Arizona Metals Corp. (TSX.V:AMC): Two Projects in Arizona: The Past-Producing, High-Grade Kay Gold-Copper Mine, and the Sugarloaf Heap-Leach Gold Project, Both Have Extremely Good Upside Potential; Interview with Marc Pais, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/10/2019

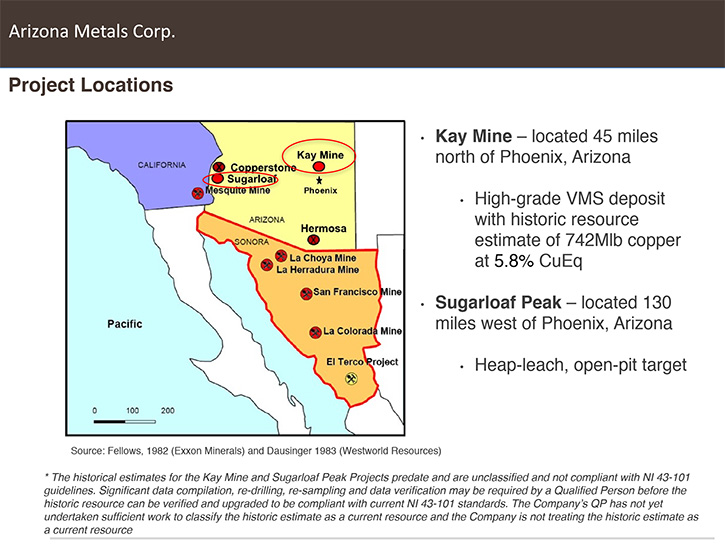

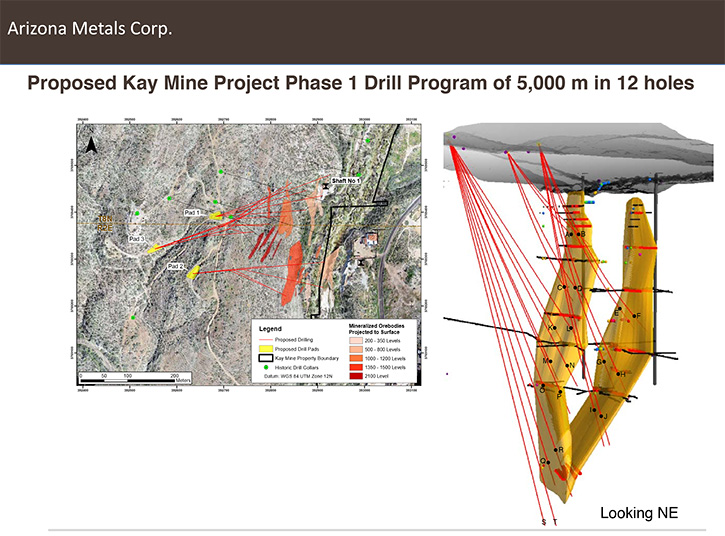

We learned from Marc Pais, President and CEO of Arizona Metals Corp. (TSX.V:AMC), that they are a gold and copper exploration company, that was started in 2014 and listed about three weeks ago in August of 2019, and owns 100% of two projects in Arizona: the past-producing high-grade Kay Gold-Copper Mine in Yavapai County, and the Sugarloaf Peak Gold Project in La Paz County. Arizona Metals is currently working on permitting both Sugarloaf and Kay projects, with the immediate focus on Kay, where they expect to start a 5,000-meter drill program in late September to early October, with the goal to upgrade the Exxon Minerals historic resource estimate into NI 43-101 compliance. According to Mr. Pais, both of their projects, located in mining friendly jurisdictions with excellent infrastructure, have been significantly de-risked thanks to the amount of historic work done on them, and both have extremely good exploration upside potential.

Arizona Metals Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Marc Pais, who is President and CEO of Arizona Metals Corp. I wonder if you could give our readers/investors an overview of your Company and also what differentiates it from others and maybe a little bit of a historical background of the Company, Mark.

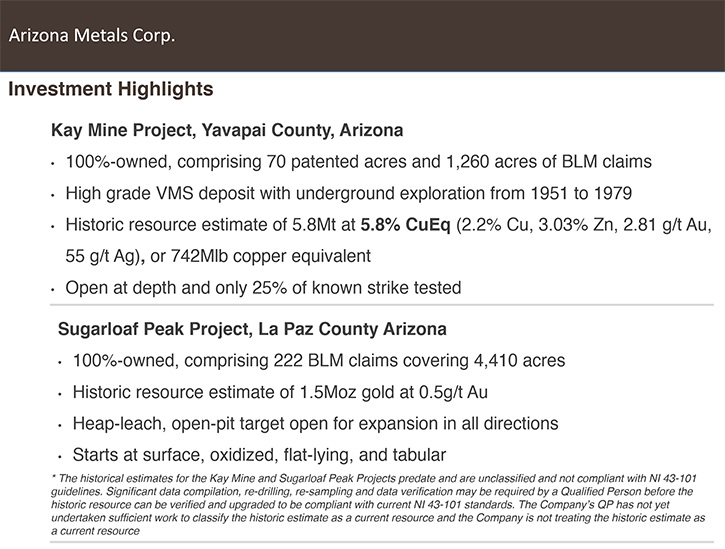

Marc Pais: Arizona Metals Corp was just listed about three weeks ago in August of 2019. The Company was started in 2014 and we were looking for assets, with historic resources, that we could upgrade through drilling to NI 43-101 compliance and increase value that way. The first asset we acquired was the Sugarloaf Peak deposit in Arizona, located about two hours directly west of Phoenix in La Paz County. Sugarloaf Peak has a historic estimate of 1.5 million ounces gold at 0.5 grams per tonne. It's a heap leach oxide, open pit target. It starts right at surface and is about 300 meters wide by one kilometers of strike. The historic estimate was defined down to a depth of 70 meters by a Vancouver junior, called Westworld Resources from work that was done in 1982. We completed the Sugarloaf Peak acquisition in 2016 and now own 100%, with no further payments due.

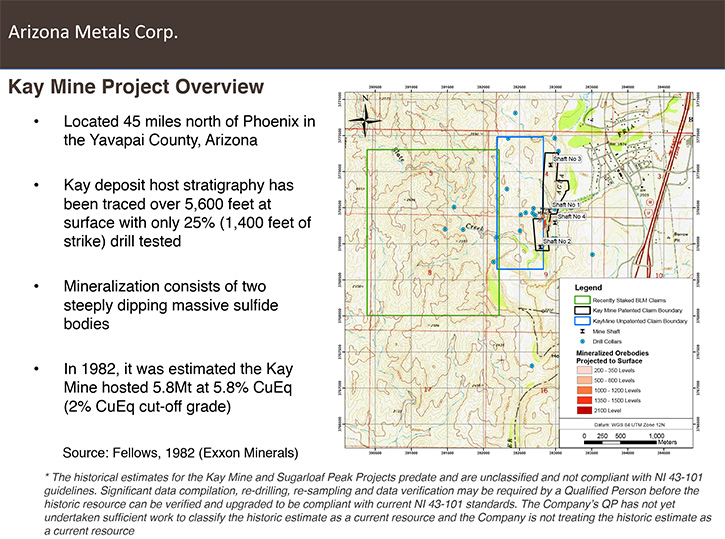

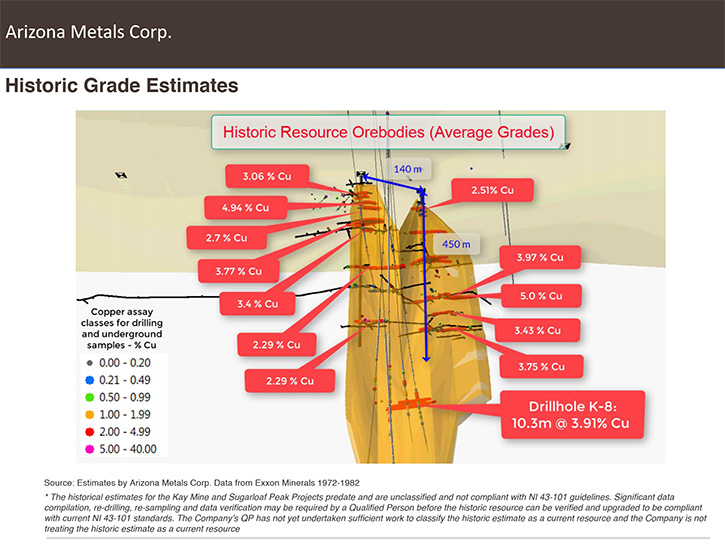

The second asset we acquired at the end of 2018 was the Kay Mine, located about an hour north of Phoenix near Black Canyon city. The Kay Mine was discovered in the early 1900s and was worked on and off, basically test mining for the last century. In the 1920s, two main shafts were put down to a depth of 450 meters. Those are the access shafts and there are also two ventilation shafts off to the side. Some test mining was done in the 20s and in the 1950s. Some very good grades were encountered by historic operators from a depth of only 150 meters. The test ore that was sent to local smelters (two of which are still in operation today) averaged 5% copper and two grams per tonne gold. Those were recovered grades, after mining dilution and smelter recoveries, so we believe the head grades could have been significantly higher.

That operation was shut down in 1955 and restarted in 1972 by Exxon Minerals, which was a subsidiary of Exxon Oil and Gas. Exxon Minerals spent approximately seven years exploring from underground. There were 12 underground mine levels down to a depth of 450 meters, which Exxon drilled and sampled extensively. Exxon also did 7,000 meters of surface diamond holes to test below the underground workings. They tested to a depth of about 900 meters and from all that work produced an internal report, which reported a proven and probable reserve of 6.4 million short tons at 2.2% copper, 2.8 grams per ton gold, 3% zinc, and 55 grams per ton silver. Importantly, the historic estimate is located on private land, and is not subject to any royalties, or any further property payments.

We consider this a historic estimate and plan to upgrade it to NI 43-101 compliance. Exxon’s work was all done using a 2% cutoff grade, which at today's metal prices would equate to a grade of about 5.9% copper equivalent. The deposit has roughly an even split of metal value between copper and gold, so on a gold equivalent basis, it would be about 9 g/t gold. Exxon estimated that they could expand the resource to about 18 million short tons.

At today's metal prices, we think we could probably reduce the cutoff grade from 2% to 1%. Only about a quarter of the strike traced at surface has been tested underground. The deepest it was tested to was about 900 meters. We know that similar types of VMS deposits in the region, like United Verde, as well as others around the globe, like Kidd Creek or LaRonde, can reach depths of more than three kilometers. So, we think there's significant potential for expansion of the Kay Mine at depth too.

We're currently completing the drill permitting for both Sugarloaf and Kay, but our initial focus will be the Kay Mine. We expect to start drilling in late September or early October. We have a 5,000-meter drill program planned, with the aim of collecting data to begin upgrading the Exxon historic estimate into NI 43-101 compliance.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your leadership team?

Marc Pais: The Company was founded by Paul Reid and me. Paul is the Chairman. I'm a geological engineer by training. I spent seven years as a mining research analyst at various boutique firms in Toronto, covering the junior mining sector. At those firms I was working with Paul, who was a mining investment banker. In 2012 we were at an investment bank called MGI securities, which is now Industrial Alliance. While there we started a company, whose aim was to acquire California gold assets. We raised about $8 million privately and the main acquisition for that company was the Castle Mountain mine in California, which had an historic resource estimate of about 2 million ounces gold at a grade of a gram per tonne.

We raised enough money to make the acquisition and list the company. It was listed as Castle Mountain Mining, and later the name was changed to Newcastle Gold, and was then acquired by Equinox Gold last year.

After Castle Mountain was listed, Paul and I stepped away, but the same investors were happy with what we'd done and asked us to find new assets. We started a new company and decided that this time, after our experience in California, where that the permitting of mines can be fairly difficult, we would focus on Arizona. At the time, there were very few juniors operating there or looking at projects. We reviewed quite a number of projects over the last three years and we're very happy with the two we've acquired. We focused on finding projects with historic work, where we have confidence in the people that did the work and also confidence that with additional work, we can bring the historic estimates into NI 43-101 compliance. For both projects, we think the value proposition is in converting them from historic estimates to NI 43-101 compliant resources. Each project also has, we believe, significant expansion potential.

As for the Board, we have three Directors in addition to me and Paul. Colin Sutherland was most recently the President of McEwen Mining. He's run a number of successful junior companies. He was the President of Capital Gold when it was acquired by Gammon Gold in 2012 for about $450 million. Capital Gold’s main asset was very similar to our Sugarloaf project. It was a heap leach open pit running around 65,000 ounces gold a year at half a gram that had a resource of 2 million ounces at half a gram. That sold for a very big premium at the top of the market. Our goal with Sugarloaf will be similar, with an aim to go from a million and a half ounces to hopefully significantly bigger.

Rick Vernon is also on the Board. He's a geologist that worked in investment banking in Toronto for the last 20 years at various firms. He's been very helpful in giving us introductions in the capital markets. Our third Director is Conor Dooley, who's also our Corporate Secretary. He's our legal counsel and partner at WeirFoulds in Toronto and has been with the company from the beginning. We've added a special advisor to the Board, Dr. Mark Hannington, who is a Professor of Geology, currently at the University of Ottawa, and he's also one of the world’s leading experts on VMS deposits. He’s helping us with the data review for targeting the drilling at the Kay Mine. He's pointed out some very interesting similarities between what we have at Kay and what he's seen at other world-class VMS deposits.

Our VP Exploration, David Smith, has been working with us on both projects for the last three years, and has 30 years of experience in discovering and drilling out these types of deposits.

Dr. Allen Alper: It looks like you have a very experienced team and so that's excellent. Could you tell us a little bit about your capital structure?

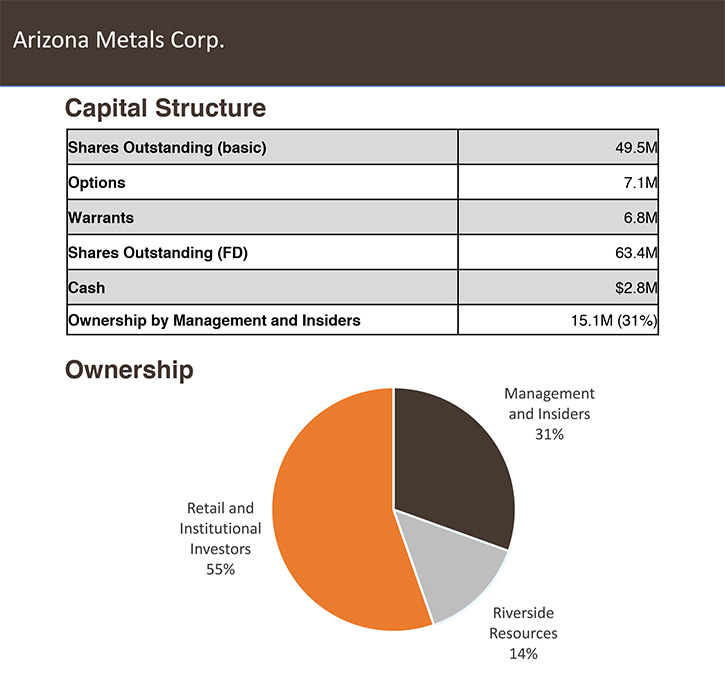

Marc Pais: We currently have 49.5 million shares outstanding with 7 million options and 7 million warrants. Those warrants were issued on the RTO financing. As a private company, we didn't issue any warrants. The RTO financing was completed at 40 cents per unit, with a 60-cent full warrant for three years. We have approximately $3 million in cash in the bank right now and our initial drill program budget is about $1.5 million. We have enough cash to fund the Phase 1 drill program easily and working capital for that period.

Dr. Allen Alper: Well that sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in the Arizona Metals Corp?

Marc Pais: We think our projects have been significantly de-risked, compared to grassroots projects, just because of the amount of historic work on each of them. They're both in mining-friendly Arizona. Sugarloaf is 20 kilometers directly south of Kerr's Copperstone Mine, which is going into production next year. We're on the same type of BLM claims, in the same County, with the same permitting regime.

Significant historic work has been completed on both projects, and we believe both have the potential to be moved into NI 43-101 compliance, without spending too much money. Each project also has significant expansion potential. At Sugarloaf, the historic resource was defined to a depth of only 70 meters, but work done in 2009 and 2012, by previous operators, shows consistent mineralization of half a gram down to a depth of at least 180 meters. It's also open on strike, both to west and east.

The Kay Mine is an extremely high-grade deposit, at 6% copper equivalent. Most of it is above a depth of 700 meters. In the 70s, when the historic resource estimate was done, that grade was considered too low. But at today's metal prices, this would be in the first quartile of projects in terms of grade. We think 6 million tonnes is a very decent starting point, and the deposit is open at depth with drilling on only a quarter of the strike traced at surface.

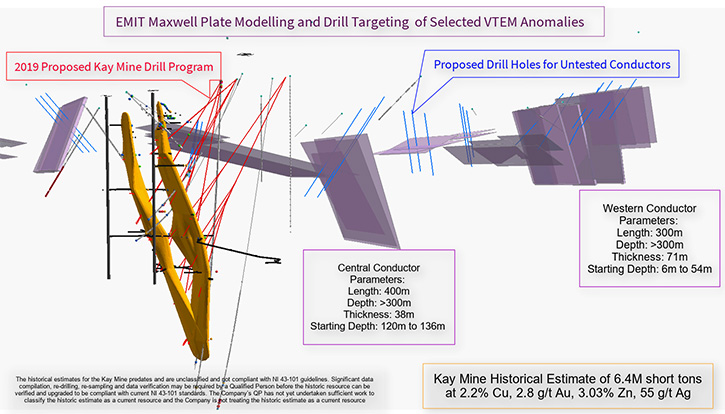

Exxon believed they had the potential to expand the resource to 18 million short tons and that was using a 2% cut-off grade. We think we can use a 1% cut-off grade, so we see lots of expansion potential at Kay just on that basis. On top of all that, in March of this year, after we'd acquired the project, we staked an additional thousand acres to the west of what we acquired and did a VTEM helicopter survey. Right in the center of the claim block that we staked, the VTEM survey identified two large and untested targets. Both start very near surface and show good conductance, but have never been drilled.

The larger conductor, located a kilometer to the west of the Kay Mine, starts near surface and goes to a depth of at least 300 meters, with a strike of 300 meters and thickness of 70 meters.

The second conductor, located 500m west of the Kay Mine, has dimensions of 300 meters length by 300 meters depth by about 40 meters in thickness. It also starts just below surface.

Dr. Allen Alper: Those sound like very good reasons for our readers/investors to consider investing in Arizona Metals Corp. Is there anything you'd like to add, Marc?

Marc Pais: Regarding the capital structure of the 49.5 million shares outstanding, 15 million shares are owned by Management and insiders, or about 30%. We have another significant shareholder, Riverside Resources. They have 7 million shares, or 14%. That came about through our acquisition of the Sugarloaf Peak project. Riverside and Management together own about 44% of the Company.

Dr. Allen Alper: It's good to see that Management has skin in the game. Anything else you'd like to add, Marc?

Marc Pais: We believe the real value proposition is to re-rate the Company, based on upgrading both projects from historic estimates to NI 43-101 compliant resources, while at the same time expanding them.

Thank you for interviewing Arizona Metals Corp. for Metals News.

Dr. Allen Alper: Sounds excellent! I’ve enjoyed talking with you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://arizonametalscorp.com/

Marc Pais

President & CEO

416.565.7689

mpais@arizonametalscorp.com

|

|