Chalice Gold (ASX: CHN, TSX: CXN, OTCQB: CGMLF): Portfolio of District-Scale Gold and Nickel Sulfide Exploration Projects, in High-Grade Mining Regions of Australia; Interview with Alex Dorsch, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/9/2019

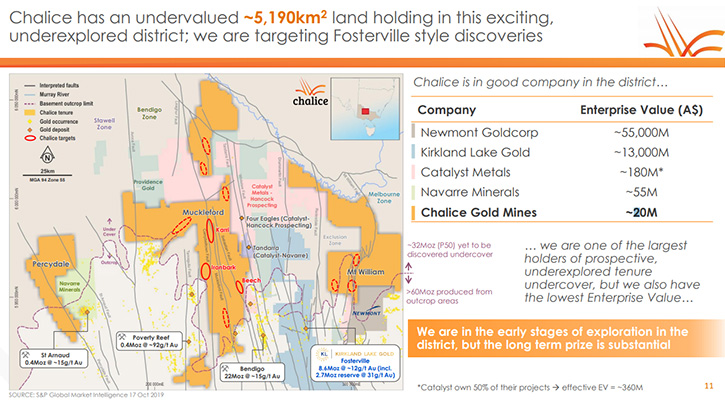

Chalice Gold Mines (ASX: CHN, TSX: CXN, OTCQB: CGMLF) is focused on a portfolio of district-scale gold and nickel sulphide exploration projects, in high-grade mining regions of Australia: the 100%-owned Pyramid Hill Gold Project, in the highly prospective and reinvigorated Bendigo gold district of Victoria, and the King Leopold Nickel Project, in the frontier west Kimberley region of WA. Chalice has been actively exploring across both projects, with an exciting new phase of drilling, recently commenced in Victoria. We learned from Alex Dorsch, Managing Director of Chalice, that multiple well-timed asset sales have positioned them in a strong and unique financial position for a small exploration company. Since 2012, Chalice has returned about a third of that profit to its shareholders, while still keeping ~30 million AUD in working capital. According to Mr. Dorsch, Chalice hasn't raised any capital for about eight years, avoiding dilution. Mr. Dorsch believes that the large-scale gold targets they are currently drilling at their 5,190km² Pyramid Hill Project in Victoria, represent high profile targets, with strong upside potential. The Company's team is made-up of highly credentialed mining executives, who have made discoveries and run successful mining companies before.

The Pyramid Hill Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Alex Dorsch, Managing Director. I wonder if you could give our readers/investors an overview of your Company and what differentiates your Company from others.

Alex Dorsch:Chalice is a well-funded mineral exploration business based in Perth, Western Australia. The sheer size of our two flagship projects and level of our exploration activity makes us unique, and our strong balance sheet means we can explore quickly and at scale.

Chalice has a dual gold-nickel focus with two significant exploration programs currently underway on our key projects, both located in favourable Australian mining regions and in proximity to some major discoveries.

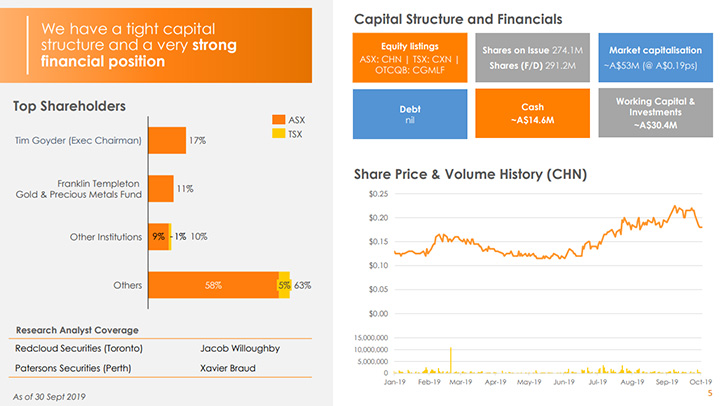

Our strong financial position is another unique factor for a company of our size, and we have a strong track record in generating that capital. We have approximately 30 million Australian dollars in working capital and investments, which equates to about 11 cents Australian per share. And that's in the context of our market capitalization, which is sitting today at 19 cents or about 52 million Australian dollars.

We haven't raised any capital since 2011, but we have sold a couple of assets at a very good profit. That's positioned us exceptionally well, from a financial perspective. Of about 100 million Australian dollars that we generated, about a third has gone back to shareholders in the form of special dividends.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors about your two projects, the gold project and the nickel project?

Alex Dorsch: The Pyramid Hill Gold Project in Victoria, Australia, is our flagship asset. We hold over 5,190 square kilometers under license, which is about 1.3 million acres in the old system. That's a very, very large land holding in a very, very prospective but unexplored gold district. All those licenses are 100% owned by Chalice and we've essentially held those since late 2017. It is early days still, but we believe it is a very high potential area.

Our King Leopold Nickel Project is on the opposite side of Australia in the West Kimberly region of WA. Chalice is exploring for nickel sulfides, again in a very large area of about 1,800 square kilometers in a very under-explored part of Australia. However that province has substantially grown in prospectivity over the last couple of years with some recent nearby discoveries, as well as an entry by Aussie mid-cap company IGO.

Dr. Allen Alper: Sounds like two exciting opportunities. Could you elaborate more on any data you have, so far, on the gold project?

Alex Dorsch: At the Pyramid Hill Gold Project, we've been exploring for about 18 months. We've done a lot of targeting work and compilation of regional data sets, like geophysical data sets and geochemistry soil sampling to narrow in on areas and prioritize drilling. We started our first phase of drilling in November 2018. We drilled almost 40,000 meters of air core drilling, quite a lot of in meterage terms, but fairly low in terms of expenditure.

This Phase 1 program successfully identified three large-scale areas – the Ironbark Target, Karri Target and Beech Target. We recently commenced our Phase 2 ~24,500m AC drill program, targeting these anomalies, with the first round of assays due mid-November 2019.

One of the benefits of exploring in Victoria is that it's a fantastic place to explore in terms of the geological endowment. It has fantastically prospective geology. It also is a very temperate climate and a very accessible part of the world. Most of the land we drill on is farm land, either paddock or crops, so very cost effective to drill. Our all in costs for that program are about $40 a meter, which is very cheap compared to doing an equivalent program in Canada, say. That would be in the $200 per meter price category. It's a good place to explore because we can do a lot of meters for not much money.

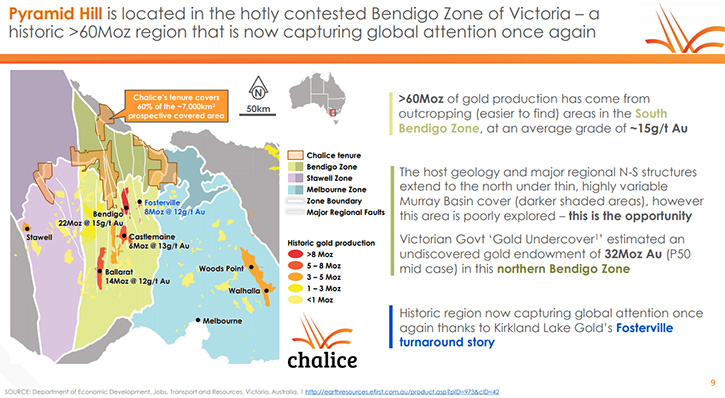

Dr. Allen Alper: Could you tell our readers/investors a little bit about the amount of gold that has been found in the Bendigo zone of Victoria.

Alex Dorsch: Bendigo is a province that has a lot of similarities with the Californian gold fields. It's a sedimentary belt that kicked off the initial gold rush in Australia, which began in central Victoria. In the mid-19th century, a similar time to the Californian Gold Rush, there were literally hundreds of thousands of prospectors and miners that mined about 60 million ounces of gold out of central Victoria, from a number of pretty prolific high grade gold fields. But they didn't go beyond the areas where the geology goes undercover. Our license covers only those areas of cover where there hasn't been any real effective systematic exploration applied.

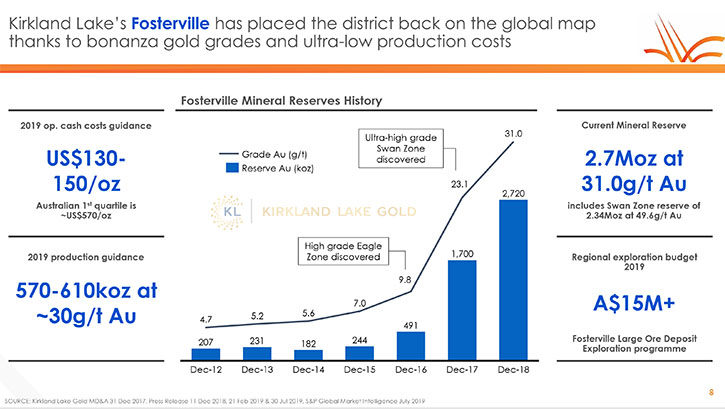

The other reason Victoria is more preeminent now, particularly for North American investors, is because of Kirkland Lake Gold. Kirkland Lake acquired a little operation there, called Fosterville, in 2015. Then they subsequently drilled deeper and found a very, very high-grade zone, called the Swan Zone. Now they are producing about 600,000 ounces per year, from that Swan Zone, at a very, very low cash cost, around 130 US dollars an ounce. That is obviously a very profitable type of operation, which is putting Kirkland Lake where they are in terms of their valuation. It's also putting this district back in favor with the gold industry.

Dr. Allen Alper: Oh, that sounds great. Could you tell us a little bit more about your nickel project and why you feel it's a way to be a exploring for nickel?

Alex Dorsch: Nickel has been an interest of ours for some time. We have a number of early stage nickel projects in Western Australia, led by our flagship King Leopold Project in the Kimberley. We entered this province on the back of a major nickel miner, called Independence Group, a multi-billion dollar company listed on the ASX (IGO). They entered this province in late 2018 and did a joint venture with a junior which had an isolated high-grade nickel sulfide discovery.

Subsequently we acquired the King Leopold Project on the basis that the region hadn't been effectively explored for nickel sulfides, nor other magmatic sulfides. We have been exploring for just a few months now, since we acquired it in the middle of 2019. We think it's particularly prospective because there's an isolated, single high-grade nickel discovery in the province, but none of the other similar geology has seen any modern exploration like electromagnetics or any sort of drilling. We think that's obviously a good opportunity to find more nickel sulfides.

Over the last three months we've completed an airborne EM survey as well as a ground CM survey, which has outlined some pretty interesting EM targets. Further ground-based EM and drilling activities have been deferred until the 2020 field season, but we are definitely excited to start drilling those targets in the new year.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors about your background, your Team and your Board?

Alex Dorsch: The Board is led by the founder of Chalice and Executive Chairman, Tim Goyder. He has a very sound track record in the industry. He's had a number of successful public companies in his time. He's currently a Director of two other public companies, Liontown Resources and DevEx Resources. They are all within our group, so we share some capacity and resources collectively. Tim is also the major shareholder of Chalice. He owns 17% of the shares, which is quite powerful for a junior company to have such strong inside ownership. Tim’s a very successful entrepreneur in the mineral space, having made several discoveries and delivering value for shareholders.

I joined Chalice about two years ago. I was working with McKinsey, the Management Consultancy, obviously a very big consultancy. I was advising resources clients on exploration as well as optimization of their businesses. Prior to that I was a mechanical engineer by training. I'd been in the resources space for about 10 years. I also hold a finance degree. I actually started my career in corporate finance. I've worked extensively in capital markets. I've spent a lot of time on the technical side of the resources sector and accumulated a broad experience in that time.

The other two independent Directors on our Board are: Morgan Ball, who is a chartered accountant. He's also the CFO of a mid-cap Australian miner called Saracen. Steven Quin is our Canadian Director. He's President and CEO of Midas Gold and he's a very well regarded and well respected geologist.

Also, I have a General Manager of Exploration, Dr. Kevin Frost, who has made a couple of nickel sulfide discoveries in his time. Richard Hacker, who is my CFO, has been a long serving CFO, with the group. We've just hired Bruce Kendall, who also made a substantial gold discovery in Western Australia, called Tropicana in 2012. We also have an exploration manager based in Canada as well, Patrick Lengyel, who led our project in Quebec for a couple of years. We subsequently sold that project in Quebec to O3 Mining, a spin-off of majors Osisko Mining.

Dr. Allen Alper: Oh, it sounds like you and your Team and Board have very strong and diversified backgrounds and understanding of mining. So that's great.

Alex Dorsch: Yeah, exactly. We are driven to find the mine, not for technical or geological success, but to find a commercial mining operation of decent scale. That's how we explore, how we utilize our capital, to find substantial gold and nickel discoveries.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors more about your capital structure and financials?

Alex Dorsch: On the capital structure, we have 274 million shares on issue, somewhat large in North American terms, but in Australian terms it's fairly constrained versus our peers in Australia. We're trading about 52 million Australian dollars in market capitalization and there's a strong cash backing component to that, so about 30 million in cash and liquid investments, as of the end of the last quarter.

Our trading history has been quite strong in the last four or five months. We have traded close to our cash backing recently, around 11 and a half cents to 12 cents. We have seen a lot of strong interest in the stock from our exploration programs. Also the improvement in the gold price over the last months has drawn a lot of interest. We've managed to trade over 20 cents for a few months now. In terms of the top shareholders, our Executive Chairman, an insider, holds almost a fifth of the Company, 17% of the shares. A long-serving, very supportive shareholder, the Franklin Templeton Precious Metals Fund, own 11% of Chalice. They've been holding that position now for more than eight years. There's another group of small Australian institutions, holding collectively about 8% of the Company.

It's a fairly tightly held stock, strong inside ownership. About 7% of our register trades over in Canada on the TSX.

Dr. Allen Alper: Well, that sounds excellent. It's nice to see that the Directors and Management have skin in the game. So that's excellent.

Alex Dorsch: Absolutely. We are firm believers in what we do. We back ourselves to take exploration risks. We're looking for the big prize for shareholders.

Dr. Allen Alper: Well, that's excellent. Could you summarize the primary reasons our readers/investors should consider investing in Chalice Gold?

Alex Dorsch: The targets Chalice is drilling, particularly at our Pyramid Hill Gold Project in Victoria, are very high profile targets. The sort of targets you don't come across very often, particularly in premiere jurisdictions like Australia. We believe there is a very strong upside case for our 5,000 square kilometer holding, particularly having an operating mine like Fosterville in the district demonstrates what the size of that prize could be.

Secondly, we have a good financial position. We haven't diluted our holders nor raised any capital for many years now. So we've got the cash to be able to explore effectively and at a scale which is not typical of other juniors in the industry.

Thirdly, the team behind Chalice has had success in the past. So if past success is a measure of future success, then I would say then we're sitting on very strong footing there.

Dr. Allen Alper: Oh, it sounds excellent. Alex, is there anything else you would like to add?

Alex Dorsch:Chalice’s current projects are a fairly new story in the global space, even though the Company has been around since 2006. What we're doing, the assets, the exploration activities, the transactions, over the last few years are relatively new. So I think there's an opportunity for people who want to be exposed to a very new and up and coming business, like Chalice. The factors I've described, set us apart from our peers.

Dr. Allen Alper: Well, it sounds to me like you have an excellent company, with great opportunity, in a great jurisdiction, with a great team. You also have the funds to do the exploration and development, so that sounds excellent.

Alex Dorsch: I appreciate that, Al.

Also, thank you for interviewing Chalice for Metals News.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://chalicegold.com/

Alex Dorsch

Managing Director

Chalice Gold Mines Limited

+61 8 9322 3960

info@chalicegold.com

|

|