Kore Mining Ltd (TSXV: KORE): Funded by Eric Sprott, 5-Million-Ounce Gold Opportunity in USA and B.C., Canada; Interview with Scott Trebilcock, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/9/2019

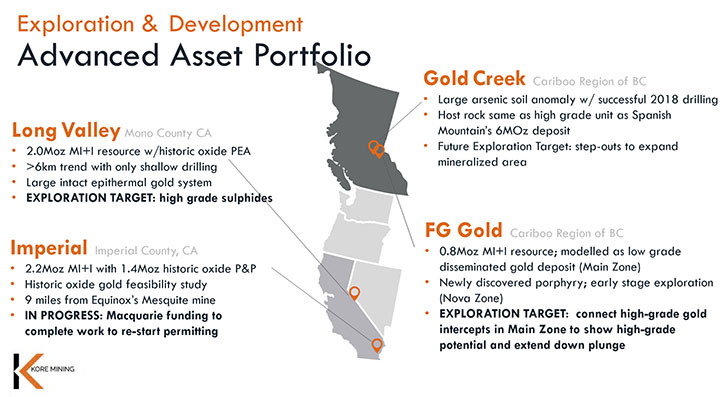

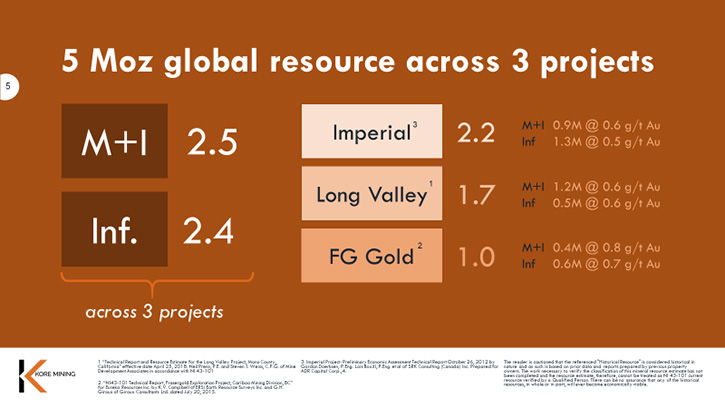

Kore Mining Ltd (TSXV: KORE) owns 100% interest in the Imperial and Long Valley gold development projects, located in California, USA and the FG Gold and Gold Creek exploration projects, located in the Cariboo region of British Columbia, Canada. Combined, the Company’s projects boast a 5 million ounce gold opportunity. We learned from Scott Trebilcock, President and CEO of KORE Mining, that they were able to acquire their advanced gold assets at rock bottom prices, and then they were able to secure two strategic investments: $3 million from Eric Sprott for the exploration, and $4 million from Macquarie Bank for the permitting and development of the projects. All Kore projects have gold discoveries on them, two of which are quite advanced. According to Mr. Trebilcock, the Company is currently undervalued.

Kore Mining Ltd

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Scott Trebilcock, who is President and CEO of KORE Mining. Scott, could you give our readers and investors an overview of KORE Mining, and also what differentiates KORE Mining from your peers?

Scott Trebilcock: Sure thing, Al. KORE Mining was only recently established after being a private company for several years. Founders of the Company had a mission to acquire advanced gold assets at rock bottom prices. We in the Company believe they were quite successful in doing so. They built a portfolio of exploration and development stage gold assets, with a total resource of 5 million ounces across three different projects in California and British Columbia, Canada.

We believe having 5 million ounces with companies in the past who drilled out those resources, having spent in the neighborhood of 75 million US dollars on those projects, gives up a leg up as a small junior company trying to advance those projects.

Rolling that back to today, KORE is a 30 million market cap junior gold company with a lot of gold in the ground. We've raised some money from Eric Sprott and Macquarie Bank to put some meat on the bones of those assets and try and take advantage of a robust gold market to generate shareholder value.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your key projects?

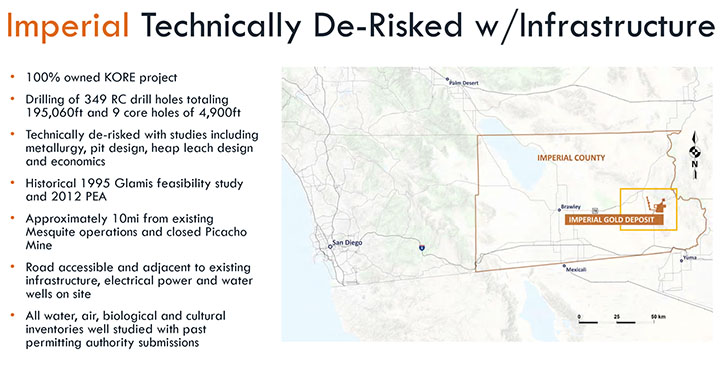

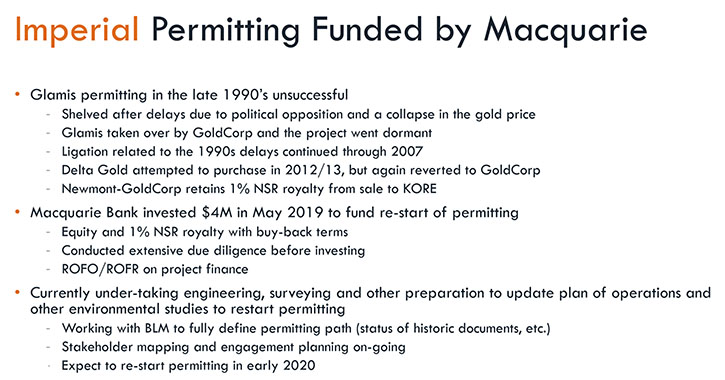

Scott Trebilcock: Absolutely, Al. The main project, on which the Company was founded as a private company, is called the Imperial Project. Imperial is a 2.2 million ounce gold oxide deposit in Southern California, right on the Mexico, Arizona border. The Imperial Project has had a long history. It was originally discovered by Glamis Gold in the mid '90s. It was going to be the next mine in the growth sphere of their company. However, unfortunately for them, they got caught up in the Clinton era environmental politics and the project was blocked in permitting. Then the gold price collapsed to 300 bucks and they shelved the project and were eventually taken over by Goldcorp, where the project basically sat dormant right through to today.

So we believe it's a different time. All the land is managed by the federally administered Bureau of Land Management, so we believe that as long as we exceed all of California's robust environmental laws, the local county in California that's quite poor and already hosts the Mesquite Mine of Equinox, will be amiable to permitting the project. We have a development-ready project in a tiny little Company and we don't have to do any technical work because Glamis did a full feasibility study. We just need to go through the permitting process, which, while it takes time, doesn't cost a lot of money. So Macquarie Bank has funded us to advance that project.

Dr. Allen Alper: That sounds excellent.

Scott Trebilcock: Yes and our second project, also in California is a bit earlier stage, with 1.8 million ounces of oxide on the Nevada border, closer to Reno. Our plan is to go back into that project and do some exploration work to try and define a higher grade sulfide resource that will fit better with the environmentally sensitive nature of the location for that project. It's looking for sulfides under a large oxide resource, much like what all the big companies are doing in Nevada, having mined out all those kinds of oxide deposits.

We have lots of exploration, opportunities in this Company, the reason Eric Sprott put money in. We also have two gold assets in the Cariboo region. That's up near Williams Lake, right near the Mount Polley Mine, Spanish Mountain, Barkerville. In that jurisdiction we have two properties, which are earlier stage exploration projects. However, they have discoveries. One of them has an 1,000,000 ounce low-grade resource that we'd like to do some more work on and look at trying to find some higher grade components.

Anyways, lots of things to do, and Eric Sprott gave us $3 million for the exploration and Macquarie gave us $4 million for the permitting and development.

Dr. Allen Alper: Sounds like an excellent position to move the Company forward, amazing. It's such a young company and with so much potential. Could you tell our readers, investors a little bit about your background and the team?

Scott Trebilcock: Absolutely. I'll start with the Founders. The two Founders of the Company are Directors. One is the Executive Chairman, James Hynes, a very successful entrepreneur, who had a lot of success in the aggregates business. He founded the Company along with ex-Goldcorp executive, Adrian Rothwell. They're both large shareholders today.

I most recently worked in Nevsun Resources, where I worked for nine years building out the corporate development for that company, buying Reservoir Minerals. Eventually the Company was sold for 1.9 billion cash to Zijin, late last year. Prior to that, I'm a process engineer, who worked at Noranda and Hatch and I’ve been around for just over 25 years in the sector now.

Dr. Allen Alper: Well, it sounds like you have a great background and devoted Board Members that have skin in the game. Excellent! Could you tell our readers/investors a little bit about your share and capital structure? I know you've mentioned a bit, about it, but could you tell us a little more?

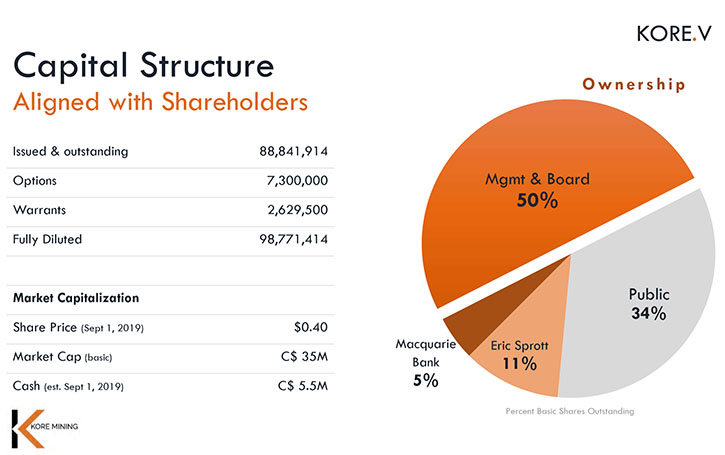

Scott Trebilcock: We currently have 89 million shares outstanding trading at about 35 to 40 cents, giving the Company an undiluted market cap something in the 30 to 35 million Canadian level.

50% of those shares are owned by Management and the Board. Macquarie owns 5% and Eric Sprott owns 12. Those are the large shareholders. There's not a big float. 34% of the shares actually trade on the market. We trade on the TSXV under KORE. We have probably today somewhere in the neighborhood of $5 million cash in the bank from the Macquarie and Sprott placements to deliver drill results from the Sprott money doing exploration and hopefully some positive steps on permitting the Imperial Project with the Macquarie money.

Dr. Allen Alper: Ah, that sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in KORE Mining?

Scott Trebilcock: Well, I can tell you the primary reason I invested in the Company. I bought a fair chunk of the Company after it was founded, after it was already public, on the market, and continued to buy shares up until even a couple of weeks ago. I bought another block when there was a little dip in the price. So I think it's a great opportunity. It all comes down to valuation.

So we need to go out with very conservative exploration dollars, do some step outs, do some confirmation drilling, generate appropriate news flow to let the market better understand the Company, because it's so new to the capital market. It's not like some equity has gone through the whole last cycle and it has a bunch of disgruntled shareholders that saw a higher price before. Everybody, who has ever bought a share in this Company so far is up. We expect that to continue as the capital markets understand this company better and just give it a valuation similar to its peers.

Next we need to de-risk the assets and add value. We’ll do that by permitting and hopefully making some discoveries or resource growth on the other assets.

Dr. Allen Alper: Well, those sound like excellent reasons to consider investing in KORE Mining. Anything else you'd like to add, Scott?

Scott Trebilcock: Five million ounces, at less than $5 US an ounce, certainly gives one the ability to add value. Certainly a huge win if we can permit the Imperial Project. So I think we have some great potential, and we have a little bit of money in our jeans to do it.

Thank you for interviewing KORE Mining for Metals News.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.koremining.com/

Scott Trebilcock

President, Chief Executive officer

info@koremining.com

+1-888-407-5450

|

|