Rubicon Minerals Corporation (TSX: RMX | OTCQX: RBYCF): Advanced Gold Exploration Company, Main Projects in Red Lake, Northern Ontario; Interview with George Ogilvie, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/13/2019

Rubicon Minerals Corporation (TSX: RMX | OTCQX: RBYCF) is an advanced gold exploration company that owns the Phoenix Gold Project, located 14 kilometers outside of Red Lake, Ontario, Canada, in the prolific Red Lake gold district. We learned from George Ogilvie, who is President and CEO of Rubicon Minerals, that although it is still an exploration project, it already has a 730-meter-deep fully functional shaft with a production hoist system, an 1800-metric tonnes per day mill, which is permitted for 1250 metric tonnes per day, and 14,000 meters of development already established within the mine. According to Mr. Ogilvie, the mine is 95% complete. In addition to that, the project has access to electricity, fresh water, and a 200-person camp on site. Last week, the Company published a new PEA showing a six-year mine life, and a robust economic potential. Near term plans include an updated NI 43-101 Mineral Resource Estimate, a decision to embark on a bankable feasibility study in the first half of 2020 and engage with potential financiers for the project.

Rubicon Minerals Corporation

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing George Ogilvie, who's President and CEO of Rubicon Minerals Corporation.

George, I wonder if you could give our readers/investors an overview of Rubicon Minerals and tell them what differentiates Rubicon Minerals from your peers.

George Ogilvie: Certainly, Al. Rubicon is an advanced exploration project company that has its main projects in Red Lake, northern Ontario, where we have the Phoenix Gold Project.

What's interesting about the Phoenix Gold Project is that, under old management, over $770 million of sunk costs were put into the project. Although it's an advanced exploration project, today we have a 730-meter-deep, fully functional, shaft with a production hoist system. We have an 1800-tonne per day mill, which is permitted for 1250 tonnes per day. And we have 14,000 meters of development, already established within the mine.

In conjunction with that, we are 14 kilometers outside of Red Lake, northern Ontario. We have access to power, electricity, a 200-man camp on site, and access to fresh water. With the previous sunk costs, under the old management, we also have $690 million in tax loss pools, meaning that if the Phoenix Project were ever to go to commercial production, we would not pay any income tax on any of the profits that we generate, nor would we pay any Ontario mining tax in the province of Ontario.

Unlike other advanced exploration stories, this Company has a proven management team, with substantial experience in managing producing mines, and turning around difficult companies and difficult assets in the past very successfully. There's no reason to believe that we cannot do the same with the Phoenix Gold Project.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your new PEA and the Phoenix Gold Projects in more detail?

George Ogilvie: Absolutely. I've been with the Company 2-1/2 years now, since we restructured it in late 2016. Over that period of time, we've gone back and done some of the basics that were missing under the old Rubicon.

We did over 60,000 meters of orientated drilling within the mine. We put together a new geological structural model. Last year we put 30,000 tonnes of material through our mill and found a 14% positive reconciliation from gold out of the mill, versus what the geological model predicted.

We recently put out, in the last week, a new preliminary economic assessment, which is the first PEA that's been put out on the project, during my 2-1/2 year tenure, since we've de-risked the project.

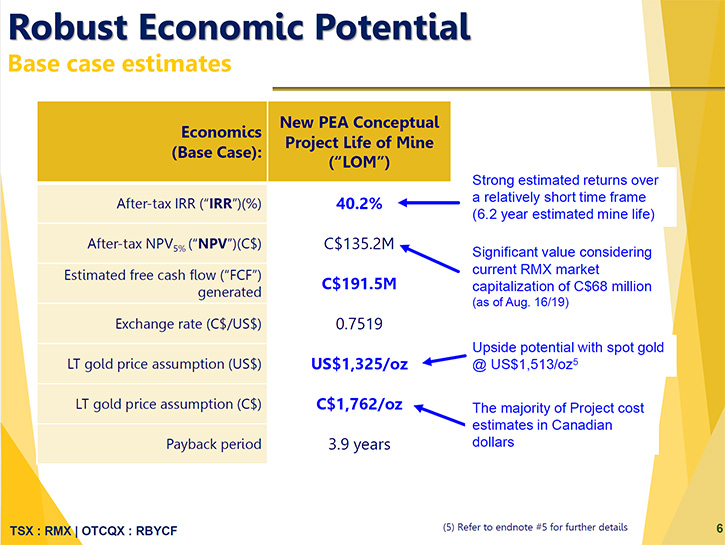

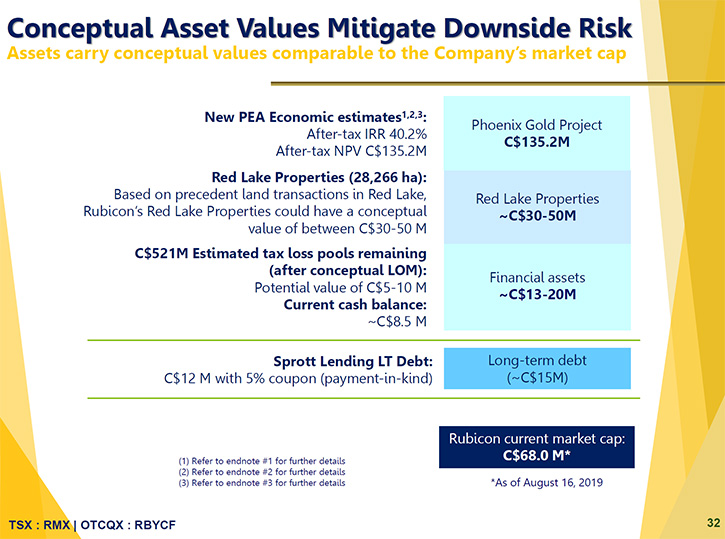

At a high level, the project is showing approximately a six-year conceptual mine life. We're showing an internal rate of return, after-tax, slightly north of 40%. The project is showing an after-tax NPV, using a 5% discount factor, of 135 million Canadian dollars; which is substantial when you consider the market cap of Rubicon today, is approximately 70 million Canadian dollars.

That valuation does not include the unused tax pools, which are substantial. Nor does it include the 28,000 hectares of land which Rubicon controls in the camp, which is 40% of all the claims and concessions within Red Lake.

Within the PEA, we're also showing 191 million Canadian dollars in free cash flow over the conceptual life of mine. We're using conservative assumptions, so we're using a U.S. dollar 1325 per ounce gold price, with a .75 exchange rate to the Canadian dollar, or $1,762 per ounce in Canadian dollars.

Today as we talk on the phone, the U.S. dollar gold price is hovering around 1540 U.S. And the Canadian dollar gold price is north of $2,000 an ounce.

Dr. Allen Alper: Well, that sounds excellent. Sounds like you have a great project there, and a great PEA. Could you tell our readers/investors your plans going forward for the rest of 2019, going into 2020?

George Ogilvie: Absolutely, Al. The PEA obviously uses measured, indicated, and inferred resources, within its mine plan, which then is fed into a financial and economic model. I've shared some of the high-level numbers with your listeners.

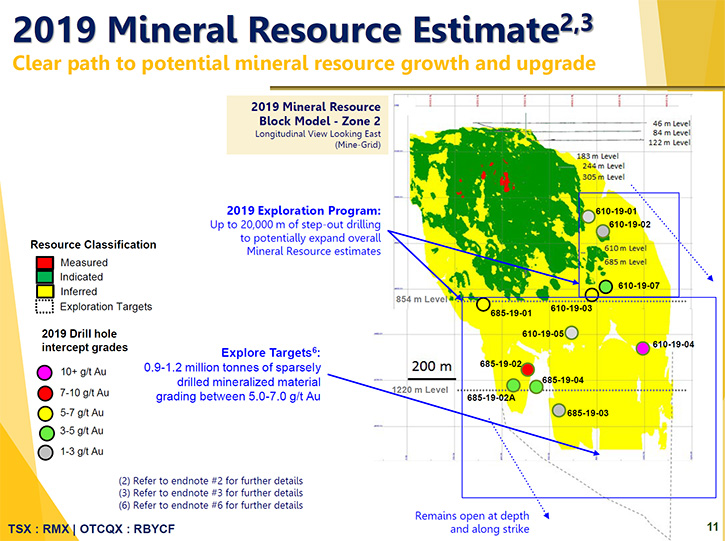

The last NI 43-101 mineral resource estimate that we put out, in April of this year, consisted of 589,000 ounces of gold in the measured and indicated category, at a weighted average grade of 6.26 grams per tonne. And 540,000 ounces of inferred resource at 6.53 grams per tonne. All those ounces and grades are obviously in situ.

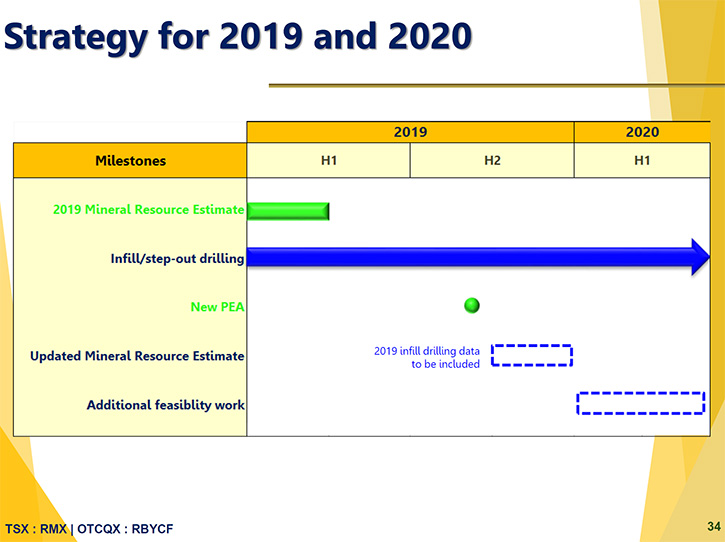

The plan of action now is that in the fourth quarter of this year, we will put out an updated national instrument 43-101 mineral resource statement and technical report, which will consist of approximately 2,000 meters of drilling from 2018, which is not in the current resource. And approximately 15,000 meters of new orientated drilling that has been conducted this year and is not in those resource numbers that I just shared with your readers/investors.

Assuming the next NI 43-101 sees a further growth in the measured and indicated resources, and we believe that somewhere north of 750,000 ounces of M&I, is the required threshold, assuming we can see those types of numbers in, then Rubicon would be in a position to decide to embark on a bankable feasibility study in the first half of 2020.

Given that the Project is already substantially built and 95% complete, the potential feasibility study could be completed for under a million dollars in cost, and probably take somewhere between six to eight months to complete.

We would be hoping that over the course of the first half of 2020, as we potentially embark on the feasibility study, we would be engaging with potential financiers for this project. We would look at putting out a bankable feasibility study that is potentially fully financed.

The PEA indicates that once the project is financed and has been given a green light to commercial production, it takes eight months to see first production, and then a further 12 months to declare commercial production.

Over the ramp-up period, Rubicon would produce 44,000 ounces of gold. Over the remaining 5.1 years life of mine under commercial production, we would produce about 450,000 ounces of payable gold.

That's at an all-in sustaining cost of about 882 U.S. dollars an ounce, and a C1 cash cost of 624 U.S. dollars an ounce. Which is obviously considerably below the current gold price in even our conservative assumptions.

If we don't see the 750,000 ounces or more of M&I come December, obviously we could still get to those targets by continuing to drill and convert more inferred into that M&I category.

This deposit, as well, has never been cut off at depth. It's also open across strike. So there's considerable upside in further exploration over the ensuing quarters.

Dr. Allen Alper: Well, that sounds excellent. Sounds like there's great potential. Could you tell our readers/investors about your background and your team?

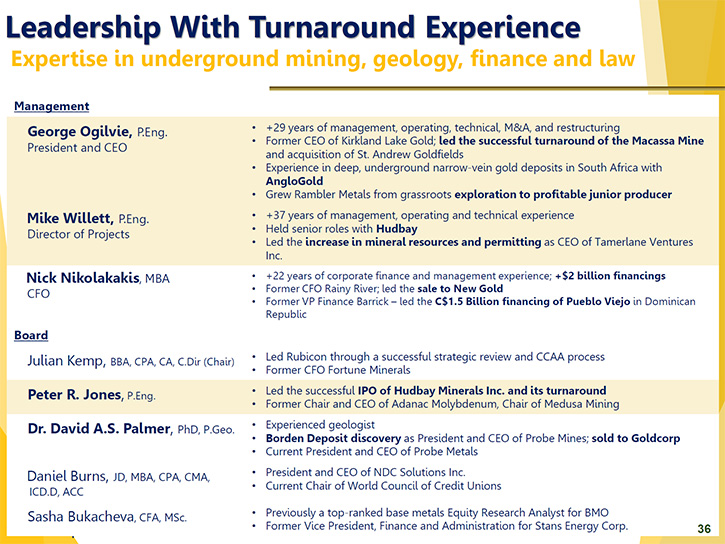

George Ogilvie: Yeah, absolutely. I'm a mining engineer from Strathclyde University, Glasgow, Scotland. I graduated in 1989, so this October will be my 30th year anniversary.

Upon graduation, I went to work for Anglo Gold in the ultra-deep gold mines of South Africa, where I spent eight years cutting my teeth, probably in some of the toughest gold mines in the world, and being very successful there.

I was fortunate to get a transfer in 1997 from Anglo Gold to Anglo Base Metals, and ended up working at Hudson Bay Mining and Smelting in northern Manitoba, which obviously was part of the Anglo Base Metals group at the time.

I spent eight years in progressive levels of management with Hudbay, both in a production scenario and assisting with the sinking of the triple 7 shaft. In 2004, I resigned from the Anglo Group of companies and went to work in the nickel Sudbury belt, working for Dynatec and FNX, who were bringing some of the old Anglo mines back into production.

After three years with Dynatec FNX, I jumped over to a small grassroots explorer, by the name of Rambler Metals and Mining that had a property in Baie Verte, Newfoundland. It was a dormant copper gold mine that had been closed for 20 years. It was flooded; it needed permitting. It needed financing.

Over a period of three years, we eventually got that mine into commercial production. And over its first three years ... granted, the copper price was in excess of $4 U.S. a pound, it was profitable and free cash flowing.

In 2013 I joined Kirkland Lake Gold, who had seen its market capitalization fall from 1.2 billion down to 250 million Canadian dollars. We restructured the Board, and brought in Eric Sprott as non-executive Chairman. We changed the mine plan out of Macassa, and over a period of three years, we took the production from 95,000 ounces annually to 165,000 ounces annually.

We also completed the acquisition of St. Andrew Goldfields, which added in an extra 100,000 ounces of annual production, taking Kirkland Lake beyond a 250,000-ounce producer.

When I exited in the summer of 2016, the market capitalization of the Company was now close to 1.4 billion U.S. dollars. We saw a five times increase in the share price of the Company.

Of course, today, I would say Kirkland Lake has been one of the darlings of the street over the last five years, and is now in excess of a 13 billion market cap company, particularly considering the acquisition of Fosterville in Australia, which has been transformational.

I joined Rubicon 2-1/2 years ago, and we're slowly but surely de-risking this project from a technical perspective. Certainly, given the significant infrastructure and those tax loss pools, the Phoenix Project can be a commercially viable mine, with significant returns for its existing or any future shareholders. Particularly when you consider today's market cap of only 70 million Canadian dollars, and where the mine is located, in one of the most prestigious gold mining camps.

We should also say that my CFO has 25 years of experience starting out with Placer Dome and Barrick. Although we're in a small company, he has big company experience and he himself has raised over 2-1/2 billion dollars in the capital markets over the last 25 years.

Another key individual on the team is our Director of Projects, Mike Willett. He runs the day-to-day operations in Red Lake. Like myself, he's a mining engineer. He has significant production experience, but he's also brought mines into commercial production.

He's spent time as C-suite executive when he was a CEO with Tamerlane Ventures. He knows what's expected of executives, and how they should interact with shareholders and their Boards. He's also spent time as a consultant, conducting feasibility studies, PEAs, NI 43-101s, et cetera et cetera.

I think, as a core executive team, we have close to, 100 years’ worth of experience, mostly in the management and turning around mines and getting them into commercial production. Which can be a key differentiator in companies. Certainly management is a key cornerstone of a successful company.

Dr. Allen Alper: Well, that sounds excellent. You have a fantastic background and you have a great team.

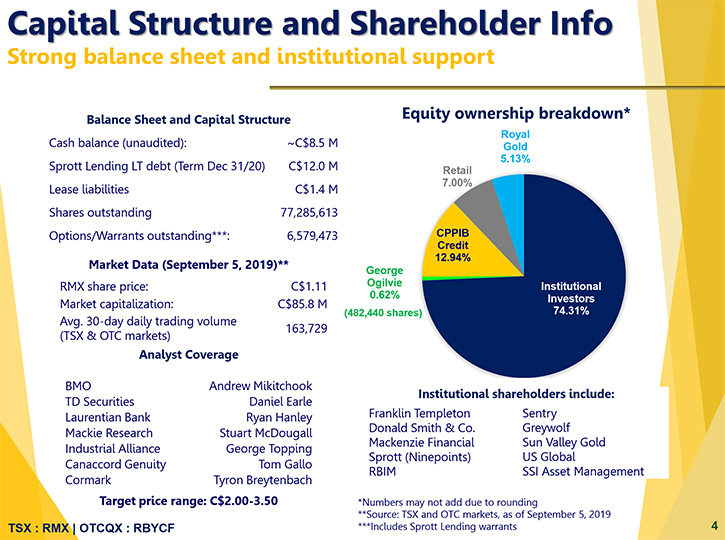

Could you tell our readers/investors a little bit more about your capital structure and share structure?

George Ogilvie: Yes, absolutely. When we restructured the Company 2-1/2 years ago, sadly for our old shareholders, the stock was rolled back significantly. Of course, over the last couple of years, we have had several financings.

But today, we still only have 77 million shares outstanding. When we look at the small warrants and options that we have on a fully diluted basis, we'd be looking at somewhere in and around 84 million shares on a fully diluted basis.

As we conduct this interview, the share price of the company is approximately 95 cents. The options and warrants have a weighted average price of $1.35 Canadian. So they are underwater, and therefore management is significantly incentivized to see the share price, significantly increase from these levels. We believe, over the next 12 to 18 months, that will occur, as we continue to de-risk this project. This time next year, we plan to have out a bankable feasibility study.

As far as debt is concerned, Rubicon has a 12 million Canadian dollars long-term debt that was all part of the restructuring of the Company, with the former senior secured lender. The debt is repayable by December 31st, 2020. That's some 16 months away. But still, some considerable time to maturity. And the debt can be repaid at any time without any penalty.

It's our current thinking that next year, with a potentially positive bankable feasibility study, and hopefully the project financing in place, we would look to restructure that debt and push out beyond the date of the commercial production, which is expected in late 2021 or the first half of 2022, depending on when we green light the project.

Other than that, apart from some small accounts payables, Rubicon has no other outstanding debt.

Dr. Allen Alper: Well, that sounds like the Company is well on its way for excellent turnaround. Could you tell our readers/investors the primary reasons they should consider in investing in Rubicon Minerals?

George Ogilvie: Well, I think the key points are: At these valuations we are significantly undervalued. Our management team’s track record is extremely successful. The preliminary economic assessment that we put out uses very conservative and prudent assumptions. Remember, the operating and capital costs that have gone into the PEA are real numbers that we've actually seen over the last five years, as this project has been worked by former management and my Management Team over the last 2-1/2 years. It's a very strong PEA, although I do recognize it uses inferred resources in the mine plan, and therefore economics. But the valuations look extremely attractive at conservative assumptions.

If you start to consider sensitivity analysis, and you look at this thing at 1500 U.S. dollar an ounce gold, which is slightly below the current spot, the IRR increases to over 60%, and the NPV of the project is in excess of 220 million Canadian dollars.

Even at 1100 U.S. dollars an ounce, and keeping all other assumptions the same, the project still has an IRR of 12%, and 25 million NPV.

In addition to the Phoenix Project, the Company has 28,000 hectares of land in Red Lake that really needs to be explored. We believe, with Newmont acquiring Goldcorp earlier this year, there is going to be a shakeup in the camp in the next six to 12 months.

We certainly believe, as a significant landholder in the camp, we can be part of the equation of potentially consolidating the camp, which is going to be extremely good news for the shareholders or potential shareholders of Rubicon. That's what I believe differentiates us from our other advanced exploration peers out there.

Of course, I'm sure your readers/listeners know that Red Lake, northern Ontario has produced in excess of 30 million ounces of gold over 80 years of mining. It's a prestigious gold mining camp not just in Canada, but the world. We deal with third- and fourth-generation miners, and it's a Tier 1 jurisdiction.

Dr. Allen Alper: Well, that sounds like outstanding reasons to consider investing in Rubicon Minerals. Is there anything else you'd like to add, George?

George Ogilvie: I think we covered all the key salient points. I just want to thank you, obviously for giving me this opportunity to have Rubicon Minerals interviewed for Metals News. Certainly putting out the PEA and this substantial information, I feel now is the time to get this information out there.

Dr. Allen Alper: That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.rubiconminerals.com

George Ogilvie, P.Eng.

President, CEO, and Director

Investor Relations: +1 (416) 766-2804 or toll-free +1 (844) 818-1776

Email: ir@rubiconminerals.com

|

|