Champion Iron Limited (TSX: CIA) (ASX: CIA): Largest High-Grade, Low-Contaminant Iron Ore Pure-Play Producer, Listed Publicly in the World; Interview with Michael Marcotte, VP of Investor Relations

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/1/2019

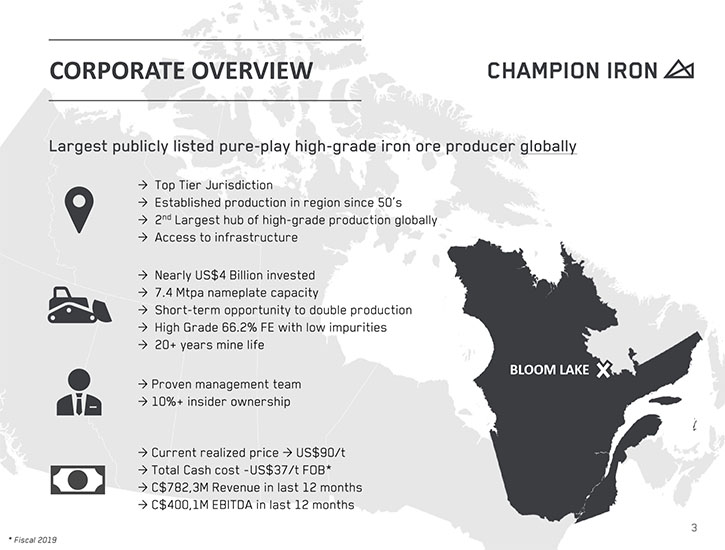

Champion Iron Limited (TSX: CIA) (ASX: CIA) is a producing iron development and exploration company focused on its flagship asset, the Bloom Lake iron ore property, located in Québec, Canada. We learned from Michael Marcotte, VP of Investor Relations for Champion Iron, that they are currently the single largest high-grade, low-contaminant iron ore pure-play producer that's listed publicly in the world. Following the acquisition of Bloom Lake, Champion implemented upgrades to the mine and processing infrastructure, and was able to reposition the property on a global basis, where it can compete with the majors. The Company has partnered in projects, associated with improving access to global iron markets, including rail and port infrastructure initiatives, with government and other key industry and community stakeholders. Plans for 2020 include advancing the Phase II expansion as proposed by the feasibility study released in August 2019, which proposes to double the capacity at Bloom Lake to 15 million tonnes per year of high-grade iron ore concentrate.

Champion Iron Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Michael Marcotte, who is VP Investor Relations for Champion Iron. Michael, could you give our readers/investors an overview of Champion Iron and what differentiates your Company from others?

Michael Marcotte:Champion Iron is a fairly new company, but it's quite interesting to highlight that already today we're the single largest high-grade, iron ore, pure-play producer that's listed publicly in the world. This is a big accomplishment as we've turned around an operation that was recently built in Northern Quebec, Canada. But what really differentiates the Company is the nature of the high- grade iron ore, containing very low contaminants that we produce, something which is a rising issue in the industry, where grade has been declining and contaminants have been increasing amongst many of the important producers. I want to highlight why we got here today at such a quick pace.

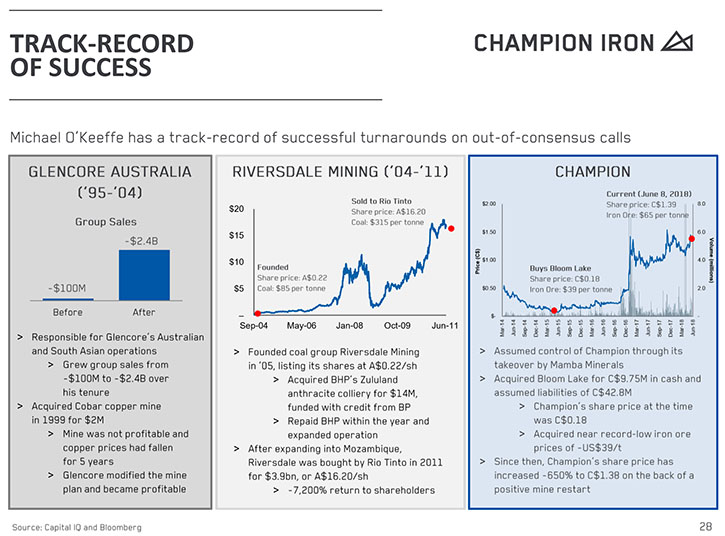

It's due to the backing of our Founder and Executive Chairman, Michael O'Keefe, who's extremely well-known in the business community in Australia, maybe a little less in North America, but he was a partner of Glencore. He was in charge of their Asian corridor of business. He's an operator! Under the Glencore franchise, he built and bought several operations.

When he departed Glencore, he went on to seed a company called Riversdale, which was sold in 2011 to Rio Tinto for $3.9 billion. Then he did Riversdale 2, which was sold very recently in 2019 to the richest person in Australia for just north of $800 million. Both of those Riversdales were coal entities. It speaks to Michael's ability to identify assets and bring them forward. He's also been able to monetize at the right time.

Michael really thinks on a multi-decade basis, which ends up bearing fruit within the story that we have today. He foresaw a structural shift in the iron ore market. Quite often, people will talk about iron ore being one product, but iron ore differs importantly, primarily in grade and in contaminants.

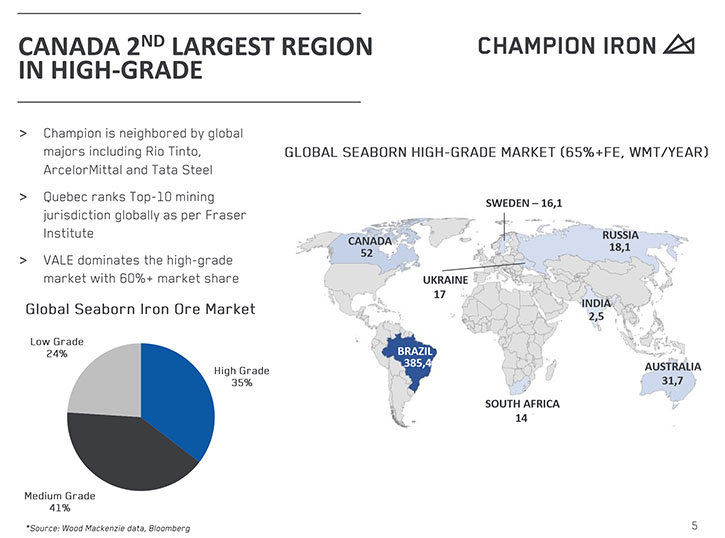

The biggest consumer of iron ore is by far China. They consume almost 70% of the global seaborne market. China had really been on a mission for the last 30 to 40 years to build their economy. They've done that at the expense of emissions, where steel making is one of the largest emissions industry in China. Michael foresaw that at one point China would be forced to implement emissions standards in the steel making process, just like Europe, the US, and Japan, and he wanted to position himself for that.

He looked globally for opportunities. There aren't many hubs of high-grade production in the world. Brazil controls almost 80% of the high-grade production globally today, on the seaborne market. He knew he couldn't really compete there because Vale controls most of that. But there was a very good opportunity here in Quebec, where there was readily available infrastructure, tremendous resources, and government support.

He moved his family here from Australia and acquired an asset, called Fire Lake, which Champion has had since 2013. As he was in the process of looking to develop Fire Lake, in 2015, Bloom Lake, which we own today, became available from Cleveland-Cliff in the US at one point. It came into trouble at the same time as the commodities started the rollover and Cliff started to have financial issues.

Michael managed to rescue the property literally for pennies on the dollar, with the help of the Quebec government, and restructure the asset. Very quickly, we were able to re-engage the asset, recommission it, and reposition the property on a global basis, where we can compete with the majors.

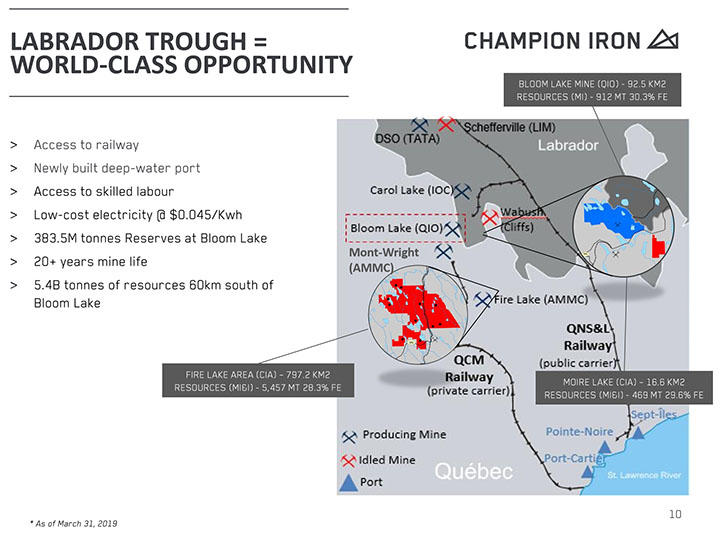

Looking at the infrastructure in the region, in the Quebec and Labrador provinces of Quebec, Canada, the QCM Railway is owned 100% by Arcelor Mittal of Canada, or AMMC and the railway QNS&L is controlled by the Iron Ore Company of Canada, which is a conglomerate primarily controlled by Rio Tinto. They own that railway, but because that railway crosses two Provinces, Labrador and Quebec, it becomes federally regulated and forces the operator to grant access to any third party. This is quite key.

This asset was built in 2009-10 by a company called Consolidated Thompson, who built the property for $1.2 billion US. They sold the property to Cliff in 2011 for $4.9 billion US. Cliff went on and improved the asset from there, but when initially Consolidated Thompson signed the rights to the railway, there were many other operators in the region that were trying to bring a project forward. China was on a growing mode at the time and all commodities were quite buoyant, so there were many projects trying to get on that single rail line.

Iron Ore Company of Canada, or QNS&L Railway, foresaw that they were going to get muscled out of their own capacity on the railway, but they knew they needed to provide access to anybody by law, so they were charging prices that were quite expensive. They initially signed a contract of $18 a ton, but more importantly, it was a take or pay contract on the entire capacity. Now, the contract would have probably been fine at $18 a ton, but given it was a new mining operation, sadly something went wrong in the mine and they couldn't stop mining to make a repair because they had take or pay contracts with the railway.

To help visualize what went wrong at the mine, iron ore is quite a simple process. We don't use any reagents or anything like that, like many other commodities. We mine, we crush, we mill, and then after that, we put the material in a slurry with water. Then you have to picture a room Walmart-size of these things called spirals that are about 12 to 15 feet high. They're exactly what you're probably thinking. It's just a spiral that turns. Because iron ore is denser, the iron ore goes in the middle and the silica, which is the only other thing we're separating it from, goes on the outside. Then you have our final product. It's that simple.

But when Consolidated Thompson built the property, they were starting to struggle for capital and they installed spirals that were meant for mineral sands. Now, they worked just fine for the first couple of years, but after a couple of years, they started to decay because iron ore is coarser than mineral sands. The recoveries went down from 80% to about mid-sixties. That on its own is a cost issue because about 1% of recovery is about a dollar a ton, but more importantly, they couldn't shut down and replace the spirals because they needed to oblige the take or pay on the rail and they weren't producing enough to oblige the full take or pay on the rail.

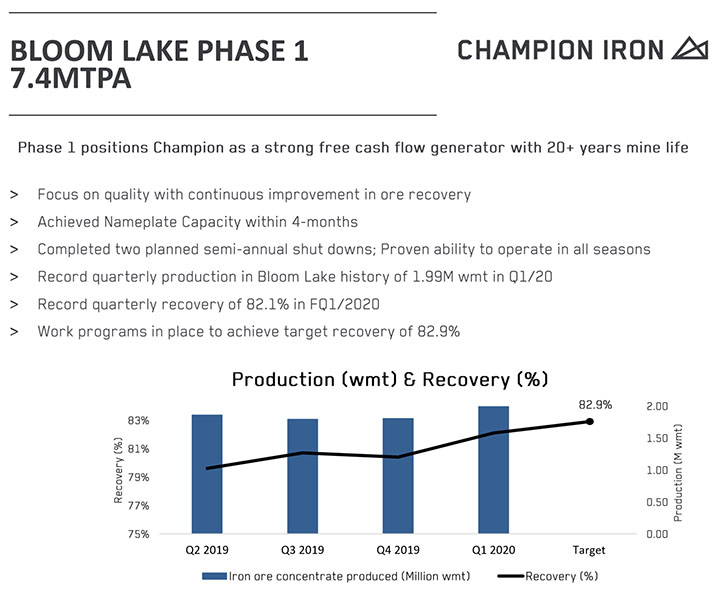

Because they had resources for decades, they figured they would build a second phase and once the second phase would be online, they would use the tons from the second phase to satisfy the take or pay on the rail. Then shut down the first phase, replace the spirals, reopen phase one, and be able to produce for decades because of the resources. Today, the phase one at Bloom Lake is 7.4 million tons of nameplate capacity.

They almost got there, but the market turned. Cliff's market cap in the US, which owned the property back then and owned many other properties, went from $14billion to $400 or $500 million or so. Their debt went from near zero to over $2 billion US.

Sadly, because this property had many liabilities linked to the railway and other liabilities linked to off state agreements, they had with counterparts in Asia, they were forced to shut down the property, which went through a process in Canada called CCAA, or bankruptcy protection.

This is where we came in, and we bought the property for pennies on the dollar. We walked onto the property, took the right spirals, WW6+ that are currently being used for decades by other operators in the region, and they work just fine. They were already installed by Cleveland-Cliff in phase two. We put them into phase one, turned on the switch, and just in our first year, we realized $655 million in sales and almost $150 in income. That was just in our first year.

After doing a few fixes, we've proven our ability to deliver a ton to the port for approximately $35 US. Our freight to the end market last year averaged around $23 US, and our product currently is fetching near $100 a ton. We make currently, on a cash basis, about $40 US margin per ton, and our nameplate capacity is 7.4 million tons today, although we've proven our ability to beat that throughput.

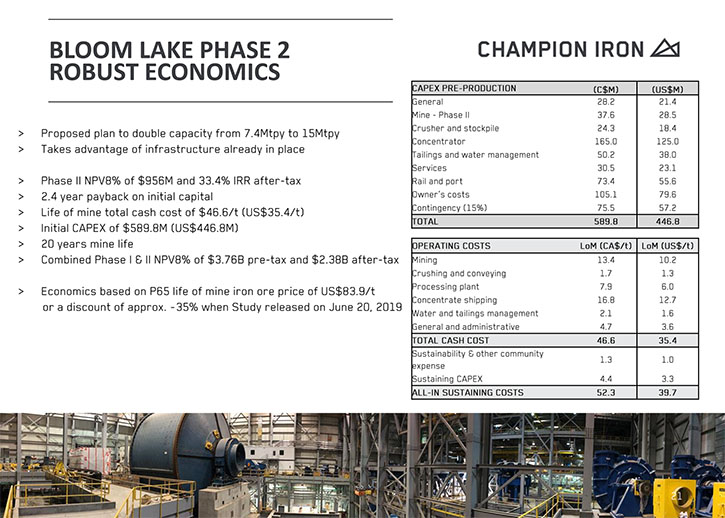

The beauty is that we also have the phase two expansion, which was already started by Cliff, and that phase two is approximately 75% finished. The Company has recently published a feasibility study in August, where we highlighted the proposal to complete this expansion, which would, again, take us from 7.4 to 15 million tons. The feasibility study has the expansion potentially being finished as early as the first half of 2021, which is a very rapid turnaround for this type of expansion and global landscape.

Dr. Allen Alper: That sounds excellent. Amazing what your team has been able to do. Could you tell us a bit more about improvement on the balance sheet and what the forecast might be once you have the second phase going?

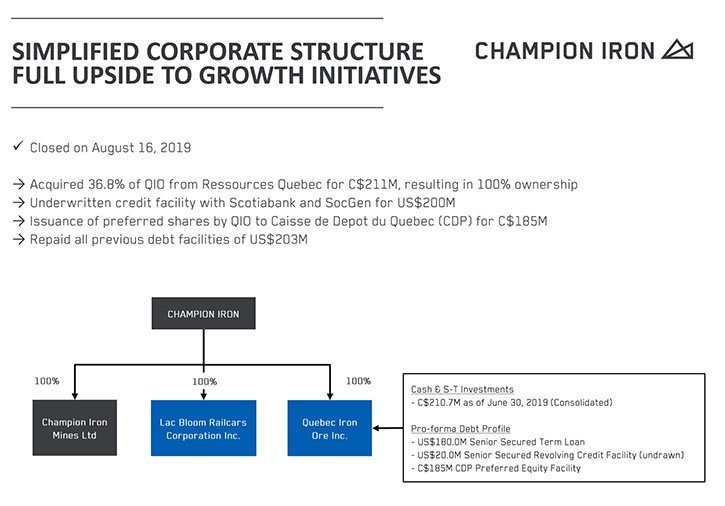

Michael Marcotte: Let's start about the balance sheet. It's very timely because in the last four weeks, we announced the closing of many transactions. In September 2019, we announced three transactions that restructured our capital and our corporate structure.

One, we acquired a minority stake from a government entity who owned 36.8% of the property. When we acquired the property in 2016, there was a clause where Champion had the right and the option to purchase the minority stake from the government. Given we've proven our ability to successfully operate at Bloom Lake and then do so economically, we definitely wanted to exercise this option. We also had a set mechanism to price the transaction, which resulted in a very attractive proposition for us, but also a very healthy rate of return for the government of Quebec, who quadrupled their money and are still in our shares today at the Champion level.

To continue onto our capital structure, we initially had some debt that we retired that was more expensive. This prior debt was put in place for the construction and the recommissioning of Boom Lake. Now that we've proven our ability to produce and do so economically, we decided to restructure that debt. Today, we have a bank debt for $180 million US, which was led by Scotiabank and Société Générale S.A.

We also have a $20 million US senior secured revolving credit facility, which is not pulled today.

We also have a $185 million Canadian preferred equity facility, which sits at the Quebec Iron Ore level. This was issued by the largest financial institution in Quebec and a top three in Canada. The beauty with this preferred facility, one, it helped us repurchase the minority stake from the government, but two, it offers a lot of flexibility where we can repay it at par with no penalty after two years. It's very flexible.

The beauty with our portfolio is we effectively have three significant size companies that are merged into one another in a way. When Michael O'Keefe came to Canada the first time, he came in with a property called Fire Lake, which was just north of Fire Lake AMMC. It's currently operated by AMMC, or Arcelor Mittal Canada. There is a property called Fire Lake that we own in the portfolio, but we control a dozen other tenements that have defined resources in the district that combine 5.4 billion tons of resources of high-grade iron ore with low contaminants.

That's over five times the scale that we currently have at Bloom Lake per se. The beauty is that yes, we can take our current run rate of 7.4 and go to 15, which we're looking to do via the recent feasibility study and hopefully get to do so within the next 20 months or so, but after that, we'd be able to contemplate an additional growth opportunity, with the entire district identified resources.

Champion already controls the lion's share of the undeveloped resource in the trough and hence one of the largest undeveloped resource of high-grade low contaminant in the world. This is somewhat hidden within our portfolio, and because we've just proven our ability to turn around operations, I don't think that's something that people are really focused on when they try to evaluate our Company.

Dr. Allen Alper: That sounds very promising! Could you elaborate a bit more on Champion's 2020 focus?

Michael Marcotte: Our fiscal year ends in March, like most Australian companies, because we have a history of being an Australian company with our founder. With regards to 2020, the calendar year, as we enter into next year, the focus for us is definitely going to be to advance the phase two expansion and secure financing for it. We do believe we have the ability to advance the project, without diluting existing shareholders.

Michael O'Keefe, our founder, owns 10% of the Company and definitely has a vested interest to create value on a per share basis, and so do some of our key shareholders. Almost 25% of our Company is held by family offices, which is quite abnormal for a mining company of our size. These are primarily Michael O'Keeffe's close relationships that have supported him in prior vehicles that also would like to see our company deliver without diluting existing shareholders.

Wynnchurch Capital, a private equity group out of Chicago, manages, to our understanding, around $4 billion and they own about 16% of our stock. They're also a great supporter of our Company and motivated to make sure that we deliver without dilution. The same thing for the government of Quebec who owns almost 9%.

Next year is a big transition year, where we get to potentially double the scale of our enterprise. We really feel like we're in a position of strength here to be able to deliver that. Not only because of the market positioning, where iron ore prices are very healthy, but because we feel that we re-anchored Champions cost, where we get to compete in any kind of cycle at this point.

Dr. Allen Alper: That sounds excellent. Michael, could you tell our readers/investors the primary reasons they should consider investing in Champion Iron?

Michael Marcotte: One, we think like shareholders, and that's proven by our ownership. I don't think many mining companies can claim to be owner operators, and we are.

Two, there is a massive structural shift ongoing, within the iron ore market, where grade is starting to be an issue, where there are a lot of new emissions standards being implemented, primarily in China, that are forcing steel mills to reduce emissions. To reduce emissions, you need a higher quality product. Also, within the quality differential, there is a growing contaminant issue globally in iron ore. The Quebec Labrador trough, where we control a very strong resource base, has long been one of the cleanest in the world. Our product is in growing demand, while other basins are having rising issues.

Three, we have resources in the district, to either operate, on an economic basis at the expanded rate literally for a hundred years, or consider organic growth thereafter to continue growing our Company and delivering value to shareholders.

Dr. Allen Alper: That sounds excellent, is there anything else you'd like to add?

Michael Marcotte: I just want to thank you for interviewing us for Metals News.

Dr. Allen Alper: Thank you. I’ve enjoyed talking with you about your amazing Company. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.championiron.com/

Michael Marcotte, Vice-President, Investor Relations

514-316-4858

info@championironmines.com

|

|