Mako Gold Limited (ASX: MKG): Exploring Large High-Grade Gold Deposits in West Africa; Interview with Peter Ledwidge, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/28/2019

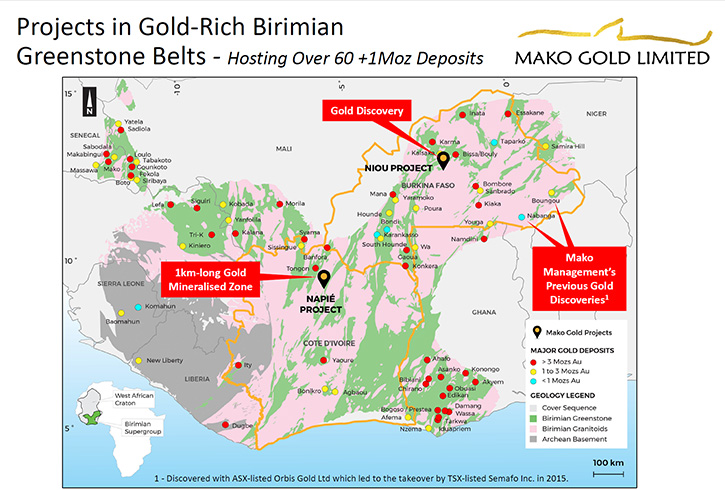

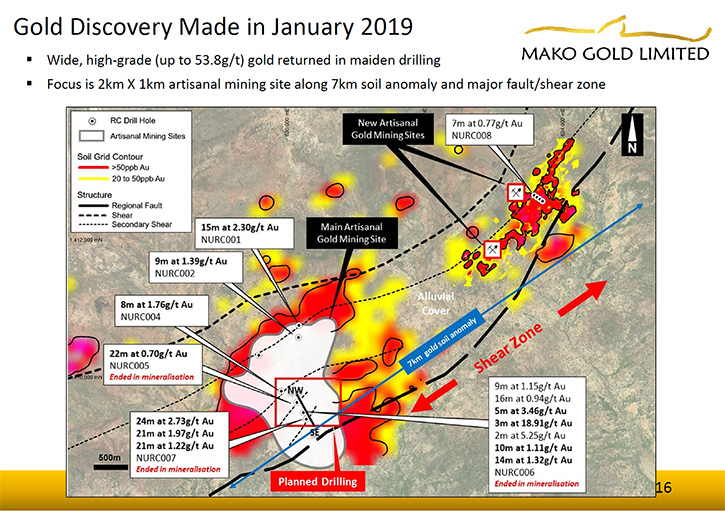

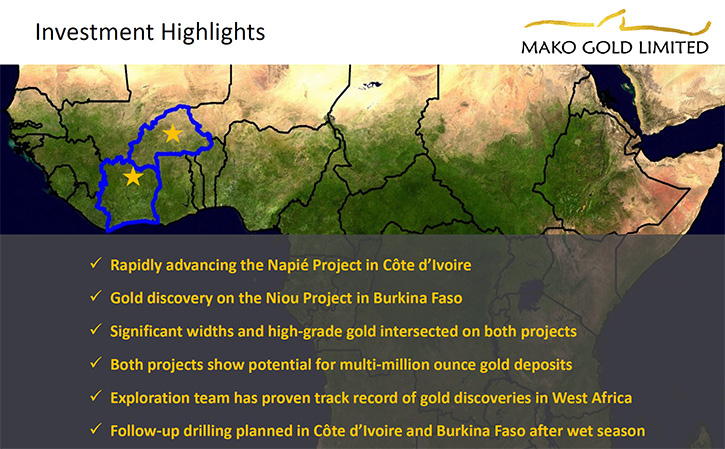

Mako Gold Limited (ASX: MKG) is focused on the discovery of large high-grade gold deposits in highly prospective and under-explored terrains in Cote d'Ivoire, Burkina Faso and other favourable countries in West Africa. The Company's flagship project is the Napié Gold Project, located in the north central part of Côte d’Ivoire 30km southeast of the city of Korhogo, it is easily accessed by a good road system. Mako Gold's other project is the Niou Project, located within the Goren Greenstone Belt, in the central part of Burkina Faso, 50km north of Burkina Faso's capital Ouagadougou and is easily accessed by a good road system. The Company made a new gold discovery there, in January 2019, with grades of up to 53.80g/t Au. We learned from Peter Ledwidge, Managing Director of Mako Gold, that they are focusing on the Tchaga Prospect, at the Napié project, with the goal of coming up with the resource within the next year. Another drilling program is about to start at the Napié project in October.

Mako Gold Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Ledwidge, who is Managing Director of Mako Gold Limited. I wonder if you could give our readers an overview of your Company and also tell them what differentiates Mako Gold Limited from others.

Peter Ledwidge: We're a gold explorer listed on the ASX. We only listed on the ASX in April of 2018 and already have done a lot of valid work, with some very good results. We work in West Africa. Our flagship project is in Côte d'Ivoire, Ivory Coast, and the other one is the Niou project in Burkina Faso. We announced a new gold discovery on that project earlier this year. What differentiates us from other companies is we move really fast, although cautiously, like our namesake. We're named after the mako shark. The mako shark is a very successful yet careful hunter, so we model ourselves after that.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors more about your properties in West Africa, where they're located, and something about what you found up to date, the resources, etc.?

Peter Ledwidge: Our flagship project is the Napié Project in Côte d'Ivoire, or Ivory Coast as it's also known, which is in West Africa. We have that through a farm-in and joint venture with a subsidiary of Perseus Mining Ltd (ASX: PRU) a good Australian mining company that focuses on Africa. We can earn up to 75% by taking it to feasibility. We've already reached the first milestone by spending $1.5 million US on it, and so already have 51% ownership of the project. To date we've identified two prospects. One is the Tchaga Prospect, and the other one is the Gogbala Prospect, all within the same permit. Keep in mind the permit is 30 kilometers north to south. On that permit there's a 23-kilometer auger and soil anomaly. Coincident with that, there's a 17-kilometer interpreted shear from the geophysics. That's where those two prospects are that we outlined.

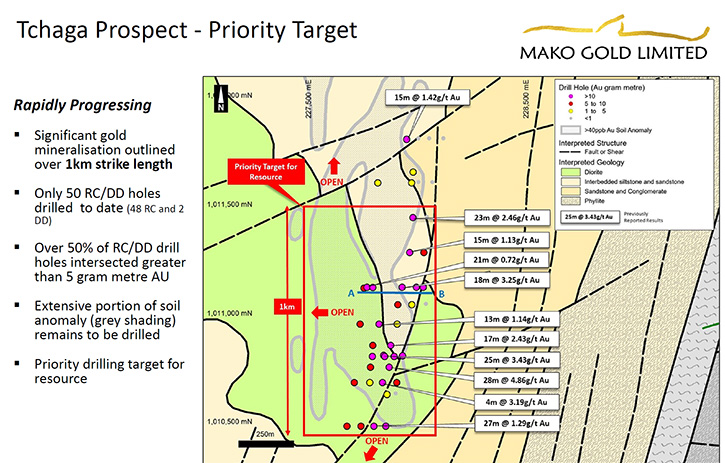

We're focusing on the Tchaga Prospect where we've outlined, to date, one kilometer of more or less continuous mineralization. Some of the better assays we've gotten there are pretty wide intercepts; 25 meters at 3.4g/t Au, 28 meters at 4.9g/t Au, 17 meters at 2.4g/t Au, 18 meters at 3.2g/t Au. When you consider we've only done 50 drill holes on that prospect, we really want to get drilling on it again. The object of that is to progress it to a resource. We don't have the resource yet, but we're really going to focus on that. It would be tempting to drill everywhere along that 17-kilometer shear, but we're really focused and we know the milestones that make or break a company.

For example, on our Gogbala Prospect, we've outlined two kilometers of mineralization, but that's on very wide space drilling. We've done less than 20 drill holes on that. We're really focusing on the Tchaga. Once we have the Tchaga Prospect, hopefully we find a resource on it within the next year. That's the target. Then we'll focus on the Gogbala Prospect. Shall I talk about the Niou Prospect in Burkina as well right now?

Dr. Allen Alper: That would be great. Yes, excellent.

Peter Ledwidge: We're in the process of transferring the permit over to us from the permit vendor. This is located in Burkina Faso only 50 kilometers from the capital of Ouagadougou. We've done all the work. On the joint venture we have with Perseus, in Côte d'Ivoire, they did some very valid work. We were happy to take it from that point on because it really needed to be drilled.

The Niou Project in Burkina Faso is not a brand new project. That's just the name of the project. We did all the hard work ourselves, doing the airborne geophysics, the mapping, the rock chip sampling. We announced, earlier this year, a discovery on it in just 11 drill holes. That's all the drilling we put on it so far. We have a soil anomaly that's seven kilometers long. That's coincident with a regional fault and shear zone once again. The highlight of that is there's a two-kilometer long by one-kilometer artisanal gold mining site on it. Just on that site we put seven RC drill holes on it, and six out of the seven returned significant results. For example, the northern most one gave us 15 meters at 2.3 grams for gold.

What's really exciting, if you go to our presentation, you'll see them in section, but the three holes that we drilled had intermittent mineralization over a width of 315 meters. There're areas where we didn't drill, where we didn't get any results. For example, the best hole out of that is hole NURC07. Just in the one hole alone, we got an intersect of 24 meters at 2.7 grams gold, then 21 meters at 1.9 gold, and 21 meters at 1 gram gold. Basically, the entire 100-meter long hole is intermittently mineralized.

We're hoping to drill that after we drill on Napiee in Cote d’ivoire. We're going to try to get some more strike length. When we're done we hope to be able to say, "Hey, that 315 meters of width that we've identified, well it goes 500, 600 meters along strike." Both of those projects have the potential to host multimillion ounce deposits along these major shears.

Dr. Allen Alper: That has excellent potential. Could you tell our readers/investors a bit about operating in West Africa?

Peter Ledwidge: Some people think Africa is one big country, which it's not. There're over 50 countries in Africa, and we focus in West Africa. I've been working in that part of the world since the mid '90s for Canadian companies. Since I moved to Australia, I've been there for about the last 10 years. I find it a very easy place to work. For example, at the previous company I worked for when I was working in West Africa, I applied for permits that were granted within six months. I find the administration easy to get along with. They want you to be successful because they're poor countries. So, if you can create jobs, they're very happy. We find it very easy. We have good drill contractors. It's a great place to work.

Dr. Allen Alper: Very good. Could you tell our readers/investors a little bit more about your background, Peter, and your Board, and your Management Team?

Peter Ledwidge: I'm a geologist with over 30 years’ experience, and our Chairman is a geologist as well. He has about 40 years’ experience, so we get his input as well. One of the key members of the team is my colleague and spouse of 25 years. We've been working together most of that 25 years. We previously worked for another company called Orbis Gold, an ASX listed company. Because of our success, we were taken over by Semafo, Inc. a TSX listed company. The reason we were taken over is in three years we made three gold discoveries. One of those discoveries is actually a producing mine now. It's the Boungou mine. It's about one and a half million ounces at roughly four grams per ton. It's operating at all in sustaining costs of under $700 an oz., just to show that we're proven explorers.

Because of that, when we did our IPO last year, Resolute Mining, another good Australian explorer, put in $2 million of our $6 million raise. We have a good track record, and we really think we have the formula for finding the right permits. When I was at Orbis Gold, I acquired the entire portfolio for the company. Obviously it was a pretty good portfolio if we made three discoveries in three years. We think we have the formula for finding the right ground, and we think we have the teams for exploring it.

I don't want to leave out our West African team, who are, for the most part, ex-Orbis Gold as well. When we created Mako Gold, they all wanted to come back and work for us. They find it exciting working for us because we find good ground to work on, with a high chance of a discovery. As a geologist, it's pretty boring if you're working on a project that doesn't have a potential. To give you an idea, we had three projects. We drilled our number three project last year and it didn't meet our expectations, so we let that one go. We certainly don't fall in love with our projects if they're not producing the results that we're hoping for.

Dr. Allen Alper: Well, that sounds excellent. It's great to be in an area that has so much promise and you're finding so much gold, and has potential to be a district size gold property. That's excellent. It's good to have such a strong team that has experience in discovering gold. It sounds like Mako Gold is well-named and well-set.

Peter Ledwidge: Yes, it really is.

Dr. Allen Alper: Could you tell our readers/investors a little bit more about your capital structure and your share structure?

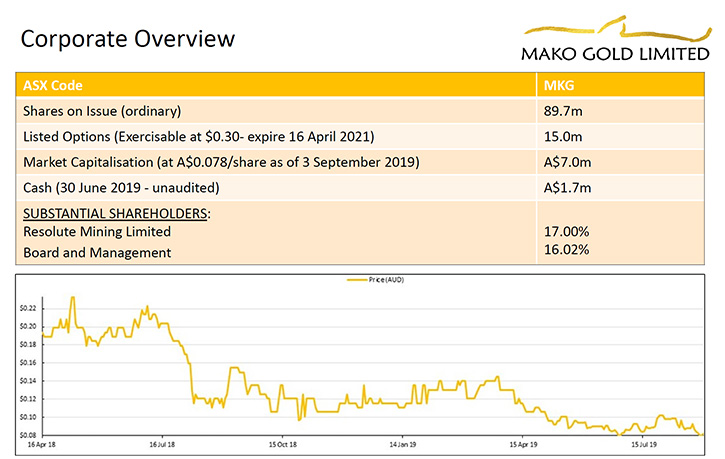

Peter Ledwidge: We have just under 90 million shares on issue, and we have a market cap of about $7.5 million. We don't have very many shares on issue. Currently our share price is at 8.4 cents. We think we're undervalued. I don't think you'll ever meet a managing director that'll tell you that they're overvalued! But considering the quality of the projects that we have and the results we're getting, we're hoping that with our next round of drilling, the market will take notice and we'll shoot up to where we think we should be. The markets have been a little bit difficult lately, but the price of gold has helped the producers. My view is that it is just starting to trickle down to the juniors like ourselves. It's trickled down to some of the juniors that are actually putting mines into production. I think the next step will be trickling down to companies like we are, who don't yet have a resource, but who some people may feel, "Wow, they have pretty good results. I've got to get some of that."

Dr. Allen Alper: That sounds excellent. It does sound like the timing is changing, with the gold pricing. As you pointed out, investors are beginning to invest back into the juniors. It's been a very difficult time for five or six years. It looks like it's turning around, and that should help.

Peter Ledwidge: The cannabis and blockchain shares that investors were investing in, seem to be losing a little bit of their pizzazz. I think investors are starting to come back into the resource industry, and specifically into the gold resource companies.

Dr. Allen Alper: That's what it looks like. Could you summarize the primary reasons why our readers/investors should consider investing in Mako Gold?

Peter Ledwidge: Our share price is pretty low. We listed about a year and a half ago at a 20 cent share price, and we're currently sitting at 8.5 cents. When we listed, we hadn't done any drilling on any of our properties. Now a year and a half later and we've done some drilling. We aIso got rid of our third project, which didn't meet our expectations. The other two projects have returned pretty spectacular results. We've definitely de-risked the project and then added value. Furthermore, we recently announced our preliminary metallurgical tests on the Napié Project, specifically on the Tchaga Prospect within it, where we hope to advance to the resource stage in the near term. All the results came back with cyanide gold recovery of over 94%. We've de-risked it to that extent as well.

It's something that we needed to find out. Investors were asking about it. They were happy with the wide high-grade intersects that we were getting in drilling, but a lot of investors were calling me up and saying, "Well, what's the metallurgy on it?" We listened to the investors, and it's something we wanted to do. We feel we've de-risked the project a lot and added a lot of value. We did a raise a little while back, and I personally put $20,000 in. All the other directors contributed, also. We wouldn't be putting money in if we didn't think we were going somewhere.

Dr. Allen Alper: Well, it does sound like you're in an excellent position to move forward, that you have gotten some excellent results in West Africa, and you have great targets to pursue. It sounds like you're very well-positioned, and very well-experienced. You know your Team, and you know what you're doing. That's great. Is there anything else you would like to add, Peter?

Peter Ledwidge: West Africa is prospective. The Birimian Greenstone Belts cover a number of countries in West Africa, from Senegal in the Northwest to Niger in the Southeast, including Burkina Faso and Côte d'Ivoire. Within that Birimian Greenstone, there are 60 gold deposits that are over one million ounces, 35 of which are over three million ounces. That's one of the reasons we're there.

One of the other reasons we're there is they have shallow deposits. For example, a lot of companies are exploring in Western Australia right now, drilling under historic mines. In order to make a discovery they have to drill 300-meter holes. Whatever they discover is going to have to be an underground mining scenario. Where we go there're artisanal miners, mining at surface or near surface. Straightaway that's a gold anomaly for us. We have the potential of finding open pittable mines. Obviously the capex and opex for those are usually a lot cheaper than the underground, so quite appealing for investors.

Dr. Allen Alper: That sounds excellent. Is there anything else you would like to add?

Peter Ledwidge: Just to thank you for interviewing Mako Gold Limited for Metals News.

Dr. Allen Alper: You are very welcome. I’m very impressed with what you are doing. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.makogold.com.au/

Mr Peter Ledwidge

Managing Director

Ph: +61 417 197 842

Email: pledwidge@makogold.com.au

|

|