TriStar Gold Inc. (TSX-V: TSG): Well Financed by Royal Gold, Advancing Brazilian Gold Projects with the Potential of Becoming a Significant Producer; Interview with Nick Appleyard, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/4/2019

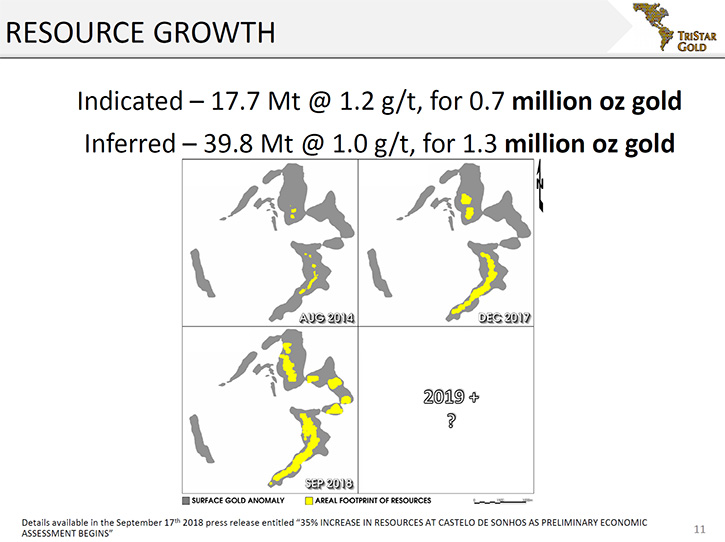

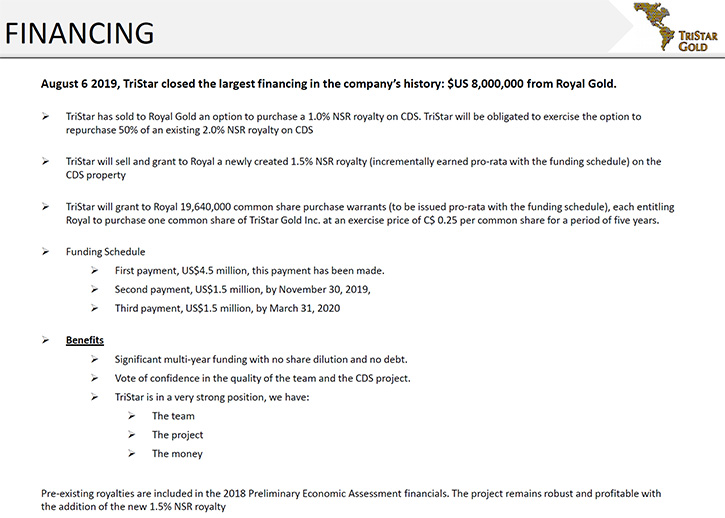

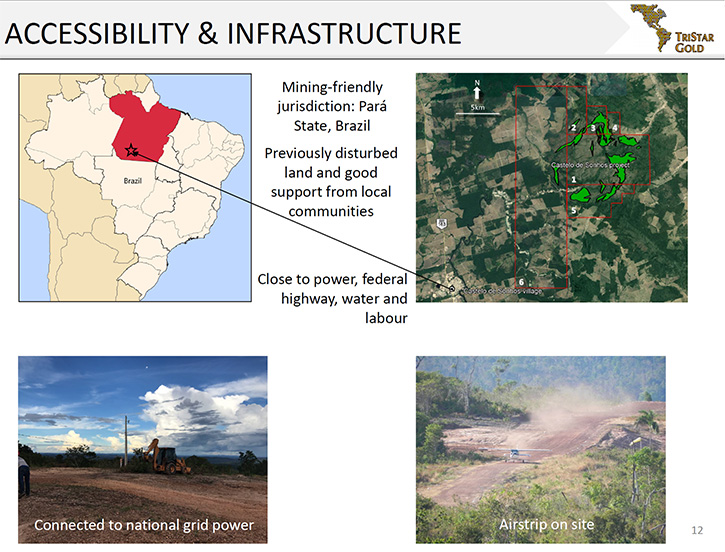

TriStar Gold Inc. (TSX-V: TSG) is an exploration and development company focused on precious metals properties in the Americas that have potential to become significant producing mines. Their flagship property is Castelo de Sonhos in Pará State, Brazil. The Company has recently completed a US $8 million finance with Royal Gold Inc. with proceeds used to advance the project to completion of a feasibility study in 2020. We learned from Nick Appleyard, President, CEO and Director of TriStar Gold, that they have de-risked the project and moved it forward, quite rapidly, over the last few years through a difficult time, growing the resource from 280,000 ounces in 2016, to 1.3 million inferred and 700,000 indicated. The Company is now fully financed to complete a pre-feasibility study. TriStar Gold is very well positioned to continue to grow and to take advantage of the current high gold prices.

TriStar Gold Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nick Appleyard, who is President, CEO and Director of TriStar Gold. Nick, could you give our readers/investors an overview of your Company and also what differentiates TriStar Gold from others?

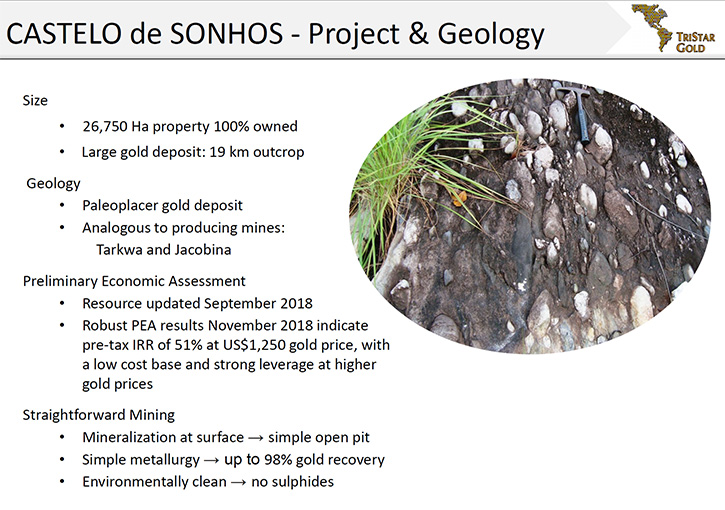

Nick Appleyard: Absolutely. Tri-Star is a TSX Venture-listed Company. We focus on gold. Our principal property is called Castelo de Sonhos, and it's in Brazil. What differentiates us is that we have a very high quality technical team, and our business model is using that technical team to develop projects through to a production decision, with the quality of work with which major companies are very, very familiar and expect.

I think what also differentiates us is that over the last three, four, five years, which have been pretty hard for the junior sector, we've moved this project forward quite rapidly, considering the difficulty in raising funds. We’ve gone from having a 280,000-ounce resource in 2016, to having a 1.3 million inferred and 700,000 indicated right now and the scoping study. Now we are fully financed to complete a pre-feasibility study. So the project has been being de-risked and growing rapidly over the last few years, through a difficult time. It's very well positioned now to continue to grow and to take advantage of these metal prices we're seeing today.

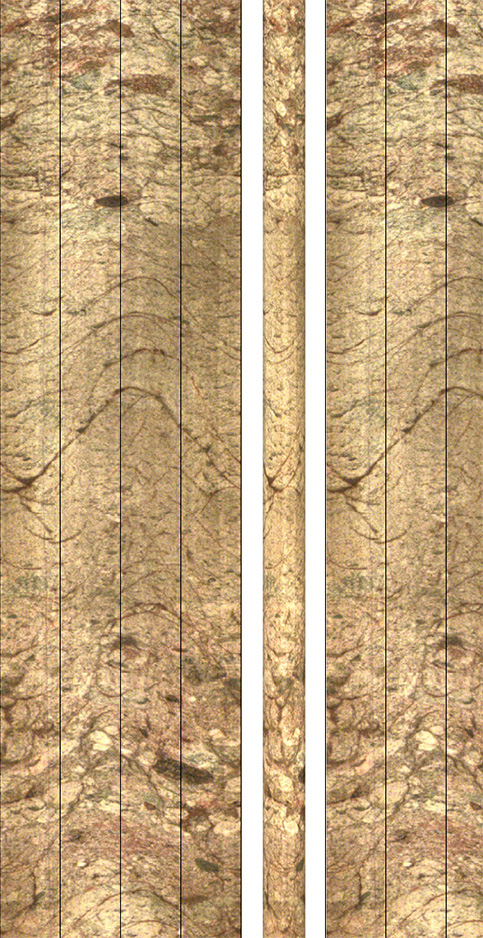

OTV Image of Hole RC17-186, showing a conglomerate band. Core view on right, unwrapped image on left.

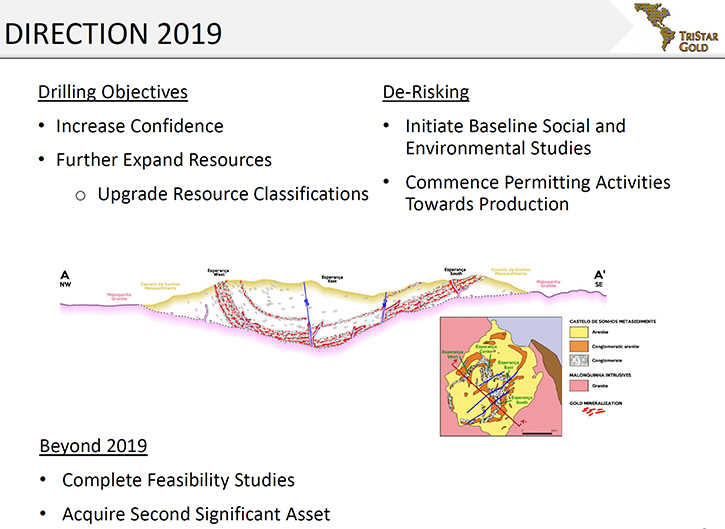

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors your primary plans for the remainder of 2019 going into 2020?

Nick Appleyard: Absolutely, yes. We've just sold a 1.5% royalty to Royal Gold, with which we're obviously very happy. They're a great company to have involved with us. For Royal Gold to go through their due diligence is a very nice third party validation. With that 8 million US that we got from them, we will be completing a pre-feasibility study by the end of next year.

As we speak today, the drill rigs are on low loaders, heading towards Castelo de Sonhos, and they'll start drilling within the next week or two. We will be drilling approximately 20,000 meters, predominantly with RC rigs. All the resource drilling will be our RC rigs. There'll be a little bit of geotechnical work with the core rig, but basically 20,000 meters of infill drilling to turn our scoping study into a pre-feasibility study.

We’ll be upgrading the inferred resources that were in that study to indicated, and also taking the engineering to the next level of de-risking and in parallel, starting the permitting process. All the baseline studies, all the social license work that needs to be done to move a project forward these days is also starting right now.

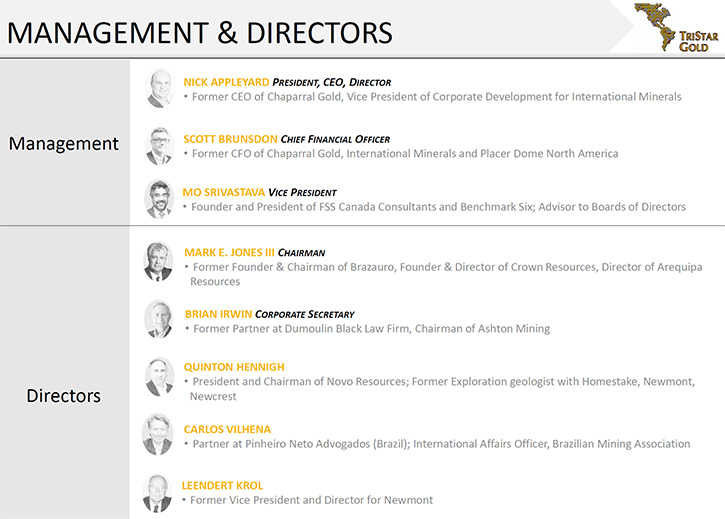

Dr. Allen Alper: That sounds excellent. I know that you and your Team and Board have a very, very strong background and accomplishments. I wonder if you could tell our readers/investors a little bit about yourself, your Team, and your Board?

Nick Appleyard: We have a six man Board, Mark Jones is the Chairman. He was involved with Brazauro and Crown Resources and has a history of developing projects and having them sold to the benefit of shareholders. We also have on the Board Carlos Vilhena, who is probably one of the preeminent mining lawyers in Brazil. So that's a great asset to have. He's in Brasilia with the highest level of contacts with the Federal Government.

We have Brian Irwin and Len Krol as long-term Board members. Brian is a retired lawyer, Len a retired geologist. And very importantly Dr. Quinton Hennigh, who is one of the world's leading expert on paleo placers. And our deposit is a paleo placer. So it's great to have Quinton and on the Board as a sounding-board for me to chat with about all the work we are doing, to review, to talk about paleo placers, how we moved from forward, how we work with them. So that's the Board.

I'm a geologist from Australia by training. I've been working in the Americas and in South America now for 23 years. My history, my specialty, and the team that I brought to TriStar, three and a half years ago now, specialize in derisking projects and moving them from discovery through to a production decision. We were in Peru, Ecuador, Nevada, with a company called International Minerals which was sold to Hochschild Mining. Then Chaparral Gold, which was sold to Waterton.

Developing projects; we developed Pallancata and Inmaculada, which are now two of Hochschild's core assets. We developed Goldfield in Nevada, Rio Blanco in Ecuador, which is a great deposit although Ecuador is a challenge. We developed a specialty of taking a deposit through the study phases quickly and efficiently to get to that production decision. So that's where we think we have a great skill set, not seen in many juniors ( there are juniors who are good small scale producers or good explorers), but there are very few juniors who have that skill set on de-risking a project and moving it through the study phases quickly and efficiently. We have great people on the ground in Brazil also.

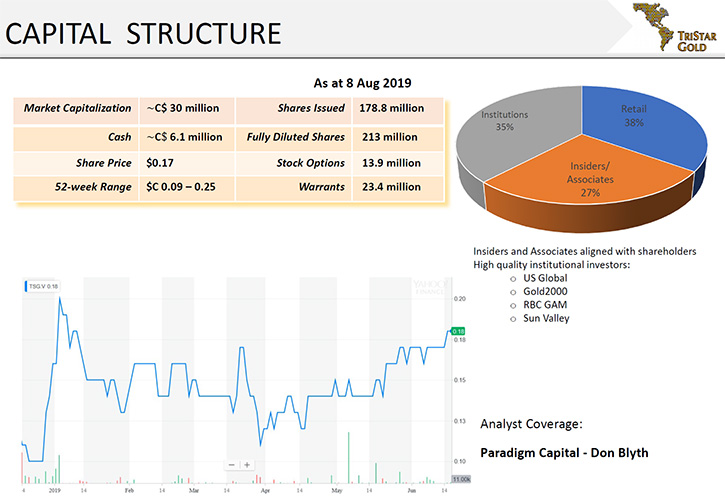

Dr. Allen Alper: You, your Team and your Board have extremely great backgrounds and are very well poised to move your Company forward. Excellent! Could you tell our readers/investors a bit about your share and capital structure?

Nick Appleyard: We are currently TSX venture listed. We have 179 million shares outstanding right now. Fully diluted it's 230 million. There were about 20 million warrants issued to Royal Gold. I think the important factors is our major shareholders. Our biggest shareholder is US Global out of Texas, that's Frank Holmes. Second biggest shareholder is Gold 2000 out of Zurich.

Interestingly, both of those funds, who are very good funds and run by very astute technical people, have as much as they can have. US Global can only hold 20%, Gold 2000 can only hold 10 under their own rules, they both hold right up to that amount. We also have RBC Global Asset Management and Sun Valley as major shareholders. Insiders and associates, we hold 27% between myself, the Board, friends and family. We're vested right in there alongside the shareholders. I think it's a very nice structure for the shares; some really good institutions, an aligned management, and then a 35-38% retail float. We also have analyst’s coverage for the target share price from Don Blyth of Paradigm Capital.

Dr. Allen Alper: That sounds excellent, really great. It's nice to see that management has skin in the game, really excellent.

Nick Appleyard: When I took over three and a half years ago, in December 2015, funds were short and we wanted to do work. So we requested all senior executives, management, to defer salaries for six months. When we raised money six months later, those deferred salaries were rolled into the raise and as part of the placements. People got enough to cover their tax and the rest of it was just to make sure that all senior management were aligned. You can't force staff to do that. Everybody did it willingly. I thought it was really good that the whole team got behind doing that.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors the primary reasons they should consider investing in TriStar Gold?

Nick Appleyard: Right now, valuation. This Company has grown so quickly. We've had our heads down working, so we've grown from 280,000 ounces to now a total 2 million, or 1.3 plus 700,000. There's a lot more growth to do. But with the Royal Gold money now coming in, the feasibility study is going to generate a lot of news. When we complete the feasibility study, assuming positive results, which we expect, 2P reserves by the end of next year. And that should be a major re-rating for the Company. That shows that this is a mine that can be built and will be built.

TriStar Gold Inc.

Now we're funded, with a longer horizon in front of us, with a good scope of work to do, the project's taking off. It's one thing for me to say that as a CEO, but Royal Gold putting their money in, they only make money when this mine is built and is selling gold so they can receive their royalty. They really have faith in the project and the team. I think that helps, as an external review on us, as a third party validation.

Dr. Allen Alper: Well that sounds excellent. Very strong reasons to consider investing in TriStar Gold. It sounds like great timing.

Nick Appleyard: Yes.

Dr. Allen Alper: As you move your project aggressively forward and well-financed. Nick, is there anything else you'd like to add?

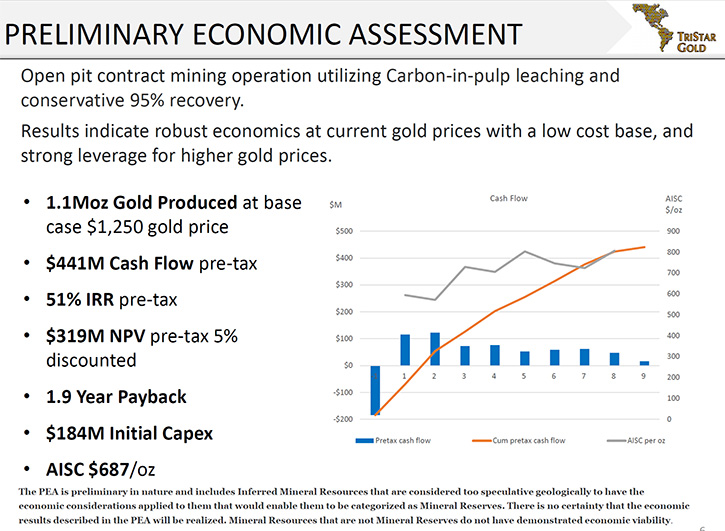

Nick Appleyard: I could just touch on the project a little. We published the PEA last year, which produced 1.1 million ounces. It had a rate of return pretax of 51%, post-tax of 43% at 1250 gold. Interestingly enough, we're currently at 1500 gold, so the project economics should be really good.

The one thing I didn't touch on was the simplicity of this project. We're right near a highway, we're right near power lines, our camp already runs on mains power. We have no sulfides on site, so it's a very clean rock. It's just sand and gold. Metallurgically, it's very simple, very clean. We're looking at a hundred meter deep pits that are about seven kilometers long, so it's a very simple mine as well. As a mine developer, I know mining is complicated, and so the simpler you can keep it, the faster it will move forward and the better it will be. I think that's it. We're not near any national parks and not near indigenous communities that will impact us. Yeah this is a good mine. It's going to get built.

Dr. Allen Alper: Sounds like an excellent project, excellent team, and that's really great.

Nick Appleyard: Yeah. Thank you for interviewing TriStar Gold Inc. for Metals News.

Dr. Allen Alper: It has been great talking with you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.tristargold.com/

TriStar Gold Inc.

Nick Appleyard

President and CEO

480-794-1244

info@tristargold.com

|

|