Bluestone Resources Inc. (TSXV: BSR, OTCQB: BBSRF): Near term producer targeting 125,000 oz/yr at an AISC of less than $600/oz. Interview with Darren Klinck, President, CEO.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/5/2019

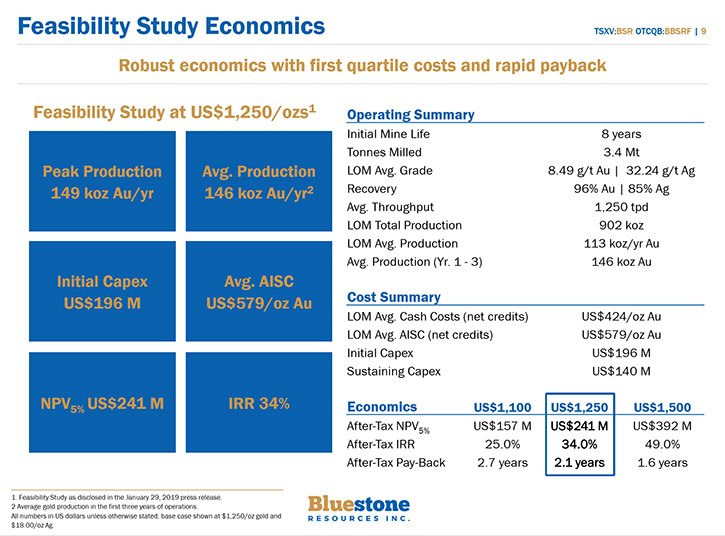

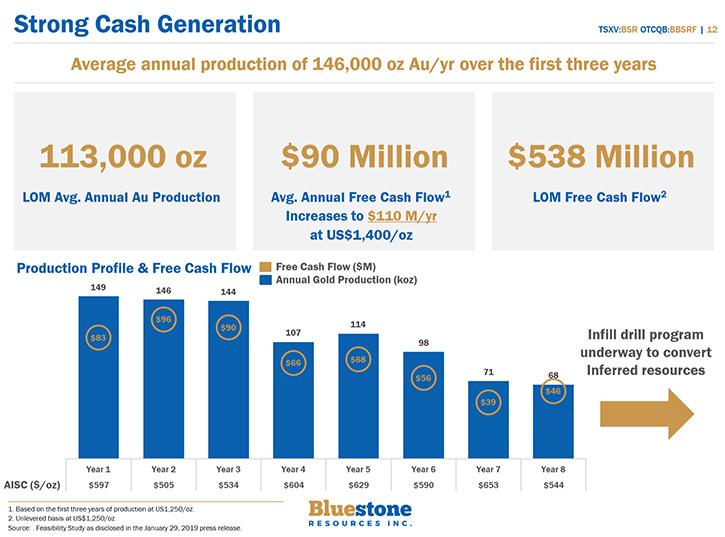

Bluestone Resources Inc. (TSXV:BSR, OTCQB:BBSRF) is a mineral exploration and development company that is focused on advancing its 100%-owned Cerro Blanco Gold and Mita Geothermal projects, located in Guatemala. A feasibility study on Cerro Blanco, completed in January (the “Feasibility Study”), returned robust economics, with a quick pay-back and an average annual production projected to be 146,000 ounces per year, over the first three years of production, with all-in sustaining costs of $579/oz gold. We learned from Darren Klinck, President, CEO, and Director of Bluestone Resources, that the Company is working to put together a financial package to begin construction next year, with a goal to be in production by the end of 2021. According to Mr. Klinck, Bluestone is on track to become a producing gold mine at great margins, with the support of major shareholders such as the Lundin Family Trust, CD Capital, Newmont Goldcorp, and management, Bluestone Resource’s sole focus over the next two years will be bringing this mine into operation.

Cerro Blanco Gold project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Darren Klinck, who is the President, CEO, and Director of Bluestone Resources Inc. (the “Company” or “Bluestone”). Could you give our readers/investors an overview of Bluestone and also what differentiates the Company from others?

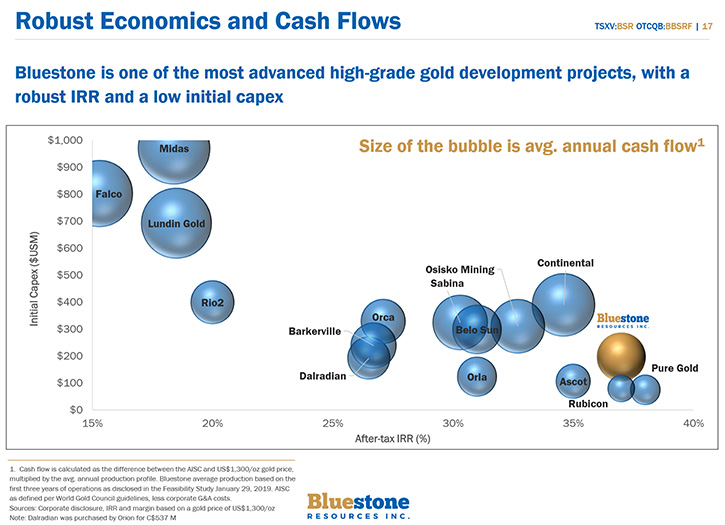

Darren Klinck: Absolutely, Allen. It’s great to be here. Thank you for interviewing Bluestone Resources Inc. for Metals News. Bluestone has a bit of a unique situation. When you look at the Company just over two to two and a half years ago, it didn't really exist in its current formation. In fact, it was a shell company with $35 in the bank and one unpaid employee. If we fast forward over the last two years, we've been successful in acquiring one of the highest-grade undeveloped gold projects out there that's had more than $200 million previously invested primarily by Goldcorp. We've completed a Feasibility Study that demonstrates that we have got a project that will produce between 120,000 and 150,000 ounces of gold per annum at an all-in sustaining cost of less than $600 an ounce.

Over several months, we have been very focused on putting in place the project financing package which would see us then able to kick off construction on this high-grade undeveloped gold project next year with a view of producing gold by the end of 2021. It's a really exciting opportunity on a very advanced, high-grade gold project, which coincides with a time where the gold market and the precious metals market are getting a bit more attention for all the right reasons. We're not too far from a producing gold mine with great margins.

Dr. Allen Alper: That sounds fantastic. It's great to have a high-grade, low-cost project, and the timing is right for the goal marker. That sounds excellent. Could you tell our readers/investors the highlights of the work that you have done this year?

Darren Klinck: Sure. We delivered the feasibility Study in January much to market expectations. We had set out an objective to deliver that, and we did it. We were successful on the back of that. As many of your readers/investors would have remembered, we raised some money during a fairly anemic time in the marketplace earlier this year. In February, we announced a $10 million bought deal financing. That actually was upsized twice to $22 million. It was really on the back of the robust numbers on the Feasibility Study, which we as a management team have been able to accomplish in a very short amount of time. I think there is an increasing level of confidence in the project, where we're located, and what we're really doing to advance this into a construction phase.

A key aspect of where we've been focused on the technical side this year has been on the geology and in particular the infill exploration program, which we kicked off at the back end of last year. Based on the current resource, where we have 1.2 million ounces of gold in measured and indicated, and almost another 400,000 ounces in inferred, this presents a unique opportunity for us. The large majority of those inferred ounces are actually on veins that we currently have in the mine plan. But of course, when we did the Feasibility Study, they weren't in the measured and indicated categories and were not eligible to be considered reserves. We kicked off that program and have really been focusing on the exploration to upgrade and increase the density of drilling of those inferred resources.

When you look back at the results that we have released in the last eight months, they are arguably the most consistent drill results for a gold project out there for high-grade intervals. It really comes down to the fact that we've done so much technical work in 2017 and 2018, firming up our confidence in the geologic model. In terms of intercepting veins where we have intended to, our success rate is very close to 100%. On the back of that, we expect to update the northern part of the resource before the end of the year, with the drills now focused on the southern part of the resource. As we head into next year, our overall objective will be to try and upgrade another 200,000 ounces into that indicated category, which will continue to drive significant returns and further improvements to an already very robust economic project.

A lot of our management's time has been focused on project financing. In our industry, we need financing to bring these assets into fruition and ultimately into production. Creating the benefits and the opportunities for our local stakeholders, our local governments, and of course our shareholders, has been a key focus for us over the last number of months as we look to put the project financing package in place. I'm very pleased with how that progress has gone over the last number of months. We'll be looking to bring this into finality in the first quarter of next year.

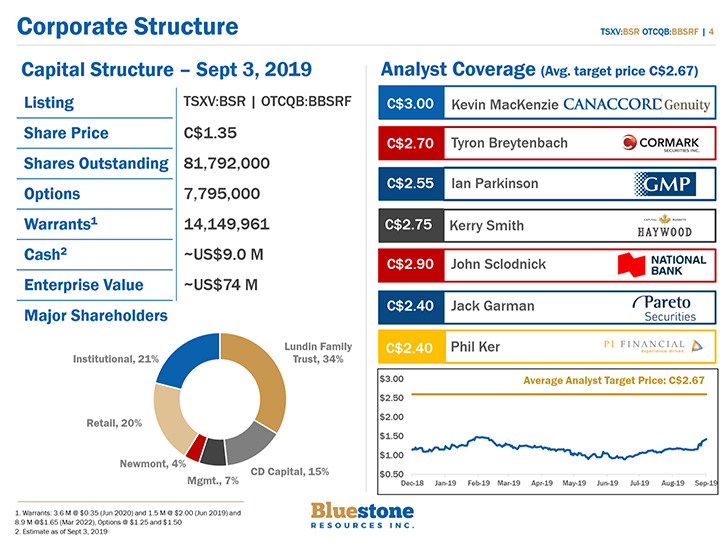

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your capital structure?

Darren Klinck:Bluestone Resources is traded on the Toronto Stock Exchange Venture and also on the OTCQB. We have 83 million shares outstanding. The stock has been trading at ~C$1.30, somewhere between the $1.25 and $1.40 range, over the last number of weeks. Cash in the bank right now is about US$9 million. From that perspective, we have good finance in place. We're in the process of trying to put the overall project financing package in place, so we can shift from development into construction mode. From a timeline perspective, if we can kick that off in the early part of next year, we should be producing by the end of 2021. There's no debt in the Company at all, but ultimately, we will have to get the financing package in place to bring this into construction mode.

Dr. Allen Alper: That sounds very good. Could you highlight some of the major shareholders?

Darren Klinck: Yes. One of the real advantages for Bluestone has been the strong support we have received from some very well-known investors in the space. 35% of our shares are controlled by the Lundin family. The Lundin family has been very successful in the metals and mining and oil and gas spaces over the last 30 to 40 years. That's been a real foundational point for us, as we've been able to take advantage of a lot of information sharing, including back and forth between some of the other Lundin group companies, as we continue to advance Cerro Blanco and grow out Bluestone. CD Capital in London has 14% of the Company, which have been big supporters. When you take those two shareholders, including management and Newmont Goldcorp, which owns 4.5%, about 65% of the shares are tied up within these groups.

Beyond that, several institutional investors that are well-known in this space throughout Europe, the United States and Canada are shareholders as well. We have had good support. That's also been part and parcel demonstrated through the financing we did earlier this year on the back of the Feasibility Study, which has allowed us to kick off some of the work on project readiness as we get ready to kick off the project in 2020. As we look to put the project financing package together, we expect strong support from our shareholders that have been very supportive in the first two and a half years of this new evolution for Bluestone.

Dr. Allen Alper: That sounds great. That's a great position to be in, to have such strong major shareholders to back you up in a time when raising capital is quite challenging. It's great that you have such great support.

Darren Klinck: Without a doubt. We are very fortunate to have that. The quality of the project really sets it apart and is the reason why we have continued to have that sort of support. There are not a lot of development-stage projects that are effectively construction-ready and have had this sort of amount of sunk capital, which really give us a strong feel for what the opportunity is. That has been part and parcel why we have had such strong support as we continue to focus on bringing this project into operations over the next two years.

Dr. Allen Alper: That sounds excellent. Could you say a few words about analyst coverage and what the target price is?

Darren Klinck: Sure. For a small company such as ourselves, we have actually had quite good analyst coverage initiated over the last 18 months. There are seven analysts that cover the Company and the average target price is C$2.67, which is about 100% uplift from where we are right now, probably not too atypical for a company such as ourselves that is moving into that construction phase. You tend to see the re-rating as the project is brought from developer toward operations because that is when the cash flows are going to be generated. Over the last six months, there have been some good examples of that in our industry. Groups like Alacer and Lundin Gold have both brought on new projects, and you have seen the share prices increase by 100% to 150% on that. These are the sort of returns that can really be generated as you bring projects through that phase.

The other unique thing about this project is that it is a high-grade mine, so ultimately, the footprint is relatively small. The mill and the processing facilities are relatively small. It has a relatively modest capital expenditure requirement, just under $200 million. At $1,250 gold price, this project would pay itself back in just over two years with an IRR of 34%. If you use today's gold price, that IRR would move up closer to 50% and a payback of a year and a half. This asset will produce more free cashflow in the first year of annual production than the market capitalization today, a truly remarkable opportunity. Regardless of whether you're producing gold or you're making Swiss chocolates, or you're manufacturing tennis shoes, those sorts of margins present a very attractive business. It's a great opportunity for our stakeholders.

Dr. Allen Alper: Outstanding potential for stakeholders and shareholders! Could you tell our readers/investors about your background and your team?

Darren Klinck: We have a relatively small team, but most of us have come from either mid-cap or large-cap companies. We have been drawn to the opportunity to get involved in a new startup, not one that was a startup from grassroots, but one that has had more than $200 million of investment and more than 15 years of history on advancing it. In today's world, I think the average time from a discovery, through to production, is somewhere between 15 and 20 years. To have an opportunity where you can short circuit that has been pretty exciting and is the reason that we have been able to assemble the team that we have.

Prior to joining Bluestone, I spent just over a decade with OceanaGold and was a key part of the senior management team, as we brought that company from a single asset producer in New Zealand, all the way through to a multi-mine producer in several jurisdictions. Peter Hemstead, our CFO who was previously with Capstone, was involved in a similar growth profile for that company. Our Chairman, John Robins, was the founder of a company called Kaminak, which was bought by Goldcorp only a few years ago, for $520 million. When Goldcorp was actually looking to sell something rather than buy something, it was John that was the key figure that identified the opportunity at the Cerro Blanco project. It was through his initiative that we were able to line up and acquire this project for only $18 million. Given the sunk capital that had gone into it and the head start, it was quite an attractive acquisition.

We have assembled a very strong team made up of mine builders, technical experts, explorers, as well as those who have experience on the mergers and acquisitions side and financing projects. We're really confident with the core group that we have. We have such a strong core team in Guatemala! That's part of the head start we were able to take on when we arrived just over two years ago. Our Guatemala team has been building relationships with our local communities, managing our environmental obligations, and working with our local government stakeholders, as we advance this project.

Dr. Allen Alper: You have a very strong team and a proven track record, so that's excellent! Our readers/investors will have confidence in your group. Could you tell our readers/investors what it’s like to operate in Guatemala?

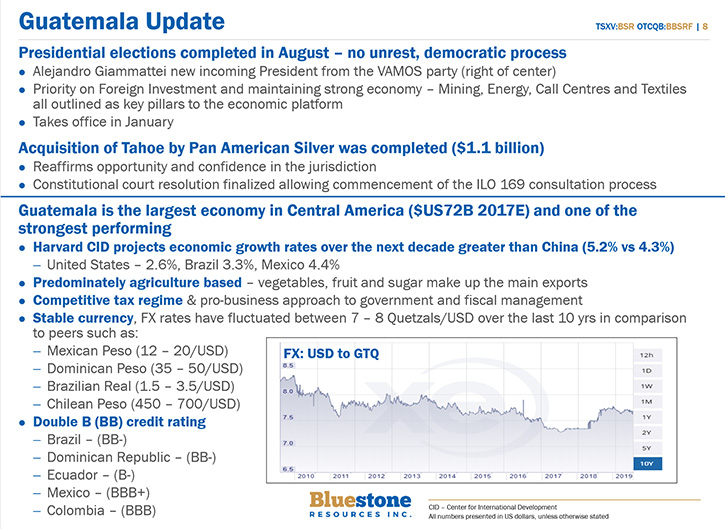

Darren Klinck: Guatemala has the largest economy in Central America. Many of your readers/investors may not have been there, and many may not realize this, but over the last 10 years, Guatemala has had the most stable currency in Latin America, and that's on the back of a very strong fiscal policy. The country itself has continued to get very good, strong report cards from the International Monetary Fund, in terms of how they run their fiscal policy. For example, they don't run deficits. Harvard Business has actually flagged that they expect Guatemala to be one of the 10 fastest growing economies in the world over the next 10 years. In fact, the 10-year government bond rate in Guatemala is about 30% lower than what you'd find in more well-developed Latin American economies such as Mexico and Brazil.

From a business standpoint, it has a very strong foundation. We've just seen national elections earlier this year, with a new government taking over in January of 2020. We're very much looking forward to working with President-elect Giammattei and his cabinet as they take over in Guatemala. President-elect Giammattei was campaigning on a pro-investment, strong economic platform, focusing on industries such as the textile industry, call centers, energy, and mining. Agriculture is also a big contributor to the economy.

We're really excited about the future there. From a geologic perspective, it has a huge endowment. Having spent a large part of my career in emerging markets and in developing countries, I'm continuing to increase my confidence in operating in Guatemala from an operations perspective. I really like the structure and the government engagement. I think this is going to be the next opportunity in the country to develop a resource project. We're very much looking forward to bringing that to fruition here over the next two to three years.

Dr. Allen Alper: That sounds excellent. Could you highlight the primary reasons our readers/investors should consider investing in Bluestone Resources?

Darren Klinck: This is an advanced-stage project that is going to go through that all-important transition phase from development to cashflow through the operations. It has modest capital needs. That's an important part in this marketplace, as the hurdle to bring that on is not too significant. It is backed by some of the smartest resource investors in the sector who have been successful in backing quality assets and quality teams for the last 20-40 years. The important part is that the size of the prize here is quite significant, not only for our shareholders but for our local stakeholders. This is a high-grade mine, and if it were in Ontario, or in Australia, or in Nevada, it would have most likely been mined 30 years ago, hence the opportunity here for us.

It's a very robust project that has great margins. It's going to create a lot of jobs, opportunities, social benefits in and around the project itself, and will pay itself back after we borrow money to build it. At today’s gold price, this project will pay itself back in a year and a half and generate an IRR close to 50%. Management is 130% focused on exactly that. I think your readers/investors will look forward to getting more information, and we'd be happy to provide that if they reach out to us at www.bluestoneresources.ca.

Dr. Allen Alper: That sounds like a very outstanding Company, Darren and a really fantastic opportunity for our readers/investors. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

http://www.bluestoneresources.ca/

Bluestone Resources Inc.

Darren Klinck

President, Chief Executive Officer & Director

info@bluestoneresources.ca

|

|