Marathon Gold Corporation (TSX: MOZ): Rapidly Advancing Its 100%-Owned Valentine Gold Project, in Central Newfoundland; Interview with Dr. Matt Manson, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/23/2019

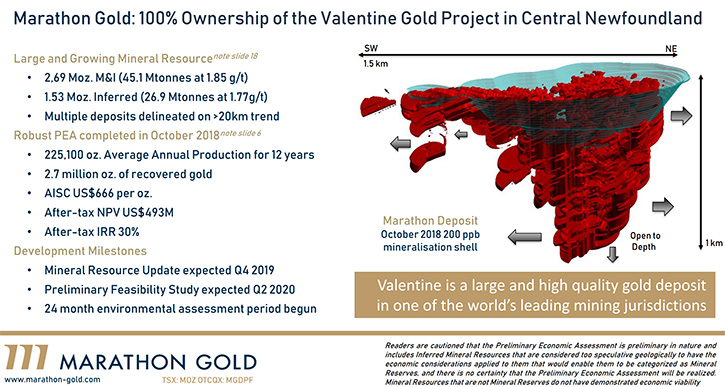

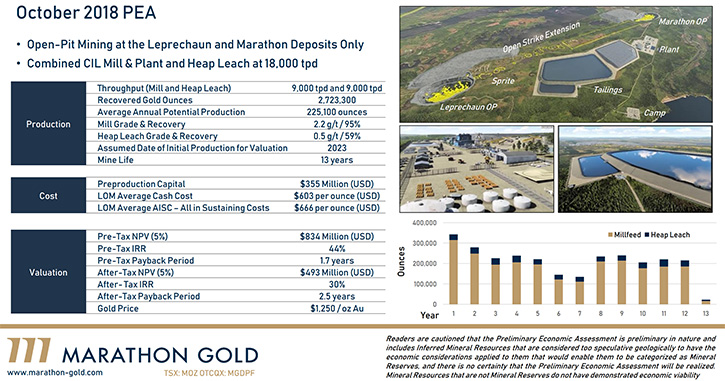

Marathon Gold Corporation (TSX: MOZ) is a Toronto based gold Company, rapidly advancing its 100%-owned Valentine Gold Project, located in central Newfoundland, one of the top mining jurisdictions in the world. To date, four gold deposits at Valentine have been delineated, including the large Leprechaun and Marathon deposits. We learned from Dr. Matt Manson, President and CEO of Marathon Gold, that Valentine is currently about 4 million ounces of combined measured, indicated and inferred, with 2.6 of measured and indicated, and 1.5 of inferred, with an average gold grade of about 1.8 grams per ton. 2018 PEA showed a healthy medium-to-large scale project, with the open pit mining and conventional milling of 125,000 ounces a year, over a twelve-year mine life, 30% rate of return, $500 million MPV, with a $350 million US CapEx. We learned from Dr. Manson, the Company has a straightforward strategy and all the means to develop, build, and operate this mine.

Drill rig at the Marathon Deposit, Valentine Lake Gold Camp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Matt Manson, President and CEO of Marathon Gold. I wonder, Matt, if you could give our readers/investors an overview of Marathon Gold? Also tell us what differentiates Marathon Gold from others?

Dr. Matt Manson:Marathon Gold is developing the Valentine gold project, in central Newfoundland. Right now Valentine has about 4 million ounces of combined, measured, indicated, inferred. 2.6 of measured, indicated and 1.5 or so of inferred, with an average gold grade of about 1.8 grams per ton. The Company is at the stage where there have been several years of drilling. There's been a PEA released in the fall of 2018 that shows a pretty good project, 125,000 ounces a year over an initial 12 years, 30% rate of return, $500 million MPV, with a $350 million US CapEx. So, a very healthy project, a good medium to large scale project.

Marathon has a very good resource there. The resource is growing. When you visit the site, you're impressed by the scale. It's a 20-kilometer long trend, where you have a relatively simple mineralizing style of shear parallel and diagonal veins, which are consistent the whole way along the trend. There are two areas, where drilling has outlined two open pittable resources, big, open, pits a kilometer-and-half long, 300 meters deep.

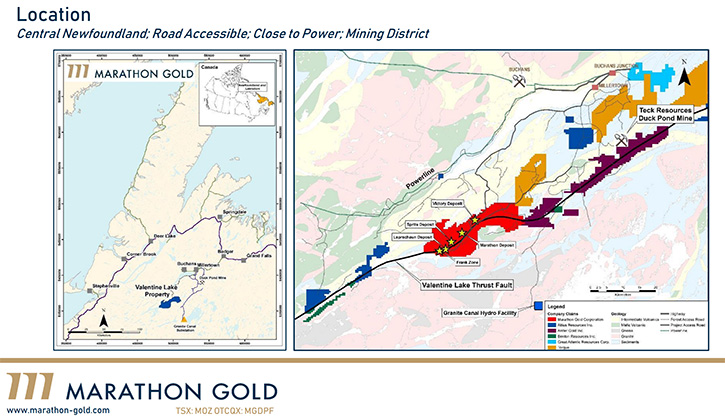

Being in Newfoundland, we have all the benefits of working in a resource-based economy. Newfoundland has historically been a resource-based economy, with the fishery, with oil and gas, and with mining. We're down the road from the old Buchans and Duck Pond mines of the Duck Pond mine of Teck that closed just a few years ago.

What sets us aside from the pack? Why did I join Marathon? This is my third week on the job, Allen. The Valentine project is a project, which can be relatively straightforward in every area of its development. It has a relatively straightforward mineralizing style. It has a relatively straightforward mine plan, open pittable with conventional milling and metallurgy and cyanidation of location concentrates.

It's on land. There's no major civil engineering project required to access the ore. There's no water diversion. There's no enormous pre-strip. It's in a part of the world which is sensitive. Anywhere we are doing major mine development, we are very cognizant of our impacts on the environment and local population. All of that's at play here, but it's in a part of the world, where you can conceivably see a project of this scale and importance being developed, with strong stakeholder support.

The size of financing required here, the economics of the project, the relative proportion of valuation to capital raises required, puts it in a nice, sweet spot, where it is a manageable project, which can be executed financially and in construction by a Company like Marathon. All the way along that list of boxes to check, with this project, it's something which lends itself to good, professional development in a relatively uncomplicated, straightforward way. That's why I was certainly attracted to come on board as the CEO, and why we're pushing hard on the development of the asset.

Dr. Allen Alper: That sounds excellent. Sounds like a fantastic project. Could you tell our readers/investors a little bit about your outstanding background, and how you've been very successful in your career? I know you've won many awards and are well-recognized. Also could you tell us about your team.

Dr. Matt Manson: I'm Scottish. I did my first degree at University of Edinburgh in geophysics, so a geophysicist originally. I did a PhD in geology at the University of Toronto, which brought me to Canada. I worked in the Arctic of Canada. I worked a little in South America and Brazil. I had quite a varied first few years of my career, when I was doing diamonds and gold exploration. I was involved in a base metal deposit. The Aripuanã Deposit in Brazil that's now being developed by Nexa.

Late '90s, I went to work for what was called the Aber Diamond Corporation which had the 40% interest in the Diavik Mine. We were building the Rio Tinto in the Northwest Territory. That was my first experience with a mine build, from the perspective of the junior joint venture partners that were watching Rio Tinto do it. I was involved in the project financing. I was the technical guy at Aber. I was sitting on the Rio Tinto construction committee at Diavik.

I was hired from there, in 2004, by Nick Weigle to run a subsidiary company that they had, with some diamond assets in it. I sat in the Nico shop for two years and watched a highly successful, functional, gold company develop and grow. I was running Contact Diamond, the subsidiary Company that Nico has parlayed into Stornoway Diamond Corporation. That was the acquisition and development of the Renard diamond mine in northern Quebec. I was the CEO of Stornoway for 10 years. That's where I won all those awards you were mentioning.

We took Renard, from a greenfield project, all the way through project financing, with a major financial raise to production. That project was a dream scenario in every regard. We did a major project financing in ways that were creative. In a bad market, we raised stream. We raised equity. We raised debt. We had a home run with the construction. It was five months ahead of schedule. It was $35 million below budget, got it ramped up, and opened it at underground. Got all the speed bumps ironed out in the ramp-up, but the challenge there was the diamond market. On the first day of production, we had a diamond price that was 50% or so of what was expected in the feasibility.

This is a malaise, which is affecting the diamond mining business right across the world. All those diamond mining companies have been affected, with lower prices than expected. I was the CEO of Stornoway up until the summer of '18. I stamped the way, and it was basically up to the next guy to take it to the next stage. He was our chief operating officer, Patrick Godin, who took on the CEO role there. I thought I'd taken it as far as I could. 12 months later, I'm here at Marathon as the CEO of Marathon.

I've gone through two successful main builds in my career. One watching somebody else do it, and one doing it myself. This will be the third. The opportunity here is to do this in gold, with again a mine plan, a resource, a geology, a permitting environment, a financing structure that doesn't need to be award-worthy. It doesn't need to be challenging. It can be something, which is much more straightforward and understandable and demonstrable to everybody.

Dr. Allen Alper: That sounds excellent. Sounds like you have the right background to build the mine. You have a fantastic project, very large in a great area. Looking at your PEA, even before the gold prices had gone up, looked like an outstanding, excellent IRR.

Dr. Matt Manson: Oh, yeah. This thing flies off the table in spot price right now with gold, at $1,250 gold at a 30% rate of return. Because of the big gold production profile, it's heavily levered to the gold price. Yeah, it's great.

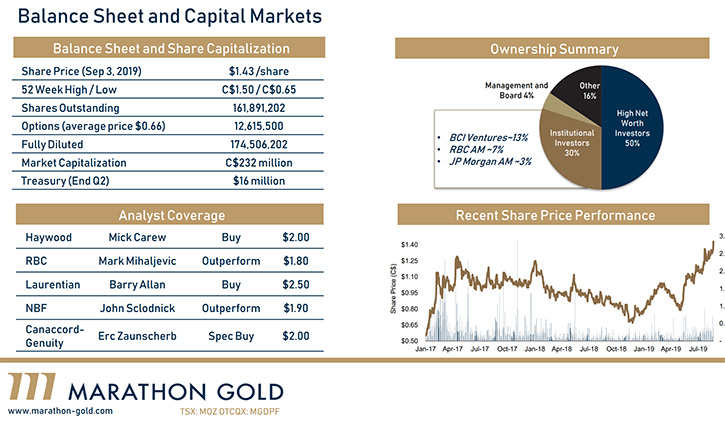

We did a financing this morning. We raised $20 million. It was oversubscribed. I think we'll close it out a little bit higher than that.

That was mostly pretty big institutional investors. We're trying to build the shareholder registry and cashing out for all the development work we now have to do, pre-feasibility, feasibility, environmental assessment, permitting process. Giving ourselves a healthy treasury as we go through all of that and to take us to the project financing lane.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

Dr. Matt Manson: Yeah. We have about 162 million shares outstanding, before the financing we did this morning. The capital structure's pretty simple. There's no strategic investor here. There's no corporate with 19.9 or 9.9%. We have our largest shareholders of 13% is an individual investor in Vancouver. We have a number of gold funds, in the one to five percent shareholder's ownership level. Those gold funds are in Toronto, New York, London.

No private equity invested in this Company at this stage. It's a very clean, traditional, corporate structure. There's a two percent royalty on the asset that Frankel and Nevada purchased last year. That's a straight-up royalty. No streams, nothing that's complicated, no debts on the balance sheet. Very, very clean and straight ahead, traditional, corporate structure.

Dr. Allen Alper: That's sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Marathon Gold?

Dr. Matt Manson: Well, all the reasons I've given. The valuation of the asset, the PEA level, and the relative straightforwardness of the path ahead. If you look around the world for major gold projects, with strong economics in good jurisdictions that can be developed in a professional, responsible manner, I think we top the list. Very clean, straight-ahead, understandable corporate structure. There's no private equity firm invested, through a closed-end fund, with a big chunk of stock here. Again, no strategic investment so there's liquid stock.

Our strategy is we will develop, build, and operate this mine. It's no secret that we're on the radar for a lot of larger companies, who look for 200,000 ounce a year plus pittable resources in good jurisdictions. I think for the gold investor looking for exposure to a high gold price, for an asset that can be developed, one that's not billions of dollars of capital, and an impossible to complete funding plan, I think Marathon checks a lot of boxes that your average gold investor and your readers/investors would find appealing.

Dr. Allen Alper: Sounds like outstanding reasons to consider investing in Marathon Gold. Matt, is there anything else you'd like to add?

Dr. Matt Manson: Just to thank you for interviewing Marathon Gold for MetalsNews.

Dr. Allen Alper: I really enjoyed talking with you about Marathon Gold. What you’re doing sounds very exciting. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.marathon-gold.com/

Matthew Manson, PhD

President and Chief Executive Officer

Tel: 1-416-987-0711

E-mail: mmanson@marathon-gold.com

|

|