Seabridge Gold (TSX: SEA, NYSE:SA): a Gold Exploration Company, with Huge Reserves, Providing Shareholders with Exceptional Leverage to a Rising Gold Price, Interview with Rudi Fronk Chairman and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/17/2019

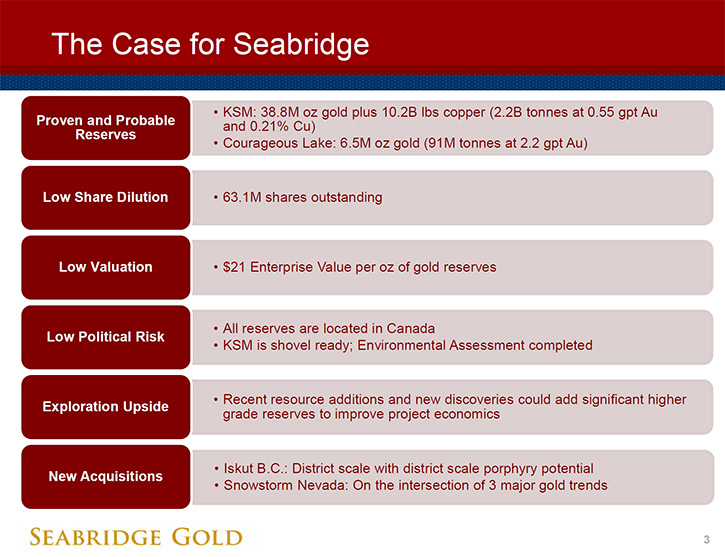

Seabridge Gold (TSX: SEA, NYSE:SA) is a gold exploration company, designed to provide its shareholders with exceptional leverage to a rising gold price. The Company holds one of the world's largest resource bases of gold, copper and silver, in keeping with its prime objective of growing resource and reserve ownership per share. We learned from Rudi Fronk, Co-Founder, Chairman, and CEO of Seabridge Gold, that the Company was formed 20 years ago in October of 1999, with the goal to grow ounces per share through its acquisition and exploration programs. Presently, with 62 million ounces of measured and indicated gold, and another 61 million ounces of inferred gold, Seabridge Gold is far ahead of everyone in the industry in terms of ounces per share, and has outperformed the gold price by about six to one on average over the past 20 years.

Seabridge Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Rudi Fronk, who is Chairman and CEO of Seabridge Gold. Could you give our readers/investors an overview of Seabridge Gold and also tell us what differentiates Seabridge Gold from your peers?

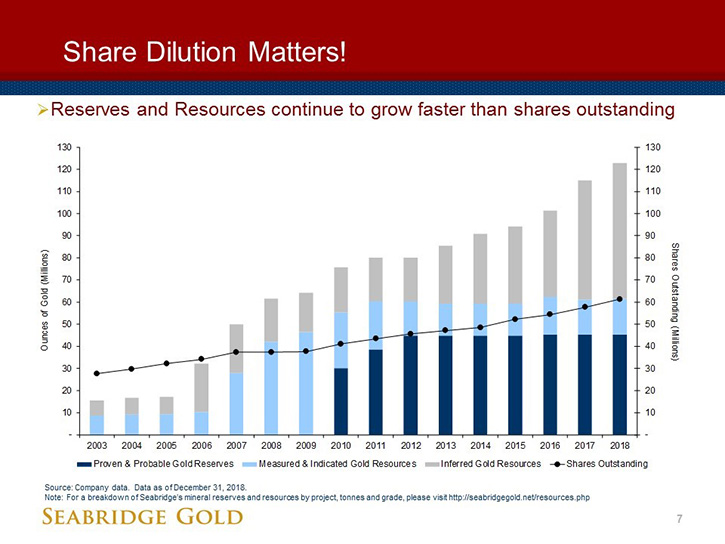

Rudi Fronk: Happy to do so, Allen, and thanks for the opportunity to be interviewed again for Metals News. Seabridge is a bit unique in our space. My colleagues and I formed the Company 20 years ago this October. Hard to believe that we're coming up on our 20 year anniversary! When we formed the Company in October of 1999, it was on the belief that the price of gold would go substantially higher from the then gold price of about $260 per ounce. Our goal was to create the best leverage play to a rise in the gold price. Our strategy is quite simple, grow ounces of gold resources and reserves faster than shares outstanding.

We grow our resources through acquisitions and exploration. When the gold price is low and our industry is in the doldrums, we acquire new opportunities. As the industry prospers, we buy less and explore more. Either way, our discipline comes from insisting that our resource ounces must grow faster than our share count. This prevents us from chasing expensive or unproductive opportunities.

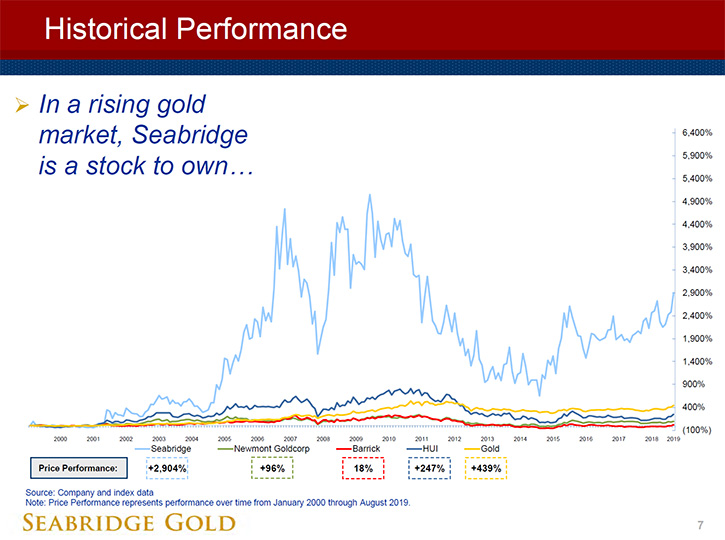

If you look at our track record over the past 20 years, this discipline has worked. We have 62 million ounces in the measured and indicated resource categories, and another 61 million ounces in the inferred category, with only 63 million shares outstanding. Nobody in the industry comes close to us in terms of ounces per share. What that has translated to over the past 20 years is significant outperformance to the gold price and most other gold equities. On average over the past 20 years, we've outperformed the gold price by about six to one, meaning every 10% increase in the gold price on average has resulted on average over a 60% increase in our share price.

Dr. Allen Alper: That's fantastic. Could you talk a little bit more about the proven and probable reserves that Seabridge Gold has?

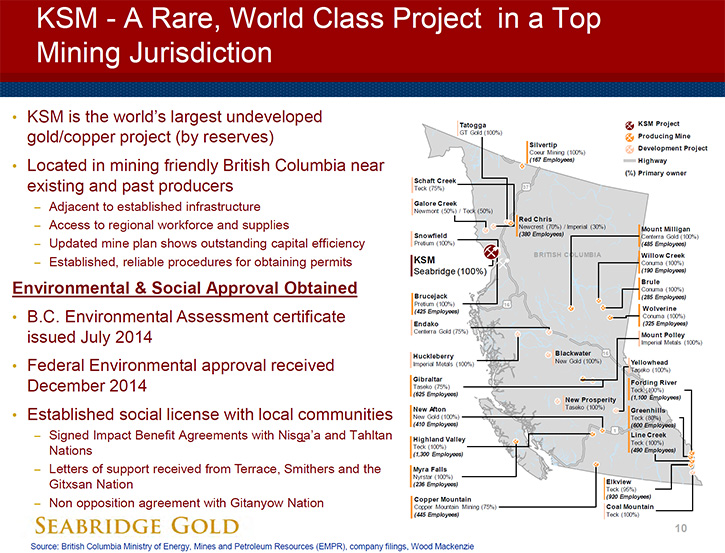

Rudi Fronk: Yes. We have two assets right now, both situated in Canada, that have proven and probable gold reserves. At KSM, which is our flagship project located in northern British Columbia, we have 39 million ounces of proven and probable gold reserves and over 10 billion pounds of copper.

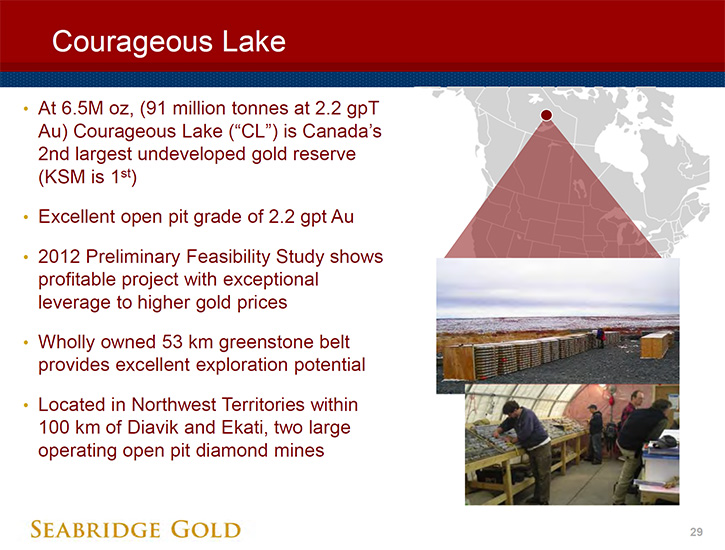

At Courageous Lake, located in the Northwest Territories, we have 6.5 million ounces of proven and probable gold reserves, so collectively just over 45 million ounces of proven and probable gold reserves in the ground that have been demonstrated and quantified by preliminary feasibility studies.

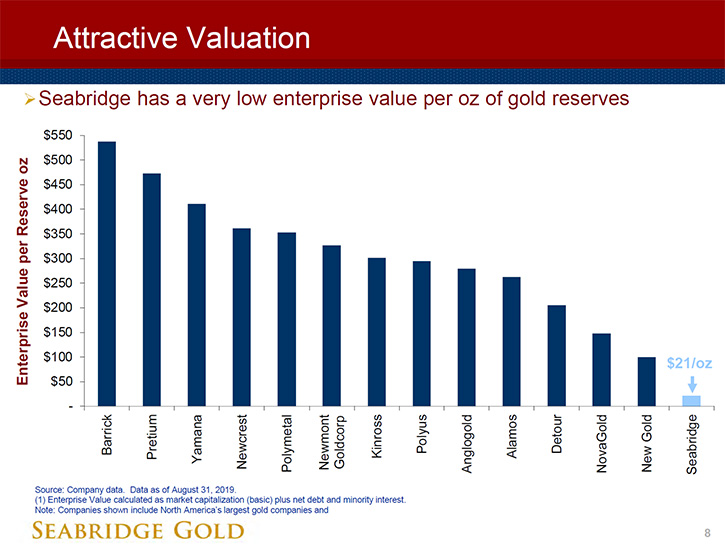

Dr. Allen Alper: Well, that's excellent. That's outstanding. Could you tell our readers/investors a little bit about your low valuation compared to your peers?

Rudi Fronk: Today we are trading at about $20 per reserve ounce, and less than $10 per total resource ounce which compared to other gold companies is quite low. This reflects the fact that in a depressed gold market, non-producing ounces in the ground do not attract a high valuation. Another major reason for this is that we have made it very clear to the market many years ago that we don't intend to build mines ourselves but intend to partner our projects with major mining companies whereby they will fund most of the construction costs, while we maintain a meaningful interest in the project. Since a transaction with a major mining company has not yet happened, the assumption is that it never will. As the gold price rises, we expect to get terms we can accept and our share price will move significantly higher.

At KSM we have been engaged with most of the major miners for many years, and we've turned down a number of proposals Our view is we only get to do this once and it has to be with the right partner on the right terms.

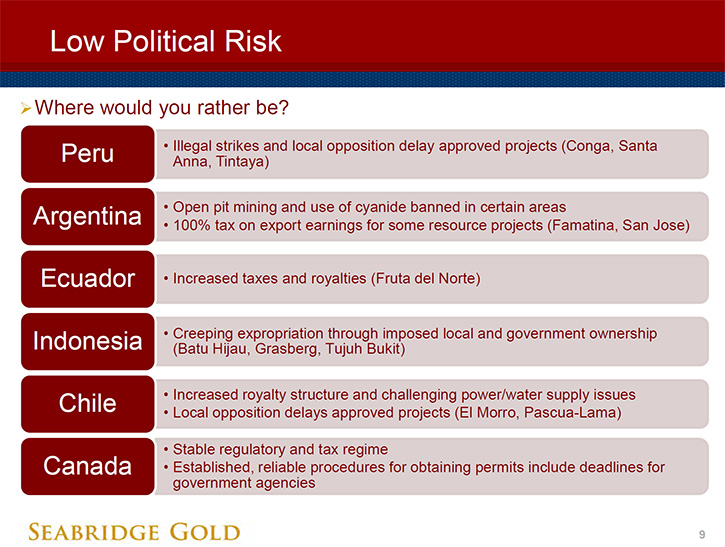

Dr. Allen Alper: Could you also mention how Seabridge Gold has an advantage over many because of the low political risk?

Rudi Fronk: Yes. When we formed Seabridge back in 1999 we focused on the less risky jurisdictions in the mining space, namely the US and Canada. In my career, I've been involved with mines that were expropriated by governments. We realize how real political risk can be, not just in outright expropriation, but also in creeping higher taxes, higher royalty rates, and governments now demanding a larger percentage of a project, without putting up any capital to earn that.

We believe that the U.S. and Canada are two of the best jurisdictions to be in and they are our sole focus.

Dr. Allen Alper: Oh, that's excellent. Since we talked last in March of this year, Seabridge Gold has initiated additional exploration. Could you discuss that?

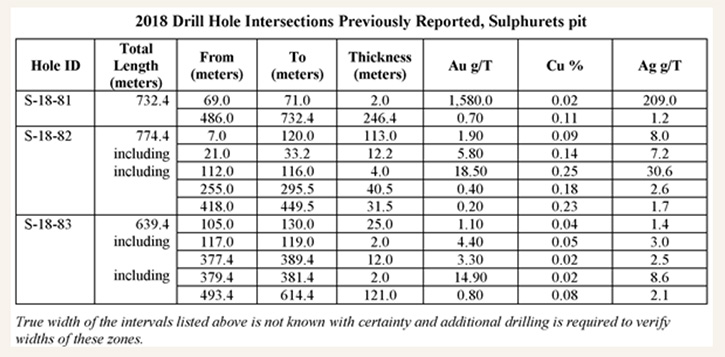

Rudi Fronk: We currently have two exploration programs going on right now. At KSM we have now turned our attention to finding higher grade gold zones as well as looking for a 5th porphyry deposit. In 2018, geotechnical drilling at the Sulphurets deposit found some higher grade gold zones that were not yet calculated into our resources and reserves. One of these holes intersected two meters of almost 1,600 grams per ton, that's over 50 ounces per tonne. This intercept was within the open pit boundaries of the Sulphurets deposit that is included in KSMs mine plans. We also had some other high grade intersections in the same area, so this year we went back in with a program focusing on high grade gold, within an already established open pit boundary. That program is on-going and results will be announced in the 4th quarter.

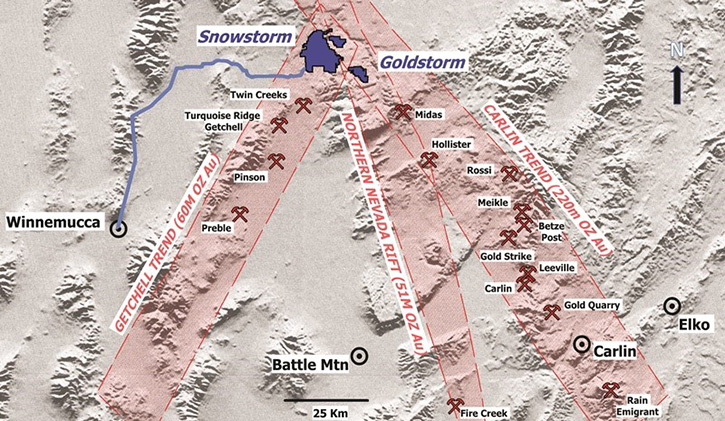

I think the exploration program that excites me more, though, is what we have going on at our Snowstorm Project in Nevada. Snowstorm is our most recent acquisition. We acquired it a little over two years ago for common shares. It sits on the intersection of the three most prolific gold belts in Nevada, the Getchell Trend, the Carlin Trend, and the Nevada Rift Trend.

Over the past two years, we assembled all the data that had been historically collected at this project. We also did some geophysics, mapping and sampling. Based on this work, we identified a number of targets that we think have the potential to host another Turquoise Ridge or Twin Creeks style of mineralization. In fact, the Snowstorm Project sits only about 10-15 kilometers north of these two big mines that are now in a joint venture between Newmont and Barrick.

Our goal this year is to try and confirm our geologic model for Snowstorm and start to vector in on where the best opportunities lie for a Turquoise Ridge style deposit. It's important to note that Turquoise Ridge is still a big mine that has an average grade of 13 grams per ton with about 9 million ounces in gold reserves.

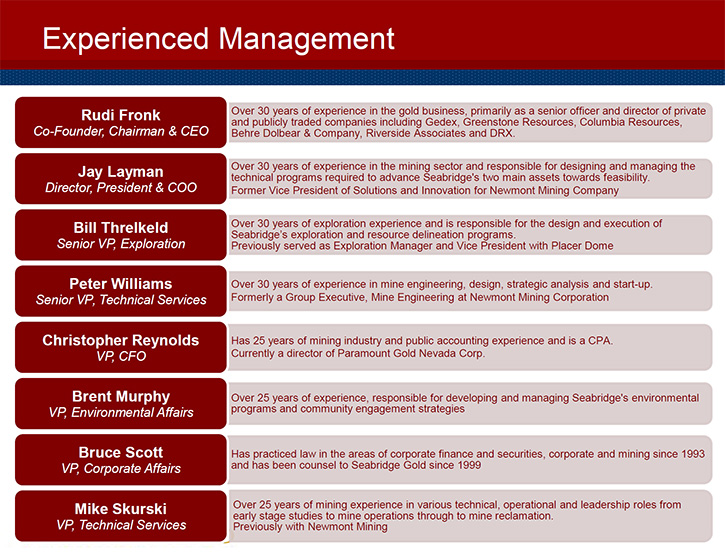

Dr. Allen Alper: Well, that shows that Seabridge Gold has excellent exploration upside and with your new acquisitions, great new opportunities for growth of reserves, and you're at such an excellent location. Could you tell our readers/investors about your excellent background and the quality of your team?

Rudi Fronk: I've been in the business for a long time. I think this is year 38 for me, since I've been in the mining sector, almost all of it entirely in the gold space. I am a mining engineer by background. I was trained initially at Columbia University. I also did graduate degrees in economics and finance, both at Columbia. I love what I do. I am a student of the gold market. I believe that the best is yet to come, in terms of the gold price.

Dr. Allen Alper: Well, that's excellent. Could you say a few more words about your team?

Rudi Fronk: We have a very seasoned team. Most come from the likes of Newmont, Placer Dome and some of the biggest mining companies in the world. All have been involved in big project development throughout their careers, either on the exploration side or on the construction and operation side. In addition to the assets, I think it's important to look at the quality of management and the team around them in terms of assessing how well a company will do, and I would put our seasoned team up against just about any other team in our space.

If you look at what we've accomplished on the exploration side, over the past 10 plus years, our team has found more gold through exploration activities than any gold company on the planet. That includes Newmont, Barrick, Goldcorp, Kinross and Agnico Eagle. I think it's a testament to how committed we are to the strategy of offsetting dilution with accretion of ounces and how successful we've been in delivering that over a 20 year period.

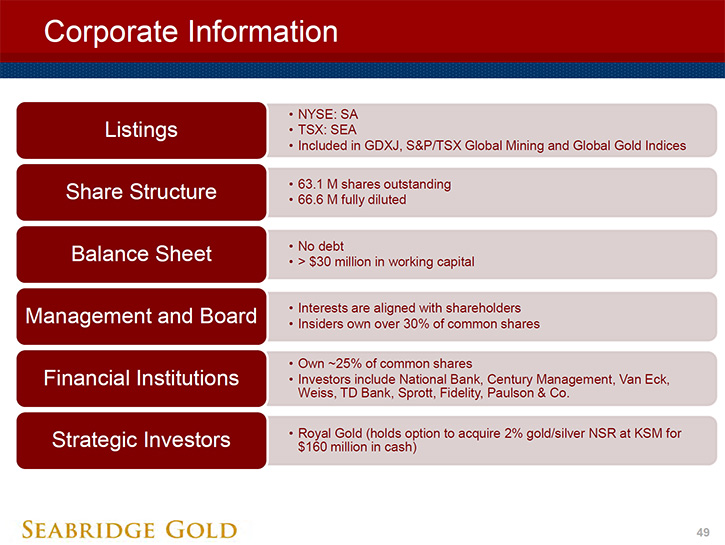

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit more about your share and capital structure?

Rudi Fronk: It's tight. We only have 63 million shares outstanding, something of which I am very proud. When you think about 20 years of being in business, not producing any gold or any revenues up to this point, but just growing ounces, we've managed a very effective capital structure, with limiting equity dilution. On top of that, if you look at our ownership structure, well over 30% of the shares are held or controlled by insiders or co-founders of the Company and people that have been around for almost 20 years now. I think it's important to see the insider ownership of this Company relative to our peers. You'd be hard pressed to find any gold company on the planet that has such a tight insider ownership structure, with so few shares outstanding.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors your thoughts on what's happening in the gold market, giving them some insights?

Rudi Fronk: We view gold a little differently than some people might. We view gold, not as a commodity, but as money. It's been money for thousands of years. It makes gold the ideal hedge against risk of all kinds, whether it be inflation, deflation, government overreach, political turmoil, currency debasement, default, bank failures and market crashes. If you look at the quantity and the value of all the gold that's ever been mined throughout history, it's very small compared to the amount of debt or financial assets that exist in the world today. The roughly $8.4 trillion value of all the gold ever mined is the ultimate backing for about $250 trillion in global debt, $78 trillion in tradeable equities and a world economy with a GDP of about $80 trillion.

So I think a lot of smart people are starting to recognize that owning some gold is not a bad thing. The likes of Ray Dalio and others, have recently stated that gold is one of the best assets to hold in the world we live in now.

We're in the middle of unprecedented central bank experiment in monetary policy. We believe that central bank intervention has created huge, unsustainable increases in paper wealth compared to the supply of real goods and services. On top of that, the global economy is now slowing down. If we do see a recession, that would lead to waves of default and huge deficits. Gold protects wealth against all of these types of risks.

Gold made a high in 2011 of $1,920.00 an ounce. It dropped as low as $1,050.00 in 2015. It's now rebounded back to about $1,500.00 and we believe that over the next period of time, perhaps less than a year, gold will make an all-time high, and I think go to levels that will surprise a lot of people.

Dr. Allen Alper: Well, that's very important information for our readers/investors to consider in balancing and protecting their wealth. Rudi, could you tell our readers/investors the primary reasons they could or should consider investing in Seabridge Gold?

Rudi Fronk: First and foremost, it's the idea of leverage to the gold price. If you do believe that gold is going to go higher or you just want some portfolio insurance through owning gold, we've delivered that in spades over the past 20 years. Since inception, the price of gold is up about 440%. Our share price is up about 3000%, meaning on average we've outperformed the gold price by better than six to one.

The second reason would be a continuation of our exploration success. The numbers speak for themselves in showing that we have been best in class in terms of finding gold at minimum share dilution. We're now have 2 new exploration projects, both of which have tremendous exploration potential.

Third, is what we've been able to accomplish at KSM. KSM is an asset that historically was viewed as low grade and not very economically efficient. But if you look at what we've been able to show over the past few years, through independent engineering studies, we've been able to show a project that has an all-in cost of production at today's metal prices below $400 an ounce. And that all-in cost of production includes not just the operating costs, net of copper credits, but also all of the capital required to build and sustain that project over a 50 year mine life. We're now in the process of updating the mine plan once again, incorporating what we've added at the Iron Cap deposit over the past two years. Recent resource additions at Iron Cap have some of the best grades we've seen to date. We expect to see further improvement on the economics at KSM when that updated study is done in the first quarter of 2020.

Finally, a driver of value will be in our ability to getting a joint venture done at KSM. We understand that one of the reasons we're trading at such a low valuation is we have not yet completed a joint venture yet. We believe a joint venture with the right partner and with the appropriate terms will drive a higher share price.

Dr. Allen Alper: Well, that sounds like an excellent business approach and a great opportunity for investors. Is there anything else you'd like to add, Rudi?

Rudi Fronk: Just that I appreciate the opportunity to talk with you and look forward to the next time we talk. Thank you for interviewing Seabridge Gold for Metals News.

Dr. Allen Alper: I’ve enjoyed talking with you and I'm very, very impressed with what you and your team are doing with Seabridge Gold. Not only do you have great projects in BC, but now you're expanding and have great opportunities in Nevada, in an excellent location, with excellent potential. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Rudi Fronk: Thank you.

http://seabridgegold.net/

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

|

|