Royal Road Minerals Limited (TSXV: RYR): Exploring and Developing World Class Gold and Copper Deposits in Nicaragua and Colombia; Interview with Dr. Tim Coughlin, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/14/2019

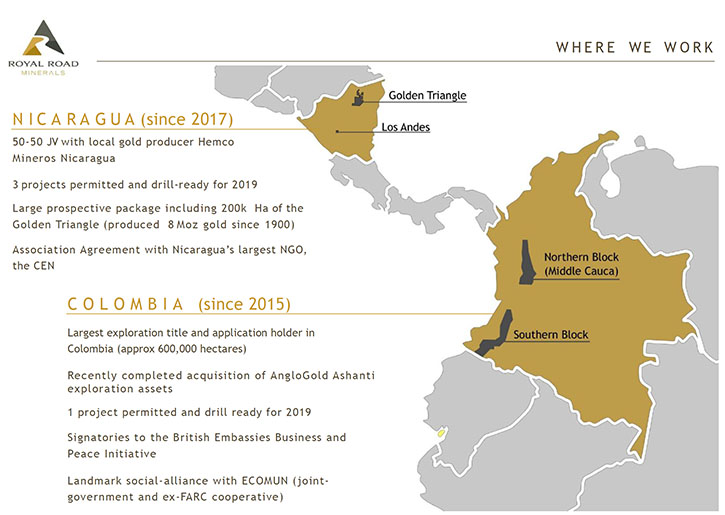

Royal Road Minerals Limited (TSXV:RYR) is a gold and copper exploration and development company, focused on projects, with world class potential, in Nicaragua and Colombia. We learned from Dr. Tim Coughlin, President and CEO of Royal Road Minerals, that Agnico Eagle owns just under 20% of Royal Road, and they are only interested in the tier 1 asset, large land packages, and large ore deposits, essentially, the big picture. Royal Road Minerals is currently the largest tenement holder in both Nicaragua and Colombia. We learned from Dr. Coughlin, that in Nicaragua they have just finished a drilling program at the Luna Roja gold project, and moved on to the new porphyry gold discovery called Caribe. According to Dr. Coughlin, in Nicaragua, Royal Road Minerals controls a prolific gold mining district, called the Golden Triangle, where they have a dominant position, with over a five million ounce gold potential. Last year, Royal Road Minerals acquired, from the Company holding AngloGold Ashanti's exploration assets in Colombia, all top quality projects. In Colombia the Company is currently focused on La Llanada goldfield, the Rio Nulpe porphyry cluster and the drill-ready Guintar-Niverengo gold project.

The Luna Roja Gold Project, Royal Road Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Tim Coughlin, who is President and CEO of Royal Road Minerals. Tim, could you give our readers/investors an overview of your Company, and also what differentiates your Company from others?

Dr. Tim Coughlin: We do the big-picture exploration style of story, if that's the right word. What I mean by that is we're by far the largest tenement holder through our joint holdings with Hemco in Nicaragua. We are the largest title and title application holder in Colombia. We focus on finding something new, something big, which is tier one. The reason it needs to be tier one is that we have a significant corporate and some large funds on the share register. Agnico Eagle own just under 20%.

The large funds and Agnico are not interested in anything less than a tier-one size asset. We do what a lot of companies big or small have neglected to do over the last 10 or 15 years, which is large land package, large ore deposit exploration programs.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors more about the projects in Nicaragua and also Colombia, what excites you the most?

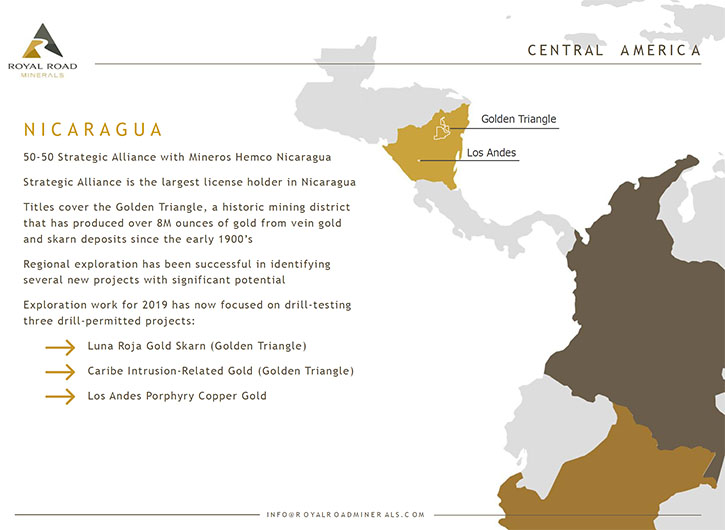

Dr. Tim Coughlin: It's going to sound corny, but they all excite me. Let's start with Nicaragua. In Nicaragua we have the drill rig turning right now. We've just finished a scout drilling program on a skarn gold project called Luna Roja. The rig has just moved to a new discovery we've made called Caribe, which looks like it's a porphyry gold project.

Results from Luna Roja were released last week and included some impressive hits including 49 meters at 2.8 grams per tonne, 49 meters at 2.4 grams per tonne and 80 meters at 1.1 grams per tonne gold. The size potential of this project depends on its continuity along-strike to the south and down-dip to the west. Actually the project is a skarn and we haven’t found the elusive intrusive rock responsible for the gold yet.

We have an arrangement with Mineros, a Colombian company operating the Bonanza Gold Mine in Nicaragua. By virtue of that arrangement we have a large exploration package over what's called The Golden Triangle, a prolific gold mining district located in northeastern Nicaragua, something that you very rarely come across. It's just one of these remarkably endowed pieces of crust, which has produced in excess of eight million ounces since the early 1900s, from a variety of different deposit styles. Luna Roja is located in the Golden Triangle.

It's one of those camps that will turn up discoveries for many years to come. I'm sure of that. We have, by far, the dominant land position covering almost the entire Golden Triangle. Then in the west of Nicaragua, we have two projects. One called Los Andes, which is a seven kilometer long lithocap alteration system, which we hope is hiding a porphyry copper gold deposit at depth. We intend to drill that, if not late this year, early next year. We also have an iron oxide copper-gold project, which needs some deep drilling up in the north of Nicaragua.

We wouldn't be interested in any of those projects, unless we thought they had plus five million ounce gold potential. They're all significant projects, with some hope. We went into Colombia in 2015. I was there a lot earlier, but we went back in 2015, and we staked up an area on the border with Ecuador. It's about 350,000 hectares, under application, which covers the Eocene porphyry belt, which hosts many copper deposits in Latin America, but most notably the Cascabel Copper-Gold Project, which is just across the border in Ecuador.

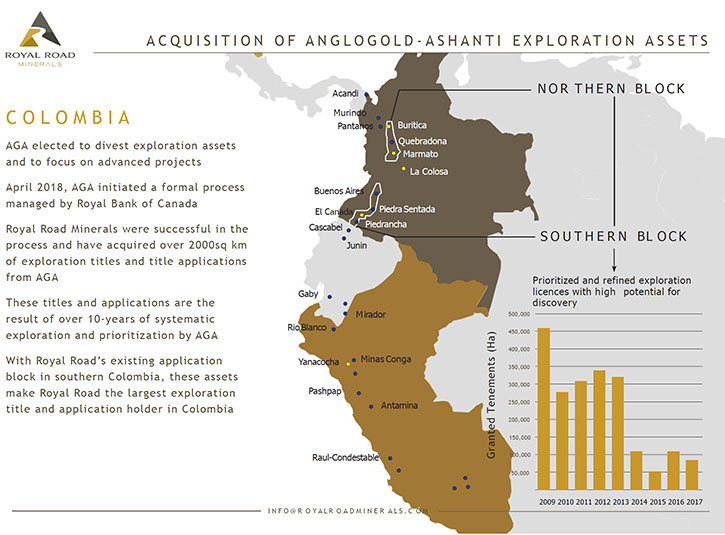

It also hosts a goldfield, called La Llanada Goldfield. When we originally staked that area, AngloGold Ashanti owned the La Llanada gold district under mining title, we tried for many years to come to some sort of an arrangement with them. In April last year, they announced they were going to sell all of their exploration assets in Colombia and focus on their three development assets in that country.

That was a 12-month process managed by RBC which we ultimately won. We have now acquired the majority of AngloGold Ashanti's exploration assets in Colombia. These assets have all been prioritized over the last 10 or 11 years, during which time AGA reduced their concession holdings in Colombia by about 80-odd percent and focused on their best projects.

These are top quality projects. In terms of priority, our current top three would be the La Llanada Goldfield which are very high-grade veins. By virtue of the deal with Anglo we own the concession titles, covering the entire goldfield.

Within that goldfield there are eight operating mines. The district started life back in the 1900s with two American companies operating there. We estimate it produced somewhere in the order of about three million ounces from small artisanal operations. There's a big one lurking there somewhere. That's top of our list.

The second would be the Rio Nulpe porphyry region, which is right on the border with Ecuador where we know there are three porphyries sitting under our application package, which is also very exciting. The third priority would be the drill-ready Guintar-Niverengo gold project up in Antioquia, in what they call the Middle Cauca Belt, a belt which has produced something in the order of 50 million ounces of discoveries over the last, 10 to 15 years.

I know most of your readers/investors would be interested in what the drill bit's telling us. We have results from four more holes at Luna Roja to come and from the short scout drilling program at Caribe. We hope to start drilling at Guintar-Niverengo in Colombia before the end of the year.

Then into next year we'll be drilling on operations that sit within our titles in the La Llanada Goldfield. There's a full agenda.

Dr. Allen Alper: That sounds great. Sounds like 2019 to 2020 is going to be a very exciting time, and a time of discovery for Royal Road Minerals. That'll be a lot of fun for you and your exploration geologists. That sounds great.

Dr. Tim Coughlin: Yeah. I think we're set up now for this recovery. You're right. There's a lot for us to do. We have the pick of the projects at least in Colombia and Nicaragua.

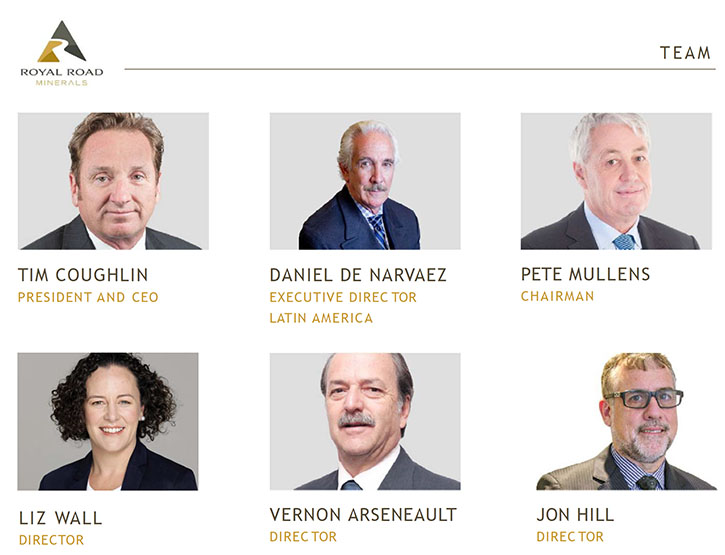

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background and your team, Tim?

Dr. Tim Coughlin: I'm a geologist. I have a master's degree in economic geology and I have a PhD in structural geology, which I did in the Andes. I've worked all over the world in about 27 countries, but spent most of my time in Latin America. Moved off to Eastern Europe and Russia for a while, with another company, I founded, called Lydian International. I then hopped out of that to get back into exploration, as we were developing a five million ounce goldmine there. I formed Royal Road and moved it into Colombia.

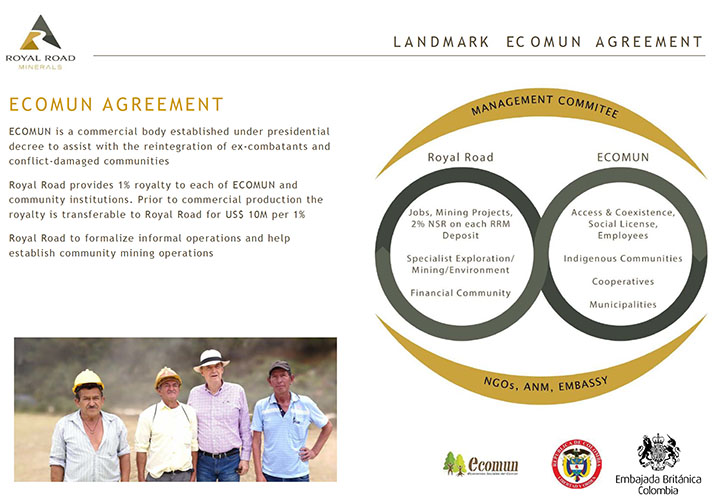

One of the things we do that we are proud of is our work in post-conflict environments. We worked very closely years ago, with the World Bank and the EBRD and various other multilateral institutions, on the value of new discoveries and responsible mining in post-conflict environments.

Our projects, particularly in Colombia are very much linked with the post-conflict aspirations of the government. We're aligned with them. We work with a cooperative, which is aimed at reintegrating ex-combatants.

That brings me to some of the rest of our team. There's a Board that's worked with me through that post-conflict process with Lydian. We also have, on the Board, a guy called John Hill, who was AngloGold's Exploration Manager in Colombia up until recently. He helps us with those assets.

We have a highly experienced and well regarded social and environmental specialist called Liz Wall, who's a non-executive Director. She's a global authority on indigenous communities and on community relations and environmental stewardship. Our team is technically strong, very familiar with the well-known challenges in Colombia and also Nicaragua. I like to think that we're fit for purpose.

We are proud of the ex-military and ex-combatants we employ either directly or through our arrangement with ECOMUN.

Dr. Allen Alper: That sounds great. Sounds like you and the team have excellent backgrounds and experience, so very capable to keep your project going. Could you tell our readers/investors a bit about your capital structure?

Dr. Tim Coughlin: As well as Agnico we also have some very strong North American and European institutions on the register. We are planning to work on building up our retail following.

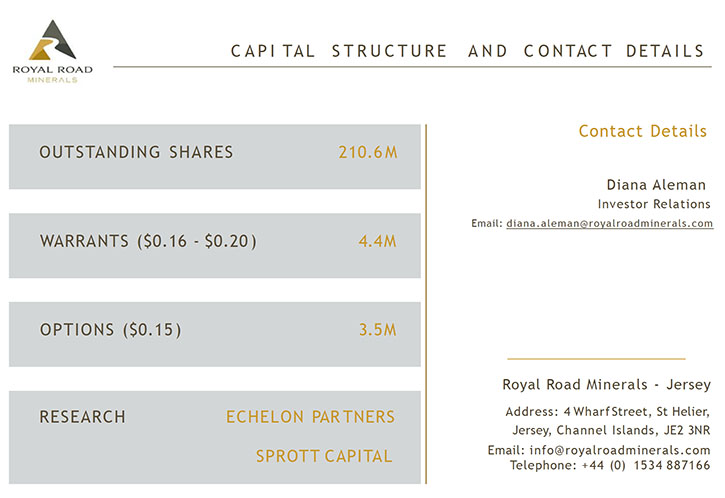

We have about 210 million shares out. A very small amount of stock options. The only warrants we have out are broker warrants.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors why they should consider investing in Royal Road Minerals?

Dr. Tim Coughlin: We've gone through a process, over the last 10 years, of transitioning our industry into one that is more community facing, socially and environmentally responsible. New more efficient and environmentally friendly mining techniques have been developed. It is a new and very exciting sector sitting on the brink of a long awaited recovery.

If you accept that, then it would seem logical that the best leverage in this environment would come from investing in companies, with new and exciting projects. The premium will lie in new discoveries, in a new industry, in a new market. The difference between us and many of our peers is that we're not sitting on single projects, we have an impressive portfolio of potentially new discoveries. We're taking advantage of this new environment. We're looking for new big deposits, in a highly prospective and very large land package. I would encourage your readers/investors to do their work. There are only a handful of companies around like ours.

Dr. Allen Alper: That sounds excellent. Great potential, a great team, great area to explore, very strong reasons for readers/investors to consider investing in Royal Road Minerals. Is there anything else you'd like to add, Tim?

Dr. Tim Coughlin: Just to thank you for interviewing Royal Road Minerals for Metals News.

Dr. Allen Alper: I’ve enjoyed talking with you and learning more about what you’re doing. Sounds like your Company has great potential. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.royalroadminerals.com

4 Wharf Street,

Saint Helier, Jersey,

JE2 3NR

T. +44 (0) 1534 887 166

E. info@royalroadminerals.com

|

|