Troy Resources Limited (ASX: TRY): Junior Gold Explorer and Producer in Guyana; Interview with Ken Nilsson, CEO and Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/23/2019

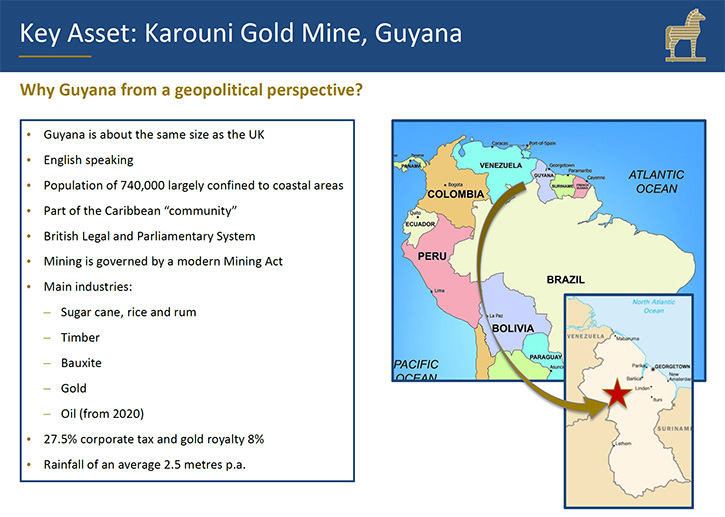

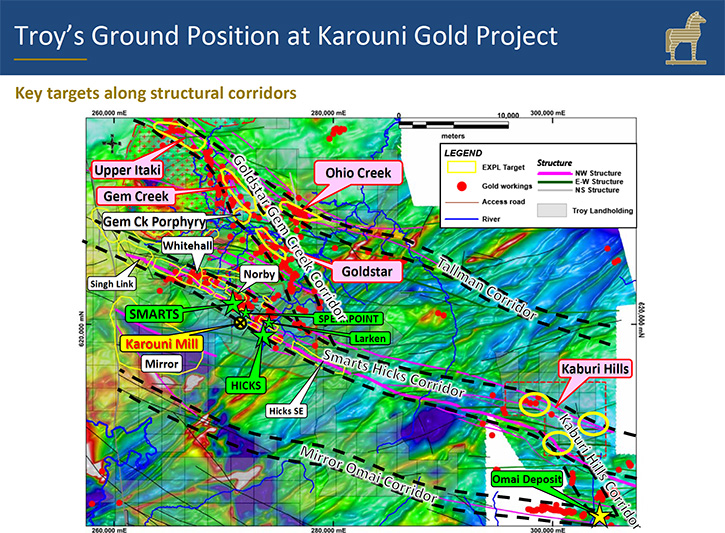

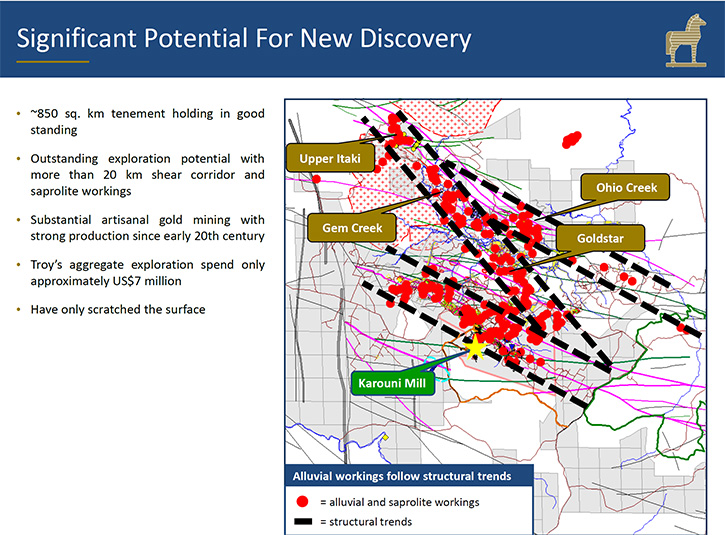

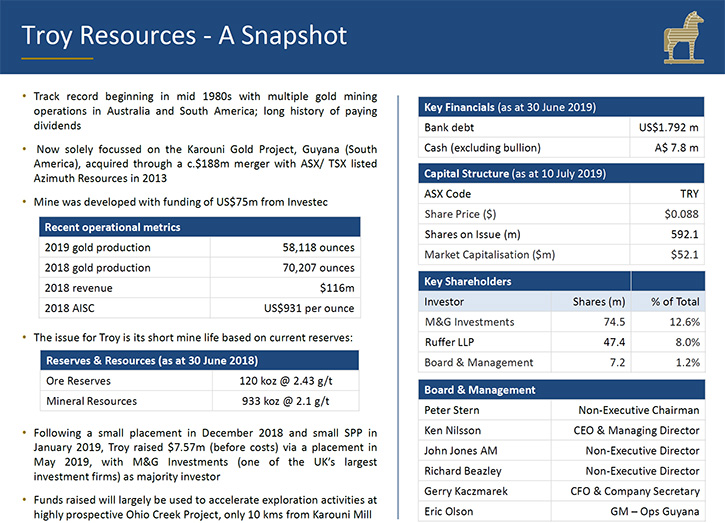

Troy Resources Limited (ASX: TRY) is a junior gold producer, operating the Karouni project in Guyana. We learned from Mr. Ken Nilsson, CEO and Managing Director of Troy, that they have been in existence since 1987, and are one of the longest survivors in their class of small to mid-cap producers. We learned from Mr. Nilsson that Troy has a number of exploration-stage prospects in Guyana including Ohio Creek, Goldstar, Gem Creek and Upper Itaki, with the goal to increase the mine life, by bringing these new resources into the fold, as well as by mining the Smarts 3 pit cut-back. Troy has a long track record of mine development, low cost operations, strategic acquisitions and exploration discoveries, together with a strong commitment to health and safety, environmental stewardship and social responsibility.

Troy Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ken Nilsson, who is CEO and Managing Director of Troy Resources Limited.

Ken, could you give our readers/investors an overview of Troy Resources? Also tell them what differentiates your Company from others?

Ken Nilsson: Certainly. Thank you for interviewing us at Troy Resources for Metals News. Troy Resources is an Australian company, previously also listed on the Toronto Exchange, but we withdrew from that a couple of years ago because our market was fairly small in Canada. We do have some exposure in the US, and we are looking at increasing that again. The Company has been in existence since 1987, so we haven't changed names except from a no liability to a limited liability company.

We are one of the longest survivors in our class of small to mid-cap producers. We went from being a pure explorer to producer in the earlier days in Australia. We moved to South America in 2002/2003 to a project called Sertao in Goias State, which was highly profitable.

We were one of the lowest cost gold producers in the world at the time, backed by high grades. We have remained in Brazil ever since, but we do not have an operating mine there currently, it was shut down some time ago. But we have other interests including iron ore.

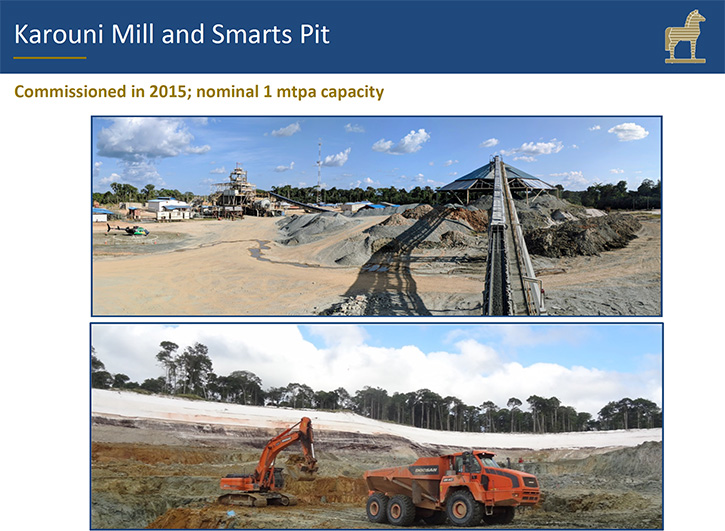

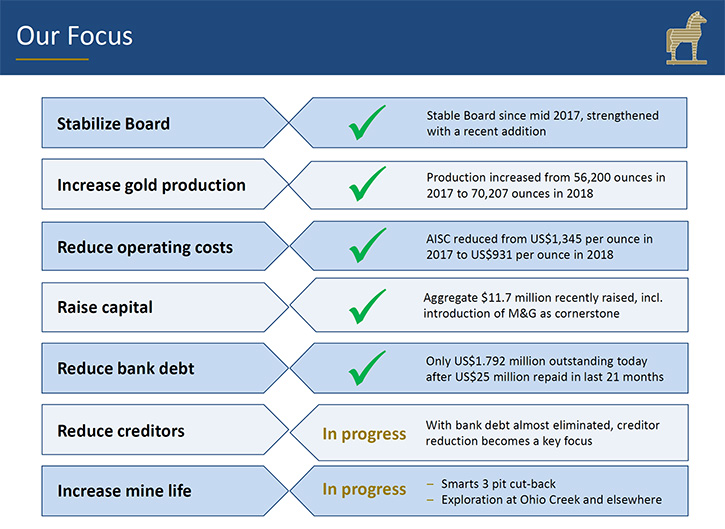

In Brazil, we operated a number of open pits and mines, all relatively small and short life, but moving our plant around it worked. A few years ago we closed the Andorinhas operation in Para state. We are currently focused on the Karouni project which is in Guyana, (former British Guyana). We've been operating there since 2013 and the project is in production, current reserves will be used up by the middle of next year but conversion and extensional exploration together with the development of the Ohio Creek project is expected to significantly extend reserve life. At this point in time we are progressing with a cut back of our Smarts 3 pit to return to a higher grade mill feed in the near future; this is part of the Karouni project which has a total of 8 mining areas within two principal structures.

Our operating history in South America has encompassed 17 years of gold and silver production with construction of 4 processing plants, 9 open pits and 2 underground mines. This includes the Casposo mine and plant in Argentina, a 70% stake in which has been sold to another Australian/Argentinean company.

The Karouni project in Guyana has quite a large resource based on the initial work done, which currently stands at around 900,000 oz; a new resource and reserve statement is due in the near future.

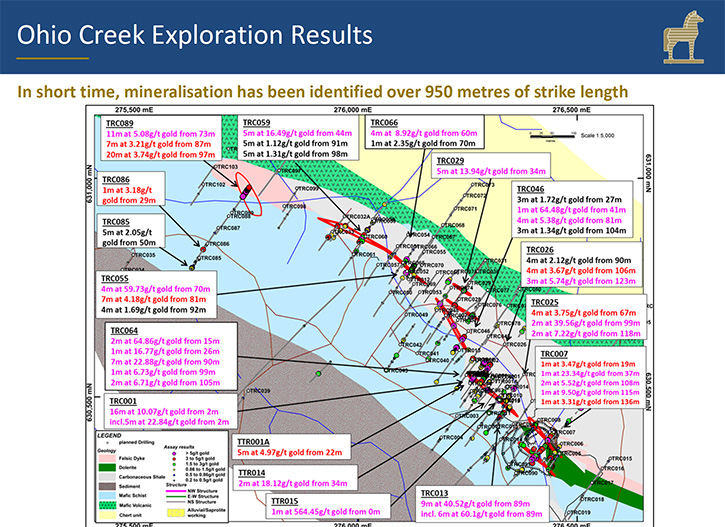

Our latest Guyana project is Ohio Creek, about 10 km from the processing plant, with a drilled strike length of 950 meters. We have now reached the point of focusing on a small portion of that, conducting resource and reserve calculations in an environment of very high grades at the surface and we are currently adopting this into our mine plan and resource to maintain a stronger cash flow. Other near to medium term promising projects in the area which represent high probability for good results in their own right include Goldstar, where we have good early intercepts giving a smaller resource, but it's early days and it needs to be drilled out and the mineralization extended. Similarly, the Gem Creek area is a promising area with some interesting and significant early results.

Upper Itaki is an area where past artisanal workings are prominent but boosts the highest stream sediment results in the region in a Government Survey from almost 40 years ago. Modern exploration is yet to be conducted.

Extensional exploration work at the Hicks mining area has outlined a relatively shallow high grade extension to Hicks 1 along a strike length of approximately 450 metres though open in one direction which will come into production in the near term.

The operation in Argentina, which was meant to pay for the development of Guyana, didn't fare too well. So, the Company borrowed what was probably an excessive amount, which coincided with some short term operational issues.

By the end of this year and after having paid out the final part of our bank loan, we will be back to a more stable and financially stronger position and normal operations, albeit with a small reserve for the time being. But by completing the cutback of Smart 3, which was a high grade producer we will see gold production increase with increased grade in mill feed. All of the projects mentioned above, other than Hicks, are approximately 10 kilometers from the Karouni Mill. Planning for Ohio Creek is focused on starting the pit scenario towards the end of the year. All the targeting is on track including permitting and so on.

The Ohio Creek project already has mining permits for small scale mining, so its transition is not too hard. Everything is now waiting for us to do the final input, in terms of the mine plans, technical details including metallurgy, geotechnical and hydrology to bring this into a mining operation.

Unfortunately the Company did no exploration for a couple of years, because of financial restraints, until I was again back as MD and restarted the exploration. It's been a setback in terms of maintaining the reserve status. I’m targeting getting back to 300,000 to 400,000 ounces in reserves for a start in the not too distant future. I think it's possible. I'd be surprised if the team doesn't generate even more gold. But it is a complex scenario, with a lot of structures happening, lots of cross cutting and offsets and all the rest of it.

Ohio Creek, instead of being run as one large pit may instead become a few smaller pits, still fairly deep. It has been drilled down to about 125 meters and the mineralization is not closed off at this stage. Troy is currently creating block models, optimizations and design. We are of course helped by the higher gold price, lending some help in resource conversion over all.

Operating in Guyana has its challenges and particularly so in terms of weather. Guyana is a small nation, with a currently troublesome time at the moment in terms of politics, but the country is looking out to the future. With the recent large amounts of oil found off the coast of Guyana, it seems that ExxonMobil will shortly start producing which will increase revenue, job opportunities and training in Guyana. Other companies are also here now in the oil and gas sector and are having some success. Guyana is a small country with a strong income being derived from mining and now augmented by income from oil and gas.

The future of Guyana looks interesting and the impact of the oil and gas industry on mining will most likely be positive due to an enhanced service sector. Mining in the past has predominantly been focused on the small producers. Typically, the artisanal miners use dredging in streams and some dry mining to limited depth. I think last year the total output from Guyana was officially about 400,000 ounces. This includes contributions from Gold Fields of Guyana plus our own production.

The challenge of building a mine and a processing plant in the middle of the jungle was not easy but highly successful where poor to no internal road systems except for logging tracks was the real challenge. Add to this is a largely untrained work force which had little experience in working on large projects. The end result was a well performing processing plant build around a 1.2 Mtpa capacity grinding mill which continue to operate fine. Our workforce is now well trained by both internal and external trainers and reaching a good industry standard. The Company now has about 95% of its work force drawn from Guyana with the remainder principally drawn from South America and with a North American General Manager, backed by a small number of expats from Australia and Europe.

The Company as a whole is on the verge of expanding in Guyana. We have a very large tenement holding in Guyana and many nearby promising targets.

As a Company we are also looking at projects in other jurisdictions on an ongoing basis to grow the company and perhaps diversify.

From an operational point of view, we have not had any serious issues with governments across South America. It's a question of fully understanding what you have to do in each country, sensitivity to cultural differences and operating norms plus be absolutely clean in business practices.

Looking forward to the future, I'm pretty sure we will shortly have a very solid financial platform, generating cash, to plug back into more exploration and also focus on trying to get other projects into the fold. We have a long list of worthwhile targets.

The company was in the past known for paying dividends to our shareholders for a number of years. People ask, "When are you going to start paying dividends?" It may be a few years. But, I suspect, that's not really why most people invest in gold.

We run a very tight company with the CFO and Company Secretary based in Perth, Australia together with one accountant and two other part time staff with myself as MD and CEO and I am basically based in South America. So there is a bit of travel involved every now and then, but not too bad. Our head office expenses are among the lowest that I know of in Australia.

The operating Company in Guyana is also more or less a separate entity with a corporate administration. We have also a small corporate presence in Brazil to continue dealing with our tenements and small business activities which will be self-funded very shortly.

Troy Resources Limited

Dr. Allen Alper: Oh, it sounds very good. Could you tell our readers/investors a little bit more about your background, Ken?

Ken Nilsson: I was born in Sweden and after high school went off to do my military duty. I studied chemical engineering and worked in research in Sweden for a little while before heading to Australia for a short term contracted role in New South Wales, after which I moved further north and eventually ended up working for Mount Isa Mines, in those days a lead, copper, silver, zinc mine and still in operation today under the name Xstrata.

I spent seven years with Mt Isa Mines and during that time decided I should go back to school. So, I started mining engineering in Australia, initially on a part time basis for a number of years before I finished. Following on with coal mining development and construction through Thyssen Construction in Australia based in NSW.

I then moved to Western Australia, working in charge of underground development of the main shaft sink at Agnew nickel mine, where I stayed for about six years. When Agnew Nickel closed, I moved on and took over the management of a small mine in the north of WA, a gold and antimony mine with a processing plant developing technology in high pressure leach systems. A small research and demonstration mine that ran for a number of years and was part of the Minproc Group in Australia, a metallurgical design and construction group.

I moved to Perth and then accepted the role of General Manager of the Copperhead mine, based in the small town of Southern Cross, a company founded in Adelaide by two well-known identities in Australia where I stayed for approximately 7 years. I took part in designing a plant which grew from 400,000 tpa to one and a half million tpa by the time the Company merged with the Sons of Gwalia entity. During that time, I developed two underground mines and three open pits in the region. At this time, I was also part of the Board of Burmine Operations.

My career then took me to Coolgardie, a historical gold mining town close to Kalgoorlie where I assumed control of Gold Mines of Coolgardie which was a large operation with 2 processing plants and a number of underground and open pit mines.

Moving on, I moved towards Perth with two children at University and started with Troy Resources where I still am and have been for roughly 20 years, designing and running operations in Australia and South America. Over my career I have been involved in most if not all mining and processing methods dealing with underground and open pit mines both operational in all positions as well as design and optimization. So the background is diversified both technically and practically with exposure to mining, exploration, exploitation and management at all levels including directorships.

Dr. Allen Alper: Excellent experience! Could you tell our readers/investors, the primary reasons they should consider investing in Troy Resources?

Ken Nilsson: We are well known for fast development at low cost. We have had a long history in operation since 1987. We have skills in exploration and mine development, design and operation. We have the infrastructure in place to deal with anything new that comes up and also the technical background. We've moved from being a pure exploration company to an explorer, developer and operator.

Investing in Troy today will give access to a very high level of blue sky potential that's backed up by actual results from early work, methodically working our way through results and picking the best targets which I think will come to fruition as we move forward. The company’s structure has a very low-operating cost and focused on re-growth and expansion in the near time with an operating mine generating cash.

We are operating in what is probably one of the last underexplored greenstone belts in the world and one which can be traced from Venezuela through Guyana, Suriname, French Guyana and North Brazil to join with the extension of the West African Shield and which in South America has a number of large multimillion ounce deposits.

We have long term supportive shareholders, both retail and institutions, who understand the market. And I think, going forward, we are in a pretty good position, having a very, very good understanding of the structures controlling the gold in our region in Guyana. We use some of the world's best experts in this area, both North Americans and Australians. We’ve been around for a long time surviving gold price undulations and changing markets being able to move with the markets when needed.

Dr. Allen Alper: Sounds like very good reasons! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.troyres.com.au/

Ken Nilsson

CEO and Managing Director

+61 8 9481 1277

troy@troyres.com.au

|

|