Sandstorm Gold Ltd. (NYSE American: SAND, TSX: SSL): Growing Portfolio of 190 Gold Streams and Royalties; Interview with Kim Forgaard, Director, Capital Markets

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/25/2019

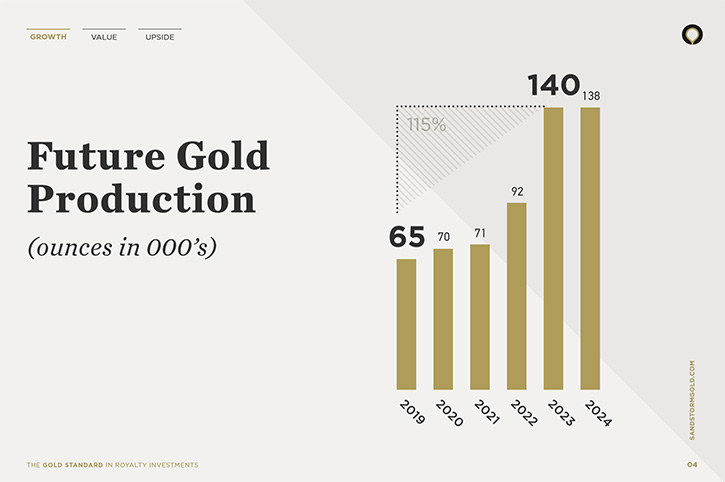

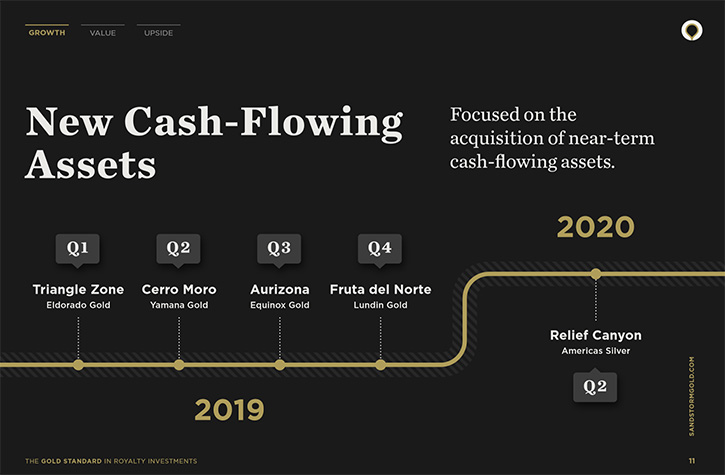

Sandstorm Gold Ltd. (NYSE American: SAND, TSX: SSL) is a gold royalty company, with a growing portfolio that consists of a stable base of cash-flowing royalties. We learned from Kim Forgaard, Director, Capital Markets for Sandstorm Gold, that Sandstorm has about 190 streams and royalties in its portfolio, 23 of which are producing. This year, in 2019, they are expecting to have between 63 to 70 thousand gold equivalent ounces from their producing assets. According to Ms. Forgaard, in addition to exploration upside, Sandstorm is expecting to more than double production by 2023 from their existing streams. We learned from Ms. Forgaard, that their largest stream to date - the stream from the Cerro Moro mine owned by Yamana Gold - just recently started producing and sending them ounces in Q2 of this year.

The Cerro Moro mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Kim Forgaard, who is Director, Capital Markets for Sandstorm Gold, Ltd. Kim, could you give our readers/investors an overview of Sandstorm Gold, Ltd. and what differentiates Sandstorm from others?

Kim Forgaard:Sandstorm is a streaming and royalty company. We provide financing to mining companies. We will give mining companies money up front and in return, we will receive a percentage of revenue or a percentage of production for the life of the mine.

For mining companies, it's a unique method of financing. It's different from traditional forms of financing, such as debt or equity. Equity financing can be quite dilutive and not always available to companies depending on markets conditions. Debt can be expensive through banks, with restrictive covenants.

Streaming and royalty is a great way for mining companies to help finance their mine and gain a strategic partner. Sandstorm has about 190 streams and royalties in our portfolio, 23 of which are producing. In 2019 we're expecting to have from 63 to 70 thousand gold equivalent ounces from our producing assets.

Dr. Allen Alper: Sounds excellent!

Kim Forgaard: Thank you. What makes Sandstorm different from other streaming and royalty companies is the growth already built into our portfolio. From our existing streams we expect to more than double production by 2023. That's with streams that have bought and paid for.

We have exploration upside as well. When we invest in mines, we try to look for ones that have large land packages, with the ability to expand the mine life from what originally was outlined in a feasibility study when we made the acquisition.

We find a lot of the streams and royalties that we've invested in over the years continue to grow their mine life and are discovering more ounces year over year. Sandstorm’s shareholders get exposure to that upside without having to pay for the exploration costs.

Dr. Allen Alper: That sounds excellent! Could you give our readers/investors, some examples of some of the mines that you have invested in and how they're doing?

Kim Forgaard: We actually just had our largest stream to date start cash flowing in Q2 on the Cerro Moro mine, owned by Yamana Gold. We did a deal with Yamana in 2015 that included a copper stream on their Chapada asset silver stream on Cerro Moro and a royalty, with an option for a gold stream on Agua Rica project. Lundin Mining recently purchased the Chapada mine from Yamana.

Our silver stream on Cerro Moro is for 20% of the silver production, up to a maximum of 1.2 million ounces of silver annually. Once we’ve received 7 million ounces of silver, our stream drops down to 9% of the silver production. Our ongoing payment for the silver ounces is 30% of the spot price.

This is our largest stream to date. Yamana brought Cerro Moro into production on time and on budget and are spending money on exploration, with a goal to further increase the mine life.

Dr. Allen Alper: That sounds very good. Could you mention a few other examples of your investments?

Kim Forgaard: Yes. Another example would be the Aurizona mine. We did a stream on Aurizona about 10 years ago. It was in production for a number of years and then shut down. It was just recently restarted. It's now owned and operated by Equinox Gold, which is a Ross Beaty backed company.

They hit commercial production on July 1st of this year and have started production. We have a 3-5% NSR on that project. At gold prices below $1,500 it's a 3% NSR and at gold prices from $1,500-$2,000, it's a 4% NSR. Given where the gold price is right now, our royalty is a 4% NSR.

Fruta Del Norte is another asset we have coming into production, which is Lundin Gold's property in Ecuador. We purchased an existing royalty in early 2019. Fruta del Norte is expected to pour gold in the fourth quarter of 2019 and then hit commercial production in 2020.

It has a large land package that hasn't had a lot of exploration done on it. We're quite excited about the exploration potential and optionality.

Dr. Allen Alper: That sounds great. Could you give us a run down on what has happened with your record cash flow, your discount value to peers, and your upside exploration and success?

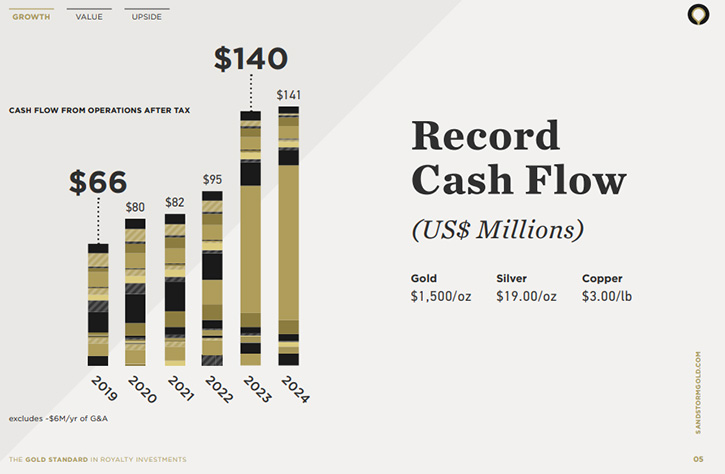

Kim Forgaard: Q2 of 2019 was a record for Sandstorm in terms of cash flow and ounces. The big driver on that is the Cerro Moro silver stream, from which we received the first payment in Q2. With new assets coming in, we expect to continue to have record ounces and record cash flow. We're continuing to expect record growth from an existing portfolio of assets.

Dr. Allen Alper: That sounds excellent. Could you discuss the value and discount to peers share buyback?

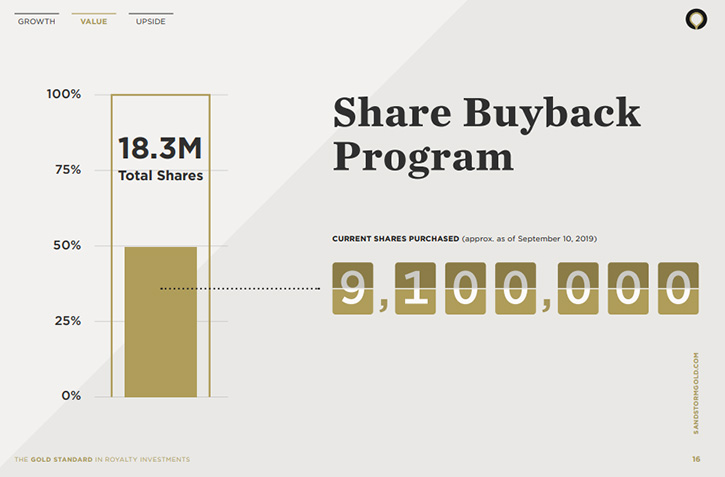

Kim Forgaard: In November 2018, we announced a large share buyback. Our Board approved buying back, at the time, about 10% of our shares outstanding, so just over 18 million shares. We started buying back shares in Q4 of 2018. To date, since that announcement, we've bought back about nine million shares.

Dr. Allen Alper: That sounds very good, a very logical approach. Excellent! So could you also talk a little bit about the upside and the exploration success and leverage to gold price?

Kim Forgaard: We're adding projects to our portfolio that the operators and owners are investing in and continuing to spend money and further grow the reserves and resources in mine life.

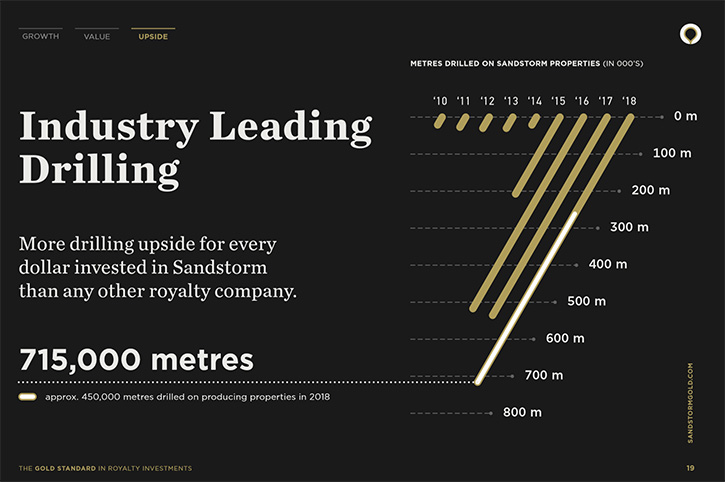

We have a chart in our investor presentation that shows the amount of drilling by year on the properties. It has continued to grow and in 2018 over 700,000 meters was drilled on the properties. Of that, about 450,000 meters were on producing properties.

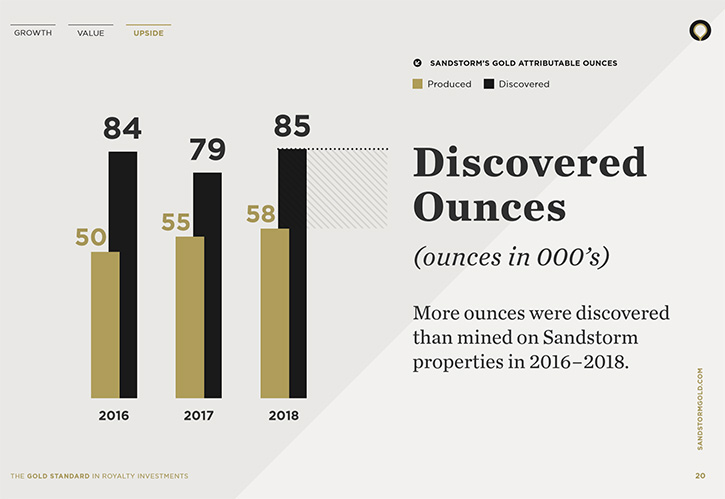

A second slide in our investor presentation shows the amount of ounces that have been discovered on Sandstorm ground, compared to the number of ounces produced in a year.

So, for example, in 2018 we received approximately 58,000 gold equivalent ounces from our producing assets. Within our portfolio, approximately 85,000 ounces were discovered and added to reserves and resources. More ounces are being discovered than being mined, further adding value to Sandstorm shareholders.

Dr. Allen Alper: That sounds excellent. Could you say a few words about the diversified global assets?

Kim Forgaard: Of our approximately 190 streams and royalties, we get diversification through numbers and through different counterparties but also through geographical location. We're all over the world.

In the second quarter of this year, about 29% of our ounces received were from mines located in Canada. 16% from the rest of North America, 36% from South America, and 19% from other countries.

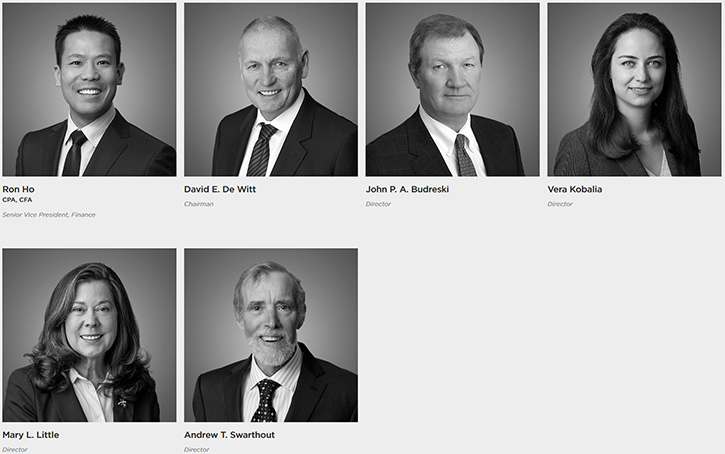

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background, Management Team, and Board?

Kim Forgaard: My background is in finance. I've been with Sandstorm for about six and a half years. I started more on the corporate development side, evaluating new potential streams and royalties. Now I have moved into the capital markets and investor relations side. I help manage our existing royalty portfolio as well as work with institutional and retail investors.

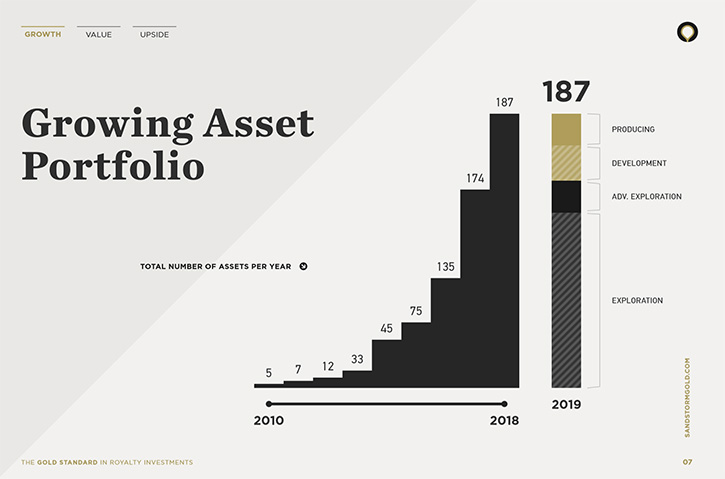

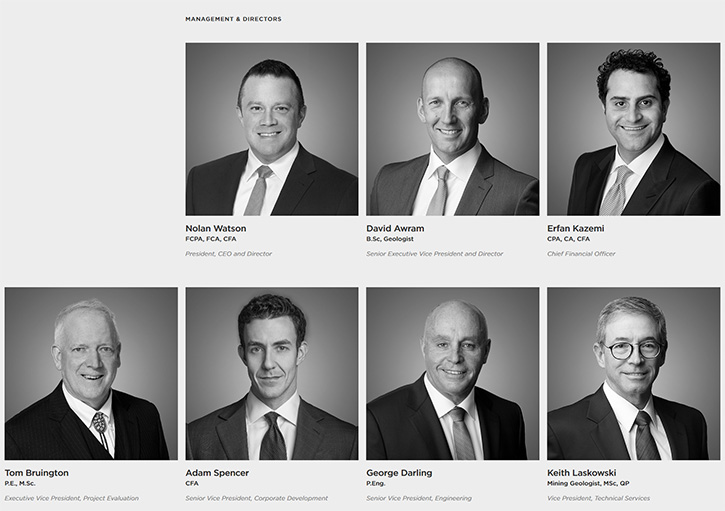

Our management team has a diverse background. Nolan Watson and David Awram founded the Company. Both were previously at Wheaton Precious Metals, at the time it was called Silver Wheaton. Nolan was the CFO there and he was the youngest CFO of a New York stock exchange listed company at the age of 26. Nolan and Dave started Sandstorm about 10 years ago and have built up the Company from zero royalties to almost 190.

Our technical team has a lot of experience in a lot of different countries around the world. They have been in mining companies, worked at mines, founded companies, and explored. Both Tom Bruington and Keith Laskowski previously were at the IFC, in the mining division. They've seen a lot of different projects and evaluated them and brought a lot of experience and knowledge to our technical team.

Our Board of Directors is quite diverse as well, with backgrounds in mining, finance, politics, and law.

Dr. Allen Alper: Sounds excellent! Sounds like you and the Board have great experience, great knowledge and are well balanced.

Kim Forgaard: Yes.

Dr. Allen Alper: That's extremely good. Could you tell our readers/investors the primary reasons they should consider investing in Sandstorm?

Kim Forgaard: One of the benefits of investing in a streaming royalty company is for the diversification. We've done the due diligence and found the deals with the greatest upside and when you invest in Sandstorm, you get access to almost 190 different projects. An investor get the benefit of the diversification, as well as protection from downside risk.

Since the royalties are a percentage of revenue, we're unaffected by operating costs. And with streams, we pay either a set price per ounce or a percentage of spot price. If the prices and costs increase at a mine level, we're unaffected by that.

When you compare Sandstorm to other streaming and royalty companies, we have more growth built into our portfolio. We trade at a discount to peers and we have more exploration upside.

Dr. Allen Alper: Excellent! Outstanding! I'm very impressed with Sandstorm, your team and projects and the streams. I think it's a great company. Is there anything else you'd like to add, Kim?

Kim Forgaard: Just to thank you for interviewing Sandstorm Gold for Metals News. We appreciate it.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.sandstormgold.com/

info@sandstormgold.com

Kim Forgaard

Investor Relations

604 628 1164

|

|