First Mining Gold Corp. (TSX: FF, OTCQX: FFMGF, FRANKFURT: FMG): Advancing the Springpole Gold Project in Ontario, One of the Largest Undeveloped Gold Projects in Canada: Interview with Dan Wilton, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/11/2019

The below transcript of this interview is subject to the notes and disclaimers set out at the end of the transcript.

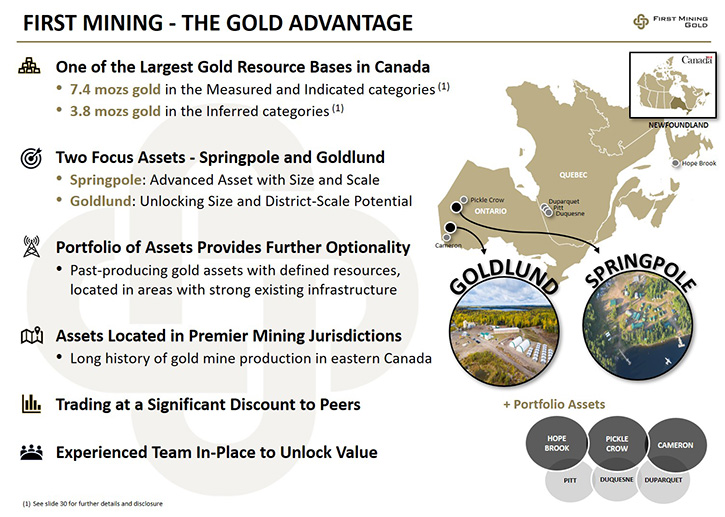

First Mining Gold Corp. (TSX: FF, OTCQX: FFMGF, FRANKFURT: FMG) is an emerging development company with a diversified portfolio of gold projects in North America. The Company’s key focus is on advancing and de-risking both its Springpole and Goldlund gold assets in Ontario. The Springpole Gold Project, located in Ontario, is one of the largest undeveloped gold projects in Canada, with 4.67 Moz Au in the Indicated category and 0.23 Moz Au in the Inferred category(1). We learned from Dan Wilton, CEO and a Director of First Mining Gold, that this Fall they are releasing an updated PEA, based on the very successful new metallurgical work that demonstrated the ability to increase the recoveries up to 91% for gold and up to 95% for silver. The Company is also continuing to advance permitting at Springpole. The Company’s second key asset, which is being advanced this year, is its Goldlund project, also located in Ontario, where First Mining Gold is conducting further exploration drilling, after publishing a mineral resource update this past spring that was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

The Springpole Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dan Wilton, who is CEO and a Director of First Mining Gold.

Could you give our readers/investors an overview of First Mining Gold Corp., your focus and current activities, and also what differentiates First Mining from others?

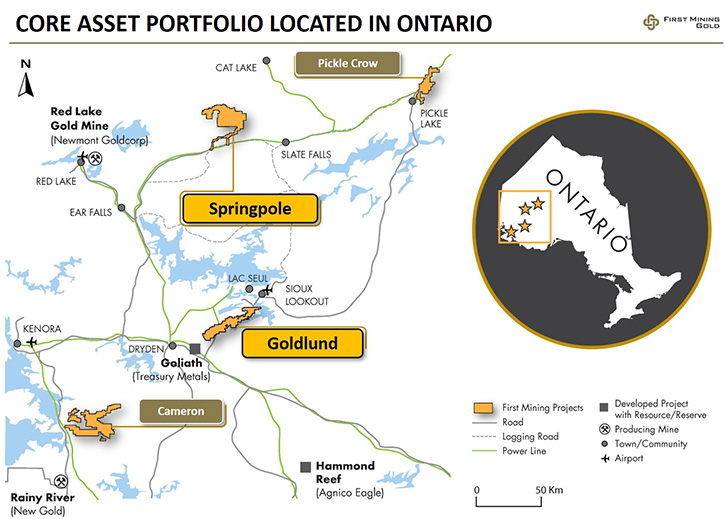

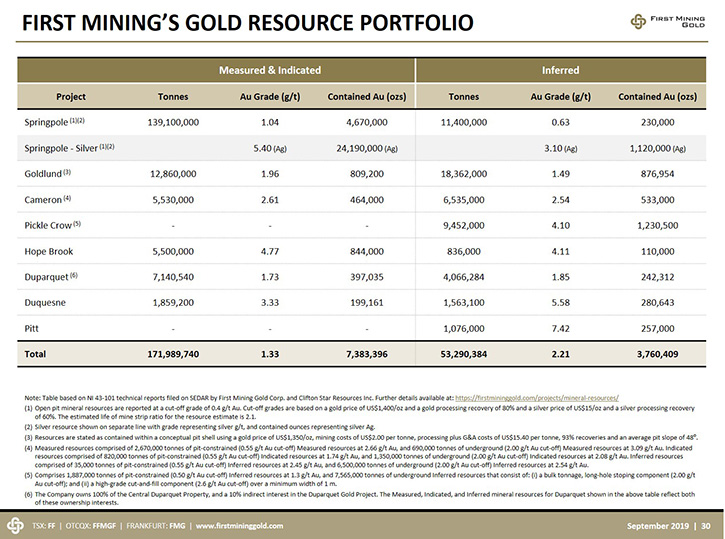

Dan Wilton: First Mining is a company developing a portfolio of gold assets, all located in Canada. Right now we have approximately 7.4 million ounces of gold in the Measured and Indicated category, and approximately 3.8 million ounces of gold in the Inferred category across the entire portfolio(1).

The bulk of our projects are located in northwestern Ontario, in the Dryden area, which we think is a great place to be developing projects - great infrastructure, great workforce, supportive communities.

Full size image

I think the following really differentiates First Mining from a number of other investment opportunities: Number one is just the size of the portfolio, the sheer number of ounces of gold. Number two, the fact that they're all located in good jurisdictions; all of our ounces are in Canada, and the bulk of them in the same area of northwestern Ontario.

Full size image

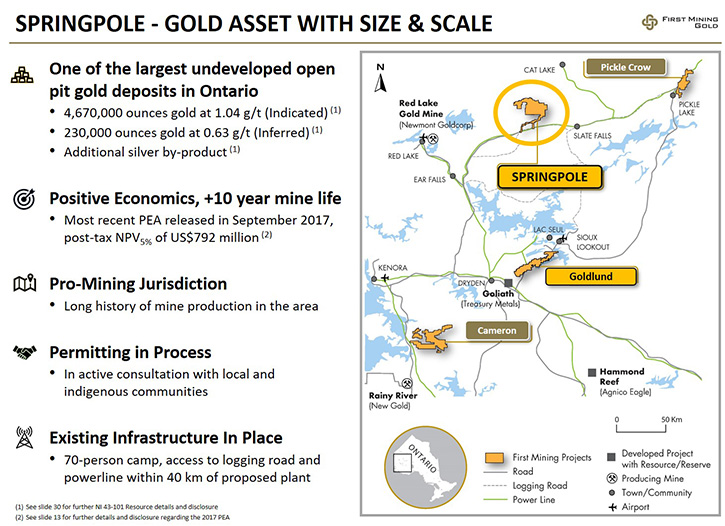

Our Springpole project hosts an approximate 4.7 million ounce gold Indicated resource project(2) that we're moving through permitting right now. Were it producing today, it would be one of the largest gold mines in Canada. This is a large-scale opportunity, which we think represents a pretty unique opportunity for investors today.

Full size image

Dr. Allen Alper: That's amazing! The portfolio you put together and in such a great location; that's really outstanding.

Could you tell us a bit more about the portfolio and its contents? What are your plans going forward in 2019?

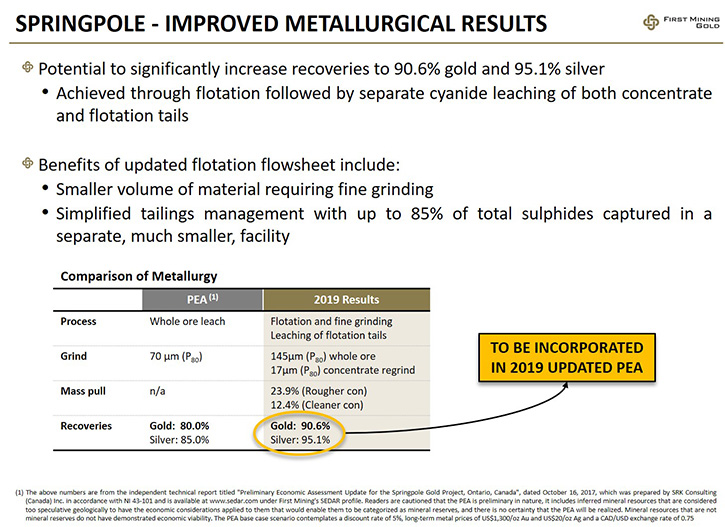

Dan Wilton: We are updating our Preliminary Economic Assessment (PEA) on Springpole. The last one we did in 2017 showed the Company developing a 36,000-tonne per day mine and mill, at an initial capital cost of just under US$600 million. That had an NPV of almost US$800 million at a US$1,300/oz gold price(3). Real major scale deposits! Right now, we're updating that because over the course of 2018, early 2019, we did some very important metallurgical work at Springpole.

The 2017 PEA had used 80% recoveries of gold, and 85% from silver on a metallurgical flow sheet that was basically a whole-ore leaching- grinding to 70 microns in a whole-ore leach(3).

I think the metallurgical test work that we've done most recently demonstrates that we have the capability to increase those recoveries up to, and hopefully in excess of, 91% for gold and 95% for silver. That's a meaningful increase in metal recovery from the same mine plan.

Full size image

Through nothing particularly novel, just moving to a flow sheet that is a coarser grind, with flotation and then fine-grinding of the flotation concentrate, and leaching of the flotation tails.

That has a couple of really important benefits. One is the increase in recoveries. The second is it concentrates most of the sulphur from the deposit into the concentrate, which has about 1/7th to 1/8th of the mass of the total.

That gives us a lot of other options for managing the sulphur-laden tailings, and dramatically reduces the footprint of the sulphur-laden tailings in the project. That's important.

This new PEA is going to come out before the end of the year. We're working on it right now, and we're optimistic about what that's going to look like from an economic perspective.

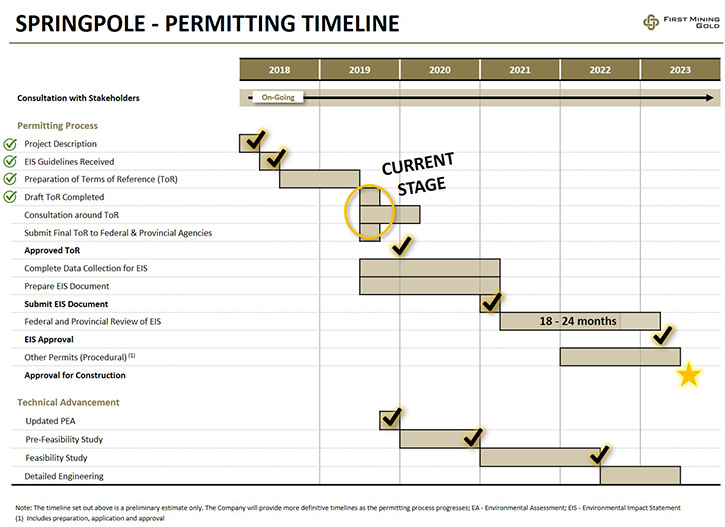

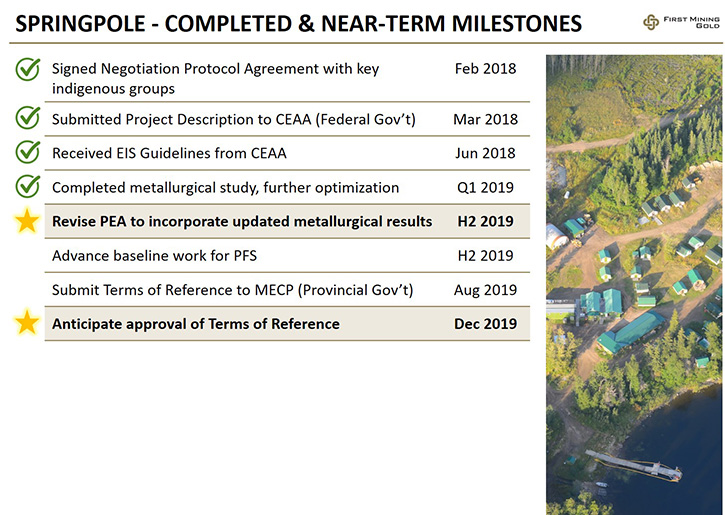

At the same time at Springpole this year, we're collecting a lot of baseline data and technical data in support of the preparation of an Environmental Impact Statement. And ultimately, advancing through the environmental assessment process, both federal and provincial.

We aim to have all of that data collected by the middle of next year, then the document compiled and submitted by the end of 2020. That's a very important milestone in the permitting process, once that Environmental Impact Statement is submitted.

Full size image

In general, in Ontario, it takes about 18 to 24 months for the federal and provincial governments to review and accept comments on Environmental Impact Statements. Then ultimately, they render their decision on them. We're moving forward on some very important, although, from the market's perspective, not all that exciting, work at Springpole.

Full size image

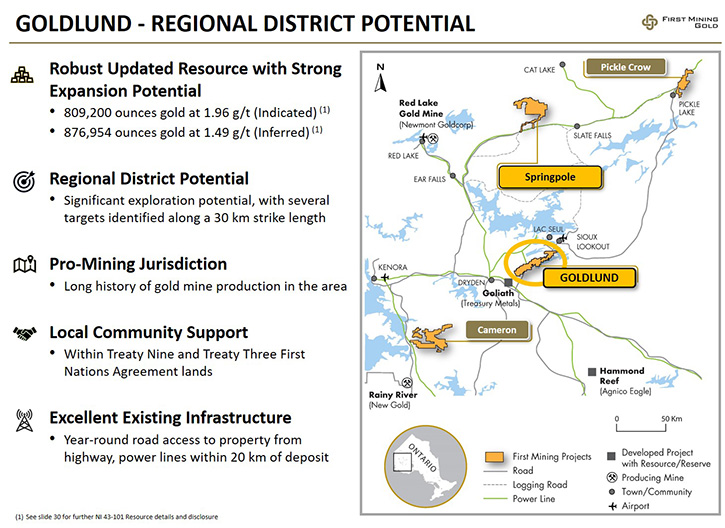

Our other key project, about half of our budget this year, is Goldlund. Goldlund is a fantastic project, located just off the highway between Dryden and Sioux Lookout in Ontario.

It has about 810,000 gold ounces Indicated, and about 875,000 gold ounces Inferred(4), sitting in a reasonably shallow, 200-metre deep open pit, with what we think is going to be an attractive strip ratio, and still room to grow on every side.

We put out a new NI 43-101 mineral resource update on Goldlund in March of this year(4). So far, the 2019 work program at Goldlund has been testing the regional exploration upside.

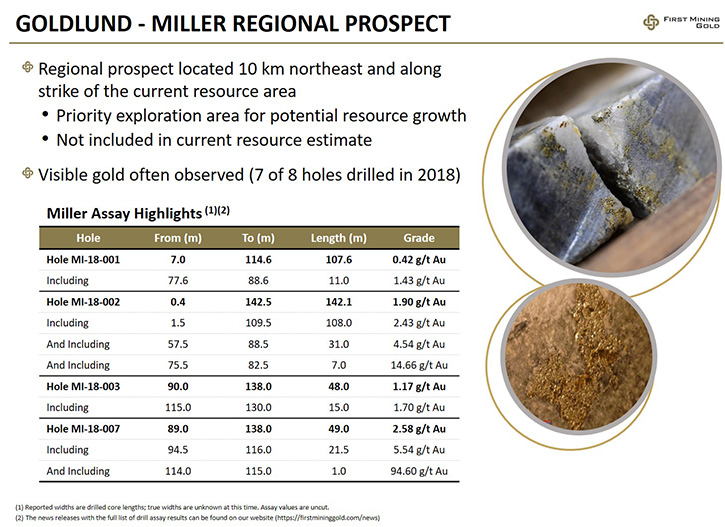

We drilled eight holes last year, about 10 kilometres to the northeast of the main Goldlund resource area, along this big regional structure, at a prospect called Miller. All eight of the drill holes hit the structure we were looking for; seven of those holes had visible gold in them. Very exciting!

Full size image

So we're following up on that, doing a couple of infill holes where we drilled last year. Then we are going to step out, to see how big this structure really is, and test if there are any parallel structures along the way at Miller.

Ultimately, this prospect is 10 kilometres away from the main project. But we're seeing a number of gold occurrences along a 30-kilometre strike length across the property and we're going to test a few of them before we take the project through an economic analysis, so we can start to understand if we are dealing with one deposit, or a string of deposits, along this big regional structure.

Full size image

It's very exciting! We're also doing some environmental baseline work on the balance of our portfolio at Cameron and at Pickle Crow, two other million-ounce projects in Ontario. We are spending about a million dollars this year understanding a couple of key technical parameters on our broader portfolio assets, so that we can understand the path forward for those, whether that's finding partners or us moving them forward ourselves. We have some very important high-value, low-dollar work going on at the other projects.

Dr. Allen Alper: That sounds excellent. Sounds like the rest of 2019 and 2020 are going to be extremely exciting times for our readers/investors and stakeholders of First Mining Gold. Excellent!

Dan Wilton: Yes we think so.

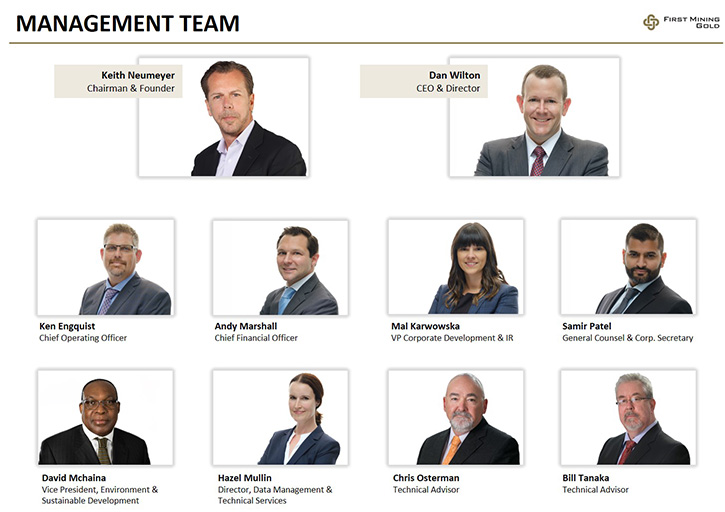

Dr. Allen Alper: Dan, could you tell our readers/investors a bit about your background? I know you have a fantastic finance and investing background. Could you also tell us about your Team and your Board?

Dan Wilton: Yes. I've basically been doing mining, corporate finance, capital raising, and mergers and acquisitions for most of my career. I started my career at Morgan Stanley in New York, in their Mergers and Acquisitions Group, and immediately started working on mining projects, fortuitously.

Running the mining investment banking team at National Bank Financial, I was involved in raising a lot of equity and ultimately finding partners for, or selling a number of larger, single-asset projects in that 2009 to 2013 time frame, where we advised on a number of multi-hundred-million-dollar project sales, doing a lot of projects that would be quite comparable to the ones we have in the portfolio at First Mining.

Full size image

For the last five years prior to joining First Mining, I was a partner at a mining-focused private equity fund, called Pacific Road Capital. We had approximately $800 million under management in two funds and were focused on investing in later-stage mining project development; commodity agnostic, and with a global mandate. We spent a lot of time looking at gold projects in Canada.

All of us have a background in the gold sector. If you're going to be investing, you want to pick the best jurisdiction that you can, because it'll allow you to sleep at night a lot better than when you're invested in some trickier places in the world.

What's interesting, through the time at the private equity fund, we'd actually looked at many of the projects that we have in the portfolio at First Mining, before First Mining bought them. I had a good appreciation for a number of these projects coming into this role.

I've been at First Mining since the beginning of January of this year, so rounding the corner on eight months. Importantly in that eight months, I joined to find a great team here, including Keith Neumeyer, our Chairman. Keith probably doesn't need much of an introduction. He's the CEO of First Majestic and a real company founder and company builder, and great entrepreneur. It's been wonderful getting to work with Keith and building that relationship.

We've also made a few important changes on the team over the last several months, including bringing in Ken Engquist as our Chief Operating Officer. Ken's background is in project definition and taking projects through feasibility.

The last couple of projects with which Ken was involved, include his leading the Feasibility Study for the Taylor Project for Arizona Mining, just before Arizona Mining was sold to South32 for $2 billion. Prior to that, he led the Feasibility Study for the Timok Project in Serbia, which was in a company called Nevsun. Last year Nevsun, largely on the back of Timok, was sold to a Chinese group for something in that same $2 billion range.

Ken has a great capability and understanding of how you take these deposits and do the kind of work that you need to do on them to attract the biggest mining companies in the world as partners.

So much of the challenge that the mining sector faces, particularly junior miners, is that you don't have a lot of capital. You don't have a limitless budget; you do need to be really strategic about where you're spending and prioritizing spending. But Ken's background has been fantastic. I think we have a really sharp focus on where that spend is going.

That was one very important addition. Just prior to Ken joining, I brought on Mal Karwowska. You've had a chance to speak with Mal, who has worked with me both in the corporate finance world and at Pacific Road in the private equity fund. She is one of the sharpest financial minds and one of the best corporate development financial modeling professionals I've ever worked with. She has a broader role now that's encompassing both corporate development and investor relations, but she has made a huge difference for us, moving these projects forward.

Dr. Allen Alper: Sounds like you have an amazing Team and Board with Keith. Sounds like First Mining Gold has what's really needed: great assets and a great team with financial backing and technical backing to carry the project forward. That's really excellent!

Could you tell our readers/investors a bit about your share and capital structure?

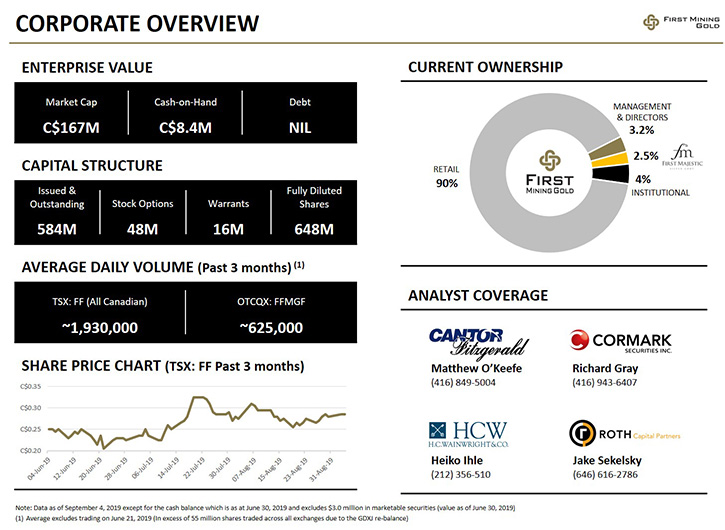

Dan Wilton: We have about 584 million shares outstanding. That would put us at a market cap of approximately C$165 million today. We closed a financing in May of this year, where we raised C$7.4 million, including C$1.9 million of flow-through to fund exploration at Goldlund. We are well funded for the work programs that we have outlined for 2019.

Full size image

We're really blessed with a great group of shareholders, as a significant amount of this financing was taken up by some of our long-standing and supportive shareholders.

One of the other distinguishing factors that we have, relative to a number of other developers in our side of the market cap, is we do have exceptional share trading liquidity. We trade on average about somewhere between a million and a half and 2 million shares a day, between our TSX listing and our listing on the OTCQX.

It is the kind of company that it's possible to trade in and out of. We think that those couple of things distinguish us from a number of our competitors.

But our current shareholder base is predominantly retail and almost always has been. A lot of that is that the Company was put together, and a lot of the seed capital raised from a lot of relationships of Keith Neumeyer's.

A lot of those are First Majestic shareholders and a lot of high-net-worth and retail investors from Canada, from the U.S., from Europe, really quite a broad range. But we don't have much of an institutional shareholding, and that's something that we are looking to address.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors the primary reasons they should consider investing in First Mining Gold, Dan?

Dan Wilton: Primary reasons: Number one, the project portfolio, and the size and scale of the resource. 7.4 million gold ounces in Indicated, and 3.8 million gold ounces in Inferred(1).

This is a really sizeable resource base in projects. Second point, all located in great jurisdictions. All of our gold ounces are in great places in Canada to advance and develop projects.

We have a great team that's capable of moving them forward. Ultimately, Al, it's interesting. When you look across the opportunities in which people can invest in the mining sector right now, there are a number of exploration stories starting to get some real traction. In fact, some companies that are exploring with market caps larger than ours don't even have a resource yet.

With our portfolio of assets right now, we are trading at about US$10/oz in the ground, versus the average developers that are trading at about US$40/oz. Even reverting to the mean, we believe there’s potential return by just getting back to an average multiple.

When you look at how advanced our projects are, how much more capital it takes to get these projects to a pre-feasibility or a feasibility stage, which in the case of Springpole is not very much.

We think we can get it to pre-feasibility and to complete our Environmental Impact Statement, in total with about a $10 million spend, between now and the end of 2020. For a deposit of this size it's tough to find opportunities like that in this market.

Full size image

And the leverage that we have to the gold price rising, and we're in a constructive gold environment; remembering that all the costs of these projects, or most of the costs of these projects, will be in Canadian dollars. You look at the gold price on a Canadian dollar basis, we're at all-time highs right now.

I think the quality of the portfolio, the jurisdiction, the team, and the deep value that we're trading at right now, all make this a pretty compelling investment opportunity.

Dr. Allen Alper: I would agree. Those sound like extremely strong reasons to consider investment in First Mining Gold. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.firstmininggold.com/

Daniel W. Wilton

Chief Executive Officer and Director

Mal Karwowska | Vice President, Corporate Development & Investor Relations

Direct: 604.639.8824 | Toll Free: 1.844.306.8827 | Email: info@firstmininggold.com

Notes & Disclaimers:

1. Based on NI 43-101 technical reports filed on SEDAR by First Mining Gold Corp. and Clifton Star Resources Inc. Further details available at: https://firstmininggold.com/projects/mineral-resources.

2. Based on the independent technical report titled “Preliminary Economic Assessment Update for the Springpole Gold Project, Ontario, Canada”, dated October 16, 2017, which was prepared by SRK Consulting (Canada) Inc. in accordance with NI 43-101 and is available at www.sedar.com under First Mining's SEDAR profile.

3. Readers are cautioned that the PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

4. Based on the independent technical report titled “Technical Report and Resource Estimation Update, Goldlund Gold Project, Sioux Lookout, Ontario”, dated April 1, 2019, which was prepared by WSP Canada Inc. in accordance with NI 43-101 and is available at www.sedar.com under First Mining's SEDAR profile.

Cautionary Note Regarding Forward-Looking Statements

This transcript includes certain "forward-looking information” and "forward-looking statements” (collectively "forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this transcript. Forward-looking statements are frequently, but not always, identified by words such as "expects”, "anticipates”, "believes”, “plans”, “projects”, "intends”, "estimates”, “envisages”, "potential”, "possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements in this transcript relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the Company’s plans to update the Springpole PEA and its belief in the increased gold and silver recoveries that are expected to be set out in such update; (ii) timing of the updated Springpole PEA; (iii) the Company’s goal of collecting all baseline data and technical data in support of the preparation of an Environmental Impact Statement for Springpole by the middle of 2020, and to submit the Environmental Impact Statement by the end of 2020; (iv) the Company’s plans on targeting further definition of the resource potential at the main Goldlund deposit; (v) the potential for the 2019 work program to advance First Mining’s understanding of the exploration upside at Goldlund; (vi) the Company’s focus on advancing its material assets towards production; and (vii) realizing and unlocking the value of the Company’s gold projects for the Company’s shareholders. All forward-looking statements are based on First Mining's or its consultants' current beliefs as well as various assumptions made by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the presence of and continuity of metals at Goldlund at estimated grades; success in realizing proposed drilling programs; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration and exploration drilling programs, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities, indigenous populations and other stakeholders; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; title to properties.; and the additional risks described in the Company’s Annual Information Form for the year ended December 31, 2018 filed with the Canadian securities regulatory authorities under the Company’s SEDAR profile at www.sedar.com, and in the Company’s Annual Report on Form 40-F filed with the SEC on EDGAR.

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

Cautionary Note to United States Investors:

This transcript has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this transcript have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum 2014 Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource” does not equate to the term "reserves”. Under U.S. standards, mineralization may not be classified as a "reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC's disclosure standards normally do not permit the inclusion of information concerning "measured mineral resources”, "indicated mineral resources” or "inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that "inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated "inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an "inferred mineral resource” exists or is economically or legally mineable. Disclosure of "contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of "reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as "reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

|

|