High-Purity Quartz Ltd (HPQ) Supplying the Booming Solar PV and Semiconductor Industries; Interview with Stuart Jones, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/28/2019

High-Purity Quartz Ltd (HPQ), who is exhibiting and presenting at IMARC 2019, is aiming to be a new entrant into the global high-purity quartz-sand market, with near term plans to join a very limited group of High-Purity quartz-sand producers to supply manufacturers of ultra-High-Purity applications, such as optics, Solar PV wafers and Semiconductor wafers. HPQ Ltd will export its products under an Offtake and Sales & Distribution Agreement, signed earlier this year, with Wogen Resources Limited. We learned from Stuart Jones, CEO of HPQ, that Solar PV and Semiconductor manufacturing are fast growing industries, and they cannot manufacture without high-purity quartz-sand. There is currently only one main producing source of high-purity quartz-sands in the world, which is a supply concentration risk for the downstream manufacturers in China, Japan and elsewhere. According to Mr. Jones, the Company's flagship Sugarbag Hill high-purity quartz-mine in Queensland, Australia, once developed, is in a strong position to supply high-purity quartz materials to the green-tech, high-tech markets for decades to come.

High-Purity Quartz Ltd

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Stuart Jones, who's CEO of High-Purity Quartz, Ltd. I wonder, Stuart, if you could discuss the investment highlights of High-Purity Quartz, Ltd.

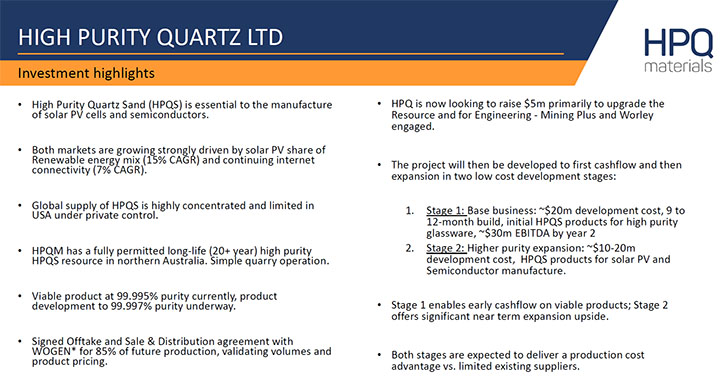

Sure Allen. I think the pure investment opportunity here is driven by the fact that we aim to produce very pure sand which goes into the manufacturer of solar PV wafers and semiconductor wafers. You cannot produce either semiconductors or solar PV cells, without high-purity quartz-sand and it's important to keep that fixed in your minds. The two things that are really driving demand for this product are solar PV manufacture, which is growing at around 15% compounded annual growth and semiconductor wafer manufacture, growing at 5% to 7% compounded annual growth. So they're two great industries growing strongly and if you're going to be manufacturing or producing anything, it’s a real strategic benefit to be a part of those markets right now.

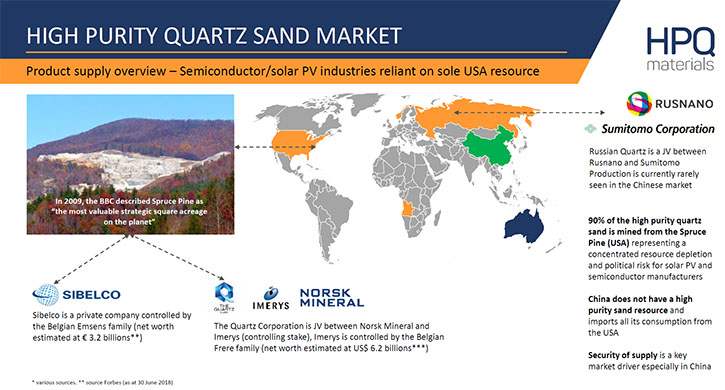

On the one hand we have demand booming. It's a global driver. The global renewable energy shift is driving solar PV demand, internet connectivity/electrification and semiconductor demand. Global supply of high purity quartz-sand, on the other hand, is concentrated around one major resource. If you trace the supply chain right back into the upstream, you realize that those industries are dependent on the supply of high-purity quartz-sand from a single major resource in Spruce Pine, North Carolina, USA.

That is quite a startling fact. I would recommend to your readers/investors to look at the 6 minute YouTube video of The Quartz Corporation, publicly available (Video: https://youtu.be/A_b7FCyD_5Y) it really reinforces the fact that those two industries are heavily reliant on sand from a single resource. The consequences for those industries in terms of security supply are therefore very plain. Now, what's the opportunity there for High-Purity Quartz Limited?

Well, we have a high-purity quartz resource in situ in Queensland, in Australia, a suitable source of high-purity quartz- sand feeding into those growing industries. That's basically the raw opportunity that HPQ Limited is offering. Right now we have a product which is 50 parts per million impure or 99.995% percent pure. That is a product used in high-purity optical equipment manufacture. We have a pilot plant in Australia where we demonstrate that we can make that product. Our product development, in the near term, is underway. We have very clear plans to improve the purity down to solar grade (99.997% purity) and then into semiconductor grade (99.999% purity).

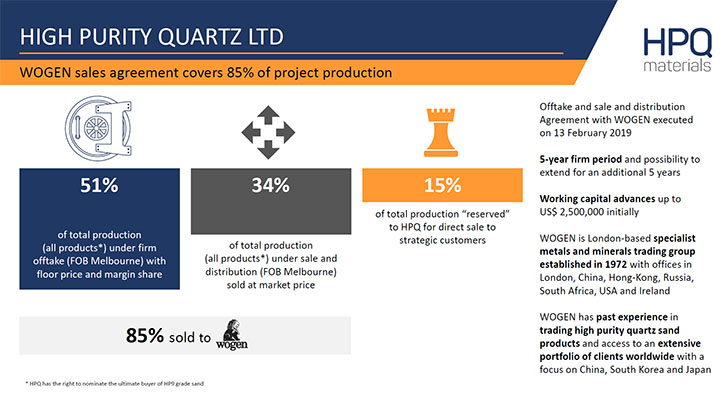

So, we have the resource in place and we know that we can make the initial product. We've also signed a definitive offtake and sales & distribution agreement with Wogen Resources Limited. They'll take 85% of our future production; that validates the volumes and the product pricing in our plans. That's important because the industry is so closely held by the owners of the resource at Spruce Pine, North Carolina. There is little reporting around that and the buy-side of the industry is quite fragmented; China, Japan, Korea, Taiwan, Europe and the USA, so it's important to get a credible and visible industry entity between HPQ as a new producer and the end market. That's particularly important for investors, so it's a key highlight.

We recently signed a strategic partnership agreement with a premier Australian mine planning and engineering company, Mining Plus Limited. Strategic because it's not just to do the drilling or the resource upgrade, but it also extends into mine planning and then mining operations phase. So that's a very strategic long-term partnership with those guys. They're vested in us in the sense that they'll do the work and defer part of the costs to do that. It's a strong validation of our resource and the fact that they're on board really means that investors can take additional comfort around the quality of HPQ’s resource. That's a big tick in the box from the resource risk point of view.

Currently we're looking to raise 5 million Australian dollars to do the resource upgrade to a measured and indicated resource and also to do the equipment testwork and engineering.

We intend to work with Worley, an international engineering firm, on the equipment testwork and engineering. Once that's done, Allen, the costs of then developing the project are really quite low at around A$20 million estimated. The reason the CapEx is so low is that HPQ is a very small volume processor/producer into high value markets, and that means our process footprint is small, our process throughput is low at around 12 tonnes per hour. It's a very simple process, our purity is high in situ, so we can mostly use off the shelf equipment. Because of these factors, the capital equipment cost is around A$15 million and another A$5 million for working capital. The A$20 million gets HPQ into first stage production of an initial high-grade product, and then we'll be using this, not only as a sale product, but also a feedstock into a further process to get to the higher purities as I've described earlier.

This is a relatively low risk quarry operation, with low volume processing, using existing equipment. We don't need anything new in our process. There are some clever bits in there, but we have the right people on board to deliver those clever bits. That's essentially the investment opportunity. We’re not looking at 250, 300 million US dollar builds, we're looking to raise A$5million now into A$20 million in around 12 months to get into early cashflow and then levering those cashflows into an expansion project.

Fundamentally, if you don't have the quartz with the right chemical signature, it's either uneconomic to process or it's just impossible to remove some of those key impurities. That’s fundamentally why there are few producing resources globally. Our resource has tremendous scarcity value.

Finally, we expect we'll be the lowest cost producer globally because the nature of our resource means we avoid some of the up-front processing costs of the two existing producers at Spruce Pine in the USA.

So to summarize the investment highlights, Allen: We own a pure resource in Australia, it's a low volume business and so that means low CapEx, it's relatively pure in ground and so the OpEx is relatively low. We have a viable initial product and we have Offtaker signed-up selling into high growth markets. This combination makes this a very healthy project. In my background as an international project finance banker and small/mid-cap listed company CFO, this is probably the best opportunity that I've come across in 20 years of dealing with projects. That's what drew me to the opportunity in the first place.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a bit about what your accomplishments, achievements have been to date?

Sure. The opportunity has been de-risked steadily; we've raised A$5 million to date. We've drilled 16 holes in the resource. It's an outcropping resource, 600 meters long, so the footprint is small. The holes to date have enabled a Competent Person's Report to be issued at an Inferred Resource level; so around about 1.9 million metric tons. At our planned production, that's sufficient for 20-year project life. The resource is open at depth, so we haven't found the full extent of the resource – that’s upside. The process test work that we've done to date demonstrates that it's a very high-purity quartz in situ, and more importantly, that the impurities lend themselves to removal by physical and chemical separation and that is key to product viability and market entry. We have a pilot plant which has enabled us to demonstrate our abilities.

We have a fully permitted mining lease in Queensland, Australia. All of the environmental permits are done; the access, the native rights agreements are in place as well as the landowner agreements. Alongside the Offtake and Distribution Agreement with Wogen Resources Limited, we also have a strategic agreement with Mining Plus Limited. More on this below but that's the summary of what we've achieved to date, Allen.

Dr. Allen Alper: Sounds great! Could you say more about your Sugarbag Hill project?

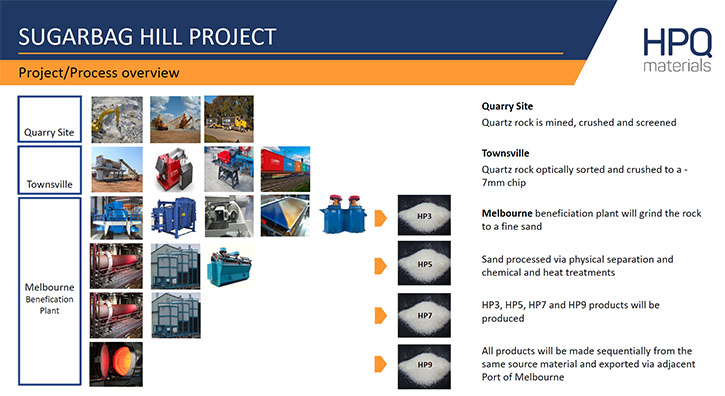

The Sugarbag Hill resource will essentially be mined as a quarry, we're not underground, and we’re not removing large amounts of overburden. This is an outcropping resource. We don't need any pits for the first three years; the first three years of mining operations would be around removal of surface quartz and processing of sand and we'll do that under contract with Mining Plus, a preeminent Australian mine engineering company and we very recently signed a long-term strategic partnership agreement with those guys. HPQ Limited is not a mining company. We're a specialized processing company at high chemical purity levels, that's our specialism, that's our focus.

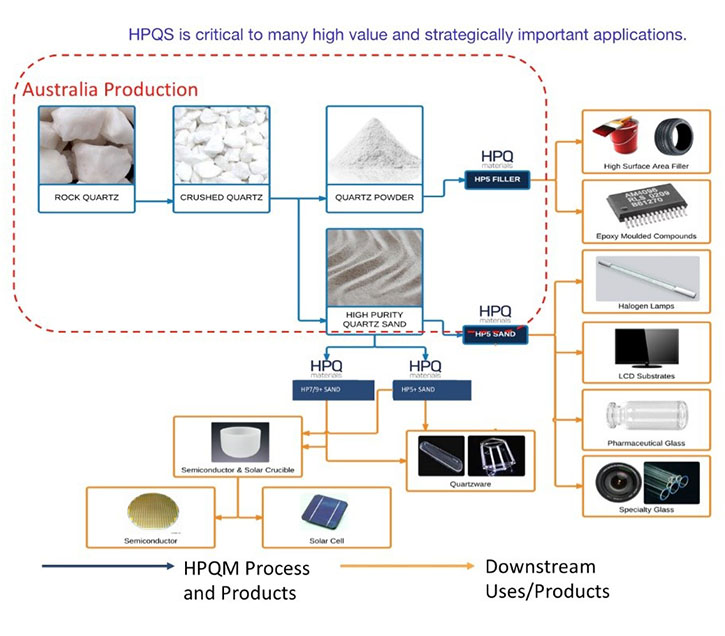

The resource and mining side of this can be done by the experts at Mining Plus on a mining campaign basis for three to six months each year, so we intend to do that and we've signed that contract and there's more in the media about that. We'll do the pre-processing in Queensland; optical sorting and crushing down to a seven-millimeter chip and that chip will be loaded on rail containers and shipped down to our planned processing facility in Melbourne. That's when the real processing of sand starts and that's a very simple process; sorting, grinding, magnetic separation, scrubbing, sorting, gravity separation to get to the HP3 base product.

To then get to the HP5 product we have an acid leach and then more leaching and calcination process to get to HP7 and then to get to the HP9 product, we plan to be using high temperature gas diffusion treatment. All of that process is small scale. A lot of the equipment that we intend to use is off the shelf and it's not expensive to buy that for the volumes that we're processing, as mentioned earlier.

So we generate a very healthy EBITDA from those operations, and from an early stage we'll be in production, within around 24 months. Year 2 into operations and EBITDA is around A$24 million dollars. And that's the process, very simple. Nothing new in that, but we do have the right people on board designing this process and we're comfortable that they can get to that product as I've described and then expand the project into HP7 (99.997% purity) and then HP9 (99.999% purity).

That's the overview of the project, the emphasis is on simplicity, low volumes, and existing equipment yielding high value products. Our processing plant will be adjacent to the port facilities and sold FOB at the port of Melbourne and products will be moved to market from there by Wogen Resources Ltd.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about the Wogen sales agreement that you have?

Wogen is very important to the way we intend to procure the project generally. We're looking to simplify the project. We aim for the fewest moving parts and clean contract interfaces. We’ve just entered into a strategic partnership with Mining Plus. They'll take care of all the resource and mining operations and they'll deliver the pre-processed products to the rail head in Queensland, Australia. As for the logistics, we'll be working with a couple of big logistics providers in Australia, so we're looking to simplify this too. Wogen is part of that same procurement strategy, once we've produced the sand materials, we deliver the product over the ship rail at Port of Melbourne and that's effectively the sales point to Wogen.

Wogen is an international specialist distributor based in London but with a very strong China presence which they've had for 50 years so we minimize issues around how we sell products in China and other overseas jurisdictions. They'll take 85% of all our production for the first five years and that can be extendable by agreement. 60% of the 85% or 51% of our total production will be on firm volume and a floor price. 40% of the 85% under that agreement or 34% of our total production will be under a straight sales and marketing agreement, so that will be market price, less a sales commission to Wogen.

So we're very pleased with our agreement. It doesn't tie up volumes at fixed prices for the long-term. Because of the nature of the sand supply/demand around this industry, we see price risk on the upside. We retain the flexibility to move 15% of the product into the market for our own trading purposes. We don't want to lose contact with the market and we'll use that to develop a relationship with some of the bigger downstream solar PV module and semiconductor manufacturers in China, Japan, Korea, Taiwan, and also Europe as well. So that's the Wogen agreement. It's fundamental to our ability to demonstrate that a) we have a product that will sell into international markets and b) gives visibility on volumes and price. We think that's the key agreement that we now have in place.

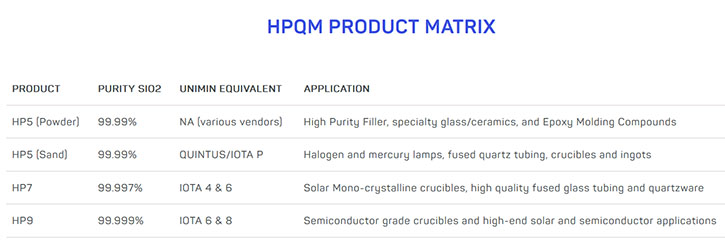

Dr. Allen Alper: That sounds excellent. Could you say more about the product range overview?

We have the ability to produce a range of products from our feedstock, which are viable now at the HP3 sand level, which is a 99.99% purity, and we've demonstrated that we can move impurities down to the HP5 product, which is a 99.995% pure product (HP5). The HP5 sand is a saleable product but also feedstock into the product development and the further purification down to 99.997% purity (HP7) and then you get a real step up in price. So right now, we're developing our products to move up from optical equipment, (High-Purity specialty quartzware), at the HP5 sand level, into solar grade sand for the manufacture of crucibles used in the solar PV industry at the HP7 level, and there's a step up in price, around about 7,500 US dollars a metric ton.

Then, if we get to the holy grail, which is to remove impurities down to 10 parts per million (99.999% purity), that is a semiconductor-grade sand and there’s another step-up in price. Subject to funding, we aim to be at bench scale HP7 purity level in around six months and HP9 within nine months. Importantly, we have very good operational flex in our plan and products to move things around between those different price points, dependent on market signals over time.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about the product supply overview?

Our products will sell into solar PV and semiconductor industries, and those industries are growing as described earlier. Those are global drivers, most of that manufacturing takes place in China, Japan, Korea, but also Europe and the US, but the big growing market is China. China is probably 90% of the solar PV manufacturing market and has nascent semiconductor industry, but right now they rely heavily on sand from a single resource in the USA. So all of those industries are largely dependent on continued supply of sand from a resource situated at Spruce Pine, North Carolina, USA. Two companies share the resource there, Sibelco and The Quartz Corporation.

There is another resource in Russia but we see little reported of its availability on the market.

So global manufacturing of solar PV and semiconductor grade wafers are running a risk on a single resource at Spruce Pine in North Carolina. In 2009 BBC described Spruce Pine as the most valuable strategic square acreage on the planet; that hasn't changed.

The importance of that resource has only increased, as the solar PV industry has boomed in the 10 years since 2009. That's placing increased strains on the supply chain for sand and these industries. HPQ intends to help alleviate those concerns by developing its resource in Australia. So the whole of that supply demand dynamic is likely to favour a new entrant such as HPQ.

I’m not suggesting that this is a real risk but it is interesting to ponder the implications of the existing Spruce Pine resource not being available or depleting. We don't know how much is left, I hope it never depletes. I don't want to see that scenario where the value of tech stocks and our access to technology and its benefits is potentially diminished simply due to a lack of high purity sand to make semiconductors. It does however highlight the critical importance of high purity quartz-sand to stake a claim to be the most strategic mineral on the planet. The YouTube video, showing The Quartz Corporation, will reiterate the fact that every single piece of electronic equipment in the world today is manufactured using the sand from Spruce Pine resource, so well worth a quick look at that video.

The only other point to mention, Allen, is that China/Japan/Korea/Taiwan don't own high purity resources, so it’s in their interest to encourage other sources of a long-term, reliable supply of high purity sand. That's where HPQ Limited intends to play into the existing supply demand equation.

Dr. Allen Alper: Can you tell us a little bit about your background and your management team.

Dr Udo Jakobs is an integral part of our management team. He's one of the very few experts globally that can demonstrate involvement in a commercial project, because there are very few of those projects globally, but he's been involved fundamentally in the process design and implementation of the plant in Norway, so he's a key part of our team.

Jason May is also a key part of that. He provides the link between Udo and on the ground execution and continued product R&D work. Those are the two key technical players on the team.

I've previously been a listed company CFO here in Australia for roundabout five years. Prior to that I've been in international project finance banking based in London, so I have a very good appreciation of project finance transactions globally from my training as a banker, five years on the credit side, so I saw a lot of project finance transactions. So my background is in structuring risk mitigation, risk management, risk transfer. All of those core skills needed to bring the project together from a corporate risk management and execution point of view.

Brook Burke was a lawyer and special counsel, with DLA Piper, in Australia and experienced working as company secretary in energy/mining related companies in Australia.

Andrew Hamilton is an experienced, broad-range commercial person and gets things done. They are the five key members of the Management Team and the Board right now, but we will transition the Board from essentially a founder Board to an independent board as we look to migrate the Company from a private company to a public company as part of the exit strategy. We'll aim to do that within about 18 months. We want to get this next A$5mmillion in the bag and then we'll look to list the Company.

Dr. Allen Alper: Sounds excellent! Could you summarize why High-Purity Quartz makes a good investment?

Sure. High-Purity Quartz Limited is a good investment. If you look at other investment opportunities, they will usually have a much bigger footprint than HPQ, they'll require large amounts of capital and people. Certainly, in the mineral and mining space, they will normally require a movement/processing of large amounts of overburden/ore/product to extract small amounts of valuable end product. The investment case differentiator for HPQ is that our yield of value-added product which is currently estimated around 60-65% of everything we mine, and we're not moving large volumes. Fully ramped up, we'll be mining about 100,000 tonnes per annum. Of the 100,000 tonnes, we'll sell about 63,000 tonnes of the high-value sand and a valuable byproduct powder. That is a key differentiator.

We're not mining large volumes, therefore the development CapEx is very low. Because we're selling into growing high-purity markets, the sales prices are high. High sales price and low operating costs, means there's a very attractive EBITDA margin of about 83% on our fully ramped up case and we can develop that in stages. So we have low capital investment requirement to get into early and strong cashflow.

We will then use the initial cashflow to expand the project with increased revenue of A$400 million a year and earnings (EBITDA) of about A$340 million. Again, we don’t require additional equity capital for this expansion. Those are very strong economics when measured against any other projects I have seen and with the low up-front CapEx means that the IRR is as good as any that I have seen. So part of the investment case is around those investor returns, but the other side of that is we believe we have a very clear pathway to generate those strong economics, and that's fundamentally the investment case for investors to take a look at the $5m investment opportunity right now.

Dr. Allen Alper: Sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

www.hpquartz.com

Registered Office

level 18, 530 Collins Street

Melbourne, VIC 3000

Australia

info@hpquartz.com

|

|