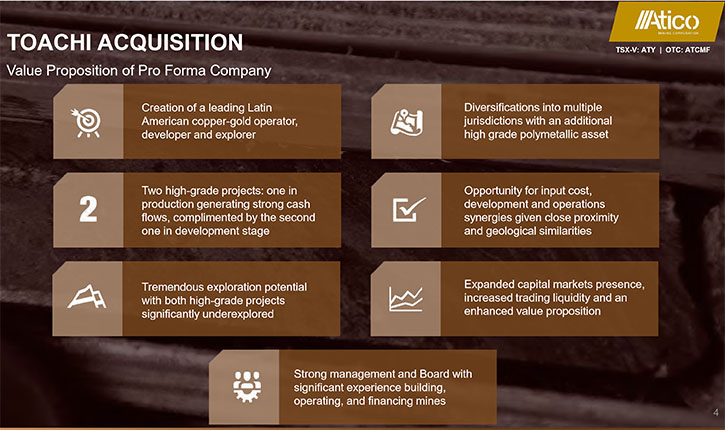

As a part of our mandate, we also have a parallel strategy. With El Roble, the plan is to grow the operation organically, through discovery. But we also have a strategy to grow through mergers and acquisitions, by adding other assets to this Company. We did just that, in September of this year, we ended up merging with Toachi Mining.

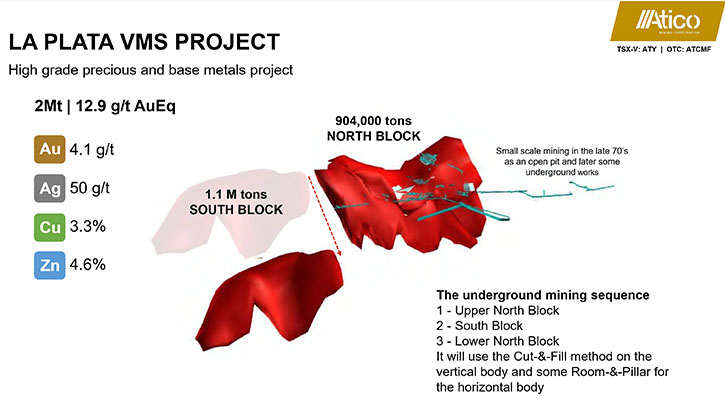

Toachi Mining is a very interesting company, with a very interesting high-grade project called the La Plata, a VMS project in Ecuador. We think we can execute like we've done with El Roble, but this time at La Plata. The plan, over the next 24 to 30 months, will be to advance La Plata, a high-grade copper-gold VMS, just like El Roble. It has a very nice resource base already, including warm targets that already have had some exploration success, but are not a part of the current resource. We think in the short term, in the next following quarters, we can have drill results from these target areas and hopefully grow the resource base further at the La Plata VMS.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your management team and your background?

Igor Dutina: Absolutely. The Ganoza family is a very reputable mining family in South America. Fortuna Silver Mines is their first public vehicle. But they've been in the mining business for generations. Our CEO is a fourth-generation miner. The group has successfully put into production three operations in the last, I would say, 10 years, and they are on to their fourth in Argentina, in the first quarter of next year. The track record speaks for itself. These guys are proven mine-builders and operators.

I've been with the Company now for almost seven years, the following year after Atico was created. Together with the team, we've continued to grow this Company, delivering on most of our objectives, if not all.

Dr. Allen Alper: Sounds like a great team and you have an excellent background. Could you tell our readers/investors a bit about your share and capital structure?

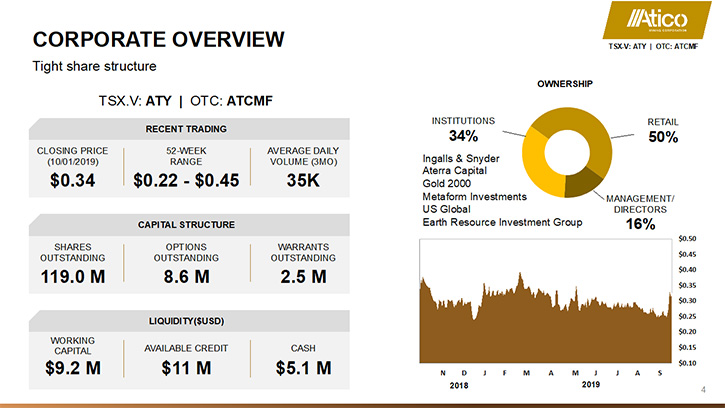

Igor Dutina: Absolutely. The new Company should have around a hundred million, 119 million shares outstanding, with about 9 million options and about 2.5 million warrants.

The Company is in a very strong financial position. Our cash is north of 6 million. And we have a working capital of over $9 million.

We currently have about $3.3 million in long-term along with some short-term debt which is mostly used for day-to-day working capital needs.

We also have around $11 million in available credit facilities in Colombia, which we mostly use for working capital needs in country.

Our market cap today sits at around $40 million Canadian. Our three-month volume averages around 40,000 shares traded. This is a tremendous opportunity, given that the Company generates close to $60 million in revenue and about a $12 million free cashflow per year. These are all U.S. numbers. So one can have a strong argument that we are significantly undervalued.

We are trading at just over two and a half times free cashflow. So we think there is a tremendous opportunity to grow in the coming years as we continue to deliver on our objectives.

Dr. Allen Alper: Sounds excellent. Sounds like a great opportunity, a great position you're in. Could you tell our readers/investors a bit more about how it is operating in Colombia and Ecuador?

Igor Dutina: We've been in Colombia for over six years. It's been challenging, mostly because Colombia is a new mining jurisdiction. It has some larger-scale operations, but they're in other resource sectors like oil, coal and other mining businesses. When it comes to metals mining, it is a very young jurisdiction. But aside from that, given that we have an operating permit, we find it manageable. You can navigate the challenges and continue to operate successfully.

Ecuador, from our point of view, is becoming a booming jurisdiction because the government is making a tremendous push towards mining. Ecuador has had a number of large companies that have started to invest in the country, such as BHP and Newcrest. Codelco has been there for a while, and now recently Lundin Gold. These guys typically move into jurisdictions, where they feel they can operate. So the road is being paved for us by companies like Lundin Gold and the Fruta del Norte project. This property should be going into production by the end of this year. I think that speaks volumes for what Ecuador's trying to do. And we think it's the right time to be thinking about going into Ecuador.

Dr. Allen Alper: That sounds excellent. Great opportunity for Atico. Could you summarize the primary reasons our readers/investors should consider investing in Atico?

Igor Dutina: Absolutely, from our perspective, this is a company that has now diversified into two jurisdictions. It has free cashflow. It has a plan on how to increase that free cashflow. On top of all of that, it has two properties, both with very large land packages in their respective jurisdictions, with tremendous exploration upside.

If we are successful delivering on our goals, we can be very accretive to our shareholders and prospective shareholders, while at the same time mitigating the downside risk, by having a strong financial position and continuous cashflow while trying to execute these strategies.

Dr. Allen Alper: All right. Sounds like very strong reasons for readers/investors to consider investing in Atico. Is there anything else you'd like to add, Igor?

Igor Dutina: Thank you for interviewing us for Metals News. If any of your readers/investors have any follow-up questions, I would really appreciate if they would contact me. My contact information is available on the Atico website. The phone number here at our office is 604-633-9022. I can also be reached at info@aticomining.com. I would love to have a discussion or an opportunity to answer any questions that may arise from this.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://aticomining.com/

Igor Dutina

Corporate Development

Atico Mining Corporation

604-633-9022

idutina@aticomining.com

|

|