Gold Standard Ventures Corp. (NYSE AMERICAN: GSV, TSX: GSV): Second Largest Land Package in the Carlin Trend, Nevada, Very Robust PFS Economics, Strong Corporate Support; Interview with Jonathan Awde, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/29/2019

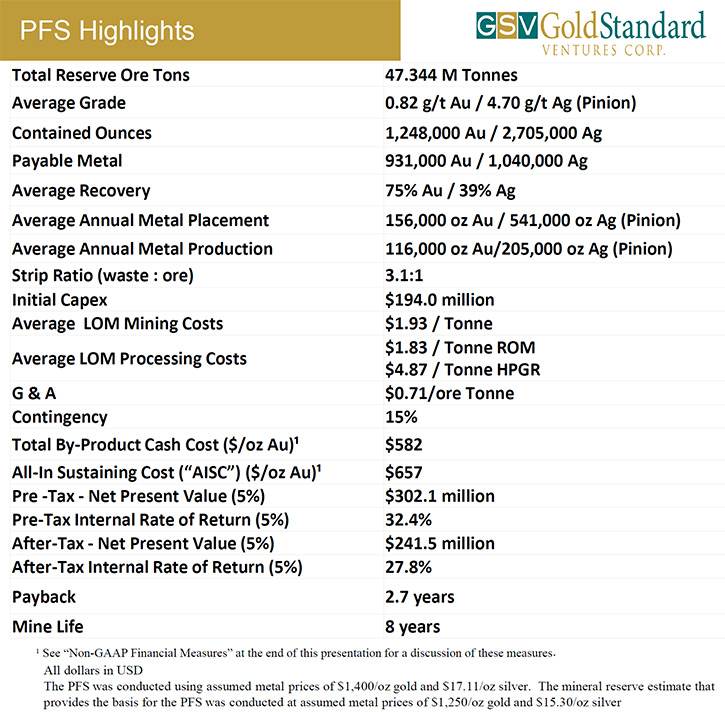

Gold Standard Ventures Corp. (NYSE AMERICAN: GSV, TSX: GSV) is an advanced stage, gold exploration company, focused on district scale discoveries on its Railroad-Pinion Project, located within the prolific Carlin Trend in Nevada. We learned from Jonathan Awde, President and CEO of Gold Standard Ventures, that with the support of such corporate shareholders as Newmont/Goldcorp and OceanaGold the Company has consolidated the second largest land package in the Carlin Trend. The recently announced PFS shows a robust project, with an initial eight year mine life, $657 all in sustaining cash costs, and a $194 million CapEx. The Company is currently working on lowering the capital, extending the mine life and enhancing the project economics.

Gold Standard Ventures Corp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jonathan Awde, who is President and CEO of Gold Standard Ventures Corp. Jon, could you give our readers/investors an overview of Gold Ventures Corp., and also what differentiates your Company from others?

Jonathan Awde: Sure, thanks. I think one of the biggest things that separates Gold Standard from a lot of other junior explorers/developers is our location and our land package. We are in the Southern portion of the Carlin Trend and have amassed, through consolidation, staking and swapping, what is now the second largest land package in the Carlin Trend.

We have the support of two 10% corporate shareholders in Newmont Gold Corp and OceanaGold. Cashed up we have four rigs active on the project, and we just recently announced our PFS a couple of weeks ago and came out with a very robust project with $657 per oz all in sustaining cash costs, which puts it in the lowest quartile, manageable CapEx and an initial eight-year mine life. We are currently going through all of the optimization and trade-off studies. We think there are a number of ways for us to lower the capital, extend the mine life and enhance the project economics.

Dr. Allen Alper: Ah, that sounds fantastic. That's an amazing project. Could you give our readers /investors a bit more information about your PFS highlights?

Jonathan Awde: The capital is $194 million. This assumes the purchase of a brand new mining fleet. We're going to look at some optimization and trade-off studies to determine what the cost is if we lease it, do contract mining or purchase used equipment. We think there are a number of savings for us to achieve. It's 156,000 ounces of gold placed, just under 120,000 gold ounces recovered, $585 per oz. cash costs, $657 per oz. all in sustaining cash costs, so I think that's really, really important.

This initial eight year mine life has 1.24 million ounces. However, there's an additional 550,000 or 600,000 ounces that is in the inferred category that we're going to look to convert from inferred to measured and indicated, and that would likely add another three or four years to the mine life. When you have an oxide heap leach project, such as this, that's amenable to heap leaching, it really lowers your barriers to entry, lowers your capital and allows you to be in the lowest quartile for your cash costs.

Dr. Allen Alper: Oh, that sounds excellent, really great. Could you mention some of the key considerations and opportunities Gold Standard Ventures Corp. has?

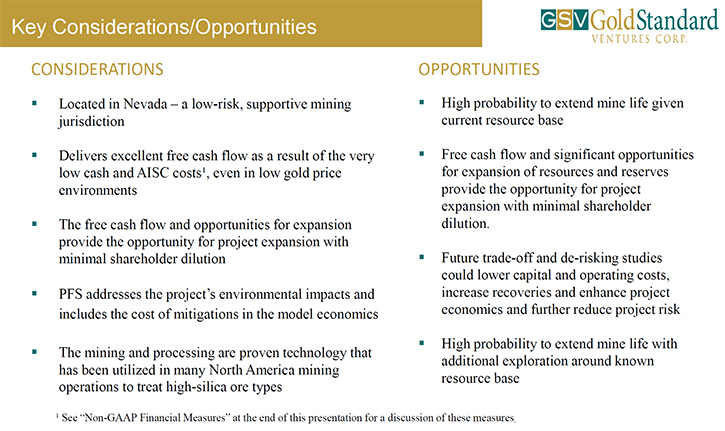

Jonathan Awde: One of the things that has become very clear, with the consolidation, of a lot of the Nevada assets that Barrick and Newmont have, into a joint venture, is that a big part of the future potential for discovery in Nevada is likely going to be deeper and it's likely going to be sulfide. Now we are planning to go underneath our oxide targets to look for some kind of a deep, higher grade sulfide feeder. Those are company makers! I think most people invest in Nevada, looking for that next elephant, that next major discovery. And that's why you can see the valuations go from $30 or $40 million bucks to $700, $800 million on a drill hole, which is what happened to Gold Standard.

Dr. Allen Alper: Oh, that's excellent. Could you tell our readers/investors a bit about your sensitivity to the gold price?

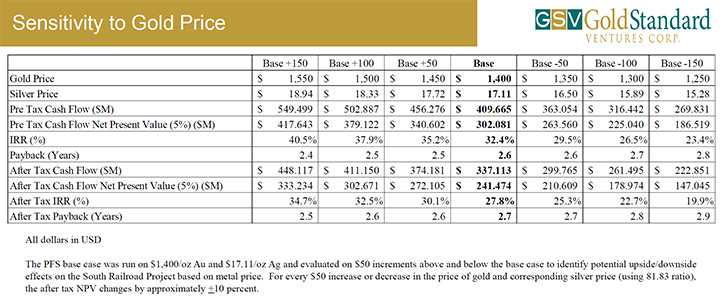

Jonathan Awde: We did our reserves at $1,275 US and the financials were run at $1,400. When you apply spot price to the numbers, it's about $35 million to the NPV for every $50 move in the gold price. So at spot price you have an NPV that's over $300 million US. That does not include the additional inferred ounces, or lowering the capital through any kind of leasing option.

We strongly feel the PFS, is a great first start, real numbers, valid inputs, but there are a number of clear ways for us to optimize the project through; bringing in those inferred ounces, looking at some different trade-off studies, lowering the cost of capital, lowering the overall capital and thereby extending the mine life.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors about your background and your team?

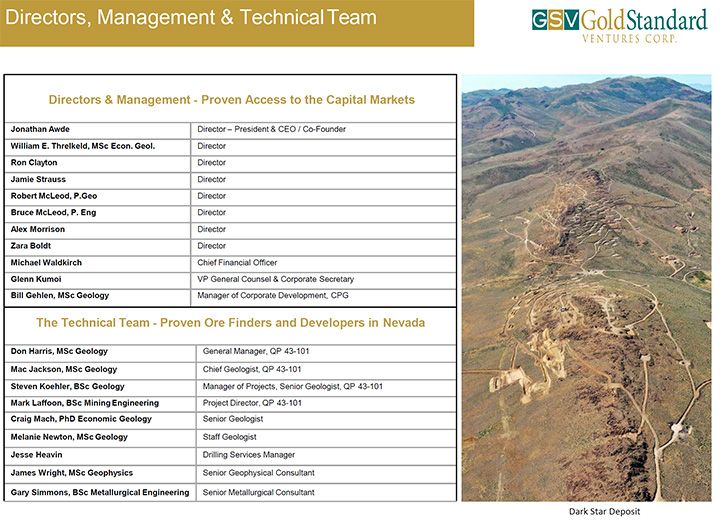

Jonathan Awde: I'm like the architect. I acquired this land package in 2009 and took it public in 2010. My background is finance. I hired Dave Mathewson, who was the former head of exploration for Newmont. Dave retired a few years ago. That position was taken over by Mac Jackson.

Mac Jackson was an extremely successful senior geologist at Newmont and has two significant discoveries to his credit, Leeville and Fiber Line. Both are very relevant to the joint venture between Newmont and Barrick.

Most recently, we just brought on Mark Laffoon, a senior engineer. Mark was project manager for Barrick at their massive Goldrush operation.

We have a Nevada-focused team, with lots of relevant experience. We have a Board that is very active, very involved, led by our lead independent Director, Bruce McLeod.

Dr. Allen Alper: Sounds excellent, a very, very strong team, very knowledgeable and very equipped to move your projects forward on such a large land package and by the South Carlin Trend. Could you highlight what your drilling programs are, for 2019 and going into 2020?

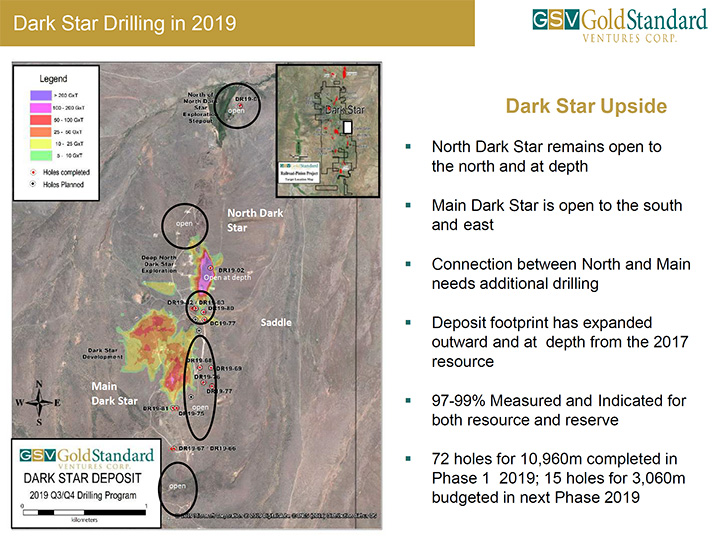

Jonathan Awde: So we have four rigs active on the project now that are really focusing on stepping out, both laterally and at depth underneath Dark Star, along that whole 12 kilometer, highly prospective corridor. We're really stepping out and looking at testing some of these new targets after doing a couple of years of field work, sampling, mapping, geophysics, geochemistry, to really layer on the data and get that information understood before we put in our first drill hole.

We're branching out and really stepping. We think there are a lot more discoveries for us to make, given the size of the land packages and the nature of these Carlin systems, where you typically start with a shallow oxide path that often outcrops. Then you often get into a much higher grade, often a more significant underground sulfide situation.

Dr. Allen Alper: Sounds excellent! Could you give us the highlights of your share and capital structure?

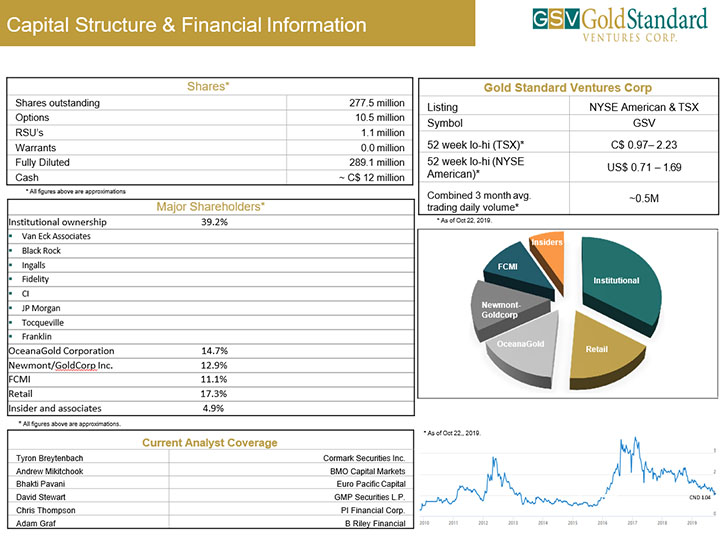

Jonathan Awde: Right now there're 278 million shares out. About 40% of the Company is owned by three people, OceanaGold, Newmont and Albert Friedberg. A number of key institutions own us; Blackrock, Fidelity, Franklin, Ingalls, Tocqueville, CI, and JPMorgan. That's another 30%. Almost 70% is owned between the strategics and the institutions. Management owns about 5% and The Company has about 17 and a half million dollars in cash.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Gold Standard Ventures Corp.?

Jonathan Awde: Being a financial guy, I think timing is everything. The valuation now and the share price is back to where we were below our discovery. This is basically when Goldcorp came in. Our stock is trading at a dollar three, a dollar four Canadian. We've been as high as $4.12 Canadian. We've de-risked the Company, significantly, through the release of our PFS and through adding additional resources and ounces. So I think for those reasons. The price of gold went from $1,250 to $1,550. It's back a little bit here in that $1,480 level. I think there is significant room for this thing to grow and play catch-up.

Dr. Allen Alper: Sounds like excellent reasons for our readers/investors to do their research and consider investing in Gold Standard Ventures Corp. Jon, is there anything else you'd like to add?

Jonathan Awde: Just to thank you for interviewing Gold Standard Ventures Corp. for Metals News. Thank you very much for your support. I think it's important for your readers/investors to know that there're a lot of upcoming catalysts and milestones here, and this is at the forefront of what is relevant in the gold mining space. Let's keep in touch. Let me know if there are any questions I can answer.

Dr. Allen Alper: Sounds like you are doing a brilliant job with Gold Standard. I have enjoyed talking with you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.goldstandardv.com/

Jonathan Awde

President

Tel: 604-669-5702

Email: info@goldstandardv.com

|

|