Rogue Resources Inc. (TSX-V: RRS): Acquiring Cash Flow- Two New Limestone Quarries, to supplement its Advancing Silica/Quartz Business; Interview with Sean Samson, President & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/1/2019

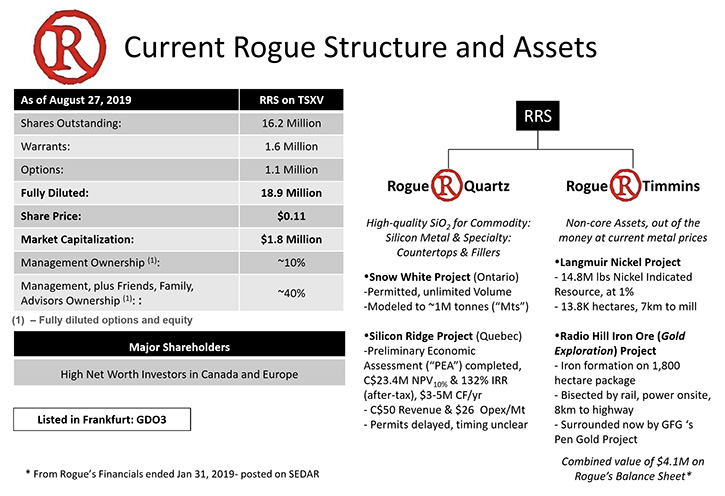

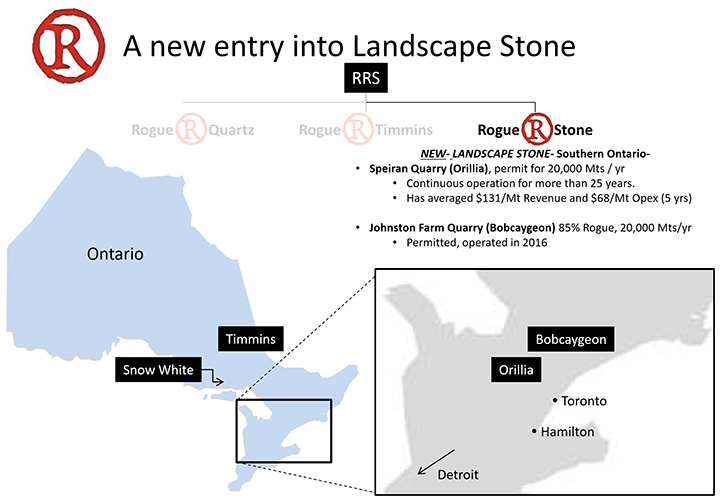

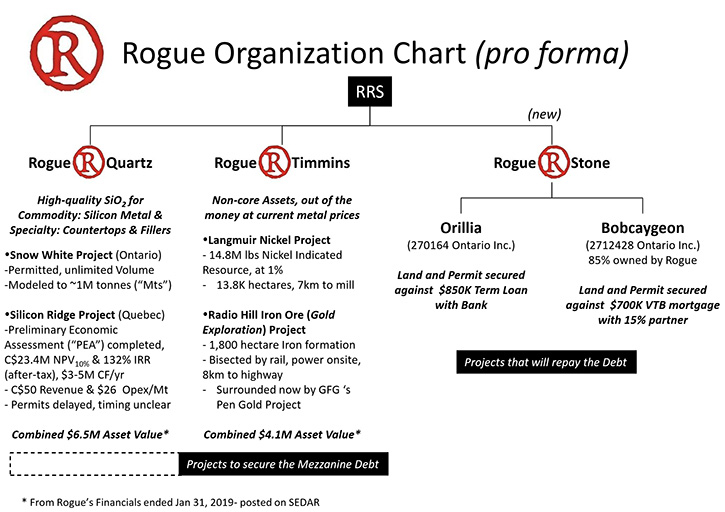

Rogue Resources Inc. (TSX-V: RRS) has been focused on advancing its silica/quartz business, with the Snow White Project, in Ontario and the Silicon Ridge Project, in Quebec, while at the same time watching the paper value of its other assets increase with rising metal prices, including the gold potential at Radio Hill and nickel potential at Langmuir. We learned from Sean Samson, President, CEO and Director of Rogue Resources, that Rogue is acquiring, at very good terms, two limestone quarries in Southern Ontario that are specifically focused on selling into the landscape stone market and will be immediately cash flowing. According to Mr. Samson, Management, and friends and family now own about 40% of the Company's stock, and they haven't been taking salaries, since last October, until they were able to see a path to cashflow- which they think the limestone quarries will provide.

Snow White Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sean Samson, who is President, CEO and Director of Rogue Resources. Could you give our readers/investors an overview of Rogue Resources and also tell them what differentiates Rogue Resources from their peers?

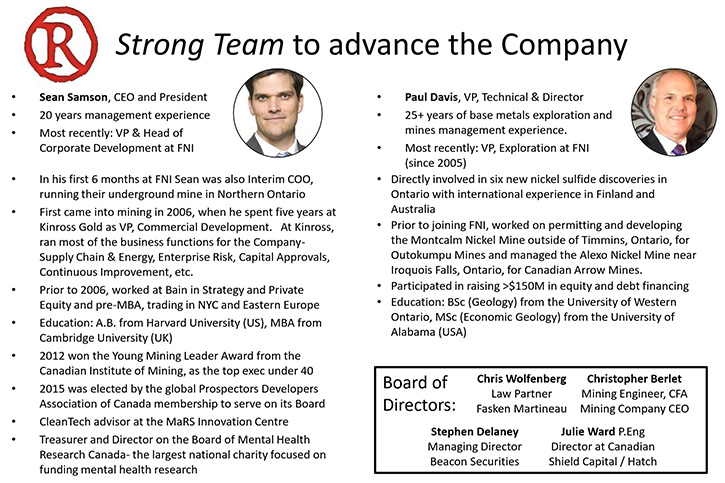

Sean Samson: Sure. It's been a while since we last spoke, I think probably a little over a year. So to reorient your readers/investors, I took over Rogue Resources in 2016. My background had been helping to run a very large gold Company, Kinross Gold, where I left after four or five years and then was at another junior called First Nickel/FNI. At FNI we were operating a mine and looking for additional acquisitions to grow, because we had a large private equity fund controlling us and keen to get more funds into the market. My intent, coming into Rogue from the very beginning, was to try to find assets, from which we could make some money to then continue to re-invest in the portfolio.

When I came into Rogue, it had an industrial minerals project, a high quality quartz deposit in Quebec called Silicon Ridge, and a couple projects near Timmins, an iron ore project called Radio Hill, with excellent gold exploration potential and the Langmuir nickel project with a 15M lb Resource. In 2016 we really focused in on that quartz project and we advanced Silicon Ridge along to a PEA. The type of quartz that we have, is used primarily in the manufacture of silicon metal, and various specialty applications, including quartz countertops, additives for paint manufacturing, and similar things.

Silicon Ridge is a really neat deposit with very good economics. Our PEA had a $23.4 million net present value discounted at 10% with a phenomenal 132% IRR, all after tax. Pre-production capital is only $3.5 million so it is a very doable project for a company of our size. It's an interesting business because it can operate like a simple quarry and the material can be sold off and used in the manufacturing of silicon metal and then these other specialty applications.

Now we reached a roadblock with the Province of Quebec in permitting on Silicon Ridge, which has been extraordinarily frustrating for us. For Silicon Ridge, we are beside another quarry that’s operated for more than 50 years, we have support of the local community and spent extensive time proactively changing our project concept for the lightest impact possible but still, the Province refuses to allow us to advance. Alongside the project work, we spent considerable time downstream, with the buyers of that high quality silica quartz, and based on those relationships, we bought a permitted project, called Snow White, with even better quality quartz and importantly it’s fully permitted and based in our home province of Ontario. In my experience, Ontario has been “open for business” from even before the last election, especially when compared to our neighbours. We've been focused on advancing Snow White, trying to get purchase orders lined up so we can bring the project into production.

We had anticipated we were going to get that quartz production this summer, but for a number of reasons, with our potential customers, it's taken longer than we had hoped. In the meantime we've been focused on trying to figure out where we could find assets that have three main criteria.

Rogue is always looking for projects that we can turn into profitable business. We are metal agnostic meaning, projects that can be in any metal. But we need to have good quality rock value, so high-grade and the amount of contained value per ton needs to be worth going after. Comparing rock value, and using basic extraction costs, it allows comparison between metals- focusing on the actual potential business of a project. The second thing, we want to make sure it's close to cashflow. I don't want to do early stage exploration. We always filter assets, looking for businesses that we could get into positive cashflow within two-three years. Finally we want to have it in jurisdictions where we actually want to work. I've spent a lot of my career working around the world and I have experience in finance, consulting and mining on the ground in many remote corners of the world. But I don't think you can run a small resource Company effectively that produces from remote spots, the costs add up and kill you. So we are focused on keeping things tight, and in North America.

So based on these three criteria, we have looked at lots and lots of potential projects. This summer we announced we are acquiring two limestone quarries that are specifically focused on selling into the landscape stone market. Usually miners don't think about taking limestone out of the ground to sell into something like landscape stone but there are excellent margins in this space. And we found two projects that we're acquiring at very good terms. They both check the box for each of our three criteria and will be immediately cash flowing.

The two quarries are close to home, in southern Ontario. Because one of them operates to this day, we've been able to secure bank financing for half of it. We have negotiated a combination of bank financing and a vendor take-back mortgage which has us focusing on a couple additional pieces before we close. We're now selling some shares in a private placement in addition to finalizing some mezzanine debt, which will be secured, I hope, against other parts of my portfolio. These acquisitions will hopefully get us into a very appealing, cash flowing business, by selling limestone into landscape stone.

So, getting back directly to your question- what I think differentiates us from many others in our space is that we do have assets that have a path to cashflow and we're not just talking about exploration potential. We now see that path to cashflow, both with our quartz business and then definitely with these limestone quarries that we're buying. Hopefully this means that we're not going to be repeating the process of continuous dilution and ongoing financing to move projects along, a pattern that too many juniors, even those that are seemingly stars fall into to. Recently I looked at one gold company, one that received many public awards and had loads of focus and excitement, mainly because they loaded up on paid promotion and then eventually sold out to a mid-tier gold producer with much fanfare. If you look closely at it though, at the end of the day management hadn’t invested much or owned much stock, they just paid themselves really well and shareholders didn’t get a great return either, because they just kept selling more and more shares as they went along. That’s not the game I want to get into. I think like an investor, because I am one.

We have 16 million shares presently and we're looking to add around another 10 million by completing these financings. I hope we're going to keep a nice tight share count and be able to finance these projects on a partially non-dilutive basis by going after the debt options, and then managing our way along to repay the debt and get a very nice return for the equity holders from some very nice, long-life, cash flowing assets. I think what differentiates us is likely that we're setting ourselves up with a capital model where we're not always dependent on going back to the market and continuing to dilute out shareholders.

Secondly, I think we have a range of experience across our very small team, both Management and Board, and we've actually built and run businesses before. So we're not just geologists out looking for metal deposits that will eventually be taken out by larger mining companies. We actually have experience in running businesses, which enables us to run either an industrial minerals business like quartz or a business, like we're stepping into now, quarrying and selling into the landscape stone space.

Thirdly, I think the other differentiator is that we have put our money where our mouth is. We are personally heavily involved, invested in the Company, with a broad group of friends and family. About 40% of our stock is held by them and that has also steered a number of decisions.

So we have not paid salaries, inside the Company, since last October when we were slow in selling the quartz. Back then I said, "Hold on, I don't want to sell another share or take another dollar into the Company, until we actually have an idea of where we are going to be getting cash flow from." So we have been working without spending. Both our internal employees have not been getting paid, nor have our major suppliers, including our advisors. But we've been full steam ahead in that process, since October of last year, trying to find a business that we could get into where we would get cashflow. And that's where we're at now with the Rogue Stone business.

So to sum up the things I feel differentiate us, I'd say first our asset base and its potential to almost immediately cashflow. Secondly, our capital structure and our focus on non-dilutive sources of financing. And third, I would say our own investment and commitment, which, we made a very difficult decision fourth quarter of last year to stop compensation knowing that the only way out was to work through, which has required the full focus of Management and the Board through that period. I hope that as we soon get through that period, we'll be able to look back and say that really is a differentiator in terms of the investment and commitment of the Team.

Dr. Allen Alper: It sounds like you're moving nicely forward. When do you anticipate having funds flow from your limestone project?

Sean Samson: As soon as we finalize the acquisition of the two limestone quarries, we'll be in a position to move into operation. We're acquiring inventory on surface at both of the projects so almost immediately there'll be limestone that's ready to be sold.

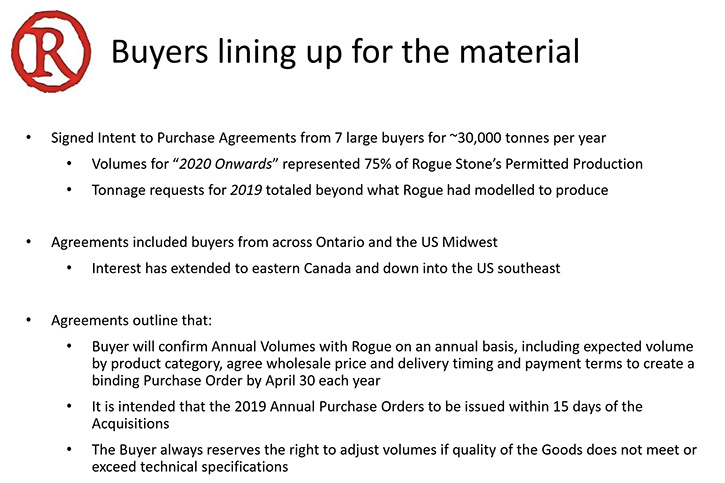

Also, over the last few months, we’ve been spending extensive time, both through due diligence and then, since August when we announced, lining up stone buyers. We have announced publicly that we now have 80% of our permitted tonnage signed into buyer intent agreements. These agreements, with buyers of the stone, very clearly lay out their interest level for volume across our products, and what the specific path is going to be for us to get each of them into binding purchase orders.

For 2019, we intend to have binding purchase orders agreed, within two weeks of us at closing on the transactions. These are evergreen type agreements and they should continue on in the future. In a typical year, we will agree what the purchase order volume will be by April 30th of each year and then we'll do draw-downs against those blanket POs. That annual process is laid out in detail in these intent agreements the stone buyers signed. We have announced now that we have 80% of our potential volume sold through those intent agreements.

The economics of the business are very interesting to investors. The Orillia quarry, which we are partially financing with the bank debt, has averaged $131/tonne in Revenue and $68/tonne in Opex over the past 5 years. Those are the numbers that really attracted the bank to lend to us. They have averaged only 2,722 tonnes per year over that period but had mainly one operator and two pieces of heavy equipment - not really geared for maximizing production. Each quarry is permitted to produce 20,000 tonnes per year so our new Rogue Stone business will be permitted to produce 40,000 tonnes and if we can hold a similar margin, it will be a very healthy business.

Dr. Allen Alper: Sounds very good! What would you say are the primary reasons our readers/ investors should consider investing in Rogue Resources?

Sean Samson: First, I think it comes back to the assets. Our assets will themselves generate cashflow almost immediately, which is a nice place to be if you intend to invest either further in our existing portfolio, in moving assets along, or investing in other potential mining assets.

Secondly, I would say the team. The team has experience surviving through some very difficult markets, making the decisions to go after assets, and thinking outside the box by going after, for example, landscaping stone.

So I'd say assets, team, and thirdly our tight share count. We have a relatively low share count and substantial personal investment in the stock. We’ve had a lack of trading volume in the stock, but that's beginning to edge its way up. I think as people begin to realize that we're a junior that's going to have an ongoing source of funding, not playing the continuous dilution game with investors. Once we have some dollars on the bid for our stock, there should be some real potential for a rise in share price.

So I'd say asset mix, team and share count.

Dr. Allen Alper: It sounds very good. Is there anything else you'd like to add, Sean?

Sean Samson: As I mentioned, we don't spend money on paid promotion or a lot of time out in the market. I try to spend more time focused on our portfolio and developing businesses, building long term value for our shareholders instead of short term share price bumps associated with the junior mining market. I'm focusing my time on building a portfolio and a business for value. We think about that sunrise to sunset. For the past few years, our Company has been going after rock value, time to cashflow, and jurisdiction- looking to uncover opportunities and I think we have done that with these limestone quarries.

Dr. Allen Alper: Thank you for interviewing Rogue Resources Inc. for Metals News. I’ve enjoyed talking with you. Sounds like you have a good approach. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.rogueresources.ca/

Sean Samson

+1 647 243 6581

info@rogueresources.ca

|

|